Cycle Trading: Where will the A-share market go in the future?

Original author: Cycle Capital, Lisa

Since the 924 new policy, Chinas stock market has experienced an epic surge. The policies of the three financial ministries and the Central Political Bureau meeting boosted market sentiment beyond expectations, and the A-share and Hong Kong stock markets ushered in a strong rebound, leading the global market. However, after the National Day, the market turned to decline under the generally optimistic expectations. Is this round of market a flash in the pan or has the bottom been reached? This article will try to make a judgment from the perspective of analyzing the domestic economic fundamentals, policies and the overall valuation level of the stock market.

1. Fundamentals

Overall, the domestic fundamentals are still weak, with some marginal signs of improvement, but no clear turning point. During the National Day holiday, the consumption boom improved both year-on-year and month-on-month, but it has not yet been reflected in some major economic indicators. In the next few quarters, Chinas growth may show a trend of mild recovery under the policy boost.

In September, the manufacturing Purchasing Managers Index (PMI) was 49.8%, up 0.7 percentage points from the previous month, and the manufacturing industrys business climate rebounded; the non-manufacturing business activity index was 50.0%, down 0.3 percentage points from the previous month, and the non-manufacturing industrys business climate declined slightly.

Affected by factors such as the high base of the same period last year, profits of industrial enterprises above designated size fell by 17.8% year-on-year in August.

In August 2024, the national consumer price index rose by 0.6% year-on-year. Among them, food prices rose by 2.8%, non-food prices rose by 0.2%; consumer goods prices rose by 0.7%, and service prices rose by 0.5%. On average from January to August, the national consumer price index rose by 0.2% year-on-year.

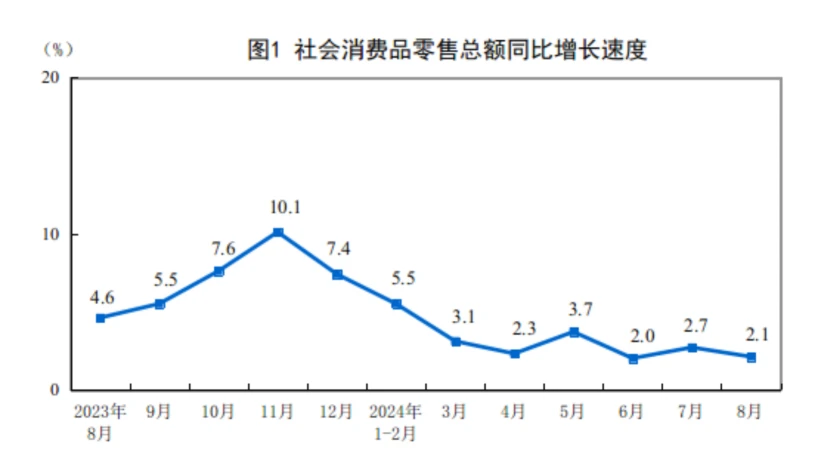

In August, the total retail sales of consumer goods was 38,726 billion yuan, a year-on-year increase of 2.1%.

Second-hand housing sales price index in 70 large and medium-sized cities in August 2024

