2024 Airdrop Research Report: Why do nearly 90% of token airdrops fail?

Original title: Airdrops in the Barren Desert: Surveying the traits behind 2024s 11% success rate

Original author: Keyrock

Original translation: Scof, ChainCatcher

Key Takeaways:

-

Unsustainable

Most airdrops collapsed within 15 days. In 2024, despite an initial price surge, 88% of tokens lost value within a few months.

-

Big ups and downs

Airdrops distributing more than 10% of total supply have seen stronger community retention and performance. Those below 5% have typically faced a quick sell-off following release.

-

High FDV

A project is most hurt by a high fully diluted valuation (FDV). A high FDV inhibits growth and liquidity, leading to a sharp drop in price after an airdrop.

-

Liquidity is crucial

Without enough liquidity to support high FDV, many tokens collapsed under selling pressure. Deep liquidity is key to price stability after an airdrop.

-

A tough year

Cryptocurrency struggles in 2024, with most airdrops being hit the hardest. For the few that succeed, smart allocation, strong liquidity, and realistic FDV are their strategies.

Airdrops: The Double-Edged Sword of Token Distribution

Since 2017, airdrops have been a popular token distribution strategy used to create early hype. However, in 2024, many projects have struggled to succeed due to oversaturation. While airdrops still create initial excitement, But most airdrops have resulted in short-term selling pressure, which has led to low community retention and protocol abandonment. Nevertheless, a few standout projects have managed to break this trend, proving that with the right execution, airdrops can still bring to meaningful long-term success.

Purpose

This report attempts to unravel the mystery of the airdrop phenomenon in 2024 — differentiating the winners from the losers. We analyzed 62 airdrops across 6 chains, comparing their performance in several dimensions: price action, user adoption, and long-term sustainability. While each protocol has its own unique variables, the collective data paints a clear picture of how effective these airdrops are in achieving their intended goals.

Common manifestations

When examining the overall performance of the 2024 airdrops, most have underperformed following their release. While a few saw impressive returns early on, most tokens faced downward pressure as the market readjusted their value. The pattern points to a broader problem within the airdrop model: many users may be there simply to receive the incentives, rather than engaging with the protocol long-term.

With all airdrops, a key question arises – does the protocol have staying power? Once the initial rewards are distributed, do users continue to see value in the platform, or is their participation purely transactional? We look at multiple time frames to see if this is true. Analysis drawn from data from CoinMarketCap reveals a key insight: for most of these tokens, enthusiasm dies down quickly, usually within the first two weeks.

Overall performance

Looking at the 15-day, 30-day, and 90-day price trends, it is clear that most of the price movement occurred in the first few days after the airdrop. Three months later, very few tokens have been able to achieve positive returns, and only a few have bucked the trend. Still, it’s important to consider the broader context: the crypto market as a whole hasn’t performed well during this time, which complicates the situation further.

