Exploring the true cost of the one-click chain launch L2 project: How much does it cost to run an L2?

Original title: Blockchain Economics: How much does it cost to run your own chain?

Original article by Sharanya Sahai, Hashed Emergent

Original translation: 0x 26, BlockBeats

Editors note: Galaxy Research recently published an article stating that Since the Cancun upgrade, Ethereum mainnet protocol revenue from Layer 2 is almost zero. Ethereum is going further and further on the road to expansion, but how much is actually needed to operate an L2? What about the cost? Through the introduction of this article, we can understand the real cost of the one-click chain launch L2 project.

The number of new Layer 2 (L2) solutions has increased significantly over the past year, driven by technological advances, focus on specific use cases, and strong community engagement. While this development is encouraging, the main challenge remains how to Scaling these blockchains in a more cost-effective manner. Running application chains has become a key means to solve this problem, as application chains can control the operating costs of blockchains through various initiatives in a modular infrastructure stack.

While L1 — Ethereum’s specific initiatives — have significantly reduced transaction costs on the blockchain, major Rollup and infrastructure service providers are also pushing hard to further improve scalability and unlock use cases that are currently too expensive to execute on-chain.

We can categorize and analyze these developments by three categories: a) L1 approaches, b) L2 approaches, and c) modular infrastructure approaches, all of which make a difference in reducing the barriers to entry for on-chain transactions. made a meaningful contribution.

The first is that Ethereum has made some upgrades, such as EIP 1559 and 4844, which have reduced costs and improved scalability.

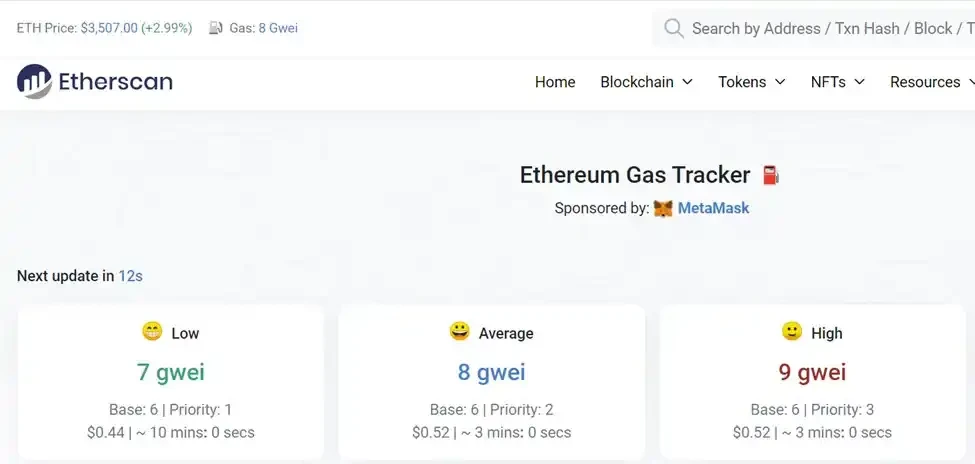

Let’s first look at the contribution of L1 initiatives to rationalize transaction costs on Ethereum, such as EIP 1559 and EIP 4844 (Cancun Upgrade). EIP 1559 introduces the concept of base fee + tip/priority fee, as well as dynamic pricing based on network congestion. The mechanism provides users with a better mechanism to estimate costs and trade on the network based on their priorities and network congestion. EIP 4844 introduces a new transaction type to Ethereum through the concept of Blob. Enables L2 to store data in the form of blobs instead of expensive callData, significantly reducing costs when settling transactions on L1.

The implementation of Blob has significantly reduced transaction costs due to the reduction in storage cost per byte and the expansion of each block capacity, because Blob does not compete with Ethereum transactions for Gas and is not stored permanently, but will be removed from the blockchain after approximately 18 days. Deleted from the block chain.

Each blob contains 4096 32-byte field elements, and the total number of blobs in a chunk is capped at 16, providing approximately 2MB (4096 * 32 bytes * 16 blobs per chunk) of additional maximum capacity. The capacity is 0.8 MB, with a target of 3 blobs per block, and a maximum of 6 (after EIP 4844 is implemented). Considering the historical callData standard of 2-10 KB per block, EIP 4844 means that the maximum theoretical increase is 384 times the capacity.

