Competition on the BTC (Re)staking supply side intensifies, with Wrapped BTC scrambling to seize the WBTC market

Original author: 0x Maiaa, BeWater Research

With the launch of the first phase of the Babylon mainnet a month ago, the launch of BTC LST on Pendle, and the launch of various BTC packages, market attention has been constantly brought back to BTCFi. The following content will cover the recent major updates on BTC (re)staking and BTC-pegged assets:

BTC (Re)staking:

-

The importance of ecological strategy to BTC LST

-

Pendle is coming to BTCFi

-

SatLayer joins the BTC re-staking market competition

BTC anchored assets:

-

Coinbase Launches cbBTC

-

WBTC’s multi-chain expansion

-

FBTC’s aggressive expansion

1/ Current BTC LST competition situation

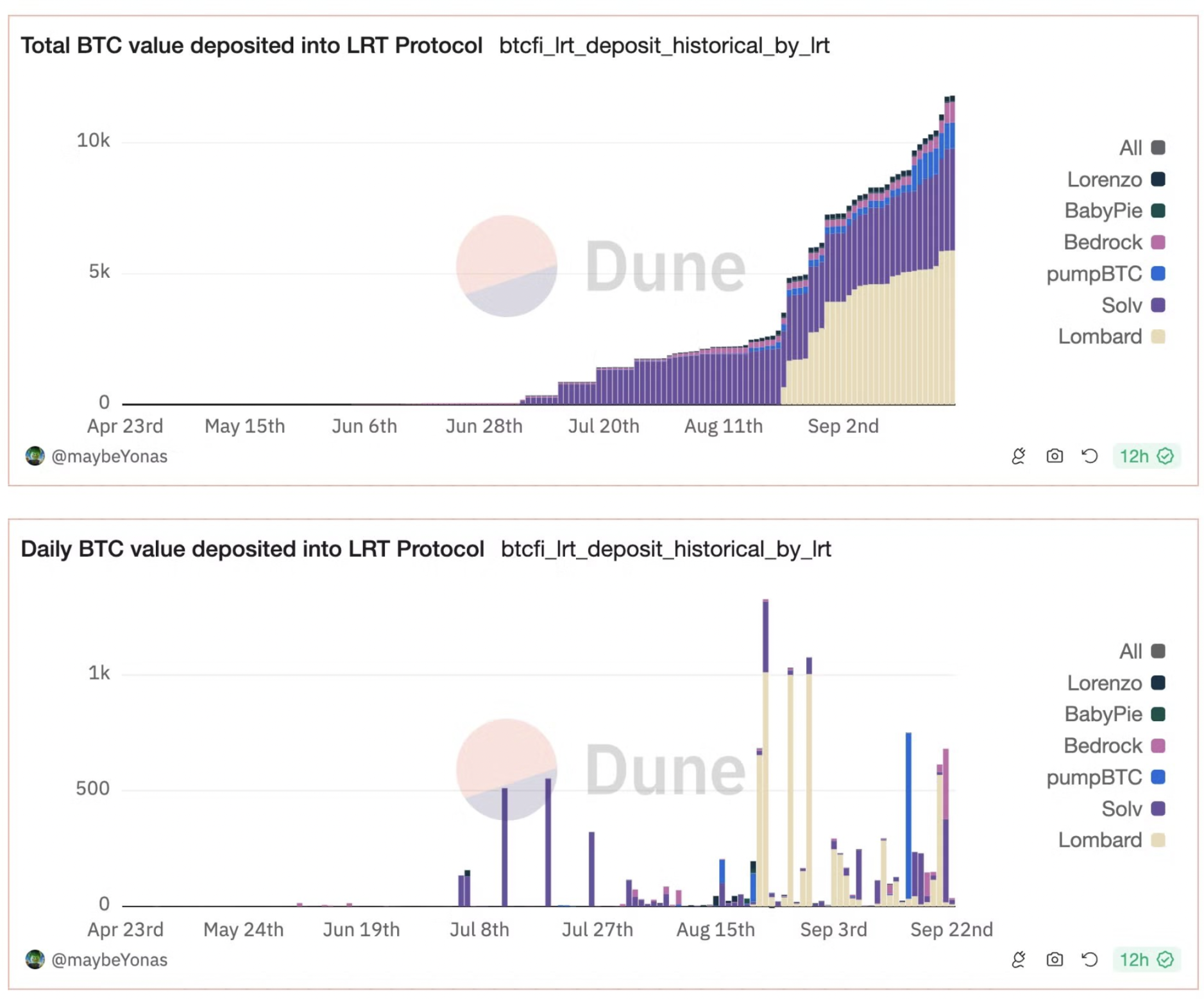

After Babylon Stage 1 quickly reached the 1000 BTC cap, competition among BTC LSTs continued to heat up, with all parties vying for the interest-earning entry point for staking BTC and its wrapped assets. In the past 30 days, @Lombard_Finance has achieved rapid growth, reaching the current highest TVL with 5.9k BTC in deposits, surpassing @SolvProtocol, which has long been in the leading position.

Lombard has gained a competitive advantage at this stage by reaching a strategic partnership with the top re-staking protocol @symbioticfi, providing its participants with a richer source of re-staking income from the ETH ecosystem and opportunities to participate in DeFi.

2/ The importance of ecological strategy to BTC LST:

In the field of BTC LST, ecological strategy has become a key factor affecting the current competitive landscape. Unlike ETH LRT, which natively benefits from the mature DeFi ecosystem of ETH and ETH L2 to support downstream token applications, BTC LST currently faces more complex considerations, including downstream DeFi application scenarios, the development stage of BTC L2, the combination of BTC anchored assets on various chains, and the integration with the re-pledge platform. At the current stage, the choice of ecological strategy will affect the growth rate and the grab of early market share. The specific situation of each BTC LST provider is as follows:

