Grass airdrop claim caused Phantom wallet to crash, token price rose by more than 80% after hitting bottom

Original | Odaily Planet Daily ( @OdailyChina )

Author | Asher ( @Asher_0210 )

“Finally, the coin is being issued” is believed to be the voice of the “grass-grabbing party” in the Grass community.

At 9:30 last night, after the Grass token claim was officially opened (claim link: https://www.grassfoundation.io/claim ), due to the popularity of user claims, thousands of people tried to claim the airdrop at the same time, causing Phantoms backend system to become unresponsive and crash, and the outage lasted for 60 minutes.

Since the Grass token was not listed on Binance as expected by the community, and even OKX only launched contracts instead of spot. Therefore, the sentiment of smashing the market after receiving the token spread in the community. According to the market conditions (GRASS token contract address: Grass7B4RdKfBCjTKgSqnXkqjwiGvQyFbuSCUJr3XXjs), when the GRASS token was first applied for, the token fell from $0.66 to below $0.5. It can be seen that the grass party did not hesitate to smash the market after receiving the token. However, a large number of buying orders appeared afterwards, and the price of GRASS once broke through $0.9, with an increase of more than 80% from the low point. Although the second round of smashing occurred in the early morning, the price of GRASS was quickly pulled up again, and the current price is temporarily reported at $0.904.

At the same time, according to the official website, there are nearly 5 million GRASS tokens staked, and the current APR is 253.49%. It is worth mentioning that it takes 7 days to unlock the tokens.

Grass Project Introduction

Image source: Official Twitter

Grass (commonly known as Xiaocao in the community) is the first project deployed on Solana that combines AI, Depin, and Solana technologies, and is positioned as the data layer for AI. As a decentralized network, Grass aims to provide the data needed for AI model training by accessing the public network. This makes Grass an important part of the AI data layer as it expands to clean and prepare structured data sets, laying the foundation for its foundation in the field of AI.

According to ROOTDATA data , Grass has completed secondary financing with a total amount of US$4.5 million, including:

-

In July 2023, Grass announced the completion of a $1 million Pre-Seed round of financing, with No Limit Holdings, Big Brain Holdings, Builder Capital, Cogitent Ventures, Kyle Samani, Neel Somani, Rahim Noorani and others participating in the investment;

-

In December 2023, Grass announced the completion of a $3.5 million seed round of financing, led by Polychain Capital and Tribe Capital, with participation from Bitscale, Big Brain, Advisors Anonymous, Typhon V and Mozaik.

Token Economic Model

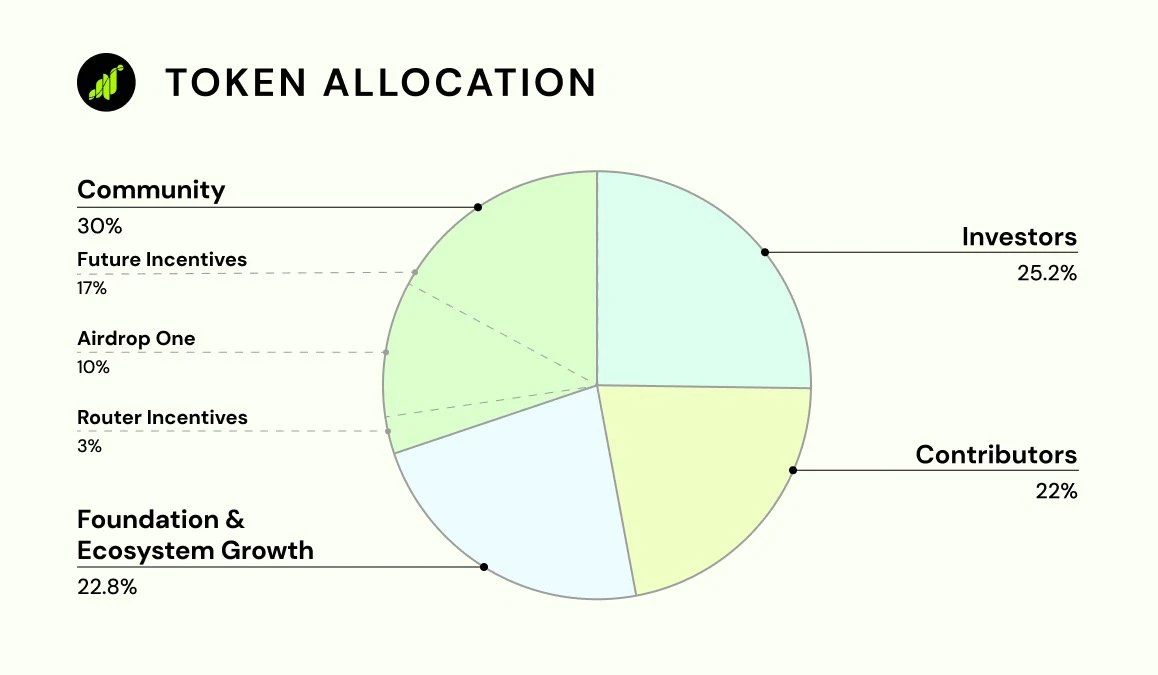

According to official information, the total supply of GRASS tokens is 1 billion, and the specific token distribution is as follows:

-

Community: 30% of the total token supply, which is 300 million tokens. The portion claimed in this airdrop is Airdrop One, which accounts for 10% of the total token supply, which is 100 million tokens; Future Incentives (future token incentives) account for 17%, which is 170 million tokens; Rounter incentives account for 3%, which is 30 million tokens;

-

Foundation and Ecosystem Development: 22.8% of the total token supply, or 228 million tokens, will be used to support community and development initiatives such as network upgrades, collaboration, research and development to expand the scale of the ecosystem;