On-chain distribution

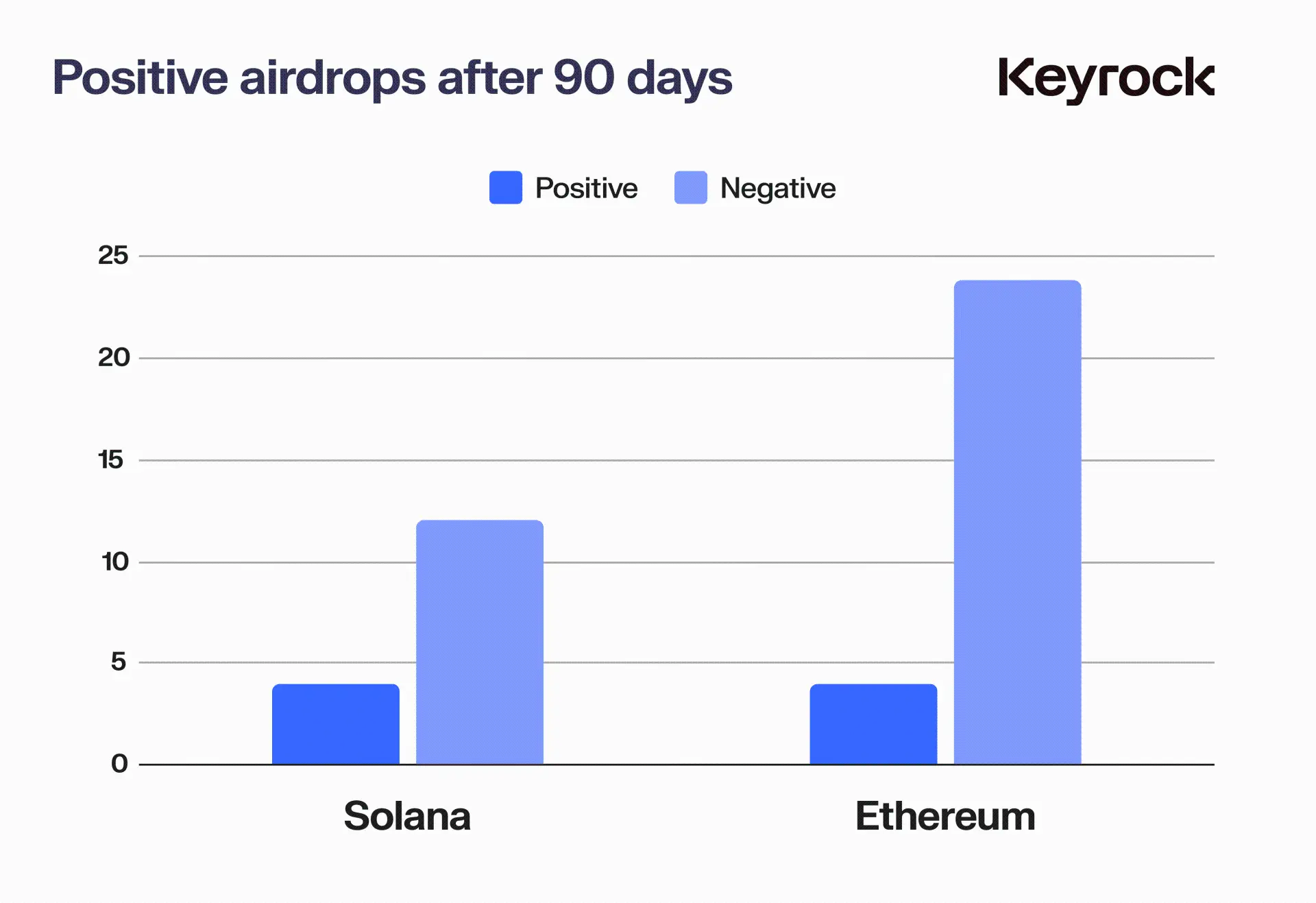

Despite the overall poor performance, this is not the case for all chains. Of the 62 airdrops analyzed, only 8 achieved positive returns after 90 days – 4 on Ethereum and 4 on Solana. There were no winners on Starknet, Arbitrum, Merlin, Blast, Mode, and ZkSync. Solana had a success rate of 25% and Ethereum had 14.8%.

This is not surprising for Solana, as the chain has become a retail favorite and a real challenger to Ethereum’s dominance over the past two years. And given that many of the other chains we looked at are It’s not shocking that with a second layer chain that is directly competing with another chain, only the parent chain retains a handful of winners.

While we didn’t include Telegram’s TON network, we did want to point out that there have been quite a few successful airdrops on that network as enthusiasm and adoption grew.

The difference between different public chains (Chain Division)

That is, if we try to separate the large chains and their airdrops, does the data change when we take into account the performance of the public chain tokens? When we normalize these airdrop prices and compare them to the performance of their respective ecosystems – e.g. , compare the airdrop on Polygon to the price action of $MATIC, or the airdrop on Solana to $SOL — the results are still not encouraging.

Yes, the market has fallen and the 2023 highs have cooled, but that’s not enough to mask the lackluster nature of the airdrops, both compared to system tokens and altcoins in general. These sell-offs are not completely isolated from the larger narrative, This reflects the general fear of short-term exuberance in the market. When something that is already considered established is falling, no one wants something untested or new.

