Data research: BTC halving effect has diminished since 2016

Original article by Jasper De Maere, Outlier Ventures

Original translation: 1912212.eth, Foresight News

Four months after the Bitcoin halving, we are witnessing the worst price performance in history. In this article, we explain why the halving no longer has a fundamental impact on the price of Bitcoin and other digital assets, the last time this happened was in 2016. As the digital asset market matures, founders and investors should gradually abandon the idea of a four-year cycle.

Summarize:

-

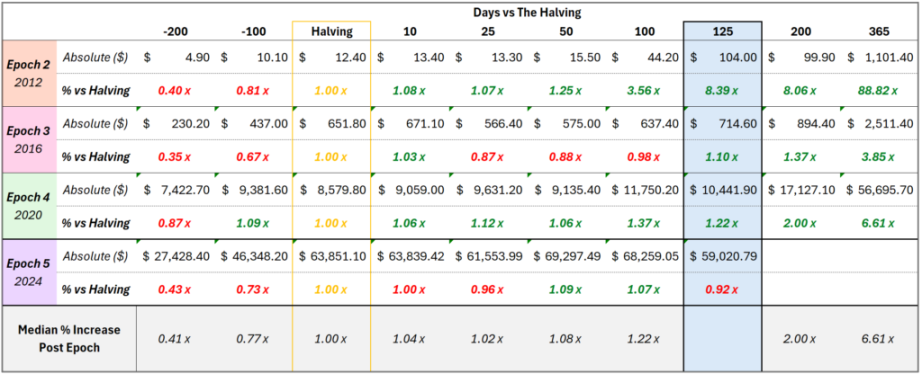

After the 2024 halving (Epoch 5), Bitcoin’s price performance was its worst ever, with BTC prices falling 8% 125 days after the event, compared to a median increase of 22% in previous cycles.

-

We believe that 2016 was the last time the halving effect had a huge impact on Bitcoin prices. Since then, as the crypto market has matured and diversified, the Bitcoin block rewards miners receive have become insignificant in the market.

-

The strong performance of Bitcoin and the crypto market after the 2020 halving is purely coincidental, as the 2020 halving coincided with an unprecedented period of capital injection around the world after the pandemic, with the U.S. money supply (M2) alone increasing by 25.3% that year.

-

The argument that the four-year cycle in 2024 is still valid, but the approval of a Bitcoin ETF triggered demand in advance, leading to a sharp rise in Bitcoin prices before the halving, is problematic. The approval of a Bitcoin ETF is a demand-driven catalyst, while the halving is a supply-driven catalyst, and the two are not mutually exclusive.

Bitcoin’s price dynamics significantly impact the overall market, and therefore founders’ ability to raise capital through equity, SAFTs, and private or public token sales. Given the liquidity that cryptocurrencies introduce to venture capital, founders must understand top-down market drivers to better anticipate funding opportunities and plan for the life of their funds. In this article, we will break down the concept of the four-year market cycle to lay the foundation for future discussions of real market drivers. Debunking the myth of the four-year cycle does not mean that we are pessimistic about the overall market.

First, let’s review the price performance of Bitcoin in recent cycles before and after the halving. Obviously, in the data after 125 days, the 5th Epoch (2024) has the worst performance since the halving, which is the first cycle in which Bitcoin has fallen based on the price on the halving day.

Figure 1: Bitcoin price performance before and after halving in various cycles

Why is the halving so important to the price of Bitcoin? In short, there are two main reasons:

-

Fundamental factors: Bitcoin halving reduces new supply and creates scarcity. This scarcity can drive prices up when demand exceeds limited supply. This new dynamic also changes the economic benefits for miners.

-

Psychological factors: Bitcoin halving deepens people’s perception of scarcity, reinforces expectations of price increases based on historical patterns, and attracts media attention, which may increase demand and drive prices higher.

In this article, we argue that the fundamentals driving Bitcoin price action are overstated and have become irrelevant over the past two cycles. We will use data to show that the net effect of the halving is not enough to significantly impact Bitcoin prices or the overall digital asset market.

