The US election is approaching, and the global capital market is facing a new trend

Original author: Rhythm Worker, BlockBeats

Just 2% away from its all-time high, Bitcoin is ready for Trump鈥檚 return to the White House.

As the 2024 US presidential election approaches, the global capital market, the crypto industry, and the US financial circle are in a state of high tension. The confrontation between Trump and Harris is not just a contest between candidates, but also involves the fluctuations of a series of conceptual assets, the bets of political fat cats, and the violent reaction of the cryptocurrency market.

Just like his performance when he was shot and assassinated, Trumps political tactics are very sophisticated. At the last minute, he chose New York to launch a campaign. This state has belonged to the Democratic Party since 1984. The effect was unexpectedly good. The stock price of Trump Media Group (DJT.US) soared more than 21% on Monday. In addition to his background in New York, the policy of relaxing financial regulation during his previous presidency has won many supporters from Wall Street and Silicon Valley, such as Paypal Gangster Peter Thiel and JPMorgan Chase CEO Jamie Dimonso. Musk has spared no effort in supporting Trump, campaigning in key swing states and distributing $1 million to voters every day. He once joked that investing in Trump was the riskiest bet in his career, and if Trump loses the election, he will also be finished.

The crypto industry is more obvious in its support for Trump. The crypto industry has donated $94 million to the 2024 US election, a record high. At the same time, the core capital forces of the crypto industry, such as the well-known venture capital firm Andreessen Horowitz (a16z) and the crypto trading platform Coinbase, have also shown their absolute support for the Republican candidate.

Cryptocurrency is inherently political and always has been; if the left relies on the politicization of finance, then cryptocurrency is by definition a right-wing technology, and it is delusional to meekly suggest that cryptocurrency is nonpartisan and hope for the best. The remarks of Nic Carter, the father of smart contracts, almost represent the attitude of most crypto investors.

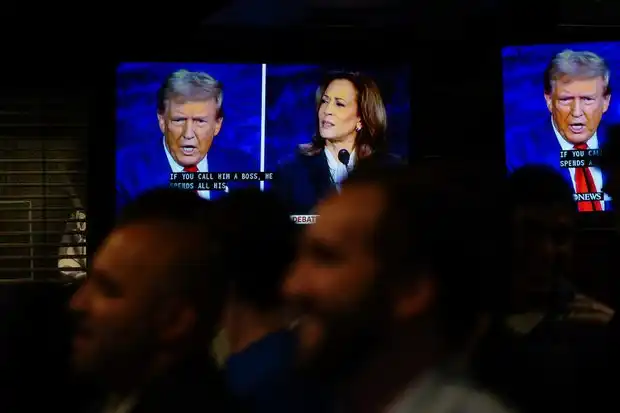

Current battle situation: Harris and Trumps entanglement

Taking advantage of Bidens recent mistake of blurting out Trump supporters are garbage in a conference call, Trump was full of fighting spirit like a real performer.

How does my garbage truck look? This truck is in honor of Harris and Biden. (Reuters)

According to US media reports, Trump was wearing an orange reflective vest when he arrived at the Wisconsin airport that day. After he walked out of the cabin, he got into the drivers seat of a white garbage truck with the words Trump Make America Great Again 2024 printed on it and answered reporters questions.

In the final sprint, the two candidates – current Vice President Kamala Harris and former President Donald Trump – are doing their best to win the last bit of support from voters. As the election enters the countdown, the campaign strategies, poll data and betting dynamics of both parties are attracting much attention.

Harris held a campaign rally on the south side of the White House on October 29. Source: Reuters

Trumps campaign rally in New York on October 27, source: Visual China

Against this backdrop, the support rates of Harris and Trump have shown a subtle tug-of-war in the polls, and the betting fever in the market has continued to rise. As the election date approaches, how these polls and betting platform data will predict the outcome of this evenly matched election has become the focus of public attention.

Polls show a close race

Lets first look at the polls. According to the latest report from Reuters, Harriss support rate advantage over Trump has gradually narrowed in recent days, and the Democratic Party currently leads the Republican Party by only 44% to 43%. This result shows that the support rates of both parties are almost equal nationwide, and as the election date approaches, voters decision-making space and intention to vote are becoming more critical.

