Analysis of daos.fun: Can the sudden popularity of ai16z recreate the myth of pump.fun?

Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

The rise of ai16z has boosted the popularity of meme fund startup platform daos.fun.

-

Odaily Note: For detailed information about ai16z , please see Inventory of the Hottest Meme Concepts: AI, Artists, Zoos and Minecraft .

Protocol Principle

daos.fun is positioned as a Solana-based meme fund launch platform, and the fund launched based on this platform will operate in the form of a DAO and issue corresponding DAO tokens (for example, ai16z is the DAO token of the fund).

The operation mode of daos.fun imitates the start-up mode of conventional funds, which can be divided into three stages: fundraising, operation and redemption.

Fundraising Stage

The first is the fundraising stage, during which the initiator of the fund ( daos.fun calls it creator, and currently only creators who have been reviewed can initiate the fund ) can set a target fundraising amount (in SOL) and have one week to publicly raise funds from the market. You can think of this stage as the fundraising stage of the fund DAO token.

After the fundraising starts, if the SOL fails, it can be redeemed ( early redemption will result in a 10% discount ). If successful, it will enter the next stage, the operation stage.

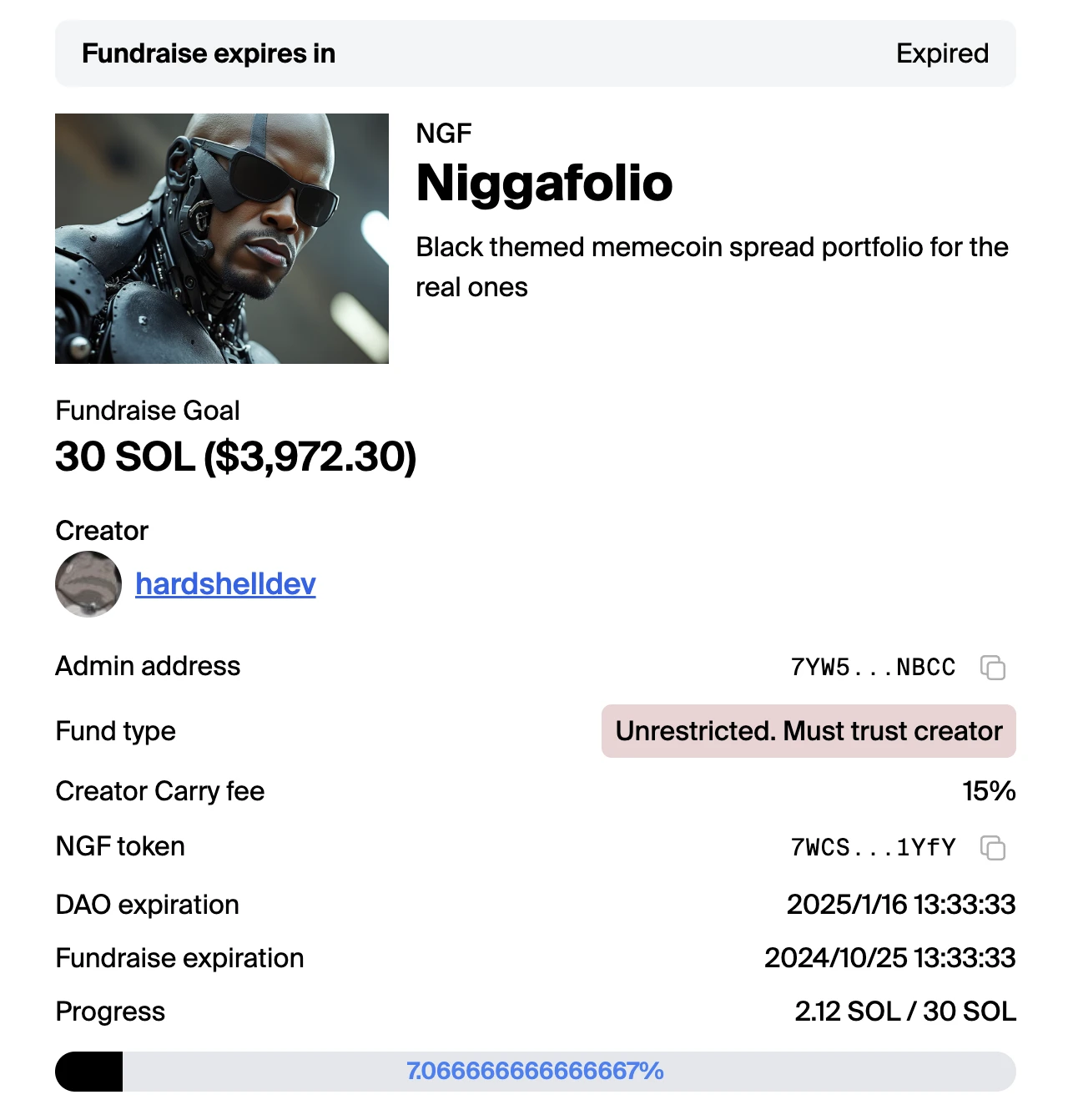

Example: In the above picture, the Niggafolio fund is in the fundraising stage, hoping to raise 30 SOL. So far, it has only obtained 2.12 SOL, with a progress of about 7%.

Operational stage

Next is the operation stage of the fund, during which the initiator of the fund (i.e., creator) can use the raised SOL to freely invest in various meme tokens on Solana. At this stage, the market value of the DAO token will fluctuate according to the real-time holdings of the fund (Odaily Note: It is not completely bound, in fact, the market value of most DAO tokens is currently at a premium ) , and the corresponding DAO tokens can also be publicly traded on the market.

Example: The total holdings of the ai 16 z fund are approximately US$800,000, but the market value of the DAO token is temporarily reported at US$47 million due to the market boom, which is a significant premium.