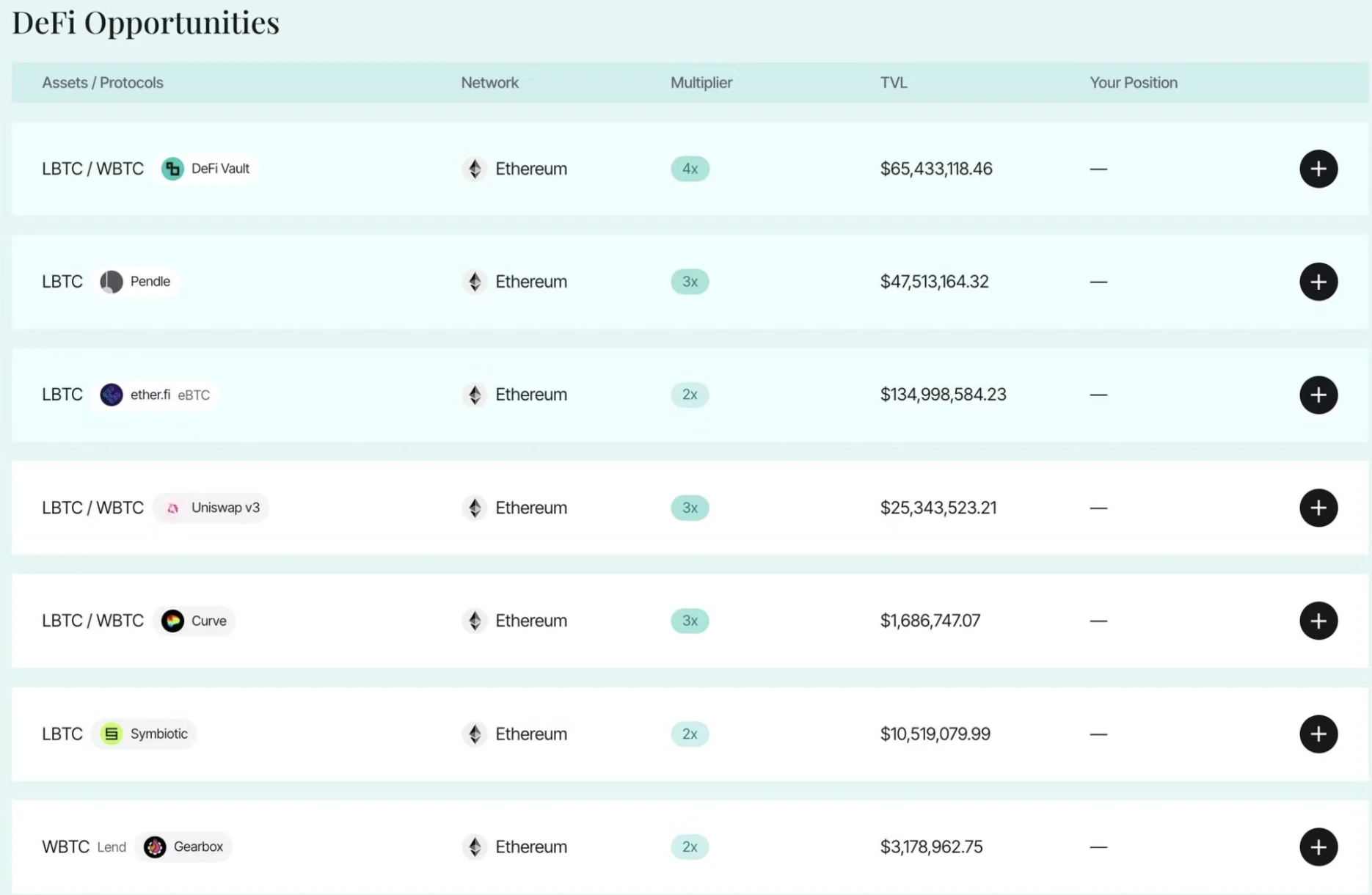

3/ At this stage, @Lombard_Finance is strategically focused on the development of the ETH ecosystem. Through cooperation with @symbioticfi and @Karak_Network, Lombard provides pledgers with rich external rewards outside of @babylonlabs_io. At the same time, $LBTC is the first BTC LST to be supported by the re-staking protocol on ETH. In addition, in terms of LST utility, Lombard is actively promoting the leverage of $LBTC on ETH, and important partners include @pendle_fi@GearboxProtocol@zerolendxyz, etc. It is worth noting that with the acceptance of $LBTC deposits by http://Ether.Fi, $LBTC will benefit from all future downstream applications related to $eBTC, further enhancing its competitive advantage.

4/ Unlike Lombards focused strategy, @SolvProtocol@Bedrock_DeFi are actively expanding multi-chains, and ecological development covers the reception of upstream deposits and the construction of downstream applications. At present, the main liquidity of SolvBTC.BBN and uniBTC is concentrated on the BNB and ETH chains, while also injecting BTC liquidity into other L2s. Solvs strategy worth mentioning is that users are required to deposit SolvBTC to convert to SolvBTC.BBN to participate in Babylon, which will drive market demand for SolvBTC and consolidate Solv as the core business of Decentralized Bitcoin Reserve.

5/ @LorenzoProtocol and @pStakeFinance, backed by @BinanceLabs, are focused on building the BNB chain in their initial launch phase. They already support receiving $BTCB deposits and have minted LST – $stBTC and $yBTC respectively on the BNB chain. Lorenzo is unique in that it has built a yield market based on BTCFi, using a structure that separates the Liquid Principal Token (LPT) and the Yield Accumulation Token (YAT), similar to Pendles model, making the gameplay based on BTC restaking yield more flexible.

6/ From another perspective, the different ecological strategies of various BTC LSTs – the acceptance of upstream BTC derivatives and the minting of LST – will affect the liquidity and DeFi adoption of BTC-anchored assets in each ecosystem. As the BTC LST market continues to expand, this trend will become more and more significant, triggering a TVL defense war between chains.

7/ Pendle is entering BTCFi:

