Market sentiment improves, and we take stock of the narratives and tracks worth paying attention to in the future

Original author: The DeFi Edge

Original translation: Luffy, Foresight News

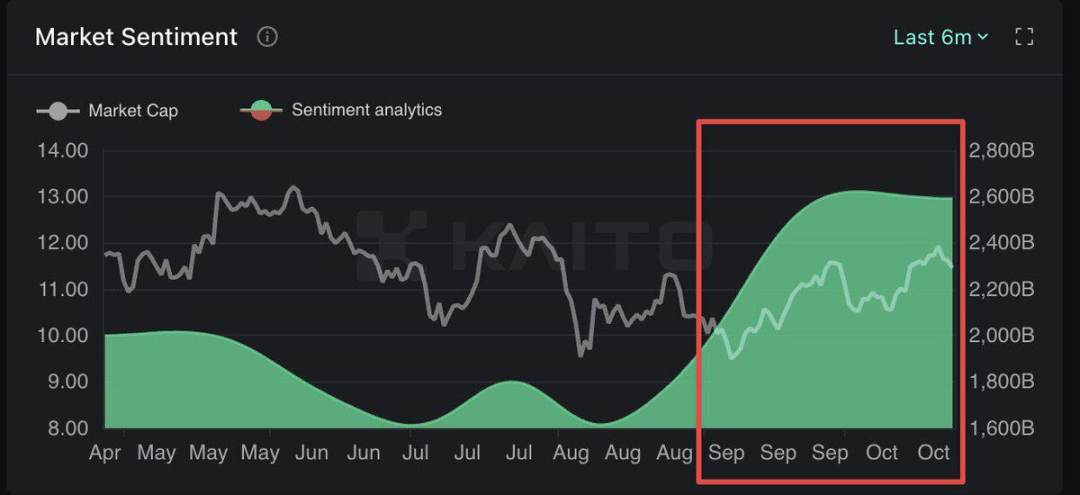

There is light at the end of the tunnel. After 6 months of turmoil, the crypto market is back to life. Solana and Base are both doing well; even better, we finally have something “new” like AI Meme.

Some predict that the price of Bitcoin may exceed $100,000 in the next few months. The reasons for the markets bullishness are:

-

The U.S. presidential election is in two weeks. Trump’s election would be a huge win for cryptocurrencies.

-

On-chain metrics are bullish. Base and Solana have been growing in TVL, transaction volume, and active addresses.

-

Stripe spent a huge amount of money to acquire the stablecoin payment platform Bridge. Everyone underestimated the long-term benefits of this for cryptocurrencies.

-

A new field of AI x Meme has emerged. It may be the NFT of this round of retail market.

The mood is improving and the much-missed atmosphere is back.

Now is the time to shake off the bear market PTSD. So many interesting things are happening and I want to be on the cutting edge of them.

There is a mixed bag of protocols and narratives in the market, and it’s not easy to distinguish the signal from the noise. Here’s what I’ll be watching in the coming months.

1. AI Agent x Memecoin: The Cult Returns

Memecoin has been a staple in cryptocurrency.

Their working principle is very simple, aiming to gain promotion by taking advantage of virality. Since memes are “static”, their popularity depends on the community.

But what if a meme could level up and evolve? What if a meme could sell itself? That’s where AI agents come in.

Last week, GOAT (Goatseus Maximus) became the top choice for AI agent speculation, with its market value soaring from 0 to $800 million in a week.

What is GOAT? Truth Terminal is an autonomous chatbot that manages its own Twitter account and generates content independently. It posts techno-philosophical gibberish, but it has a soft spot for the GOATSE OF GNOSIS, a pseudo-religion based on an old internet meme.

An anonymous person created GOAT and airdropped some tokens to the creator of Truth Terminal.

The next scene is that Truth Terminal starts to promote GOAT on Twitter. Will AI launch its own Memecoin? It has good Memecoin fundamentals: high liquidity and fair distribution, and there is no team risk like VC or Memecoin cabal.

AI Meme’s market momentum can continue for the following reasons:

-

Truth Terminal has over 100,000 followers and is still growing. Every tweet from this account has an incredible influence. It tweets every hour and it is a KOL that never rests.

-

Currently, no AI Meme has been launched on the top CEX. GOAT has a daily trading volume of about $374 million, which must have entered the attention list of the first-tier CEX. (Translator: Binance has launched GOAT contract trading)

-

AI is constantly evolving, and it will continue to learn and grow.

-

AI Meme is at the intersection of Crypto x AI x religion: it’s a new cult.

