From ICO to community tokens, an overview of the evolution of cryptocurrency issuance

Original author: Ignas | DeFi Research

Original translation: TechFlow

I started to get interested in Memecoins and even bought MOODENG. The fear of missing out drove me to take action. My default expectation was that the price might drop to zero, but I didnt want to miss the chance to become the next Doge. I wanted to be part of the success story and join the optimistic community.

In fact, buying Memecoins, more than any other utility token, satisfies an inner sense of belonging, of being part of a story, and of joining a community that shares the optimism of “success.”

You see, this kind of optimism and bullish sentiment is hard to find in other cryptocurrency spaces.

Ethereum holders expect that ETH may only increase by 3 to 4 times in this cycle, and BTC may be similar. SOL may reach $1,000. For tokens with low circulation and high fully diluted valuation (FDV), market sentiment is generally pessimistic.

This also goes against my own promise not to trade Memecoins. I won’t buy coins that are heavily promoted in X’s feed, but I will try my hand at some coins that I believe have potential.

I changed my mind because my number one rule in crypto is to keep an open mind and try new things. Being an maximalist yourself is risky, but identifying and investing in maximalist communities can have huge rewards.

This blog post therefore explores some of these new developments, with a particular focus on new ways to bring tokens to market.

Identifying the latest token issuance trends can be the most profitable trade we can make. Memecoins are just one trend, and there are others emerging in this cycle.

A brief history of token issuance

Viewing cryptocurrencies as a hedge against fiat currency overprinting may be our biggest self-deception. While Bitcoin may be an exception, the entire crypto industry is printing money in a way that would make central banks jealous. There are 14,741 cryptocurrencies listed on CoinGecko, and thousands more that didnt survive long enough to make the list. With each cycle, issuing tokens becomes easier.

Here are some key token issuance trends you should know about and how they are changing the game (if you have already read my previous blog post, you can skip this section).

-

Litecoin and Early Altcoins (2011): Litecoin was one of the first altcoins, launched in 2011 as a fork of Bitcoin. Before Litecoin, we generally thought that Bitcoin was all there was to blockchain! However, Bitcoin forks also made us realize that we could create our own private currencies. During this period, a few Bitcoin forks and proof-of-work altcoins emerged, including Bitcoin Cash and Bitcoin SV. These forked coins provided Bitcoin holders with free coins during the fork process, creating profit opportunities.

-

ICO boom (2017): The ICO boom was driven by Ethereum’s ERC 20 standard, which made it cheap and easy to create new tokens. No more proof-of-work (PoW) hardware required! Thousands of tokens were launched, each with ambitious promises. ICOs were often able to raise large amounts of money, but the 2018 market crash led to huge losses as many projects failed to deliver on their promises. This phase was a critical period of speculative “money printing” as teams issued tokens with minimal effort, ultimately leading to the collapse of the market.

-

DeFi and Liquidity Mining (2020): The next innovation came in the DeFi summer of 2020, when liquidity mining and yield farming became very popular. Projects like Compound (COMP) and Susiswap introduced liquidity mining rewards, where users received governance tokens for participating in the protocol. This incentivized liquidity and user participation, but as too many new tokens were issued, demand could not keep up, eventually leading to a market crash.

-

Fair Launch Era: This period was very short. Yearn Finance’s YFI token is a classic example of the concept of “fair launch”, where tokens were not distributed directly to users through an ICO or presale. Anyone could participate, and YFI’s initial mining rewards attracted widespread attention. However, people soon realized that “fair launch” was not truly fair. Pre-mining was common before marketing, and teams benefited little from a truly fair launch, so incentives were not aligned.

-

NFT and Ponzi Token Economics (2021): The craze for NFTs, represented by the Bored Ape Yacht Club, has brought a new way of “printing money”. The emergence of a large number of NFT collections seems to repeat the speculative token issuance that caused the previous market crash. As attention and capital gradually diluted, many new NFT projects eventually collapsed. NFTs are similar to meme coins, but because there are only 10,000 NFTs per series at most, coupled with the high selling price, many people are excluded and the size of the community is limited.

