TRON Industry Weekly Report: Mainstream Cryptocurrencies Underperform Traditional Assets in August, Ethereum, MakerDAO F

1. Conclusion

1. Macro-level summary and future forecasts

The Federal Reserves preferred inflation gauge rose modestly on Friday and household spending remained steady, suggesting policymakers are on track for a soft landing, thus reducing the need for the Fed to cut interest rates by 50 basis points in September. Wall Street still expects a larger rate cut in November or December, though.

In the future, the market will continue to pay close attention to changes in the labor market and the upcoming employment data. Although interest rate cuts have become a high probability, the resilience of the economy and the mild rise in inflation may limit the extent of interest rate cuts, especially when economic fundamentals remain stable.

2. Cryptocurrency market changes and warnings

After several days of rebound, the cryptocurrency market lacked upward momentum and continued to show weakness last week, with most currencies continuing to retreat. BTC fell to around $57,100 again, and ETH fell to $2,400. Most people believe that the market is in the process of a second bottoming out, and market sentiment is still showing panic. The market is still waiting for more macro data signals to guide it.

It is worth noting that, dragged down by the market decline in the last two weeks of August, the prices of Bitcoin and Ethereum fell by 8.6% and 17.3% in August, while the global stock and bond indices rose by about 2% during the same period. It can be said that mainstream currencies significantly underperformed mainstream traditional assets in August.

3. Industry and track hot spots

Ethereum continues to perform poorly, and the community has pointed part of the blame at the Ethereum Foundation and Vitalik Buterin. The Ethereum Foundations recent transfer of 35,000 ETH has attracted widespread attention and doubts from the community. Community members pointed out that the Foundations annual expenditure report lacks transparency, which has raised doubts about its use of funds.

Vitalik Buterins views on decentralized finance (DeFi) in recent discussions have sparked controversy. His remarks were interpreted by some community members as a misunderstanding of DeFi, and that he failed to clearly express the potential value and applications of DeFi. This poor communication may have caused the community to doubt his leadership, further exacerbating concerns about the future development of Ethereum.

In addition, MakerDAOs brand upgrade and its new stablecoin USDS and freezing function have sparked debate about decentralized stablecoins. Although stablecoins play an important role in the cryptocurrency market, the problem of centralized control has gradually emerged, especially when the freezing function is introduced, which is contrary to the original intention of decentralization and casts a shadow on the future of DeFi.

This incident not only shows that DeFi projects need to make compromises under regulatory pressure, but may also lead to the division of the community. Nevertheless, in the long run, this may prompt the DeFi field to make deeper innovations and changes, and explore new technical solutions to balance compliance and decentralization.

II. Macroeconomic Data Review and Key Macroeconomic Data Release Nodes Next Week

Last week, U.S. stocks rose for four consecutive months. The Dow Jones Industrial Average rose 0.94%, setting a new intraday record high. In Europe, Germanys DAX 30 index fell slightly by 0.02%, Britains FTSE 100 index fell slightly by 0.04%, and Frances CAC 40 index fell by 0.13%. Asia-Pacific stock markets also basically closed higher after experiencing fluctuations at the beginning of the month, among which the Hang Seng Index performed particularly well, rising by more than 3.7%. The Nikkei 225 Index rose 1.5% in the month;