Harris has been slightly ahead in most opinion polls since July, but her lead has gradually narrowed since late September, especially on key policy issues such as the economy and immigration. The latest data shows that voters are more inclined to believe that Trump has better policy performance in solving economic and employment problems, with a ratio of 47% to 37%. The economy is considered one of the core issues of this election, and about 26% of voters regard it as the most pressing issue for the country. On immigration policy, Trump leads by 48% to 33%, showing that his tough stance is attractive to some voters.

Meanwhile, Harris has a slight advantage on the issue of dealing with political extremism and threats to democracy, but the advantage is shrinking. Polls show that 40% of voters believe Harris is more effective on this issue, while 38% choose Trump. This narrowing gap reflects the voters divergent views on the issue of extremism, especially when both sides emphasize their respective positions, and voters attitudes on this issue remain vacillating. Harris team used the January 6th Capitol riots to emphasize the extremism of Trump supporters, but this strategy had limited effect and deepened the voters divisions in this regard.

However, the errors in polls have a linkage effect and are not necessarily accurate. In some swing states, the margin of error has a particularly significant impact on the final result. In the 2016 election, polls generally underestimated Trumps support rate, especially in the Midwestern battleground states. Polls in Pennsylvania, Michigan, and Wisconsin seriously underestimated his support, resulting in unexpected final election results. Although the FiveThirtyEight platform only gave Trump a 28% chance of winning at the time, he eventually won in these states, successfully reversing the national forecast trend.

Green, a political science professor at Columbia University, noted that polls have become more difficult over time, and more so in the United States than in other countries. Potential voters in the United States are less willing to be surveyed than in the past, with only about one in seven people who are asked actually agreeing to a survey.

After logging into Twitter, the US election voting day information is displayed

Predicting the rightward shift in betting

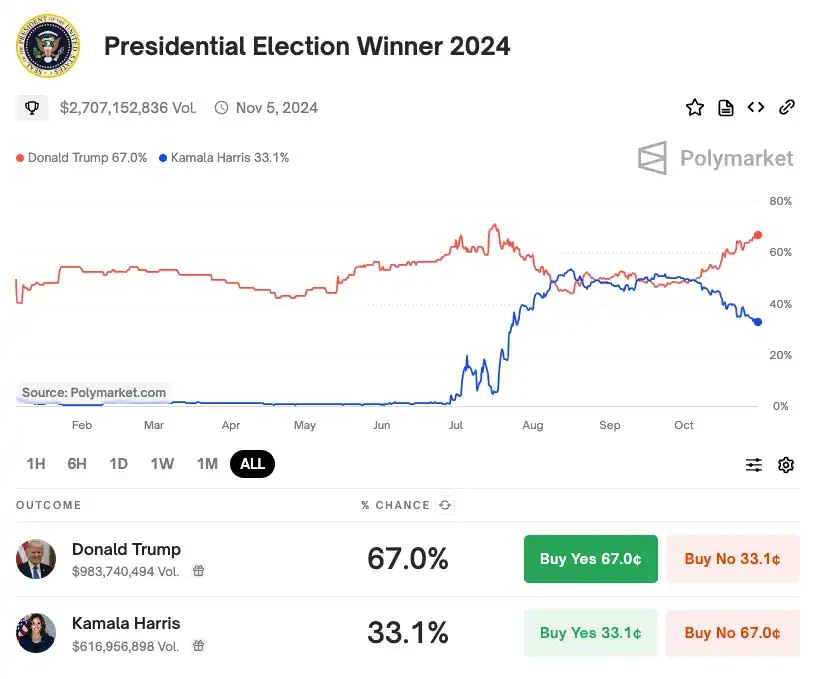

In addition to poll data, this years betting data is also a weather vane worth paying attention to, because bettors are playing with real money. Unlike the general public opinion polls showing that the two sides are evenly matched, although there is some difference in the specific values, because Trump focused on getting closer to the cryptocurrency circle during this campaign , he showed a strong rightward shift on almost all cryptocurrency prediction platforms.

