100 times in 6 hours, a detailed explanation of the new player TaxFarm of Ethereum Pump.fun

Original author: Joyce

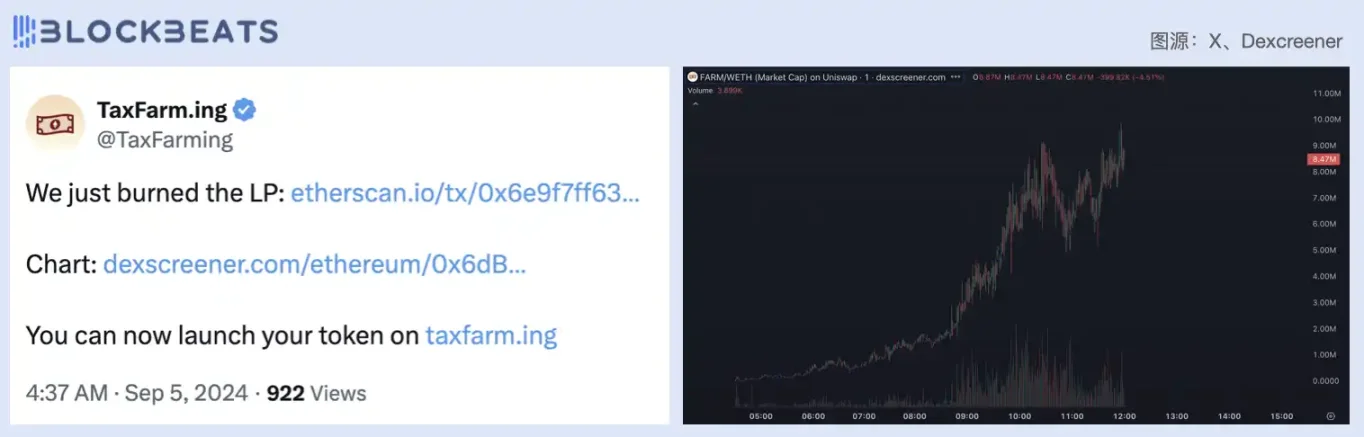

At 4:30 this morning, TaxFarm.ing, a meme coin platform on Ethereum, posted its first tweet on Twitter, releasing the contract and protocol platform entrance for the token FARM. Since then, FARM has been rising all the way, with a market value of over $8 million in 6 hours after going online, reaching a peak of $9.6 million. If calculated based on the purchase price 10 minutes after the opening, the maximum increase is 150 times, which takes 5.5 hours to achieve. As of writing, the price of FARM is $0.009, with a cumulative trading volume of $11 million.

What is TaxFarm?

Compared with other meme coin issuance platforms, the biggest mechanism of TaxFarm.ing is that it provides meme coin developers with a way to make profits besides selling tokens, and combines this mechanism with the profit expectations of its platform coin FARM holders.

TaxFarm.ing proposed a Supply clogging mechanism. When a new token is issued on the TaxFarm.ing platform, 1 ETH is required as initial liquidity, and 20% of the total supply will be clogged (locked), which is equivalent to a refund fund.

If the token is able to generate enough transaction fees to cover at least 1 ETH of initial liquidity, the tax rate will remain at 5/5, and when enough fees are accumulated and the locked portion is released, the tax rate will be reduced to 1/1.

If the token fails to generate enough fees within 24 hours (not enough to cover the developers initial 1 ETH liquidity), an automatic liquidity protection mechanism will be activated. The supply of clog will be withdrawn and returned to the developer. This mechanism is equivalent to an exit mechanism that can quickly reduce the developers losses when the project performs poorly, giving the developer the opportunity to redeploy tokens or invest in other more promising projects.

Through such a design, the TaxFarming protocol attempts to achieve a game balance in the market: For token issuers: it reduces financial losses caused by project failure, ensures the security of initial investment, and encourages them to focus more on long-term development and project quality improvement. For token buyers: it provides a relatively safe investment environment. With the development of the project and the release of the 20% locked supply, buyers can enjoy lower and lower transaction tax rates and get a better trading experience.

