The most important thing to make money in a bull market is to build your own trading system

There is no trading system that guarantees profit and no loss

A trading system is actually an operating system. When placed in a computer, it can be understood as a complete human-computer interaction system. People use this system to make the computer work. From a biological perspective, it is similar to a conditioned reflex, that is, when signal A appears, action B will definitely appear.

A trading system is a set of complete signal rules for entry, exit, stop loss and take profit of buying and selling.

There are many misunderstandings about trading systems. Some people believe that the reason they cannot make money is that they lack their own trading system, and once they have a trading system, they will be able to make money. Others believe that the reason they cannot get excess returns is that their existing trading system is not good enough, so they need to find a better system. There are also people who firmly believe that there is a magical trading system in the world, and as long as you follow it, you can make money without losing money.

Are these views true and credible?

First of all, it should be made clear that there is no perpetual motion machine or elixir of life in the world, and naturally there is no universal and always stable and profitable trading system. If such a system exists, smart people have already discovered and used it.

Secondly, even if you have an excellent trading system, it does not mean that you can achieve stable profits. An excellent trading system first requires the user to have strong execution ability and be able to follow its instructions 100%. In addition, a good trading system is not necessarily suitable for everyone. Everyone needs to find a trading system that suits them, which cannot be measured by standardized good or bad.

In order to find a trading system that suits you, you first need to correctly understand and position the role of the trading system.

The trading system is similar to the military guiding ideology. Completely following these guiding ideologies may not guarantee victory in every battle, but at least it can ensure that there will be no disastrous defeat and leave subsequent opportunities. The trading system is at the strategic level, while the combination of operational thinking and operational strategy belongs to the campaign level, and the specific trading actions are the performance of the tactical level.

Only by correctly understanding the role and limitations of the trading system and finding a suitable system based on your own characteristics can you achieve better results in trading.

How to evaluate an operating system

When evaluating a trading system, I believe there is only one core key metric to focus on: the “profit-loss ratio.” The so-called profit-loss ratio is the average amount of profit divided by the average amount of loss.

For example, you invest 1 million yuan and trade 10 times according to a certain operating system. You make profits 4 times, with profits of 150,000 yuan, 250,000 yuan, 350,000 yuan and 450,000 yuan respectively; you lose 6 times, with losses of 100,000 yuan, 150,000 yuan, 100,000 yuan, 50,000 yuan, 70,000 yuan and 200,000 yuan respectively. At this time, the average profit is 300,000 yuan when profitable, and the average loss is 111,700 yuan when losing. The profit-loss ratio is 30/11.17 ≈ 2.69. If you use this trading system for continuous trading, whether it is 100 times or 1,000 times, according to the profit-loss ratio of 2.69, you can theoretically achieve profitability. A profit-loss ratio below 1 indicates a loss.

However, when making an objective evaluation, we need to consider certain redundancy factors. Personally, I think the profit-loss ratio should not be less than 2 in any case. Specifically:

-

A profit-loss ratio of 3 is considered a pass, or 70 points;

-

A win-loss ratio of 4 is considered good, or 80 points;

-

A profit-loss ratio of 5 is considered excellent, or 90 points;

-

A trading system with a profit-loss ratio above 5 can be considered a perfect score.

It should be noted that it is very rare for a trading system to have a profit-loss ratio higher than 5. It is recommended that you calculate the profit-loss ratio of the trading system (or buying and selling rules) that you have adhered to for a long time in order to better evaluate its effectiveness.

What elements should be included in the design of an operating system

Before building an operating system, we should first ask ourselves, what is the purpose of investing? Is it to get rich overnight? Is it to increase value steadily? Or is it to increase value quickly? In addition, what is the expected rate of return? Is it 100% in a year? Is it 100% in a month? Is it 30% in a year? Is it 30% in a month? Is it 200% in a year? Or is it 50% in a year? These questions will greatly affect how we design our own operating system.

In addition, what is our tolerance and risk appetite for risk? Can we tolerate a large drawdown of more than 30%? Can we tolerate a small drawdown of less than 20%? Can we only tolerate a slight drawdown of less than 5%? Or can we not tolerate any drawdown at all? These questions about risk must also be considered. If these questions are not clarified, it is meaningless to blindly establish an operating system, at least it is not the most suitable one for you.

A complete operating system should include the following seven elements:

-

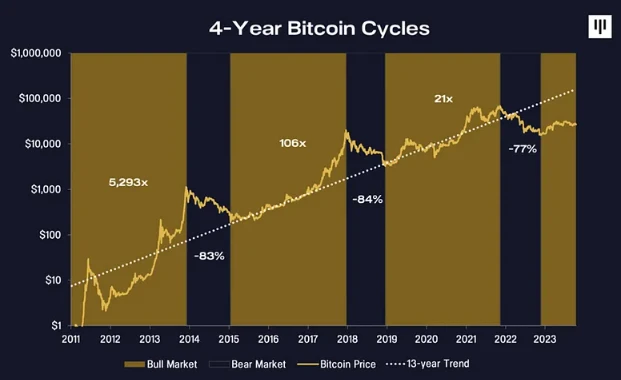

Cycle judgment: Understand the general trend of the market and judge the current market cycle (such as bull market, bear market, volatile market, etc.).

