EIGEN unlocking imminent? A brief analysis of EigenLayer鈥檚 current valuation and profit expectations

Original | Odaily Planet Daily ( @OdailyChina )

Author: Azuma ( @azuma_eth )

In the past two days, EigenLayer, the pioneer of the restaking track, has officially announced two major actions regarding the EIGEN token.

-

First, the Season 2 airdrop is now open for claiming, and the claim window will last until March 16, 2025.

-

Second, programmatic incentives (Programmatic Incentives V1) will be launched. Starting from October (historical behavior can be traced back to August 15), EIGEN incentives will be issued to qualified stakers and operating nodes on a weekly basis. It is expected that approximately 66.95 million EIGEN will be distributed in the first year, equivalent to 4% of the initial supply of EIGEN.

In the view of some users who follow EigenLayer, the sudden acceleration of EigenLayers pace is to warm up for the upcoming EIGEN Unlock event, in order to win more market attention and participation after EIGEN is officially circulated.

On May 10 this year, EigenLayer opened the first season (Season 1) airdrop application, but since the application, the EIGEN token has been in a non-transferable state. This more or less appetite-keeping behavior has also prevented EigenLayer from gaining the discussion in the secondary market that matches its status.

When will EIGEN be unlocked?

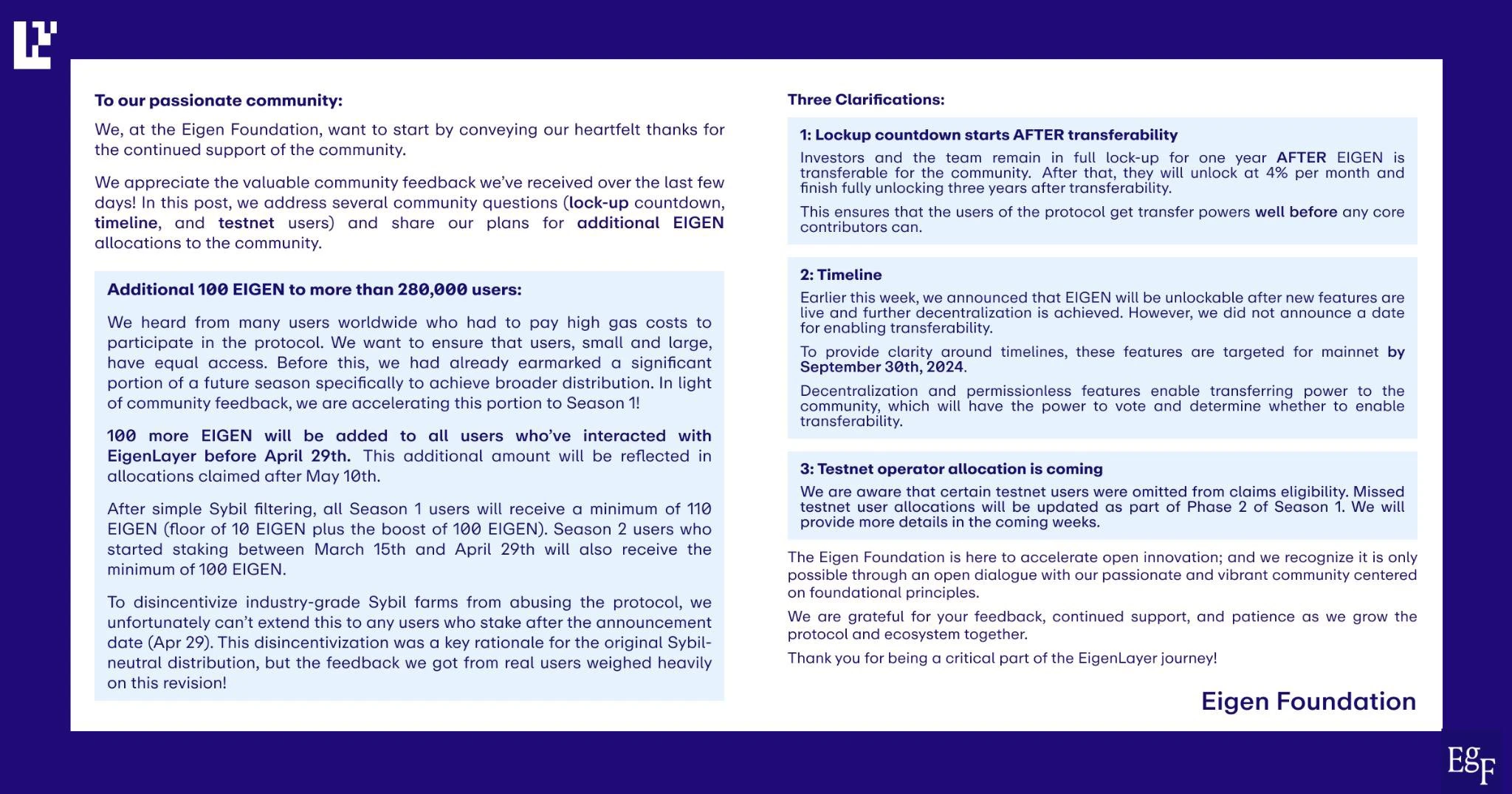

Regarding the unlocking time of EIGEN, the first thing that needs to be mentioned is that there has been a misunderstanding circulating in the market for a long time – the circulation unlocking time is September 30th.

The reason for this misunderstanding is that the Eigen Foundation mentioned the date of September 30 in its official document on the unlocking timeline in May, but if you look closely at the description of the Eigen Foundation, you will find that the description is actually: Earlier this week, we announced that ElGEN will be unlocked after new features are live and further decentralization is achieved, but we did not announce a specific date. In order to clarify the timeline, we plan to implement these features on the mainnet before September 30, 2024.

From the statement of the Eigen Foundation, it can be seen that the unlocking of EIGENs transfer function should be after the realization of launching new functions and further decentralization, and September 30 is the time expectation set by EigenLayer for launching new functions and further decentralization.