In addition, the platform currency of TaxFarm.ing is FARM, and holders earn profits through the transaction fees of meme coins. Of the transaction fees generated by meme tokens on the platform, 80% goes directly to the developers, and the remaining 20% is allocated to the platform, half of which (10%) will be redistributed in the form of ETH to users who hold and stake $FARM tokens.

Interactive Experience

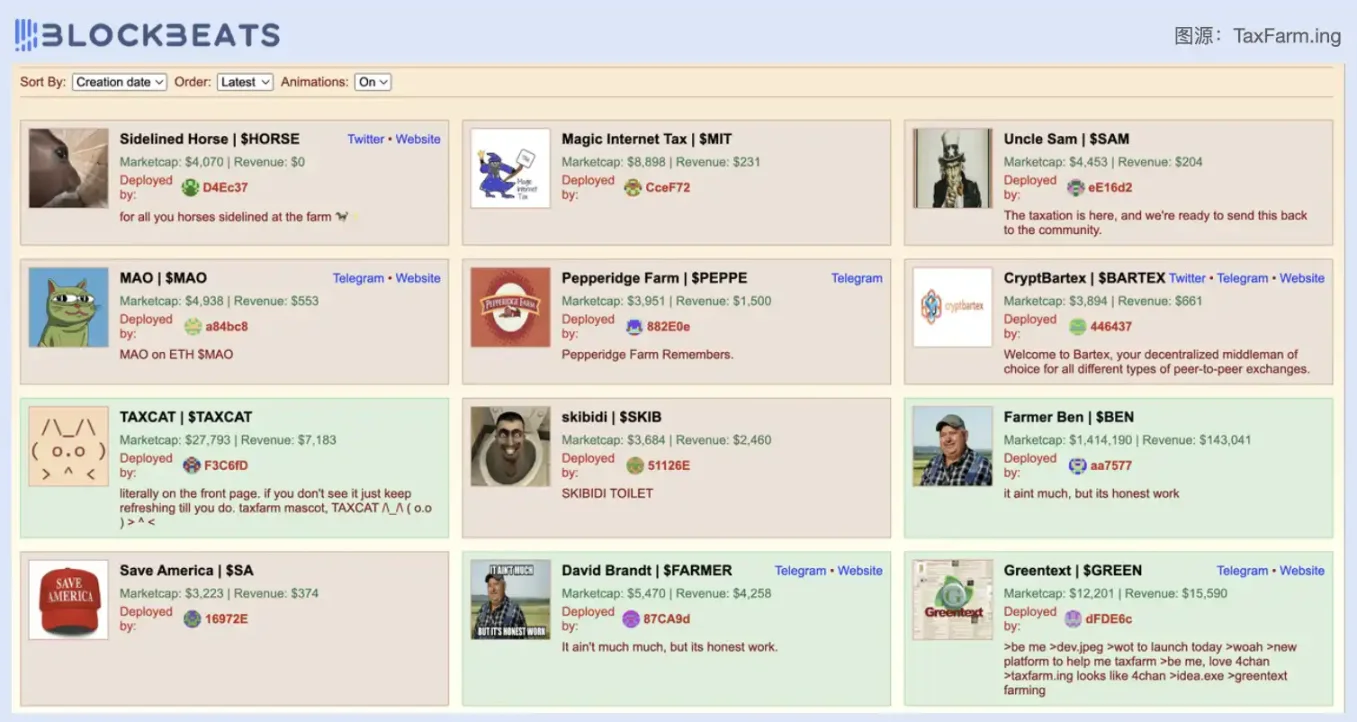

The homepage of TaxFarm.ing is similar to that of Pump.fun, and the front-end layout is almost 1:1 restored. It also has the vibration switch that Pump.fun pioneered, and can view tokens based on market value or token income ranking. Currently, there is no token on TaxFarm.ing with a stable market value of more than 1 million US dollars, and the highest market value is 260,000 US dollars.