Overall, the improvements have been modest at best, with Solana and ETH seeing around 15-20% drops in some 90-day windows at worst, which still suggests that these airdrops are far more volatile and Only connected in the overall narrative, not in the price performance.

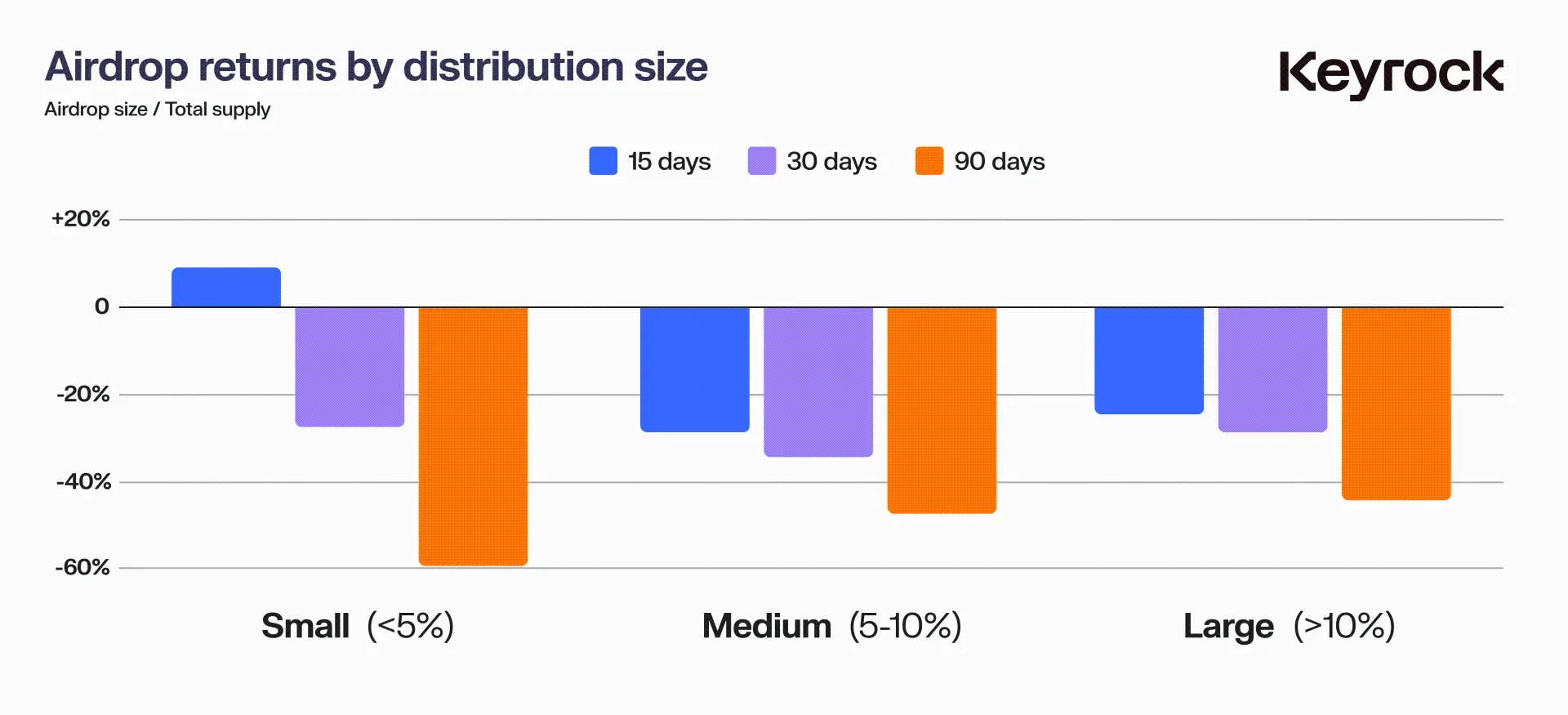

Performance by allocation

Another key factor affecting airdrop performance is the allocation of the total token supply. How much of the token supply a protocol decides to allocate can significantly affect its price performance. This raises key questions: Is it worthwhile to be generous? Or is it safer to be conservative? Would more tokens lead to better price action, or would it be risky to give too much away too quickly?