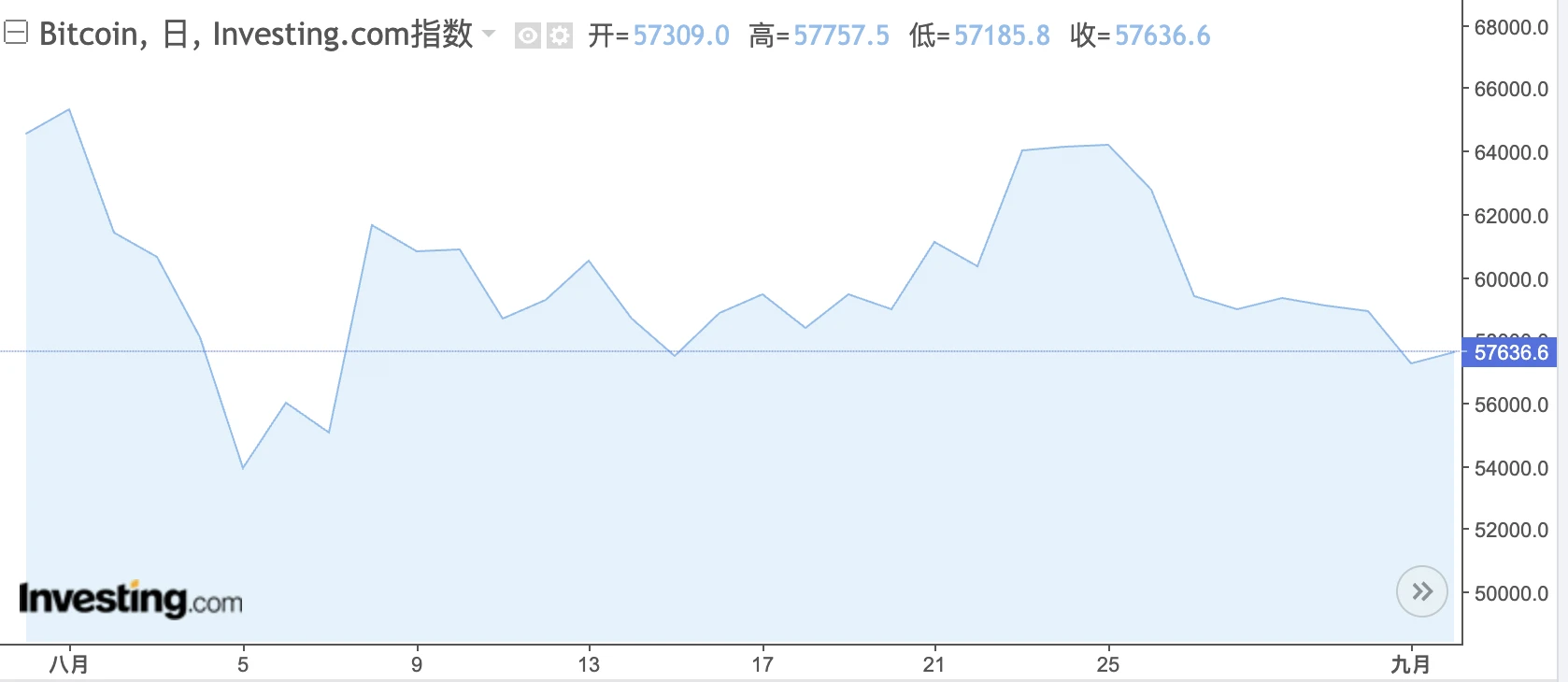

Bitcoins August trend Source: Investing.com

The crypto market showed a volatile downward trend last week. Bitcoin and Ethereum both fell by about 10% during the week, with Bitcoin hitting a low of $57,230 during the session. Data shows that Bitcoin fell 8.6% in August.

