BTC and ETH this week overview

Market performance

The overall cryptocurrency market rebounded this week:

-

Bitcoin: This week, Bitcoin showed an overall rebound trend. Market traders sentiment towards economic recession trading has eased, and it is generally believed that the probability of a recession in the US economy in the future is relatively low. After the release of the US August CPI data this week, it can be seen that the CPI has been greatly alleviated and has taken another step towards the 2% that the Federal Reserve is concerned about. As a result, most market traders bet that the Federal Reserve will cut interest rates by 25 BP next week, which means that it is only a defensive rate cut and the US economy has not entered a recession. Therefore, this weeks rebound occurred after a sharp drop in the last two weeks.

-

Ethereum: This week, Ethereums performance was weaker than Bitcoin, and its rebound was weaker than the overall market. In addition to external macro factors, the main reason is that Ethereum is now confused about its future development direction. The market does not buy into the opinions of Ethereum developers, and Ethereum developers do not adopt the opinions of market users, which has caused serious disagreements. The main reason is that there are no innovative and rapidly developing star projects on the Ethereum chain, which lacks the ability to tell stories and create wealth in the future, causing funds to be transferred from the Ethereum chain to other public chains, making the construction of the Ethereum ecosystem face severe challenges.

Key Events

US CPI data is lower than expected and lower than the previous value

-

On September 11, the U.S. seasonally adjusted CPI annual rate for the end of August was 2.5%, significantly lower than the previous value of 2.9% and lower than the expected value of 2.6%, indicating that the current U.S. inflation is rapidly declining and is under very good control. The value is constantly approaching the Feds expected value of 2%, which further confirms the Feds interest rate cut next week. And the market is most worried about the number and magnitude of the Feds future interest rate cuts. Through this CPI data, the market understands that the continuous decline in CPI data is in a controllable stage and will not easily cause a rebound, so the Feds interest rate cuts will continue for many times.

