Three Times in One Month, How Did Raydium Become the King of Solana DeFi?

Original title: Raydium: King Of Solana De-Fi

Original author: @0xkyle__

Original translation: zhouzhou, BlockBeats

Editors note: This article mainly talks about Raydiums position and advantages on the Solana blockchain, especially its dominance in meme coin transactions. The article also analyzes Raydiums growth strategy, liquidity management, buyback mechanism, etc., and explains how these mechanisms help Raydium stay ahead in the Solana ecosystem.

The following is the original content (for easier reading and understanding, the original content has been reorganized):

Preface

The 2024 cycle has so far seen Solana’s dominance, with the main narrative of this cycle, meme coins, all born on Solana. Solana is also the best performing Layer 1 blockchain in terms of price appreciation, up about 680% year to date.

Although the meme coin is deeply intertwined with Solana, Solana has regained attention as an ecosystem since its recovery in 2023, and its ecosystem has flourished – tokens of protocols like Drift (Perp-DEX), Jito (liquidity staking), Jupiter (DEX aggregator) have all reached billion-dollar valuations, and Solanas active addresses and daily transaction volume surpass all other chains.

At the heart of this thriving ecosystem is Raydium, Solana’s leading decentralized exchange. The old saying, “selling shovels during a gold rush” perfectly describes Raydium’s position. While meme coins are attracting a lot of attention, Raydium is quietly driving liquidity and trading behind the scenes, supporting this activity. Thanks to the continued influx of meme coin trading and broader DeFi activity, Raydium has solidified its position as critical infrastructure in the Solana ecosystem.

At Artemis, we believe in an increasingly fundamentals-driven world – therefore, the purpose of this article is to construct a fundamentals report that highlights Raydiums position in the Solana ecosystem. We take a data-driven approach and aim to analyze Raydiums place in the Solana ecosystem from first principles.

Raydium Brief Introduction

Launched in 2021, Raydium is an automated market maker (AMM) built on Solana that supports permissionless pool creation, ultra-fast trading, and yield earning. Raydium’s key differentiator is its structure — Raydium is the first AMM on Solana and launched the first hybrid AMM in DeFi that supports order books.

When Raydium launched, they adopted a hybrid AMM model that allowed liquidity from idle pools to be shared with centralized limit order books, whereas at the time regular DEXs could only access liquidity in their own pools, meaning that liquidity on Raydium also created a market on OpenBook that could be traded on any OpenBook DEX GUI.

While this was a major differentiator early on, the feature is currently turned off due to an influx of primarily long-tail markets.

Raydium currently offers three different types of pools, namely:

-

Standard AMM Pool (AMM v4), formerly known as Hybrid AMM

-

Constant Product Exchange Pool (CPMM), supporting Token 2022

-

Centralized Liquidity Pool (CLMM)

When a swap is made on Raydium, a small fee is charged depending on the specific pool type and pool fee tier. This fee is distributed among liquidity providers, Raydium token buybacks, and the Treasury.

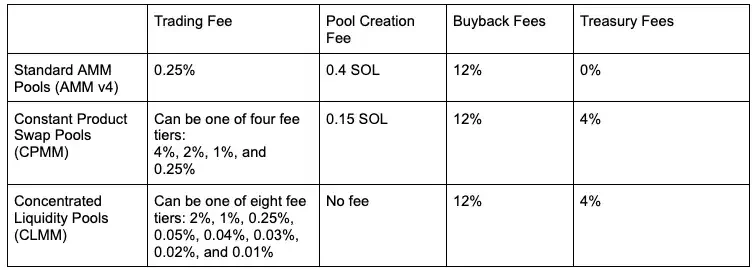

Below are the transaction fees, pool creation fees, and protocol fees for different Raydium pools that we have recorded. Here is a quick breakdown of each term and its corresponding fee level:

-

Transaction Fees: Fees paid by traders when exchanging

-

Buyback Fee: A percentage of the transaction fee used to buy back Raydium tokens

-

Treasury Fee: A percentage of transaction fees allocated to the Treasury

-

Pool creation fee: A fee charged when a pool is created, designed to prevent pool abuse. The pool creation fee is controlled by the protocol multi-signature and is used for protocol infrastructure costs.