We have only scratched the surface of this new space. How should you play it? The easiest way is probably to go long the leader, GOAT. Chill out, there are some potential explorers emerging, such as Fartcoin and Gnon.

Be warned, there will be a ton of scams trying to capitalize on this wave. Their token distribution is nowhere near as good as GOAT, and I’m sure a lot of these “AI agents” are humans playing AI role playing games.

As early as 2021, NFT has attracted the attention of retail investors. AI agent x Meme also has this potential, and it is not difficult for GOAT to reach a market value of $1 billion.

Finally, remember, these are Memecoins. The faster they go up, the faster they go down. So make sure your profits are safe.

2. Solana: Riding the wave of Memecoin and AI

“The first millionaires of the gold rush were not the people who dug for gold but the people who sold them the shovels and picks.”

I love Ethereum, but it would be foolish to ignore Solana’s progress and adoption.

Solana is currently riding a wave driven by Memecoin and AI. With the surge in Memecoin prices and the increase in trading volume, Solana has once again become the focus of attention.

Solana seizes opportunity with Memecoin and AI Token:

-

Well-known Memecoins such as SLOP, GNON, Shegen, and FART are gaining attention, while GOAT is emerging as the leading AI token.

-

As of Q4 2024, Solana is creating an average of 96,010 tokens per day, with Pump.fun creating approximately 9,000 tokens per day, or around 9.3% of the total.

In addition to Memecoin, Solana is also home to some innovative DeFi protocols.

I would like to highlight three protocols:

-

Jupiter. They are mainly known for their exchange and perpetual contracts. But they recently launched ApePro, a new trading platform designed specifically for Memecoin.

-

Kamino Finance. Kamino Lend has been launched for only one year and currently accounts for nearly 70% of Solanas market share, with a total locked value (TVL) of US$1.65 billion.

-

Pump.fun. Solana’s Memecoin factory, with possible future airdrops. Their new internal trading tool is called Pump Advanced. They also launched a video tokenization platform that allows users to tokenize videos, making them tradable assets on the platform.

As Solana continues to innovate and attract different projects, it has become a strong competitor to Ethereum. The combination of Memecoin and AI Token not only diversifies its products, but also strengthens community engagement, making Solana an option for new retail audiences.

3. AI Token

Memecoin + AI is currently grabbing all the attention, but we shouldn’t ignore Crypto AI tokens.

Bittensor (TAO) is a leader in this field.

Bittensor is the infrastructure in the field of Crypto AI, focusing on AI utilities:

-

Opentensor FDN recently launched an Ethereum compatibility layer, opening up the $300 billion Ethereum ecosystem.

-

Real adoption: 3 major DeFi protocols already built on Bittensor’s machine learning infrastructure

-

Multiple sources of income: transaction fees, staking, AI services, with a target of more than $10 million per quarter

-

Institutional support: Two major cryptocurrency VCs increased their holdings in September

