Bitcoin Weekly Observation (9.16~9.22): In the first week of interest rate cut, BTC is close to breaking through the key

Written by: Shang2046 聽

The information, opinions and judgments on markets, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice.

The 50 basis point rate cut is coming, and the market reaction is generally stable. With the gradual influx of funds, BTC may be entering the second half of the bull market

Market Week

In the first week after the US interest rate cut on September 18, Bitcoin opened at 59122.70 and closed at 63577.66, with a high of 64140.67 and a low of 57477.00. It rose 7.54% for the whole week, with a slightly larger volume.

BTC daily line has jumped above the 7/14/30/60/200 day lines, and the moving averages are gradually moving towards an even arrangement, indicating that the market is moving out of divergence and forming a trend.

Although there are some differences, major financial institutions have already expected the Fed to cut interest rates by 50 basis points. In addition, in order to balance the 50 basis point range, Fed Chairman Powell made hawkish remarks, saying that subsequent interest rate cuts will be decided one by one based on relevant data. The combination of doves and hawks has prevented the market from experiencing major fluctuations. The market has thus bid farewell to the various expected price-in and entered a stage dominated by actual capital flows.

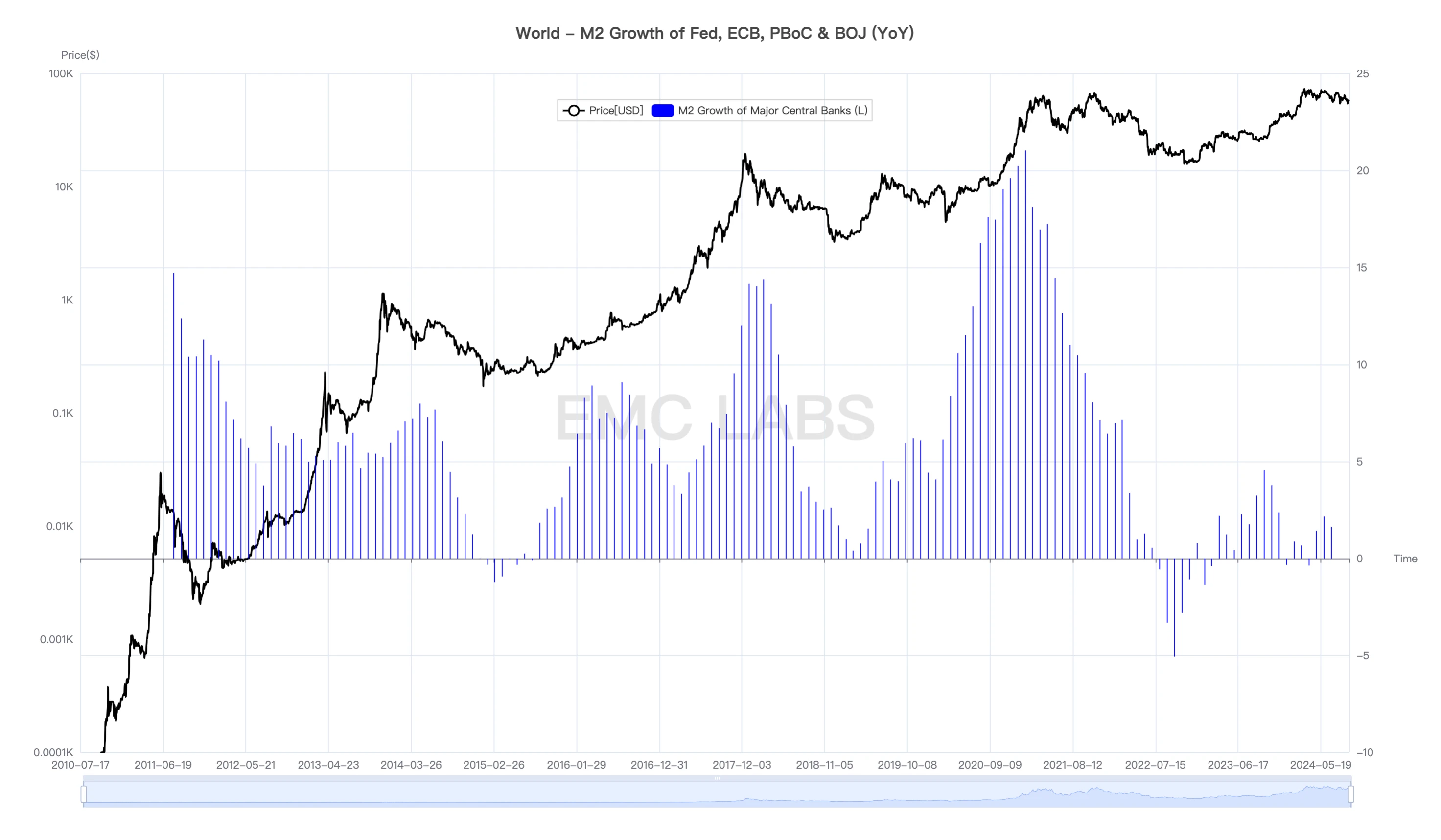

BTC is obviously one of the biggest beneficiaries of the interest rate cut. The broad money supply M2 of the worlds four major central banks, the United States, China, Japan, and the European Union, which we monitor, has also entered a new round of expansion. Historically, the BTC cycle has shown a strong correlation with this (see figure below).