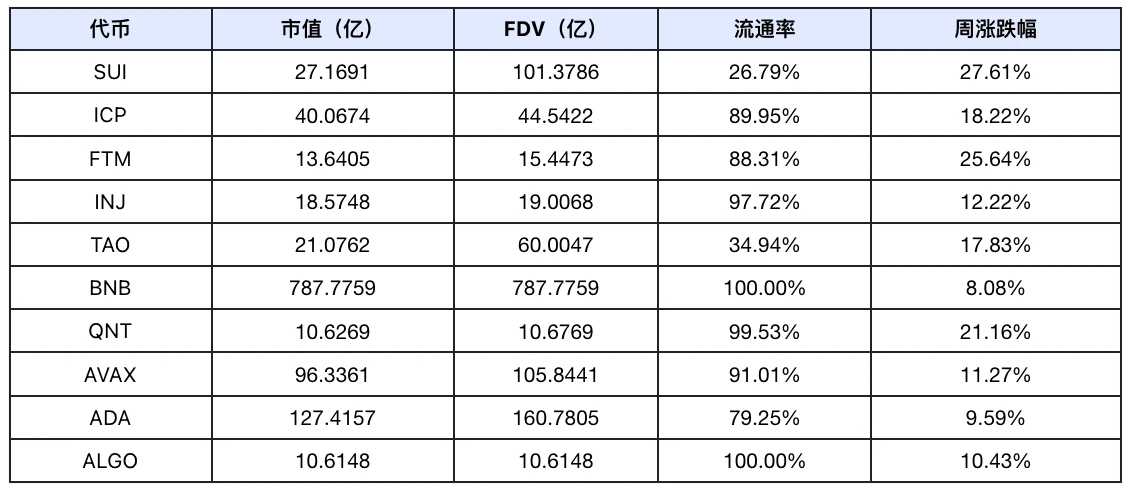

Altcoin Overview of the Week

Overall performance

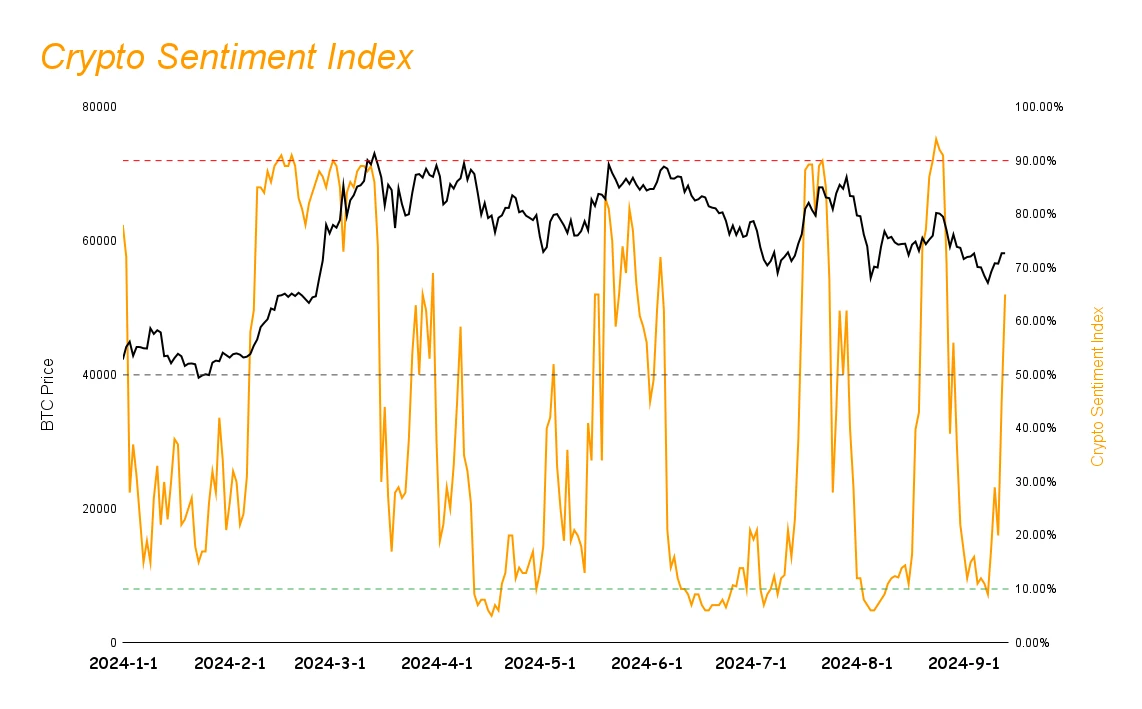

This week, the market sentiment index recovered quickly and has risen to 65.5%, a sharp increase from 11% last week. As the market gradually rebounded this week, market sentiment turned from extreme fear to greed.

The Altcoin market followed the rebound trend of the broader market this week and rebounded more strongly than the broader market. This rebound was mainly because the market believed that the possibility of a recession in the US economy in the future was reduced, which eased the concerns about the recession, thus triggering this weeks rise. And a lot of funds flowed out of the Ethereum ecosystem and began to flow to other public chains, causing projects in various ecosystems to rise.

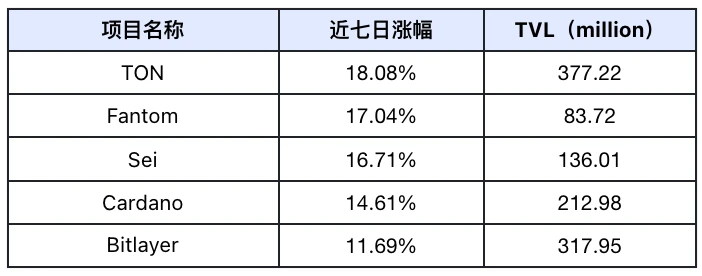

Overview of public chain TVL growth

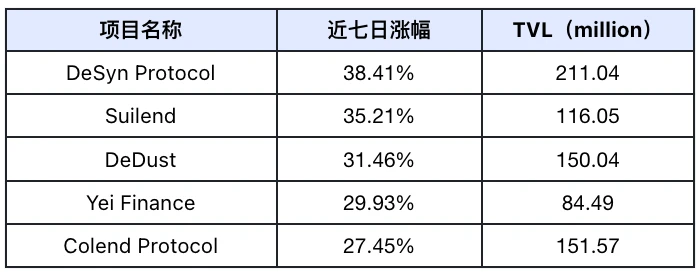

The top 5 public chains with the highest TVL growth in the past week (excluding public chains with smaller TVL), data source: Defilama

