Original author: CoinGecko

Original translation: Vernacular blockchain

Stablecoins are a type of token that anchors its value to other assets (such as commodities or fiat currencies) to stabilize its price. By maintaining a peg to a specific fiat currency, asset, or commodity, most stablecoins act as a bridge between real-world assets and cryptocurrencies, mapping these assets to the blockchain in the form of tokens.

Since 2014, companies like Tether and Circle have issued tokenized currencies backed by real-world financial assets, such as bank deposits and short-term bills. Through these companies, users can enter the cryptocurrency space directly by converting real-world deposits into newly minted stablecoins. Conversely, they can also exchange stablecoins back to fiat currency.

However, not all stablecoins are fully backed by real-world tangible assets. Decentralized stablecoins, such as DAI and AMPL, maintain their pegs through mechanisms such as overcollateralizing crypto assets or adjusting supply (rebasing), which allows stablecoins to be minted without a centralized entity while maintaining their peg.

The true value of a stablecoin lies in its ability to maintain its peg at all times, even during market volatility. Unfortunately, many stablecoins fail this test. In this report, we cover the types of stablecoins, total market capitalization, number of transactions, and emerging stablecoin models.

Five key takeaways from CoinGecko’s 2024 State of Stablecoins report:

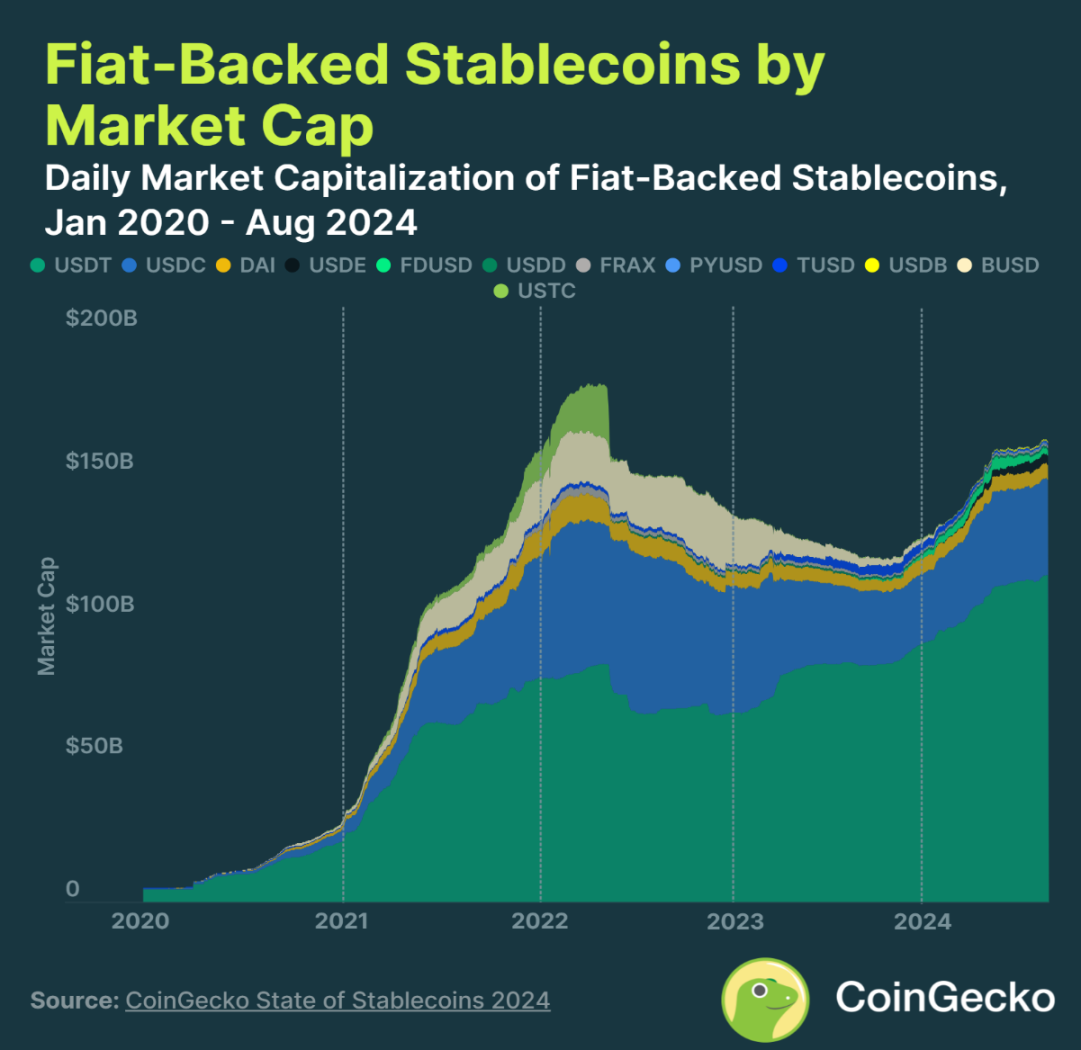

Fiat-backed stablecoin market cap surges to $161.2 billion in 2024, but remains below 2021 peak of $181.7 billion Despite growth in the fiat-backed stablecoin market in 2024, with a total market cap of $161.2 billion, this figure still fails to surpass 2021s all-time high of $181.7 billion.