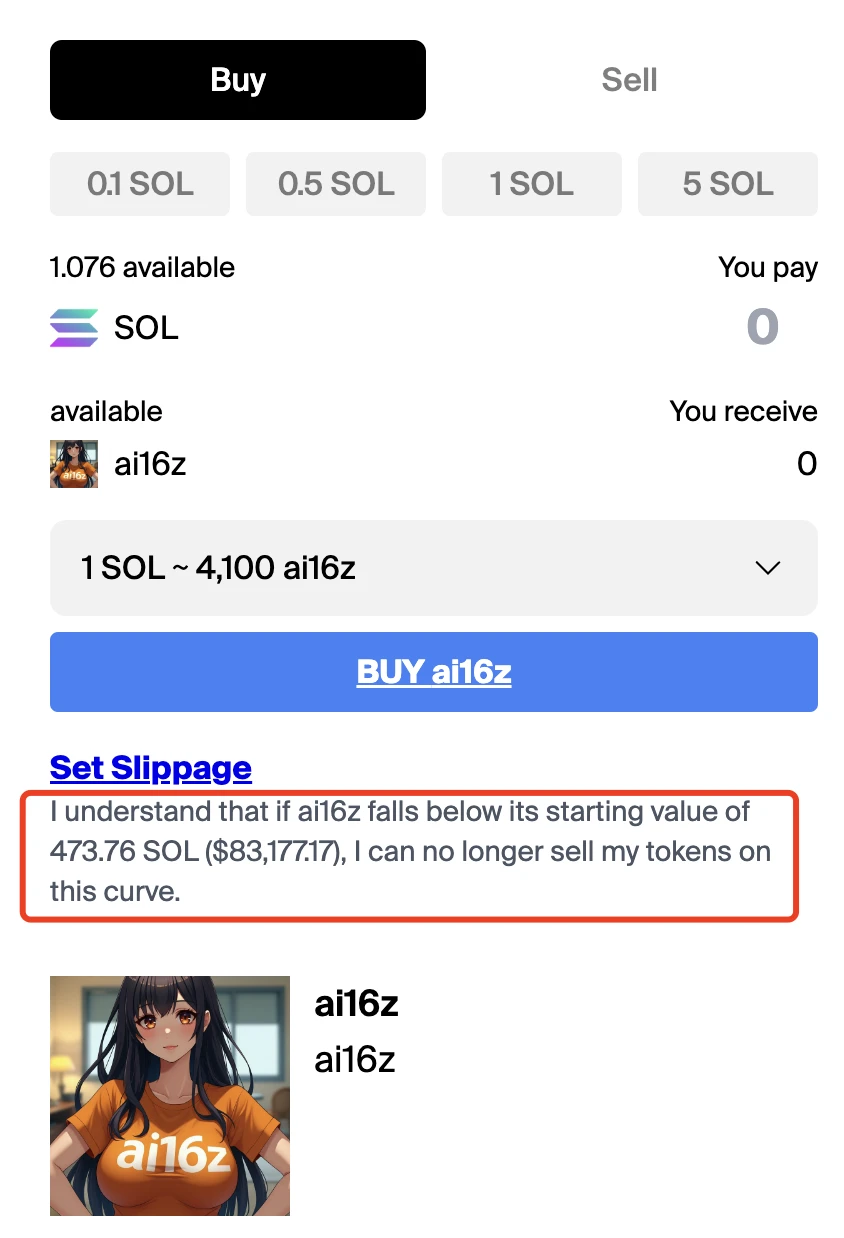

It should be noted that daos.fun has limited the downward space of the price curve of all DAO tokens, which means that only when the real-time market value of the DAO token is greater than the initial fundraising amount of the fund, the holders of the DAO token can sell it at any time for cash, otherwise they will need to wait for the third stage (redemption).

Redemption Phase

After the fund expires, the DAO wallet will be frozen and the SOL profits will be distributed back to the token holders. At this time, investors can redeem the underlying assets of the fund by destroying DAO tokens – if the market value is always higher than the initial fundraising amount, they can cash out at any time by selling.

