This article comes from: Galaxy; original author: Alex Thorn, Gabe Parker

Compiled by Odaily Planet Daily ( @OdailyChin a ) Azuma ( @azuma_eth )

Market Background

Since March, the price of Bitcoin has fluctuated in a wide range, and other mainstream cryptocurrencies have failed to return to their all-time highs, which has kept venture capital activity in a relatively calm state in 2024. The barbell market effect continues (that is, Bitcoin leads the market at one end, and meme tokens gain momentum at the other end), coupled with the lack of interest from institutional investors (here refers to LPs invested by funds) and comprehensive venture capital funds, resulting in a slightly flat overall cryptocurrency venture capital market in 2024. Despite this, there is still no shortage of opportunities in the market, and native funds in the cryptocurrency field still maintain a relatively prominent frequency of shots. It is expected that with the decline in interest rates and the relaxation of the regulatory environment, venture capital activity may heat up in the fourth quarter of 2024 and the first quarter of 2025.

Galaxy’s quarterly report analyzes two aspects of the venture capital market — venture capital fund investments in cryptocurrency startups and institutional investors’ allocations to venture capital funds — based on public filings, data services such as Pitchbook, and Galaxy Research’s own VisionTrack fund performance database.

Key Points

-

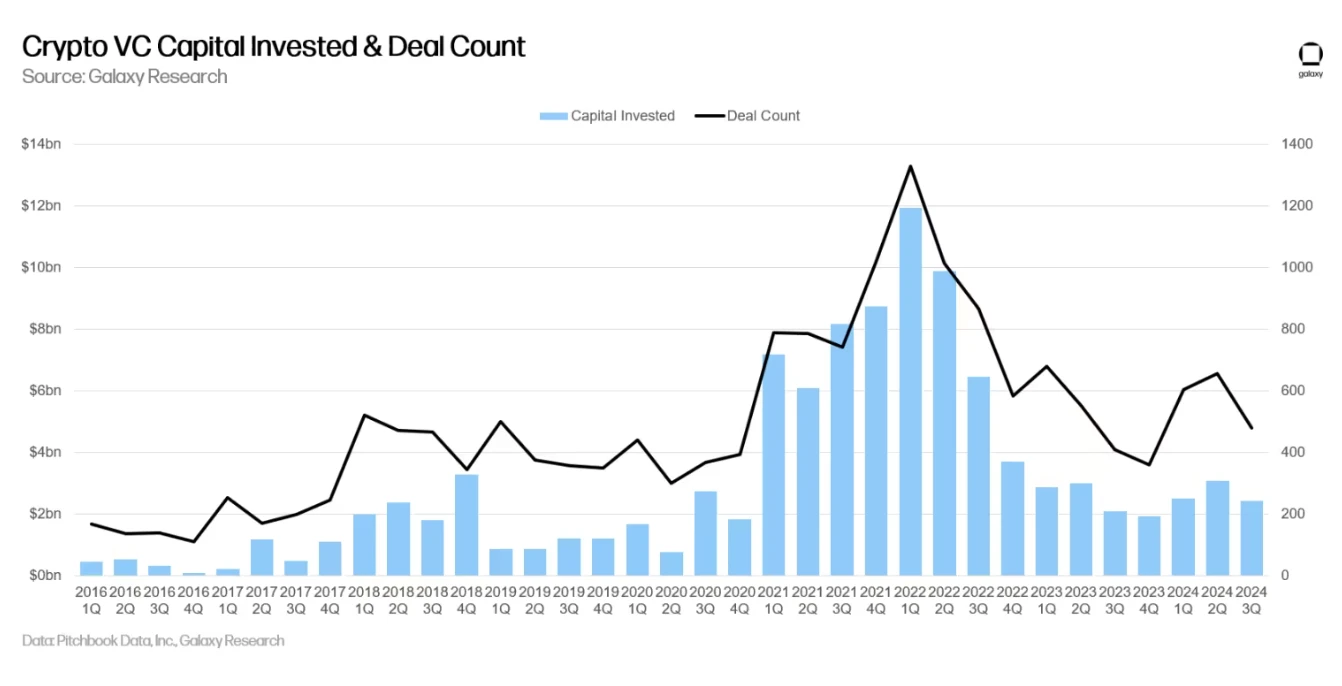

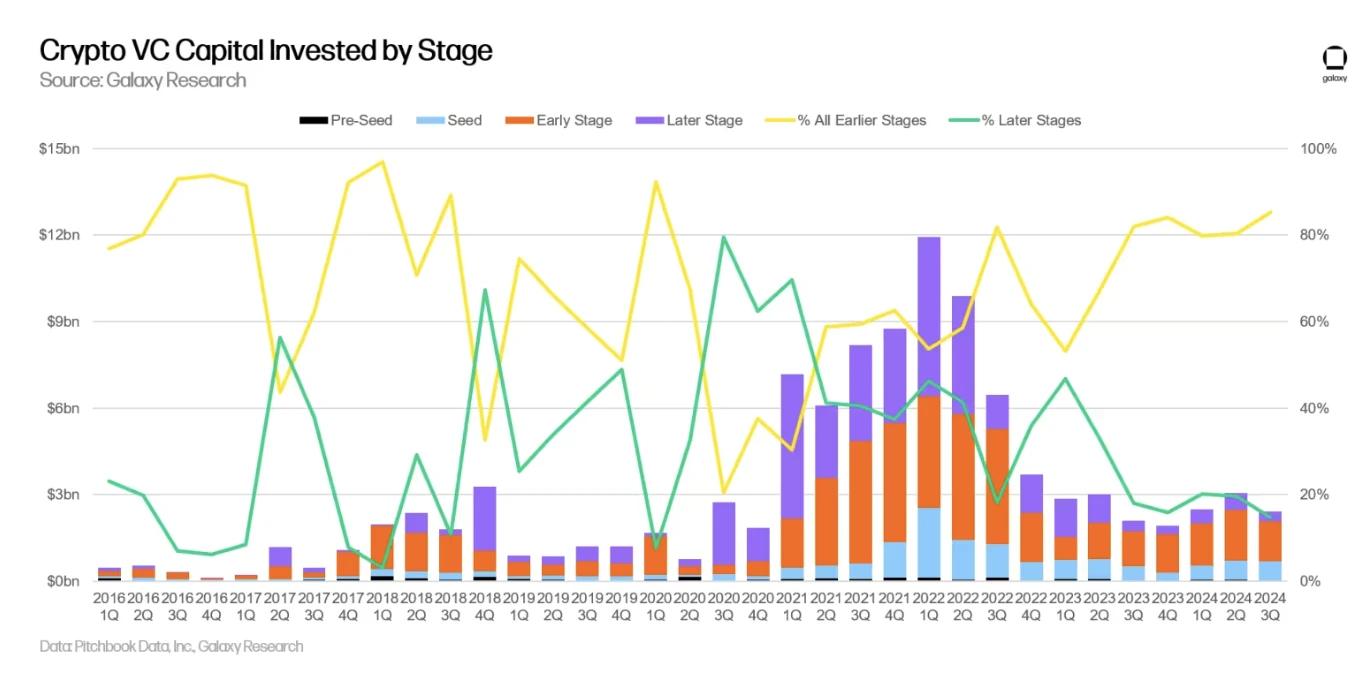

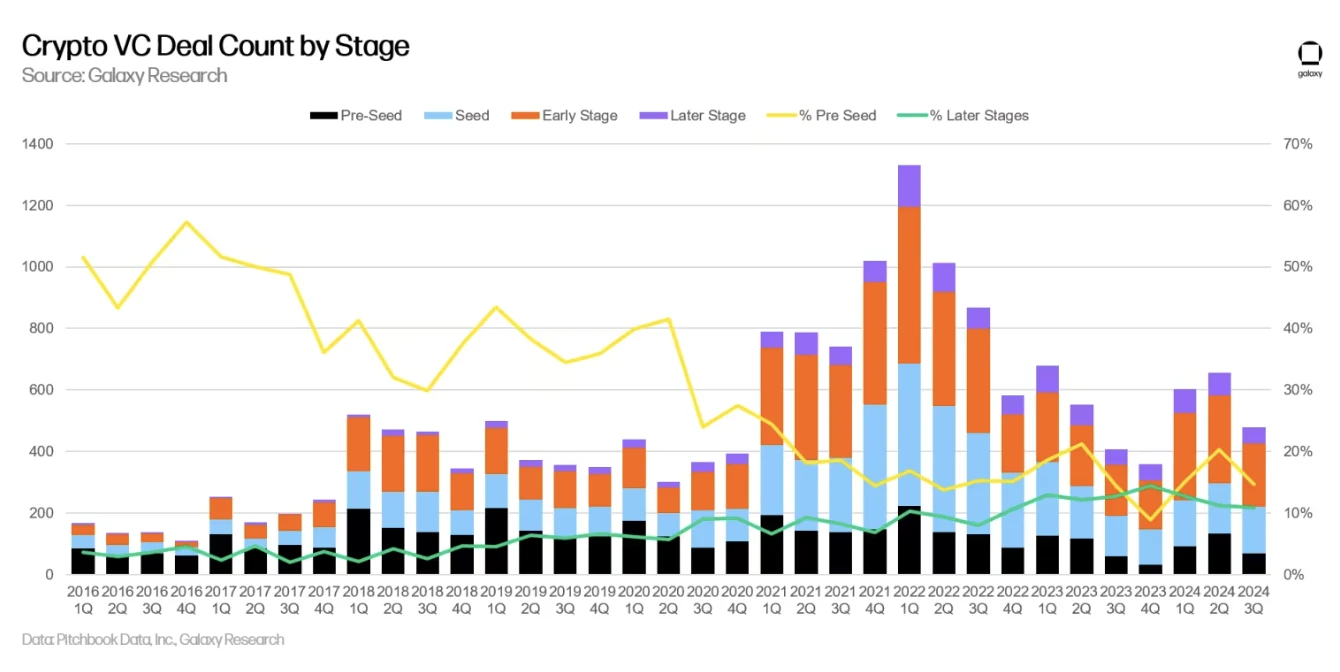

In the third quarter, venture capital funds invested a total of US$2.4 billion in cryptocurrency startups, a 20% decrease from the previous quarter ; a total of 478 transactions were involved, a 17% decrease from the previous quarter.