Figure 1. Raydium fee structure

DEX Ecosystem on Solana

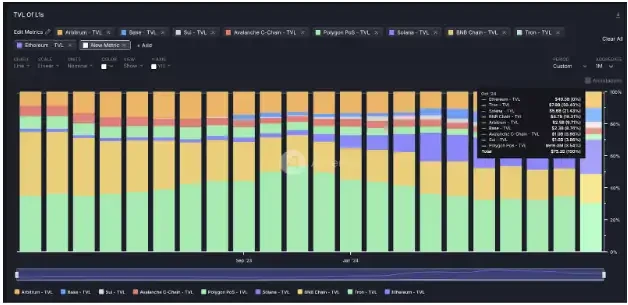

Figure 2. TVL on Solana

Now that we have analyzed how Raydium works, we will evaluate its place in the Solana DEX ecosystem. Needless to say, Solana has already climbed to the top of the L1 chains in the 2024 cycle – looking at Ethereum, Solana is the third highest TVL chain, behind Tron (second) and Ethereum (first).

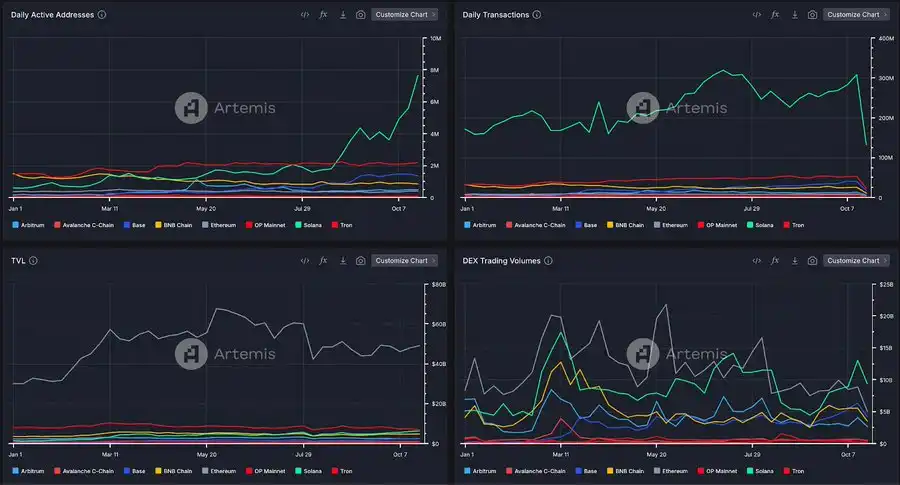

Figure 3. Daily active addresses, daily transaction volume, TVL, and DEX transaction volume of each chain

Solana continues to dominate metrics related to user activity, such as daily active addresses, daily transaction volume, and DEX transaction volume. The increase in activity and currency liquidity on Solana can be attributed to several different factors, the most notable of which is the meme coin craze on Solana.

Solana’s high speed and low cost in settlement, combined with the smooth user experience it provides for Dapps, has led to the growth and prosperity of on-chain transactions. Tokens like BONK and WIF have reached multi-billion dollar market caps, and with the emergence of Pump.fun, a meme coin launch platform, Solana has become the de facto place for meme coin trading.

Solana is far and away the most widely used Layer 1 during this cycle, and continues to lead other L1s in terms of trading activity. As a direct beneficiary of increased activity, this means that DEXs on Solana are performing extremely well – more traders means more fees, which in turn means more revenue for the protocol. However, even among DEXs, Raydium has managed to capture a significant market share, as evidenced by the following data:

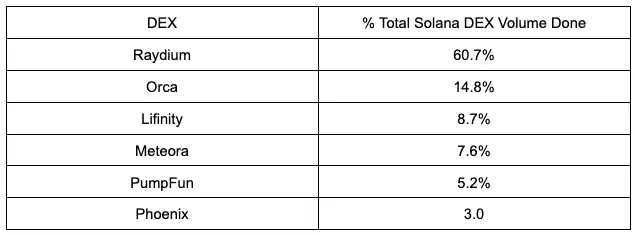

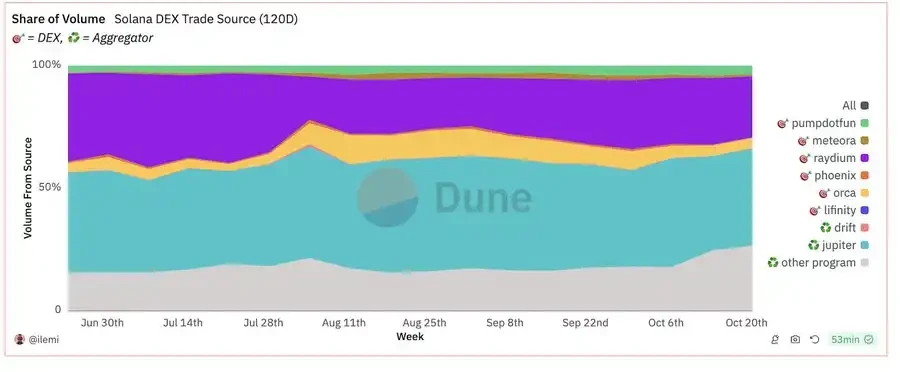

Figure 4. SolanaDEX trading volume market share

Currently, Raydium ranks first among other SolanaDEXs and has the highest trading volume among all DEXs. Raydium accounts for 60.7% of the total trading volume of SolanaDEX, thanks to Raydiums support for a variety of activities – from meme coins to stablecoins.

One way Raydium achieves this is by providing pool creators and liquidity providers with multiple options when creating new markets, with users being able to choose a constant product pool for price discovery at the time of initial issuance. Or choose to provide liquidity in a more tightly bounded range in a centralized liquidity pool – this allows initial price discovery of long-tail assets to take place on Raydium while remaining competitive in markets such as SOL-USDC, stablecoins, LST, etc.

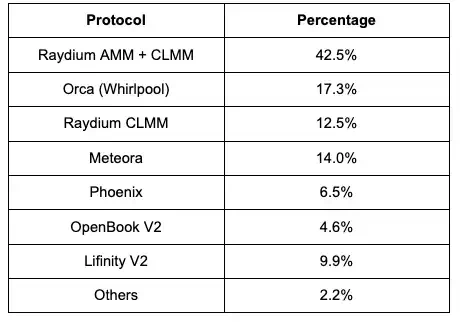

Figure 5. Liquidity between SolanaDEX

Additionally, Raydium remains the most liquid DEX when trading, and it is important to note that DEXs often face economies of scale as traders tend to cluster on the most liquid exchanges to avoid slippage. Liquidity breeds liquidity – this creates a positive cycle where the largest DEXs attract the most traders, which in turn attracts liquidity providers who profit through fees, which in turn attracts more traders who want to avoid slippage – and the cycle continues.

Liquidity is often overlooked when comparing DEXs, but it is critical when evaluating top performers — especially considering that traders on Solana are trading meme coins, which are not only extremely illiquid, but also require a common rally point. If liquidity is fragmented across DEXs, it will lead to a poor user experience and frustration with each purchase of a different meme coin.

Examining the relationship between memecoin and Raydium

Raydium’s popularity is also due to the resurgence of meme coins on Solana, specifically the meme coin launch platform launched by Pump.Fun, which has generated over $100 million in fees since its inception earlier this year.

There is a direct link between Pump.Fun’s meme tokens and Raydium – when the tokens issued on Pump.Fun reach a market cap of $69,000, Pump.Fun will automatically deposit $12,000 worth of liquidity into Raydium. Continuing with the emphasis on liquidity, this means that Raydium is actually the most liquid platform for trading meme tokens.

It’s like a virtuous cycle, pump.fun connects with Raydium > meme coins are issued here > people trade here > it gets liquidity > more meme coins are issued here > it gets more liquidity, and the cycle repeats itself.