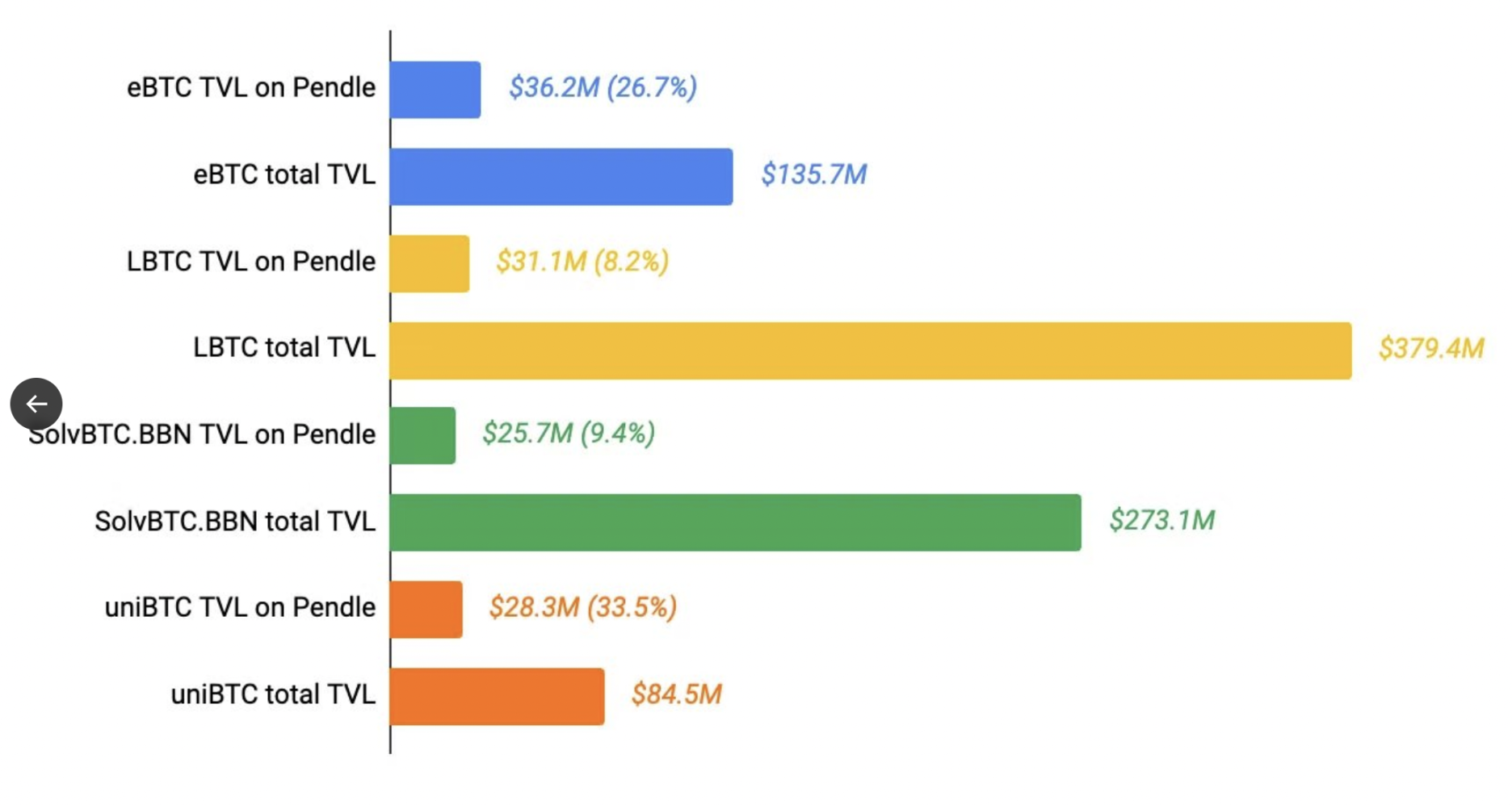

Recently, Pendle has integrated four BTC LSTs into its points market, including $LBTC, $eBTC, $uniBTC, and $SolvBTC.BBN. The current liquidity and total TVL of each LST on Pendle are shown in the figure. Among them, the actual adoption of $LBTC is higher than the surface value in the LBTC (Corn) pool. Since 37% of $eBTC is supported by $LBTC, Pendles integration of $eBTC will also indirectly benefit Lombard, giving $LBTC holders more opportunities to optimize their income strategies.

8/ Except for $eBTC, the other three LSTs are all tied to another important participant, @use_corn. Corn is an emerging ETH L2 with two unique designs: veTokenomics and Hybrid Tokenized Bitcoin. Since Corns gas token $BTCN will be minted through a hybrid method, the current cooperation also indicates the possibility of BTC LST with a trust basis being accepted for minting $BTCN in the future.

The future integration path may be: Wrap BTC → BTC LST → BTCN → DeFi. This architecture adds another layer of leverage to the BTCFi system. Although it enables users to kill two birds with one stone in more protocols, it also introduces new systemic risks and the possibility that the points system of each protocol will be over-mined and the final benefits will be far less than expected. For the release of Corn and Lombard points, please refer to: https://x.com/PendleIntern/status/1835579019515027549

9/ Points leverage is one of the key scenarios for interest-bearing asset strategies including ETH LRT, BTC LST, etc. As a leader, Pendles integration of BTC LST will largely drive the wider application trend of the DeFi ecosystem. Currently, @GearboxProtocol has introduced $LBTC in its points market, and @PichiFinance has also hinted that BTC LST will be integrated in the near future.