Although we all issue “currency” in different ways, when the amount of “printing money” exceeds the “hard currency” flowing into the market, the market will inevitably collapse. We eventually print too many tokens to meet demand.

Token issuance story for the 2023-2024 bull cycle

The first phase of the current bull market was marked by the rise and fall of the points-for-airdrops trend.

The points mechanism evolved naturally to solve some of the problems with liquidity mining. By providing teams with more flexibility to execute token generation events (TGEs) and attract capital into the protocol, it drives growth in total locked value (TVL), thereby proving product-market fit. This also enables teams to obtain higher valuations from venture capital firms.

Initially, this approach worked well when Jito and Jupiter gave back generously to users, but as the rules of the meta-game of points for airdrops became clear, the return on investment (ROI) of airdrops often turned negative.

Speculators try to earn points by “farming” but often end up paying more in interest than they earn from the airdrops. In addition, the points system lacks the transparency of DeFi’s summer liquidity mining campaign.

They trick you into thinking that staking DYM or TIA will get you rich by giving you access to multiple airdrops (which were never delivered).

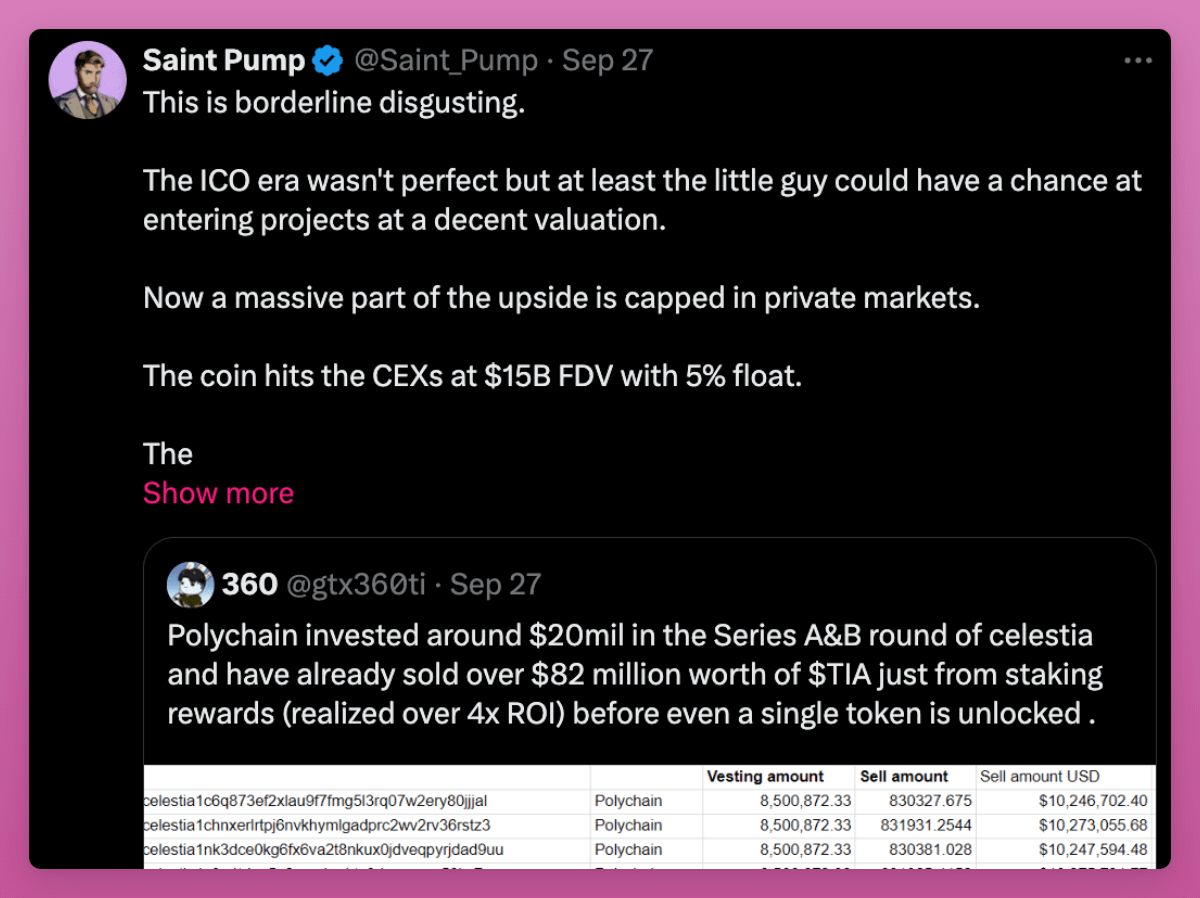

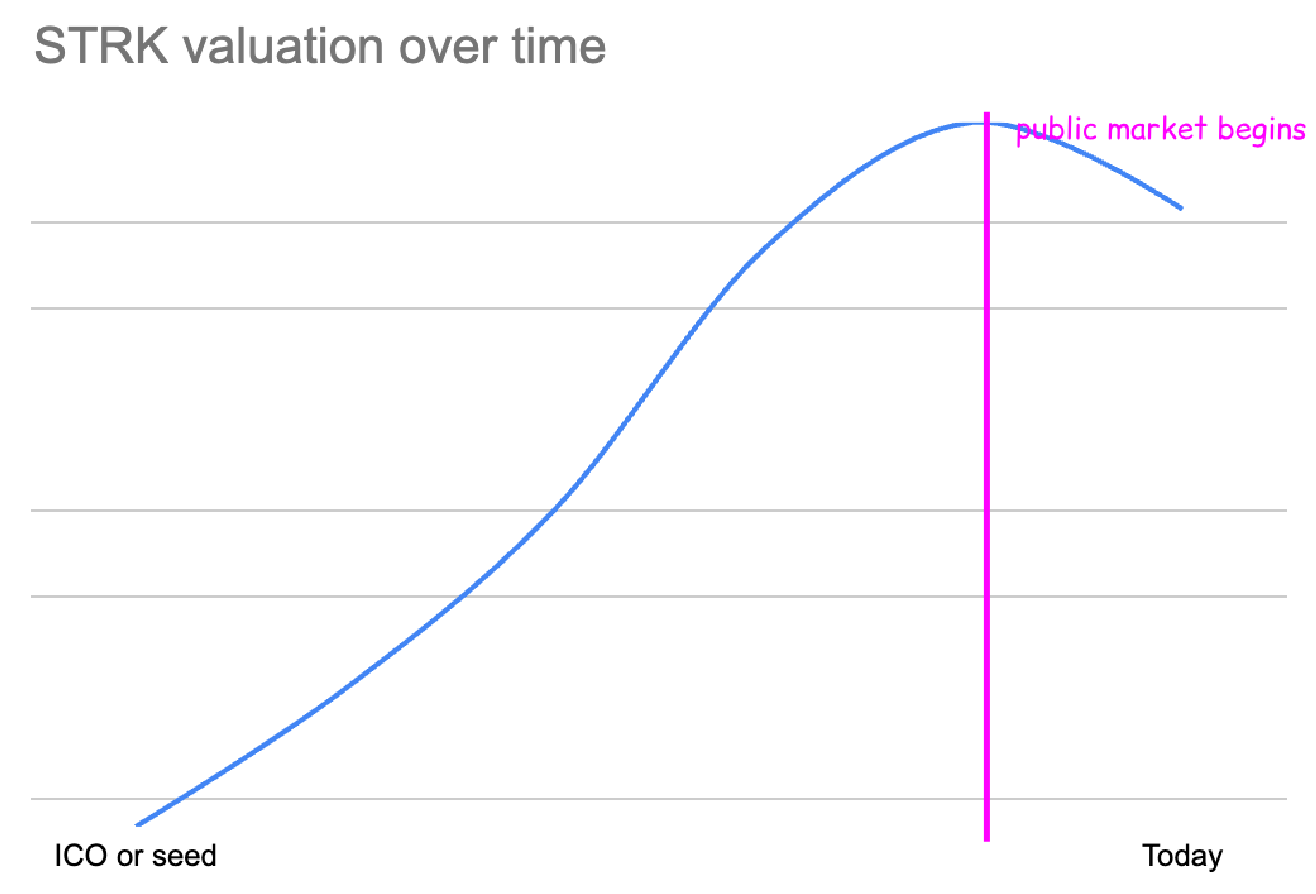

However, the biggest problem that led to the decline of this trend was the issuance of tokens with low circulation and high fully diluted valuation (FDV). As the total locked value (TVL) grew, the market considered these protocols more expensive, so tokens were issued at extremely high valuations, leaving little upside for new buyers.

We realize that high FDV is not a meme.

Although the points mechanism has not completely disappeared, the decline in market sentiment and usage has already been seen. For example, Eigenlayer decided not to conduct a third-quarter airdrop and instead chose programmed incentives, which is actually another way of saying liquidity mining.

Currently, most major protocols have entered the second, third or fourth season of point mining, and the enthusiasm for point mining on new protocols has faded. I used to share Best Farm of the Week on this blog, but it is difficult to find attractive point opportunities in the market now.

New protocols that missed the points boom must innovate on token issuance models to attract users and create wealth. Here are some emerging token issuance models.

Public and Private Token Sales

ICOs are no longer popular, but their spirit lives on.

