In the field of Web3 innovation, Alliance DAO has become one of the most influential accelerator projects.

As a decentralized autonomous organization (DAO) comprised of experienced crypto founders, Alliance is dedicated to discovering and nurturing the next generation of groundbreaking Web3 projects.

At the just concluded AL L1 3 Demo Day, a new batch of highly promising startups presented their roadshows. These projects not only represent the current innovative direction of the Web3 field, but are also high-quality projects that have been strictly screened. According to statistics, the median financing of Alliance projects has reached 3.5 million US dollars. In the past two years, it has incubated Moonshot, Pump.fun, Fantasy.top and Time.fun, and other popular and successful projects.

Thanks to @QwQiao for the invitation, TechFlow was also fortunate to be invited to participate in this event.

The editor made a quick record of the project demonstrations in Demo Day. This article will bring readers an overview of the innovative projects displayed in ALL13 Demo Day, covering multiple tracks from infrastructure to application layer, showing the latest trends in current Web3 innovation.

0 All l1 3 Demo Day Background

The opening host Qiao Wang quickly introduced the overview of this Demo Day.

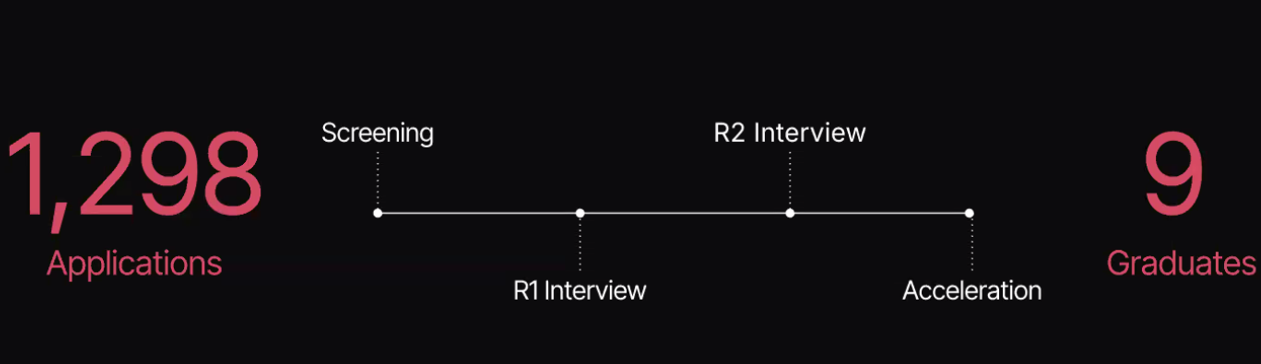

The event received a total of 1,298 applications for startup projects. After screening, double interviews and a three-month acceleration program, 11 teams finally stood out (9 new + 2 previous teams), with an acceptance rate of only 0.7%.

The 11 projects are as follows:

1. Offramp: Stablecoin bank on Telegram

Project website: https://www.offramp.xyz/

Project Twitter: https://x.com/OfframpXYZ

Project Details:

In the past four years, stablecoin transaction volume has increased 10 times, reaching $3.7 trillion per year, which has exceeded the sum of PayPal and global remittances. However, in emerging markets, users face serious difficulties when converting stablecoins to fiat currencies: either exchange through local exchanges and risk having their bank accounts frozen, or pay high fees of 3-8%.

Although some stablecoin banking services have emerged on the market, they all adopt a custodial model and not only compete directly with centralized exchanges, but also face strict licensing requirements worldwide.

Off Ramp has adopted an innovative solution: providing non-custodial services through the Telegram applet, allowing users to directly connect their wallets without having to entrust their assets to the platform.

Users can top up their Visa debit cards with stablecoins, receive bank transfers, save and invest. Choosing Telegram as the entry point instead of developing separate iOS and Android apps not only saved millions of dollars in compliance costs, but also enabled them to quickly expand to 90 countries.

Currently, the platforms monthly transaction volume has exceeded US$1.5 million and maintains a month-on-month growth rate of 60%.

2. Starpower: DePIN-like energy management protocol

Project official website: https://www.starpower.world/

Project Twitter: https://x.com/starpowerworld

Project Details:

With the rapid development of renewable energy, solar and wind power are expected to provide 40% of the worlds electricity supply by 2030. But this growth also brings serious challenges: the volatility of renewable energy can cause grid instability and even cause power outages.

While companies like Tesla have successfully achieved grid stabilization in places like California and Australia with their Powerwall battery systems, a single company鈥檚 proprietary network cannot meet global demand.

Star Power has pioneered a cross-brand solution: establishing an independent energy agreement, breaking down barriers between different brands, and allowing all energy devices to be connected and realize value.