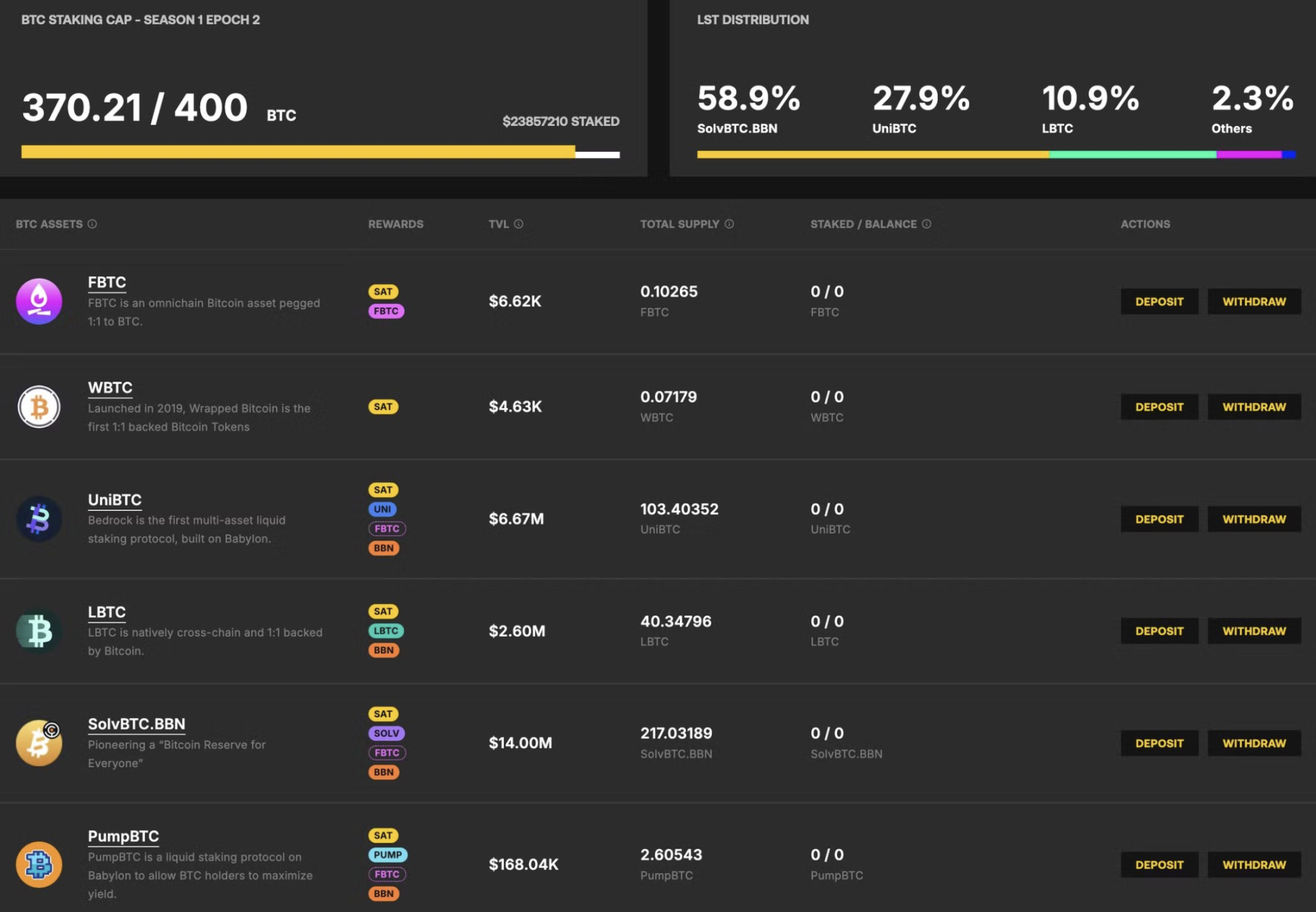

10/ SatLayer joins the BTC restaking market competition: @satlayer enters the BTC restaking space and becomes an emerging competitor to @Pell_Network. Both accept BTC LST restaking and use it to provide security for other protocols, similar to @eigenlayer. As a pioneer in the BTC restaking space, Pell has accumulated $270 million in TVL and has integrated almost all major BTC derivatives across 13 networks. On the other hand, SatLayer is also rapidly expanding its market after announcing a financing round led by @Hack_VC@CastleIslandVC last month.