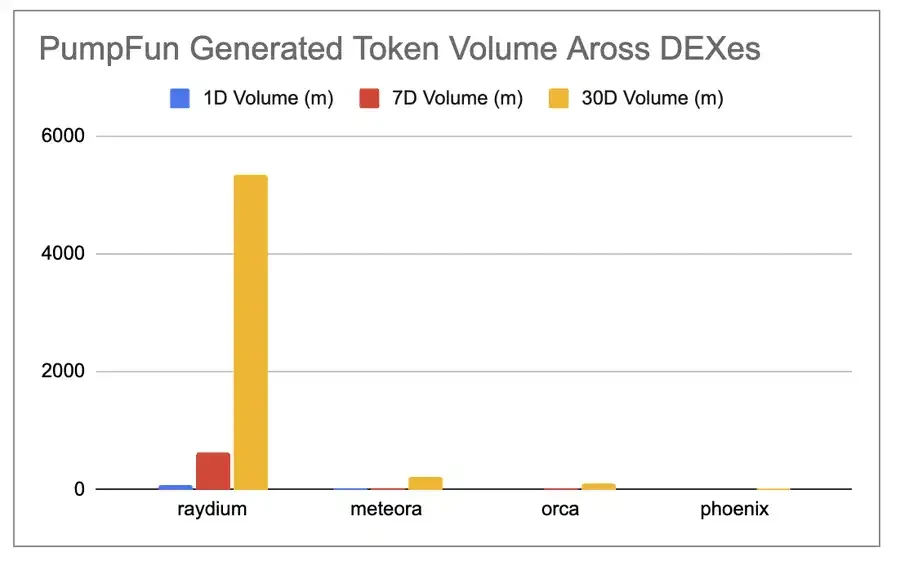

Figure 6. Trading volume of Pump.Fun generated tokens on DEX

Therefore, Raydium is considered to follow the power law principle, and almost more than 90% of the meme coins generated by Pump.Fun are traded on Raydium. Just like a large shopping mall in a city, Raydium is the largest shopping mall on Solana, which means that most people will choose to shop in Raydium, and most merchants (tokens) also want to open stores there.

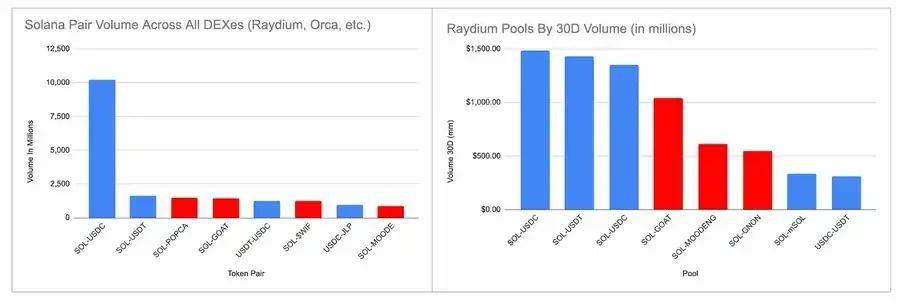

Figure 7. Comparison of trading volume (30 days) of trading pairs on Solana and Raydium (30 days) (red = meme coins, blue = non-meme coins)

Figure 8. Raydium trading volume by token type

It is important to note that while Pump.Fun depends on Raydium, the reverse is not true – Raydium does not rely solely on meme coins for trading volume. In fact, according to Figure 8, the top three trading pairs in the past 30 days are SOL-USDT/USDC, accounting for more than 50% of the total trading volume. (Note: the two SOL-USDC trading pairs are two different pools with different fee structures.)

Figures 7 and 9 also support this view. Figure 7 shows that SOL-USDC far exceeds all other DEX trading pairs in terms of trading volume. Although Figure 7 shows the trading volume of all DEXs, it still shows that the trading volume in the ecosystem is not entirely driven by meme coins.