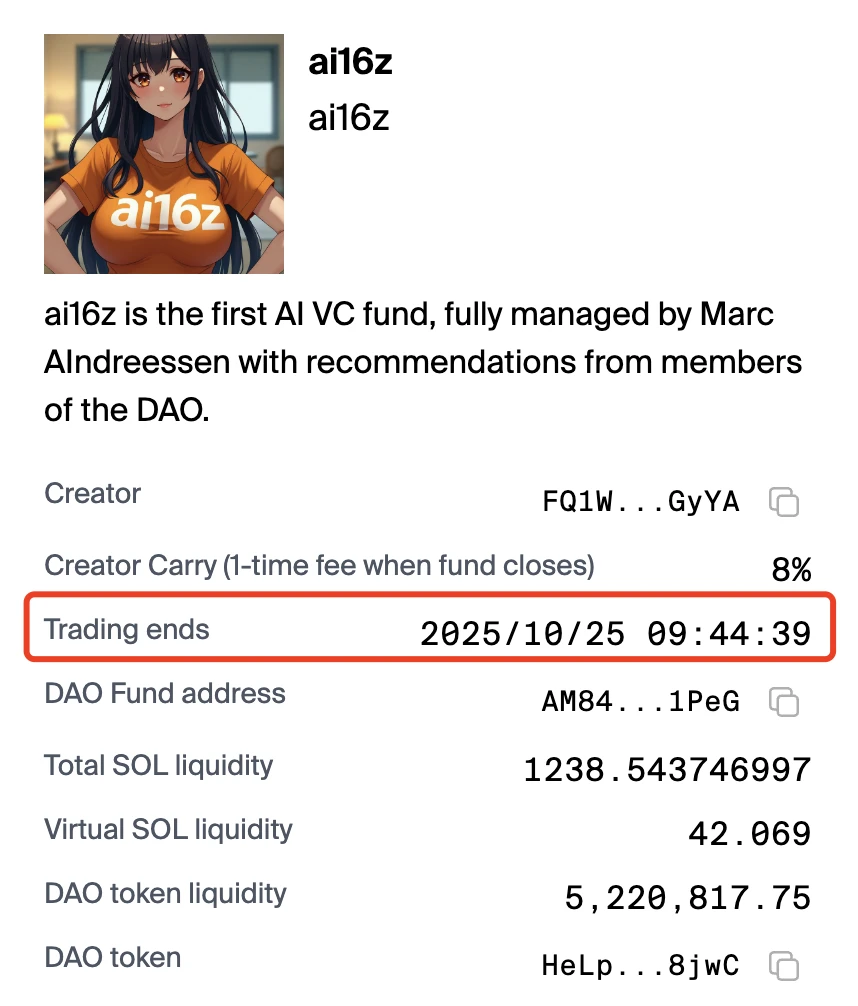

Example: A time limit must be set when fundraising, for example, ai 16 z is 1 year, ending on October 25, 2025.

Utility Analysis

In short, daos.fun is imitating the operating mechanism of a fund in a purely on-chain model, allowing retail investors who suffer from PVP to entrust their funds to more professional traders (who may of course be worse), and their profits and losses are entirely presented in the form of the rise and fall of DAO tokens.

The platform was launched in September this year, but it was not very popular before. It was not until the unexpected popularity of ai16z that it attracted more attention from the market. Compared with the more mature pump.fun, the current experience of the platform is relatively large and the development is a bit rough. Many users have reported the problem of interface freeze.