11/ SatLayer is currently deployed on Ethereum and already supports receiving multiple BTC LSTs including WBTC, FBTC, pumpBTC, SolvBTC.BBN, uniBTC and LBTC, and more integrations are expected. As more and more homogenous re-staking platforms emerge, the liquidity competition for BTC and its variant assets will become more intense. Although this provides participants with an additional layer of nesting doll income opportunities, it also shows signs of oversupply of supply-side infrastructure in the restaking sector.

12/ Current status of BTC wrapped tokens:

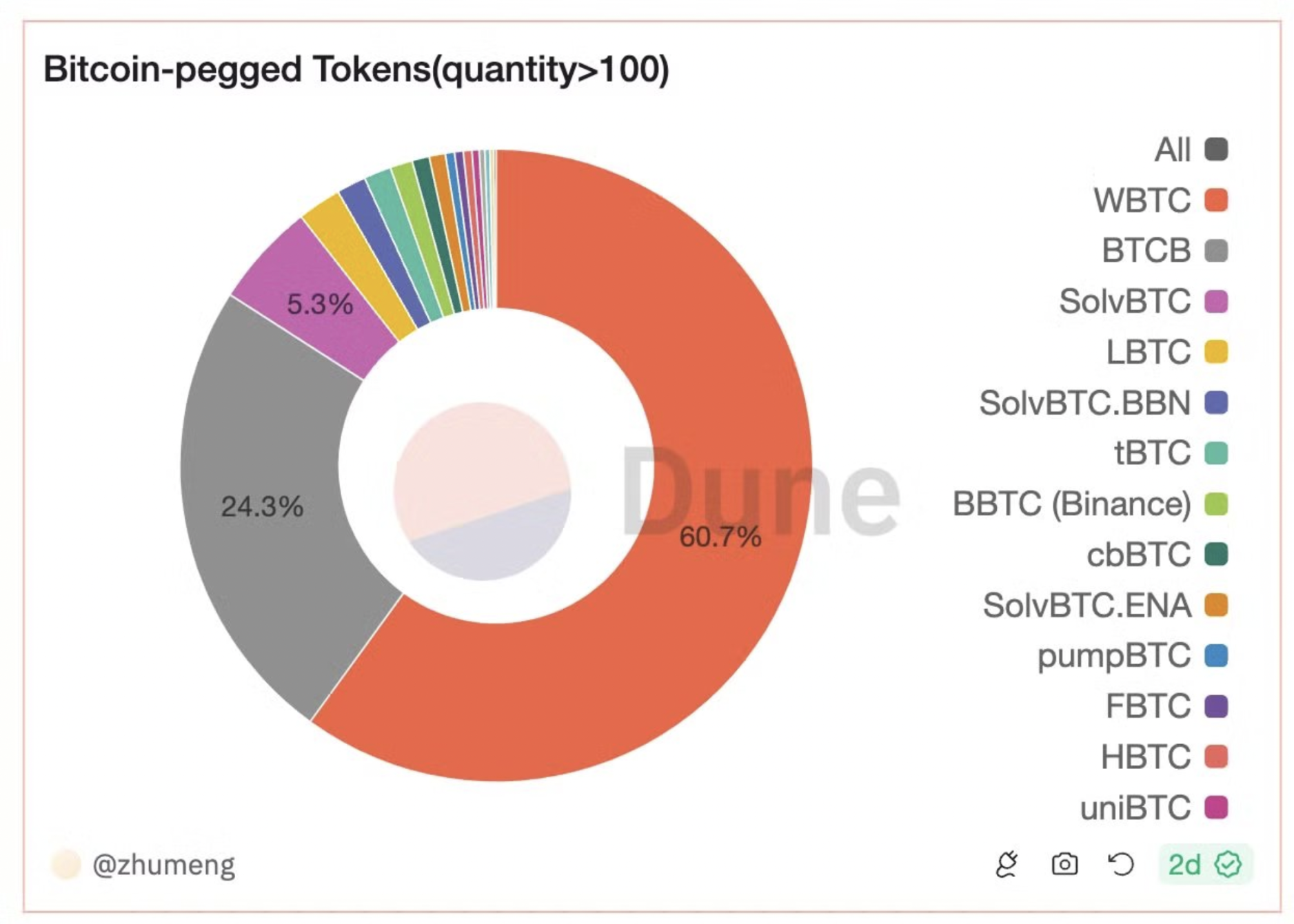

Since Justin Suns involvement in WBTC custody caused a stir, competition in the wrapped BTC market has intensified. The main competing alternative assets currently include @Binances $BTCB (supply 65.3k), @MerlinLayer 2s $mBTC (supply 22.3k), @TheTNetworks $tBTC (supply 3.6k), @0x Mantles $FBTC (supply 3k) and the various BTC LST assets mentioned above.

13/ Coinbase launches cbBTC:

Coinbase launched $cbBTC, a wrapped asset supported by its custody, last week, with a current supply of 2.7k. $cbBTC is deployed on Base and Ethereum networks, and has been supported by multiple mainstream DeFi protocols including @0x fluid, and plans to expand to more chains in the future. In addition, BTC LST @Pumpbtcxyz and @SolvProtocol quickly stated that they would cooperate with Base after $cbBTC was launched, showing the development potential of $cbBTC in BTCFi.

14/ WBTC’s multi-chain expansion:

Despite security concerns, $WBTC still holds over 60% of the wrapped BTC market. @BitGo recently announced that it will deploy $WBTC on Avalanche and BNB chains, and through @LayerZero_Cores OFT standard, it aims to consolidate its market position with multi-chain scaling.

However, the adoption rate of WBTC continues to decline. As leading DeFi protocols such as @aave and @SkyEcosystem begin to remove WBTC as collateral, this trend will affect the attitudes of more DeFi protocols towards WBTC.

15/ FBTC’s aggressive expansion:

$FBTC, managed by Mantle, Antalpha and Cobo, has been deployed on Ethereum, Mantle and BNB chains. Through the Sparkle Campaign, @FBTC_official is actively promoting the wider adoption of $FBTC in the BTCFi field. In the BTC (re)staking field, $FBTC has been adopted by Solv, BedRock, PumpBTC and Pell, providing Sparks points incentives for early adopters.