In fact, after the implementation of EIP 4844, fees on many L2s dropped by more than 90%. However, these upgrades alone are not enough to make Ethereum more scalable. With tens of thousands of Rollups, With the emergence of large-scale on-chain applications, storage space requirements increase and transaction costs may rise sharply.

As L2 moves execution off-chain to cut costs and maintain security, industry initiatives such as open source frameworks and revenue-sharing models are shaping the competitive landscape of the “L2 Stack War.”

The emergence of Rollup in the previous cycle aims to significantly reduce the cost of on-chain operations by moving execution off the main chain while obtaining security from the main chain. Although Op Rollup allows a single honest entity to submit a fraud proof and be recognized by the sorter that identifies improper behavior And get rewards, but ZK Rollup uses zero-knowledge proof to prove that the L2 chain has been correctly updated.

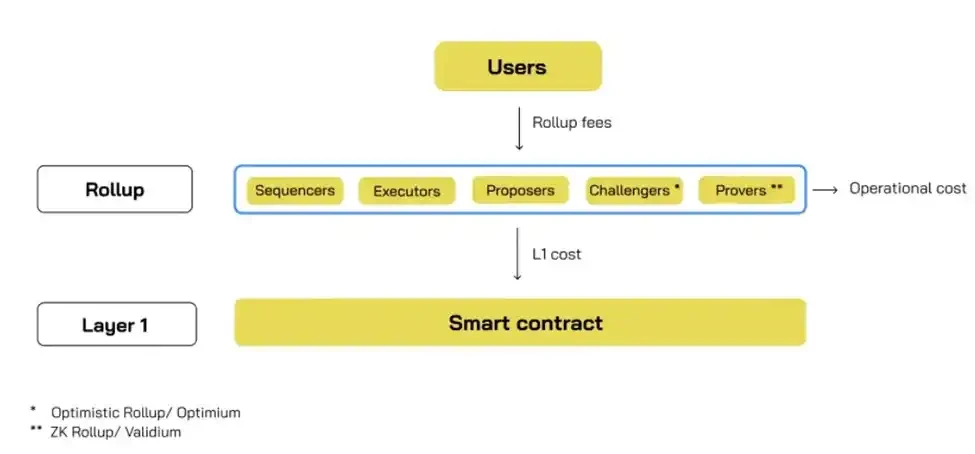

Rollup performs the following tasks:

Sequencing: Organize end-user transactions in order, group them, and occasionally publish these grouped batches to L1

Execution: Stores and executes operations and updates the state of the Rollup

Proposal: Proposer regularly updates the Rollup state root on L1, which is very important to ensure that the blockchain remains trustless and verifiable

State root challenge: Submit evidence of state root fraud and challenge the state root on L1 (only applicable to Op Rollup)

Proof: Generate verification of state root state update from Rollup to L1 (only applicable to ZK Rollup)

They make money from transaction fees paid by users (sorter income) and potentially MEV (maximum extractable value), although currently no MEV is extracted as part of their strategy. Their costs mainly come from L2 (operating costs) and L1 ( Organizations looking to launch their own chain typically only consider doing so if they expect transaction fees to be higher than the cost of such an initiative.