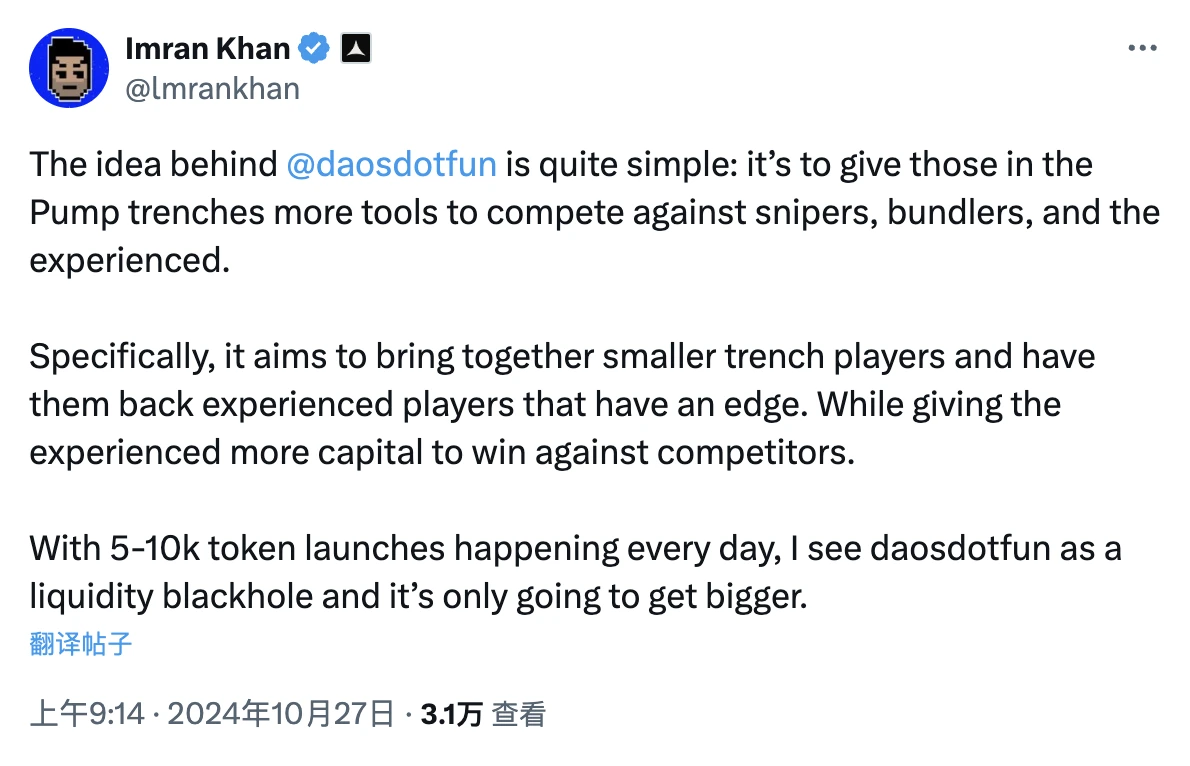

Imran Khan, co-founder of Alliance, gave a very high evaluation of daos.fun: The platform provides more tools for retail investors who are struggling with PVP to fight against snipers, clamps and experienced investors. Specifically, daos.fun can bring together smaller retail investors and let them support high-level players who have experience advantages; at the same time, high-level players can also obtain more capital to PVP with competitors. Now that 5,000 to 10,000 tokens appear every day, daos.fun will become a black hole of liquidity and will only get bigger and bigger.

Chinese KOL Timo (the original tweet is very detailed, it is recommended to read it directly) also mentioned in his personal post that daos.fun can partially solve the dilemma of retail investors being smart money in this casino, but also emphasized two layers of risks: one is that there is still uncertainty as to whether the so-called meme fund managers can help retail investors win money, and the other is that when the holdings are transparent, the fund managers original effective strategies may become ineffective.

In addition to ai16z , what other tokens are there?

