Markets were stable for most of last week, but on Friday, the markets expectation of a 50 basis point rate cut in September suddenly soared from around 15% to about 50%, with little clear news to explain the change. Economic data was largely in line with expectations and was not a factor, while the Federal Reserve was still in a blackout period, which led market participants to speculate that this repricing may have been triggered by comments from former Fed officials and reporters.

First up is Timiraros from the Wall Street Journal, who quoted Powells former senior advisor Jon Faust as saying that he slightly favors starting at 50 basis points and that he believes theres a good chance the FOMC will do that. Additionally, he mentioned that the Fed could manage investor concerns about a larger rate cut with a lot of verbal explanations to mitigate… so that a big rate cut wouldnt be a sign of concern, and that if the Fed instead chooses to start with a smaller 25 basis point cut, it could cause awkward questions.

Next, the Financial Times also published an article saying that it would be a very difficult decision for the Fed to cut interest rates by 25 or 50 basis points in September. Finally, former New York Fed President Dudley made a stronger comment, saying I think there is a strong case for a 50 basis point cut, whether they will do it or not, adding that considering that the current federal funds rate is nearly 200 basis points above the neutral rate, the question is: why not start cutting rates now?

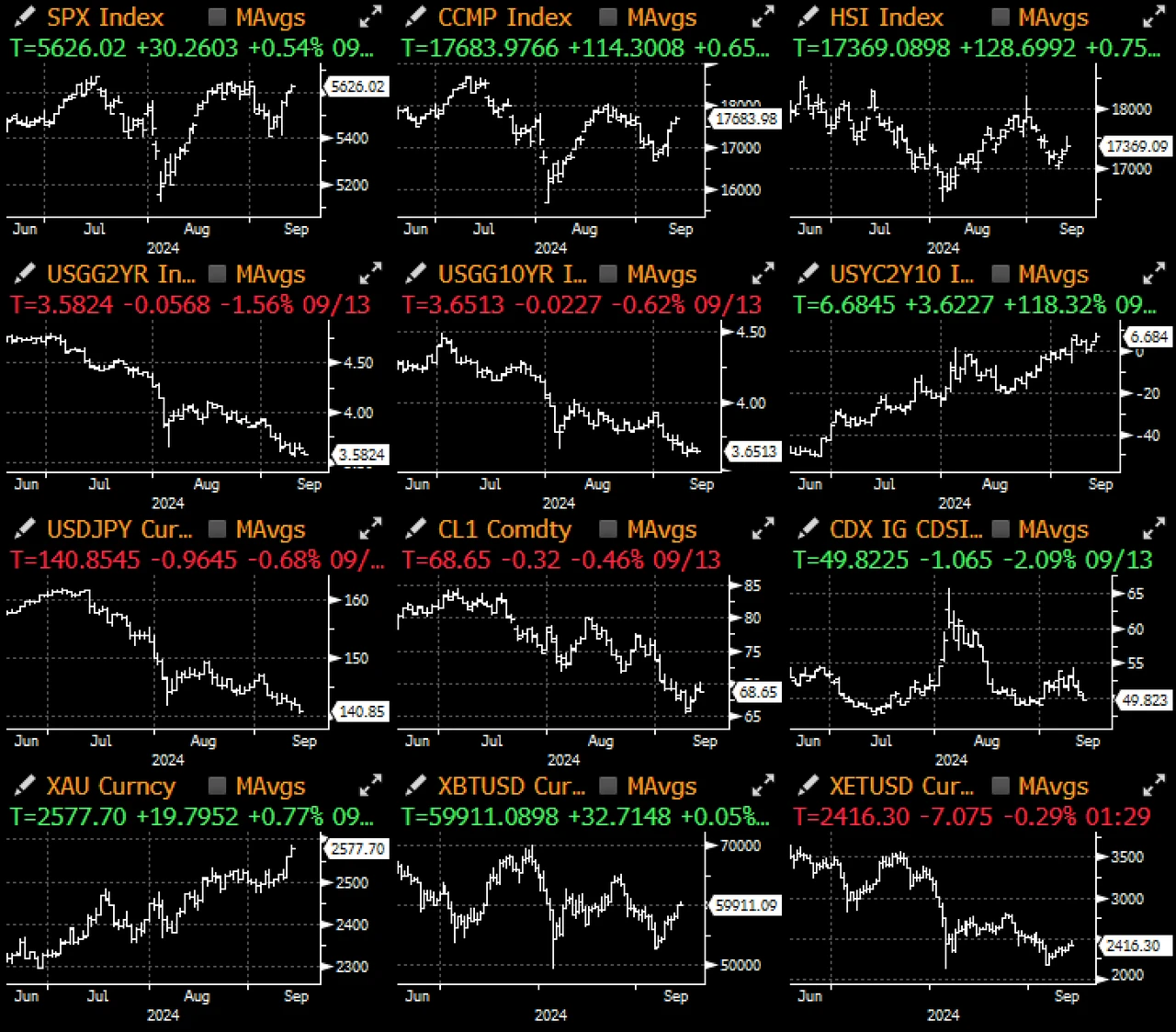

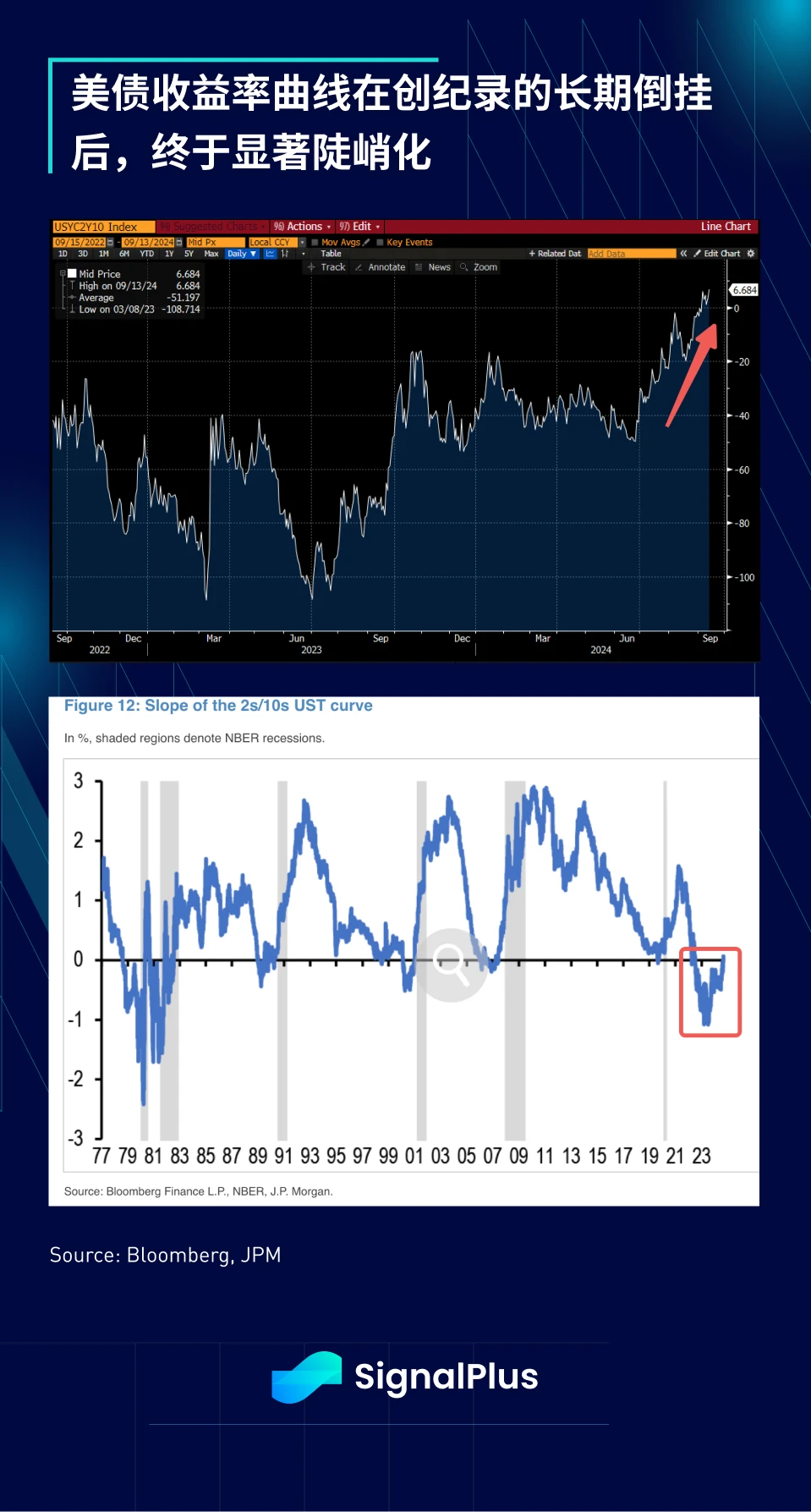

The U.S. Treasury yield curve continued its steepening trend due to the repricing of interest rates, with 2/10s rising 4.5 basis points, bringing the curve to its steepest level in two years and returning to positive territory after a long period of inversion (since 2021).

We have spoken several times about the “policy change” of the Fed’s official shift to an easing bias, evident through the continued yield curve steepening and the bond-equity correlation moving back into negative territory.

Over the past year, stocks and bonds have moved in near lockstep, with both asset classes reflecting the market’s one-way bet on Fed policy. However, since the August “flash crash,” however, markets have once again begun to focus on the trajectory of the economy rather than just the Fed’s stimulus measures, bringing both asset classes back into risk-spreading mode.