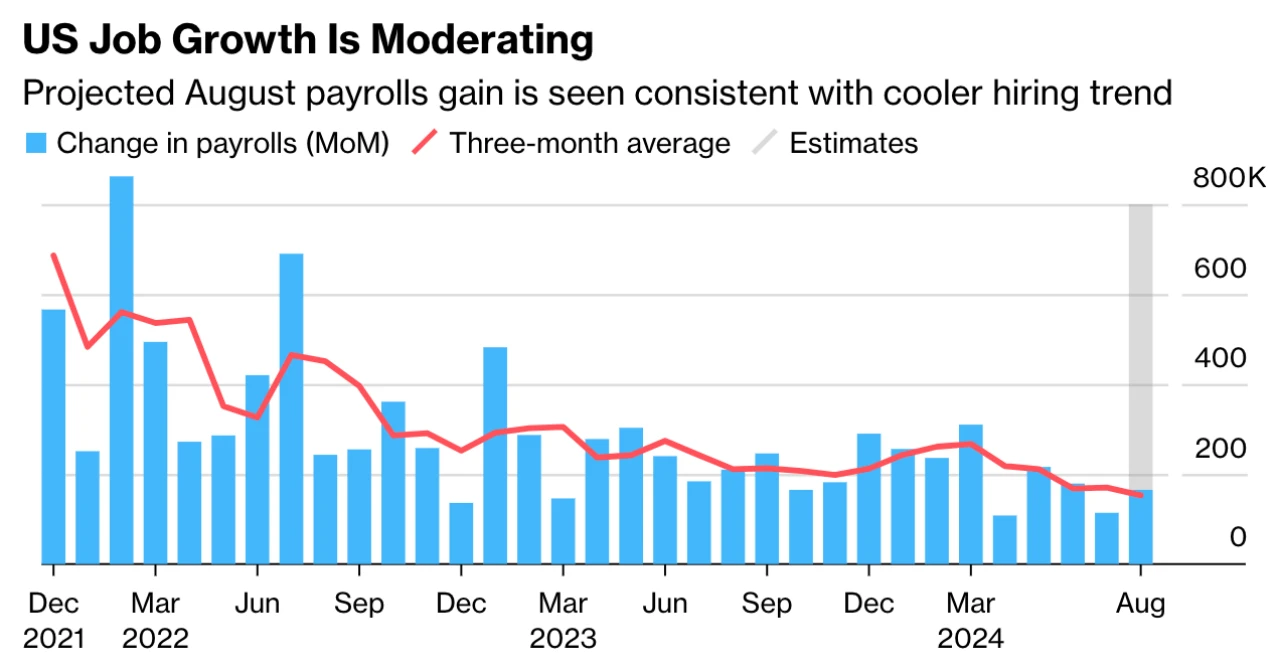

The focus this week will be on the U.S. nonfarm payrolls report after Federal Reserve Chairman Jerome Powell hinted at a rate cut in September amid slowing inflation and modest labor market growth.

US job growth slows Source: Bloomberg

Several important data will be released next week. The US will release the August non-farm payrolls report, July job openings data, weekly initial jobless claims and ADP employment data, which will affect the Feds decision to cut interest rates. The market expects the Bank of Canada to cut interest rates for the third consecutive time.

Europe is to release the euro zone policy statement, data on German factory orders and industrial production, euro zone three-month GDP data, and final data on the UK manufacturing and services PMIs.

