The price has fallen by nearly 50% in the past six months. How can ETH, which is facing a mid-life crisis, regain new vi

Original author: Arain , ChainCatcher

Original editor: Marco, ChainCatcher

Does the price of Ethereum matter?

Yes. Even Justin Drake, a member of the Ethereum Foundation, believes in the latest AMA that the appreciation of ETH is crucial to the success of Ethereum.

But in this cycle, Ethereums price performance is not satisfactory. According to Coingecko data, in the past year, Bitcoin rose by more than 116% against the US dollar, Ethereum rose by 44% against the US dollar, and Solona rose by more than 548% against the US dollar. In a blue-chip investment portfolio, Ethereums price performance is obviously lagging behind.

The absence of star projects, low prices, and the dazzling performance of Ethereum killer Solona have put Ethereum in a dilemma in public opinion in the past year, with doubts popping up from time to time. The criticism against Ethereum entered a white-hot stage when the content of the program Bankless Dialogue with Multicoin was presented.

During the show, Bankless mentioned a set of worrying data: the annual growth rate of SOL/ETH has reached 300% in the past year, but the ratio of ETH/BTC has fallen by 50% in the past two years, and its market value has been halved relative to Bitcoin.

This set of data further magnifies Ethereum’s lagging performance in this cycle. In this talk show, Multicoin partner Kyle Samani has described Ethereum’s current situation as a “midlife crisis.”

Interestingly, although the host of Bankless claimed that Kyle was the best person to talk about Ethereum at this time, Multicoin has been firmly bearish on Ethereum from the beginning and invested in Ethereum killers. It once became popular for betting on the famous EOS and refused to admit its mistakes. Now Solana may have a chance to compete with Ethereum.

Now the question is, does the stagflation of Ethereum prices really mean that there is something wrong with Ethereum? Is Ethereum really experiencing a midlife crisis as Kyle said?

Sideways, what happened?

The description of Ethereum not rising is inaccurate, especially when Ethereum is compared to itself. According to Coingecko data, between October 2023 and March 12, the price of Ethereum was on an upward trend, although not as good as Bitcoins performance – it once again reached the high point of the previous cycle and set a new high. Ethereum reached a high of $4070.6 per coin during this period, and the historical high was $4878.26 per coin.

During this period, the market intensively released information about Bitcoin spot ETF and Ethereum spot ETF. The SEC finally lived up to expectations and approved the Bitcoin spot ETF and Ethereum spot ETF on January 11, 2024 and May 24, 2024, respectively.

Perhaps affected by the news of the approval of the spot ETF, the prices of Bitcoin and Ethereum began to riot in October 2023, and there is a possibility that the positive news was digested in advance.

For Ethereum, there is another difference, that is, the Dancun Upgrade occurred during this period. This upgrade is a major upgrade event for Ethereum. It is another upgrade of the main chain after the Shanghai upgrade. The goal of the upgrade is to further improve performance and reduce network fees. The most intuitive manifestation is that the Gas fee required for digital asset transactions on the Ethereum Layer 2 network will be significantly reduced, and the reduction is expected to reach more than 90% (the result is in line with expectations).

The Cancun upgrade was completed on March 13, 2024, and the start and end events basically coincided with the time period of Ethereum price increase. That is to say, after the Cancun upgrade, Ethereum formed this no increase phenomenon, and there is still no sign of reversal.

After the upgrade event, Ethereum spot ETF and Ethereum spot ETP were approved by the SEC to be listed and began trading one after another – this can also be said to be a positive factor at the trading level. Bitcoin continued to rise and set a record high after the Bitcoin spot ETF was approved, but this script did not happen to Ethereum.

According to Sosovalue.xyz data, since its approval, the US Bitcoin spot ETF has accumulated a net inflow of approximately $16.9 billion, while the US Ethereum spot ETF has accumulated a net inflow of -$560 million. The listing of the Ethereum ETF did not promote the inflow of funds, but instead aggravated the outflow of funds, putting pressure on the price of Ethereum.

Dune data shows that currently 64.7% of the US Ethereum spot ETF asset management scale (AUM) belongs to Grayscale. As its corresponding buy-side research, Grayscale Research stated in a study in May this year that the US Ethereum spot ETF will help increase the demand and price of ETH, but based on the corresponding high valuation at the time of approval, they believe that the US Ethereum spot ETF has little room for price increases after approval.