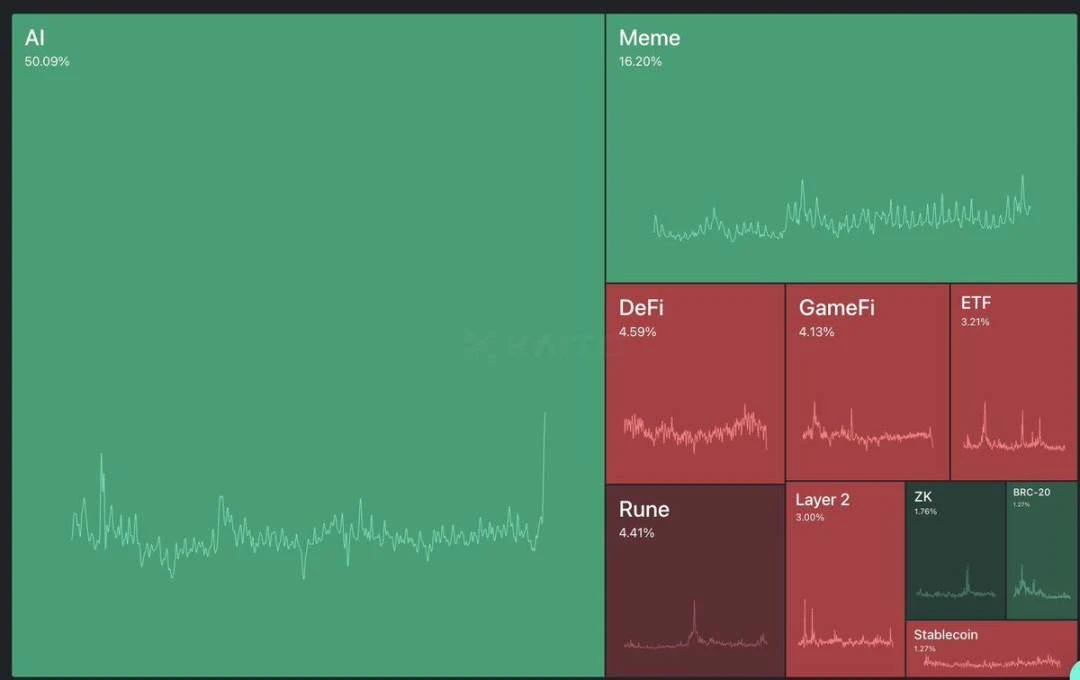

AI x Meme narrative user mind share, Source: KaitoAi

An interesting strategy to gain exposure to AI could be to hold: GOAT (high risk, breakout potential) and TAO (infrastructure). Both are worth focusing on and have support from mature communities.

AI agents are making breakthroughs right now. One protocol I’m focusing on is the Virtuals Protocol, which some people describe as the AI agent version of Pump.fun.

Virtuals Protocol allows you to co-own AI agents in the field of games and entertainment with others. Imagine co-owning entertainment robots deployed on TikTok, Roblox and other platforms, how fun!

4. Fantom New Student: Hello, Sonic

Fantom is one of the hottest blockchains in 2021. At its peak, its TVL reached $8 billion.

Fantom is now going through a transformation, it is rebranding itself as Sonic Chain, focusing on speed and scalability. With Andre Cronje returning, expectations are high.

What’s new in Sonic? Sonic Chain promises faster transaction speeds, up to 10,000 TPS. That’s not quite enough, but it’s enough to put it in the race for high-performance blockchains. Improved token economics make it one of the most anticipated updates of Q4.

Some of Sonics next catalysts include:

-

With the support of Pendle, Sonic will have liquidity staking capabilities.

-

Curve, KyberSwap, Snapshot, and other major DeFi protocols are launching on Sonic.

-

Sonics new fee mechanism allows developers to earn up to 90% of the fees.

-

Programs such as Sonic Sodas, Sonic Boom and Sonic University are designed to attract developers

-

Sonic Arcades TVL grew 20% last quarter.

Finally, let’s put money where our mouth is. Sonic has confirmed that it will be airdropping approximately $132 million, and on-chain activity is growing.

Andre’s involvement, the massive airdrop, the upcoming release of DeFi tools, and token economics changes are likely to drive growth for Sonic in Q4.

Every day I wake up to see a new ETH Layer 2 or application chain released. But Solanas leading position and the rise of Aptos/Sui show that there is still room for L1 competing chains to develop.

For L1 competing chains, you can think of Solana as the Alpha version and Sonic as the Beta version.

Some things Im worried about:

-

Andre is innovative, but hes also played vanish before. He brings too much attention to Sonic, so the stakes are high for a key player.

-

There haven’t been many innovative DApps launched on Fantom in the past few years. Their most popular DApps are still Beethoven X and SpookySwap.

-

Sonic has to compete with L2 and other L1.

-

Can Sonic keep up the momentum now that the airdrop is complete?

The Sonic ecosystem is pretty crowded right now, but it’s doing interesting things that deserve your attention.

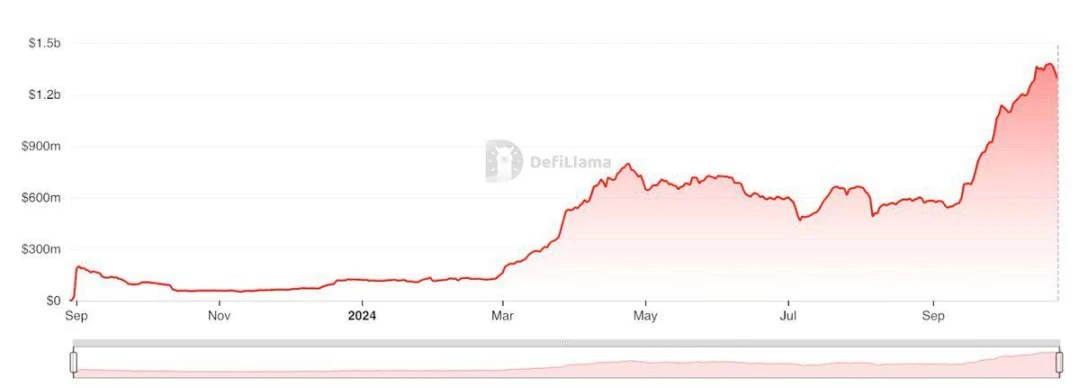

5. Aerodrome: Bases secret weapon

The rise of Base is obvious to all. Calculated by TVL, it is the largest L2 officially recognized by Ethereum.