-

Operational thinking: clarify the basic concepts and strategies of operation, whether to pursue short-term quick entry and exit or long-term holding.

-

Coin selection: Select potential stocks based on certain standards and methods.

-

Timing: Determining the best times to buy and sell.

-

Buying and selling rules: Develop clear buying and selling strategies, including entry and exit conditions.

-

Fund management: Allocate funds rationally, avoid excessive concentration or dispersion, and ensure the efficiency and security of fund use.

-

Risk control: Develop risk management strategies, including stop-loss mechanisms, position control, etc., to control and reduce investment risks.

By comprehensively considering and integrating the above factors, you can establish an operating system that suits you and achieve your investment goals more effectively.

Let’s take a closer look below.

1. Cycle judgment

Going with the flow is the first principle of investment. When the market is rising, the success rate of our various strategies, coin selection and timing will be significantly improved. Even if the strategy and timing are not perfect, it is possible to make money from the rising market. And if it is judged that the market is rising steadily, the psychological state of holding positions will be more stable, and even dare to buy at a low point, thereby reducing the cost of holding coins and obtaining the maximum profit. On the contrary, if there is no clear judgment on the trend of the market, the psychological state of holding positions will be turbulent, and it is easy to overreact to small fluctuations, resulting in deformation of operations.

In addition, the judgment of the cycle will provide an important reference for subsequent operations. In a bull market, all buying and selling operations must be heavy and concentrated; in a bear market, all buying and selling operations must be light and dispersed.

2. Operational thinking

Operational thinking can also be called an operational strategy under different market conditions, but this operational thinking can only be determined on the basis of the judgment of the market, so the accuracy still depends on the judgment of the market. Operational thinking is like a plan for a battle. How long will it take and how large the battlefield will be must be set in advance. You cannot modify the battle plan while fighting, increase troops at will, or change the direction of the battle at will.

3. Coin selection

Especially in a bull market, the importance of currency selection is more prominent. If you want to obtain excess returns, you must carefully select the currencies you hold, and try to avoid frequent currency changes in a bull market. Frequent currency changes may lead to missed opportunities for growth. It is often the case that the currency you sell rises sharply, while the currency you hold performs mediocrely. The key to profits in a bull market lies in the combination of heavy investment and holding time.

For large institutions and large funds (managing funds of more than 100 million yuan), the importance of currency selection is even more significant. Global equity long funds rely on stock selection as their unique advantage, which is also an important mark to distinguish different funds. Timing operations usually assume that they can beat the market. Operators who manage millions of funds may still be able to make profits through timing, but once the scale of funds increases, the effectiveness of timing will drop significantly.

So what characteristics should a coin with excess returns have? We can look at it from the perspective of the banker. If you are a banker, or an institution, or the main force, with a large amount of funds, and want to operate a coin, which coins would you choose?

First, the circulating volume should be small, but not too small. If the volume is too small, the liquidity will be poor, and it will be inconvenient for funds to flow in and out, making it impossible to operate.

Second, there are both major trend-setting themes and no historical problems, such as having been previously speculated by major market makers or having a bad market image.

Third, there must be solid on-chain data support or conditions for improved performance in the future. When the coin price reaches a high level, performance improvement + high transfer (such as airdrops, dividends, on-chain rewards, etc.) + themes can complete the shipment without a sharp drop in the coin price.

4. Timing and trading rules

Timing is the precise confirmation of the entry and exit timing, which is mainly divided into two levels: mid-term swing and short-term speculation. Buying and selling rules are clear definitions of trading discipline. For example, when buying, the buying point requirements of technical indicators must be met, and it should be a short-term buying point, and it must rise quickly after buying. Timing is the primary means of controlling risks. Even in a bull market, there may be a large adjustment. The core role of timing is to avoid these adjustments and a big bear market. If the market conditions are not good, it is recommended to wait and see with empty positions.

In the trading system, the buying and selling rules should have a certain degree of flexibility and subjectivity, accounting for about 20% to 30%. Completely fixed buying and selling rules will lead to procedural trading and lack of adaptability. The buying rules vary due to different operating thinking and market conditions, and different market conditions will produce different buying points. However, there is a basic principle that cannot be violated: buying must be based on technical buying points.

The selling rules also vary depending on market conditions and operational thinking. The expected returns are different, and the profit-taking strategies will also be different. Selling does not necessarily have to wait until the technical selling point appears, because by then one or two negative lines have often appeared, resulting in a large loss of profits. Therefore, the selling point needs to be predicted to a certain extent. Once the profit-taking position or the possible high point is reached, you can consider selling.

By setting such rules, traders can respond flexibly to different market conditions, maximize profits and effectively control risks.