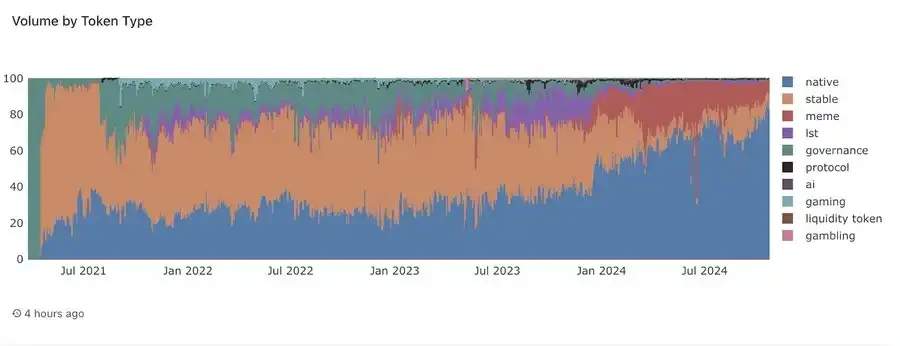

Figure 9 further shows Raydium’s transaction volume by token type, and we can see that “native tokens” account for the largest market share, over 70%. Therefore, while meme coins play an important role in Raydium, they do not constitute the entirety of the whole.

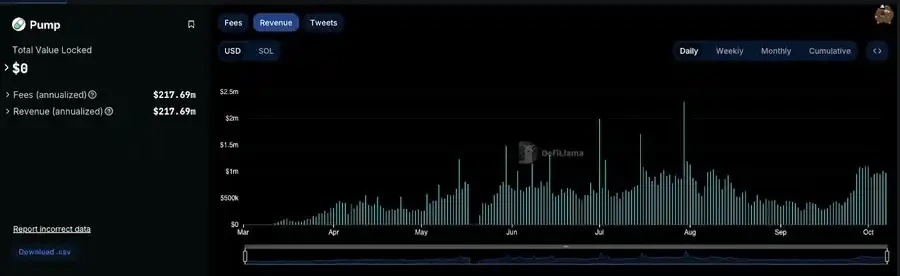

Figure 9. Pump.Fun revenue

Figure 10. Raydium revenue

That being said, meme coins are highly volatile, and pools with higher volatility generally generate higher fees. So while meme coins may not necessarily contribute that much to Solana’s liquidity pools in terms of trading volume, they are significant contributors to Raydium’s revenue and fees.

This is particularly evident when looking at data from September – since meme coins are cyclical assets, they tend to underperform in bad markets as risk appetite declines. Pump.Funs revenues therefore fell 67% from an average of $800,000 per day in July and August to around $350,000 in September; Raydiums fees fell by the same amount during this period.

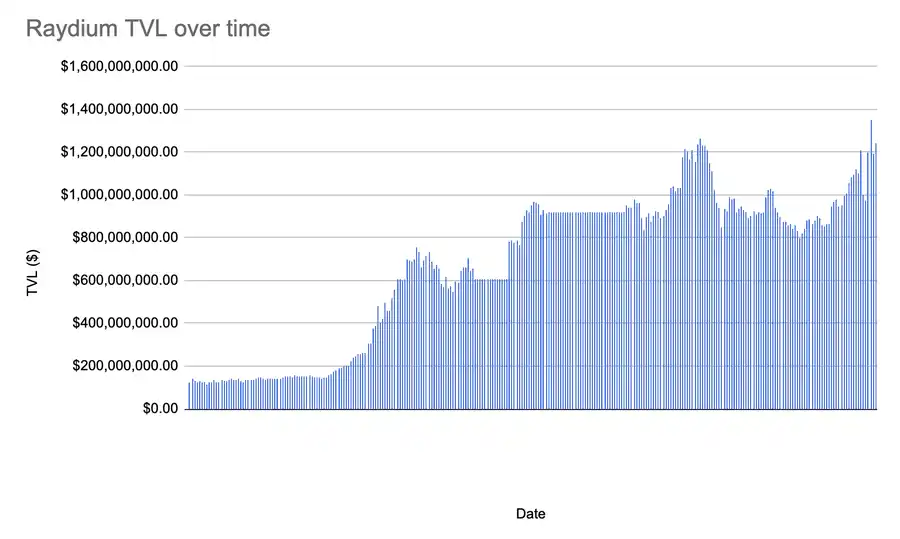

Figure 11. Raydium’s TVL over time

But like everything else in crypto, the industry is highly cyclical, and it’s normal for metrics to decline during bear markets as risk fades. Instead, we can focus on TVL as a measure of the true antifragility of a protocol — while revenue is highly cyclical and fluctuates as speculators come and go, TVL is an indicator of the sustainability of a decentralized exchange (DEX), reflecting its ability to stand the test of time.