-

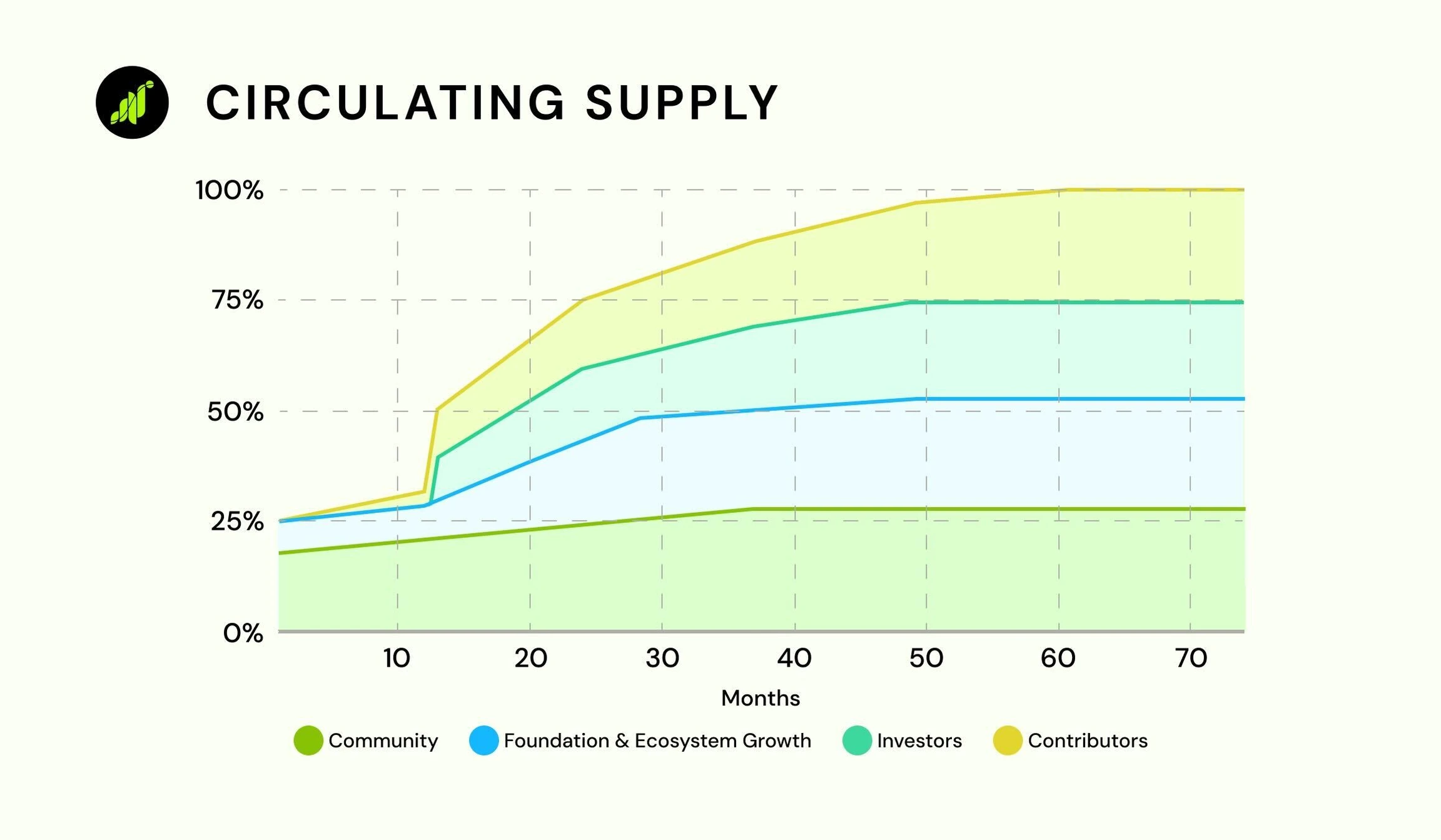

Investors: 25.2% of the total token supply, or 252 million tokens, will be locked for one year after TGE and then released linearly over the next year;

-

Website Contributors: 22% of the total token supply, which is 220 million tokens. They will be locked for one year after TGE and then released linearly over the next three years.

It can be seen that for the long-term development of the Grass project, 17% of the total supply of tokens are still used for future airdrops, and large-scale selling pressure will occur one year after TGE.

Combined with GoinGecko data , the current number of GRASS tokens in circulation is nearly 250 million, of which 100 million GRASS are airdropped tokens received by users.

For the grass-grabbing party, GRASS can finally come to an end. Although there is no story of getting rich by digging grass in the community, it can be regarded as a proper pigs trotter meal. Finally, because Grass will still have 17% of tokens airdropped in the future, while continuing to look for high-quality early projects, continuing to dig small grass may be a good strategy.

This article is sourced from the internet: Grass airdrop claim caused Phantom wallet to crash, token price rose by more than 80% after hitting bottom

Related: How to correctly value L1 assets?

Original article by Sam Kazemian, Frax Finance Original translation: Alex Liu, Foresight News There’s been a lot of talk about how to value different assets in crypto, especially with the recent AI memecoin craze, but I want to talk about my approach to valuing the most important crypto assets: L1 tokens vs. “Type 2” (dapp/L2/“equity” tokens). L1 tokens have a mysterious L1 premium that no one has systematically explained. Many people think it is a speculative Ponzi scheme, but the opposite is true. The L1 premium is a very important and fundamental property. L1 assets (ETH, SOL, NEAR, TRX, etc.) are the sovereign scarce assets corresponding to the blockchain economy. They naturally become the most liquid assets in the chain economy. Other projects accumulate it, build products/DeFi with it, and…