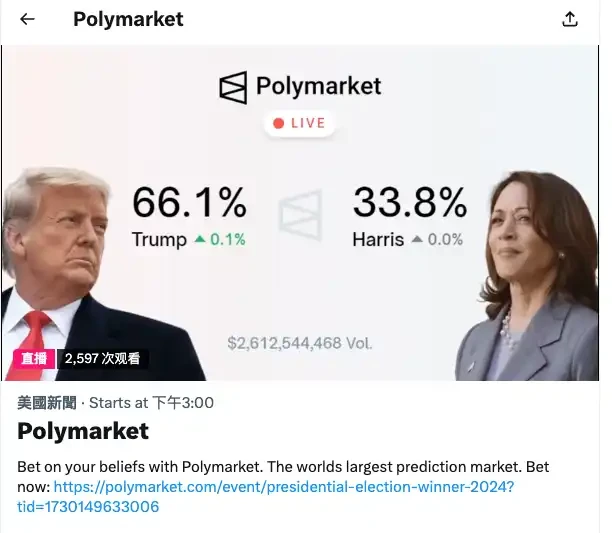

Polymarket is one of the most popular products during the US election. The main market for this years election has had a trading volume of nearly US$2.7 billion so far. Polymarket also frequently broadcasts changes in the election winning rate on major social media platforms.

Polymarket is one of the most popular products during the US election. The main market for this years election has had a trading volume of nearly US$2.7 billion so far. Polymarket also frequently broadcasts changes in the election winning rate on major social media platforms.

According to Polymarket, on October 30, the platform showed that Trump had a 67% chance of winning the November 5 presidential election. However, it is worth noting that Polymarket does not allow American users to use it, so this winning rate may not necessarily represent the opinions of all American voters. The user who currently places the largest bet is a Frenchman, who has bet $45 million on Trump to win the November election in four accounts.

In addition to Polymarkets 67% chance of Trumps winning, the winning rates of other betting platforms are RealClearPolitics 61%, Kalshi 59%, PredictIt 57%, and 538 54%.

This bustling scene has also made mainstream brokerage firms on Wall Street sit still. Among them, Robinhood, an emerging brokerage firm that has grown in recent years relying on the popularity of retail investors, announced on the 28th that it will allow users to participate in gambling on the results of the US election in disguised form.

In order to circumvent regulation, Robinhood uses smart contracts, that is, users can buy event contracts for Trumps victory or Harriss victory based on real-time changing prices. The price of each contract will fluctuate between 2 cents and 99 cents. If the contract event is confirmed to occur (that is, the user bets on the result), each contract will be paid $1.

Searching for the US election on Google, you can see Trump ads

The wind vane of the capital market during the election

As the election approaches, the volatility of the global capital market has become more significant, and various concept assets have emerged, from cryptocurrencies to Trump concept stocks, which have become hot spots for market speculation. In the field of encryption, the prices of Bitcoin and Ethereum have climbed, further consolidating their status as alternative assets in the financial market.

In the stock market, Trump-related concept stocks also ushered in a wave of gains. In this interactive game of capital and politics, investors are betting capital around the world, trying to capture the direction of the election through the financial market.

Under the dopamine shock, BTC is approaching a new high

Trumps sweet period for the crypto industry has lasted for nearly a year. Under such a dopamine shock, Trumps re-election is a huge boon to the currency circle.

As Trumps approval rating continues to rise, Bitcoin, the worlds largest cryptocurrency, has seen a strong rise in October. In the early morning of October 30, the price of Bitcoin climbed to $73,577, close to the historical high set in early March. Although the rise has slowed down since then, Bitcoin has still risen by 14.26% this month, showing strong demand for it as a high-value asset. Ethereum also hit an intraday high of $2,680 before a pullback. In the past 24 hours, the total amount of crypto market liquidations soared to $257 million as leveraged short positions were closed.

At the same time, Bitcoin open interest also increased significantly, up 5.11% to a total of $43.17 billion. The dynamics of whale investors in the market are also worth paying attention to. On the trading platform Binance, the number of long positions is 1.42 times that of short positions. This trend reflects investors bullish confidence in Bitcoin in the coming weeks and even months. The current global cryptocurrency market value is $2.43 trillion, an increase of 3.04% in the past 24 hours alone.