Regarding the progress of launching new features and further decentralization, launching new features is a relatively subjective concept. After May, EigenLayer has successively launched functions such as AVS rewards and programmed incentives, but it is difficult for outsiders to judge EigenLayers own assessment of the progress; as for the progress of further decentralization, it is relatively captureable. EigenLayers first quarter airdrop has ended, and the final claim rate is about 78.6%. The second quarter airdrop and subsequent incentive plans will further accelerate the distribution of EIGEN tokens.

In summary, EigenLayer officials did not mention that the transfer function of EIGEN will be unlocked on September 30, but combined with the progress of the completion of the condition of further decentralization, I personally predict that after the second quarter airdrop and incentive plan are opened, the final unlocking time of EIGEN will not be delayed too long.

EigenLayer basic data and valuation expectations

DeFillama data shows that EigenLayers current TVL total value is temporarily reported at US$10.79 billion, ranking third among all protocols in all ecosystems, second only to liquidity staking giant Lido and lending leader Aave.

EigenLayer official data shows that the protocol currently supports 16 AVS (active verification services) including EigenDA, covering DA, oracle, privacy, DePin, games, ZK verification and other fields. Although Symbiotic, Karak, Solayer, Jito and other major re-staking protocols from different ecosystems are coming in full force, at present, EigenLayer is still the protocol with the largest value scale, the fastest development progress and the strongest network effect in the entire re-staking track.

The reason why the network effect is particularly emphasized is that in addition to its own strong fundamentals, EigenLayer has almost single-handedly driven half of the innovation in the Ethereum ecosystem . Around different fields such as liquidity re-staking and concrete AVS services, a large number of projects including ether.fi, Renzo, Puffer, Eigenpie, AltLayer, Omni, eoracle, etc. have found the application scenarios of their own protocols and rely on the development of EigenLayer.

This is why the community once joked that EigenLayer was the guardian of Ethereum, the Emperor of Zhou…

In terms of valuation, although EIGEN has not yet activated the transfer function, some pre-market trading markets including Aevo have already started EIGEN contract trading. As of the time of writing, EIGEN is temporarily quoted at $2.95 on Aevo.

Since the total supply of EIGEN at the time of creation was 1.67 billion, the offer price of $2.95 means that the FDV corresponding to EigenLayer is approximately $4.9265 billion.