In the short term, BTC has already stood above the 200-day moving average, but still needs to break through the downward trend line. From the perspective of the on-chain holding cost line, it is necessary to overcome the 30% profit line of short-term investors who entered from $49,000, that is, $64,000-66,000. This is also the first pressure range pointed by the technical indicators, and it is an important point to judge whether the market can break out of the right trend and break through the previous high.

Federal Reserve and economic data

The interest rate was cut as scheduled, and the rate cut was 50 basis points, which was suddenly priced by CME Fedwatch. However, the market was not frightened, and the overall reaction was stable. Except for gold breaking through the price platform, other markets were basically stable. However, some investment banks believe that there is still an upward risk of CPI and the possibility of a hard landing of the economy.

After the rate cut, the US dollar index fell slightly, falling to 100.74 on the 29th. Gold rose for two consecutive weeks, rising to $2,622, effectively breaking through the $2,500 pressure level.

U.S. stock indices were mixed as expectations of rate cuts had already been priced in. The overall performance was stable at present, with the Nasdaq up 1.49%, the Dow Jones up 1.62% and the SP 500 up 1.36%.

After a sustained decline in yields, U.S. Treasury yields stabilized this week, with the 10-year yield at 3.74% and the 2-year yield at 3.60%.

The dust has settled and the interest rate cut cycle has started. All markets are digesting the situation silently. The next step will be to gradually price in the possibility of a soft landing, a hard landing or even a CPI rebound.

Stablecoins and ETFs

Following the massive inflow of $1.739 billion last week, the two major channels continued to maintain positive inflows this week, but the scale was reduced to $931 million. The market needs to closely track whether the trend of capital inflows can continue.

Specifically, 397 million flowed into the ETF channel, and 535 million flowed into stablecoins, with USDT and USDC at the same frequency.

AAVE interest, which reflects market leverage, continued to rebound to 4.52%, but it is still at a low level, comparable to last year when the market was in a bear market recovery period.

Supply Analysis

With ample liquidity, the market has once again switched from long to short. Investors who held positions for more than 5 months sold 9,400 coins this week, while short-term investors who held positions for more than 5 months increased their holdings by 14,000 coins. According to past rules, this is often one of the signs that the market has re-entered the bull market rhythm.

Long-term investors reduced their holdings by 900,000 BTC in the first half of the bull market, but since May, they have reversed the trend and accumulated 780,000 BTC this week. They have just started to show signs of reduction since September 19. We have previously pointed out that the second reduction is often accompanied by the start of the second half of the bull market.

After experiencing a period of volatility and washing out, the cost of short-term investors has now reached US$62,200, which is in a slightly profitable range. The maximum pressure level may be around 1.3 times the price, or US$80,000.

The number of exchange chips decreased by 6,000 and the inventory fell to 2.98 million. This outflow is a manifestation of the warming market.

BTC on-chain data

BTCs new addresses and active addresses did not change much and remained at a low level, while Transactions decreased slightly. The hash rate, an indicator of the scale of miners mining power, rebounded slightly.

Ecological analysis

Ethereum ecosystem has newly added addresses and active addresses, and is in a period of moderate expansion. Transaction hits a record high, with Base being the main contributor. Solanas three major indicators remain in an expansion state, with active addresses declining.

SCP (smart contract ecosystem) is currently in a relatively healthy state. The market value of Altcoins other than Bitcoin is entering a period of expansion. If the trend holds, it is also one of the manifestations of the start of the bull market in the second half.

Cycle Indicators

The EMC BTC Cycle Metrics indicator is 0.25, and the bullish signal needs to be further activated.

EMC Labs was founded by crypto asset investors and data scientists in April 2023. It focuses on blockchain industry research and Crypto secondary market investment, takes industry foresight, insight and data mining as its core competitiveness, and is committed to participating in the booming blockchain industry through research and investment, and promoting blockchain and crypto assets to bring benefits to mankind.

For more information, please visit: https://www.emc.fund

This article is sourced from the internet: Bitcoin Weekly Observation (9.16~9.22): In the first week of interest rate cut, BTC is close to breaking through the key pressure level

Market Trends In the past week, BTC has been falling from above $66,000. After falling below the two key support levels of $65,000 and $60,000 on August 1 and August 4, it entered a panic-like decline on August 5. Binance spot data shows that the largest single-day drop of BTC on August 5 was 17%, and BTC once fell to $49,000. Affected by the drastic market fluctuations, more than 200,000 people were liquidated on August 5, and the liquidation amount exceeded $1 billion. As of press time, the price of BTC has gradually rebounded and stabilized at around $55,000. As BTC prices fell, other crypto assets basically followed suit. ETH even showed a tendency to lead the decline. On August 5, ETHs largest daily drop was as high as 23.85%,…