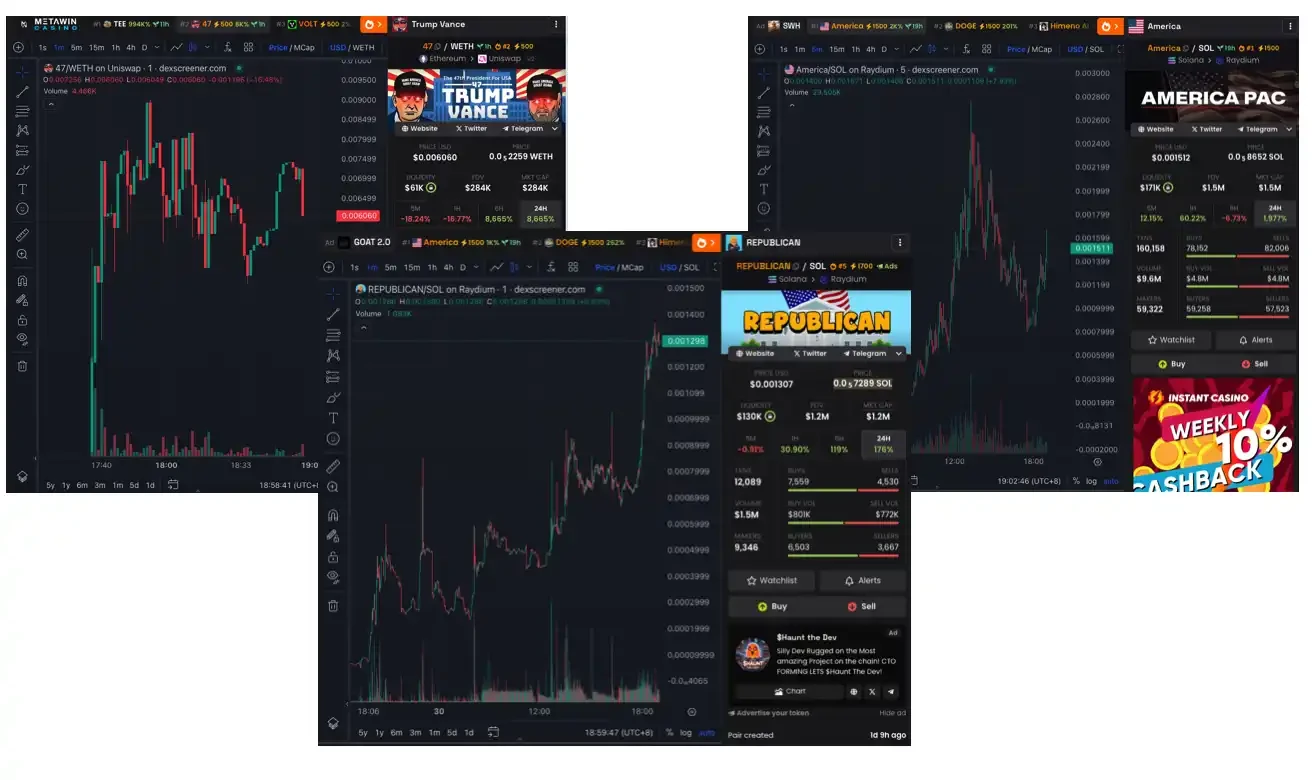

In addition to mainstream currencies, there are also some new concepts about the US election, but most of them are still based on Trump and the Republican Party.

Trump Vance 47 ($47), with a total of 47,000,000 coins, symbolizes Trump and Vances joint commitment to bring real, tangible change – empowering American workers, protecting communities and achieving economic revitalization. $Republican also stands on the side of the Republican Party and supports Trumps coming to power. $America aims to support candidates who advocate safe borders, reasonable spending, safe cities, a fair judicial system, freedom of speech and self-protection, and is also a concept coin that supports Trump. (Not as an investment advice, just as a record of the article)

US A-shares, Trump concept soared

In the United States, as the atmosphere of the election heats up, the prices of stocks related to Trump have also seen a significant rise. The share price of Trump Media and Technology Group (DJT.US), owned by Trump, rose 21.59% on Monday, attracting market attention. Since September 23, this Trump concept stock has risen by about 280% in total, and has now reached its highest level since June. In addition, other meme stocks related to Trump have also benefited. The stock price of conservative video network Rumble rose by 12% during trading on Monday, and the stock price of Phunware, a software company that participated in Trumps 2020 campaign, also rose by 15% at the opening of the day.

On the other side of the ocean, in the Chinese A-share market, some stocks of companies with Trumps symbolism are also sought after by investors. Among them, Sichuan University Zhisheng 002253 is regarded by investors as a symbol of Trumps victory because of the two words Chuan and Sheng in its stock name. On October 31, Sichuan University Zhisheng quickly rose to the daily limit after opening, and closed for four consecutive days. The stock price has almost doubled since the low point at the end of September.

Data: Flush

Sichuan University Zhisheng is not unfamiliar. On the first trading day after Trump was attacked, Sichuan University Zhisheng opened a daily limit in the call auction, with a quotation of 11.22 yuan per share and continued until the end of the trading day. Every time there is news that promotes Trumps victory, Sichuan University Zhisheng will be hyped up, which can be said to be a typical example of literal stock speculation or metaphysical stock speculation.