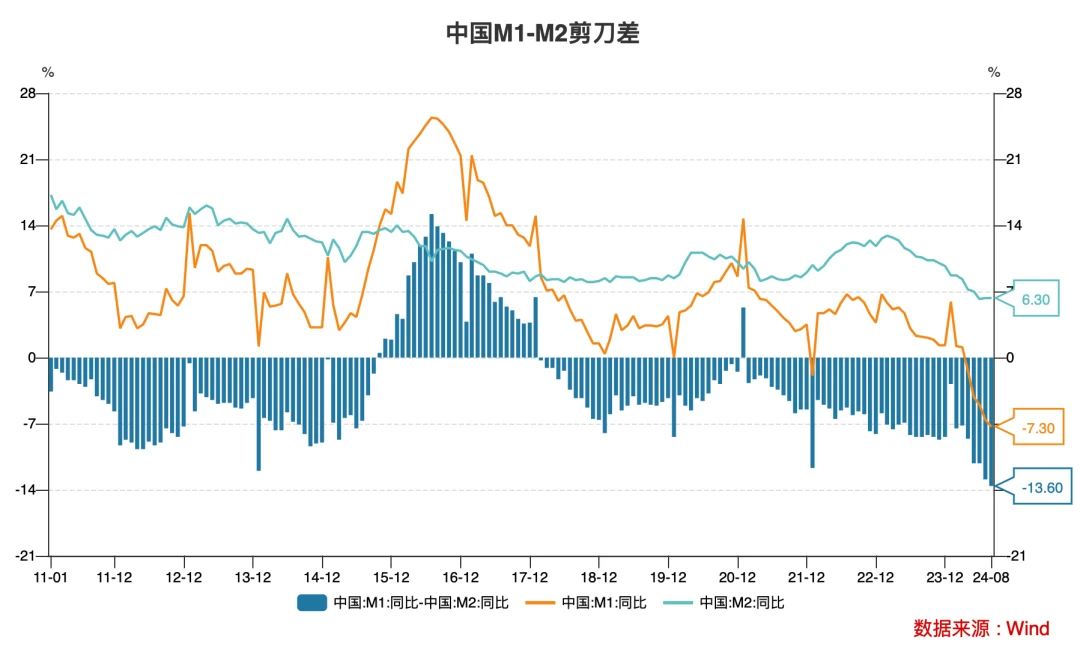

Judging from the financial forward-looking indicators, the overall financing demand of the society is relatively insufficient. Since the second quarter, M1 and M2 have slowed down year-on-year, and the gap between the two has risen to a historical high level, reflecting that demand is relatively insufficient and there is a certain degree of idleness in the financial system. The transmission effect of monetary policy is hindered, and the short-term economic fundamentals still need to be improved.

II. Policy

Combined with the periodic bottom characteristics of the A-share market in the past 20 years, policy signals are generally strong and need to exceed investors expectations at the time. Historically, this is a necessary condition for the A-share market to stabilize and rebound. Recent policies have exceeded expectations, and policy signals have already emerged.