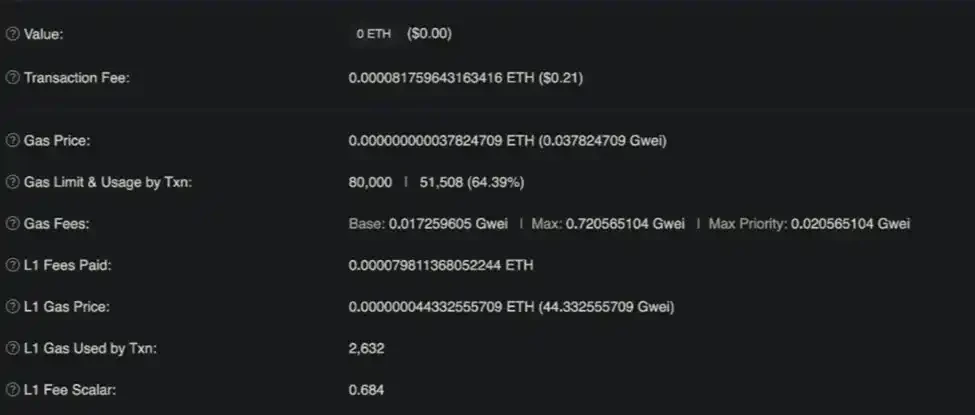

Base layer networks such as Ethereum typically charge more for computation and storage because most nodes need to sync and validate the chain. However, in Rollup, even if only one honest entity is able to validate the chain, the chain is considered secure. Therefore, Rollup charges lower fees for compute and storage, but charges higher fees for rolling up transactions to package and publish them to L1, resulting in L1 costs accounting for 98% of the L2 cost base before the introduction of EIP 4844.

In addition to base layer optimizations, L2 is also pushing hard to further reduce costs. These initiatives are referred to as L2 practices at the beginning of the article and can be mainly divided into two categories: industry alignment or company alignment.

Industry alignment initiatives include allowing new players to build their own chains through open source L2 technology stacks (Rollup frameworks). This wave of initiatives was initially led by Op Rollup through the launch of OP Stack and Arbitrum Orbit, and other mature L2s such as Polygon (Polygon CDK), ZK Sync (ZK Stack) and Starkware (Madara Stack) followed suit, promoting large-scale applications by open-sourcing their proprietary technologies.

The company alignment initiative is that these chains reduce costs and accumulate value for their tokens through direct revenue/profit sharing models or indirectly through the secondary effects of expanding their ecosystems. Optimisms Superchain vision, Arbitrums expansion plan, Polygons aggregation layer , ZK Sync’s Elastic Chain are all examples of such initiatives. The specifics of these projects may vary, but what they have in common is that they all have an interconnected network that provides enhanced interoperability, communication between multiple Rollups, and Shared key infrastructure, such as a shared data availability layer, shared cross-chain bridges, aggregated proofs (only applicable to ZK chains), etc., to further improve capital efficiency – this is currently the case with decentralized liquidity and Rollup in the Ethereum ecosystem However, these stacks also allow each chain to be uniquely tailored to its needs in terms of block times, withdrawal periods, finality, token usage, gas limits, etc., eliminating the Running on a public chain brings high gas costs and latency issues caused by other applications.

While these independent ecosystems focus on growth and adoption, we are already starting to see some established players like Optimism and Arbitrum move towards monetization.

Optimism charges 2.5% of the total sorter revenue or 15% of sorter profit (sorter revenue – L1 settlement and data availability costs) to participants who want to become part of their Superchain. Arbitrum charges a sorter fee to participants who use their stack to release L2. The ZK Rollup stack, including Polygon CDK and ZK Stack, is currently free to use, but as they develop and are applied, they may have built-in sustainable economic models.

The “L2 stack wars” are officially underway as all ecosystems compete to attract important projects with unique strategies. Optimism announced a $22 million bounty for Superchain builders, with retrospective airdrops based on usage and participation metrics, while ZK Sync is offering $22 million in ZK tokens to attract Lens to migrate from Polygon to its stack. Arbitrum offers its stack for free, provided that participants publish on Arbitrum as L3 (referring to using L2 as the settlement layer instead of Ethereum), because Arbitrum is Benefiting from increased L3 activity, these L3 chains will always pay settlement costs to Arbitrum during their lifecycle.

RaaS and alternative settlement and data availability solutions redefine blockchain cost structures, and future modular infrastructure innovations are expected to further reduce costs

Although these technology stacks are available, running a blockchain involves a lot of operational overhead, personnel, expertise, and resources. Developers who want to attract users to the chain do not want to be distracted by dealing with the operation and maintenance of the chain infrastructure, but want to focus on Core business activities.