TON: TON is a public chain project backed by Telegram. It quickly became popular by relying on the mini-programs and mini-games bound to Telegram and has very good performance. It has even surpassed Solana in TPS testing. In the past few weeks, the arrest of the founder of Telegram in France caused some adverse effects on the TON ecosystem. As time goes by, the impact of this incident has gradually faded in the market, and the TON ecosystem has begun to recover slowly. Recently, the TON ecosystem has been issuing DOGS tokens to users, which has significantly increased the number of users on the chain, thereby promoting the recovery of TONs TVL.

TON: TON is a public chain project backed by Telegram. It quickly became popular by relying on the mini-programs and mini-games bound to Telegram and has very good performance. It has even surpassed Solana in TPS testing. In the past few weeks, the arrest of the founder of Telegram in France caused some adverse effects on the TON ecosystem. As time goes by, the impact of this incident has gradually faded in the market, and the TON ecosystem has begun to recover slowly. Recently, the TON ecosystem has been issuing DOGS tokens to users, which has significantly increased the number of users on the chain, thereby promoting the recovery of TONs TVL.

Fantom: Fantom is a public chain compatible with EVM. It mainly uses the Opera mainnet and builds its architecture on the core layer to handle consensus between nodes; the middleware layer for executing functions such as rewards and payments; and the application layer, which hosts the API of dApp. This makes Fantom a high-performance public chain. Recently, Fantom changed its name to Sonic, and its mainnet was launched this week. In order to encourage everyone to join the new network, the project announced that users of Opera and Sonic will receive an airdrop of 190 million S tokens, which has triggered active participation from users on the chain.

Sei: Sei is currently promoting the construction of Game Week, and through vigorously promoting and promoting the Gamefi project, users can also receive SEI token rewards. At the same time, the Sei Foundation and OKX Wallet jointly launched a 2.67 million SEI reward sharing event, allowing users to directly lend USDC/USDT with the lowest risk and obtain an annualized return of 11%-25%. At the same time, a certain number of SEI tokens are rewarded to participating users, allowing users to increase the participation of users on the chain.

Cardano: Cardano learned from Solana and Tron, actively introduced Meme tokens, and developed a Meme listing platform similar to Pump. It also launched some Meme coins that have been popular recently, such as ADADOG. In the current environment where the money-making effect is relatively poor, it has played a certain role in increasing Cardanos on-chain activities.

Bitlayer: Bitlayer is a Bitcoin Layer-2 with BitVM as its core. BTCFi has recently attracted the attention of the market again, and Bitlayer has also returned to the publics attention. Taking this opportunity, Bitlayer and OKX launched a project of on-chain mining rewards, allocating BTR tokens and Bitlayer on-chain points to pledge users, mobilizing the enthusiasm of on-chain users to participate, and making Bitlayers TVL rise rapidly.

Project TVL Growth Overview

The top 5 TVL growth rates of market projects in the past week (excluding public projects with smaller TVL, the standard is more than 30 million US dollars), data source: Defilama

DeSyn Protocol:

-

Project Introduction: DeSyn Protocol, as a decentralized asset management platform built on the Ethereum chain, provides a full set of financial products to maximize the potential of investors funds, including derivative synthetic assets, leveraged pledge ETFs, income-earning funds, RWA funds, and customized strategies, all of which are driven by smart contracts.