Daily Bitcoin Rewards

If you take away only one thing from this article, make it this:

The strongest argument for the halving’s impact on the market is that, in addition to reducing Bitcoin’s inflation rate, it also affects the economic returns for miners, leading to changes in their fund management.

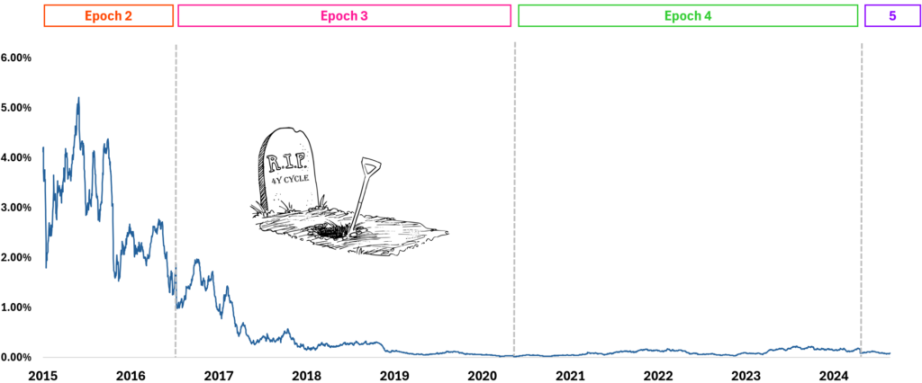

So lets consider the extreme case where all mining block rewards are immediately sold on the market. What would such selling pressure look like? The data below shows the total daily block rewards received by all miners (in USD) divided by the total transaction volume in the market (in USD) to assess this impact.

Before mid-2017, miners had an impact of more than 1% on the market. Today, if miners sell all of their Bitcoin block rewards, it only accounts for 0.17% of market volume. Although this does not take into account the Bitcoin that miners have previously accumulated, it shows that as block rewards decrease and the market matures, the impact of Bitcoin block rewards on the market has become negligible.

Figure 2: Potential market impact if all miners sold their daily Bitcoin block rewards

Summary of the Halving Impact

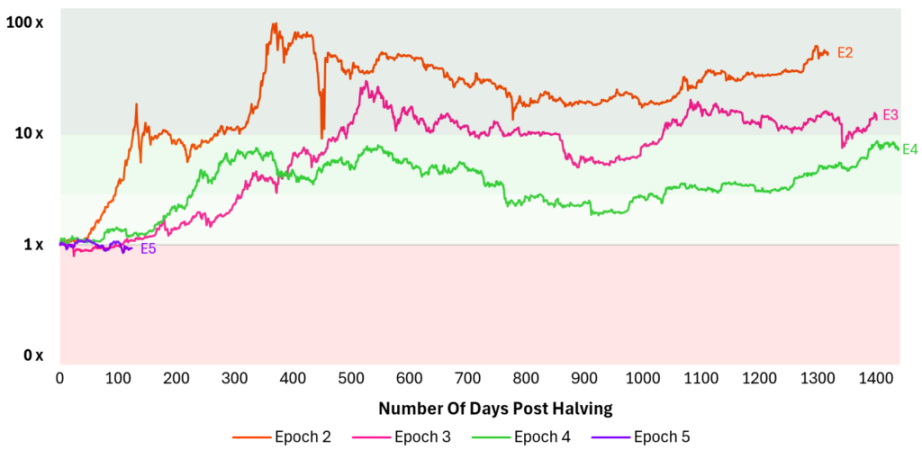

Bitcoin halving occurs approximately every four years, and the block reward for miners is halved. This reduces the rate at which new Bitcoins are generated, thereby reducing the new supply on the market. The total supply of Bitcoin is capped at 21 million, and each halving slows down the rate at which this cap is reached. The period between each halving is called an epoch, and historically, each halving has had an impact on the price of Bitcoin due to reduced supply and increased scarcity. All of this is shown in Figure 3.