This problem has led to the emergence of RaaS service providers, who work with these developers to abstract the complexity of running the chain using mature L2 frameworks/stacks. The services they provide include node operation, software updates, infrastructure management, and provision of Sequencing, indexing, analysis and other products. RaaS service providers have adopted different market capture strategies, some are aligned with specific L2 ecosystems, and others take a more framework-agnostic approach and provide integration across all ecosystems. Conduit and Nexus Network and Op Rollup integrations such as Optimism and Arbitrum, while Truezk, Karnot, and Slush focus on ZK chains. On the other hand, Caldera, Zeeve, Alt Layer, and Gelato provide integrations across Op and ZK Rollup.

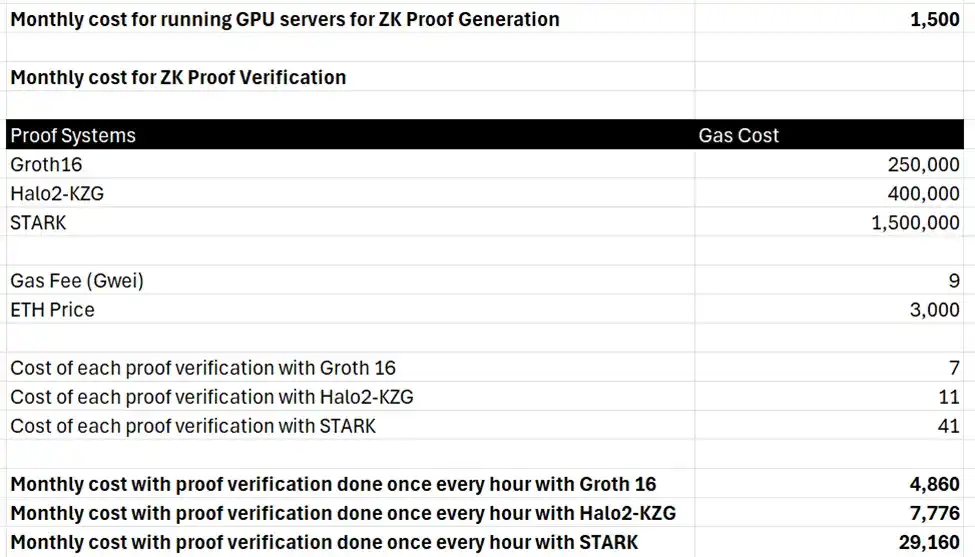

The typical business model of these services consists of a fixed fee plus a share of the sorter’s profits. The monthly subscription fee for running Op Rollup is generally between $3,000 and $4,000, while the cost of running ZK Rollup can be more than double that, at $9,500 to $14,000. The reason is that the computational intensity required to generate ZK proofs is extremely high, and the cost of proof verification is extremely high. In addition, in order to align the incentive mechanism of RaaS service providers and Rollup, 3-5% of the profits of the sorter are usually collected as a share. Allowing them to capture economic upside as these chains gain traction.

Caldera is exploring a different model with its Metalayer vision, which charges only a 2% share of sorter profits, has no fixed costs, and aims to enable interoperability between chains using Caldera, whether it is the Op or ZK series.

It is important to note that the volatility of the industry and the efforts of the team on these stacks, especially the ZK stack, may further reduce the subscription costs of RaaS service providers. In addition, due to the scarcity of strong consumer-grade Web3 businesses, large-scale consumer-oriented applications Programs may be able to negotiate better economic sharing agreements with infrastructure service providers, so initial pricing may not be standardized.

