TON and Digital Resistance

If we talk about the hottest public chain in 2024, TON (The Open Network, formerly known as Telegram Open Network) will definitely have a place. As a high-performance Layer 1 that is inextricably linked to Telegram, it is favored by the capital market with Telegrams over 900 million monthly active users. According to the TON Ecosystem Research Report released by LongHash Ventures, TONs on-chain indicators have experienced explosive growth in the past six months: the number of daily active users on the TON blockchain has increased from 200,000 to 500,000, and the number of wallets has surged from less than 10 million to more than 44 million.

In addition, Tether integrated with TON in April 2024, minting more than $700 million in liquidity, surpassing Near to become the fifth largest blockchain in terms of USDT issuance, second only to Tron, Ethereum, Avalanche and Solana. At the same time, $TON rose by more than 25% in a single day on April 10, with the price reaching 7 u and a market value of $23.7 billion, surpassing $ADA to become the tenth largest cryptocurrency by market value.

Binance also listed $TON on August 9, 2024, and unexpectedly announced TONs new coin mining on the 13th, becoming the first project that has been circulated and then launched Binances new coin mining. It is also the project with the largest market value on Binance.

However, things never go as planned. On August 25, Telegram CEO Pavel Durov was arrested by French police in Paris and accused of failing to regulate Telegram and allowing illegal activities such as terrorism, money laundering and drug trafficking to spread. Due to the close relationship between TON and Telegram, Coingecko data showed that the price of $TON fell by more than 14% in 24 hours, and DefiLlama data showed that the TVL of the TON ecosystem fell by more than 40% in 24 hours.

After the incident, heavyweights in the technology and media circles, including Elon Musk and Tucker Carlson, publicly expressed their support for Pavel. TON officials posted a message on X saying Resistance. to show their resistance, and set the Resistance Dog (REDO) hand-painted by Pavel in 2018 as their profile picture.

TON’s community account TON Society not only changed its profile picture, but also launched the #DigitalResistance campaign on the X platform.

“Today, we stand in solidarity with Pavel Durov, the creator of Telegram. In support of Digital Resistance, we are updating the Toncoin logo and profile picture on the TON Community Channel to the global symbol of digital resistance – the Resistance Dog. Pavel Durov started this movement while fighting to preserve the privacy of Telegram users and protect free speech.”

It is worth noting that the Binance official page shows that TONs logo has also been updated to Resistance Dog. A resistance movement that faces destiny is unfolding in the digital world outside of Black Myth.

The Story of TON

The story of TON is full of the entanglement of human affairs and destiny. Looking back on the development of TON, Telegram is definitely indispensable. Telegram was founded by Russian brothers Pavel Durov and Nikolai Durov in 2013 to provide a more secure and private instant messaging platform.

Here is a brief introduction to Telegrams encryption technology – the MTProto protocol. Designed for speed and security, the protocol supports end-to-end encryption, ensuring that only the two parties in the conversation can read the content of the message. Although all Telegram messages are encrypted and stored by the server, users can choose to use the end-to-end encrypted secret chat feature for specific conversations, which means that no third party, including the Telegram server, can read the chat content.

With its high level of security and user experience, Telegram has quickly grown into one of the worlds leading communication platforms, with nearly 900 million monthly active users, and has become an important tool for the Web3 community.

In 2017, in response to the security and privacy needs of Telegrams large user base, the Durov brothers began to develop a blockchain project called Telegram Open Network (TON) and planned to launch its native cryptocurrency Gram.

In 2018, Telegram raised approximately $1.7 billion through ICO, becoming one of the largest token issuances at the time. Investors included several large venture capital institutions and individual investors. ICO also attracted the attention of the SEC.

In October 2019, the SEC accused Telegram of conducting an unregistered securities offering. This legal challenge greatly hindered the progress of the TON project. After a long communication and legal battle with the SEC, Telegram announced its withdrawal from the TON project in May 2020, and the development work was handed over to an independent open source developer community. The project was renamed The Open Network and the token name was changed to Toncoin. The funds raised by the ICO were refunded.