Figure 3: Bitcoin halving dynamics, block rewards, total supply and Epoch

Bitcoin halving performance

We see that the post-halving performance has been the worst since Bitcoin’s inception. As of today (September 2, 2024), Bitcoin is trading approximately 8% below the $63,800 level seen on April 20, the day of the halving.

Figure 4: Bitcoin price performance after each halving

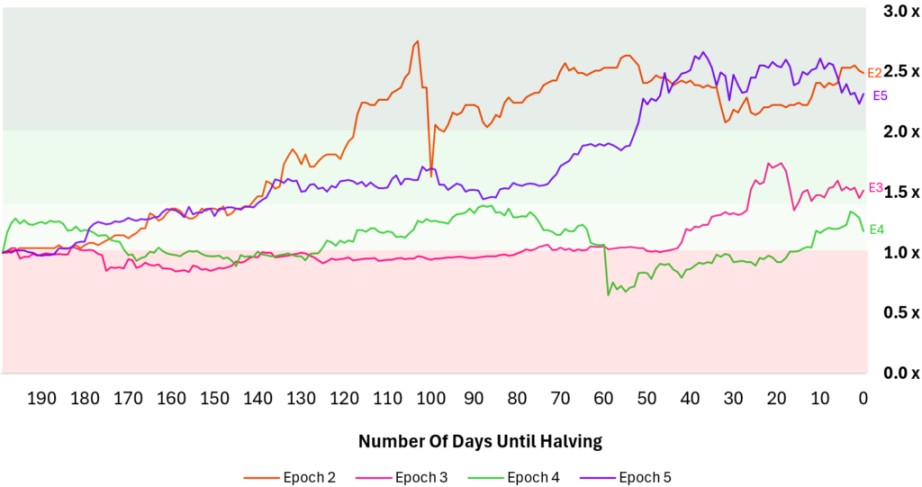

What about the increase before the halving? Indeed, we have experienced an unusually strong increase before the halving. Looking back at the performance 200 days before the halving, we see that Bitcoin has risen almost 2.5 times. This is comparable to Epoch 2, when Bitcoin accounted for 99% of the total market value of the digital asset market, and the halving is still meaningful.

Chart 5: Bitcoin price performance 200 days before each halving

Having said that, it’s also important to remember what happened during that time. We had the approval of a Bitcoin spot ETF in early 2024, and since January 11, 2024, there has been a net inflow of 299,000 Bitcoins, which has significantly boosted the price. So this rally is not in anticipation of the halving.

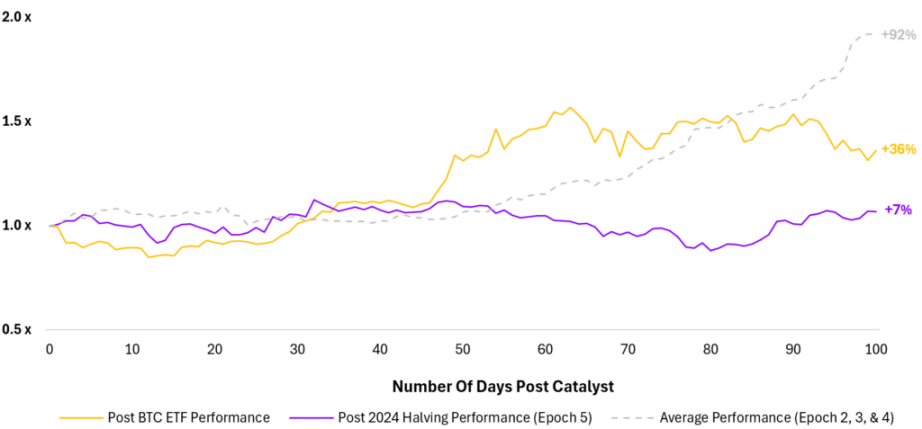

Figure 6 shows Bitcoin’s performance between Bitcoin ETF approval and halving. The Bitcoin ETF approval in January 2024 increased demand for Bitcoin, causing Epoch 5’s 100-day gain to be 17% higher than the average Epoch gain.