Ethereum price trends do not reflect the price support of U.S. Ethereum spot ETF buyers. Grayscale Research pointed out in its August research report that there are two reasons for the subsequent sharp drop in Ethereum prices:

On the one hand, there are long positions in perpetual futures. The approval of the US spot Ethereum ETP has led traders to increase their long positions. However, long positions were liquidated during the decline, which accelerated the price decline.

On the other hand, there could be actual and expected selling by a few large holders, such as market maker Jump Crypto, venture capitalist Paradigm and Golem Network. Grayscale Research estimates that these three entities held about $1.5 billion in Ethereum at the time, all of which could have been sold.

Based on the fact that Ethereum did not see a significant rebound in August, Grayscale Research believes that this to some extent reflects the long positions in CME-listed futures and perpetual futures, and the excess of speculative positions.

“More fundamentally, the Ethereum network is undergoing a major transformation… Ethereum plans to achieve greater expansion by moving more transactions to L2 networks, which will be regularly settled to the Layer 1 mainnet. This strategy is working, with Ethereum L2 booming this year and major companies such as Sony announcing projects to build in Ethereum. However, this has also led to lower fee income for the mainnet, which has a potential impact on the value of ETH,” Grayscale Research wrote in a research report released on September 3, noting that “Ethereum’s expansion strategy is working, and the current market pessimism about Ethereum is unfounded, but the shift in market consensus may take some time.”

In other words, there is no reversal now because the market has not reached a consensus on the Ethereum upgrade. One important point is that mainnet fee income has decreased, which is the actual result of the Cancun upgrade EIP-4844. The expected result is to expand L2 and reduce fees at the same time. The aforementioned Bankless dialogue with Multicoin is to point the finger at Ethereums current predicament.

So, does L2 really push Ethereum to the brink of danger?

L2 in controversy

Multicoin blasted Ethereum on a talk show, mainly targeting Layer 2. Kyle Samani proposed that Layer 2 does not belong to Ethereum because they do not contribute to Ethereums value capture. Specifically, Ethereum Layer 1 outsourced all MEV and execution to Layer 2, just like Ethereum handed over its cash cow to others.

This view essentially negates the key efforts Ethereum has made to upgrade.

Layer 2 is actually a solution, not the ultimate solution. Looking back at Ethereum’s performance in several historical bull markets, network congestion is often criticized. The consequence is that users often feel that the fees are very “expensive” during the bull market, and sometimes even cannot use it normally. The market often calls for the arrival of “ETH 2.0”.

ETH 2.0 is a long-term plan for Ethereum upgrade, and Layer 2 is a part of it. It was created to solve the problem of Ethereum expansion – this is like building an overpass on a highway to alleviate the congestion problem on the original highway.

The Shanghai upgrade completed on April 13, 2023 kicked off the Layer 2 upgrade. The content of the Shanghai upgrade mainly includes changes in the EVM object format, the development of the beacon chain to release the staking function, and Layer 2 fee reduction. The Ethereum POW mechanism is completely converted to POS.

After the Shanghai upgrade, a large amount of staked ETH was redeemed, and new participants entered the market.

According to Dune data, since the Shanghai upgrade, the cumulative net inflow of Ethereum staking is about 13.96 million ETH, which reflects the interest of market participants in Ethereum staking. However, the upgrade event has a mediocre response in the secondary market. The price of Ethereum was about $1,920 per coin on the day the Shanghai upgrade was completed, and the price of Ethereum was $1,652 per coin before the Cancun upgrade (Holesky test network launch). This may be limited by the market environment at the time, because Bitcoins price performance during the same period was similar.