It is worth mentioning that Morgan Stanley has recently become the eighth largest shareholder of Sichuan University Zhisheng. This foreign giant has appeared in the list of the top ten shareholders of Sichuan University Zhisheng for the first time. Morgan Stanley currently holds 1.274 million shares, with an estimated value of approximately 23.14 million yuan. If it has been bought since the beginning of the third quarter, the floating profit has been close to 9 million yuan. This cross-ocean bet has sparked market speculation. Some investors believe that this shows that Morgan Stanley is optimistic about Trumps victory and even follows the local customs in the A-share market and bets on Sichuan University Zhisheng. However, some analysts pointed out that Morgan Stanleys holdings may only be part of quantitative investment, and a large number of positions will be replaced every quarter, which may not involve special concept strategies.

In addition to Trump concept stocks such as Sichuan University Zhisheng, investors have found a concept stock for Harris, 002615 Hars. Hars mainly deals in water cups and foreign trade. Because of its similar pronunciation to Harris, it is jokingly called Harris concept stock.

Data: Flush

Obviously, Trumps strength is also reflected in the investment market. Compared with Sichuan University Zhisheng, Halss trend is weak. It hit the daily limit in the morning of October 30, but failed to close the board. The increase was 2.5% at the time of publication on October 31. As the election approaches, the speculative enthusiasm around concept stocks and cryptocurrencies continues to rise. Whether it is the US domestic market or Chinas A-shares, the linkage effect of politics + market has further emerged.

Critical countdown: What to watch in the final days of the election

As the countdown to the US presidential election approaches, key moments in the next few days will be the focus of the world. This includes not only the results of the vote count and possible legal disputes, but also the complexity of the US electoral system, how the Electoral College works, and who controls the two houses of Congress. The following are the main concerns about the timing of the announcement of the election results, the possibility of delays, and the relevant markets and the election situation.

When will the election results be announced?

After voting closes on Election Day, each state begins counting votes based on its own voting hours, usually starting around 7 p.m. local time. However, the United States spans multiple time zones, which means that votes on the East Coast are often counted earlier, while voters in Alaska and Hawaii may still be voting. Usually, preliminary results are available late at night Eastern Time, but if the election is a stalemate, the final results may take days or even weeks to be announced.

On the night of the election, we can usually know which candidate won in which states through preliminary statistics and predictions from various media. However, these are preliminary estimates based on statistics and voting trends, and are unofficial results. Therefore, if converted to Beijing time, the earliest we can know the preliminary election results is before noon on Wednesday, November 6.

After that, the votes are sent to Congress, and on January 6, the new Congress will meet, presided over by the Vice President (who is also the President of the Senate), to publicly count and certify the Electoral College votes. Only after this step is the election result considered official and final. The inauguration ceremony is usually held on January 20, when the new president and vice president are sworn in and officially begin their terms.

The official count can take days or even weeks, especially if there is a large turnout or a lot of mail-in voting. For example, in the 2020 election, due to the coronavirus pandemic and a large number of mail-in votes, some states continued to count votes for days, and Bidens victory was finally announced four days after voting day. 2016 was slightly smoother, with Hillary Clinton conceding to Trump the next day.

At the same time, Deutsche Bank analysis pointed out that if the election results are disputed or legal disputes arise again, just like the Bush vs. Gore election in 2000, the dispute lasted for more than a month, which not only caused uncertainty but also triggered stock market fluctuations. The SP 500 index fell 8% in November that year. This also means that the crypto industry will also face greater volatility in the near future, especially in the event of disputed votes.

The Electoral College, the key to the swing states

Winning the popular vote is a symbolic victory, but it is not a requirement for being elected.

In the US presidential election, voters do not vote directly for the presidential candidates, but for the electors who represent those candidates. These electors make up the so-called electoral college, who will formally vote for the president and vice president a few weeks after the election. This is an indirect election.

The Electoral College is composed of 538 electors, a number equal to the total number of members of Congress from the 50 states (plus the District of Columbia) (435 in the House of Representatives, 100 in the Senate, and 3 in the District of Columbia). Electors are usually selected by the political parties of each state at state-level conventions or directly appointed by the candidates. They are usually loyal supporters of the parties or senior members of the parties.

The system was designed to balance the interests of large and small states and ensure that each state has a certain amount of power in elections. The number of electoral votes in each state is based on the number of congressmen in that state, totaling 538, while at least 270 electoral votes are needed to win the presidency.