In the past six months, they have partnered with three manufacturers, activated 20,000 devices on the Solana network, and generated more than $1 million in revenue. In December, they will launch their own battery product, and have already deployed test units in Australia.

3. Farm Frens: Web3 gaming service on Telegram platform

Project website: https://www.amihan.gg/

Project Twitter: https://x.com/farmfrenslol

Project Details:

The Telegram mini-app market is thriving, with more than 100 million monthly active users even after excluding 80% of bot traffic. However, in the gaming space, Telegram鈥檚 gaming penetration is only 20%, far below expectations compared to Android or the App Store.

While hyper-casual games like Hamster Combat have attracted millions of users through simple gameplay and cryptocurrency rewards, the prices of these game tokens have generally fallen by more than 50%, exposing the problem that simple gameplay is difficult to maintain long-term user engagement.

The Farm Friends team developed a unique solution to this pain point: adopting a game as a service model, updating game content every 1-2 weeks, resisting robots through frequent updates, while keeping the gameplay simple enough for rapid iteration.

Since its launch on September 16, the game has attracted more than 200,000 players, mainly through word of mouth. It currently has 35,000 daily active users, a 30-day retention rate of 20%, and an average monthly revenue per active user of 40 cents, showing strong growth momentum.

4. DataHive: Decentralized AI Data Collection Platform

Project website: https://datahive.xyz/

Project Twitter: https://x.com/usedatahive/

Project Details:

The AI data market is expected to grow from $16 billion in 2024 to $94 billion four years later. However, more than 55% of websites block AI crawlers, and existing proxy solutions are easily detected and receive contaminated data.

Data Hive encourages ordinary users to collect data during daily browsing through browser plug-ins, which not only avoids the blocking problem, but also processes and stores data directly on the users device, resulting in faster crawling speed and lower cost.

The e-commerce data company previously created by the team has been acquired for US$210 million, and it has also created a DeFi protocol with a TVL of US$180 million.

5. Wav Leaks: Pump.fun in the music industry, focusing on music crowdfunding and trading

Project Details:

Music streaming revenue reached $19 billion last year, up 10% year-on-year. But compared with video creators, musicians have weaker digital monetization capabilities: on Patreon, musicians earn 1/50 of what video creators earn, while Bandcamp, a high-quality music download platform, only earns 1% of streaming revenue.

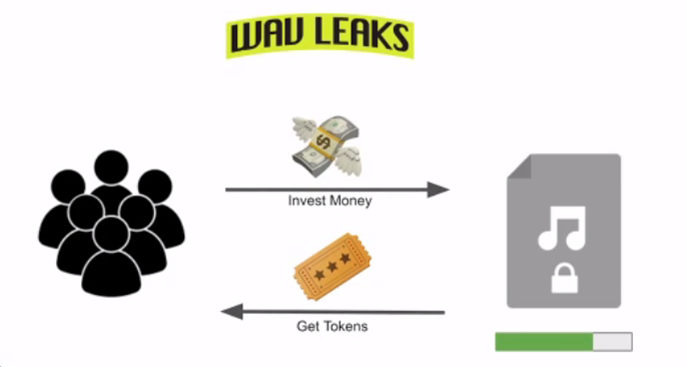

Wave Leaks allows fans to collectively purchase exclusive music. Inspired by Group Buys (an underground rap music crowdfunding phenomenon where singles often raise over $20,000) and the community effect of meme coins, the platform has created a unique incentive mechanism:

Fans invest in songs and receive tokens, which are both necessary for listening to songs and can be traded in the secondary market. This allows artists to monetize through their core fan base and reward early supporters. The founder of the project is a music producer with a technical background. He has worked with artists such as Jake Paul, and his works have accumulated more than 100 million plays.

6. Whalefare: A mobile game that combines gambling and strategy

Project official website: https://whalefare.vercel.app/

Project Details:

The crypto game market has huge potential. Axie Infinity, Stepn, and Pixels generated a total of $1.6 billion in revenue from 2021 to 2023. Emerging play to earn games such as Katison and Hamster Combat have also reached unicorn valuations due to airdrop expectations.

But these games are either too simple to retain users, or, like Primodium and Dark Forest, introduce complex on-chain mechanisms that damage the user experience.