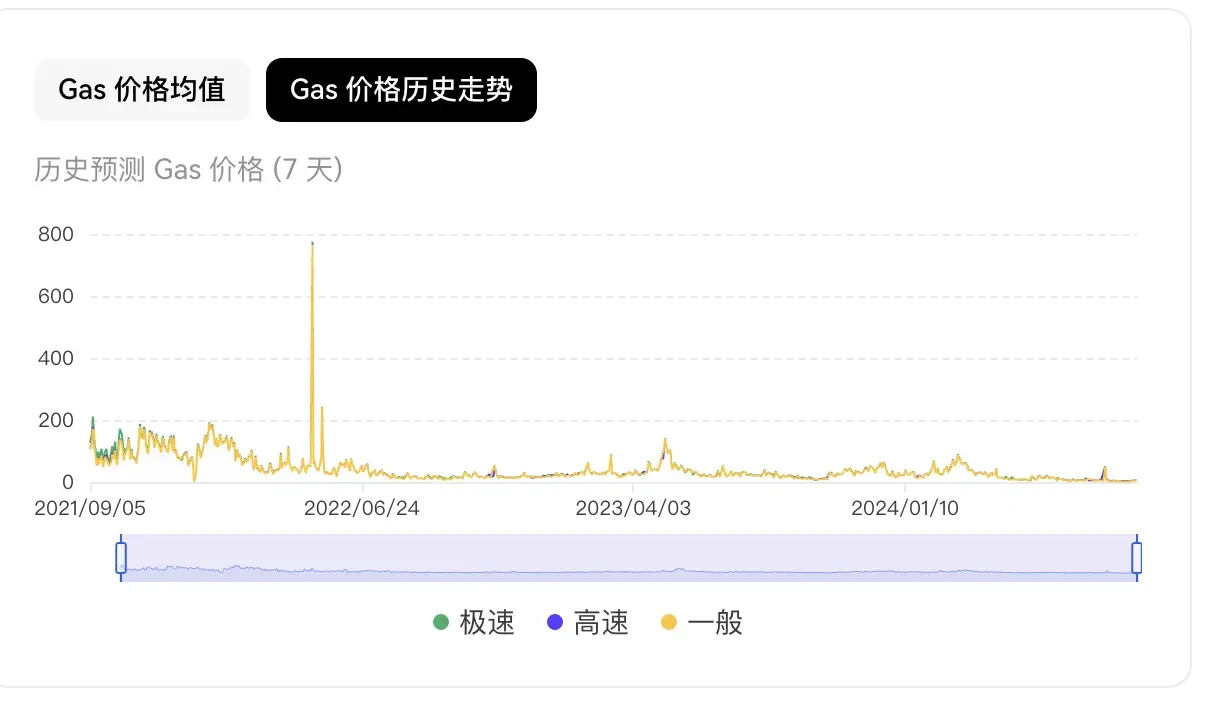

The Cancun upgrade, which was completed on March 13, 2024, is the top priority of Layer 2. The most notable point is that the GAS fee is lower: for the same amount of money, after this upgrade, you can enjoy faster speeds, better performance, and pay less GAS fees. This is related to the core EIP-4844 of the Cancun upgrade, but this is also a point that Kyle Samani fiercely criticized.

Protolambda, a researcher of the Optimism team and former researcher of the Ethereum Foundation, once wrote that Layer 1 is the data layer, L2 is responsible for performing calculations, and Layer 1 provides security for Rollup (Layer 2 is one of the solutions for Rollup) and acts as a data layer. By introducing a new design of transaction types that carry blob data, the base layer can store Layer 2 data more easily without affecting the security of data availability.

Blob data is a new type of transaction introduced by EIP-4844, which is responsible for paying transaction fees. This large data packet temporarily exists in the consensus layer, thereby reducing the fees of the Ethereum network and Rollup.

From the data, it seems that we can more intuitively feel Kyle Samanis point of view:

According to Token Terminal data, on March 5, Ethereum L1 network revenue reached the highest revenue of the year so far, about 35 million US dollars; on September 2, it hit the lowest revenue of the year so far, about 200,000 US dollars. It fell by 99.4% in half a year.

Coinbase’s Base chain, which is built on the Ethereum Layer 2 network, generated about $2.5 million in revenue in August, but only paid out about $11,000 in Ethereum.

At first glance, Layer 2 has taken a piece of the pie from Layer 1. Although from the current gas fee level, Ethereum has achieved its goal and reduced the networks gas fee. But letting the execution state leave Layer 1 and move to Layer 2 is a problem, at least in Kyle Samanis view. Ryan of Bankless further questioned that when Layer 2 develops to a certain stage, it will form a competitive relationship with Ethereum Layer 1 and lead to a breakdown of cooperation.

Independent researcher @Web3 Mario wrote that Layer 1 and Layer 2 are not an execution outsourcing relationship as Kyle Samani claimed, but a subordinate relationship, because Layer 2 does not bear the consensus task of transactions, and it relies on L1 to give finality through technical means such as optimistic solutions or ZK solutions.

Layer 2 acts as an agent for capturing the value of Ethereum in various fields, and Ethereum guarantees its security, so Layer 1 taxes Layer 2. This view seems to be closer to the original design intention of the researchers of the Ethereum Foundation.

Judging from the current data, the Layer 2 track is very inward-looking. After the Cancun upgrade, it has not yet contributed to Layer 1s revenue. Instead, it has taken away more of Layer 1s revenue. However, according to data from l2 beat., there are currently as many as 71 Layer 2 projects, and the total locked TVL has soared rapidly after March 2024, and is valued at approximately 14.48 million in ETH.