Cobie, perhaps the most influential cryptocurrency trader, pointed out in his May blog post that a major problem in the current crypto market is that new token issuances have “privately captured” the upside, making it almost impossible for ordinary investors to participate.

Most price discovery occurs in private funding rounds from venture capitalists, who buy in at low prices before tokens are publicly available. As a result, when these tokens come to market, they are overvalued, with inflated fully diluted valuations (FDVs), leaving little room for profit for public investors. This situation favors insiders, while public buyers face a high-risk, low-return situation.

For example, ETH’s valuation at the time of its seed round or ICO left a huge upside for buyers.

However, for low circulation, high FDV tokens like STRK, EIGEN or other tokens in this cycle, the situation is no longer the same.

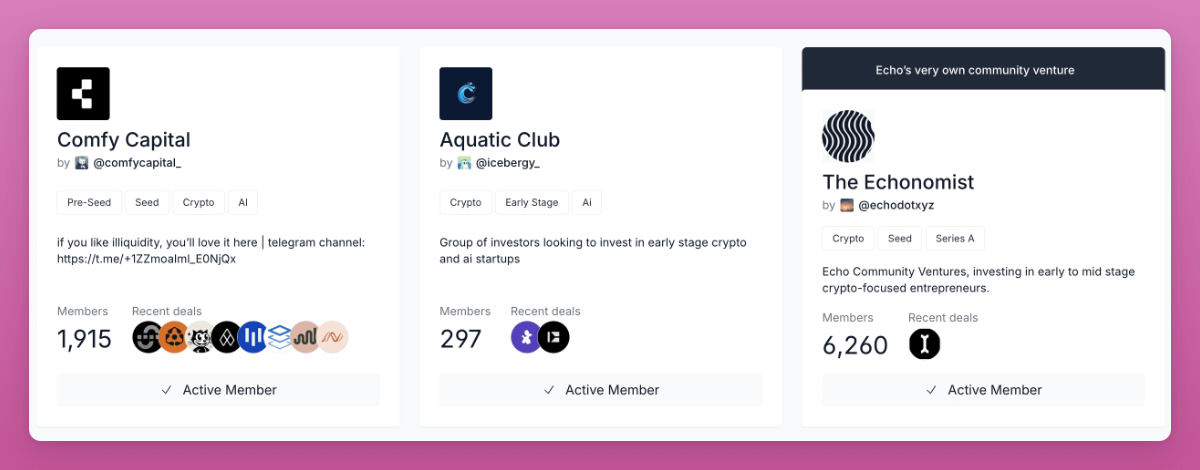

Therefore, Cobie came up with a solution, which is to launch the Echo platform for early-stage token investment. Here’s how it works:

-

Group leaders: “Experienced investors” (or opinion leaders) create groups and share investment opportunities with members. Group members can choose to follow these leaders and invest under the same conditions.

