In-depth analysis of the impact of the EU Crypto-Asset Market Regulation Act on the market structure

Original author: insights 4.vc

Original translation: TechFlow

The cryptoasset market has experienced exponential growth over the past decade, leading to increased participation from both retail and institutional investors. However, this growth has also highlighted significant regulatory challenges, particularly in the EU, where a fragmented regulatory approach has led to legal uncertainty and inconsistency across member states. The lack of a unified framework has hampered market development, created barriers to market entry, and raised concerns about consumer protection and market integrity.

Objectives of the Regulation

MiCA aims to address these challenges by:

-

Establishing a single regulatory framework: creating a comprehensive set of rules that applies to all EU member states and the European Economic Area (EEA).

-

Strengthening consumer and investor protection: Implementing measures to protect investors and mitigate the risks associated with crypto-assets.

-

Ensuring market integrity and financial stability: Introducing supervisory mechanisms to prevent market abuse and systemic risks.

-

Fostering innovation and competitiveness: Encouraging the development of crypto assets and blockchain technology in a regulatory environment that promotes trust and transparency.

Overview of MiCA

Scope and Applicability

MiCA is suitable for:

-

Crypto-asset issuers: entities that offer crypto-assets to the public or wish to trade them on an EU trading platform.

-

Crypto-Asset Service Providers (CASPs): Companies that provide crypto-asset-related services, such as custody, trading, and operation of trading platforms.

-

Stablecoin issuers: entities that issue asset-pegged tokens (ARTs) and electronic money tokens (EMTs).

MiCA is not suitable for:

-

Regulated crypto-assets: Financial instruments covered under existing EU financial services legislation such as MiFID II, EMD and PSD 2.

-

Central Bank Digital Currencies (CBDCs): Digital currencies (CBDCs) issued by a central bank.

Key definitions and classifications

Crypto assets

A cryptoasset is defined as a digital representation of value or rights that can be transferred and stored electronically using distributed ledger technology (DLT) or similar technologies.

Classification of Crypto Assets

Asset Pegged Tokens (ARTs):

Aims to maintain a stable value by being pegged to multiple fiat currencies, commodities or crypto assets.

Example: Tokens pegged to a basket of currencies or commodities.

Definition of Electronic Money Tokens (EMTs):

Reference to a single legal tender.

It functions similarly to e-money and is regulated under the E-Money Directive.

Example: A stablecoin pegged 1:1 to the Euro.

Other crypto assets:

Includes all other crypto assets not classified as ARTs or EMTs.

These include utility tokens and certain payment tokens.

Example: Tokens used to provide access to a service or product.

Overview of the regulatory framework

Requirements for Crypto-Asset Issuers

Utility Tokens

Definition: A token designed to provide digital access to a good or service, based on distributed ledger technology (DLT), and accepted only by the issuer.

Regulatory requirements:

-

Whitepaper: Issuers must draft and publish a whitepaper containing detailed information about the project, rights and obligations, risks, and technology.

-

Notification: The White Paper must be submitted to the competent national authorities prior to publication.

Disclaimer:

-

If the tokens are given away for free.

-

If the issuance is limited to fewer than 150 persons per Member State.

-

The total consideration does not exceed EUR 1 million within a 12-month period.

Definition and Regulatory Requirements for Asset-Pegged Tokens (ARTs)

Definition: A token that maintains a stable value by referencing multiple assets.

Regulatory requirements:

-

Authorization: The issuer must be authorized by the competent authority.

-

White Paper: Stricter white paper requirements apply and approval by the competent authority is required.

-

Governance and compliance: obligations to strengthen governance, conflict of interest policies and complaints handling.

-

Reserve assets: Reserve assets are required to support the issuance of tokens and include rules for custody and investment.

Definition and Regulatory Requirements for Electronic Money Tokens (EMTs)

Definition: A token that references a single fiat currency.

Regulatory requirements:

-

Authorization: The issuer must be authorized by a credit institution or an electronic money institution.

-

Redemption Rights: Obligation to provide redemption at par value at any time.

-

Conservation requirements: Standards for capital requirements and fund protection should be comparable to those under the E-Money Directive.

Cryptoasset Service Providers (CASPs)

Obligations and License

Service scope:

-

Custody and asset management of crypto assets.

-

Operation of the trading platform.

-

Exchange services between crypto assets and fiat currencies.

-

Exchange services between crypto assets.

-

Execute orders on behalf of clients.

-

The release of crypto assets.

-

Receiving and transmitting orders.

-

Providing advice on crypto assets.

-

Portfolio management of crypto assets.