-

In the first three quarters, venture capital funds total investment in cryptocurrency startups has reached US$8 billion, and the total investment in 2024 is expected to reach or slightly exceed the level of 2023.

-

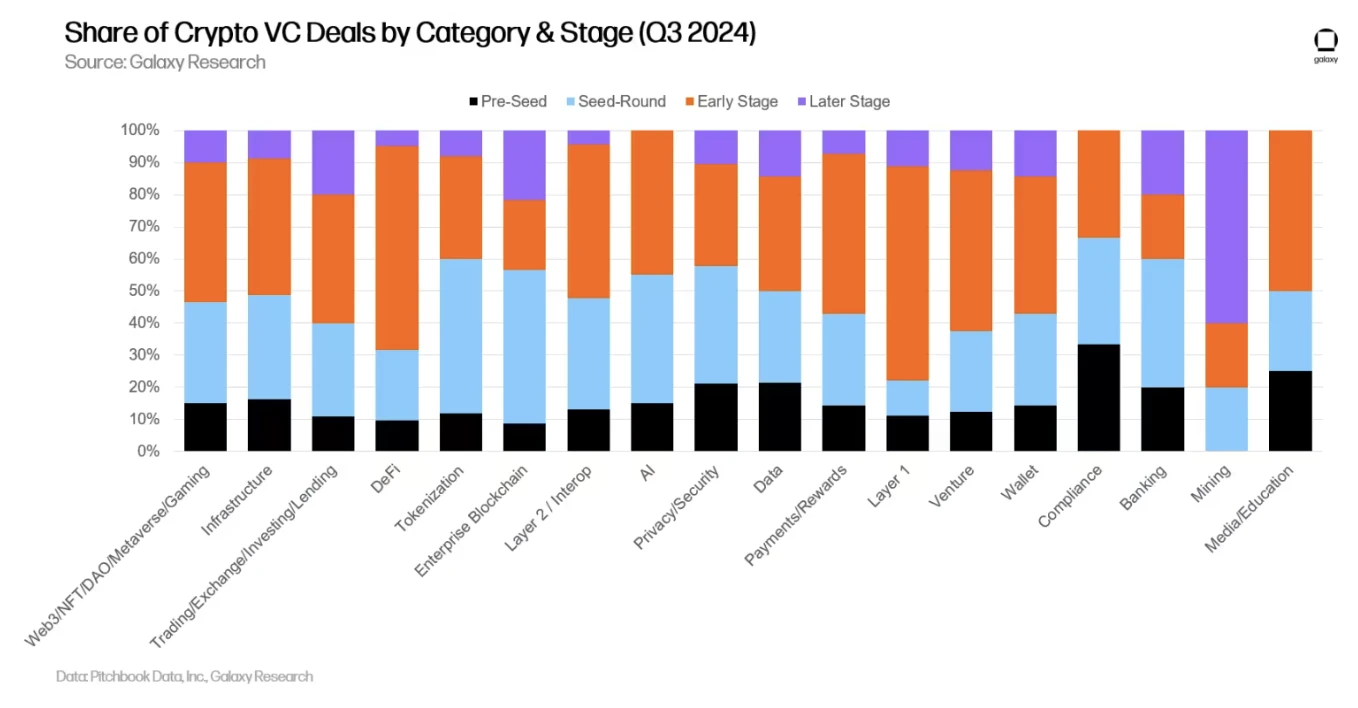

Among all transactions, early-stage investments accounted for a higher proportion (85%), while late-stage investments accounted for only 15% , the lowest proportion since the first quarter of 2020.

-

The median valuation of venture capital investments generally increased in the second and third quarters, and the valuation of cryptocurrencies increased faster than the average for the entire venture capital industry. The median valuation of investments in the third quarter was $23.8 million, slightly lower than the $25 million in the second quarter.