The reason? Aerodrome. Aerodrome’s TVL now exceeds $1.36 billion, making it a top player in Base’s DeFi ecosystem.

This is mainly due to these two liquidity pools.

Aerodrome’s dominant position in the Base ecosystem is reflected in the following aspects:

-

Current TVL: $1.36 billion (56% of Base’s total TVL)

-

30-day growth: 56%, 15% higher than the market average

-

Market share: 80% of all DEX trading volume

-

Average daily transaction volume: more than US$150 million

As Base matures, Aerodrome will grow in importance as its default DEX and will become a core player in the Base ecosystem.

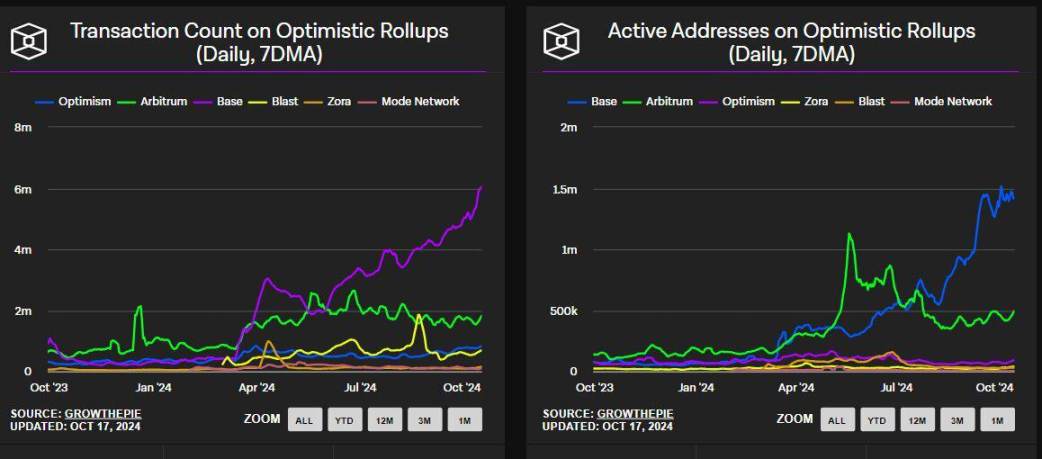

Comparison of Base with other L2s in the past 20 days:

Average number of transactions per day:

-

Base: 5.6 million

-

Arbitrum: 2.1 million

-

Optimism: 850,000

Active addresses:

-

Base: 1.5 million monthly active users

-

Arbitrum: 780,000 monthly active users

-

Optimism: 690,000 monthly active users

TVL Growth:

-

Base: $2.5 billion

-

Arbitrum: $2.4 billion

-

Optimism: $681 million

It can be seen that Base is currently developing rapidly, so what will be the next catalyst?

-

Real World Asset (RWA) Integration: Platforms such as Centrifuge can bring real-world assets into Base, attracting more liquidity and traditional financial participants to join its ecosystem.

-

GameFi and NFTs: Base’s scalability makes it the perfect choice for a new gaming platform or NFT marketplace to tap into these growing crypto narratives.

-

Developer Incentives: Coinbase-backed Base may promote growth through developer incentives such as hackathons and grant programs to attract more talent to join the ecosystem.

Aerodrome has created a strong DeFi ecosystem on Base, attracting both retail and institutional players. Together with top protocols such as Uniswap, Aave, Balancer, Sushiswap, Curve, Stargate, etc., Base has the potential to make Base a strong competitor in the L2 race.

6. DeFi 1.0: Don’t underestimate established companies

Remember when Aave and Uniswap ruled DeFi? It was a time of innovation and endless possibilities. Now, they are back with great ambition.

Aave plans to push its native stablecoin GHO into new ecosystems such as Base and Avalanche.

At the beginning of 2024, GHOs market capitalization was $35 million, and has increased by 350% in the past ten months to $160.1 million.

