From prosperity to downturn, where is the future of South Koreas NFT market going?

Original author: Tiger Research Reports

Original translation: TechFlow

Summary of key points

-

Since 2021, various projects have emerged in the domestic NFT market, including NFT platforms and communities led by large companies. However, since 2022, the market has been in an unstable state.

-

The market has declined even more than the global market due to an overly localized focus, lack of real utility, and regulatory challenges.

-

Despite the market downturn, there are still practical application cases such as tickets and product certificates in the Korean NFT market. This shows that NFT has the potential to develop into a technology with real value rather than just a speculative tool, so its future development is worth paying attention to.

1. Introduction

South Koreas NFT market has developed in sync with global trends and has experienced rapid growth since 2021, especially the popularity of blue-chip NFTs such as Cryptopunk and BAYC. This growth was driven by the rapid development of multiple projects on Klaytn, South Koreas native blockchain network. Well-known projects such as Metakongz and Sunmiya Club have attracted the attention of global investors and achieved a large number of transactions on OpenSea, the worlds leading NFT market. In addition, the launch of the local NFT market has also injected vitality into South Koreas NFT industry.

However, with major shocks such as the Terra Luna collapse in May 2022 and the FTX incident in November of the same year, the market environment began to change, triggering the so-called crypto winter. As a result, the NFT market has declined, and many projects have faced difficulties or even terminated operations prematurely. Despite this, some companies are still persisting, continuing to operate or launching new projects.

In this report, we comprehensively analyze the current state of the Korean NFT market, focusing on projects that have closed due to the market downturn and those that have successfully operated despite the difficulties. By comparing and analyzing these project strategies, we aim to identify key trends shaping the Korean NFT market and provide insights into its future development direction.

2. Overview of the Korean NFT Market in 2024

South Koreas NFT market experienced rapid growth in early 2022. As large companies in the financial, retail, and telecommunications industries actively entered the NFT field, the market was quickly dominated by these large companies.

2.1. NFT Platform

During this period, there was fierce competition among NFT platforms, and each platform competed for domestic users by providing localized services, providing a one-stop solution from NFT creation to trading. This strategy aims to quickly attract a stable customer base from established companies by providing a convenient user experience. In addition, these companies have quickly established comprehensive markets and various related functions by leveraging their rich experience and resources in the development and operation of platform-related services such as trading, sales and settlement.

Source: Pala on the left, KT Mincl on the right

In 2023, the market situation has changed dramatically. Many companies have begun to shut down their NFT platform services for a variety of reasons. Due to their excessive focus on the domestic market, their user base is relatively limited and they cannot compete with global platforms such as OpenSea, Magic Eden, and Blur. In addition, the lack of attractive NFT projects that can maintain a stable trading volume has also weakened their market position. Finally, the downturn in the entire NFT market has led to a decline in demand, which may be the decisive factor in the closure of these platforms.

2.2. NFT Projects

NFT projects are emerging from a variety of entities, from large enterprises to community-driven. Companies are launching NFT projects by leveraging existing intellectual property (IP) or developing new character IPs, aiming to provide customers with a richer brand experience and enhance customer loyalty through unique benefits. Notable examples include Lotte Shoppings Belly Bear NFT and Shinsegae Department Stores Puuvilla NFT projects, which issued 9,500 and 10,000 NFTs respectively. Both projects combined membership benefits and sold out quickly, becoming early success stories in the Korean NFT market.

Most of these projects rely on a simple membership-based business model, and primarily monetize through secondary market transactions. However, as the NFT market declined, these projects struggled to maintain sustainable revenue, causing many to deactivate their community channels or shut down entirely. Even NFT projects that rely on the brand value of large companies face the challenge of maintaining an active community. Despite some initial success, these projects failed to deliver long-term value and real utility, ultimately hindering their continued development and user engagement.

3. NFT market continues to decline

Against the backdrop of a prolonged downturn in the global cryptocurrency market, South Korea鈥檚 NFT market is experiencing a more pronounced decline. This steeper decline is primarily due to three reasons: 1) the over-localization of the domestic NFT market, 2) the large number of NFT projects that lack practical application value, and 3) the increase in regulatory barriers related to cryptocurrencies.

3.1. Over-localization of the Korean NFT market

South Korea鈥檚 preference for localized social media platforms and communities has led to an over-localization of its NFT market. When trends such as NFTs become popular domestically, they tend to form closed communities that limit participation from global users. In addition, the increase in NFT platforms designed specifically for Korean speakers has also exacerbated this isolation, as users prefer to choose native language platforms for convenience. This closed environment has hindered the integration of the Korean NFT market with the global ecosystem.

