Market tensions hit in September, and the trend is heavily dependent on data

Original author: BitpushNews

Crypto markets continued their decline on Tuesday.

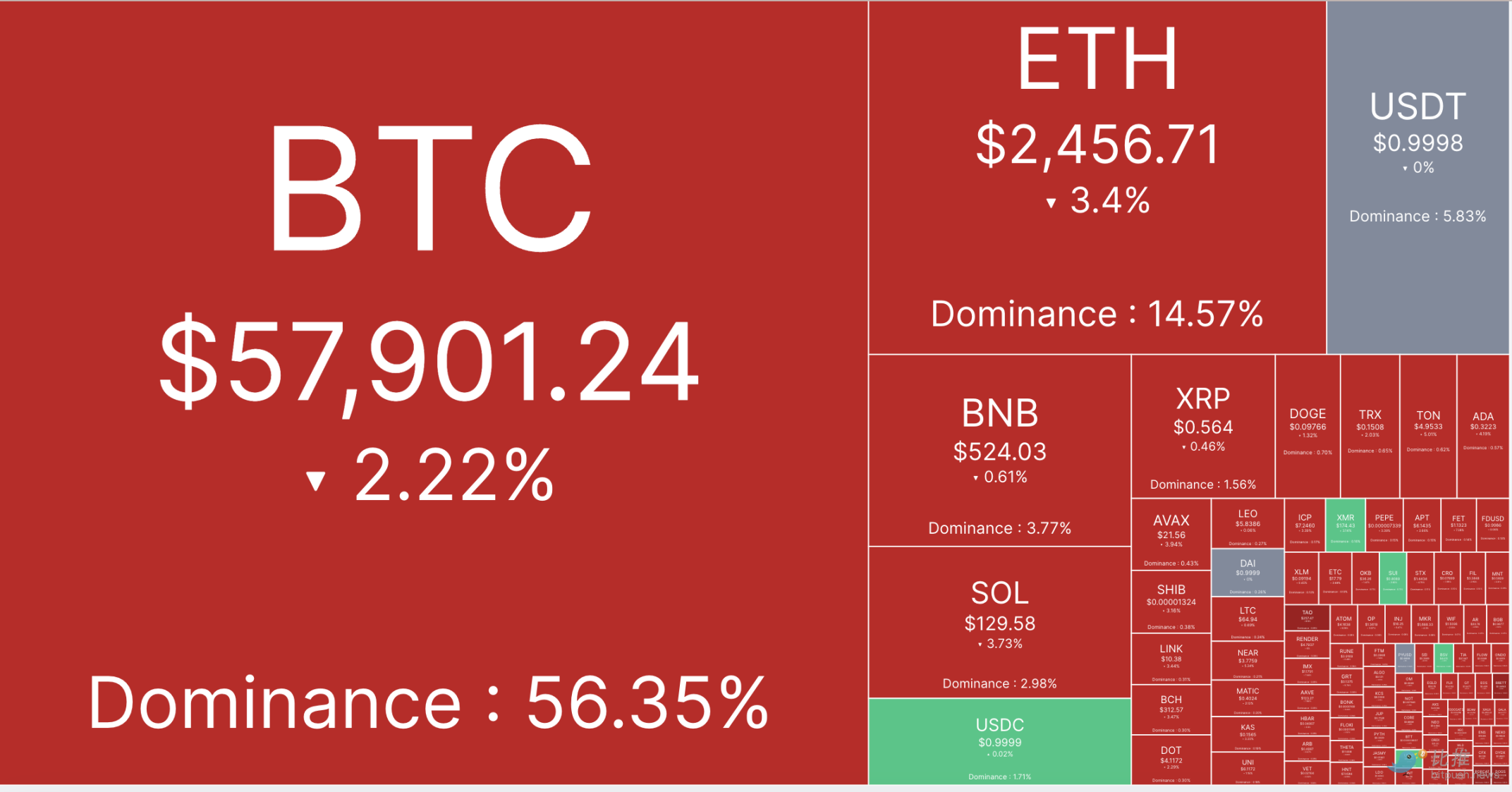

According to Bitpush data, Bitcoin hit an intraday high of $59,840 in the early hours of Tuesday morning, but fell back to the $57,500 support level after midday, and then rebounded. As of press time, BTC was trading at $57,901, down 2% in 24 hours.

Ethereum fell 3% to $2,456, its lowest level since early February. Altcoins were mostly in the red, with just over 20 of the top 200 tokens in the black.

Flux (FLUX) rose 18.6%, followed by UMA (UMA) and Sui (SUI), which rose 6.9% and 5.7%, respectively. LayerZero (ZRO) fell the most, down 9.3%, DOGS (DOGS) fell 8.4%, and Pendle (PENDLE) fell 7%.