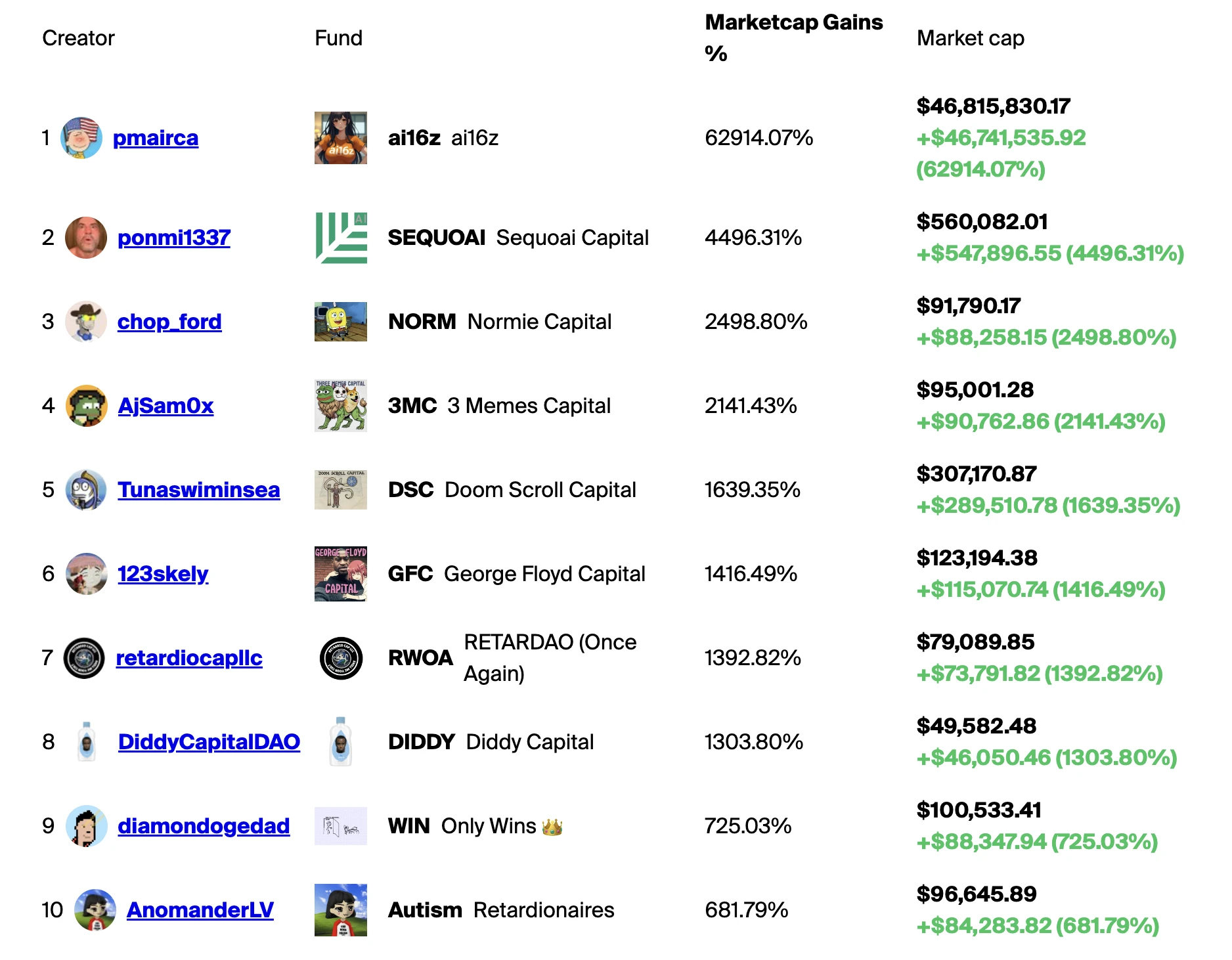

Since daos.fun has set up a review mechanism for the initiators of the fund, the total amount of tokens on the platform is not large at present.

Excluding several funds that are still in the fundraising stage, there are currently 22 fund DAO tokens that can be traded on the open market. In addition to the relatively familiar ai16z , there is also Sequoai, which imitates the well-known fund Sequoia, and many other funds whose names themselves have a certain meme color.