-

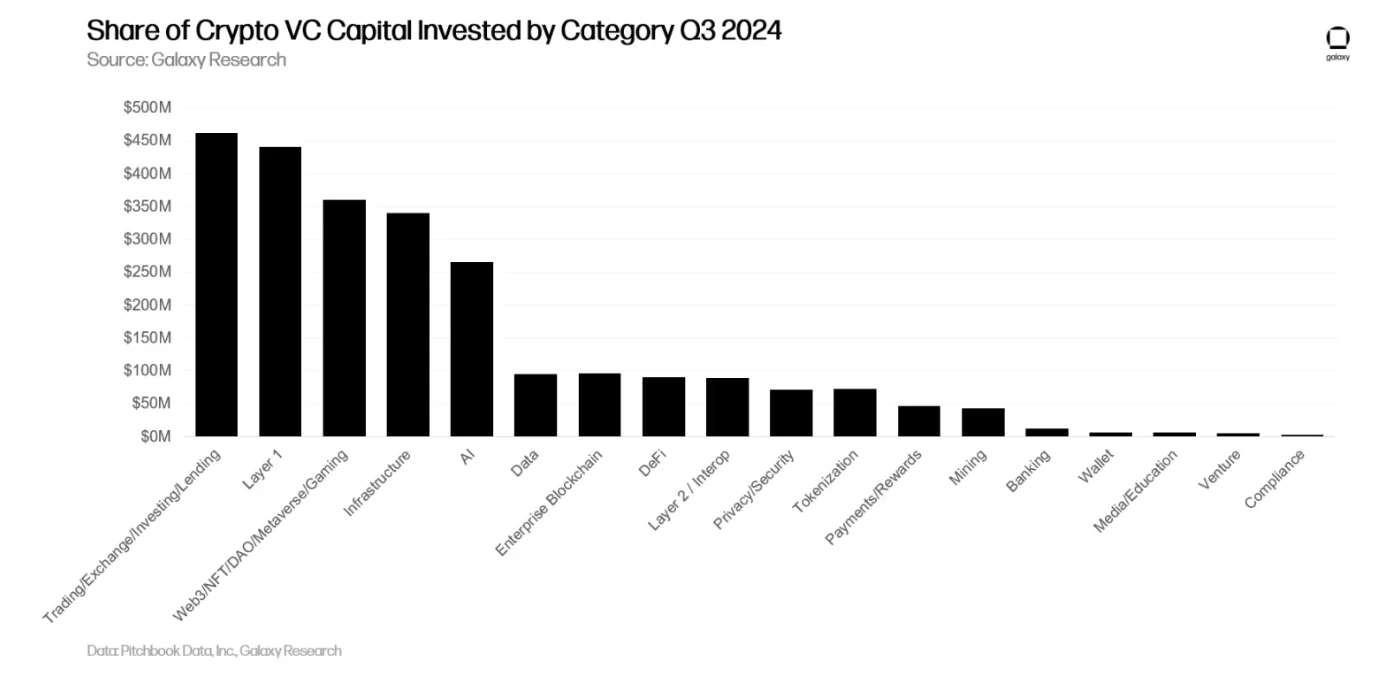

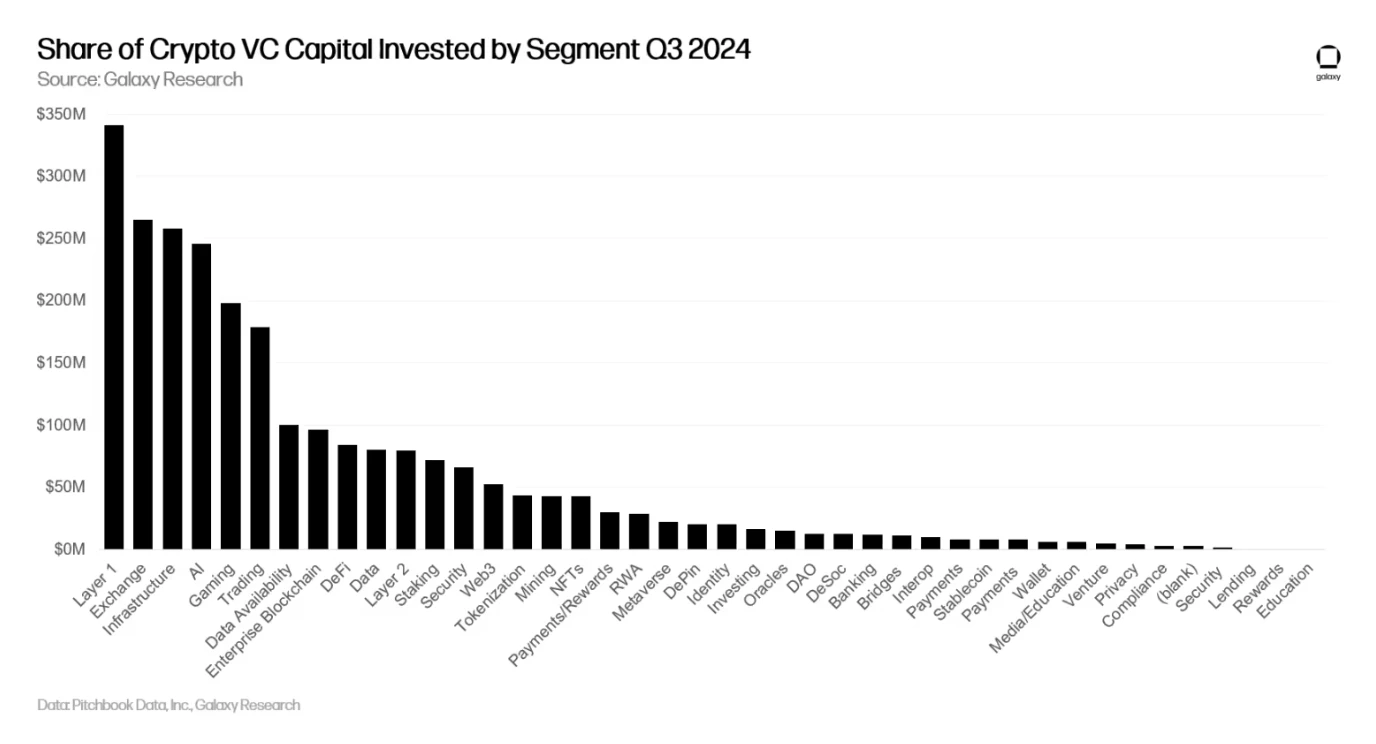

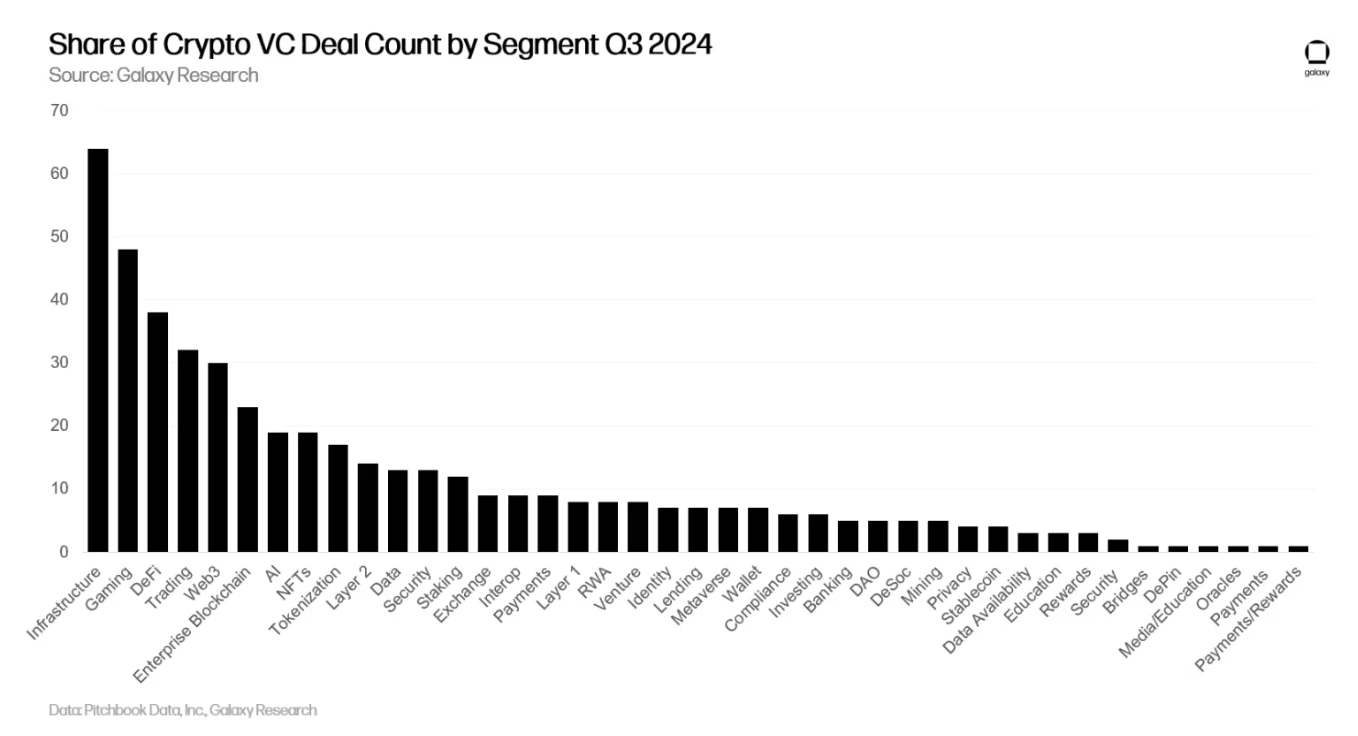

Among all financings, Layer 1 projects/companies raised the most funds, followed by cryptocurrency exchanges and infrastructure projects/companies. Most investments focused on segments such as infrastructure, games, and DeFi.