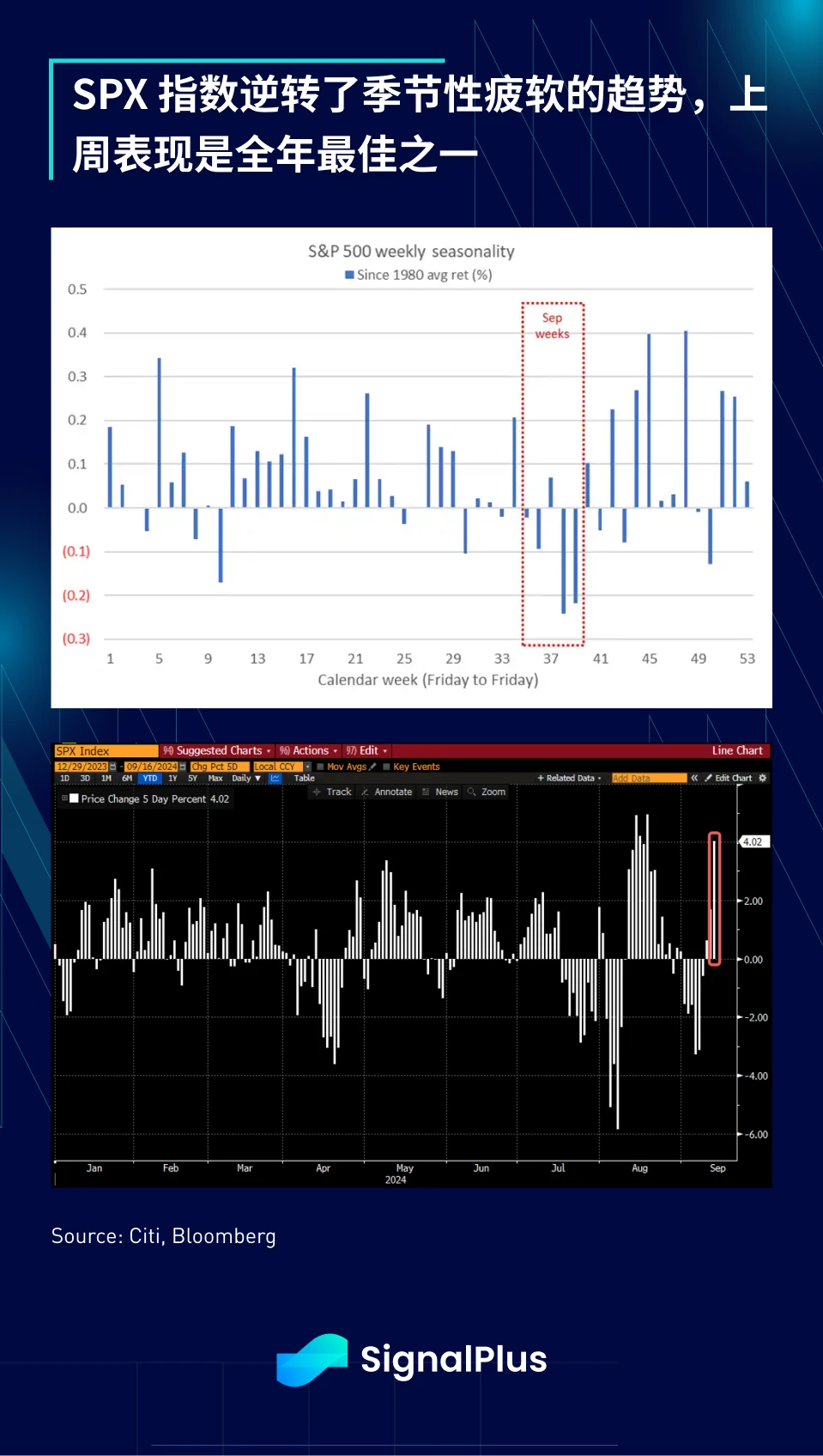

As US interest rates have once again become the focus of the market, the foreign exchange market has also responded, with the US dollar index (DXY) and the US dollar against the Japanese yen (USDJPY) both moving in sync with yields, hovering around the technically key levels of 100 and 140 respectively. On the other hand, the US stock market has at least temporarily reversed its seasonal weakness, with the SPX having one of its best performances of the year last week.