TVL is similar to a mall’s “occupancy rate” — while fashion trends ebb and flow, and mall usage may vary from season to season, as long as a mall’s occupancy rate is above average, we can measure its success.

Similar to a well-utilized shopping mall, Raydium’s TVL has remained stable over time, indicating that while its revenue may fluctuate with market prices and sentiment, it has demonstrated its ability to serve as a staple product in the Solana ecosystem and become the best and most liquid DEX on Solana. Therefore, while meme coins do contribute to some of its revenue, trading volume is not always dependent on meme coins, and liquidity will still flock to Raydium regardless of the season.

Raydium vs Aggregators

Figure 12. SolanaDEX transaction source

While Jupiter and Raydium do not compete directly, Jupiter acts as a key aggregator in the Solana ecosystem, routing transactions through multiple decentralized exchanges (DEXs), including Raydium, ensuring that transactions are routed in the most efficient way. Basically, Jupiter acts as a meta-platform, ensuring that users get the best price by pulling liquidity from various DEXs such as Orca, Phoenix, Raydium, etc. Raydium, in turn, acts as a liquidity provider, supporting many of the transactions routed by Jupiter by providing a deep liquidity pool for Solana-based tokens.

Figure 13. 24-hour Jupiter trading volume by AMM

While the two protocols work closely together, it is worth noting that the share of organic volume directly contributed by Raydium is slowly increasing, while Jupiter’s share is gradually decreasing. At the same time, Raydium accounts for almost 50% of all market maker volume on Jupiter.

This shows that Raydium has been successful in building a more robust, self-sufficient platform that is able to attract users directly rather than relying on third-party aggregators like Jupiter.

The increase in direct trading volume shows that traders find value in using Raydiums native interface and liquidity pools, and users are looking for the most efficient and comprehensive DeFi experience without going through aggregators. Ultimately, this trend highlights Raydiums independent capabilities as a major liquidity provider in the Solana ecosystem.

Raydium vs. Other Solana DEXs

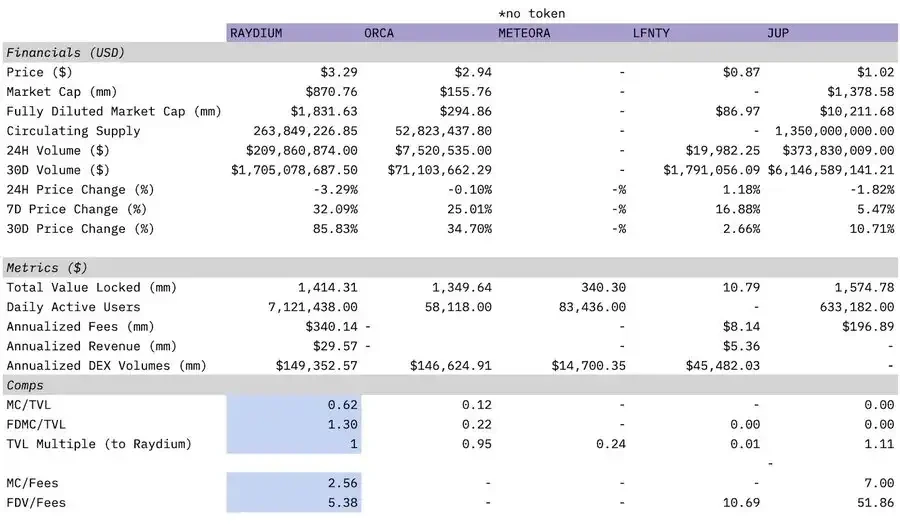

Finally, here’s a comparison chart of Raydium, which we built using the Artemis plugin, versus other SolanaDEXs (including aggregators).