Authorization process for Cryptoasset Service Providers (CASPs)

Authorization process:

-

Application: Submit detailed information including business plan, governance arrangements and internal controls.

-

Capital requirements: Minimum capital requirement is between €50,000 and €150,000, depending on the services provided.

-

Fitness and Integrity: Assessing the suitability of management and key shareholders.

-

Passporting rights: Once authorised, CASPs can use passporting rights to provide services across the EU.

Operational requirements for crypto-asset service providers (CASPs)

Operational requirements:

-

Organizational structure: A robust governance framework, including a clear organizational structure and effective operating procedures.

-

Protecting Customer Assets: Measures to protect customer crypto assets, including asset isolation and security protocols.

-

Complaints Handling: Establish procedures for handling customer complaints promptly and fairly.

-

Conflict of Interest Policy: Identifying and managing potential conflicts of interest.

-

Outsourcing: ensuring that outsourcing arrangements do not compromise the quality of internal controls and the regulator’s obligations regarding its ability to monitor compliance.

-

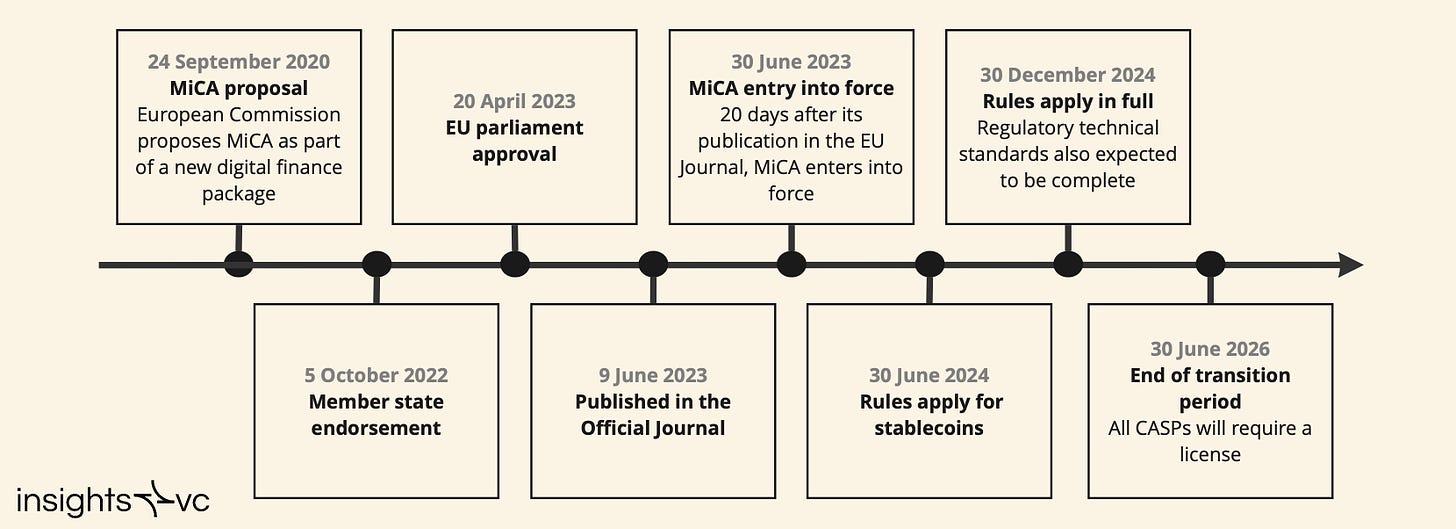

June 9, 2023: MiCA comes into force.

-

June 30, 2024: Rules related to stablecoins (ARTs and EMTs) come into effect.

-

December 30, 2024: Full applicability of MiCA to other crypto-assets and CASPs.

Transitional provisions:

-

Grandfather clause: CASPs that already provide services under current national law can continue to operate until December 31, 2025, or until they receive MiCA authorization, whichever comes first.

-

National Opt-Out: Member States can opt-out of grandfathering clauses, thereby requiring early compliance.

Impact on Swiss Web3 companies

Swiss companies, while not located within the EU, frequently interact with European markets. Understanding the impact of MiCA is critical for Swiss Web3 companies to ensure their continued market access and compliance.

Use Case 1: Issuing Utility Tokens

Scenario: A Swiss company establishes a foundation and issues a utility token intended for use within its ecosystem, with the goal of having it classified as a utility token under Swiss law.

Impact of MiCA:

-

Token Classification: Under MiCA, these tokens may be classified as crypto assets requiring a white paper, unless there is an applicable exemption.

White Paper Requirements

-

Content: Must contain comprehensive information about the issuer, the project, the rights attached to the tokens, the risks, and the underlying technology.