To break this down, we’ll divide the airdrops into three groups:

-

Small Airdrop:

-

Medium airdrop: >5% and ≤ 10%

-

Large airdrop: >10%

We then examined their performance over three time periods – 15 days, 30 days, and 90 days.

In the short term (15 days), smaller airdrops (

Medium-sized airdrops (5-10%) performed slightly better, balancing supply allocation with user retention. However, large airdrops (>10%) performed best over longer time frames. These larger allocations, while not as effective in the short term, There may be a greater risk of selling pressure, but it appears to foster a stronger sense of community ownership. By distributing more tokens, the protocol may empower users and give them a greater stake in the success of the project. This in turn It can also bring better price stability and long-term performance.

Ultimately, this data suggests that it pays to be less stingy with token distribution. Protocols that are generous in their airdrops tend to foster a more engaged user base, leading to better results over time.

Distribution Dynamics

Impact of Token Distribution

Our analysis shows that the size of an airdrop directly impacts price performance. Small airdrops create less initial selling pressure but tend to see significant sell-offs within a few months. On the other hand, larger allocations do create early More volatility, but stronger long-term performance, suggests that generosity encourages greater loyalty and token support.

Correlating distribution with market sentiment

Community sentiment is a key, though often elusive, factor in a successful airdrop. Larger token distributions are often seen as fairer, giving users a stronger sense of ownership and involvement. This creates a positive feedback loop — users feel more engaged. , are less likely to sell their tokens, contributing to long-term stability. In contrast, smaller allocations may initially feel safer but often lead to short-lived enthusiasm followed by a rapid sell-off.

While it is difficult to quantify the sentiment or “vibe” of all 62 airdrops, they remain strong indicators of the project’s enduring appeal. Signs of strong sentiment include active and engaged communities on platforms like Discord, organic growth on social media, and more. Additionally, product novelty and innovation often help sustain positive momentum because they attract more committed users rather than opportunistic reward hunters.

Impact of Fully Diluted Value

An important area of interest is whether the fully diluted value (FDV) of a token at launch has a significant impact on its performance after the airdrop. FDV represents the value of a token if all possible tokens are in circulation, including those that have not yet been unlocked or allocated. Coin, the total market value of cryptocurrencies. It is calculated by multiplying the current token price by the total token supply, including circulating tokens and any locked, vested or future tokens.

In the crypto space, we often see projects with FDVs that appear to be too high compared to the actual utility or impact of the protocol at launch. This raises a key question: are tokens being penalized for having an inflated FDV at launch, or is it the impact of the FDV that is being inflated? Does it vary from project to project?

Our data covers projects ranging from those launched with a conservative FDV of $5.9 million to those launched with a staggering $19 billion – a 3,000x difference across the sample of 62 airdrops we analyzed.

When we plot this data, a clear trend emerges: regardless of project type, hype level, or community sentiment, the larger the FDV at launch, the more likely it is that the price will drop significantly.

FDV Relationship

There are two main factors at play here. The first is a basic market principle: investors are attracted to the perception of upward mobility. Tokens with small FDVs offer room for growth and the psychological comfort of “getting in early,” which attracts investors, promising Future earnings. On the other hand, projects with inflated FDVs often have trouble maintaining momentum because the perceived upside becomes limited.

Economists have long discussed the concept of market “space.” As Robert Shiller puts it, “irrational exuberance” quickly fades when investors feel that returns are limited. In the crypto space, when a token When the FDV of a country shows that growth potential is limited, that boom disappears just as quickly.

The second factor is more technical: liquidity. Tokens with large FDVs often lack the liquidity to support these valuations. When large incentives are distributed to the community, even a small number of users who want to cash out can create huge There is selling pressure on the other side, but no buyers on the other side.

Take $JUP, for example, which launched with $690 million in FDV, backed by a range of liquidity pools and market makers that we estimate to be $22 million on launch day. This gives $JUP a liquidity to FDV ratio of just 0.03 This is relatively low compared to its meme coin $WEN’s 2% Liquidity-FDV ratio, but relatively high compared to other tokens in its same weight class.