Figure 14. Comparison between Raydium and SolanaDEX

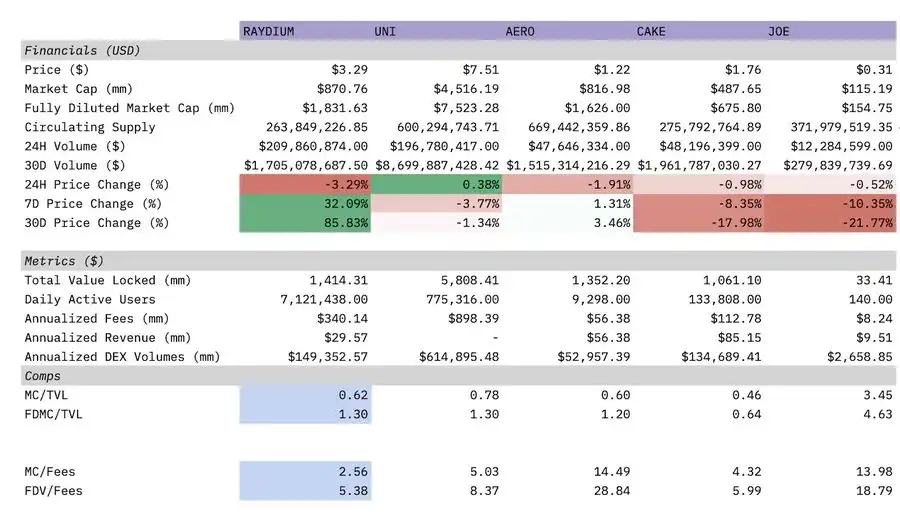

Figure 15. Comparison of Raydium and popular DEXs

In Figure 13, we compare Raydium to the most popular DEXs on Solana, primarily Orca, Meteora, and Lifinity — these four DEXs together account for 90% of Solana’s total DEX volume, and we also include Jupiter as an aggregator. Although Meteora does not have a token, we still include it for comparison purposes.

We can see that Raydium trades at the lowest market cap/expense ratio and fully diluted market cap/expense ratio of all DEXs. Raydium also has the most daily active users, and the TVL of other DEXs is more than 80% lower than Raydium – except for Jupiter, which we consider to be an aggregator rather than a DEX.

In Figure 14, we compare Raydium to other more traditional DEXs on other chains – as can be seen, Raydium has more than double the annualized DEX volume of Aerodrome, but a lower market cap/revenue ratio.

Raydium’s Token Economics

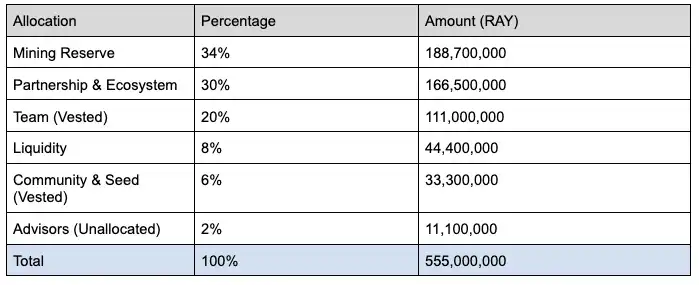

Here is a breakdown of Raydium’s token economics:

NOTE: Team and Seed (25.9% of total) are fully locked in the first 12 months after the Token Generation Event (TGE), and unlock daily from month 13 to month 36, ending on February 21, 2024.

The Raydium token has multiple use cases: RAY holders can stake their Raydium tokens to earn additional RAY. Additionally, it is also a mining reward used to attract liquidity providers, allowing for thicker liquidity pools to form. Although the Raydium token is not a governance token, a governance method is currently being developed.

Although the popularity of issuing tokens has declined after the DeFi summer, it is worth noting that Raydium has a very low annual inflation rate and its annualized buyback has performed well in DeFi. Currently, the annualized issuance is about 1.9 million RAY, of which RAY staking accounts for 1.65 million of the total issuance, which is very small compared to the issuance of other popular DEXs at their peak. At current prices, RAY issues about $5.1 million worth of RAY per year. This is very small compared to Uniswap, which has a daily issuance of $1.45 million before full unlocking and an annual issuance of $529.25 million.