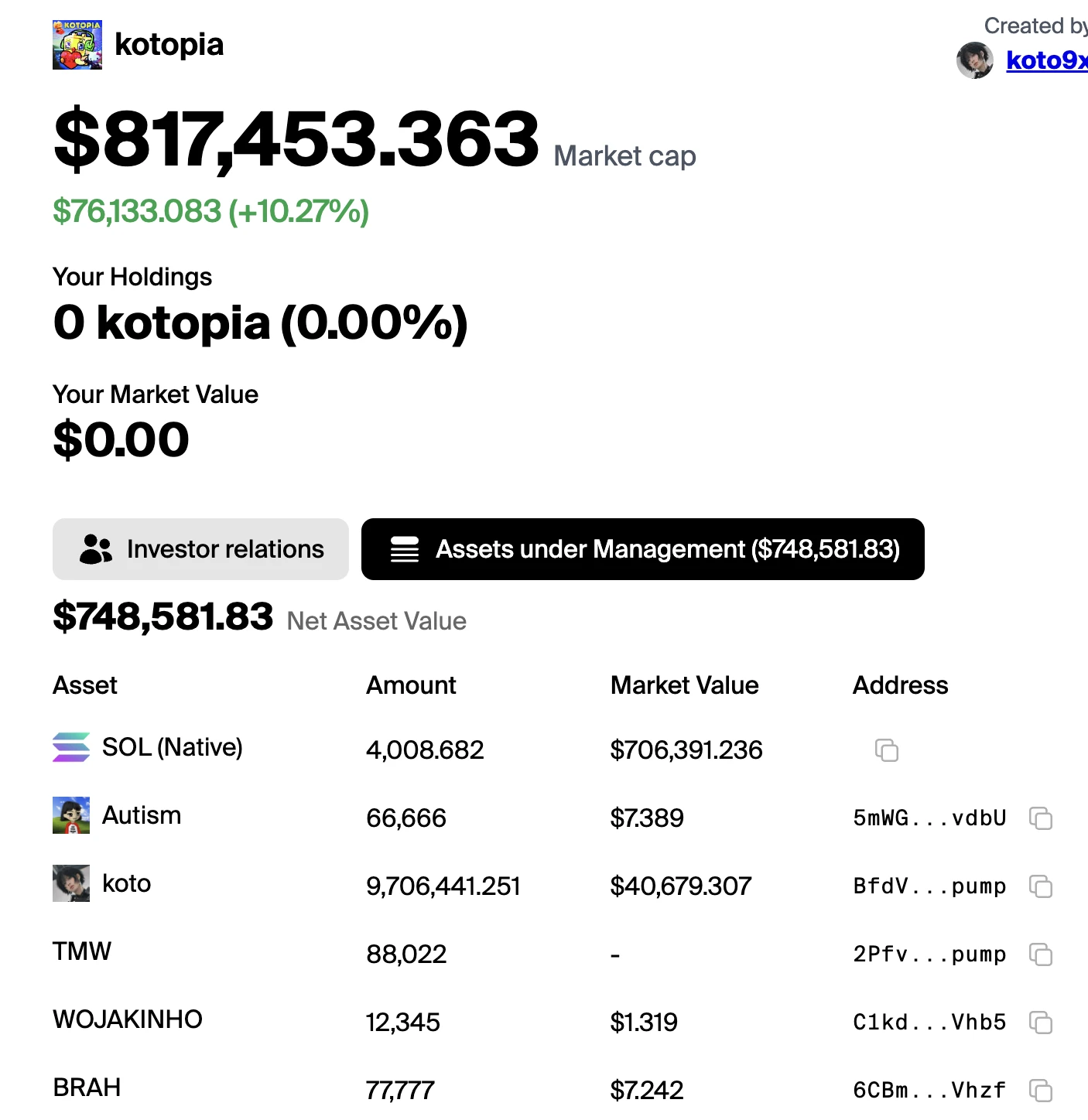

However, except for ai16z which has already come out, the market value of other fund DAO tokens on daos.fun is generally low . Kotopia, which ranks second in market value, is only over 800,000 US dollars. This is because the fund has already raised 4,206 SOL (the highest amount on the current platform), and most of the SOL has not yet been issued (4,008 SOL is still held).