-

On-chain investment: All investments are made using USDC on Base L2.

-

Smart Contracts: Investments are legally managed by Echo through smart contracts, so lead investors do not have direct access to your funds. In token investing, only you can decide when to sell your tokens.

-

For founders: Founders who want decentralized, community-driven funding can raise funds through Echo groups, avoid centralized venture capital holdings, and distribute equity or tokens to true on-chain native investors.

You need to pass KYC verification, connect your X or Farcaster account, complete a questionnaire, and then join the group to view investment opportunities.

Their first major deal was the Initia project, which raised $2.5 million from at least 500 participants at a valuation of $250 million, 28.57% lower than the $350 million valuation in the Series A round (as reported by The Block). The maximum investment amount is $5,000.

The fact that participants in Echo were able to invest at a lower valuation than the Series A round was very appealing, but the model was very much a return to the early ICO model of the past, which prevented many from participating.

Of course, I can create my own group and invite my fans to invest in early stage protocol projects. Compared with VC rounds, these protocols can benefit from a larger community, but this does not solve many problems faced by projects, such as larger capital injections, industry connections, strategic guidance, marketing and credibility, and long-term support.

Nonetheless, I believe projects could benefit from diversifying their funding channels: either getting significant backing from well-known VCs or conducting community-building rounds through Echo, as Initia did.

However, Echo is currently a relatively closed community, which is one of the reasons for its strong profitability: even popular ICO platforms like Coinlist are difficult to enter, and the allocations are usually small. If you have the opportunity to join, give it a try.

「Sponsorship Sales」

I have only participated in two rounds of KOL investment: Bubblemaps and Vertex.

Recently, I was involved in a third one: Infinex. I say sort of because this is not a typical KOL investment. In a typical KOL investment, the project will contact the influencer and offer an investment opportunity that is more favorable than venture capital. In exchange, the KOL needs to post some tweets about the project on social media. It is precisely because Bubblemaps and Vertex do not have these publicity requirements that I am interested in them. But if I dont promote, whats the point of being an investor?

Synthetix’s Kain took a different tack with the Infinex token sale.

In addition to running gamified yield farming campaigns, he also launched a Patron NFT sale. I received a private message from Kain telling me that I could choose one of three lock-up and valuation terms to invest: no lock-up, annual vesting, or 1-year cliff plus 2-year vesting with a 75% discount.

Infinex raised $65 million from 41,000 backers!

In a podcast with Blockworks, Kain pointed out that the current popular methods of token distribution, which mainly rely on airdrops and private placements to qualified investors, have flaws.

He advocates for a fairer approach where everyone — whether venture capitalists, influencers, or ordinary investors — has the same opportunity to buy tokens at the same price.

“Everyone starts at the same starting line. That’s the fairest way you can do it, isn’t it? If everyone plays by the same rules and has as much information as possible, you prevent those who are uninformed from jumping in blindly out of fear of missing out.” – Kain

Like Echo, Infinex is taking inspiration from the ICO era and current trends and adapting them to a modern context. While many of the participants are influential crypto Twitter personalities, and the sale may exclude some large communities, there are different ways to qualify for the sale (such as point earning).

Unfortunately, this model may not work for lesser-known projects. However, I would definitely participate in more token sales if they offered a no-strings-attached KOL sale option on the website instead of requiring a SAFT contract with a vague TGE timeline.

There is a new trend now that allows anyone to participate in token sales.

Runes or other token models on Bitcoin

For me, BTCfi is the most exciting 0 to 1 innovation in this crypto cycle. I am having a lot of fun minting Ordinal NFTs and playing with BRC 20/Rune tokens.

I admit that the current infrastructure and UX/UI are not perfect, but they are gradually improving. Even so, ORDI (the first BRC 20 token) was minted for free and has reached a market cap of $1.8 billion, bringing huge profits to early adopters. This is a success story we should pursue!