3. Industry data sharing

1. Overall market performance

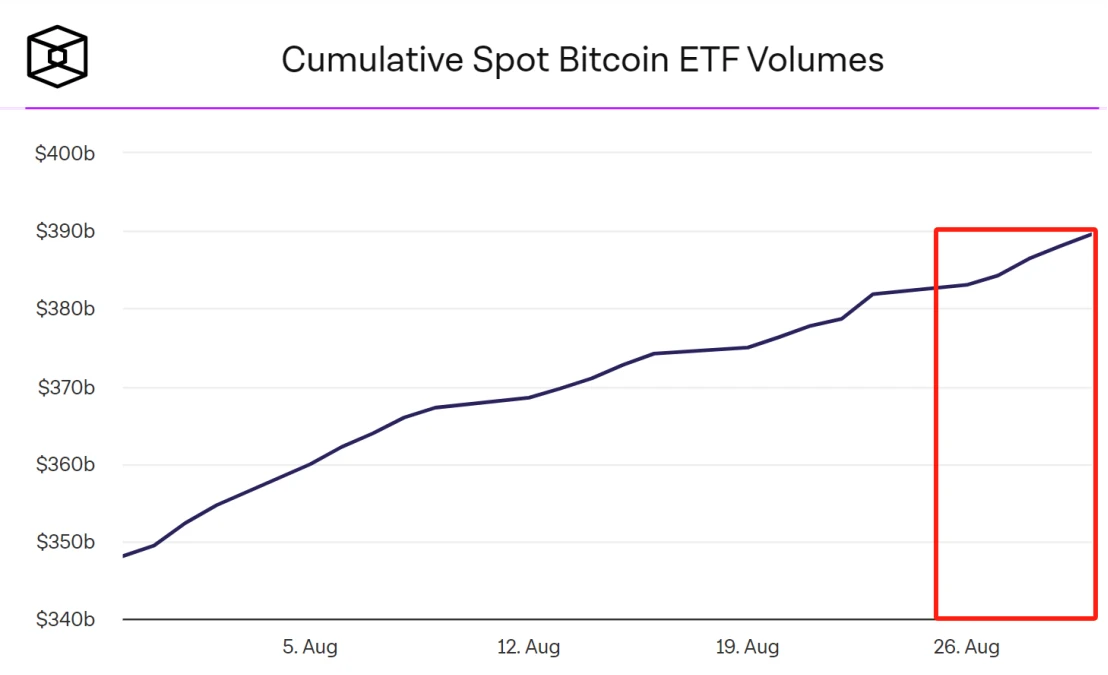

1.1 Spot BTC ETF

Last week, Ishares was still the main buyer of BTC spot, buying more than $7.6 B of BTC in the past 7 days. This shows that even if the price of BTC falls below the $60,000 mark again, the downward range is slow. This kind of trend is usually the result of ETFs continuous batch buying, so it can be interpreted as a positive for the entire market.

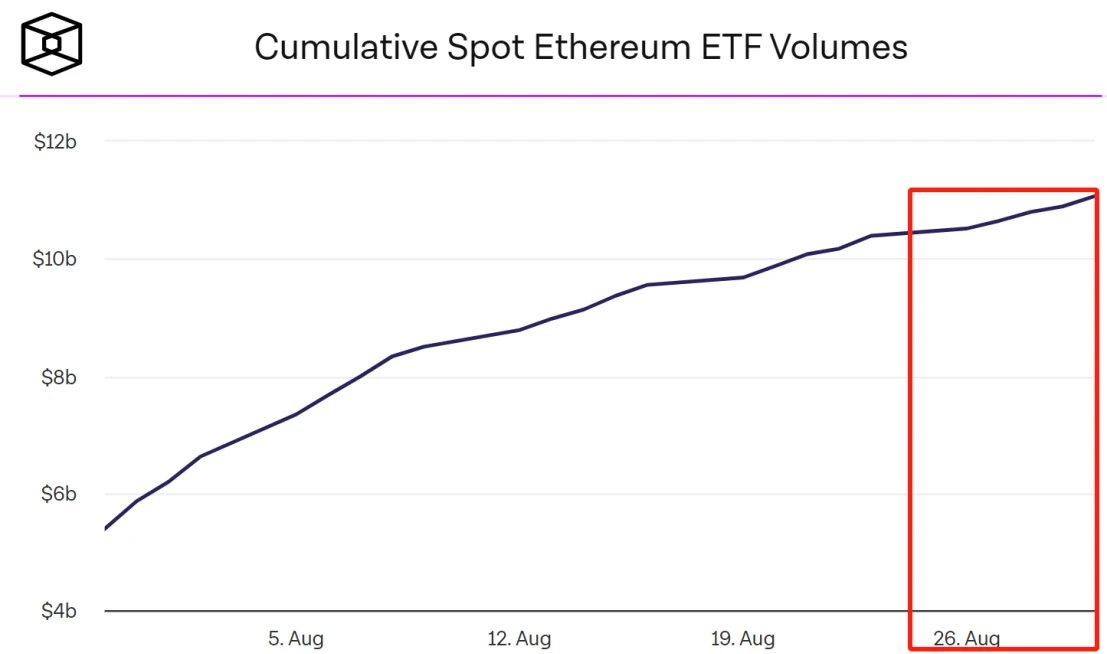

1.2 Spot ETH ETF

ETH buyers’ buying sentiment was obviously still low last week. It is almost flat as shown in the chart. The total weekly purchase amount of major ETFs did not even reach $1 B. It can be seen that the willingness and proportion of asset management giants for ETH as their asset allocation are currently low. ETH still has a difficult road to become digital silver.

2. Public chain data

Layer 1 Summary

Last week, the EVM-related new public chains experienced completely different market conditions. The public chain TON was affected by the arrest of its founder and suffered a continuous sell-off, and performed the worst. However, after the founder was released on bail, TON is expected to have a strong rebound performance.