As for the initial circulation market value, EigenLayer officials have not yet disclosed the initial circulation structure of EIGEN, but we can combine the data of the two airdrops to make a simple calculation of the users holdings ( not considering the incentive plan for the time being, because the weekly distribution will not start until October, and the early circulation accounts for a small proportion ). In the first quarter of EigenLayers airdrop, a total of about 87.89 million EIGEN were claimed (the claim rate was about 78.6%); in the second quarter, a total of 86 million EIGEN will be distributed ( 60 million to pledgers and operating nodes, 10 million to ecological partners, and 6 million to community contributors ). If the claim rate is the same as in the first quarter, the final claim amount is expected to be 67.59 million, and a total of 155 million EIGEN will be claimed in the two quarters.

This means that the total value of EIGEN obtained by all users through two quarterly airdrops is approximately US$457 million – this is also the EIGEN share that can be determined to be in full circulation.

Will there be more airdrops in the future?

When announcing the first quarter airdrop earlier this year, EigenLayer mentioned that 15% of the EIGEN tokens would be distributed in the form of airdrops. The official first and second quarter airdrops are planned to distribute 113 million and 86 million EIGEN respectively, totaling approximately 200 million EIGEN, accounting for approximately 11.9% of the total supply of 1.67 billion Genesis tokens.

This means that within EigenLayers plan, about 3.1% of EIGEN tokens will still be used for future airdrop rounds.

From my personal experience, considering that the second round of airdrops did not adopt the even distribution plan of a minimum of 100 airdrops in the first round, the airdrop shares available to small retail staking users are relatively small (after all, the base is too large), and the airdrops with larger shares are basically allocated to whale users, operating nodes and community contributors – especially KOLs who have created original high-quality EigenLayer-related content on social media, who generally received thousands or even tens of thousands of EIGEN airdrops.

Therefore, in the subsequent potential airdrop rounds, small retail users who continue to stake on EigenLayer for the purpose of airdrops may no longer have ideal profit expectations, unless they find another way and choose a higher threshold participation method such as original output.

The incentive plan has been launched, what are the expected benefits?

In addition to airdrops, another way to earn EIGEN directly is the incentive program that will be launched in October. The program aims to issue EIGEN incentives to qualified stakers and operating nodes on a weekly basis.

EigenLayer officials stated that the incentive will implement retroactive rewards based on the staking situation since August 15, 2024, and the first round of rewards will be available for collection every week starting in October. In the first year of the implementation of the plan, it is expected that approximately 6,695 EIGEN will be distributed, equivalent to 4% of the initial supply of EIGEN tokens.