-

Latest Developments: DeSyn Protocol has collaborated with HashrateAsset, Bullishs_io, AILayerXYZ, Ionic, and Bitfi_Org in the past week. Collaboration with these projects has attracted some funds to flow into the DeSyn Protocol protocol, and they have jointly developed various innovative financial products and launched new cryptocurrency funds.

Suilend:

-

Project Introduction: Suilend is a lending protocol launched by Solana ecological lending protocol Solend on Sui, with a very strong financial background.

-

Latest development: This week, Suilend raised its ETH deposit limit from 2,000 ETH to 2,500 ETH, and launched a 2-week event where you can share 436,386 SUIs by depositing or borrowing SUI, USDC, USDT, ETH or SOL. These two policies have made Suilends TVL grow very rapidly this week.

Yei Finance:

-

Project Introduction: Yei Finance is a lending project based on the Sei public chain. It is also the largest lending project on the Sei chain and is supported by the Sei project.

-

Latest development: This week, Yei Finance increased its USDT and USDC deposit limits from 50 million USDT and USDC to 15,000 ETH respectively. In addition, the Sei Foundation and OKX Wallet jointly launched a 2.67 million SEI reward sharing event. Through Yei Finance, users can directly lend USDC/USDT in a minimal risk manner and obtain an annualized return of 11%-25%. At the same time, participating users are rewarded with a certain number of SEI tokens, which has led to a rapid increase in Yei Finances TVL this week.

DeDust:

-

Project Introduction: DeDust is a DEX project based on the Toncoin chain, using the innovative DeDust protocol 2.0. It focuses on user experience, gas efficiency and scalability, and has developed a cross-chain bridge product that allows users to seamlessly connect between the Toncoin and Ethereum chains.

-

Latest development: Because the Meme coin project DOGS has been very popular recently and the price of the coin has risen significantly, DeDust has added DOGS/USDT and DOGS/TON liquidity pools to the project, and encourages users to add liquidity. In addition to the basic APY, users who add liquidity will also receive SCALE tokens as rewards.

Colend Protocol:

-

Project Introduction: Colend is a lending protocol built on the Core chain. The main collateral of the project is BTCs LST token, which aims to promote the development of the Bitcoin-Fi track.

-

Latest development: This week, Core launched LstBTC, an ERC-20 liquidity staking token pegged 1:1 to Bitcoin. While holders of LstBTC can guarantee Bitcoin liquidity, they can also earn CORE tokens as rewards every day, which has led to a surge in TVL on the Core chain. At the same time, in order to release the liquidity of LstBTC, users will choose Colend Protocol, a lending protocol on the Core chain, which has led to a rapid increase in TVL of Colend Protocol this week.

Overview of the Rising Stars

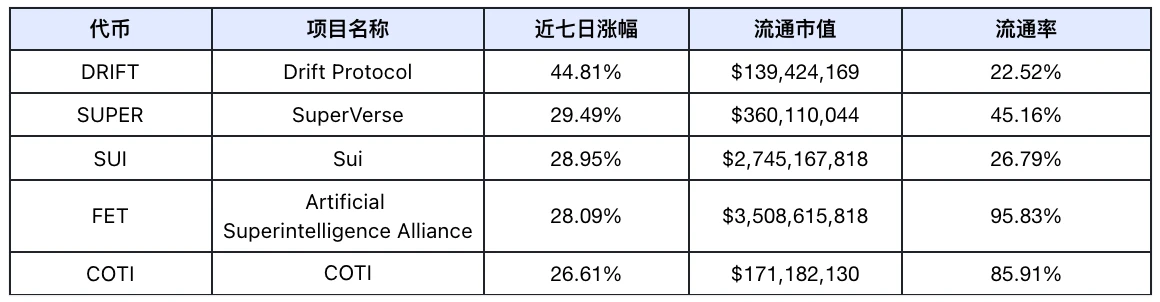

The top 5 tokens with the highest growth in the past week (excluding tokens with small trading volume and meme coins), data source: Coinmarketcap

This weeks list of gainers did not show the characteristics of sector concentration, and the rising tokens belonged to DEX, GameFi, public chain, AI and payment tracks.