Commodity-backed stablecoins grew 18.1% in 2024 to $1.3 billion, only 0.8% of fiat-backed stablecoins Commodity-backed stablecoins have grown, but their scale is relatively small, with a market value of only $1.3 billion in 2024, accounting for 0.8% of the total market value of fiat-backed stablecoins.

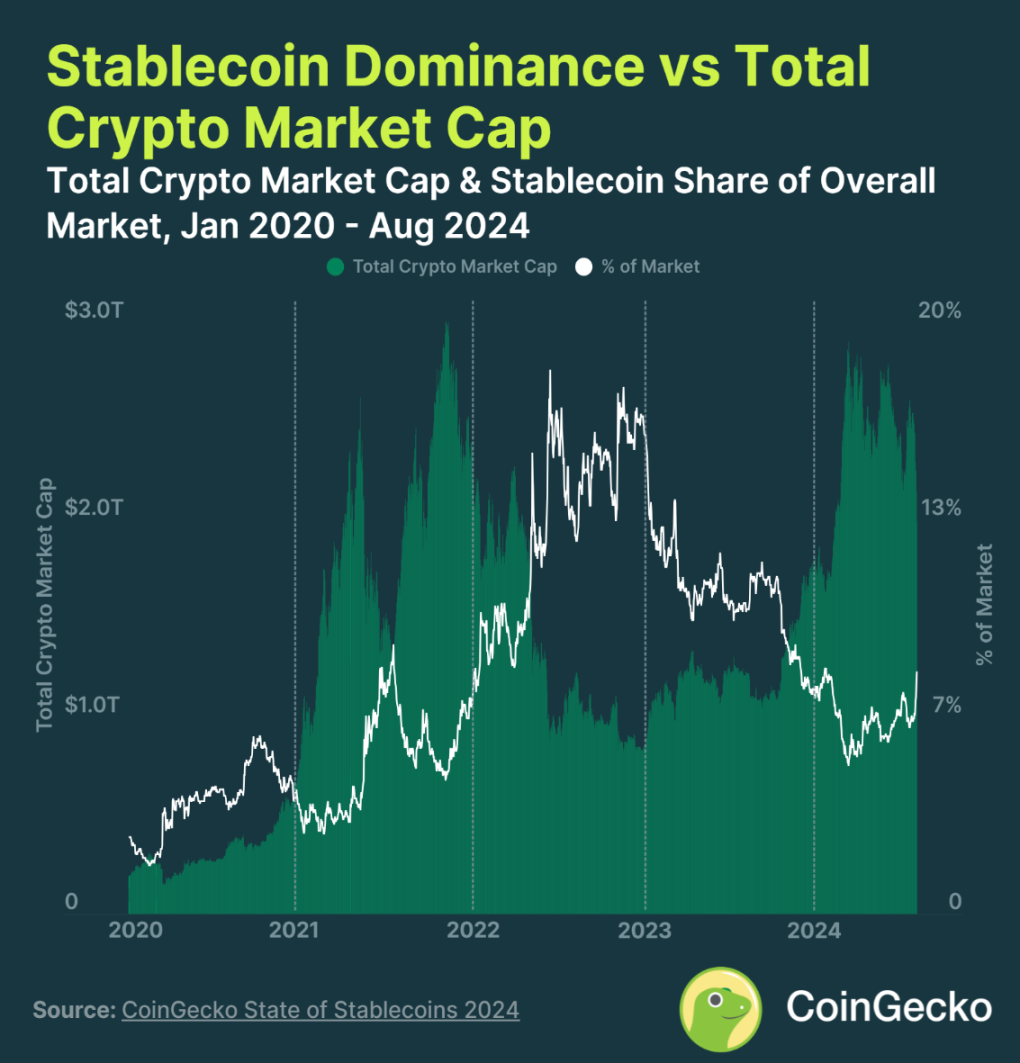

Stablecoins account for 8.2% of the total market value of the global crypto market, and their dominance increases during market weakness. Stablecoins account for 8.2% of the global crypto market, and their market dominance further increases, especially during market weakness.