In 2021, the TON Foundation, founded by Anatoliy Makosov and Kirill Emelianenko, took over the project and continued to move towards decentralization and scalability.

In 2023, Telegram officially announced that the TON blockchain would be the first choice for its Web3 infrastructure, and integrated it into the user interface of the Telegram application this year. $TON is also used for all transactions and payment activities with channel owners, becoming Telegrams de facto platform currency.

TONs economic model, core technology, and ecological narrative

The core design concept of TON is to reconstruct the traditional blockchain protocol in a bottom-up way, pursuing the ultimate performance and scalability, and will support 30% of Telegram users in the future. TON has attracted the attention of a large number of users and investors with its unique design concept and high performance, as well as Telegrams traffic empowerment. This article briefly reviews its economic model, core technology, and ecological narrative.

Economic Model

The initial total amount of $TON is 5 billion. In terms of token distribution, the team initially owned 1.45% of the tokens, and the remaining 98.55% were mined by PoW in the early stage.

Mining on TON started spontaneously and randomly, and the Telegram team was forced to stop working on TON due to the lawsuit with the SEC that ended and settled in 2020. In order to withdraw from the TON project but allow enthusiasts to explore the technology, the Telegram team put the tokens of all blockchains into a smart contract, which anyone can mine equally.

As the PoW token distribution smart contract is exhausted, traditional TON mining ends. TON has entered the PoS phase, adding more validators and increasing the tokens used for verification, thereby enhancing the stability and security of the network. By participating in network operations, validators can receive new $TON as a reward, with an annual inflation of 0.6%. Currently, there are about 650 million $TON staked.

The current total amount of $TON is about 5.1 billion, but because the TON Foundation has frozen about 1.1 billion $TON in early inactive mining wallets, and about 1.3 billion $TON locked by the TON Believers Fund (to be unlocked starting in October 2025), the circulating supply is less than 2.7 billion.

In addition to being a gas token and a staking token on the TON network, $TON can also be used as a token pool on Telegram to enhance its value. For example, Telegram recently announced that it will use $TON exclusively for advertising payments. In this setup, advertisers use $TON to fund their marketing campaigns, and the revenue is split equally between Telegram and content creators. In addition, Telegram has begun accepting $TON for payment for Telegram Premium, a service offered through the Fragment Store that currently has 5 million subscribers. These initiatives show the Telegram teams efforts to ensure that $TON is a token with real use and a clear value accumulation mechanism.

Core Technology

The core technology of TON is its Infinite Sharding Paradigm, which greatly enhances the processing power and scalability of the TON network.

Sharding is a capacity expansion solution under the scalability trilemma. Its basic idea is to divide the entire blockchain network into multiple smaller fragments (shards), each of which can independently process a part of transactions and data. By distributing transactions and data to different shards, the sharding mechanism can improve the throughput and performance of the entire network, just like when we check out at a supermarket, by opening more checkout lanes, we can intuitively reduce queuing time and improve checkout efficiency. In addition to TON, well-known sharding chains include Near, Harmony, Elrond, etc.