-

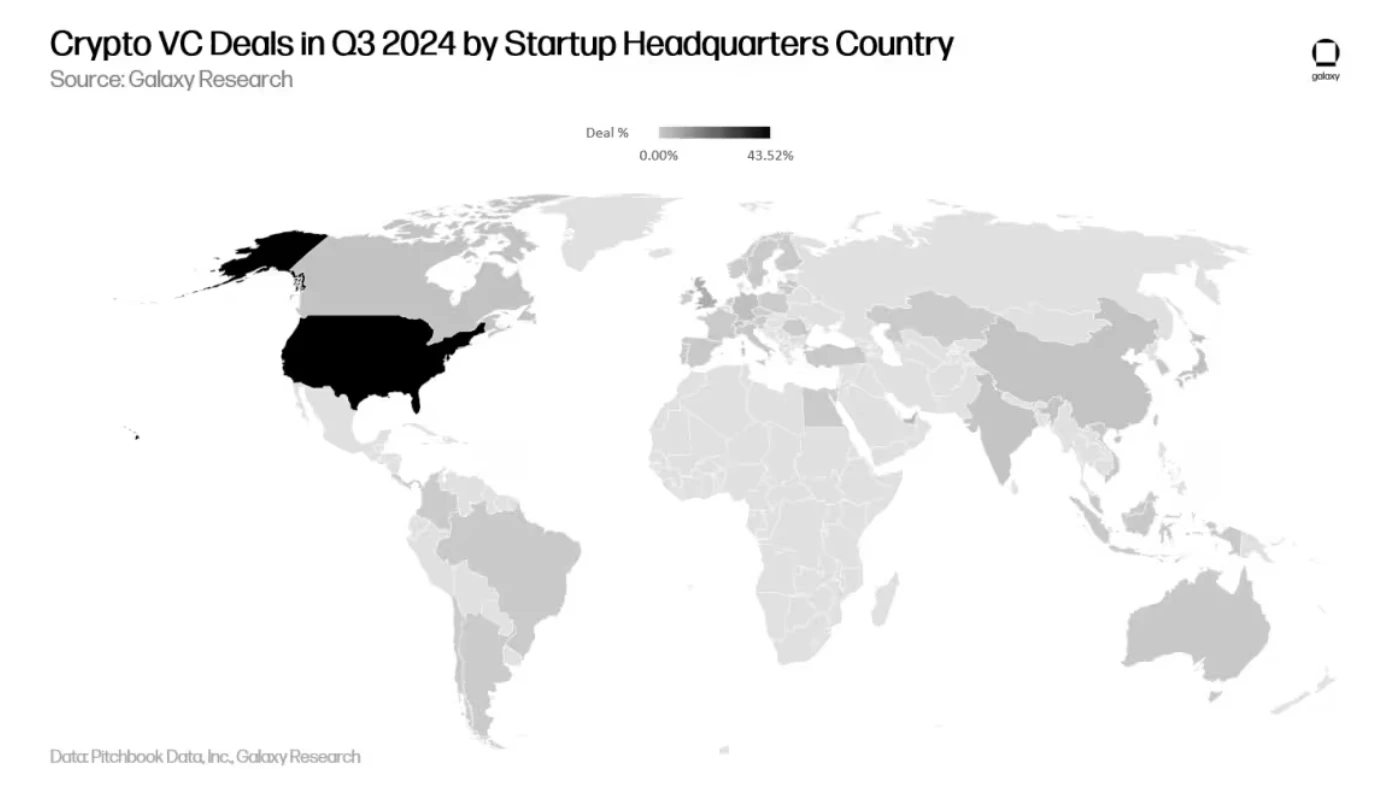

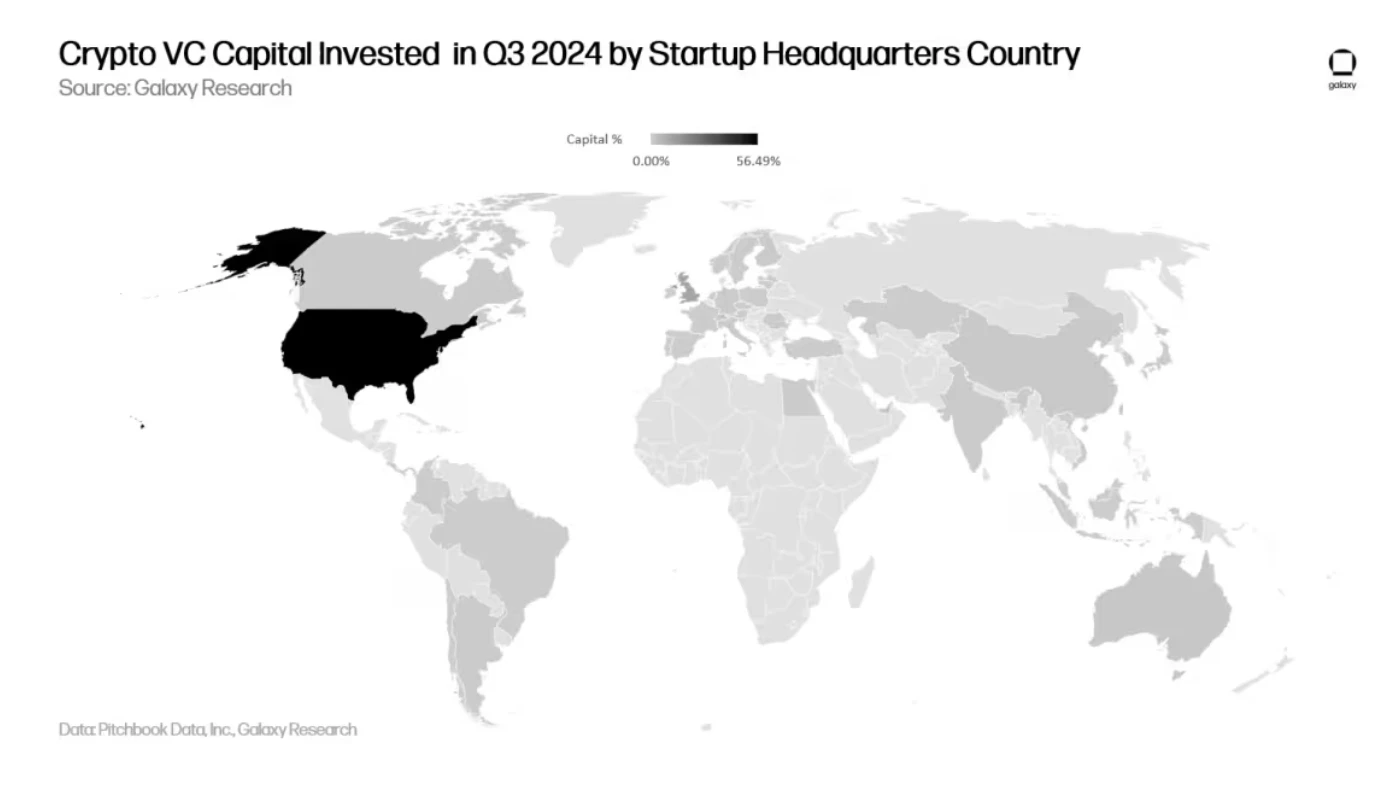

The United States continues to dominate the cryptocurrency venture capital market, with investment amounts and deal counts involving U.S. projects/companies accounting for 56% and 44% respectively.

-

In terms of fund raising, institutional investors interest remains low, with only 8 new funds successfully raising US$140 million in the third quarter of 2024.

-

The median size of cryptocurrency VC funds continues to decline , with both the median size ($40 million) and average size ($67 million) in 2024 being the lowest since 2017.

Primary market investment details

Number of transactions and investment size

In the third quarter of 2024, venture capital funds invested a total of US$2.4 billion in cryptocurrency and blockchain startups/enterprises (-20% QoQ), involving 478 transactions (-17% QoQ).

Investment totals for 2024 are expected to match or barely exceed 2023 figures.

Primary Market Bitcoin Price

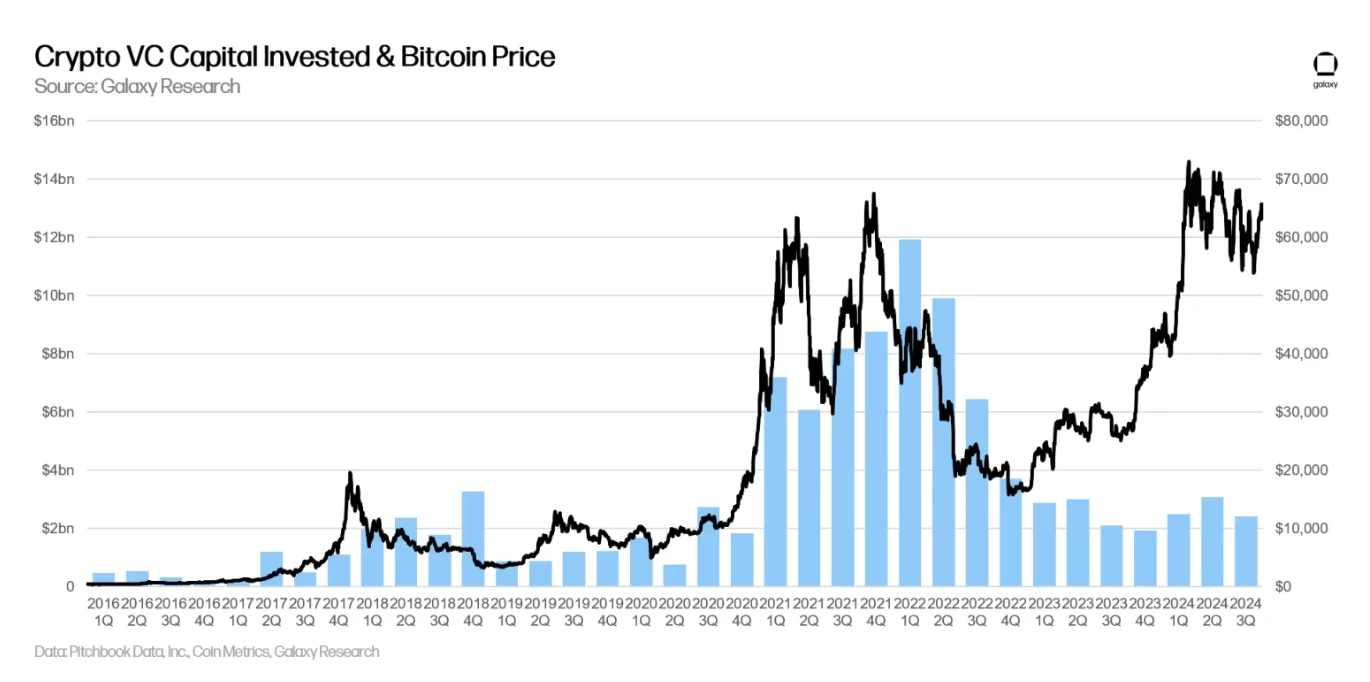

The multi-year correlation between Bitcoin price and primary market activity has broken down. Since January 2023, Bitcoin has risen sharply, while venture capital activity has struggled to keep pace. The break in correlation can be partially explained by the weakening interest of institutional investors in crypto venture capital and venture capital in general, coupled with the markets preference for Bitcoin, which has led to many hot topics since 2021 being ignored.

Distribution of shot timing

In terms of the amount distribution, 85% of venture capital is invested in early-stage projects/companies, and 15% is invested in late-stage projects/companies. Native funds in the cryptocurrency field still have the opportunity to get bullets from large financings a few years ago, and more direct contact with entrepreneurs means that they can find new transaction opportunities in some emerging narratives.

Judging from the distribution of the number of deals, the share of Pre-Seed round financing has slightly decreased, but remains healthy compared with previous cycles.

Valuation and investment size

In 2023, the investment valuation of venture capital funds in cryptocurrency projects/companies fell sharply, reaching the lowest level since the fourth quarter of 2020 in the fourth quarter of 2023.

However, as Bitcoin hit an all-time high, valuations and investment sizes began to rebound in the second quarter of 2024. In the second and third quarters of 2024, venture capital funds investment in cryptocurrency projects/companies reached the highest level since 2022. The rise in investment size and valuation in the cryptocurrency field is consistent with the rising rhythm of the entire venture capital industry, but the rebound in the cryptocurrency field is more obvious. The median pre-investment valuation in the third quarter was US$23 million, and the average investment size was US$3.5 million.