The old public chain Fantom unexpectedly became the best performing public chain last week, which may be due to the good news that its renamed Sonic Labs will soon launch a new version of the test network. Of course, ACs appointment as CTO is also a reassurance for Fantom users.

SEI and APTOS, new L1 players, have also delivered good results in the past week due to the continuous development of their ecosystems.

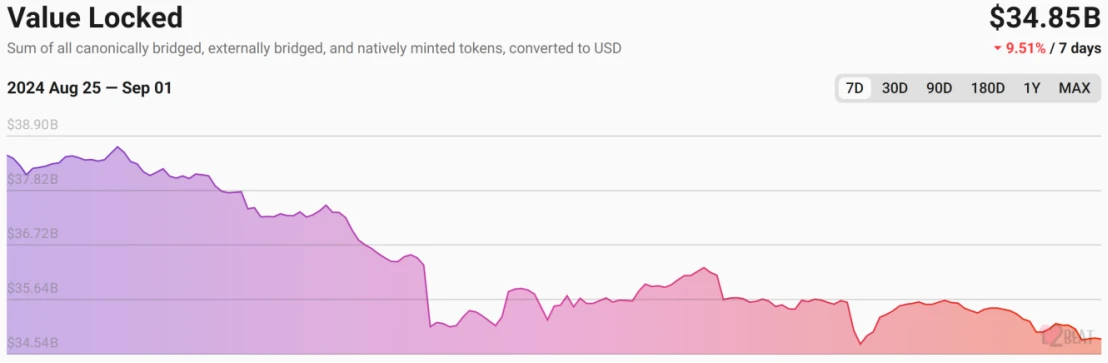

Layer 2 Summary

As the entire market weakened again this week, L2 funds fled as a whole, and the overall TVL net outflow was close to 10% in a single week. Among the top ten protocols, except for Base, which has been strong recently, Scroll, the leader of the ZK series, and OP mainnet, which fell by less than 10%, the remaining protocols all fell by more than 10%.

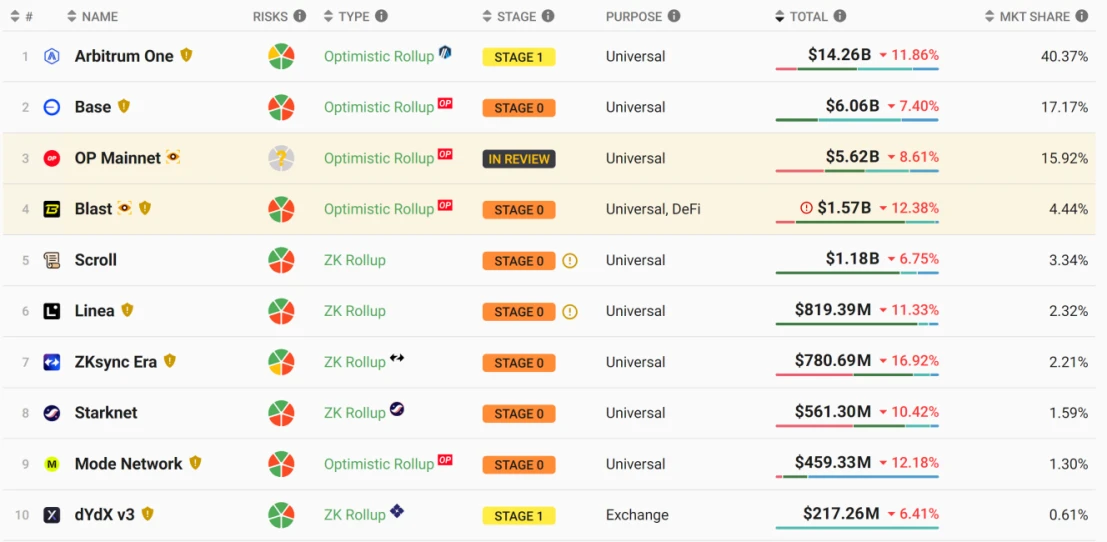

Among them, Blast is worth noting. Blasts total locked value (TVL) fell 62% from its all-time high, and the number of daily active users fell to its lowest level in six months. In early August, the network lost more than $300 million in liquidity, and TVL fell from $1.1 billion to $785 million, the lowest point in six months.