The Electoral College system has been in use since the founding of the country in 1787, but its design and actual operation are often controversial. Some critics believe that the Electoral College system allows presidential candidates to be elected even if they do not win the national popular vote.

For example, the 2000 and 2016 elections are typical examples. In 2000, Bush did not win the popular vote, but won in the Electoral College; in 2016, Trump also won by virtue of his advantage in the Electoral College, while Hillary Clinton won a lead of 3 million votes in the popular vote. This system gives a few key states a huge influence, and the issue of equivalence of voters voting rights has therefore become controversial.

The possibility and consequences of an Electoral College tie. Although unlikely, a 269-269 Electoral College tie is not impossible. Historically, this has only happened once before, in the 1824 presidential election. Under current rules, if this happens, Congress will hold a contingent election to determine the winner. Specifically, the House of Representatives will be responsible for voting, with each state having one vote, and a candidate must receive the support of at least 26 states to be elected.

The 538 website has conducted a detailed analysis of the possibility of a tie between Harris and Trump. Professor Cobb said the possibility of a tie this year is a real concern, noting that if it goes to the House of Representatives, the Republican nominee is more likely to win because the House is currently controlled by the Republicans.

In the current election, the performance of the seven major swing states will become the focus, including key states such as Pennsylvania, Michigan, and Wisconsin, which were decided by a small margin of votes in the 2016 and 2020 elections. Due to the implementation of the winner takes all rule, these swing states have become the focus of the two-party campaign, and the ownership of each vote may determine the final result. On the Republican side, 93% of registered voters said they would vote, while the Democratic Party was 89%. This shows that voters on both sides have a high willingness to vote in the fierce election, and the strong support base of the two parties also makes this election the most suspenseful election in recent years.

The battle between the two houses, the competition for legislative power

The results of the presidential election are certainly important, but the control of the two houses of Congress will also determine the policy direction of the new president. If the new president cannot control either of the two houses, it will affect the realization of the agenda.

In the election on November 5, voters and the Electoral College will not only elect the president and vice president, but also the two houses of Congress. Some seats in the Senate and the House of Representatives will also be up for re-election. In the Senate, the competition for seats between Republicans and Democrats is particularly fierce. According to the law, one-third of senators are re-elected every two years. Two of the 34 seats this year are special elections, namely the vacancy left by Nebraska Senator Ben Sasse after his resignation and the seat left by California Senator Dianne Feinstein after her death.

Every new president since Clinton has started his term with his party controlling both chambers of Congress. They usually lose control midway through their term, but at the beginning they have always had control and therefore the ability to implement their legislative agenda. This is also a key issue around fiscal policy, including spending bills (the absence of which could cause a government shutdown) or raising the debt ceiling, which both require legislation. Appointments to the Cabinet, Supreme Court justices and the Federal Reserve president also require Senate majority approval.

The ownership of the two houses of government not only affects the presidents ability to implement policies, but also determines the direction of fiscal policy. If the Senate and the House of Representatives belong to different parties, policy making will face more obstacles, especially on key issues such as the debt ceiling. The deadlock will directly lead to an increased possibility of a government shutdown. According to data from the crypto gambling platform Polymarket, the current predicted probability of a unified government scenario in which both houses and the president are controlled by the same party is about 60%, but the possibility of a divided government cannot be ignored. This means that the policy direction and actual operation of the new government will depend on the ownership of the two houses, and may affect the advancement of regulations in various industries, including the crypto industry.

According to Reuters in Washington on October 23, Republicans in the U.S. House of Representatives are defending their slim majority in the November 5 election. The Democrats only need to flip five seats to win control of the House of Representatives.

This article is sourced from the internet: The US election is approaching, and the global capital market is facing a new trend

Original title: Blockchain Economics: How much does it cost to run your own chain? Original article by Sharanya Sahai, Hashed Emergent Original translation: 0x 26, BlockBeats Editors note: Galaxy Research recently published an article stating that Since the Cancun upgrade, Ethereum mainnet protocol revenue from Layer 2 is almost zero. Ethereum is going further and further on the road to expansion, but how much is actually needed to operate an L2? What about the cost? Through the introduction of this article, we can understand the real cost of the one-click chain launch L2 project. The number of new Layer 2 (L2) solutions has increased significantly over the past year, driven by technological advances, focus on specific use cases, and strong community engagement. While this development is encouraging, the main challenge…