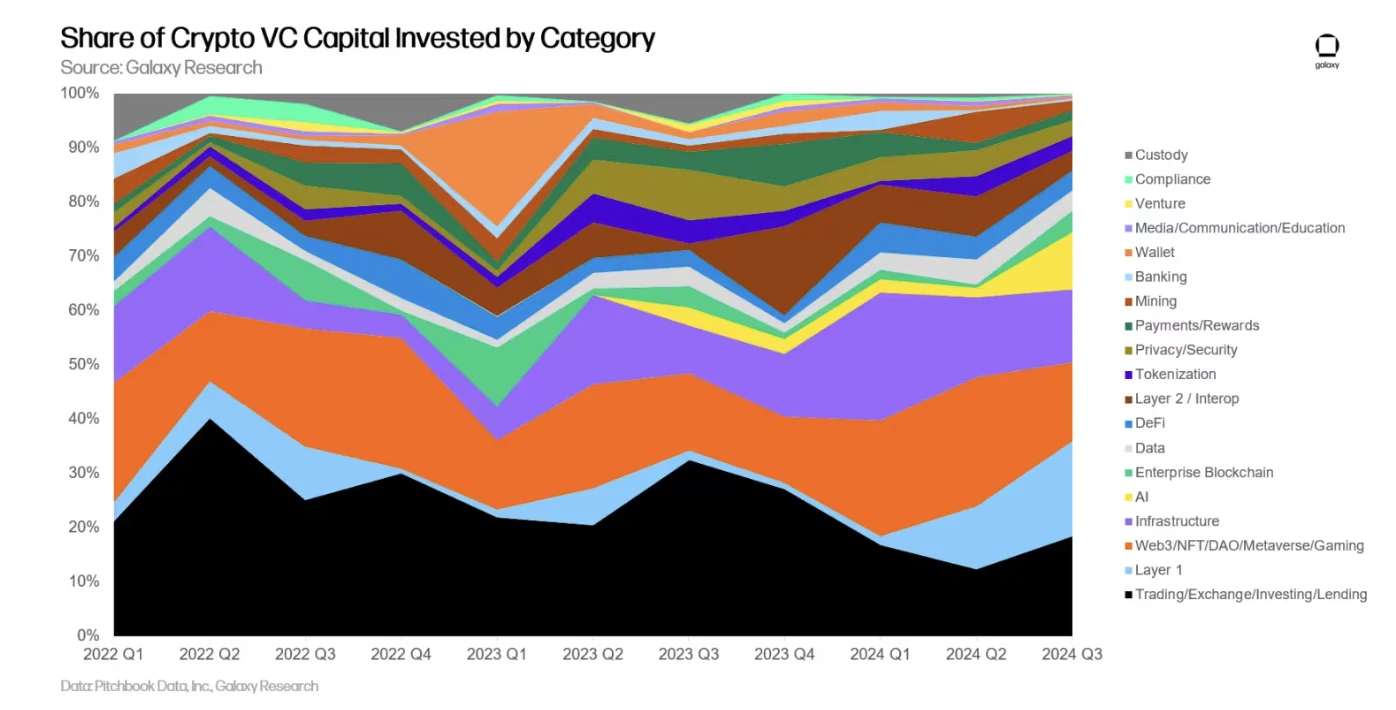

Investment Project Category

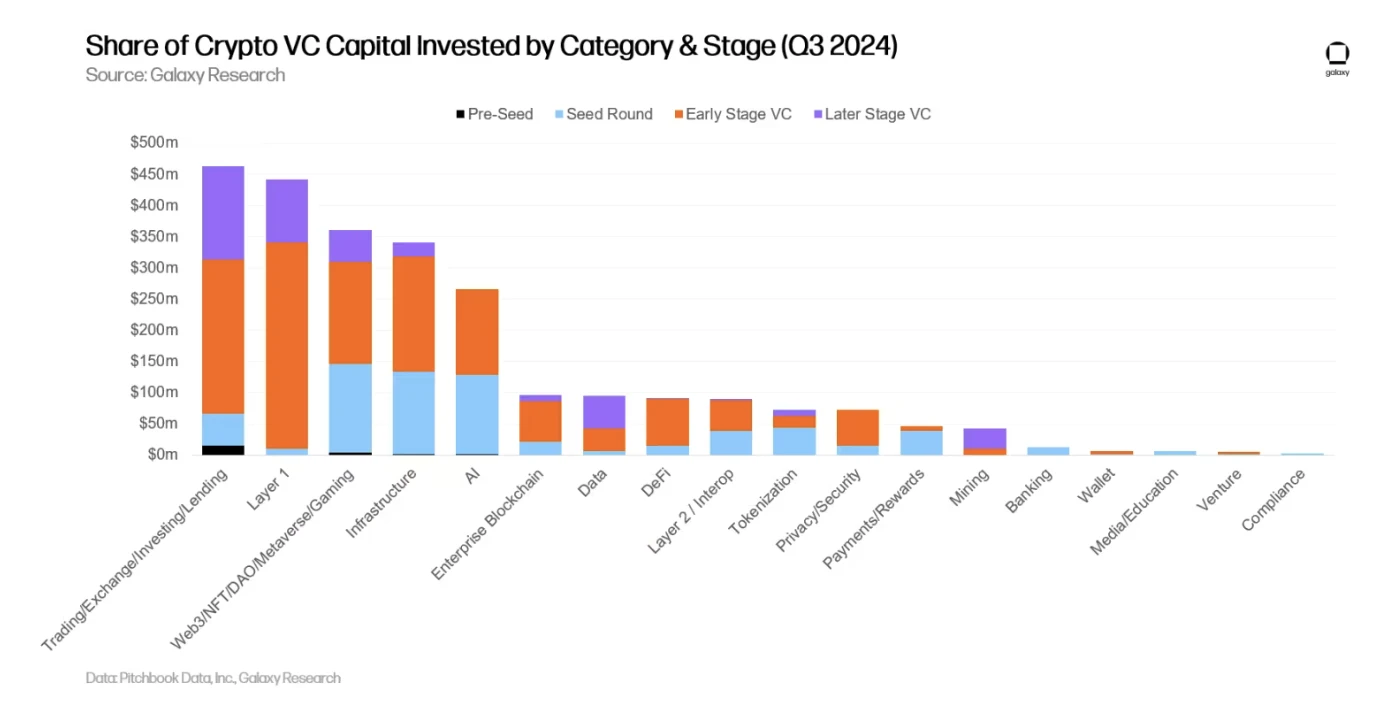

In the third quarter of 2024, projects/companies in the “Trading, Exchange, Investment, Lending” category raised the largest share of funds (18.43%), with a total of $462.3 million. The two largest deals in this category were Cryptospherex and Figure Markets, which raised $200 million and $73.3 million, respectively.

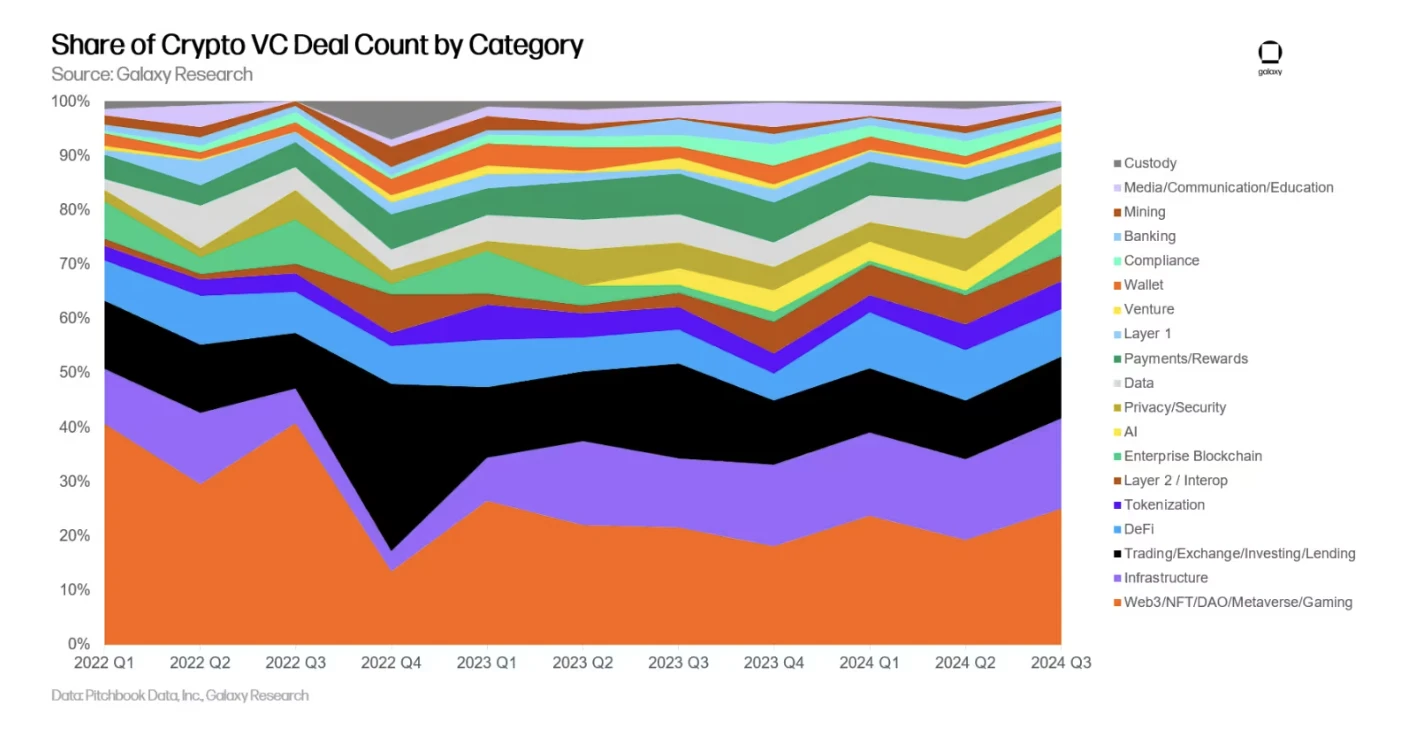

Crypto startups building AI-related services saw a 5x increase in funding in Q3 2024. Sentient, CeTi, and Sahara AI contributed significantly to this, raising $85 million, $60 million, and $43 million, respectively. Projects/companies in the “Trading, Exchange, Investment, Lending” and “Layer 1” categories also saw a 50% increase in funding. VC funding for projects/companies in the “Web3, NFT, DAO, Metaverse, Gaming” category decreased by 39%, the largest decrease among all projects/companies.

If the categories in the above figure are further broken down, Layer 1 projects accounted for the largest share of funding in Q3 2024 (13.6%), totaling $341 million. In the Layer 1 category, the top two financing transactions (Exochain and Story Protocol) raised a total of $183 million, accounting for 54% of the total financing in this category. After Layer 1, cryptocurrency exchanges and infrastructure companies ranked second and third in terms of fundraising, with $265.4 million and $258 million respectively.