In comparison, Wormhole launched with a large FDV of $13 billion. To achieve the same 0.03% liquidity ratio, Wormhole would need to have $39 million in liquidity across venues. However, even including all available pools, both official Based on the number of tokens available, whether official or unofficial, and Cex liquidity, our best estimate is closer to $6 million — a fraction of the amount needed. With 17% of tokens allocated to users, this sets the stage for a market cap that may not be sustainable. Since its launch, $W has fallen 83%.

As a market maker, we know that without sufficient liquidity, prices will be highly sensitive to selling pressure. The combination of two factors – the psychological demand for growth potential and the actual liquidity required to support a large FDV – explains Why tokens with higher FDV have difficulty maintaining their value.

The data bears this out. Tokens with lower FDVs experienced less price erosion, while those that launched with inflated valuations suffered the most in the months following their airdrop.

Overall winners and losers

To get a deeper understanding of some of the players, we picked out a few examples of the winners and losers of this quarter’s airdrops to analyze. Explore what they did well and where they went wrong, which led to successful community launches and less successful launches .

Airdrop Season: A Case Study of Winners and Losers

As we dive deeper into the airdrop season, let’s examine a standout winner and a notable underperformer to uncover the factors that led to their starkly different outcomes. We’ll explore what these projects did right or wrong that ultimately shaped the airdrop season. their success or failure in the eyes of the community.

Winner: $DRIFT

First up is Drift, a decentralized futures trading platform that has been operating on Solana for nearly three years. Drift’s journey has been filled with triumphs and challenges, including withstanding several hacks and exploits. However, each setback has forged a new The company has built a stronger protocol and evolved into a platform that has proven its value far beyond airdrop farming.

When Drift’s airdrop finally arrived, it was met with enthusiasm, especially from its long-term user base. The team strategically allocated 12% of the total token supply for the airdrop, a relatively high percentage. And a clever bonus system was introduced, which was activated every six hours after the initial allocation.

Launching with a modest market cap of $56 million, Drift surprised many, especially when compared to other virtual automated market makers (vAMMs) that have fewer users and less history, but higher valuations. ’s value quickly reflected its true potential, reaching a market cap of $163 million – a 2.9x increase since launch.

The key to Drift’s success is its fair and thoughtful distribution. By rewarding long-term, loyal users, Drift effectively filters out new Sybil farmers, fosters a more authentic community, and avoids the toxicity that sometimes plagues such events.

What makes Drift stand out?

Heritage and a solid foundation

-

Drift’s long history allows it to reward its existing base of Determination users.

-

With a high-quality, proven product, teams can easily identify and reward true super users.

Generous tiered allocation

-

Allocating 12% of the total supply — a significant proportion for an airdrop — demonstrates Drift’s commitment to its community.

-

The phased release structure helps minimize selling pressure and keep the value stable after release.

-

Crucially, airdrops are designed to reward actual usage, not just metrics inflated by point farming.

Realistic valuation

-

Drift’s conservative launch valuation avoids the trap of excessive hype and keeps expectations stable.

-

Sufficient liquidity is seeded in the initial liquidity pool to ensure the smooth operation of the market.

-

The low fully diluted valuation (FDV) not only makes Drift stand out, but also sparks a broader industry discussion about overvalued competitors.

Drift’s success is not accidental; it is the result of deliberate choices that prioritize product strength, fairness, and sustainability over short-term hype. As the airdrop season continues, it’s clear that the community that wants to replicate Drift’s success will be eager to see the next big thing. Successful protocols are best focused on building solid foundations, fostering real user engagement, and maintaining a realistic view of their market value.

$ZEND: From Hype to Crash — A Starknet Airdrop Failure

ZkLend ($ZEND) is now facing a major downturn — its value has plummeted by 95%, and its daily trading volume struggles to exceed $400,000. This is a stark contrast to a project that once had a market cap of $300 million. Unusually, ZkLend’s total value locked (TVL) is now over double its fully diluted valuation (FDV) — something that is unusual in the crypto world and not a positive sign.

So how did a project that rode high on the hype surrounding Starknet — a zk-rollup solution designed to scale Ethereum — end up in such a precarious position?