DRIFT: Drift Protocol is the largest perpetual exchange on the Solana chain. Recently, the well-known investment institution Multcoin Capital announced that it has accumulated a large position in Drift and believes that its reasonable valuation is 3.58, while the current price is 0.62. The price gap is large, and many KOLs followed Multcoin Capitals voice and called for DRIFT, causing DRIFT to rise significantly this week.

SUPER: SuperVerse is a decentralized ecosystem that unites multiple products under one governance token, SUPER. SuperVerses products have two core verticals: NFT market and games. This week, SuperVerse launched Super Champs Chain, a game-optimized L3 chain based on the Base chain, which attracted investment from institutions such as Coinbase Ventures.

SUI: Sui chain’s gaming console started pre-sale this week, similar to Solana’s mobile phone airdrop, and it can be clearly seen this week that funds began to flow into the Sui ecosystem. The BLUB and LIQ on its chain rose very rapidly this week, creating a wealth-creating effect on the Sui chain. This week, Grayscale Fund announced that Sui Trust has been opened to qualified investors who invest in SUI, increasing purchases of SUI tokens.

FET: The Super Artificial Intelligence Alliance ASI, formed by the merger of FET, AGIX and OCEAN, proposed to add the distributed artificial intelligence computing project Cudos to its collective and convert Cudoss token cudos into FET at a ratio of 112.427: 1, with a price difference of 15 points, which caused FET to rise rapidly this week.

COTI: Recently, a new track, PayFi, has emerged in the market. The Solana ecosystem regards it as a key track for future development. As an old project in the payment track, COTI performed relatively strongly this week, but the project itself did not have any positive news this week.

The growth of the five tokens on the list of gainers this week is significantly higher than that of last week. It is expected that after the Federal Reserve cuts interest rates next Thursday, the market will experience a large shock and maintain a fluctuating downward trend.

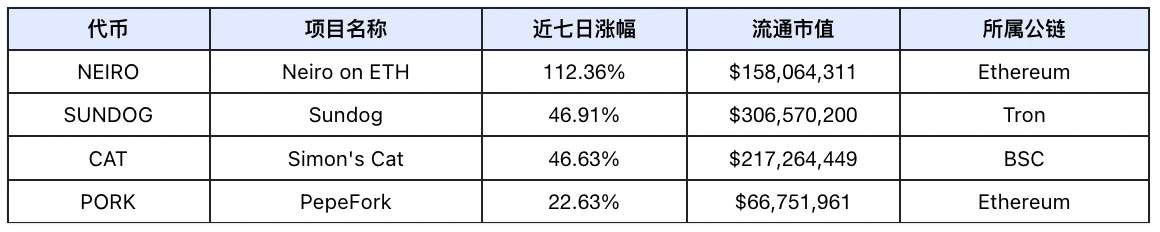

Meme Token Gainer List

Data source: coinmark etcap.com

Although the entire market is on an upward trend this week, except for a few tokens that have seen a sharp rise in the Meme coin track this week, most tokens are on a downward trend. This is mainly because the funds in the market are very limited at this stage. After experiencing a large-scale market decline last week, market funds either fled or entered projects with larger market capitalizations. Only a small amount of funds entered the Meme coin track, which is not enough to support the rise of the entire Meme coin track. Therefore, it can be seen that the Meme coin craze in the market is constantly receding, and the risks of the Meme track are also increasing at this stage.

Social Media Hotspots

Based on the top five daily growth in LunarCrush and the top five AI scores in Scopechat, the statistics for this week (9.6-9.13) are as follows:

The most frequently appearing theme is L1s, and the tokens on the list are as follows (tokens with small trading volumes and meme coins are not included):

Data source: Lunarcrush and Scopechat

According to data analysis, the Layer 1 blockchain projects with the highest social media attention this week generally followed the market and showed an upward trend, and the trend this week was stronger than the market. After the internal disagreement on the development path of Ethereum, the market began to gradually turn its attention to various public chain projects, and the market funds gradually began to flow into various public chains, so that each public chain project has its own independent trend this week.