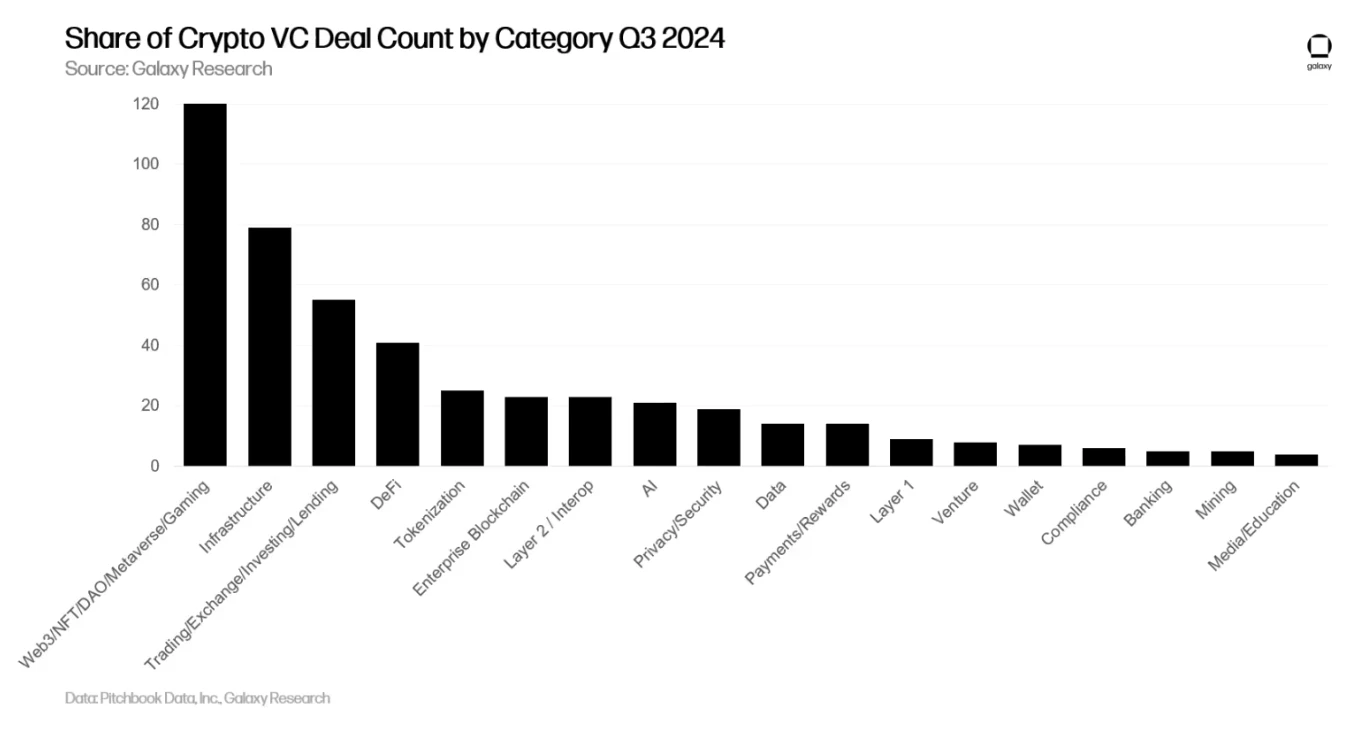

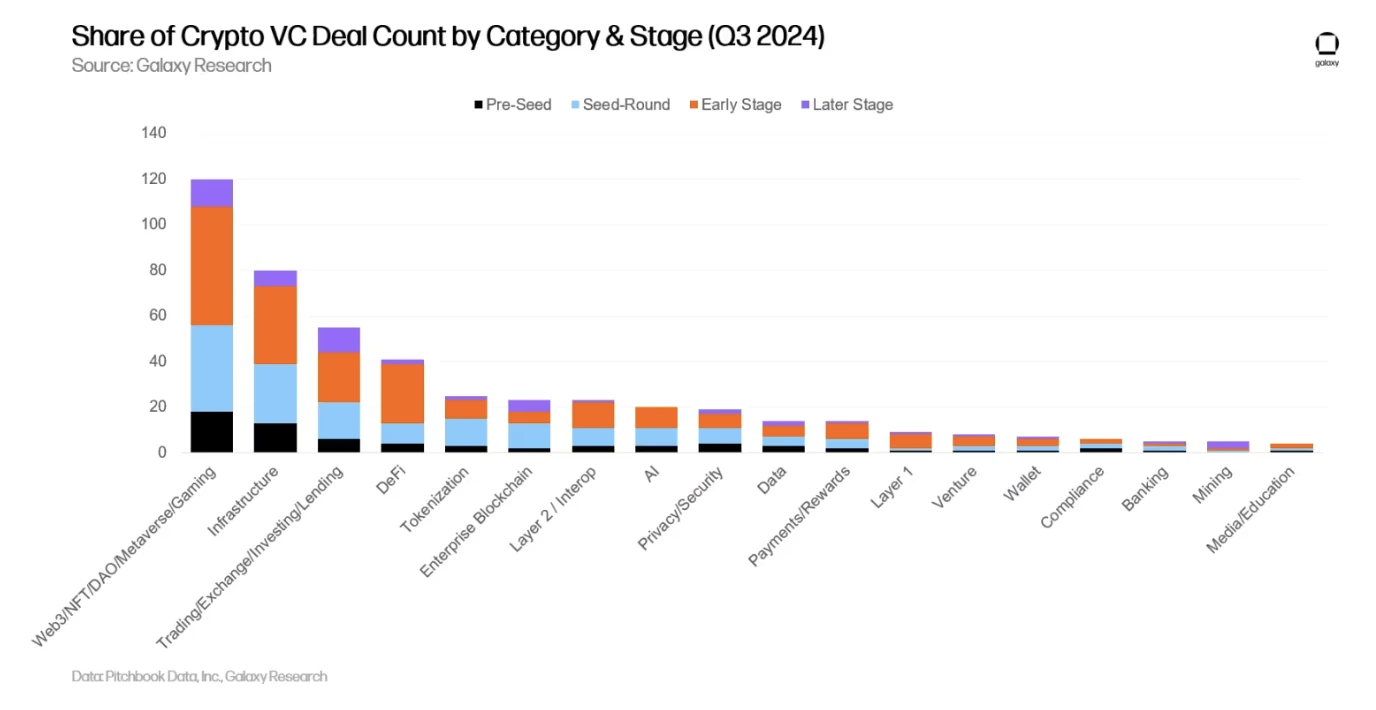

In terms of the number of financings, the financing of projects/companies in the categories of Web3, NFT, DAO, Metaverse, and Games accounted for 25% (120), a 30% increase from the previous month, of which 48 were financings for Game projects. In the third quarter of 2024, the largest Game financing was Firefly Blockchain raising $50 million in its Series B financing.

Infrastructure projects/companies ranked second in terms of financing, accounting for 16.5% (79 deals), up 12% from the previous month. Trading, Exchange, Investment, Lending projects/companies ranked third in terms of financing, accounting for 11.5% (55 deals). It is worth noting that the number of financing deals for Media, Education and Data projects/companies decreased the most from the previous month, by 73% and 57% respectively.

If the categories are further subdivided, among all industries, infrastructure related projects/companies have the largest number of financings (64); the two major sub-categories of games and DeFi follow closely behind, completing 48 and 38 financings respectively in the third quarter of 2024.