Figure 6: Bitcoin price performance 200 days before each halving

Figure 7 shows the 100-day performance of Bitcoin ETF approval and Bitcoin halving. Clearly, ETF approval has a more significant impact on price than halving, with the difference between the 100-day performance being approximately 29%.

Figure 7: Bitcoin performance 100 days after halving and ETF catalysts

“So, the Bitcoin ETF is driving demand and prices ahead of the time we would normally see at the halving!”

This is a weak argument to support a four-year cycle. The reality is that the two catalysts are separate and distinct. ETFs are a demand-driven catalyst, while the halving is considered a supply-driven catalyst. They are not mutually exclusive, and if the halving remains important, we should see significant price changes in response to both catalysts.

2016 is the last time

I believe that the halving in 2016 and when we entered Epoch 3 was the last time that the halving had a truly meaningful impact on the market. As shown in Figure 2, the following figure shows the impact on the market if all miners sold all their Bitcoins on the day they received the block reward. It can be seen that by mid-2017, this impact fell below 1%, and today this ratio barely exceeds 0.20%, indicating that its influence is insignificant.

Figure 8: Potential market impact if all miners sold their Bitcoin block rewards daily

To understand the declining importance of the influence of miners’ treasury decisions, we need to take a closer look at the different variables involved.

variable:

-

Daily Bitcoin block reward – decreases every Epoch (↓)

-

Bitcoin volume traded daily – increasing as the market matures (↑)

→ Over time, block rewards decrease and the market matures, which reduces the relevance of miner influence.

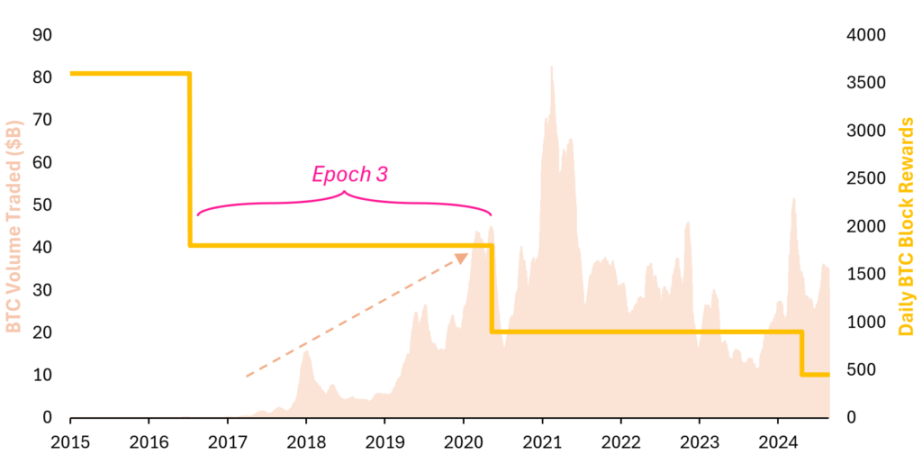

Figure 9 shows the Bitcoin transaction volume and the cumulative Bitcoin block rewards of miners. The sharp increase in transaction volume makes the impact of miners’ block rewards on the market insignificant.