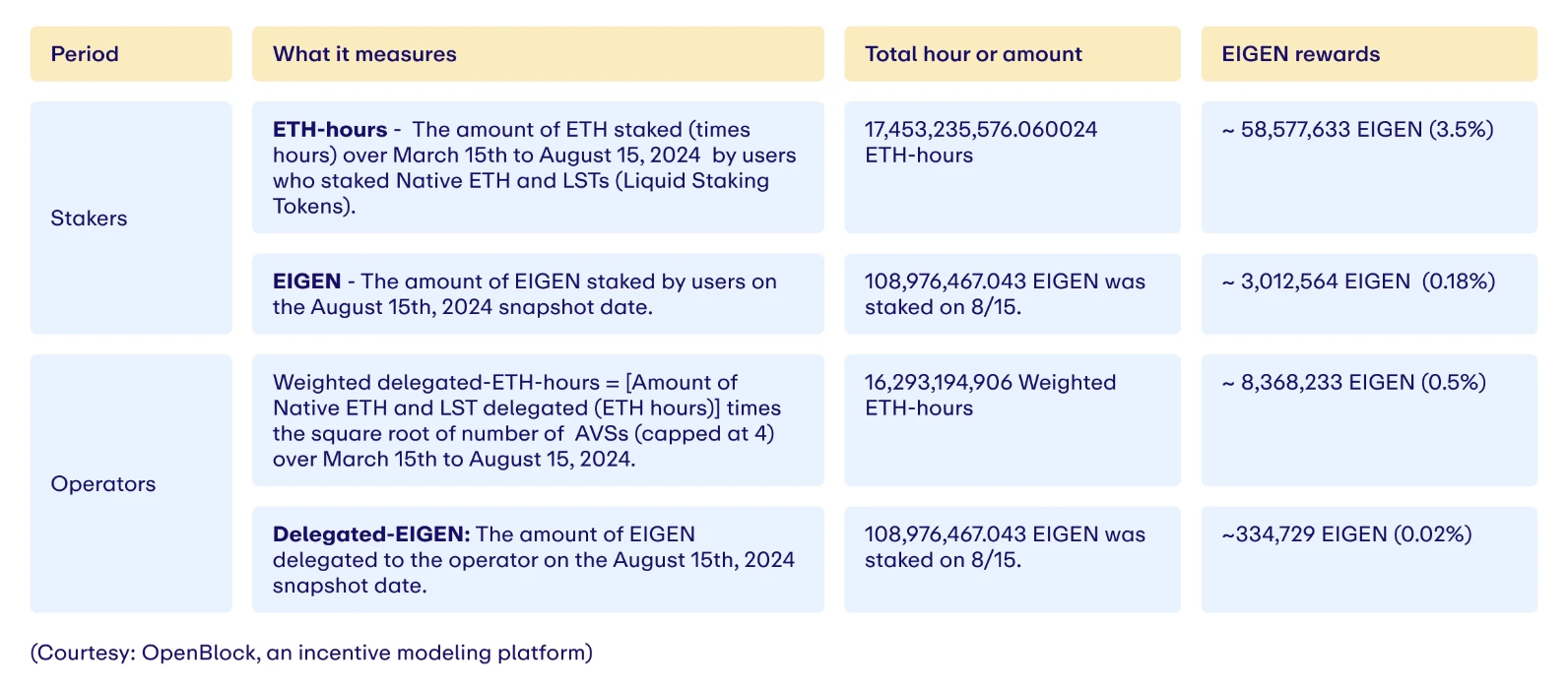

Combining the above data, we can simply calculate the potential rate of return for pledge users under this incentive plan.

First of all, the incentive plan is distributed to two major groups, namely, pledgers and operating nodes, but EigenLayer has not clearly stated the proportions allocated to the two groups. Therefore, we chose to refer to the allocation ratio of pledgers and operating nodes when EigenLayer designed the second season airdrop. As shown in the figure below, EigenLayer allocated 3.68% of the supply of EIGEN to pledgers and 0.52% of EIGEN to operating nodes in the second season airdrop. The allocation ratio of the two major groups is roughly 88:12.

Based on this ratio, it is estimated that 58.91 million EIGEN will be distributed to staking users out of the total incentive share of 6,695 EIGEN in the first year, which is about 174 million US dollars at a price of 2.95 US dollars. As mentioned above, the current TVL of EigenLayer is temporarily reported at 10.79 billion US dollars, which means that the potential income of staking users under this incentive plan is expected to be 1.6%.

It should be emphasized that the above calculations are rough calculations based on subjective allocation forecasts and static currency prices. The final yield situation still needs to be based on the actual progress of EigenLayer . Although the 1.6% yield does not seem objective, EigenLayer pledge users are mainly composed of large capital users with a left-leaning security/yield tendency. They will pay more attention to the security level and liquidity of the protocol itself. On this basis, considering that EigenLayer itself can also provide about 3% of native pledge income, coupled with the expected appreciation of EIGEN, pledges on EigenLayer still have certain financial appeal.

This article is sourced from the internet: EIGEN unlocking imminent? A brief analysis of EigenLayer鈥檚 current valuation and profit expectations

Headlines Trump-related stocks and cryptocurrency concept stocks fell after the US election debate After the US presidential debate, Trump Media Technology Group (DJT.O) fell 13% in pre-market trading. Blockchain stocks fell across the board, with MicroStrategy (MSTR.N) and Riot Platforms (RIOT.O) falling by about 3% and Coinbase (COIN.O) falling by 2%. The US core CPI is in line with market expectations, and the US dollar index DXY has risen by more than 20 points in the short term The annual rate of the US core CPI in August was 3.2%, the same as last month, in line with market expectations, after falling for four consecutive months. The US dollar index DXY rose by more than 20 points in the short term and is now at 101.67. The U.S. core CPI…