Further analysis of timing of action and project categories

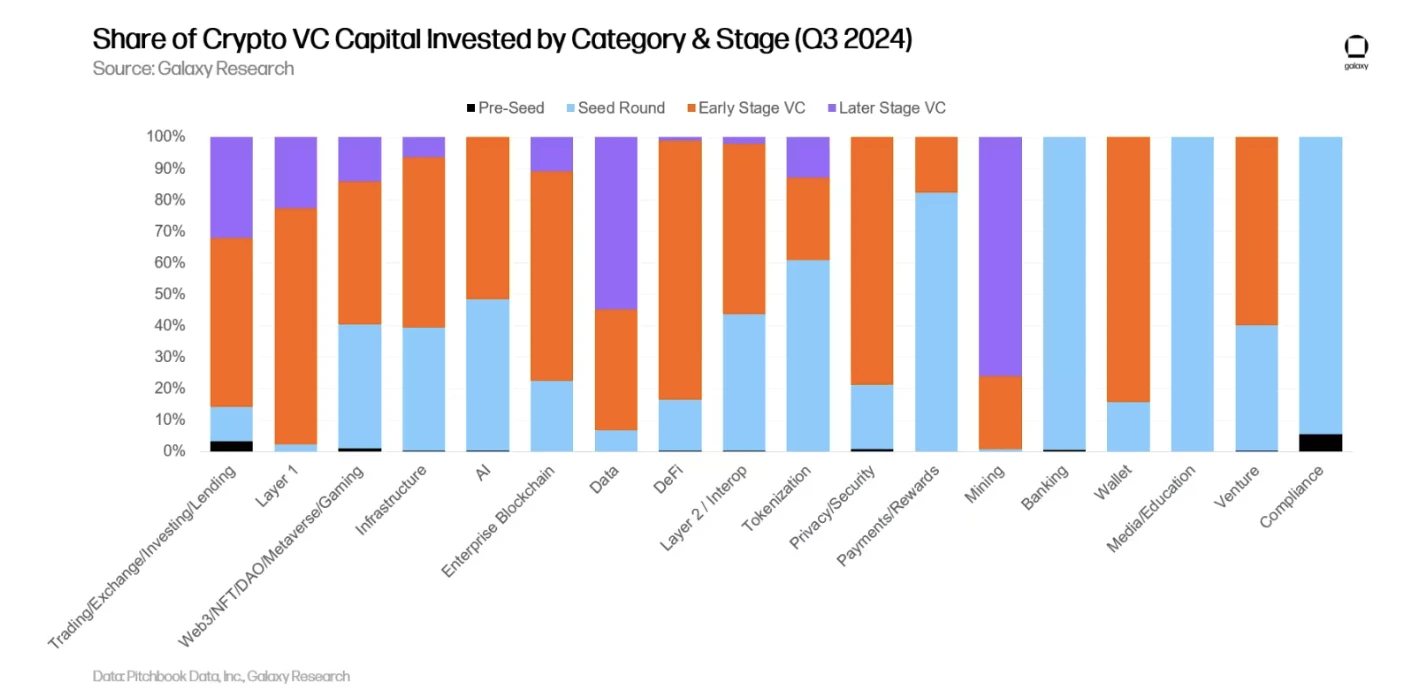

If we further sort out the financing amount and number by category and timing of financing projects, we can get a clearer picture of which types of companies in which categories are actively raising funds. In the third quarter of 2024, the vast majority of funds in Layer 1, enterprise blockchain, and DeFi went to early-stage projects/companies; in contrast, most of the funds in the mining sector went to late-stage companies.

By analyzing the distribution of funds in different categories and stages, we can see the relative maturity of various investment opportunities.

Similar to VC activity in Q2 2024, a large portion of deals completed in Q3 2024 also involved early-stage companies. Late-stage funding across all categories remained unchanged compared to Q2 2024.

By studying the amount of funding achieved by different categories at different stages, we can gain insight into the different stages of each investable category.

Geographical distribution characteristics

In the third quarter of 2024, the number of financings by US companies ranked first (43.5%), followed by Singapore with 8.7%, the United Kingdom with 6.8%, the United Arab Emirates with 3.8%, and Switzerland with 3%.

In terms of financing amount, companies headquartered in the United States received 56% of all venture capital funds, a slight increase of 5% month-on-month. The United Kingdom accounted for 11%, Singapore accounted for 7%, and Hong Kong accounted for 4%.

Age of invested company

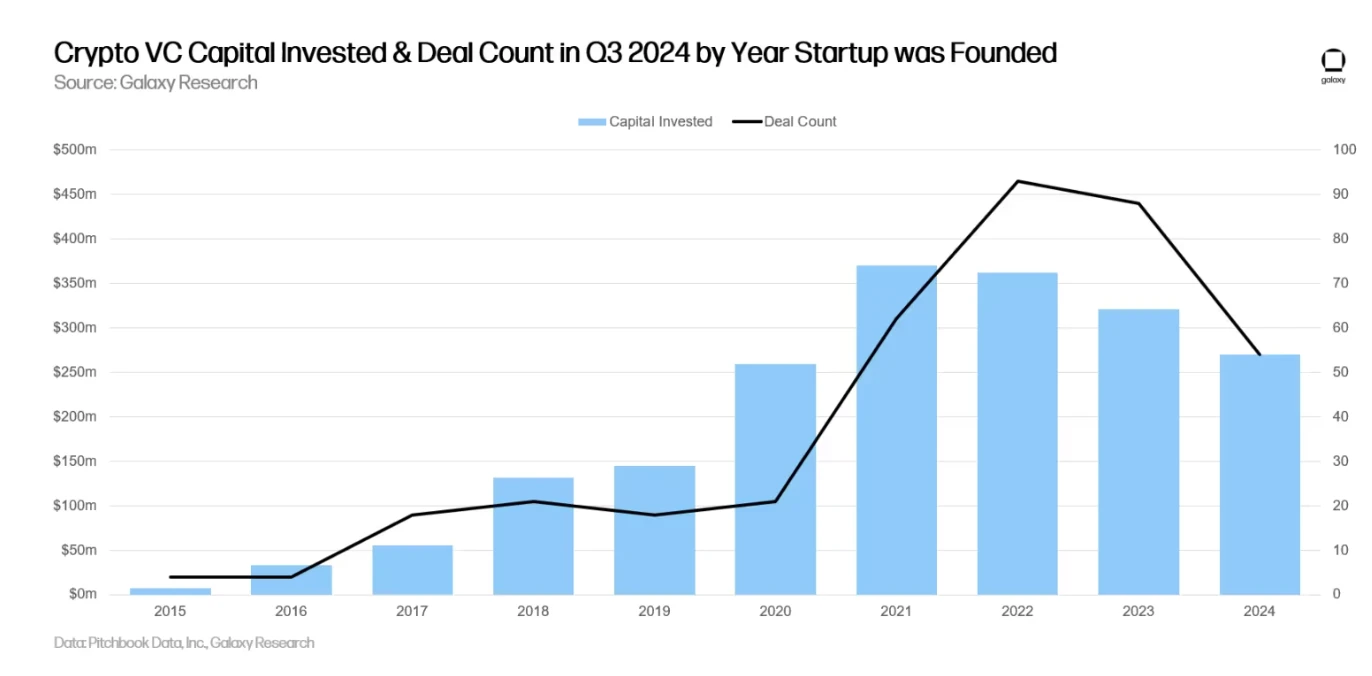

Projects/companies established in 2021 received the most investment funds, and project companies established in 2022 completed the largest number of financing transactions.