DEFI Section

1.1 RWA

Last week, the on-chain RWA assets were generally stable, but suddenly fell off a cliff on Sunday. After analysis, it is possible that the RWA sector of the BTC ecosystem re-staking protocol Solv protocol plummeted 76% within 24 hours over the weekend, so DeFi users need to pay attention to the risks of this protocol.

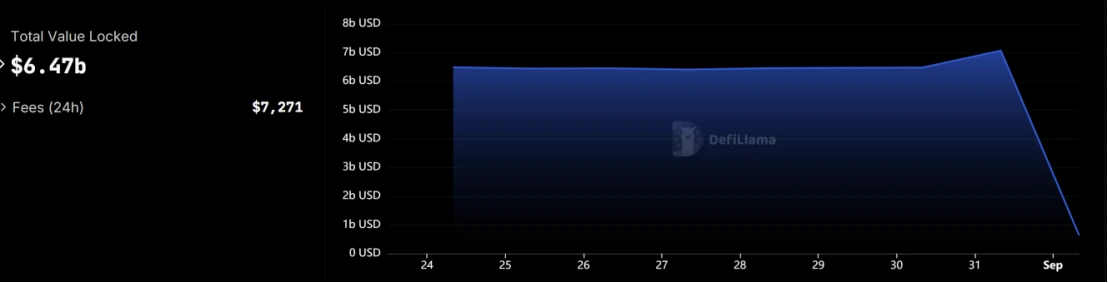

1.2 Restaking

The restaking sector has weakened slightly this week. Due to the sluggish market trend last week, the DeFi yield has declined, resulting in a decrease in on-chain transactions and lending activities. The Restaking yield is bound to be reduced to a certain extent.

However, with the rise of BTCFi, the Restaking of BTC and its related assets will have great potential.

3. Analysis of hot tracks and projects

1. What is the impact of the arrest of TON’s founder on the crypto market? Which types of meme tokens will benefit from it?

After the TON founder was released, the panic on the TON chain gradually subsided and TVL stabilized. Therefore, if there are no major changes in the future, the TON ecosystem is likely to rebound again. Of course, crypto users should be aware that the alarm for this incident has not been completely lifted.

This incident may benefit tokens related to concepts such as freedom and democracy in the meme sector in the future.

2. MAKER DAO is renamed SKY. Is the TOKEN upgrade a good thing or a bad thing?

MakerDAO was once a pioneer in the decentralization of the DeFi field. Its DAI is a stablecoin that is not controlled by a central authority. However, with the launch of USDS, its philosophy seems to have deviated from its original intention.

It is reported that USDS may introduce a freezing function similar to the centralized stablecoins USDT and USDC. Under certain circumstances, the issuer of USDS or the relevant governance entity can freeze the users funds.

The designers of USDS claim that the freezing function is to prevent risks and ensure compliance. But this also raises a fundamental question: if a decentralized stablecoin can be remotely controlled, and this centralized control requires users to rely on the goodwill and compliance of the issuer to some extent, rather than fully controlling their own assets, then the meaning of DEFI will no longer exist.

Of course, we can understand that MAKER DAO has to make a compromise to survive in the future because the RWA sector on which it depends will eventually become compliant. After all, if it continues to insist on decentralization, its RWA business will inevitably be cut off, and this huge part of the profit will be sharply reduced.

But from the perspective of the crypto industry, MAKER DAO’s “rebellion” is a setback in development.

3. Can Babylon trigger the next bull market?

Babylon is a protocol that aims to leverage the security of Bitcoin to provide security for other PoS chains. Babylon can provide secure, cross-chain-free, and custody-free native staking solutions for PoS chains including BTC layer 2, and promote cross-chain interoperability. It is often compared to Eigenlayer in the Ethereum ecosystem.

Core Principles

Remote staking: Utilize Bitcoin’s UTXO model and script system to realize the staking, confiscation and reward of Bitcoin.