-

Notification: If the offering is targeted at EU residents, the White Paper must be notified to the EU competent authorities.

Reverse request restriction

-

MiCA restricts the ability to rely on a reverse request. Active marketing to EU residents will trigger compliance obligations.

Strategic considerations

-

Avoid active marketing: Limit marketing activities within the EU to avoid triggering MiCA requirements.

-

Establish an EU presence: Consider setting up a subsidiary within the EU to facilitate compliance.

-

Legal advice: Engage EU legal counsel to help navigate regulatory obligations.

Use Case 2: Provision of Custody and Transaction Services

Scenario: A Swiss company provides custody and trading services for digital assets, targeting EU customers.

Impact of MiCA:

As a CASP grant:

The company must be authorized by the competent authorities of an EU member state to provide services within the EU.

Establishing EU presence:

-

It is necessary to set up a legal entity within the EU and follow the MiCA authorization process.

Operational requirements:

-

Implement a robust governance, risk management and compliance framework in line with MiCA.

Tax considerations:

-

Substance requirements: ensuring that EU entities have sufficient substance to meet regulatory and tax obligations.

-

Cross-border taxation: Addressing tax liabilities that may arise from cross-border operations.

Strategic considerations

-

Jurisdiction selection: Choose an EU member state with a friendly regulatory environment (e.g., Liechtenstein, France, Germany).

-

Leverage existing frameworks: Leverage existing compliance frameworks to streamline the authorization process.

-

Engagement with regulators: Early communication with the regulators in the chosen member states can help to achieve a smoother authorisation.

Strategic considerations for compliance

Dealing with Reverse Solicitation Restrictions

Definition: A reverse solicitation is the provision of services on the client’s independent initiative and without any solicitation or advertising by the service provider.

MiCA Limitations:

-

Limit reliance on reverse solicitations to circumvent regulatory requirements.

-

Active marketing or targeting of EU customers will trigger MiCA compliance obligations.

suggestion:

-

Marketing Practices: Review and adjust marketing strategies to ensure compliance.

-

Documentation: Maintain clear records demonstrating that any services provided under a reverse request were initiated by the client.

Building presence in the EU

benefit:

-

Helps in complying with MiCA regulations.

-

Access to the EU single market through passporting rights.

Considerations:

-

Jurisdiction selection: Assess the regulatory environment, costs, and regulator readiness.

-

Substance requirement: ensuring that the EU entity has substantial operations, management and control in the jurisdiction.

-

Tax implications: address potential tax residency and cross-border tax issues.

Take advantage of regulation in specific EU member states

Active Jurisdictions:

-

France: Early implementation of crypto regulation and inclusion of it within the financial regulator.

-

Liechtenstein: Comprehensive legislation aligned with MiCA, including provisions for staking and NFTs.

-

Germany: Established a framework for crypto assets and plans to connect with MiCA.

Advantages:

-

Regulatory clarity: Clear guidelines and a supportive regulator.

-

Fast Authorization: May speed up the authorization process.

suggestion:

-

Regulatory engagement: Start a dialogue with regulators to understand their expectations.

-

Local partnerships: Consider partnering with local firms that have extensive experience in the regulatory environment.

Tax impact analysis

Cross-border tax considerations

-

Tax residence: Tax residence is determined based on the management and control of the EU entity.

-

Permanent establishment: The risk of creating a permanent establishment within the EU will result in profits being taxed.

-

Transfer pricing: Comply with transfer pricing regulations for transactions between Swiss companies and EU entities. Substance and nexus requirements

-

Economic substance: Demonstrating real economic activity in a jurisdiction to satisfy tax authorities.

-

Functional and risk allocation: Clearly divide functions, assets and risks between entities.

-

Documentation: Maintain robust documentation to support tax positions and meet compliance obligations.

Policy and Regulatory Developments

The enforcement environment in EU member states

Differences in enforcement:

-

Some regulators may take stricter enforcement measures (e.g., Germany’s BaFin).

-

Other regulators may be less prepared, leading to inconsistent enforcement.

Industry response:

-

Companies may face uncertainty about regulatory expectations.

-

The importance of monitoring regulatory developments and adjusting accordingly.

Relationship with existing regulations (such as MiFID II)

MiCA and MiFID II:

MiCA covers crypto assets that are not classified as financial instruments under MiFID II.

Reclassification: Alignment of national laws to avoid duplication and ensure clarity.

Scope of supervision:

An assessment needs to be made as to whether the activity falls within the scope of MiCA, MiFID II or other regulations.

suggestion:

-

Conduct a comprehensive legal analysis to determine applicable regulations.