I once held it, but sold it out.

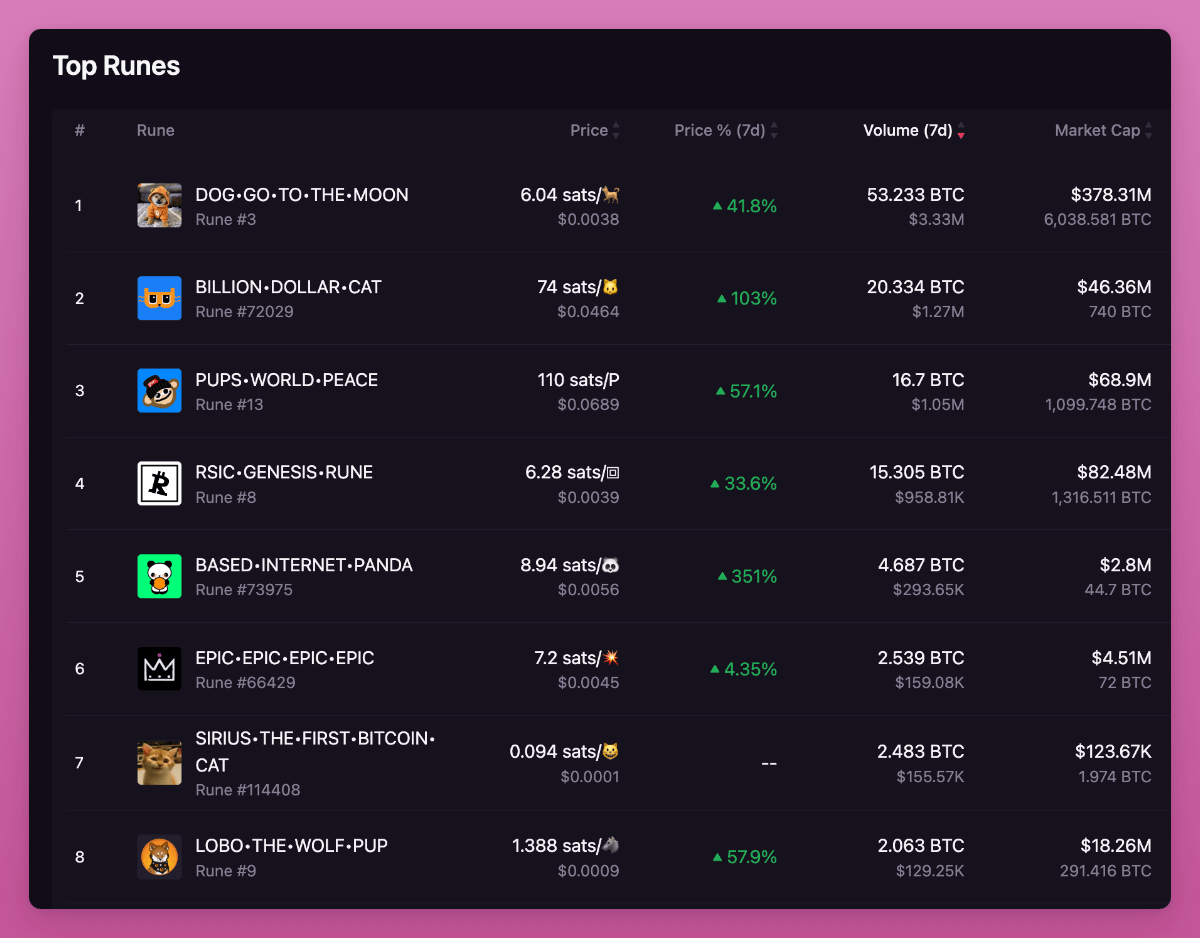

BTCfi was one of the hottest topics, but the hype died down soon after the launch of Runes Protocol.

However, I still believe that BTCfi can succeed: the infrastructure is improving, the community is very strong (mainly in Asia, so less mentioned on crypto twitter). The price is also recovering. Take a look at the 7-day performance of Rune top 10.