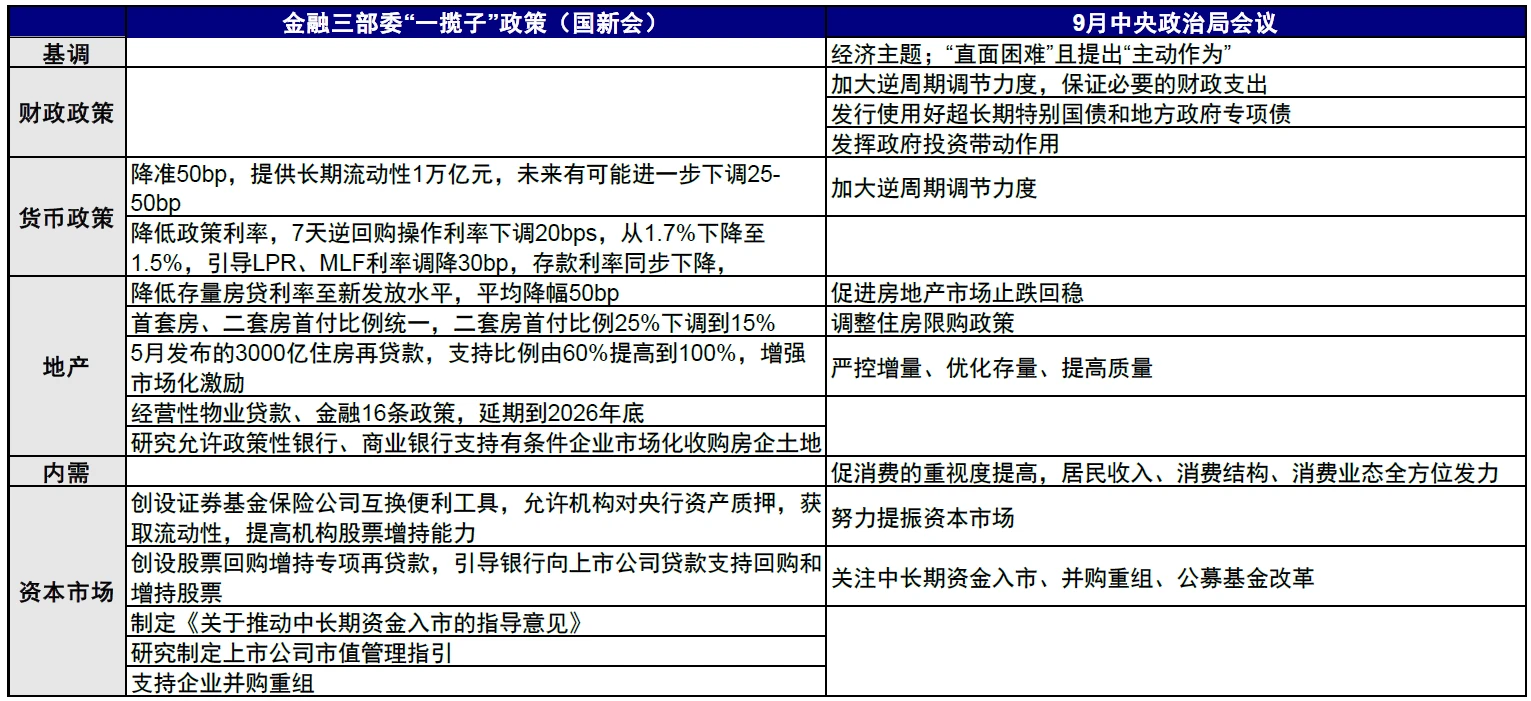

On September 24, 2024, the State Council Information Office held a press conference, at which Central Bank Governor Pan Gongsheng announced the creation of new monetary policy tools to support the stable development of the stock market.

The first is to create a swap facility for securities, funds and insurance companies, supporting eligible securities, funds and insurance companies to use their own bonds, stock ETFs and CSI 300 constituent stocks as asset pledges to obtain liquidity from the central bank. This policy will greatly enhance the institutions ability to obtain funds and increase their stock holdings. The first phase of the swap facility will have an initial operation scale of 500 billion yuan, which can be expanded in the future depending on the situation.

The second item is to create a special re-loan for stock repurchase and increase holdings, guiding banks to provide loans to listed companies and major shareholders to support the repurchase and increase of stock holdings. The initial quota of the repurchase tool is 300 billion yuan, which can also be expanded in the future depending on the situation.

On September 26, 2024, the Central Financial and Economic Affairs Commission and the China Securities Regulatory Commission jointly issued the Guiding Opinions on Promoting the Entry of Medium- and Long-Term Funds into the Market, which involved measures including 1) cultivating a capital market ecology for long-term money and long-term investment, 2) vigorously developing equity public funds and supporting the steady development of private equity funds, and 3) improving supporting policies for the entry of medium- and long-term funds into the market, totaling three connotations and 11 key points.

The root cause of Chinas current growth problems is the continued credit contraction, the continued deleveraging of the private sector, and the failure of government credit expansion to effectively hedge. The reasons for this situation are, first, low expectations for investment returns, especially the sluggish real estate and stock prices, and second, insufficient low financing costs. The core of this round of policy changes is to reduce financing costs (lowering multiple interest rates) and boost investment return expectations (stabilizing housing prices and providing stock market liquidity support). It is a remedy for the symptoms. Whether the medicine can cure the disease and achieve medium- and long-term sustainable re-inflation requires subsequent structural fiscal stimulus and actual policy implementation, otherwise the market recovery may be short-lived.