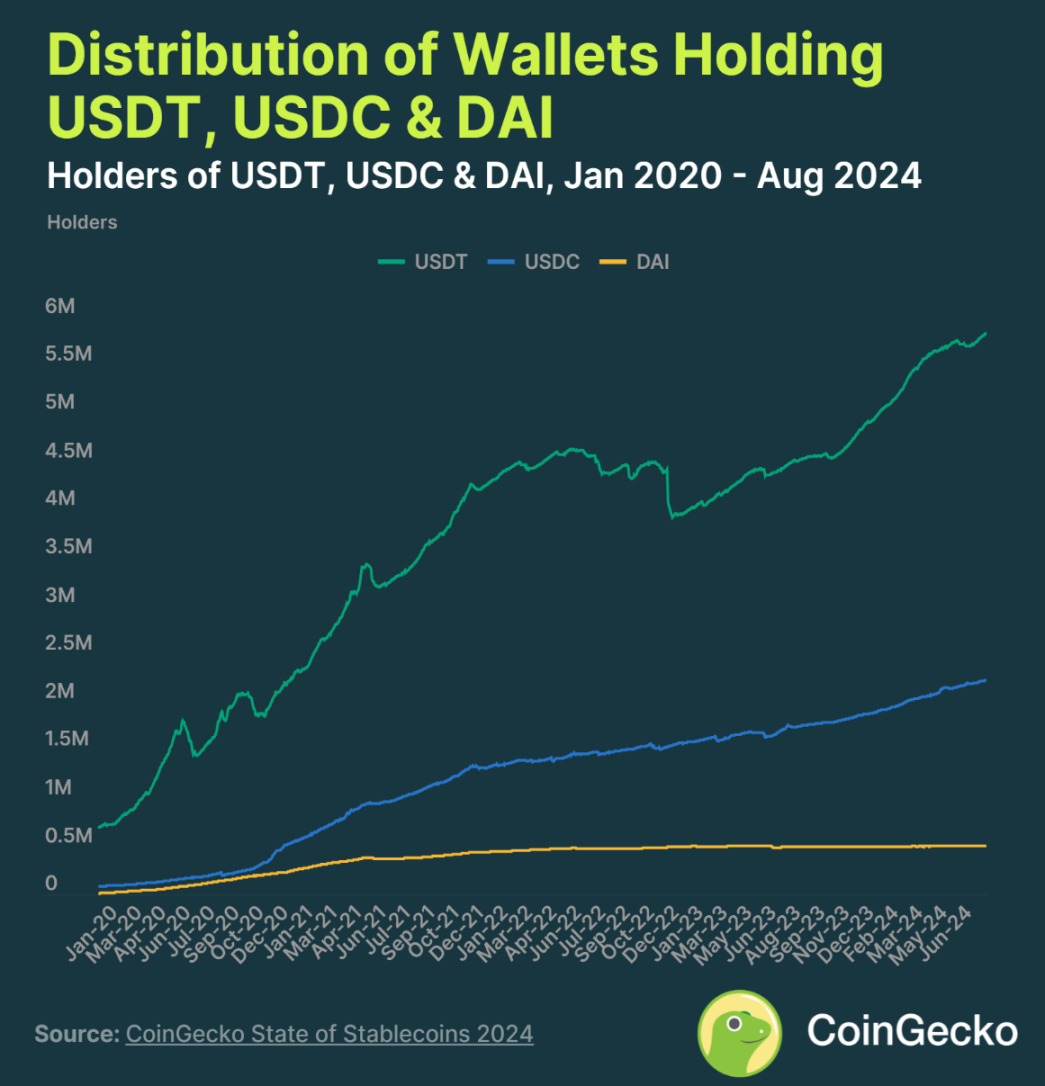

8.7 million addresses hold stablecoins, of which 97.1% hold USDT, USDC or DAI. Most stablecoin holders are mainly concentrated in USDT, USDC and DAI, with about 97.1% of addresses holding these three types of stablecoins.

Stablecoins continue to have difficulty maintaining the stability of their pegs, especially during uncertain times Although stablecoins are designed to maintain the price to which they are pegged, many stablecoins continue to face challenges in maintaining stability during periods of market volatility and uncertainty.

The total market capitalization of the top ten fiat-pegged stablecoins has grown significantly since 2020. During the 2020-2021 bull run, the total market value surged 3121.7% from $5 billion at the beginning of 2020 to $181.7 billion in March 2022. With the collapse of Terra and its UST stablecoin, the stablecoin market value fell for a time, but reversed in November 2023. As of August 2024, the total market capitalization of fiat-pegged stablecoins has increased by 35.4%, from $119.1 billion to $161.2 billion.