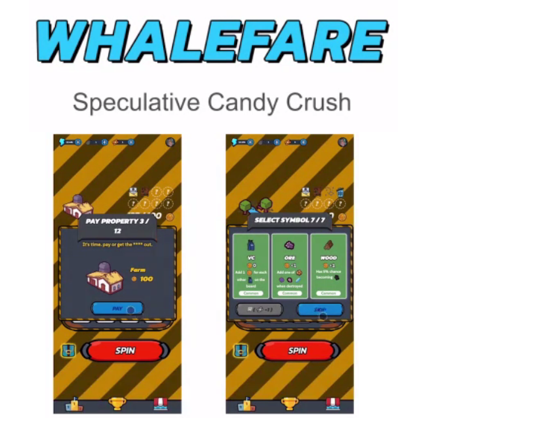

Whalefare combines casino-style gambling with the strategic depth of card building: players build cities by spinning slot machines, and the symbols that appear affect the progress of the game. The game uses the immediate dopamine rush brought by gambling to attract players, and then gradually guides them into a deeper decision-making process.

This design not only maintains the core position of cryptocurrency as an incentive, but also avoids an operating model that relies solely on airdrops and advertising. Within 6 weeks after the project implemented the speculation mechanism, the speculative trading volume exceeded US$9,000 and increased by 50% per week.

7. Qiro: Decentralized RWA Loan Underwriting Market

Project website: https://www.qiro.fi/

Project Twitter: https://x.com/Qiro_Finance

Project Details:

The private lending market will reach $1.7 billion in 2023, with an annual growth rate of 12%. Although protocols such as Centrifuge and Goldfinch have issued $15 billion in loans on the chain, DeFis bad debt rate is 4 times that of traditional finance, mainly due to insufficient credit assessment. Existing lending protocols rely on asset originators for credit assessment, and these centralized intermediaries lack the motivation to select high-quality loans.

Kiro has built a network of underwriters to protect lending protocols from bad debt losses. Underwriters must invest in the riskiest loan shares, ranked according to historical performance, ensuring they have an incentive to accurately assess borrower qualifications.

Currently working with 6 professional underwriters, the company has tested $20 million of asset origination demand with $3 million of liquidity. The team has 10 years of experience in emerging market credit and has previously successfully raised $100 million in debt financing.

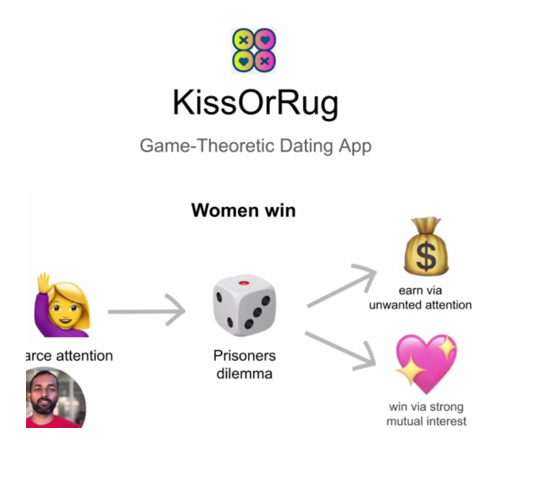

8. Kiss or Rug: Dating app with crypto-economic incentives

Project website: https://kissorrug.xyz/

Project Twitter: https://x.com/kissorrug

Project Details:

The dating app market will generate revenue of $5.6 billion in 2023, mainly through value-added services such as priority display, rose gifts and privileged likes. However, the ratio of male to female users is seriously unbalanced (80:20), resulting in a large number of harassment for women and difficulty for men to get responses.

Kiss or Rug uses crypto-economic incentives to balance the user experience for men and women. Drawing on the game theory of the prisoners dilemma, the platform has designed a value transfer mechanism: male users need to pledge funds to be matched, and if the female responds, both parties keep the funds; if the female refuses, she will receive a reward.

This ensures that women always gain: either by rejecting someone they鈥檙e not interested in, or by connecting with someone they鈥檙e actually interested in.

A few weeks after the launch, the gender ratio of the platform has reached 35%, which is 70% higher than the industry average. The short video app previously created by the founder received investment from Sequoia and was successfully acquired by a unicorn company. He has experience in acquiring 10 million users with zero marketing expenditure.

9. Force Prime: A prediction market based on traditional strategy game design

Project official website: https://forceprime.io/

Project Twitter: https://x.com/ForcePrime_io

Project Details:

From ICOs to NFTs to meme coins today, speculation has always been one of the biggest product-market fits in cryptocurrency. But as projects continue to simplify the user experience and increase speculation, they have not been able to solve the problem of user attention span – users tend to jump to the next hot project instead of waiting for the current project to rise again.

While DeFi games like Wolfgame do a good job of making speculation more interesting, they lack the classic game loop mechanics; and while Web2.5 games have classic gameplay, the user experience is hampered by separating game props from speculation.