16/ Currently, various wrapped BTC assets are actively striving to be integrated by major DeFi protocols and accepted by a wide range of users in order to compete for the market position of the next $WBTC. In addition to the existing wrapped BTC assets, new participants such as $tgBTC from @ton_blockchain and $sBTC from @Stacks will soon join the competition.

17 / In the current trend of BTCFis continued growth, BTC (re)staking and BTC anchored assets are two key sectors that deserve continued attention. In the field of BTC (re)staking, there is currently a trend of over-construction and involution on the supply side, while the market size on the demand side is still unknown. In the current early competition landscape, differentiated ecological strategies and unique downstream gameplay have become key factors affecting the competition among various BTC LSTs. On the other hand, the trend of various BTC anchored assets being nested with each other has also introduced new systemic risks, and there is a possibility that each protocol will be over-mined and ultimately have little benefit.

Trust is still a key issue for all BTC-pegged assets. Exchanges, L2 and BTC LST are actively developing their own BTC-pegged assets through different plans, striving to be accepted by mainstream DeFi protocols and a wide range of users, so as to quickly occupy the market lost by WBTC.

This article is sourced from the internet: Competition on the BTC (Re)staking supply side intensifies, with Wrapped BTC scrambling to seize the WBTC market

Original | Odaily Planet Daily ( @OdailyChina ) Author锝淣an Zhi ( @Assassin_Malvo ) Yesterday, Binance Labs announced the first batch of projects selected for the seventh season of incubation , including Astherus, CYCLE NETWORK, DILL and EigenExplorer. Their concepts and businesses are relatively cutting-edge, and the former two have launched early interactive activities, which are linked to future airdrops. Odaily will analyze the business, characteristics and interactive activities of each protocol in this article. Astherus: Liquidity Center for LRT Assets Agreement business The re-staking market space for BTC and ETH is as high as $20 billion and is still growing rapidly. Re-staking allows blockchain validators to deposit ETH or Liquid Staking Tokens (LST) into the platform, receive APR rewards and protect the network. But Astherus believes that most re-staking protocols…