On September 5, the Ethereum Foundation research team held the 12th AMA on Reddit and answered several questions of concern to the market.

Among them, foundation researcher Dankrad Feist said that Ethereum is building a most neutral financial platform. Layer 1 is the intersection of multiple sub-fields, and a large amount of valuable activities will be generated through fees (assuming that L1 is expanded enough). Otherwise, there are other options, such as ETH as the main medium of exchange or using ETH as collateral, which will also be the main logic for ETHs subsequent rise.

“Many believe that a rollup-centric roadmap will undermine Ethereum’s fee income and MEV, and that rollups may ultimately become parasites. I don’t think this is correct. The highest value transactions will still occur on Ethereum L1, and rollups will expand the entire ecosystem by providing users with a large amount of transaction space. The relationship is symbiotic: Ethereum provides cheap data availability for rollups, and rollups make Ethereum L1 a natural hub for high-value transactions,” replied Dankrad Feist.

Anders Elowsson, a researcher at the Ethereum Foundation, believes that ETH will increase in value when it promotes sustainable economic activity.

It is worth mentioning that the expansion of Layer 1 is also within the scope of Ethereums plan, and there has been new progress. At least from the latest information revealed by the official staff, it is not as Kyle Samani claimed in the dialogue program that all bets are placed on the roadmap centered on Rollup, such as abandoning the expansion kit Layer 1.

Dankrad Feist said that expanding Layer 1 execution is the goal. In parallel with building rollups, Layer 1 itself will expand to 10-1000 times the current capacity, and Rollups will provide the rest to reach world scale. Justin Drake, a researcher at the Ethereum Foundation, said that the Ethereum Foundations long-term sustainable plan is to use SNARKs to expand the EVM execution of the main network. In the past few months, the SNARKization of Layer 1 EVM has made great progress, which will make the burden on users and consensus participants very light. Validators can verify low-cost SNARKs without having to re-execute EVM transactions.

A Review of Ethereum’s Historical Crisis

Regardless of whether the crisis Ethereum is facing is real or fake, the Ethereum team’s ability to solve the problem is the most important.

Looking back at several crises Ethereum has encountered:

1. The 2016 “smart contract vulnerability crisis”, the famous incident is “The DAO smart contract vulnerability”, which led to a hacker attack and the loss of millions of dollars worth of Ethereum.

Solution: The Ethereum community decided to conduct a hard fork (Ethereum Classic) to reverse the transaction and restore the funds. This resulted in the Ethereum network splitting into two versions: Ethereum and Ethereum Classic.

2. Since 2017, the Ethereum network has been experiencing a congestion crisis. With the rise of DApps (decentralized applications), the Ethereum network has been severely congested and transaction fees have soared.

Solution: The community began to explore solutions, which led to the creation of ETH 2.0, and introduced sharding technology and Layer 2 expansion solutions such as Rollups and State Channels to solve the congestion problem.

3. Since 2018, the high energy consumption caused by the Ethereum POW mechanism has aroused concerns from environmental organizations and users. This is not strictly a major crisis, but the impact of the solution it has brought to the Ethereum network is important, so it is listed.

Solution: Ethereum seeks to transition from Proof of Work (PoW) to Proof of Stake (PoS) to reduce energy consumption.

The crisis of Ethereum has provided historical development opportunities for some new public chains known as “Ethereum killers”, including BNB Chain, Cardano, Avalanche, Polkadot, EOS, Solana, etc. Except for Solana which is currently in progress, the others have more or less competed with Ethereum in terms of momentum.

After Layer 2, the only one still claiming to be the “Ethereum killer” is Solana, and one of the largest investors and supporters behind it is Multicoin.

In this sense, Ethereum is successful.

This article is sourced from the internet: The price has fallen by nearly 50% in the past six months. How can ETH, which is facing a mid-life crisis, regain new vitality?

Headlines Biden announces he will withdraw from the 2024 presidential race Biden issued a statement formally announcing that he would withdraw from the 2024 presidential race and would give a speech to explain the situation later this week. Trump: Harris is easier to beat than Biden Trump told CNN that he thought Harris was easier to beat than Biden in the November election. A CNN reporter said Trump made the comments to the outlet shortly after Biden announced his withdrawal from the race. President of The ETF Store: US-listed spot Bitcoin ETFs hold more than 900,000 Bitcoins Nate Geraci, president of The ETF Store, posted on the X platform that currently, the spot Bitcoin ETF listed in the United States holds more than 900,000 Bitcoins, accounting for 4.3% of the…