BTC Volatility: Week in Review September 2 – September 9, 2024

Key Metrics (September 2, 4pm -> September 9, 4pm Hong Kong time):

-

BTC/USD -4.1% ($57,400 -> $55,080), ETH/USD -4.9% ($2,440 -> $2,320)

-

BTC/USD December (end of year) ATM volatility + 1.6 v (60.8->62.4), December 25 day risk reversal volatility + 0.2 v (2.3->2.5)

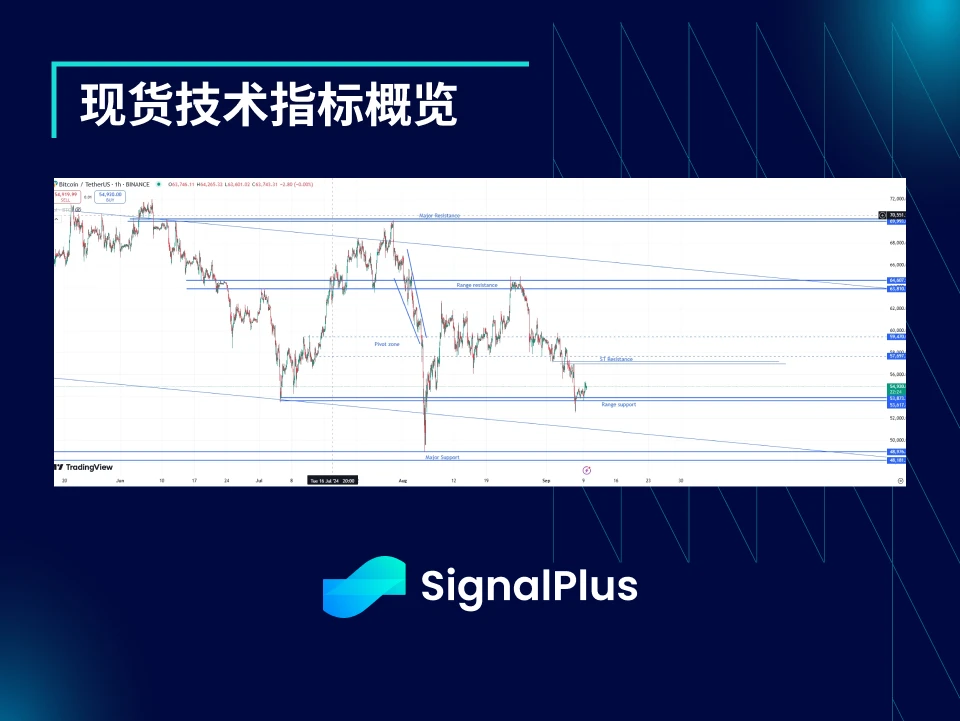

Overview of spot technical indicators

-

Spot prices continued to move downwards, challenging the $53.6k range support, and although they briefly fell below that level, the price then steadily recovered. This is likely to be a significant signal that the market refuses to continue to fall, and in addition, since the failure to break through the $65k high last month, this is also a test of the support point at the other end of the range.

-

Judging from the current trend, technically it is more inclined to build a bottom before rising again, and then return to the key price range (it is expected that there will be some fluctuations when breaking through the $58-60k area).

-

If the $53-53.6k support fails to hold, we would initially expect the price to quickly return to the major support level below $50k. However, given that the market seems to have strong buying demand here, unless there is a major risk-off sentiment in the global market, we believe the spot price will be strongly supported at this level.

Market Events:

-

“Rektember” has finally arrived, and with it comes a resurgence in implied volatility, especially in the cryptocurrency market.

-

The risk-off movement across markets made it difficult for crypto prices to rise. Finally, BTC/USD challenged the lower edge of the $53-65k price range and found some support there. Meanwhile, ETH/USD challenged the local low of $2,150 before taking a short breather.

-

The betting odds for the US election remain close to 50-50, with Trump and Harris competing very closely, especially with attention focused on the upcoming presidential debate in Philadelphia on September 10.

-

The market remains divided on the extent of the rate cut at this month’s FOMC meeting (25 bp or 50 bp). However, the cryptocurrency market’s reaction to this has been muted, driven primarily by the U.S. stock market and VIX price action.

-

If the Fed does cut rates by 50 bp, we expect cryptocurrency prices to quickly recover from their current depressed state. While this may suggest concerns about the economic growth outlook, it also clearly indicates a weaker dollar and if the Fed cuts rates too much, we expect inflation in the US to revive.

ATM Implied Volatility:

-

Actual volatility this week was relatively calm in both high-frequency and fixed-term scenarios, remaining at 40%; however, as risk aversion intensified and major future events approached (such as last weeks non-farm payrolls data, US CPI, presidential debates, and FOMC meetings), front-end implied volatility gradually rose to 50%, while the forward trend climbed further due to post-election uncertainty.

-

As the market shifts focus to the recent bad September events, demand is coming in all forms, primarily through puts in the $52-54k range, while there is also pure volatility demand through straddles and strangles covering various events this month. Roughly speaking, the market is setting aside 3-3.5% additional spread volatility for the September 10th presidential debate, while CPI and FOMC are closer to 2%.

-

As attention turns to the recent “Rektember” events, demand has started to emerge in various forms – primarily puts in the $52-54k price zone. There has also been demand for volatility, with straddles and wide straddles bought to cover the month’s major events. The market is expecting around 3-3.5% additional volatility on the September 10th US Presidential Debate, while the expected additional volatility on CPI and FOMC is closer to 2%.

-

The market’s focus has shifted away from the US election premium and towards the data release. The market did see some supply of December put options, leading to a flatter term structure curve after the election. Given that the volatility term structure of other asset classes (such as FX and equities) has higher implied volatility in November than in December and beyond, we still believe the market will gradually move towards an inversion of the curve.

Skewness/Convexity:

-

This week, the market has been relatively stable in terms of price skew and convexity as the market focuses on localized options demand related to this months events.

-

Although the very short-term skewness has fallen sharply on bearish demand in the 52-54k range, which has not been transmitted to the forward curve, the market is still focused on the bullish tail risks ahead, especially in the context of the Fed about to start a rate cut cycle and Trump still being a slight frontrunner in the election.

-

While the price skew is significant in the short term due to demand for put options in the $52-54k price range, this change has not affected the skew in longer maturities. Given that the Fed is about to enter a rate cut cycle and Trump is still slightly ahead in the election, the market continues to focus on the tail call of the long term.

Good luck to everyone!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: BTC Volatility: Week in Review September 2 – September 9, 2024

Original author | The Decentralised.co Compiled by Nan Zhi ( @Assassin_Malvo ) In the nineteenth episode of The Decentralised.co’s Podcast “ Building on First Principles ”, hosts Joel and Saurabh discussed with Pacman, the founder of Blur and Blast, the origins of Blur and Blast, Pacman’s judgment and analysis methods on the market and products, and Pacman’s judgment on the crypto market cycle. Odaily Planet Daily will compile the key parts of this article. In order to control the length and ensure the reading experience, half of the content has been deleted. Interested readers can listen to the full content in the original podcast . Viewpoint Overview The problem with OpenSea and other NFT markets is that they position their customers as consumers, and they really think that NFT is…