-

Keep abreast of amendments to national laws that interface with MiCA.

International coordination and comparative studies

Global Regulatory Environment:

-

UK: is developing its own regulatory framework, taking a nuanced approach.

-

United States: The regulatory environment is fragmented and the policy debate continues.

-

Asia Pacific: Leads in regulation of centralized intermediaries, but approaches to decentralized regulation vary.

Impact on Swiss companies:

-

Cross-border compliance: There are multiple regulatory systems to deal with when operating internationally.

-

Regulatory arbitrage risk: attention needs to be paid to different standards and enforcement practices.

suggestion:

-

Participate in policy discussions and industry groups to influence and stay informed of global developments.

-

Consider aligning internal policies with international best practices.

Cryptocurrency regulations outside the EU

USA

The cryptocurrency regulatory environment in the United States is complex and evolving, with frequent enforcement activity and ongoing legal debate.

In 2022, the United States introduced a new framework that enables regulators such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) to regulate the crypto industry. The SEC has been particularly active and has filed lawsuits against major businesses such as Ripple, Coinbase, and Binance, alleging securities violations. In 2023, a district court ruled that Ripples sales of XRP to institutions were securities offerings, but sales on exchanges were not. Additionally, in November 2023, a court vacated the SECs rejection of the Grayscale Bitcoin ETF, which led to the approval of Bitcoin and Ethereum spot ETFs in early 2024. Despite these developments, SEC Chairman Gary Gensler emphasized that the approval of ETFs should not be viewed as a broader adaptation to other crypto securities. As a result, the regulatory environment in the United States remains uncertain and challenging, requiring companies to follow federal and state laws with the help of legal counsel and establish robust compliance programs.

Cryptocurrency Regulation in China

China has taken a strict approach to cryptocurrencies, banning all related activities.

The Peoples Bank of China (PBOC) banned crypto businesses, declaring them illegal public financing. Bitcoin mining was banned in 2021, and all cryptocurrency trading was also declared illegal that year. Companies must exit the Chinese market and relocate their operations to more favorable jurisdictions, as any contact with China carries significant legal risks.

Cryptocurrency Regulation in Hong Kong

Hong Kong is emerging as a key player in the cryptocurrency space, with a regulatory framework designed to encourage innovation while protecting investors. The Securities and Futures Commission (SFC) is responsible for the licensing and compliance supervision of virtual asset service providers, including centralized and decentralized exchanges. In 2023, Hong Kong launched a new licensing regime for crypto exchanges, implementing strict anti-money laundering (AML) and customer identification (KYC) requirements to ensure market transparency and security. The city has also embraced security token offerings (STOs) and listed crypto-related products such as Bitcoin and Ethereum ETFs. In addition, Hong Kong is also exploring stablecoins and a potential digital Hong Kong dollar (e-HKD), making it a growing hub for digital assets in Asia.

Cryptocurrency Regulation in Canada

Canada offers a positive regulatory environment with clear guidelines. Cryptocurrencies are considered commodities and Canada is the first country to approve a Bitcoin ETF. All crypto companies are classified as money service businesses (MSBs) and must register with provincial regulators and are regulated by the Financial Transactions and Reports Analysis Centre (FINTRAC). Gains on cryptocurrencies are subject to capital gains tax. While Canada offers market opportunities for compliant businesses, companies must comply with strict registration and reporting obligations.

Cryptocurrency Regulation in the UK

The UK has established a comprehensive regulatory framework that incorporates crypto assets into existing financial regulation. In 2022, the House of Commons recognized crypto assets as regulated financial instruments. The Financial Services and Markets Act 2023 further expanded financial regulation to cover all crypto assets. Trading crypto derivatives is prohibited, and investors are subject to capital gains tax on crypto profits. Companies must comply with extensive regulatory requirements, including customer identification (KYC) and anti-money laundering (AML) standards, which are designed to enhance market stability and investor confidence.

Cryptocurrency Regulation in Japan

Japan is known for its progressive attitude towards incorporating cryptocurrencies into its financial system. Cryptocurrencies are considered legal property and all crypto exchanges must register with the Financial Services Agency (FSA). The Japan Virtual Currency Exchange Association (JVCEA) acts as a self-regulatory body. Trading gains are considered miscellaneous income, a provision that has important implications for investors’ tax treatment. Japan offers a transparent and business-friendly regulatory environment, although companies must invest in compliance infrastructure to meet strict regulatory requirements.