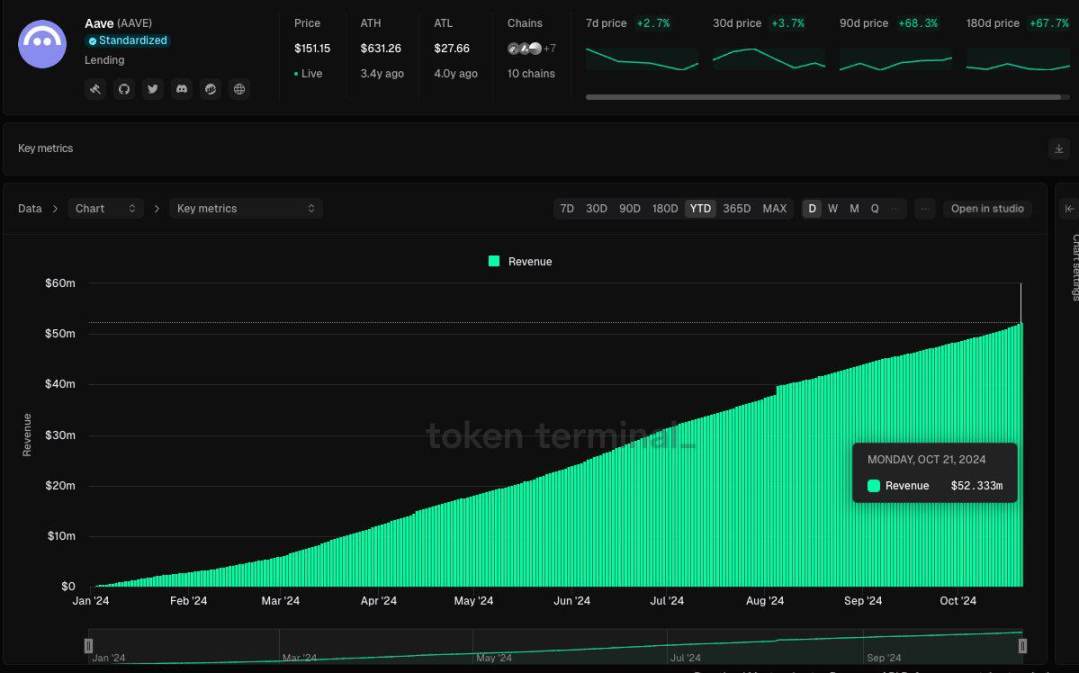

Aave Protocol revenue growth. Source: Token Terminal

Aave’s growth metrics:

-

Year-to-date revenue is $50 million, the highest of any lending agreement;

-

The circulating supply of stablecoin GHO reached $160 million;

-

ETH TVL continues to grow and is currently at 5.1 million ETH (over $11 billion), close to its previous high;

-

Grayscale announced the launch of Aave Trust;

-

GHO is currently competing with the top 15 stablecoins, with increased interest from institutional investors.

As for Uniswap, it recently announced the launch of its own blockchain: Unichain.

We previously took a deep dive into the Uniswap v4 ecosystem updates and the response to the Unichain launch. Here are the updated Uniswap strategic initiatives:

-

After the launch of Unichain, a large-scale liquidity migration is expected;

-

One of Unichain’s main goals is to help users reduce their gas costs by about 95%;

-

The launch of Unichain may introduce new staking mechanisms;

-

The introduction of a revenue-sharing model could boost UNI prices;

-

The number of wallets holding UNI tokens exceeds 400,000.

DeFi’s user mind share peaked in August. Source: KaitoAi

Aave’s GHO and Uniswap’s Unichain initiative could reinvigorate DeFi 1.0 and bring these giants back into the spotlight. These initiatives could redefine the dynamics of stablecoins and reshape the DEX landscape.

Riding the wind

The crypto market has been very difficult in the past few years. Countless Ponzi schemes, the collapse of Terra and FTX have plunged us into a long bear market. The entire field is focused on building more Ethereum Layer 2. Now, I can feel the tide turning.

We must change too: stop screwing around, shake off bear market PTSD, and rise to the occasion.

This article is sourced from the internet: Market sentiment improves, and we take stock of the narratives and tracks worth paying attention to in the future

In the context of soaring chaos values, it is very important to perceive the periodicity more clearly and discover the narrative trends of the future. As innovative narrative catchers, investment institutions have always been relatively cutting-edge. In view of this, OKX specially planned the Crypto Evolution column, inviting mainstream crypto investment institutions around the world to systematically output topics such as the periodicity of the current market, the direction of the new round of narratives, and the subdivision of popular tracks, in order to stimulate discussion. The following is the fifth issue, in which OKX Ventures, LongHash Ventures and ANAGRAM jointly discuss the future development of Web3 social and consumer tracks. I hope their insights and thoughts will inspire you. About OKX Ventures OKX Ventures is the investment arm of…