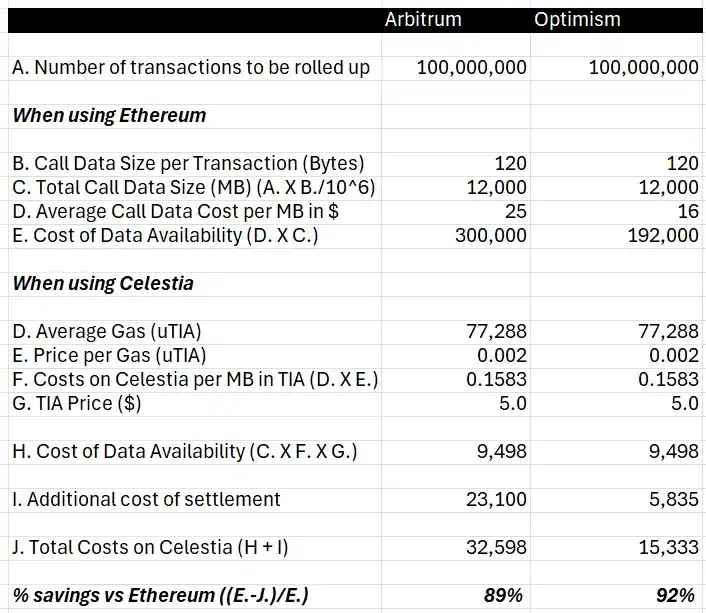

As mentioned earlier, the biggest expense of a Rollup is L1 costs, which are data availability and settlement costs. For a standard Rollup processing 100 million transactions, L1 costs can be as high as $25,000 per month, making L1 settlements only feasible for the largest and most complex Rollups. The need for alternative settlement and data availability solutions has prompted specialized players to optimize cost and performance on these layers. Ethereum’s data availability alternatives include Celestia, Near, EigenDA, and the mature L2 discussed above aims to Becoming the settlement layer of Rollup, these chains can be classified as L3. Compared with Ethereum, these players have reduced the settlement and data availability costs of Rollup by orders of magnitude. The figure below provides a rough cost comparison, showing that if Rollup publishes callData It is worth emphasizing that the cost savings increase exponentially as transaction volume increases.

In addition to the data availability cost, there is also a settlement cost, namely Celestia publishes a marker on Ethereum pointing to the relevant block on Celestia to ensure the ordering and integrity of the data published on Celestia.

The development of specialized players across the modular infrastructure stack, such as alternative data availability and RaaS providers, can be collectively referred to as modular infrastructure behavior. There are other categories of innovation that are further optimizing costs, including shared sequencers (Espresso, Astria, Radius), proof aggregation (Nebra, Electron), etc. These are currently in the early stages of development, and we expect costs to drop further as the industry matures.

Although the cost of on-chain operations has dropped significantly, Web2 founders should still conduct a thorough cost-benefit analysis before deciding to launch their own chain.

The full cost of running a chain depends on the specific usage requirements of each chain, but we can roughly estimate the cost of an average Op or ZK chain processing 2 million transactions per month using an alternative data availability solution as shown in the figure below.

Despite various optimizations at the industry level and at the individual chain level, this still requires a total of $10,500 to $16,500 per month in fees for ZK Rollup and $4,000 to $6,500 per month for Op Rollup, in addition to Once the chain starts to be profitable, the sorter will also need to share up to 20% of the profits.

The three categories of initiatives highlighted in this article will be key to driving industry adoption, with the ultimate goal of narrowing the cost and convenience gap between decentralized applications and Web2. Builders should consider their end-user needs, product priorities, and application The performance metrics required for the scenario and the existing market appeal should be carefully evaluated, and the cost-benefit analysis of running an independent chain versus building on an existing chain should be carefully evaluated.

We find that building solutions to reduce the cost and performance differences between Web3 and Web2 infrastructure is necessary because society’s preference for using decentralized systems is not sufficient to expand the scope of Web3 adoption. This challenge remains a key driver of blockchain adoption. The key bottleneck for large-scale applications.

This article is sourced from the internet: Exploring the true cost of the one-click chain launch L2 project: How much does it cost to run an L2?

Original author: OurNetwork Original translation: TechFlow The Crypto x AI space is an emerging area within our industry that has profound implications for the wider tech industry. While it is an elusive category that we are just beginning to explore more deeply, the past 18 months have seen the emergence of some exciting projects that leverage AI in a variety of ways, covering areas such as infrastructure, consumer, and decentralized finance (DeFi). Whether it’s decentralizing computation to create a peer-to-peer marketplace that turns machine learning into tradable products or leveraging AI to build the first decentralized self-managed artist, the natural intersection of blockchain technology and AI is bringing about a steady stream of innovation. So, let’s explore some of these emerging projects! 1. Bittensor Jack Forlines Bhavin Vaid | Website…