Cryptocurrency Regulation in Australia

Australia offers a clear regulatory framework that balances innovation with consumer protection. Cryptocurrencies are classified as legal property and are subject to capital gains tax. Crypto exchanges must register with the Australian Transaction Reports and Analysis Centre (AUSTRAC) and comply with anti-money laundering (AML) and counter-terrorism financing (CTF) obligations. In 2023, Australia announced plans to establish a new regulatory framework, which is expected to be finalized in 2024. Australia is open to innovation and has potential plans to launch a central bank digital currency (CBDC), but companies must prepare for the upcoming regulatory changes to ensure compliance and maintain market competitiveness.

Cryptocurrency Regulation in Singapore

Singapore is a cryptocurrency-friendly jurisdiction with a robust regulatory framework.

The Monetary Authority of Singapore (MAS) regulates exchanges under the Payment Services Act (PSA) and launched a framework for stablecoin issuers in 2023. Singapore does not impose capital gains tax, which is attractive to long-term investors. Singapores clear regulations and favorable tax policies make it an ideal market, although companies must overcome advertising restrictions and obtain necessary approvals for stablecoins.

Cryptocurrency Regulation in South Korea

South Korea has strict regulations to protect users and ensure financial integrity. Cryptocurrency exchanges must register with the Korea Financial Intelligence Unit (KFIU), and privacy coins were banned in 2021. The 2023 Virtual Asset User Protection Act designates the Financial Services Commission (FSC) as the primary regulator. Companies face strict regulatory requirements and must establish partnerships with local banks for real-name verification to ensure compliance and user safety.

Cryptocurrency Regulation in India

India has adopted a cautious regulatory approach towards cryptocurrencies, with ongoing debates and interim measures. Cryptocurrencies have neither been fully legalized nor banned. A 30% tax is levied on crypto investments, and 1% tax deducted at source (TDS) is applicable on transactions. The Finance Bill 2022 defines virtual digital assets as property and sets tax requirements on income derived therefrom. Regulatory uncertainty poses operational risks to companies, such as increased compliance costs, while high taxes can affect the profitability of businesses, forcing them to reassess their market strategies.

Cryptocurrency Regulation in Brazil

Brazil is moving towards incorporating cryptocurrencies into its financial system. In 2023, Brazil enacted a law legalizing the use of cryptocurrencies as a means of payment, with the Central Bank of Brazil designated as the regulator. The legalization of cryptocurrencies as a means of payment opens up new opportunities for companies, but companies must follow the relevant regulations of the Central Bank of Brazil to ensure compliance and effectively take advantage of this emerging market.

in conclusion

Opportunities and challenges under MiCA

MiCA brings opportunities and challenges to Swiss and European Web3 companies:

Opportunities and Challenges:

-

Market access: A unified framework facilitates access to markets across the EU, making it easier for companies to do business.

-

Investor confidence: Increased regulatory oversight is likely to improve investor trust and attract more capital flows into the market.

-

Innovation environment: Clear rules can encourage innovation within prescribed boundaries and promote the development of the industry.

challenge:

-

Compliance Burden: Meeting regulatory requirements requires significant resources and can be stressful for small businesses.

-

Regulatory uncertainty: Enforcement and preparedness vary widely between member states, which could lead to imbalances in national markets.

-

Competition: Increased compliance requirements may raise barriers to entry, making it more challenging for new entrants and thus increasing competition among existing players.

The development prospects of European Web3 companies

Web3 companies must take a strategic approach to navigate the evolving regulatory landscape:

-

Proactive compliance: Preparing and engaging with regulators in advance can help make the transition smoother.

-

Collaboration: Work with industry groups and legal experts to influence policy and share best practices to advance the industry.

-

Adaptability: Remain flexible so that business models and strategies can be adjusted in response to regulatory changes.

This report aims to provide a comprehensive understanding of the MiCA regulations and their impact. Companies are advised to seek professional legal advice based on their specific circumstances to ensure full compliance with all regulatory obligations.

This article is sourced from the internet: In-depth analysis of the impact of the EU Crypto-Asset Market Regulation Act on the market structure

introduction Many experts and industry leaders, including Ethereum founder Vitalik Buterin and the Paradigm team, believe that intent-centric transactions will become one of the important directions for the development of blockchain applications in the future. In our article, we explored the concept and potential of intent-centric transactions, analyzed how this model can simplify the user experience, enhance transaction security, and bring more innovation opportunities to decentralized applications. We also discussed the role of AI agents and explored how they can be combined with intent-centric transactions to further promote the automation and intelligence of smart contracts and provide users with a smarter and more personalized blockchain interaction experience. What is Intent Transaction When you want to take a taxi, you open a travel app. After selecting the starting point, a price…