Timestamp server: By recording events of the PoS chain on the Bitcoin blockchain, it provides an immutable timestamp for these events.

Three-layer architecture: Bitcoin as the bottom layer, Babylon as the middle layer, and PoS chain as the upper layer. Babylon is responsible for recording the checkpoints of the PoS chain to Bitcoin.

4. Potential sectors this week

Fractal Bitcoin

Fractal Bitcoin is another Bitcoin expansion solution developed by the UniSat team. By using the BTC core code, it innovates an infinite expansion layer on the main chain to improve transaction processing capabilities and speed, while being fully compatible with the existing Bitcoin ecosystem.

At present, the number of wallet addresses on the test network has exceeded 10 million. Analysis of its application scenarios may include: as a BTC pilot network, OP_CAT test field; a low-cost way for project parties and users to participate in the BTC ecosystem; and driving the development of micro-transactions.

Its ecosystem is currently in a very early stage, so users are reminded to guard against risks while participating.

Satlayer

Based on Babylons Bitcoin re-hypothecation platform, SatLayer is a universal security layer that leverages the power of Bitcoin. By deploying as a smart contract on Babylon, SatLayer enables Bitcoin stakers to use their BTC as a verification service to protect various types of decentralized applications or protocols.

SatLayers ecosystem design is relatively simple, with several important participants:

– Re-stakers: re-stake BTC wrapped assets to SatLayer.

– Operators: Choose Bitcoin Validation Services (BSV) to provide security and receive re-staking rewards from it.

-BVS: PoS networks or applications that use BTC to power their crypto-economic security.

SatLayers income mainly comes from BTC staking income on Babylon and additional staking income of SatLayer BVS. In addition, it also includes its composability, which can be used to use satAssets in other BTCFi to generate further income.

Referring to the similar protocol Solv protocol in the same track, Satlayer can provide an objective return to BTC users who re-stake at least in the early stage, so it can become the market focus in the short term to a certain extent.

IV. Regulatory policies

Although there have been no significant changes in global regulatory policies during the week, the crypto industry is penetrating into various fields at an unprecedented rate, and governments regulatory attitudes towards the crypto industry are gradually changing and improving.

Russia

Russia plans to begin testing the use of cryptocurrencies for cross-border payments. According to the new law signed by President Vladimir Putin, these payments will be carried out under the supervision of the Russian Central Bank, but the ban on cryptocurrencies as legal tender has not been lifted and they are still limited to cross-border payments. This move shows that Russia hopes to use cryptocurrencies to ensure that economic activities under international sanctions are not affected.

New Zealand

The New Zealand Minister of Revenue has introduced a tax bill proposing to implement the Organization for Economic Cooperation and Development (OECD) Crypto-Asset Reporting Framework (CARF). If the bill is passed, New Zealands Crypto-Asset Service Providers (CASPs) must collect and report transaction information of reportable users, and impose fines on non-compliant CASPs and crypto-asset users.

Nigeria

Obinna Iwuno, head of the Nigerian Blockchain Advocacy Group, said that Nigeria’s recent approval of two digital asset exchanges is a welcome development for the industry. He believes that Nigeria, as a major player in Africa’s cryptocurrency trading, should take the lead in regulation and licensing.

This article is sourced from the internet: TRON Industry Weekly Report: Mainstream Cryptocurrencies Underperform Traditional Assets in August, Ethereum, MakerDAO Faces Challenges of Change

Original | Odaily Planet Daily ( @OdailyChina ) Author锝淣an Zhi ( @Assassin_Malvo ) Yesterday, Particle Network and Berachain announced the launch of their first joint testnet. Both projects are top-tier in their respective fields and have raised high amounts of funding (US$25 million and US$142 million respectively). Officials said that points are related to airdrops and will be able to earn additional rewards on Launchpad (Accumulate points to participate in upcoming airdrops, earn bonuses on The Peoples Launchpad). Odaily will provide detailed steps and data breakdown in this article. Register an account Go to the event page and enter the wallet link interface through JOIN NOW in the upper right corner, or swipe down to enter LAUNCH and then click Link Wallet. After the jump, use a wallet that supports…