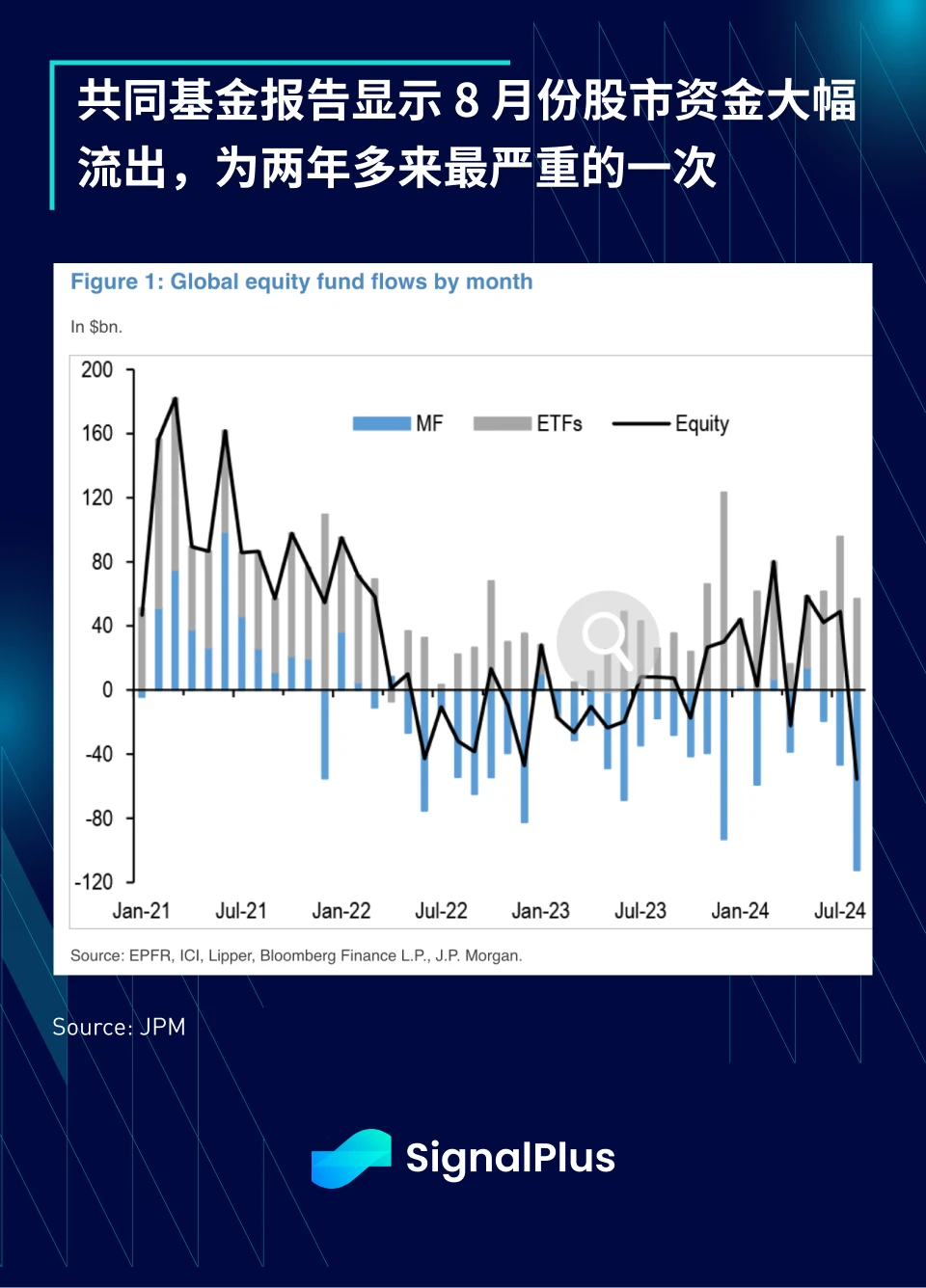

Part of the strong rebound may be due to fund managers search for yield, with JPMorgan reporting $55 billion in outflows from equity mutual funds in August, the worst so far in 2022. Is there a chance of a sharp reversal in the all-important late September month, 50 basis point rate cut or not?

In terms of cryptocurrencies, as macro sentiment continues to dominate price movements and there is a lack of other notable developments on the chain, the correlation between BTC and SPX has risen to near all-time highs. As market sentiment has temporarily improved, BTC prices have rebounded to the $58-60k range. BTC ETFs also saw inflows of $263 million last Friday, and even ETH ETFs saw outflows temporarily halted, while implied volatility has declined as traders continue to prefer selling covered call options for gains.

However, despite the temporary relief, medium-term resistance and challenges remain, and ETH continues to face difficulties, with ETH/BTC having fallen to a 5-year low with no end in sight.

In the news, Coinbase announced the launch of its own wrapped BTC (cbBTC) and SWIFT announced plans for a tokenized asset transfer infrastructure, heightening concerns about the increasing centralization of digital assets, though this trend is likely to continue as traditional finance (TradFi) continues to gain influence in the cryptocurrency space.