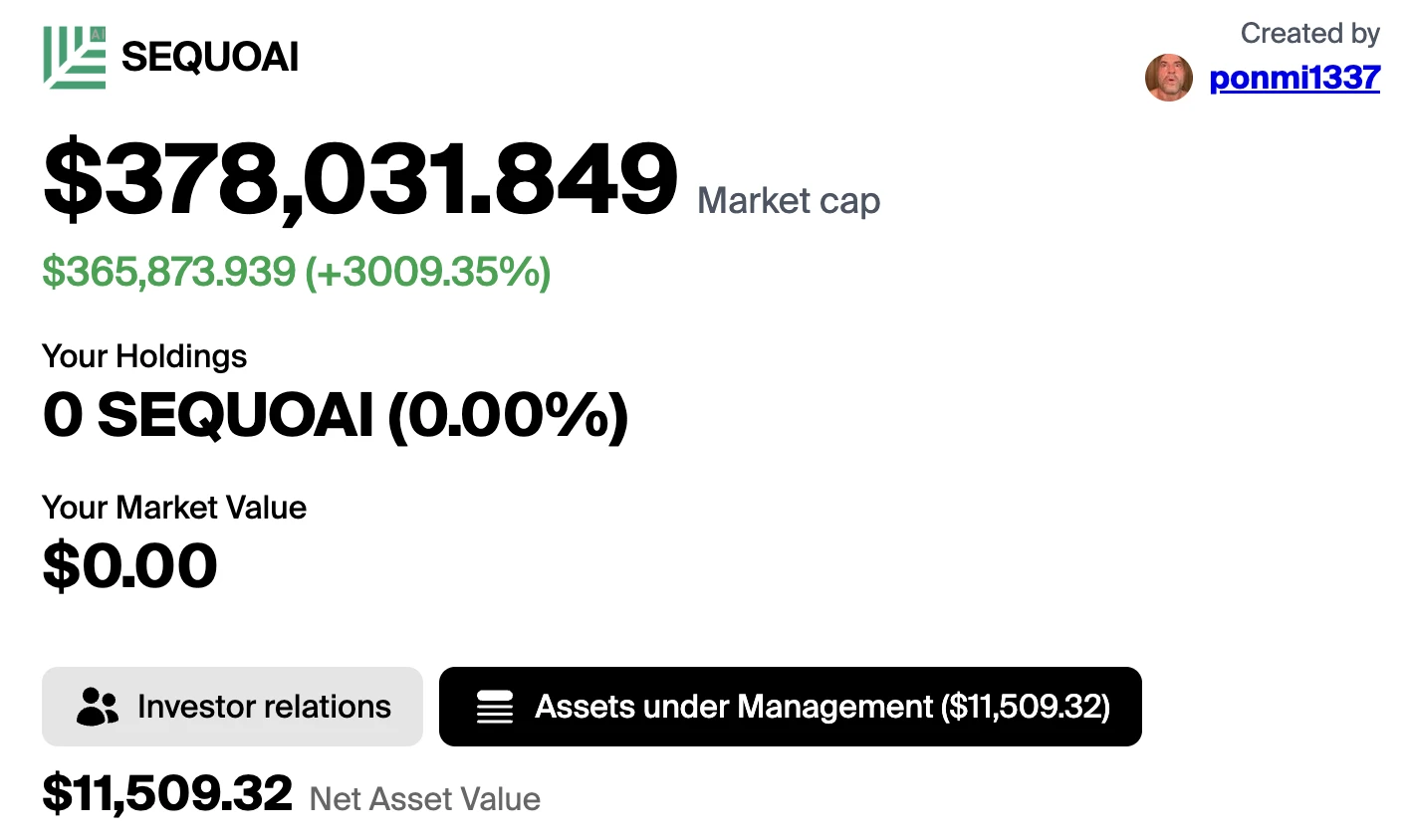

In addition, it is important to note that despite the low market value, most of the fund DAO tokens are still trading at a significant premium . The previous article mentioned ai16z s holdings. The figure below shows that the current market value of the DAO token is $378,000, and the total value of Sequoais holdings is nearly $11,509.

The author also tried to buy some DAO tokens with a very small position last night for observation. When I woke up this morning, the tokens were generally cut in half… For users who are interested in participating in daos.fun, in addition to paying attention to the quality of the sponsors of the corresponding fund, please be sure to pay attention to the premium risk.

This article is sourced from the internet: Analysis of daos.fun: Can the sudden popularity of ai16z recreate the myth of pump.fun?

Related: Arthur Hayes: Avoiding CEX traps, what are the advantages of listing projects on DEX?

Original title: PvP Original author: Arthur Hayes, Co-founder of BitMEX Original translation: Ismay, BlockBeats Editors Note: Arthur Hayes explores the current status of token listings in the crypto market, especially the impact of high CEX listing fees on project owners and investors. The article uses the case of Auki Labs to demonstrate the advantages of listing on DEX and emphasizes the importance of focusing on product development and user growth. For those project owners who blindly pursue listing on CEX, Hayes reminds them to focus on long-term value rather than short-term price fluctuations and market hype. The following is the original content: PvP, or “Player vs. Player”, is a term often used by shitcoin traders to describe the current market cycle. It conveys a predatory sentiment, where victory comes at…