At 10 a.m. on October 8 (Tuesday), the National Development and Reform Commission held a State Council press conference. Zheng Zhajie, director of the National Development and Reform Commission, and deputy directors Liu Sushe, Zhao Chenxin, Li Chunlin, and Zheng Bei introduced the relevant situation of systematically implementing a package of incremental policies, solidly promoting economic upward structure and optimization, and continuously improving development trends, and answered questions from reporters. The bullish sentiment was fully fermented during the National Day holiday. The market generally believed that A shares had bottomed out and reversed. Morgan Stanley believed that the policy volume required to promote the rebalancing of the economic structure from investment to consumption was about 7 trillion yuan in 2 years. Market participants have high expectations for fiscal policy, so the market paid high attention to this press conference of the National Development and Reform Commission, but the drastic fiscal counter-cyclical adjustment policy generally expected by the market did not appear at the meeting, which is also the main reason for the market reversal after the National Day.

3. Valuation

After reviewing the characteristics of previous market bottoms, this round of market conditions has already shown bottom characteristics from the perspectives of the length of decline, degree of decline, and valuation level.

Note: The market data involved in this decline is as of September 27, 2024. Source: Wind, CICC Research Department

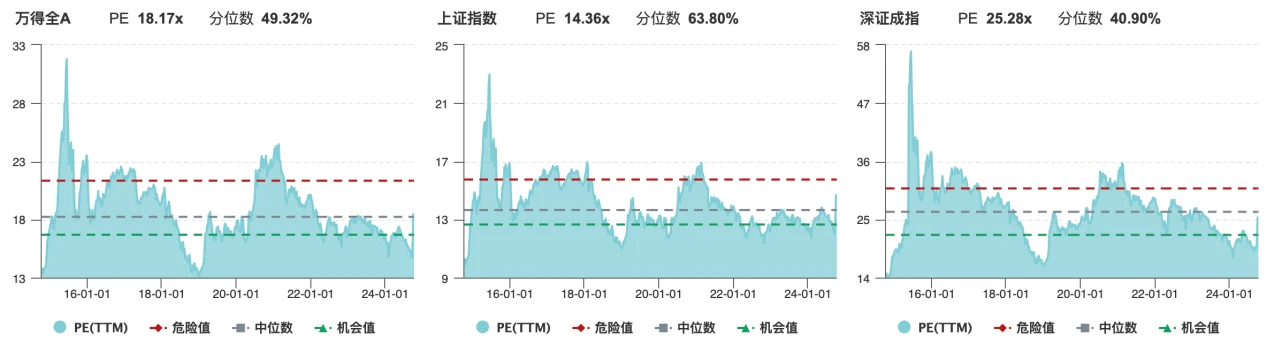

As of October 9, the valuation levels of A-shares have recovered to near the median.