This week will be full of central bank activity, including meetings of the Federal Reserve, Norway, Japan, the United Kingdom, Brazil, South Africa, Thailand, Taiwan and Indonesia. In terms of economic data, Chinas credit supply and retail data will be watched to understand the continued slowdown in the economy, while Tuesdays US retail sales data should be the most important data before the FOMC meeting, which may affect the final decision of a 25 or 50 basis point rate cut.

Good luck to everyone, and the SignalPlus team looks forward to communicating with you further at the Token 2049 event this week!

You can use the SignalPlus trading indicator function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240916): 50 is the New 25

Related: 7 potential narratives worth watching in the second half of the year

Original author: Pink Brains Original translation: TechFlow In the first half of 2024, Bitcoin’s dominance, decentralized AI, the use of DePIN, the rise of Solana, and ETH staking became the main highlights of the market. Various sub-sectors of DeFi are also booming, driven by new sources of income, airdrop crazes, and meme coins. Looking ahead to the second half of the year, there are 7 potential trends to watch. At the beginning of 2024, we predicted 12 key trends and ideas to usher in a new bull market wave. Most of them have become hot topics for top cryptocurrencies, with significant growth in price movements, active users, on-chain metrics, developers, and financing activities. After 6 months, both sentiment and the macro environment have changed. Now it is time to focus…