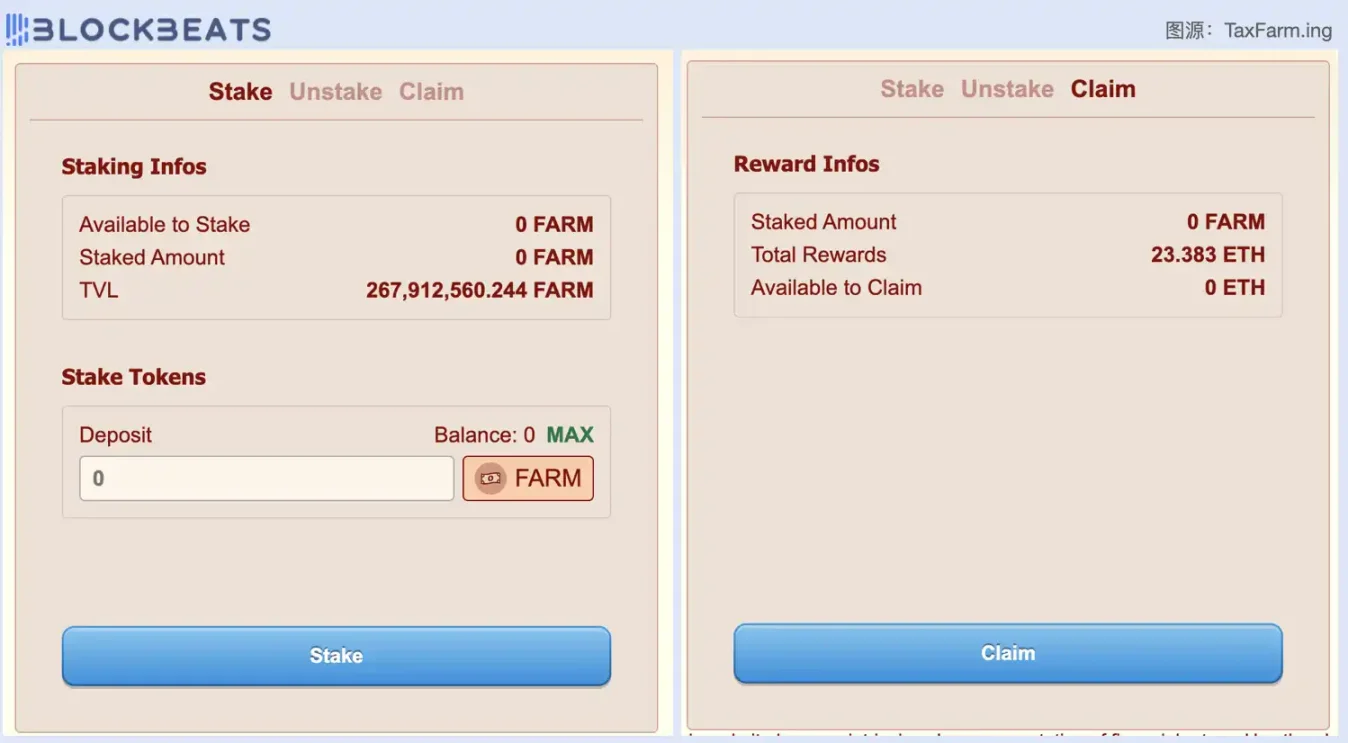

In addition, TaxFarm.ing provides a staking channel. Currently, 260 million FARM tokens have been staked, accounting for about 21.6% of the total supply. The total staking income is 23.3 ETH, worth about US$56,000.

Who makes money on TaxFarm.ing?

protocol

TaxFarm.ing did not give a specific fee for deploying tokens, but only stated that it was 50% of the standard platform fee. If we calculate based on the 0.02 SOL token deployment fee on the Pump.fun platform, the fee charged by TaxFarm.ing for deploying tokens is 0.01 SOL, which is about $1.3, which is negligible for a protocol.