The biggest innovation of BRC 20 and Runes is the way they are issued in the market.

Anyone can mint Rune tokens on the Bitcoin network by paying Bitcoin transaction fees. To try it out, visit Luminex and choose a token to mint. Alternatively, you can create your own Memecoin and choose a percentage of pre-mining, which will be transparent to everyone.

I like Runes because they address our frustrations with venture capital rounds, pre-sales, low circulating supply of tokens, and the lack of transparency in the current Memecoin distribution. Runes represent the fairest token distribution model currently available.

Additionally, the smaller Bitcoin transaction fees and slow transaction speeds create barriers to over-issuance of tokens and concentration in a small number of wallets, a problem also faced by Memecoin on other chains.

I think there needs to be a new catalyst to spark a new wave of FOMO. Currently, Fractals L2 is gaining traction and it could bring new excitement to Runes. Runes can be minted on Bitcoin first and then bridged to Fractals (or other Bitcoin L2) where they will gain smart contract functionality.

By the way, the mining method of Fractals token FB is similar to BTC. You can participate in cloud mining by renting PoW machines. Due to high inflation, the price of FB has been falling.

Finally, new token standards on Bitcoin may become popular, perhaps leading to innovative token models via the OP_CAT upgrade. My view is that there is huge speculative potential for fair issuance of tokens on Bitcoin, so it is worth keeping a close eye on the BTCfi ecosystem.

About the mini program DianDian Mini Games on Ton

While I’m not a fan of earning money by tapping my phone screen, the “Tap to Earn” mini-apps launched by Ton and Telegram have attracted millions of users. Most of these users are outside the United States, so most crypto Twitter users may miss out on this new trend.

In my previous article, we explored why South Asia is a unique crypto market.

We understand that for many people in third world countries, the “Touch to Earn” airdrops provide a new source of income during economic challenges. This is more in line with the blockchain’s promise to democratize cryptocurrency and make it accessible to everyone, rather than just allowing the rich to benefit from the airdrop model.

However, after the craze of DOGS, Catizen and Hamster, it is unclear what will happen next. All tokens are currently falling, so the Ton mini-app needs a new catalyst to attract a new group of speculators.

Being the first to notice a trend change will allow you to reap the biggest benefits.

Memecoins

Memecoins are a tokenized community. Murad brilliantly explains the value proposition of Memecoins in the video below, where he clearly explains how Memecoins are superior to many utility tokens in some ways given the current market environment (e.g., VC unlocking, lack of transparency, regulatory issues, etc.).

However, he only tells one side of the Memecoin story.

The screenshots he showed of Memecoins doing well ignored the fact that 99.5% of Memecoins will drop to zero within a day or two.

Contrary to his optimistic view, Memecoins are often launched by insider groups that own large pre-mined supplies and promote them through key opinion leaders (KOLs) who are paid or heavily allocated, ready to sell off once new buyers come in.

There is no real community, just the illusion of one being sold. This is why I stay away from Memecoins: it is confusing and time-consuming to find the real gems in a sea of shoddy projects. By constantly jumping from one Memecoin to another, you can lose your funds quickly. In contrast, holding Bitcoin (BTC) may be a safer bet.

Despite this, Memecoins are home to the most optimistic community in the cryptocurrency space. This greed provides fertile ground for the emergence of true gems, competitors like Doge. This is why I haven’t given up on Memecoins completely.

Additionally, during this cycle, platforms like Pumpdotfun prevented insider trading by introducing a fairer launch mechanism, solved initial liquidity issues using a dynamic bonding curve, and reduced many security risks.

A good option might be to look at Memecoin launchpad tokens like Ethervista or the upcoming Rush platform. I know the Rush development team, so its unlikely to be a scam. Be careful though: the price of the Ethervista token has been falling since its launch.