5. Money Management

Fund management is a set of disciplinary management regulations. For example, every 10% of profit in a fiscal year will be transferred out for protection; after the first position is opened, a new position will be opened when there is profit, etc. Another important point to consider is the leverage problem. Of course, many bigwigs in the currency circle have achieved wealth freedom through leverage, so whether to add leverage and how much leverage to add varies from person to person, but it should be noted that there is a saying in the investment industry called profit and loss come from the same source, which means that the place where you make money is often the place where you lose money. There are many people who get rich overnight, and there are also many who have their positions blown up. For novices, it is recommended to use leverage with caution, because leverage will amplify the emotional fluctuations caused by market fluctuations, leading to unsatisfactory trading results.

6. Risk Control

Risk control is a set of iron laws, and everyone has different experiences and rules. Risk control clauses play a final role in the operation process, ensuring that you will not make mistakes due to greed or lucky mentality. In addition, keeping risk control clauses in mind can also calm your mood and avoid unnecessary losses due to drastic emotional fluctuations.

Trading System Example

The trading system provides clear entry and exit signals, making trading behavior more standardized. Only when the system sends a signal, can you buy or sell, and wait patiently at other times. For positions already held, regardless of profit or loss, you should hold on; for short positions, you need to wait for the system signal to appear before making any operations.

The reason why the trading system is called a standardized operating system is mainly to avoid investors arbitrary trading. Because human nature has its weaknesses, and mentality is a crucial factor in trading. Although subjective trading can be carried out, even the simplest system can provide certain norms. For example, a moving average strategy: buy when the price is above the line and sell when it is below the line. Even a rule like buying stocks when it is foggy in Beijing and selling stocks when the sun is shining is a system. Similarly, there are some simpler so-called systems, such as buying stocks on single days and selling stocks on double days. Although these systems may not necessarily be profitable, at least they provide a complete set of rules to help traders avoid emotional operations.

The most complex operating system requires top mathematicians to build several complex mathematical models based on massive data with the help of computers to perform automated trading. For ordinary traders, the operating system is not the simpler the better, nor the more complex the better, but the more efficient the better. There is no necessary connection between simplicity, complexity and good or bad.

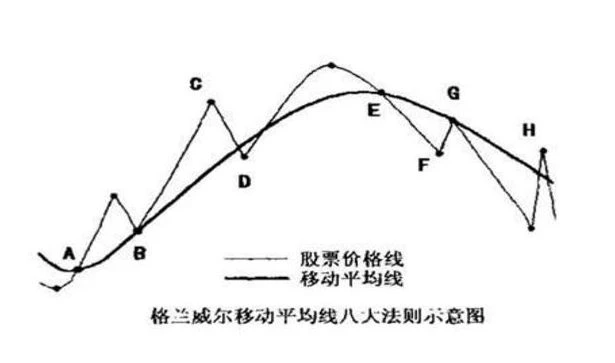

For example, among the simple moving averages, the most famous is Granvilles eight methods of operation.

Granvilles four buying rules:

(1) When the moving average gradually flattens out and then rises, and the stock price breaks through the moving average from below the moving average, it is a buy signal.

(2) Although the stock price falls below the rising moving average, it soon turns upward and runs above the moving average. At this time, you can increase your purchase.

(3) The stock price falls but does not break the moving average and resumes its upward trend. At this time, the moving average continues to rise, which is still a buy signal.

(4) When the stock price falls below the average line and moves away from the average line, there is a high probability of a strong rebound, which is also a buying signal. But remember that after the rebound, the stock will continue to fall, so dont fight too hard. This is because the general trend has weakened, and a long-term fight will inevitably lead to being trapped.

Granvilles four selling rules:

(5) When the moving average trend changes from rising to falling, and the stock price falls below the moving average from above, it is a sell signal.

(6) If the stock price rebounds and breaks through the moving average, but soon falls below the moving average, and the moving average is still falling, this is also a sell signal.

(7) If the stock price falls below the moving average and then rebounds towards the moving average, but fails to break through the moving average and then falls back, this is still a sell signal.

(8) When the stock price rises rapidly and moves away from the rising moving average, the investment risk increases sharply and a decline may occur at any time. This is also a sell signal.

In summary, Granvilles eight-method operation method is to use the moving average to judge the price trend, and should generally follow the following rules:

When the moving average rises, it is a buying opportunity, and when it falls, it is a selling opportunity; when the moving average turns from falling to rising, and the stock price breaks through the moving average from below, it is the best time to buy; when the moving average turns from rising to falling, and the stock price breaks through the moving average from above, it is an important selling opportunity.

Granvilles Eight Principles is the simplest trading system that everyone knows, but it seems to be too universal and requires specific adjustments in different markets.

This article is sourced from the internet: The most important thing to make money in a bull market is to build your own trading system

Related: dappOS: An Intention Execution Network Backed by Top Institutions

Original article by Lawrence Lee, Research Fellow at Mint Ventures Since the development of the crypto economy, the infrastructure on the chain has been gradually improved, but the user experience is still in its infancy. After the user operation experience is improved, it is expected to attract more users to enter the chain ecosystem, which in turn promotes the further development of infrastructure and the enrichment of business forms, forming a ladder cloud effect of stepping on the left foot and the right foot. The 1995 moment of cryptocurrencies may depend on the emergence of a user-oriented killer application or operating system. The intention track is committed to this, changing the current on-chain operation logic of assuming that users are experts to assuming that users are novices, hiding the complex…