Figure 9: Daily Bitcoin Miner Rewards and Daily Transaction Volume

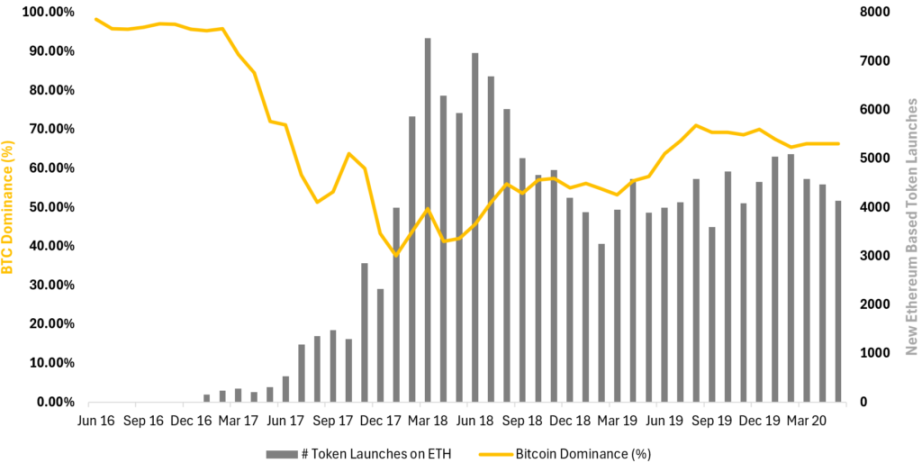

For those who were in the market at the time, everyone knows what really drove the increase in trading volume during that period. To recap: after the launch of Ethereum in 2015 and the unlocking of its smart contract capabilities, the ICO boom that followed led to the creation of many new tokens on the Ethereum platform. The emergence of these new tokens contributed to the decline of Bitcoin’s dominance.

The influx of emerging assets

(i) boosted trading volumes in all sectors of the digital asset market, including Bitcoin;

(ii) and enable exchanges to mature faster, enabling them to more easily attract users and handle larger trading volumes.

Figure 10: New ERC-20 token issuance and Bitcoin dominance during Epoch 3

How did it perform in 2020?

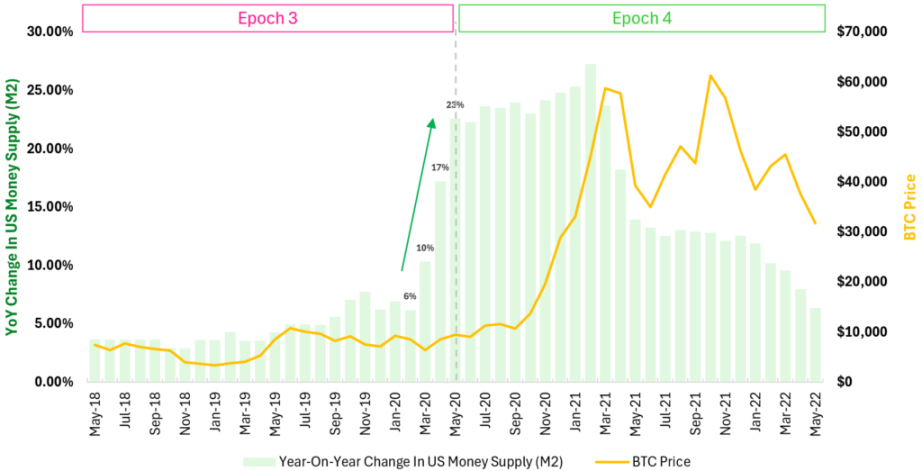

A lot of things happened in Epoch 3, which logically reduced the impact of mining treasury management, and accordingly reduced the role of halving as a catalyst for Bitcoin. What about 2020? Back then, Bitcoin rose by about 6.6 times in the first year after the halving. This was not due to the halving, but to the massive amount of money printed in response to the COVID-19 pandemic.

While the halving is not a fundamental factor, it can affect Bitcoin’s price action from a psychological perspective. Bitcoin makes headlines during halvings and provides people with a place to invest their excess funds, which is particularly important when other spending options are limited.