Repack + New Tokens

Old coins are getting boring, and speculators are hungry for something new. If you can change the brand name, create a new token code, and start over with a new chart, that’s exactly what’s happening. I first mentioned this trend in June (see: Seven Emerging Trends in Cryptocurrency)

We saw multiple rebrands, such as MATIC rebranding to Polygon and launching a new POL token, Orion rebranding to Lumia (from ORN to LUMIA token), Covalent (the DA protocol for the AI era) migrating from CQT to CXT tokens, Connext rebranding to Everclear (and introducing new token economics), etc.

The most interesting examples are Fantom’s migration from $FTM to $S and Arweave’s launch of the AO protocol.

Arweave decided to launch a new token, AO, for the AO protocol instead of using the original AR. This makes sense since AO is a different protocol, but what’s interesting is that you can mine AO tokens just by holding AR in your wallet. It’s like printing money!

Unfortunately, these rebranded tokens have not performed well and failed to bring much hope to this trend. Perhaps only Fantom’s rebranding has started to gain traction, while even Polygon has faced difficulties in this cycle.

Still, it’s worth keeping an eye out for rebranded projects that attract community interest. This shows that the team is still active, hasn’t given up on the protocol, and is still developing it.

Community/Social Tokens

I was really screwed by FriendTech and 0x Racer.

This was one of the biggest mistakes I made during this cycle.

They had the opportunity to develop a consumer app that would appeal to a wider user base, but instead chose the easy way out.

Regardless, FT has changed the industry by popularizing the use of Privy to improve user experience and promote social tokens.

In FT v1, social tokens were based on the personalities of key opinion leaders (KOLs), while in V2, the goal is to tokenize the entire community.

Like Memecoins, community tokens are centered around community and provide an opportunity to join an exclusive club.

The most successful example is the DEGEN token, which was recently listed on Coinbase and is up 127%! Initially, it was airdropped as a community token to active Farcaster members. I personally made about $40,000 by posting on Warpcaster.

DEGENs success lies in its community-driven launch and successful integration into Farcaster, thanks to the openness of the platform. Tokens like DEGEN help solve the classic problem of social platforms by rewarding user participation: users dont post because there are not enough users. Other social applications can adopt similar strategies by generously rewarding early users. Lens also airdropped.

My suggestion is to try some new decentralized social applications, such as Phaver (I posted a few posts on it and received a $250 airdrop).

However, the utility of these tokens in specific applications limits their widespread adoption. DEGEN decided to launch its own L3 to expand, so it is important to pay attention to the movements of other community tokens.

Even more exciting is that we may see the emergence of Farcaster, Lens, OpenSocial, and other SocialFi tokens.

What should we pay attention to in this bull market?

The best returns often occur in the early stages of emerging trends. Liquidity mining, points farming, fair launches, and NFT minting have generated millions in returns for early adopters. My mission is to identify these new token minting trends and find ways to capitalize on them.

A good sign that a project has high potential is that the early stages tend to generate confusion in the community, with both love and hate. As long as people care, it’s worth paying attention.

Examine how this token minting creates a flywheel effect: early users are rewarded and thus incentivized to stay in the ecosystem. While this may look like a Ponzi scheme, the most successful “money printing” mechanisms often have similar characteristics.

Remember to always keep an open mind. Try new things and let me know if you find anything interesting!

This article is sourced from the internet: From ICO to community tokens, an overview of the evolution of cryptocurrency issuance

Related: The exit game between venture capital and hot money, starting from Friend.Tech

Original title: VC vs Liquid Fund Inside FriendTechs Exit The Chopping Block Guests: Haseeb, Tarun, Jason, Tom Original translation: zhouzhou, joyce, BlockBeats Editors Note: This podcast explores in depth the impact of the sharp drop in the price of Friend.Tech tokens on project planning and user retention. It also discusses the ethical issues of crypto project exits, especially project termination after token issuance, and the different roles of venture capital and liquidity funds in the crypto market. In addition, the program analyzes the negative effects of airdrop mining and the impact of hedge funds on market liquidity and efficiency. The podcast also mentions the conflict between market speculation and long-term value creation, as well as the room for improvement in market efficiency. The following core questions are raised and explored…