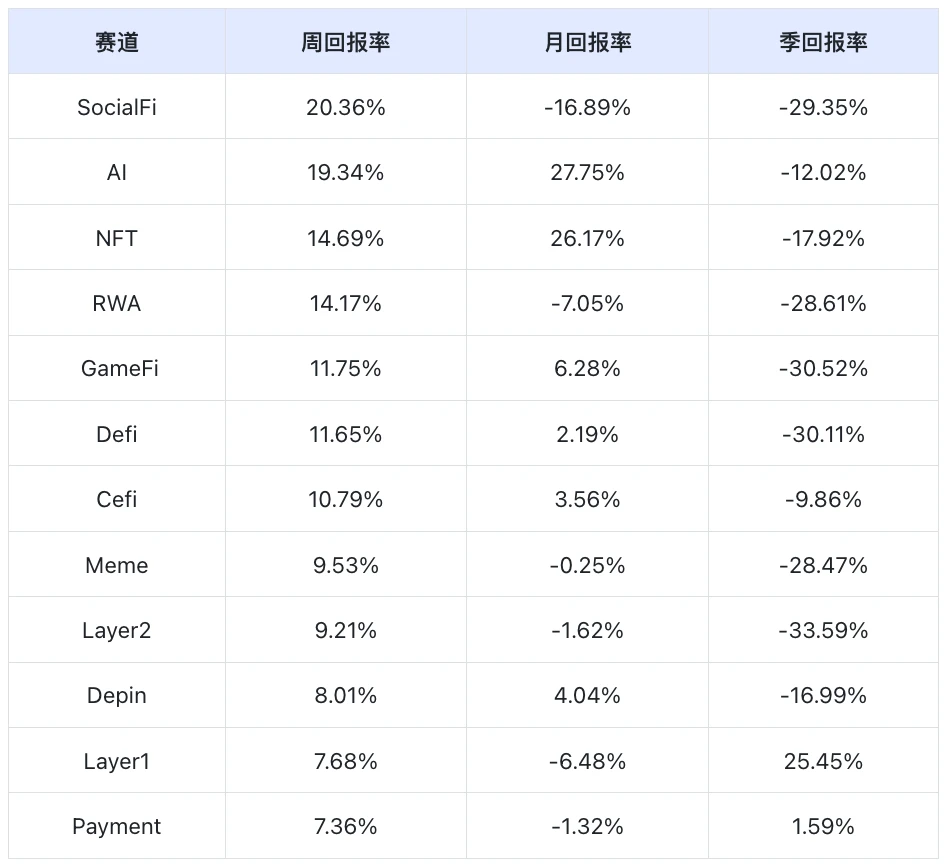

Subject tracking

Data source: SoSoValue

Based on weekly returns, the SocialFi track performed best, while the Payment track performed worst.

-

SocialFi track: In the SocialFi track, TON is still the absolute main force. A few weeks ago, the founder of Telegram was arrested and the TON public chain crashed, causing TON to fall sharply. As time went on, the market gradually faded the impact of this incident, and the TON ecosystem began to recover slowly. The TON ecosystem carried out some activities this week, such as adding taxi services on the chain and airdropping DOGS tokens to TON chain users, which made TON rebound significantly this week, and other tokens in the SocialFi track also rebounded significantly this week following the market.

-

Payment track: XRP and BCH account for a large proportion in the Payment track, and the combined share of the two reaches 79.6%. Although XRP and BCH also rebounded this week following the market, the rebound strength was lower than that of other tracks, especially XRP, which only rebounded 5% this week, and XRP accounted for 65.88% of the entire Payment track, making the entire Payment track the worst performer this week.

Market discussion direction this week

The market discusses the difficulties and future development of ETH

-

Ethereum has not performed very well recently, and the disagreement within the Ethereum ecosystem about the direction of development has led to an analysis of the difficulties faced by Ethereum in the market. The main reason is that as more and more transactions are processed on the second-layer solution, more and more fees and economic activities that would benefit the Ethereum mainnet are redirected. This shift may lead to a decrease in ETH demand and a significant reduction in Gas fees, and the sharp drop in Gas fees also affects the amount of ETH burned, causing ETH to resume inflation.