This description of the Korean market stands in stark contrast to the global NFT ecosystem, where NFT projects primarily operate through English-speaking community channels and markets. Platforms like Reddit, X (formerly Twitter), OpenSea, and Warpcast are the main venues for discussing and promoting NFT projects, all in English. This language gap is a significant obstacle for local Korean NFT projects looking to expand into international markets.

3.2. NFTs that have not yet proven their value

Source: Left)SeoulArtistNFT , Right) BlueberryNFT

Similar to global trends, the NFT market in South Korea initially attracted attention through collectible NFTs. Many NFTs related to well-known Korean artists and sports stars were launched, some of which achieved high trading volumes due to the fame of their creators. However, these NFTs, which were mainly regarded as collectibles or speculative assets, found it difficult to maintain long-term interest and were gradually marginalized in the market.

After this initial phase, the market saw a second wave of membership-based NFTs, which were primarily backed by large companies. Although these NFTs initially saw a sharp rise in issuance prices, both trading volume and prices subsequently fell sharply, with little sign of recovery.

MetaKongz NFT sales trend, source: Opensea

This phenomenon is due to the continued questioning of the intrinsic value of NFTs. While the development of digital technology has made the concept of digital collectibles popular and triggered a wave of speculative enthusiasm, this wave has gradually subsided. The mere possession of digital images has failed to maintain public interest and recognition. Similarly, membership-based NFTs initially provided holders with benefits such as discounts and exclusive events, but they struggled to create lasting value. This is mainly because these NFTs failed to meet peoples expectations and lacked practical uses, which prevented them from gaining sustainable development in the market.

3.3. High barriers to entry due to regulations

Another major challenge facing the domestic NFT market is the increasing regulatory barriers. The Virtual Asset User Protection Law, which came into effect in July, and the subsequent NFT guidelines have made the operation of NFT-related businesses more complicated. According to the guidelines, NFTs may be classified as virtual assets if they meet any of the following conditions:

-

When a large number or series of NFTs of the same or similar type are issued

-

When NFTs can be divided

-

When NFTs can be used as a method of paying for certain goods or services directly or indirectly

-

When NFTs can be used as a way to exchange virtual assets between unspecified individuals, or as a means of payment for goods or services related to other virtual assets.

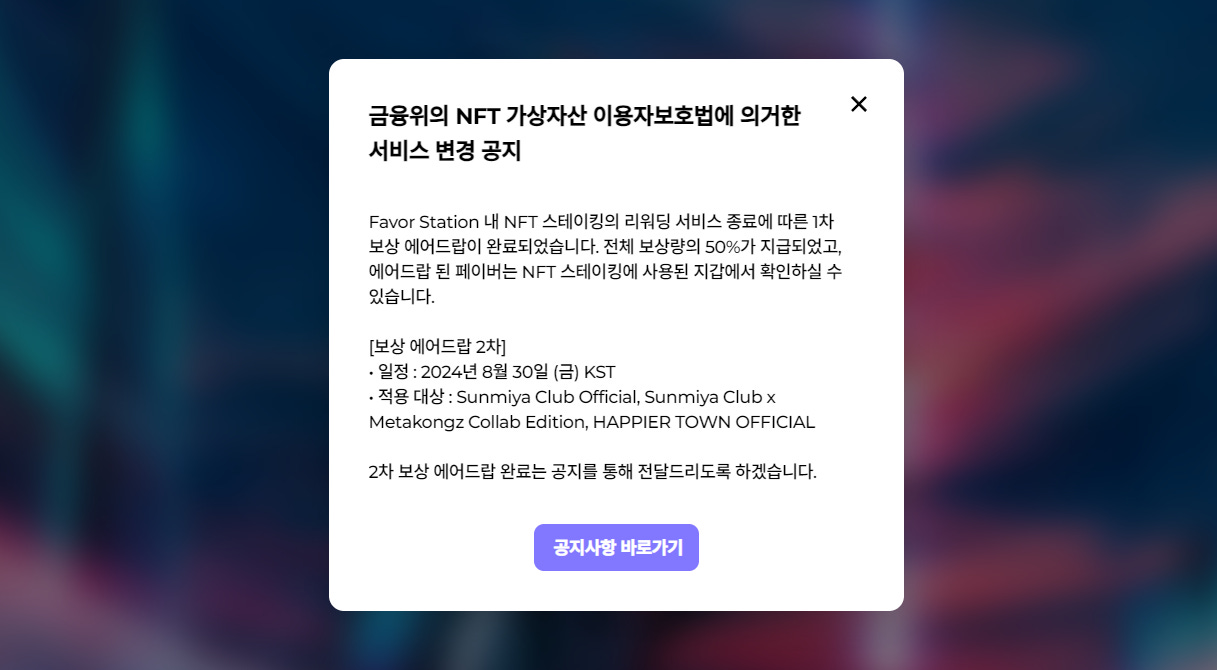

Sunmiya Club will terminate the NFT staking reward service after the Virtual Asset User Protection Law takes effect. Source: sunmiya.club

Classifying NFTs as virtual assets is a huge challenge for businesses. In South Korea, operating virtual asset-related businesses requires a Virtual Asset Service Provider (VASP) license. After obtaining the license, the company must also pass the Information Security Management System (ISMS) certification, which is an expensive and time-consuming process. This is a major obstacle for companies or project teams with limited funds and human resources, making it difficult for them to enter the NFT field. In addition, this also raises the entry barrier for startups in innovative applications of NFTs.