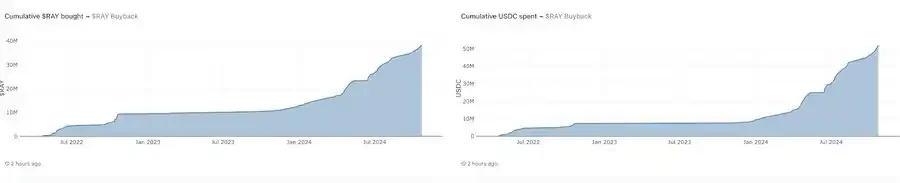

As we remember, every time a trade is made in Raydium’s pool, a small transaction fee is charged. According to the documentation: “Depending on the fees of a particular pool, these fees are allocated to incentivize liquidity providers, RAY buybacks, and the treasury. In summary, 12% of all transaction fees go to buybacks of RAY, regardless of the fee tier of a particular pool.” This fact, combined with Raydium’s trading volume, produces some pretty amazing results.

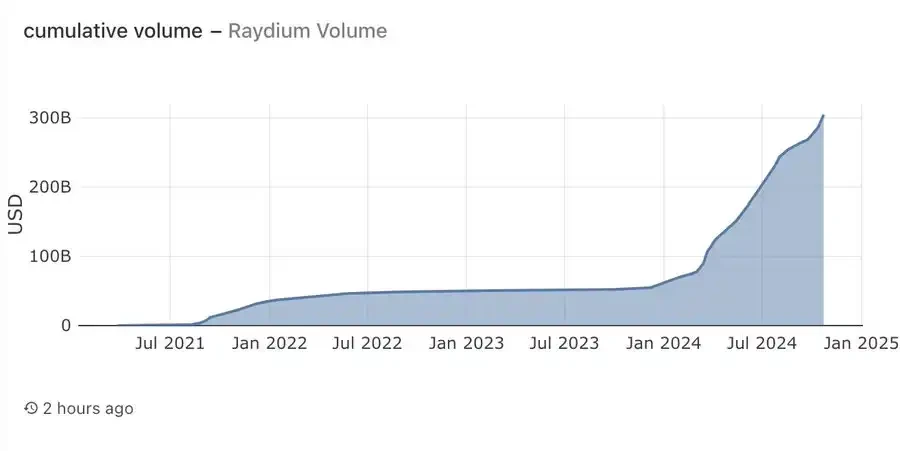

Figure 16. Raydium cumulative transaction volume

Figure 17. Raydium repurchase data

Raydium, with a cumulative trading volume of over $300 billion, has successfully repurchased approximately 38 million RAY tokens, worth approximately $52 million. This is equivalent to 14% of its current circulating supply. Raydiums repurchase program is leading the entire DeFi field, helping Raydium stand out among all Solana DEXs.

Raydium Advantages

Overall, Raydium has a clear advantage among all of Solana’s DEXs and is best positioned to continue growing as Solana continues to grow. Raydium’s growth story over the past year has been remarkable, and with meme coins’ growing dominance in the crypto market, especially the recent meme coin craze around AI (such as GOAT), its growth momentum seems to show no signs of stopping.

As Solanas primary liquidity provider and automated market maker (AMM), Raydium has a strategic advantage in capturing market share of emerging trends. In addition, Raydiums commitment to innovation and ecosystem development is reflected through its frequent upgrades, strong incentives for liquidity providers, and active engagement with the community. These factors indicate that Raydium is not only ready to adapt to the changing DeFi landscape, but will also lead this trend.

Ultimately, Raydium, as an important infrastructure in the rapidly evolving blockchain ecosystem, seems poised for good growth in the future if it continues on its current trajectory.

Disclaimer: This article does not constitute trading advice.

Original link: Artemis Research

This article is sourced from the internet: Three Times in One Month, How Did Raydium Become the King of Solana DeFi?

Related: The situation has reversed, is the rising tide of liquidity in the East coming?

Original article by Sean Tan, Primitive Ventures Original translation: TechFlow As a multi-strategy investment institution that does not stick to a single asset, our investment philosophy is not just about finding opportunities. We value how to build an investment framework that can predict and adapt to future market changes, and constantly seek the best balance between risk and return. What attracts us most are often those opportunities that are misunderstood or ignored by most market participants. Based on the experience in the foreign exchange and cross-border markets over the past decade, we have found that the transfer of liquidity or sudden external shocks are often the best catalysts. These major events often force market participants to adjust their portfolios quickly under tight time pressure. When large amounts of money scramble…