First Prime solves this problem by returning to the core gameplay of traditional strategy games. The game is based on the gameplay of the Heroes of Might and Magic series, and implements the complete game mechanics on the chain. Players choose different heroes to fight in the tournament, and a leaderboard is generated based on the players performance. Speculators can buy series shares and win the prize pool by predicting the performance of top players. The core innovation lies in separating the game utility from the speculative asset – speculators are actually trading meme coins that derive meaning from the broader game meta.

After 6 weeks of implementing the speculation mechanism, the speculative trading volume exceeded $9,000 and grew by 50% per week. The team members met in college and have more than 12 years of experience in the game industry. They have developed 17 games with tens of millions of users and created the Unity SDK for porting Web2 games to the blockchain. Seed round financing is currently underway.

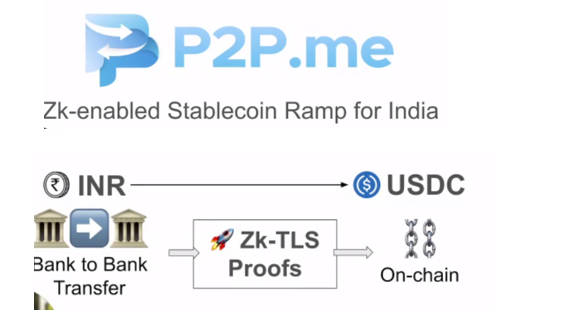

10. P2P.me: ZK-based Indian stablecoin payment channel

Project official website: https://p2p.me/

Project Twitter: https://x.com/P2P dotme

Project Details:

India is a global leader in cryptocurrency adoption, with an annual over-the-counter trading volume of $30 billion and growing at a rate of 16%. However, Indian users face serious payment difficulties: mainstream exchanges such as Wazrex and CoinDCX have banned rupee deposit users from withdrawing cryptocurrencies, limiting users ability to participate in the on-chain DeFi ecosystem. Although platforms such as Binance offer P2P trading options, transactions are slow and fraud is frequent, and users often face the risk of having their bank accounts frozen.

P2P.me provides a fast and secure on-chain payment channel. It verifies bank transfers between users through zkTLS and enables fast on-chain exchange with USDC. To prevent P2P fraud, the platform has established an on-chain reputation system based on user credit, and uses KYC supported by ZK technology to analyze user social graphs and transaction history to effectively prevent fraudsters.

It has processed 7.5 million transactions with a transaction volume of more than 1 million USDC and has achieved profitability. The founder graduated from the Indian Institute of Technology and once expanded a food delivery business to an annual revenue of US$2 million and successfully exited.

11.RPS.live: Create Twitch live broadcasts of gambling games

Project official website: https://www.rps.live/

Project Twitter: https://x.com/rps_live_gg

Project Details:

The online gambling market is expected to grow from 2023 to $114 billion in 2028. Traditional gambling games are mainly aimed at users over 50 years old (accounting for 70% of revenue), while the new generation of users prefer to participate in real-time gambling live broadcasts on platforms such as TikTok. However, in this model, players cannot obtain actual benefits, and all income flows to the platform and the anchor, and the anchor is often blocked due to payment issues.

RPS Live allows creators to monetize their influence without permission. By bypassing traditional payment restrictions through cryptocurrency, players can earn cash while gaining social recognition. In the first demo version, players can join the creators team, make moves together and bet while watching the live broadcast, and earn income by winning the game or betting community assets. The founding team comes from TikTok and Tinder and has received pre-seed round financing led by Entries in Game and Alliance.

The above is a complete introduction to all 11 projects. Overall, these projects cover many important tracks in the cryptocurrency industry, including infrastructure, financial innovation, games/social, content economy, and payment systems.

If you are interested in these projects or more, you can also visit here directly for more information.

This article is sourced from the internet: Overview of ALL13 Demo Day 11 demo projects

Related: How Roam can break the DePIN dilemma

The DePIN (Decentralized Physical Infrastructure Network) track emerged in 2019. After several years of development, it has now reached a certain scale, and the total token market value has reached tens of billions of US dollars. However, the DePIN track still faces many problems, such as the huge mismatch between user needs and products, the problem of large-scale adoption, the problem of unsustainable economic models, and the problem of inability to expand infrastructure, etc. This leads to most people being unable to feel the inclusiveness that the DePIN track projects should have, and can only participate in the hype of Tokens. Therefore, the impact of DePIN has become limited. An excellent DePIN project should generally have the following characteristics: 1. Real application requirements; 2. Easy-to-use products that meet needs; 3.…

“If you’ve lost money fraudulently to any company, broker, or account manager and want to retrieve it, contact www.Bsbforensic.com They helped me recover my funds!”

👍