Fund Raising Status

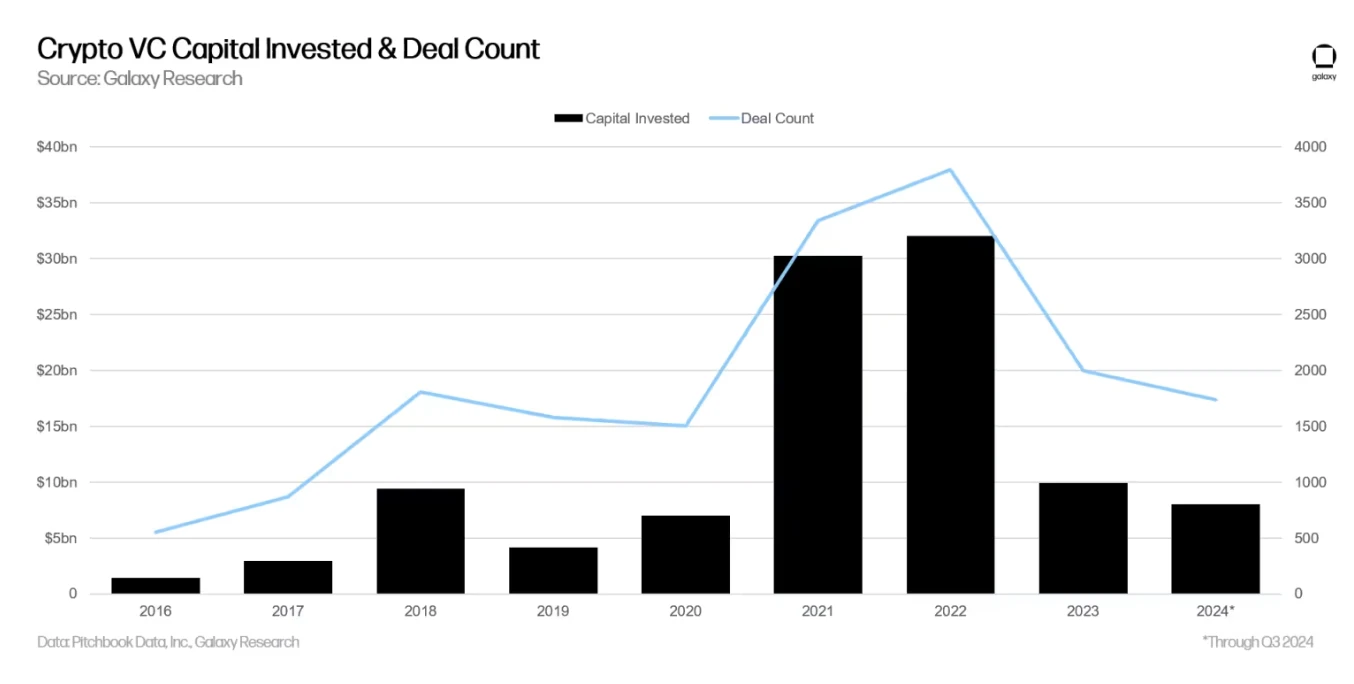

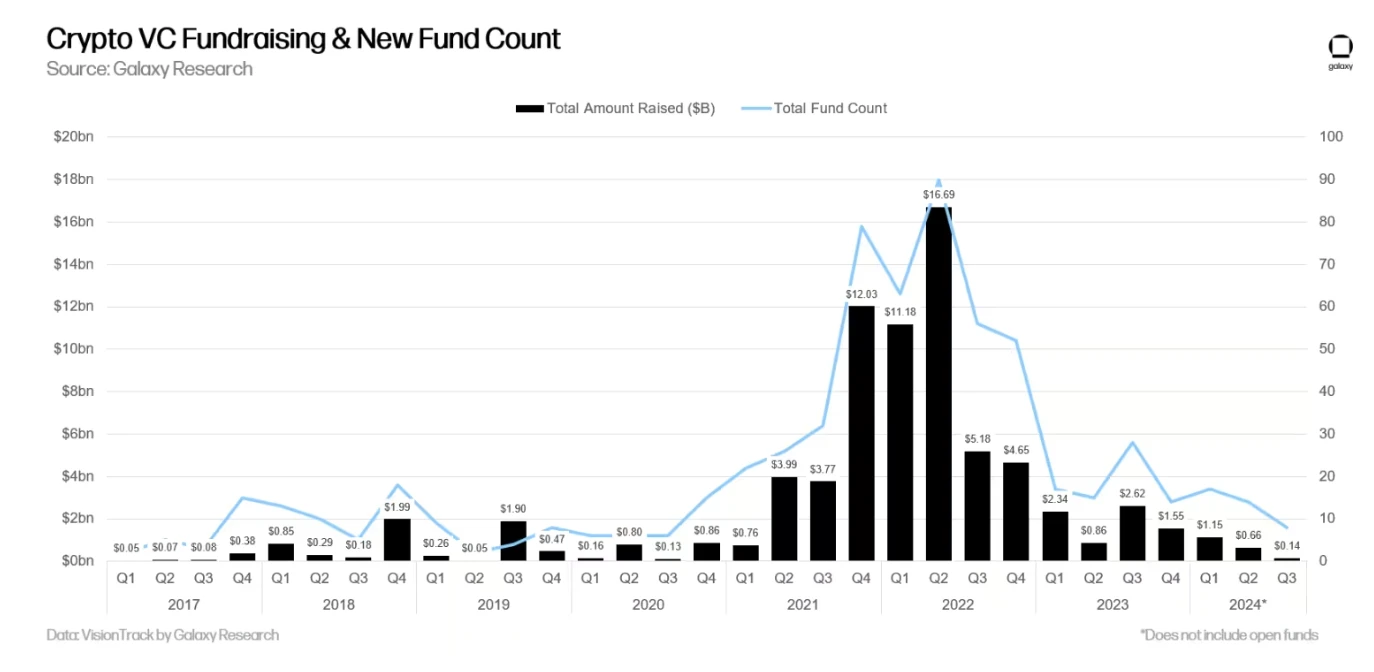

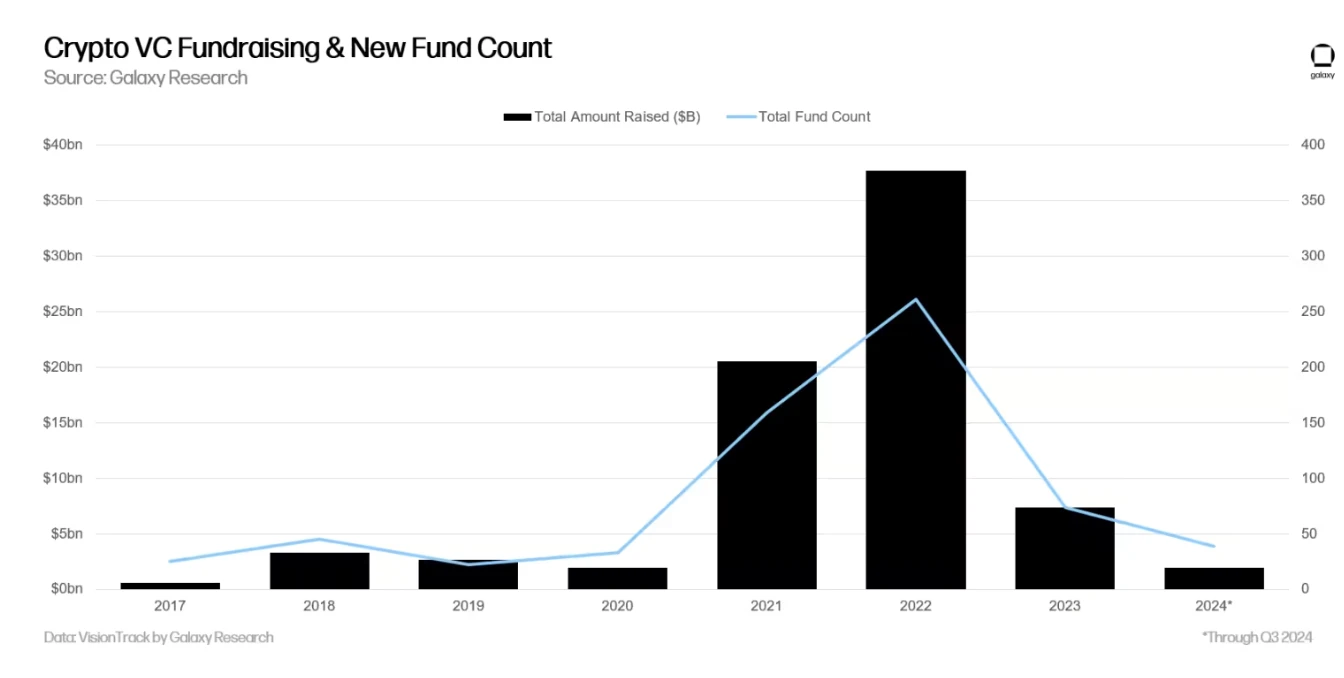

Fundraising for crypto VC funds remains challenging. The macro environment in 2022 and 2023 combined with crypto market volatility has prevented some institutional investors from contributing as generously to crypto VC funds as they did in 2021 and early 2022. At the beginning of 2024, investors generally believed that interest rates would fall significantly in 2024, although the rate cuts did not begin to materialize until the second half of the year. The total amount allocated to VC funds has continued to decline month-on-month since the third quarter of 2023, and the number of new funds established in the third quarter of 2024 was the lowest since the third quarter of 2020.

On an annual basis, 2024 will be the weakest year for cryptocurrency venture capital fundraising since 2020, with only 39 new funds raising $1.95 billion, far below the frenzy of 2021-2022.

The decline in institutional investor interest has not only led to a decrease in the number of newly established cryptocurrency venture capital funds, but also a simultaneous decline in fund size. The median and average fund sizes in 2024 (as of the third quarter) have reached their lowest levels since 2017.

Summarize

Sentiment and activity in the primary market remain well below bull market levels. While crypto asset markets have recovered significantly from late 2022 and early 2023, venture capital activity remains well below prior bull markets. The previous bull markets of 2017 and 2021 saw a high correlation between venture capital activity and crypto asset prices, but over the past two years, despite a recovery in the cryptocurrency market, venture capital activity has remained sluggish. There are many reasons for the stagnation in venture capital, including the “barbell market” effect, where Bitcoin has attracted more market attention while meme tokens have limited marginal activity, which have been difficult to fund and have questionable durability.

Early-stage investments remain mainstream, and despite headwinds in the VC market, interest in early-stage deals bodes well for the long-term health of the broader cryptocurrency ecosystem. While late-stage companies have trouble raising funds, entrepreneurs continue to find investors willing to invest in new and innovative ideas. In a difficult fundraising environment, projects/companies building Layer 1, scaling solutions, games, and infrastructure have raised a lot of money.

The launch of spot Bitcoin ETFs has put additional pressure on the primary market of cryptocurrencies. Several high-profile investments by some large investors (pensions, endowments, hedge funds, etc.) in US spot Bitcoin ETFs show that these large investors have been able to gain investment exposure to the cryptocurrency space through these very large and liquid investment vehicles instead of turning to early-stage venture capital. Although the markets current interest in spot Ethereum ETFs remains very limited, if investment demand for broader crypto asset classes (such as DeFi and Web3) increases, Ethereum ETFs may also attract some of the funds that would otherwise flow to the venture capital field.

Fund managers continue to face a difficult environment, although some new, smaller funds have been successful in raising capital. The number of new funds launched in the third quarter and the amount of capital allocated to these funds were both at their lowest levels in 4 years (since the third quarter of 2020) . With fewer new funds launched and smaller in size, coupled with the silence of comprehensive venture capital and institutional investors in this market, late-stage projects/companies may continue to struggle in terms of fundraising. If the regulatory approach to digital assets in the United States is substantially relaxed after the November 5th presidential election, late-stage projects/companies may be able to enter the public markets as an alternative.

The United States continues to dominate the cryptocurrency startup ecosystem. Despite facing an extremely tricky and often hostile regulatory environment, companies and projects headquartered in the United States have completed the most rounds and absorbed the largest amount of funds. Policymakers should be aware that their actions will affect the cryptocurrency and blockchain ecosystem if the United States is to remain a center of technological innovation in the long term. There may be some good news in the future, as both former President Trump and current Vice President Harris have expressed support for the industry – either extremely supportive or moderately supportive.

This article is sourced from the internet: Primary Market Q3 Review: Sage Time for Institutions

Related: Rigidity, Bubble, Crisis, Ice-breaking

Original author: YBB Capital Researcher Ac-Core TL;DR Unlike the previous bull market, which was driven by macroeconomic prosperity, this round of crypto market is mainly affected by macroeconomic uncertainty; ETF is just an ibuprofen sustained-release capsule, and the trend of crypto-US stocks has become a tightening curse on the industrys growth potential; The current bull market is almost limited to Bitcoin. The main reason for the sluggish performance of altcoins is the lack of overall industry innovation, insufficient liquidity, and overvaluation of the primary market. The overall capital driving force is limited, and the market is difficult to increase in volume; With industry innovation stagnating, the entry of traditional institutions such as BlackRock can provide a certain amount of incremental funds, but it cannot change the trend of market involution,…