On the eve of the implementation of the Virtual Asset User Protection Law, several existing services have chosen to scale back or close to avoid strict regulatory requirements. Many NFT-related companies may shift their business focus or exit the market completely.

4. How will the Korean NFT market develop in the future?

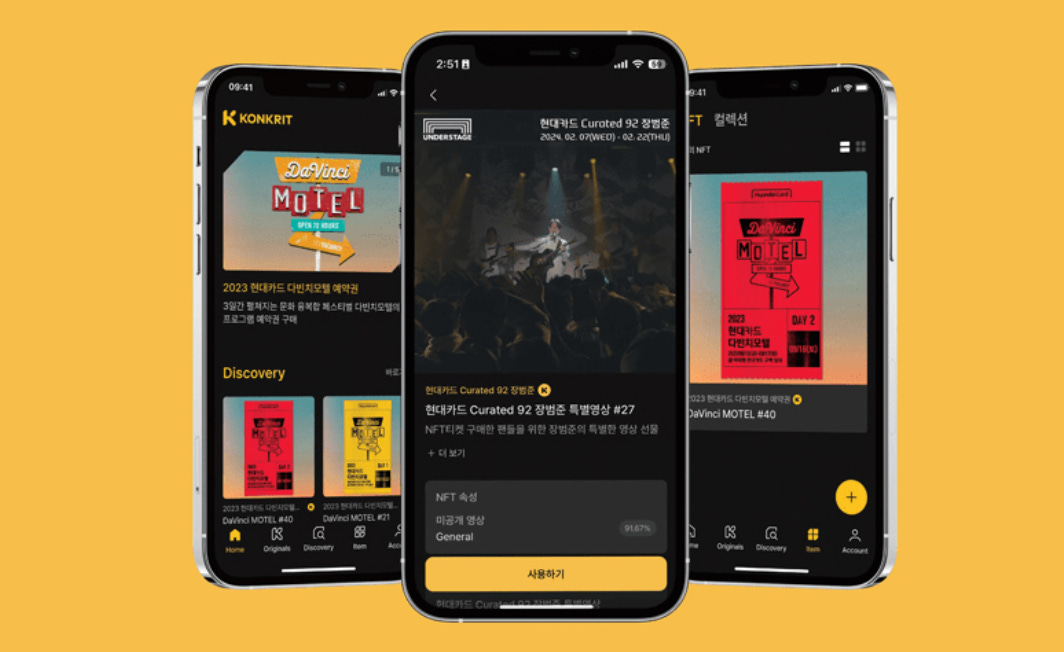

Source: Hyundai Card

Although the domestic NFT market is in a downturn, there are still many successful cases of NFT applications. One typical example is the NFT-based concert tickets launched by Hyundai Card, which is designed to prevent counterfeiting and black market transactions. This shows how NFT technology can create real value in existing industries. This move by Hyundai Card is not just a simple adoption of new technology, but solves real social problems and reflects the actual benefits of NFT. As NFT technology continues to develop, it may solve the inconveniences in daily life and enhance the publics service experience.

