Interpretation of the current state of the crypto market: Where are we in the cycle?

Original author: The DeFi Investor

Original translation: TechFlow

In today鈥檚 article we will discuss:

-

Where are we in the cycle now?

-

On-chain data analysis

Where are we in the cycle?

If you鈥檝e seen my recent X posts, you already know that I鈥檓 optimistic about the crypto market in Q4.

But in this issue, I鈥檒l detail exactly where I think we are in this crypto cycle and explain why I鈥檓 optimistic about the near-term future.

Bottom line: There are lots of reasons to be excited.

Let鈥檚 start with some crypto charts that I think are relevant.

BTC Cycle ROI is exactly where it usually is at this stage of the cycle.

Source: @intocryptoverse

BTC鈥檚 performance in this market cycle is very similar to the bull runs of 2016 and 2020.

Financial markets tend to be cyclical because human nature is constant. That鈥檚 why the likelihood that BTC has already peaked seems unlikely.

The past two bull markets have two things in common:

-

The real BTC uptrend will start about 170-180 days after the Bitcoin Halving

-

The BTC cycle top is reached approximately 480 days after the Bitcoin halving

cryptoquant.com

Just 160 days have passed since the 2024 Bitcoin (BTC) Halving event.

Based on past experience, we are now likely just a few weeks away from BTC resuming its uptrend.

Obviously, this assumes that history will repeat itself, but I can鈥檛 see any significant reason why things would be different this time.

BTC exchange reserves are declining at an extremely fast rate.

Since January 2024, over 500,000 BTC has been withdrawn from exchanges.

When large investors withdraw their tokens from exchanges, it usually means that they plan to hold them for a while rather than sell them in the near future.

The chart above seems to show that whales have been accumulating BTC in large quantities over the past few months.

If this accumulation continues, a supply crunch will be inevitable.

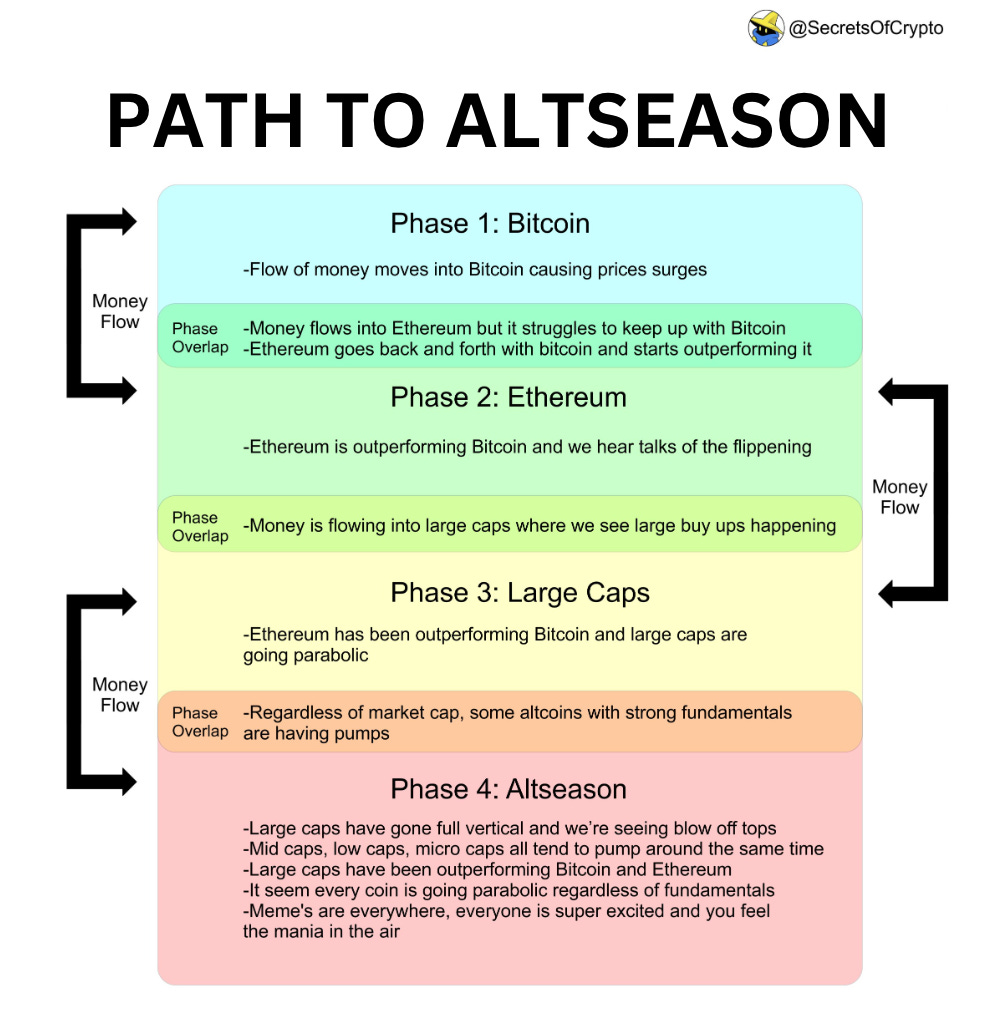

Bitcoin Season is historically the first phase of each new cycle.

The infographic in the image above was produced many years ago, but does a good job summarizing what happened in the 2016 and 2020 cycles.

-

First, BTC started to rise and its market dominance increased accordingly.

-

Then, attention began to turn to large-cap coins (such as ETH, SOL, etc.).

-

Finally, almost every altcoin started to rise regardless of its market cap or fundamentals.

Recently, BTC鈥檚 market dominance reached new multi-year highs.

This may indicate that we are still in phase 1. Historically, altseason usually starts after BTC market dominance starts to decline. I think we are approaching phase 2.

All of the above charts and historical data from previous bull cycles make me think that BTC will likely set new all-time highs in the fourth quarter.

So, is there any possibility of error?

Lets briefly discuss the possibility of a bear market.

There are still many macro uncertainties.

If a global recession sets in, digital currencies will be greatly affected.

However, I think a recession is unlikely in the near term because 2024 is an election year in the United States.

In order to give Kamala Harris a chance to win the US presidential election, the Democratic Party will do everything in its power to delay the election.

While I think a US recession could begin sometime in the next 3-4 years, I think the chances of it happening in 2024 are very small.

Therefore, I am optimistic about cryptocurrencies in the fourth quarter.

Hopefully our faith and patience will be rewarded soon.

On-chain dynamics

Sui鈥檚 Total Value Locked (TVL) surpassed Polygon for the first time.

Sui is one of the fastest growing blockchains. It is a L1 blockchain that utilizes parallel transaction execution to achieve high transaction throughput.

The reason for its recent surge on most metrics appears to be two key factors: its very strong community and its growing popularity on X.

In addition, its team has also reached some important cooperation with many Web2 and Web3 giants, including Circle and TikTok鈥檚 parent company.

This article is sourced from the internet: Interpretation of the current state of the crypto market: Where are we in the cycle?

Original author: Eterna Capital Original translation: Vernacular Blockchain The recent news that the U.S. Securities and Exchange Commission issued a Wells Notice (a prelude to formal charges) to the popular NFT marketplace OpenSea adds a new chapter to the legal saga that has plagued the blockchain industry for years. As we all know, the SEC’s historical position has been that “everything except Bitcoin is a security” — including, according to the notice to OpenSea, NFTs. The debate over whether crypto assets are securities or commodities is crucial: it determines whether the SEC or the CTFC is responsible for regulation. At its core, it is a judicial exercise in understanding what can be considered a “security” as defined in 1946: as such, it is difficult to apply to modern technologies such…