-

In view of the current situation, there are many opinions on Ethereum in the market, which can be summarized as follows: it is generally believed that Ethereum should give up its heavy investment in infrastructure construction, but should recognize the nature of the current predicament and introduce a large number of top applications to attract more users; increase the income from staking ETH through projects such as Eigenlayer; increase the standard of basic charging in Ethereum Gas fees to increase Ethereums income, thereby increasing the burning of ETH through EIP-1559; modify the pricing mechanism of Blob, etc.

Solana defines PayFi and positions it as the future direction

-

Lily Liu, Chairman of the Solana Foundation, proposed the concept of PayFi: PayFis motivation is to realize the initial vision of Bitcoin payment. PayFi is not DeFi, but a new financial market built around the time value of money. This on-chain financial market can realize new financial paradigms and product experiences that traditional finance cannot achieve. Through the concept it proposed, we can regard PayFi as a fusion of DeFi + Web3 payment, with the focus on helping users maximize the time value of money. PayFi is suitable for applications in Web3 transactions, off-chain consumption scenarios, retail environments, creator monetization, accounts receivable, payment processing, private credit pools and other scenarios. From its application scenarios, we can see that the Payfi track can be regarded as a sub-track of the RWA track. At present, it is still mainly iterating around the two needs of accounts receivable factoring and cross-border payments for Web2. The PayFi track is one of the few new concept tracks in the current lack of market hotspots. The main intention is to connect funds and assets on and off the chain. Most of the projects in its track are in the early stages and are just telling a very beautiful story to the market.

This weeks noteworthy projects

-

Nansen

Nansen was originally a blockchain analysis platform, mainly used to detect the movements of various smart money on the chain, so that users on the chain can discover market trends and opportunities in a timely manner, especially for NFT and Meme coin players. This week, it acquired the node staking project stakewith.us. It allows Nansen users to stake their assets in more than 20 ecosystems, including Solana, Ronin network, SuiNetwork, SkaleNetwork, Cosmos, dYdX, etc. Now users can use Nansen to analyze data, monitor their own investment portfolios and staked assets.

After Nansen added the pledge business, it represented a major change in its project narrative. Nansen had accumulated a large number of excellent on-chain users when doing analysis business before, and these users were active participants in on-chain activities. Now Nansen has added more than 20 chain node pledge services, which not only include a wide variety of chains, but also have a very friendly exit mechanism, allowing users to exit the pledge in a shorter time. In this way, while monitoring the real-time data on each chain, on-chain users can pledge their assets into the corresponding chain to obtain income without jumping to the application, and can withdraw the pledge in time when they need to participate in the on-chain activities of the chain, and choose the project to participate according to the on-chain data they monitor. Not only can it reduce the daily on-chain operations of users, but Nansen also clearly concentrates the pledge income of each chain in the interface, allowing users to maximize the income they can obtain.

Recently, Nansen has been reposted by various high-quality KOLs and projects, further increasing its market popularity.

-

Huma Finance

Recently, Lily Liu, Chairman of the Solana Foundation, proposed the concept of PayFi, making PayFi one of the few innovative races in the market at this stage. PayFi aims to apply web3 technology to the real economy, which is essentially to introduce programmable currency and token economics into the real economic system. PayFi is committed to exploring two aspects: on the one hand, further promoting the financial transformation of RWA physical assets, exploring derivative applications such as off-chain consumption scenarios, retail environments, creator monetization, accounts receivable, and payment processing; on the other hand, in response to the current pure on-chain DeFi interest-bearing Yield being trapped in the dilemma of stacking leverage, through the commercialization of AVS security consensus and DA capabilities, the real business economy is connected with web2, bringing a richer source of Yield to the on-chain world.