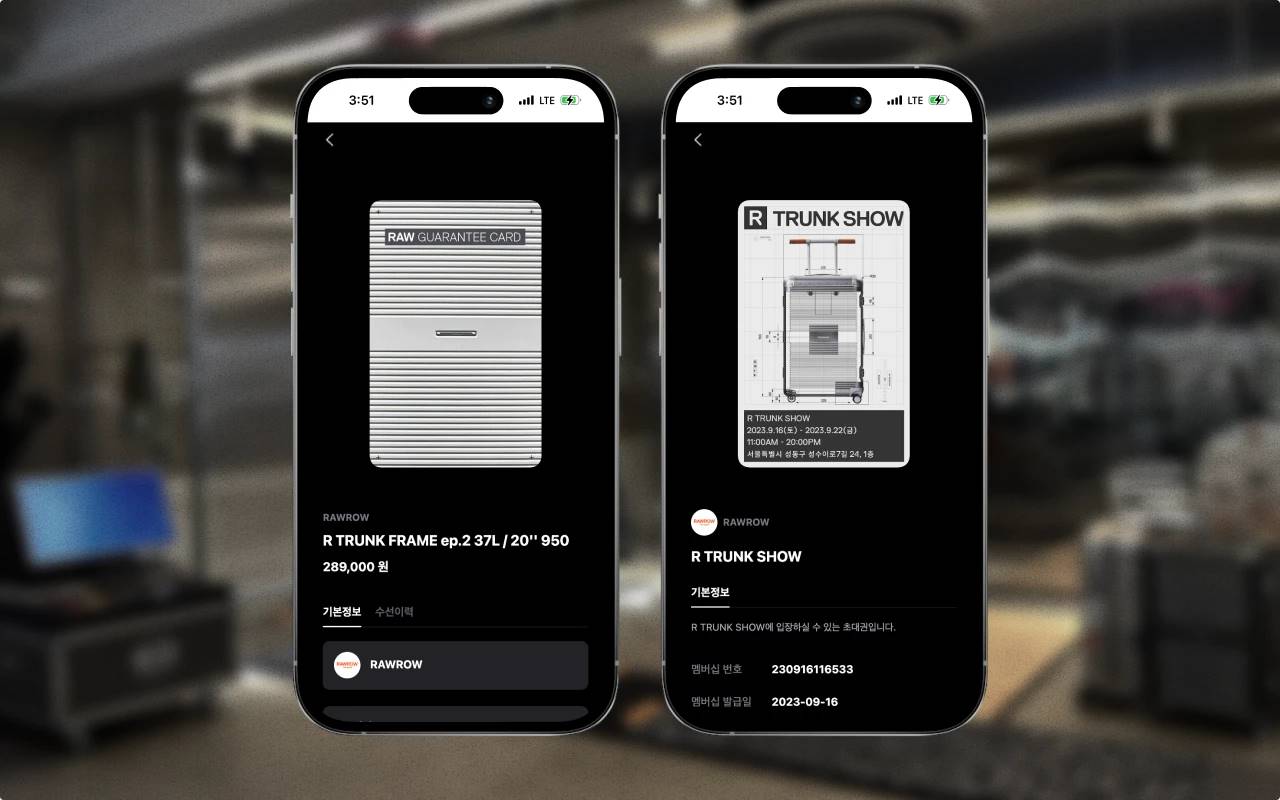

Source: Vircle

NFT technology is also being applied to areas such as product authentication and customer relationship management (CRM). A typical example is Vircle, which provides NFT-based product warranty services. The company is expanding its business through cooperation with fashion and electronic brands, as authentication and after-sales services are crucial in these fields.

NFT digital warranty has many advantages, including solving the problem of lost paper warranty and enabling customers to conveniently activate and obtain after-sales service through mobile devices. For enterprises, this data can be used for more efficient customer relationship management. In addition, digital warranty can also serve as a membership system to integrate customer information from various channels into a unified system. These examples show the potential of NFT technology to bring practical benefits to enterprises and customers.

5. Conclusion

The Korean NFT market still faces many challenges in its recovery process. In addition to the factors mentioned above, some negative events related to NFTs have also exacerbated the publics negative perception. In particular, scandals involving Korean influencers and money-making scams in multiple projects have seriously damaged public trust. In addition, many people generally believe that NFTs are mainly speculative tools, which remains a major obstacle to the development of the market.

To improve this situation, it is necessary to accumulate successful cases that can demonstrate that NFT technology creates real value. A positive shift in public perception is essential to achieving this goal. This challenge is not limited to the NFT industry, most Web3 projects face similar problems when seeking wider acceptance and understanding.

South Korea has advantages in some areas where NFTs can be effectively applied, such as games, webtoons, and K-pop. Although the market currently faces challenges due to the localized environment and unclear regulations, new attempts at NFTs within the existing framework are gradually unfolding, bringing exciting developments. With the increase in successful cases, the continuous improvement of NFT-related technology and expertise, and the increased investment of the government and enterprises, South Korea is expected to launch innovations that lead the global NFT market.

This article is sourced from the internet: From prosperity to downturn, where is the future of South Koreas NFT market going?

Original author: BitpushNews Mary Liu On Thursday, data released by the U.S. Department of Labor showed that the number of initial unemployment claims in the week ending August 3 was 233,000, lower than the 250,000 in the previous week and lower than the 240,000 expected by economists, reducing concerns about an impending recession in the United States. Investor sentiment improved and financial markets turned to recovery across the board on Thursday. According to CMEs Fed Watch data, the probability of the Federal Reserve cutting interest rates by 25 basis points in September is 43.5%, and the probability of cutting interest rates by 50 basis points has dropped to 56.55%. At the close of the day, the SP, Dow Jones and Nasdaq all rose, up 2.30%, 1.76% and 2.87% respectively. The…