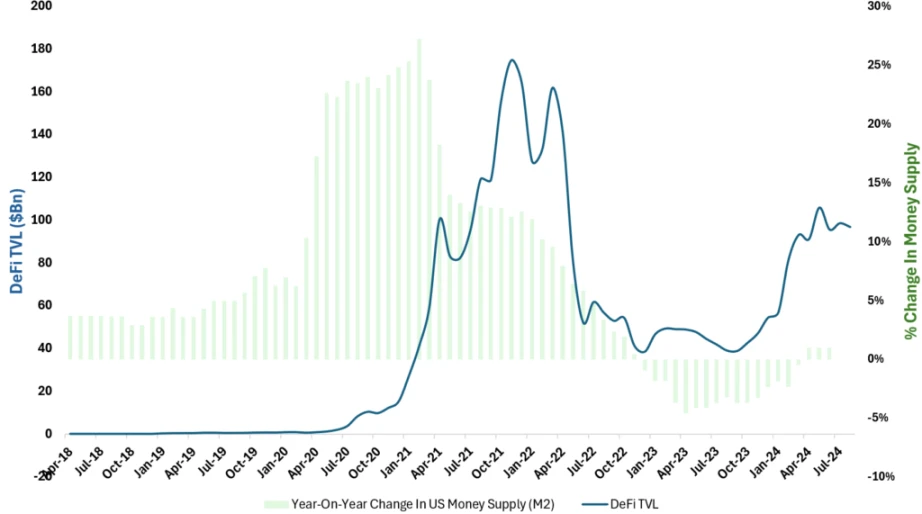

Figure 11 shows the real reason for the rise. In the months leading up to the May 2020 halving, the U.S. money supply (M2) surged at a rate unprecedented in modern Western history, driving speculation and inflation across a wide range of asset classes, including real estate, stocks, private equity, and digital assets.

Figure 11: US money supply (M2) and Bitcoin price before and after the 2020 halving

In addition to the funds flowing into Bitcoin, it is also important to recognize that money printing occurred after the DeFi Spring, which then developed into the DeFi Summer. Many investors were attracted by the attractive yield opportunities on the chain and invested capital in cryptocurrencies and utility tokens to capture these values. Due to the strong correlation between all digital assets, Bitcoin naturally benefited from it.

Figure 12: US Money Supply (M2) and DeFi TVL

A combination of factors, fueled by global helicopter money, has sparked the biggest cryptocurrency bull run to date, coinciding with the halving, making it seem as though the change in block rewards has a fundamental impact on price action.

Miners remaining supply

“What about the remaining Bitcoins held by miners in the treasury reserve? These Bitcoins were accumulated in previous Epochs when the hash rate was lower and the block reward was higher.”

Figure 13 shows the miner supply ratio, which is the ratio of total bitcoins held by miners to the total bitcoin supply, actually depicting how much supply is controlled by miners. The impact of miners’ decisions on the price of bitcoin is mainly due to the block rewards they accumulated in the early Epochs.

As shown in the figure, the miner supply ratio has been steadily decreasing over time and is currently around 9.2%. Recently, there has been an increase in over-the-counter activity from miners, who are selling Bitcoin, possibly to avoid having an excessive impact on the market price. This trend may be due to lower block rewards, rising hardware and energy costs, and the lack of significant Bitcoin price increases – forcing miners to sell Bitcoin faster to remain profitable.

We recognize the impact of halving on mining profitability and the need for miners to adjust management to remain profitable. However, the long-term trend is clear, and the impact of halving on Bitcoin prices will only continue to decrease over time.

Figure 13: Miner supply ratio and monthly percentage change

in conclusion

While the halving may have some psychological impact, reminding holders of their long-inactive Bitcoin wallets, its fundamental impact has clearly become irrelevant. The last meaningful halving impact was in 2016. In 2020, it was not the halving that triggered the bull run, but the response to the COVID-19 pandemic and the subsequent money printing. For founders and investors trying to time the market, it is time to focus on more important macroeconomic drivers rather than relying on four-year cycles.

This article is sourced from the internet: Data research: BTC halving effect has diminished since 2016

Original author: starzq.eth (X: starzqeth ) When I was discussing the TON ecosystem with @realyanxin last week , he recommended that I must read the interview with Telegram founder Pavel Durov this year. After reading it, I can deeply understand Telegrams mission, the value of TON to Telegram, and why he wants to bullish TON ecosystem, because TON is indeed an indispensable part of Telegram. So I watched this interview with Tucker Carlson and indeed had a deeper understanding of Telegram and Ton: Pavel Durov’s upbringing has made him pursue freedom all his life, and he also hopes to create a platform to enable others to feel freedom. Telegrams mission is to create a platform where users can enjoy free speech; The value of Ton to Telegram: Ton is almost…