According to TaxFarm.ing, the protocol revenue mainly comes from 10% of the meme coin transaction fees on the platform. A screenshot taken by Blockbeats at around 10 am showed that a token called $BEN (Farmer Ben) on TaxFarm.ing had already earned $140,000.

The TaxFarm.ing official account was also updated at around 10 a.m. According to the front-end data, the dev income of meme coins has exceeded 250,000 U.S. dollars. However, perhaps due to excessive traffic, the front-end data of the TaxFarm.ing official website is currently frequently displaying errors. The token income and market value figures are often displayed as 0, and the total number of users has been displayed as 551. Only the total number of tokens is continuously updated, which is currently 92.

Smart Money

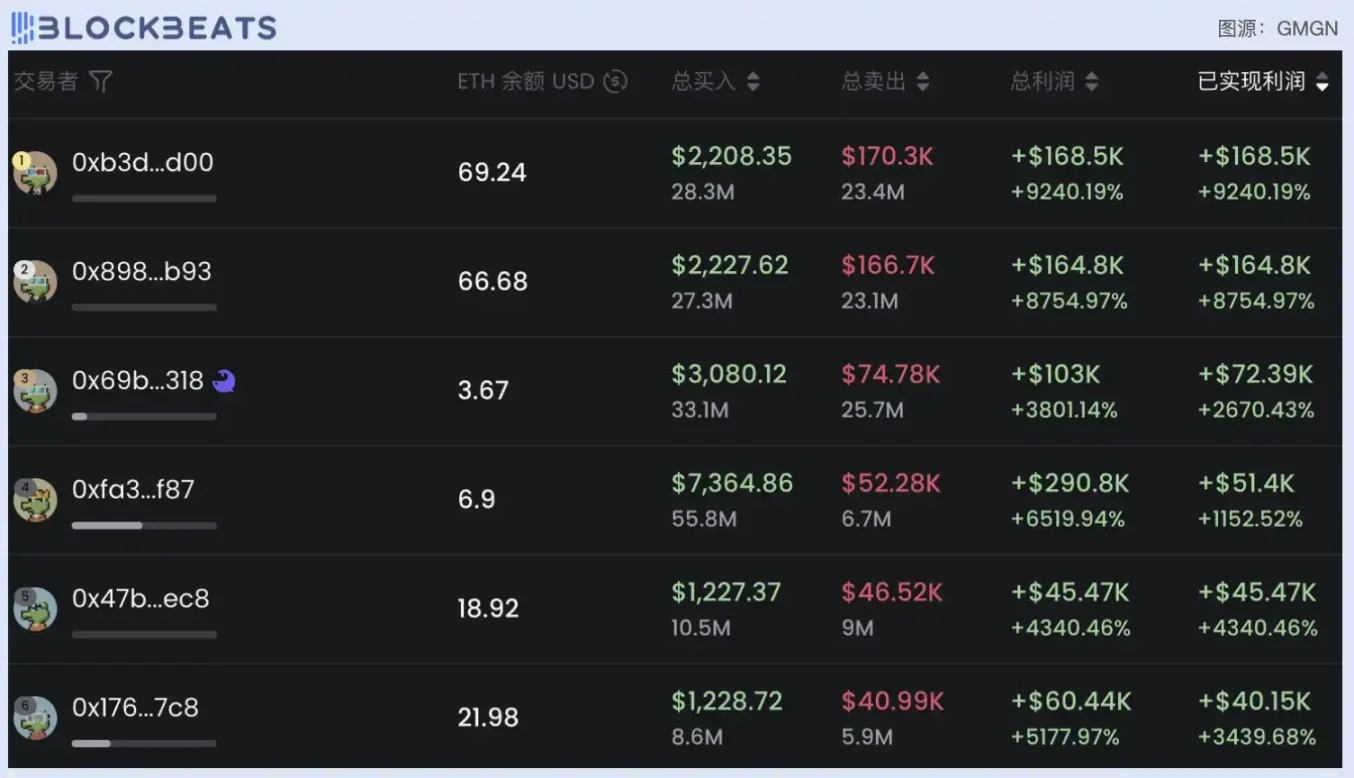

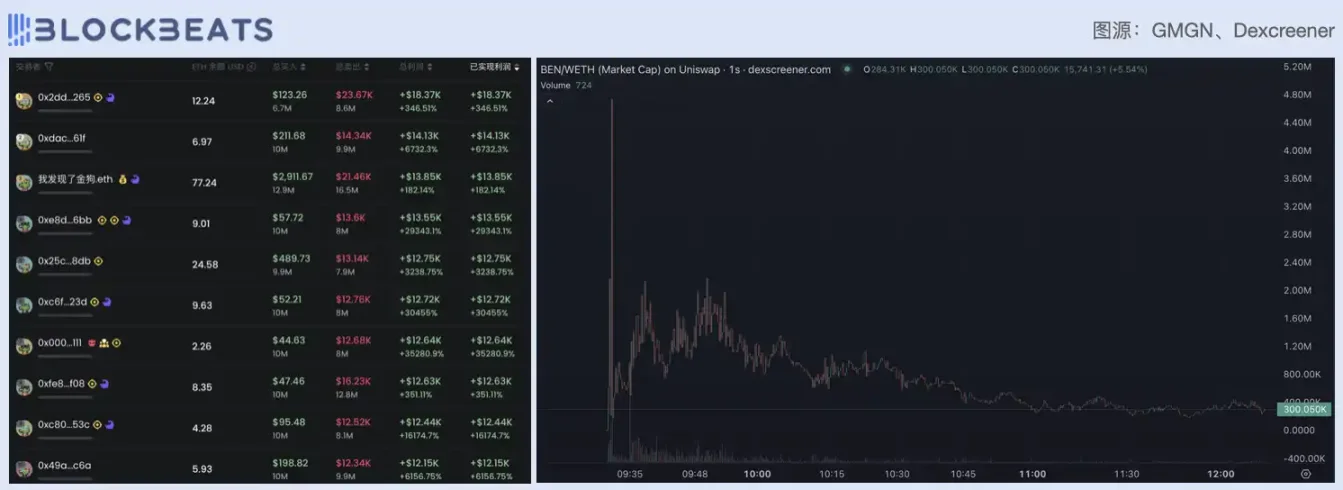

GMGN data shows that the traders with the highest profit multiples on the TaxFarm.ing platform currency FARM had a purchase cost between US$1,000 and US$7,000. The wallet address starting with 0x b 3 made a profit of US$168,000 at a cost of US$2,208, a profit of 92 times, and has now sold all the chips.

In addition to FARM, the meme coin $BEN (Farmer Ben), which earned $140,000 in fees and was officially promoted by TaxFarm.ing, also allowed many people to experience the joy of a 100-fold coin. Among the top profitable traders shown by gmgn, nine of the top ten traders with the most profits had a purchase cost of less than $500, and four traders earned $10,000 at a cost of around $50.

However, BEN fell to zero after attracting 2 million transactions in 20 minutes, and its market value was only $300,000 at the time of writing.

This article is sourced from the internet: 100 times in 6 hours, a detailed explanation of the new player TaxFarm of Ethereum Pump.fun

Original article by Jasper De Maere, Outlier Ventures Original translation: J1N , Techub News Since March 2024, the cryptocurrency market has experienced a sharp correction. Most Altcoins (tokens other than Bitcoin, Ethereum, etc.), especially some relatively mainstream Altcoins, have seen their prices fall by more than 50% from their highs, but this has not had much impact on newly listed tokens. By studying more than 2,000 token issuance cases, we found that the prices of native tokens of early-stage projects with financing scales of millions of dollars can remain stable and move independently of the market. Summary In the private equity market of Web3, the investment scale of Pre-Seed and Seed rounds is around one million US dollars. At the same time, projects with a longer financing process will have…