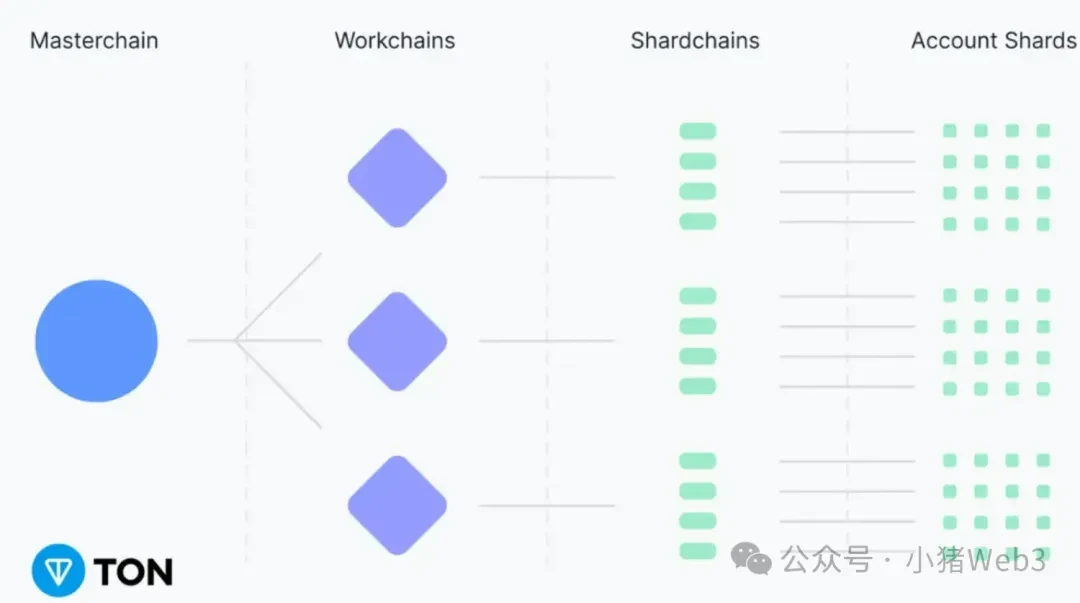

TONs sharding architecture is divided into three layers: Masterchain, Workchain and Shardchain. There is only one Masterchain, which is responsible for coordination; Workchain is a virtual concept that exists as a collection of Shardchains, and the system can accommodate up to 2^32 Workchains; Shardchain is responsible for actual transaction processing and is dynamic. It can automatically split when the load increases and automatically merge when the load decreases. Each Workchain can be split into up to 2^60 Shardchains.

In order to solve the problem of communication between shard chains, TON adopts smart contracts based on the Actor model and selects FunC as the main contract programming language. In TON, each smart contract instance has an address, code, and data unit (persistent state), and the smart contract always has atomic synchronous access to all its persistent states. However, the communication between smart contract instances is neither atomic nor synchronous, which is a huge difference from the development paradigm of other smart contract chains (such as Ethereum and Solana), which also makes the development of DeFi on TON difficult and slow.

If you have some understanding of Web2s microservice architecture, you can simply compare the smart contracts on TON to microservices, and the entire TONs infinite sharding paradigm to Kubernetes elastic orchestration service – creating new contract instances and expanding, shrinking, and moving them as needed to optimize the system.