Missed the Starknet wave but didnt get on board

There is nothing groundbreaking about the concept of ZkLend – it aims to be a lending platform for a variety of assets, benefiting from the Starknet narrative. The protocol capitalizes on the Starknet momentum and positions itself as a key participant in the cross-chain liquidity ecosystem. .

premise:

-

Generate a farming network where users can earn rewards across different protocols.

-

Attract liquidity and users through rewards and cross-chain activities.

However, in execution, the platform ended up attracting “hired” activity farmers — users who were only interested in short-term rewards and had no commitment to the long-term health of the protocol. Rather than fostering a sustainable ecosystem, ZkLend found itself at the mercy of rewards. Hunters are at your mercy, resulting in short-lived engagement and low retention.

Backfired airdrop

ZkLend’s airdrop strategy exacerbated its problems. Without significant product or brand recognition prior to the airdrop, the token distribution attracted speculators rather than real users. This critical misstep — the failure to adequately vet participants — led to :

-

Lots of bounty hunters , eager to cash out quickly.

-

There is a lack of loyalty or real engagement, and participants have no long-term commitment.

-

The token value collapsed rapidly as speculators immediately sold their tokens.

Rather than building momentum and fostering loyalty, the airdrop created a brief burst of activity that quickly faded.

The warning

The ZkLend experience is a powerful reminder that while hype and airdrops can bring users, they do not inherently create value, utility, or sustainable communities.

Key Lessons:

-

Hype alone is not enough – building real value requires more than just hype around a popular narrative.

-

Airdrops from unvetted users can attract speculation and destroy value, as happened with ZkLend.

-

There is a huge risk in overvaluing new products without a proven use case.

in conclusion

If maximizing returns is the goal, selling on the first day is often the best move — 85% of airdropped tokens drop in price within a few months. Solana leads as the top public chain in 2024, but given the market Conditions, overall performance was not as bad as expected. Projects like WEN and JUP stand out as success stories, showing that a strategic approach can still deliver strong returns.

Contrary to popular belief, larger airdrops do not always lead to sell-offs. A token with a 70% airdrop allocation saw positive gains, which highlights that FDV management is more important. Overestimating FDV is a critical mistake. High FDV This limits growth potential and, more importantly, creates liquidity issues — inflated FDV requires a lot of liquidity to maintain, which is often not available. Without sufficient liquidity, airdropped tokens are susceptible to severe Prices fall because there is not enough capital to absorb the selling pressure. Projects that launch with realistic FDVs and solid liquidity provision plans are better able to survive post-airdrop volatility.

Liquidity is critical. When FDV is too high, it puts tremendous pressure on liquidity. In the absence of liquidity, a massive sell-off can crush prices, especially in airdrops where recipients are eager to sell. With manageable FDV and a focus on liquidity, projects can create better stability and long-term growth potential.

Ultimately, the success of an airdrop is not just about the size of the allocation. FDV, liquidity, community engagement, and narrative all matter. Projects like WEN and JUP have found the right balance and built lasting value, while others have FDV inflation and Projects with shallow liquidity have failed to maintain interest.

In a fast-moving market, many investors make quick decisions — selling on the first day is often the safest bet. But for those who focus on long-term fundamentals, there are always tokens worth holding. .

This article is sourced from the internet: 2024 Airdrop Research Report: Why do nearly 90% of token airdrops fail?

Related: Thinking in the post-airdrop era: It’s time to build a long-term value-driven model

Original article by: Andrew Redden Original translation: zhouzhou, BlockBeats Editors note: Airdrops were once an important tool to promote the development of crypto projects, but over time, they have gradually exposed the drawbacks of short-term speculation and have difficulty maintaining the long-term loyalty of users and developers. Many projects rely on airdrops and funding programs, but what they attract is hot money that quickly disappears. In the future, blockchain projects should focus on building long-term, value-driven models to incentivize users and developers to continue to participate and contribute, so as to achieve a more stable ecosystem development. It’s time to focus on building long-term, value-driven models that ensure user and developer loyalty. After more than a decade of running a cryptocurrency startup, I’m ready to declare a paradigm shift: airdrops…