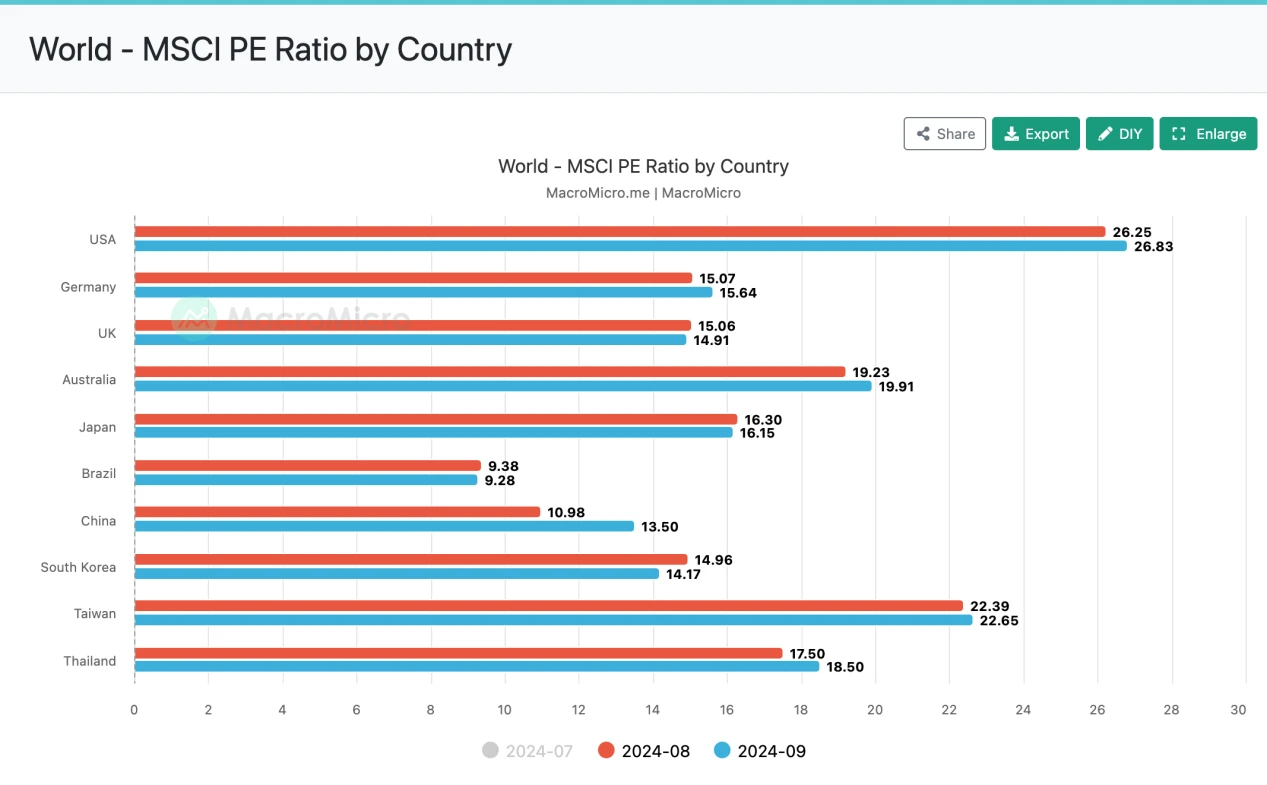

In a historical vertical comparison, the rebound at the end of September was relatively high, reaching the PE multiple expected for the economic acceleration of the restart of the epidemic at the beginning of 2023. In a horizontal comparison of major global markets, the valuation of the Chinese market relative to emerging markets is still the lowest in the Asia-Pacific region, close to the level of South Korea.

In summary, the key to market reversal lies in the confirmation of medium-term fundamental signals. Fundamental data has not yet appeared. The recent short-term rise is mainly driven by expectations and funds. The fear of missing out (FOMO) makes emotions count very quickly. Technical indicators such as RSI (Relative Strength Index) have a certain overdraft in the short term. Markets under high volatility are often accompanied by overreaction. The correction after the historical surge is both a technical need and reasonable. After the monetary policy is increased first, whether the subsequent fiscal policy can follow up is the main factor affecting the pace and space of the stock market in the near future. Just like the art of expectation management of the Federal Reserve, it is not appropriate to add fuel to the fire in a crazy and aggressive market environment, but things will be rounded up slowly and the water will overflow when it is full. From a long-term perspective, the author believes that the recent decline is an adjustment rather than the end of the trend. The mid- and long-term bottom of A-shares has been seen, and the main rise has not yet arrived.

This article is sourced from the internet: Cycle Trading: Where will the A-share market go in the future?

Related: Airdrop Weekly Report | Fractal Bitcoin airdrops to UniSat and OKX wallet users; Grass opens airdrop query (9.2-9.8)

Original | Odaily Planet Daily ( @OdailyChina ) Author: Golem ( @web3_golem ) Odaily Planet Daily takes stock of the airdrop projects that can be claimed from September 2 to September 8, and also organizes this week’s new interactive tasks and important airdrop information. For detailed information, see the text. Grass Project and air investment qualification introduction Grass is a Depin project on Solana that combines AI and is positioned as the data layer of AI. The project announced the opening of airdrop queries on September 5. The query page only reflects the allocation of Closed Alpha and Epochs 1-7, and does not include the ongoing Bonus Epoch or To Be Announced allocation. The total supply of GRASS tokens is 1 billion, of which 10% is for the first airdrop,…