Ecological Narrative

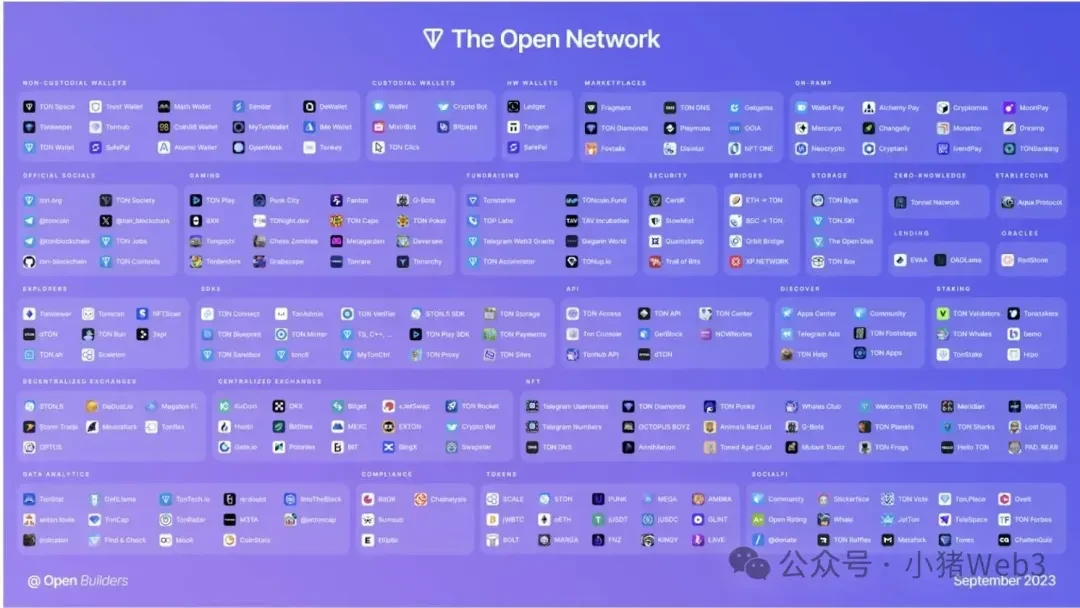

There are currently more than 500 Dapps in the TON ecosystem, covering almost all popular areas such as infrastructure, development tools, DeFi, GameFi, SocialFi, NFT, Meme, inscriptions, etc.

However, the real narrative of the TON ecosystem lies in Telegrams Web3 territory, which mainly includes Telegram Bot and Telegram Mini Apps (TMA).

Telegram Bot is an automation tool that runs on Telegram and can respond to messages, manage data, or interact with users in a programmatic way. Developers can create Bots to perform various tasks, such as sending notifications, providing information services, and even processing complex commands. Users interact with Bots through conversations to achieve automation functions. Currently, Telegram Bot plays an important role in Web3 community building, asset management, information aggregation, project promotion, DeFi transactions, and many other aspects.

TMA is a web application that runs inside Telegram Messenger. It was launched by TON Foundation and is designed to meet users needs for games, content sharing, productivity tools, etc. They can be easily accessed from Telegram chats or group conversations. @Wallet is Telegrams built-in non-custodial wallet TMA, similar to MetaMask, which allows users to accept, send and redeem tokens, and the wallet page can see the NFT assets held by the wallet.

The organic combination of @Wallet, Telegram Bot/TMA and TON provides Telegram users with a complete closed-loop Web3 experience: starting from getting messages and communicating in Telegram groups/channels, to trading tokens and interacting with DApps on TON through Telegram Bot/TMA, and then to using @Wallet and TON Space to participate in TON ecosystem projects.

Summarize

TON has gone through many hardships, from attracting much attention at its birth to being sued by the SEC which caused the plan to be shelved, and finally being taken over and grown by the community. However, it has overcome them time and time again, improved step by step, and demonstrated strong vitality.

TON is backed by Telegram, which has 900 million monthly active users, and has user traffic that is difficult for any other public chain project to achieve. TONs unlimited sharding technology theoretically supports millions of TPS, and its combination with Telegram provides a unique opportunity for the real large-scale adoption of Web3. The rapid growth of on-chain indicators, the strong support of top capital, and the success of various ecosystem projects highlight its potential.

Pavel created Telegram, which is known for its strong encryption and anti-censorship, and also created the image of REDO, which symbolizes the spirit of resistance. TON seems to have established its position as the successor of Pavels spirit of resistance, changing the community avatar and logo to REDO, and launching the Digital Resistance manifesto, which seems to be letting the horse go west and facing destiny.

This article is sourced from the internet: TON: Facing Destiny

Related: 10,000-word article: Bitcoin valuation scenarios in 2050

Original author: Matthew Sigel, Patrick Bush Original translation: Mars Finance, MK introduce Bitcoin (BTC) is expected to solidify its position as the world’s primary medium of exchange by 2050, eventually becoming one of the world’s reserve currencies. This prediction is based on the view that trust in current reserve assets may be eroded. Crucially, Bitcoin’s scalability issues have long hindered its widespread adoption, and emerging second-layer (L2) technology solutions are expected to completely solve this problem. Combined with Bitcoin’s immutable property rights and sound money principles, the enhanced capabilities provided by second-layer technology will build a global financial system that is more responsive to the needs of developing countries. Summary We predict that by 2050, the price of Bitcoin will reach $2.9 million. By then, Bitcoin will be used to…