The top three USD stablecoins – Tether (USDT) with a market value of $114.4 billion, USDC with a market value of $33.3 billion, and Dai (DAI) with a market value of $5.3 billion, account for 94% of the total stablecoin market value. At the same time, USDTs market share has consolidated to 70.3%, while USDCs market share has continued to decline since the US banking crisis in March 2023. Stablecoins anchored to other currencies (such as the euro, yen, and Singapore dollar) account for only 0.2% of the market share.

1. Commodity-backed stablecoins grow 18.1% in 2024 to $1.3 billion, accounting for only 0.8% of fiat-backed stablecoins

As of August 1, 2024, commodity-backed stablecoins have a market cap of $1.3 billion. Despite new entrants such as Kinesis and VeraOne, Tether Gold (XAUT) and PAX Gold (PAXG) still account for 78% of this market cap. Although commodity-backed stablecoins have grown 212x since 2020 and 18.1% in 2024, they only account for 0.8% of the fiat-backed stablecoin market cap.

Precious metals are the preferred backing commodity for these stablecoins, but other commodity-backed stablecoins have been launched in recent years. The Uranium 308 project launched a stablecoin pegged to the price of a pound of U 308 uranium compound, but the project is now defunct.

2. Stablecoins account for 8.2% of the total global crypto market capitalization, and their dominance has further increased during market weakness

As of August 1, 2024, stablecoins account for 8.2% of the total market value of the global crypto market. At the beginning of 2020, stablecoins accounted for a very small proportion of the crypto industry, accounting for only about 2% of the total global market value, but reached a peak of 6% at the beginning of the rise of DeFi.

Stablecoin dominance rose rapidly between November 2021 and May 2022, primarily due to the exponential growth of Terra’s UST stablecoin, which saw its market share rise from 4.8% to 15.6%. However, after the UST crash, stablecoin market share fell sharply, then quickly recovered to a high of 18.4% as investors sought stability in the bear market.

3. Stablecoins account for 8.2% of the total global crypto market capitalization and their dominance increases during market weakness

As of August 1, 2024, stablecoins account for 8.2% of the total market value of the global crypto market. In early 2020, stablecoins accounted for a very small proportion of the crypto industry, accounting for only about 2% of the total global market value, but reached a peak of 6% at the beginning of the DeFi boom.

Stablecoin dominance increased significantly between November 2021 and May 2022, primarily due to the rapid growth of Terra’s UST stablecoin, which saw its market share rise from 4.8% to 15.6%. However, after the UST crash, stablecoin market share fell sharply, but as investors sought stability in the subsequent bear market, market share surged again to a high of 18.4%.

4. 8.7 million addresses hold stablecoins, of which 97.1% hold USDT, USDC or DAI

The top ten stablecoins have a total of 8.7 million holding addresses, of which the top three stablecoins – USDT, USDC and DAI – account for 97.1% of the holding addresses.

USDT has the largest number of addresses, with more than 5.8 million wallets, 2.6 times more than its closest competitor USDC. The remaining eight stablecoins have less than 1 million addresses, and DAI is held by just over 505,000 wallets.

These stablecoins grew rapidly in 2020, but after the collapse of Terra in 2022, growth slowed significantly due to concerns about the solvency of other stablecoins.

5. Stablecoins still have difficulty maintaining the stability of their anchor prices, especially during periods of market uncertainty

In the past, stablecoins have had difficulty maintaining their pegs during periods of volatility. However, established stablecoins like USDT, USDC, and DAI are now better able to maintain their peg to $1. Stablecoins often de-peg during periods of market volatility, such as the March 2023 banking crisis, due to market uncertainty about the security of deposits at Silvergate and Signature banks.

Newer stablecoins, especially some algorithm-backed stablecoins such as USDD, DAI, and FRAX, are more volatile and rely on market arbitrage to maintain their pegs. However, there are also many failed cases, such as Iron Finance and Basis Cash, where these projects failed to successfully maintain their peg prices.

This article is sourced from the internet: The “stability” and “instability” of stablecoins in 2024

In the past 24 hours, many new popular currencies and topics have appeared in the market, which may be the next opportunity to make money, including: The sectors with relatively strong wealth-creating effects are: Curve-related tokens (CRV, CVX), Meme sector (NEIRO); Hot search tokens and topics by users are: Morpho, Aptos; Potential airdrop opportunities include: Symbiotic, Mezo; Data statistics time: August 2, 2024 4: 00 (UTC + 0) 1. Market environment The US ISM manufacturing PMI fell far more than economists expected in July, causing interest rates to fall to multi-month lows across the board. In addition, the number of first-time unemployment claims in the United States jumped to the highest level in about a year. Taken together, these data further confirm that the United States is on the verge…

Nice