Huma Finance was originally a decentralized lending platform, mainly in the scope of loans and revolving credit lines, and positioned itself as the lending track in RWA. After acquiring the payment application Arf Financial, it began to upgrade its business. Combining its own RWA lending technology with Arf Financials cross-border payment licenses in many countries, it naturally entered the PayFi track. After the upgrade, Huma Finance increased the credit line for accounts receivable guarantees to attract institutional investors, and adopted a modular approach in its construction, including the transaction layer, currency layer, custody layer, compliance layer, financing layer, and application layer, to establish a common framework and standards for the PayFi track.

Crypto Events Next Week

-

Tuesday (September 17) US August retail sales monthly rate; Stable Rise

-

On Wednesday (September 18), the verdict of the Trump hush money case was announced; TON Asia-Singapore

-

Thursday (September 19) Federal Reserve interest rate decision; Solana Breakpoint; DeFi 2049 — Beyond THE Horizon; Impact 2049

-

Friday (September 20) ETHGlobal Singapore

-

On Saturday (September 21), the U.S. Securities and Exchange Commission (SEC) decided on Bitcoin ETF options

Outlook for next week

1. Bitcoin: Bitcoin currently lacks its own positive factors. Its price fluctuations are mainly affected by market news and macro data, and it cannot move independently. Because last week the market mainly traded concerns about the impending recession of the US economy, which triggered a significant decline. This week, the sentiment towards recession trading has eased. The market generally believes that the probability of a recession in the US economy in the future is relatively low. After the release of the US August CPI data this week, it can be seen that the CPI has been greatly alleviated and has taken another step towards the 2% that the Federal Reserve is concerned about. As a result, most traders in the market bet that the Federal Reserve will cut interest rates by 25 BP next week, which means that it is only a defensive rate cut, and the US economy has not entered a recession. Therefore, this week, it rebounded after a sharp decline in the last two weeks. It is expected that the trend of Bitcoin will fluctuate before and after the Federal Reserve announces the interest rate cut decision next week, and will be greatly affected by the dot plot released by the Federal Reserve.

2. Ethereum: Ethereum is weaker than the market this week, and the ETH/BTC exchange rate has been on a downward trend. In addition to external macro factors, the most important thing is that Ethereum is now confused about its future development direction. The market does not buy into the opinions of Ethereum developers, and the opinions of market users are not adopted by Ethereum developers, which has caused serious disagreements. The most important thing is that there are no innovative and rapidly developing star projects on the Ethereum chain, which lacks the ability to tell stories and create wealth in the future, causing funds to transfer from the Ethereum chain to other public chains, posing severe challenges to the construction of the Ethereum ecosystem. It is expected that ETH will perform worse than BTC in the future, and the ETH/BTC exchange rate will continue to fall.

3. Altcoin: Although Altcoin closely followed the rebound trend of the market this week and the rebound was stronger than the market, there is no unified market hotspot in Altcoin, and the innovative tracks that have emerged are in the early stage and are not perfect, so the funds are relatively scattered and cannot form a joint force for a certain track or project. In addition, the funds in the market are not sufficient at this stage and the trading users lack confidence in future development, which will make Altcoin only follow the trend of the market in the future and will not develop its own independent trend. Therefore, it is expected that Altcoin will continue to follow the trend of BTC next week.

This article is sourced from the internet: Frontier Lab Crypto Market Weekly Report|W37

The latest research from Matrixport Research Institute shows that the general trend of the crypto market is positive. The main factors are as follows: Stablecoin daily minting data increased BTC mining hash rate increased, BTC price is expected to rise Trump may announce that BTC will be included in the US strategic reserve assets, and the expectation of BTC rising due to the election continues to be released ETH ETF finally approved, first-day trading volume is 20-25% of BTC ETF trading volume BTC maintained its upward momentum over the past week, driven by factors including: increased stablecoin minting, increased BTC mining hash rate, speculation that Trump might include BTC in his strategic reserve assets if he wins the election, and the successful launch of the ETH ETF. Stablecoin daily minting…