The current overall market value of cryptocurrencies is $2.04 trillion, and Bitcoin’s market share is 56.4%.

U.S. stocks and gold both showed a downward trend. As of the close, the SP 500, Dow Jones and Nasdaq indexes fell by 2.12%, 1.51% and 3.26% respectively.

September has historically been a poor month for financial markets as traders await the first rate cut from the Federal Reserve, several key data points that could influence the trajectory of rate cuts, and the countdown to the U.S. presidential election in November.

Key U.S. economic data released

The latest economic data from the United States has reignited concerns about a recession. The ISM August Manufacturing PMI report released on Tuesday morning showed that the US economy continued to shrink, with the actual value of 47.2, lower than the expected value of 47.5 and 46.8 in July. New orders fell from 47.4 in July to 44.6, while prices paid rose from 52.9 to 54.0.

According to CMEs FedWatch data, traders raised the odds of a 50 basis point rate cut by the Federal Reserve in September to 39% from 30% a day ago, affected by the weak data. However, the favorite bet is still 25 basis points, with a probability of 61%.

The most important macro data point (and likely the ultimate determinant of whether the Fed cuts rates by 25 or 50 basis points) remains Fridays August jobs report, with economists forecasting a rebound to 160,000 jobs from 114,000 in July. The unemployment rate is expected to fall to 4.2% from 4.3%.

“The market seems to be very sensitive to any data right now,” said Larry Tentarelli, chief technical strategist at Bloomberg. “We’ve become a very data-dependent market.”

BTC follows structural patterns from past cycles

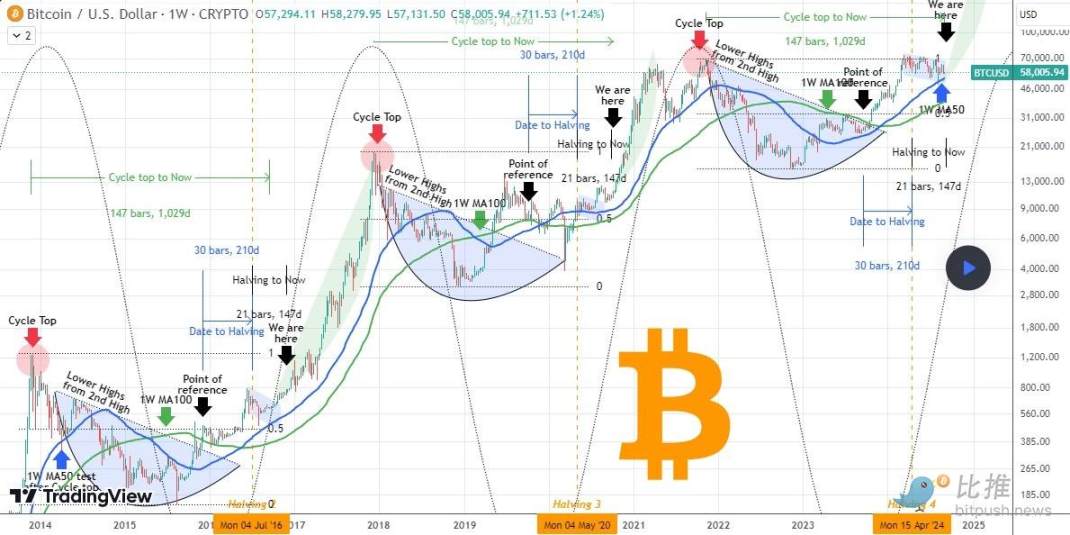

“Bitcoin has been following the structural patterns of past cycles very closely,” noted TradingView analyst TradingShot, who analyzed “sequences similar to cyclical fractals.”

TradingShot said: “BTC followed the exact path we plotted and delivered on expectations, breaking above the 1W MA 100 (green trendline above). As the price has been largely sideways for the past 6 months (bull flag/downward channel), it’s time to revisit this chart and see what happens next.”

The analyst explained: After some modifications, we can see that after successfully defending the 1 W MA 50 in the test in early August, the price should start a new parabolic rebound (green arc in the figure above) (relative to the past 2 cycles). We are 147 weeks (1029 days) away from the top of the previous cycle and 21 weeks (147 days) away from halving. In the past cycles, this was the exact point in time when Bitcoin began to rise sharply (at the we are here mark in the figure above). In all cases, the 1 W MA 50 has been maintained, so now the markets goal is to keep it unchanged so that buyers do not lose the psychological support level. If this level is maintained, breaking through 100,000 should be the minimum expectation, especially before the start of the interest rate cut cycle this month and the US election in November (traditionally the market is bullish after the election).

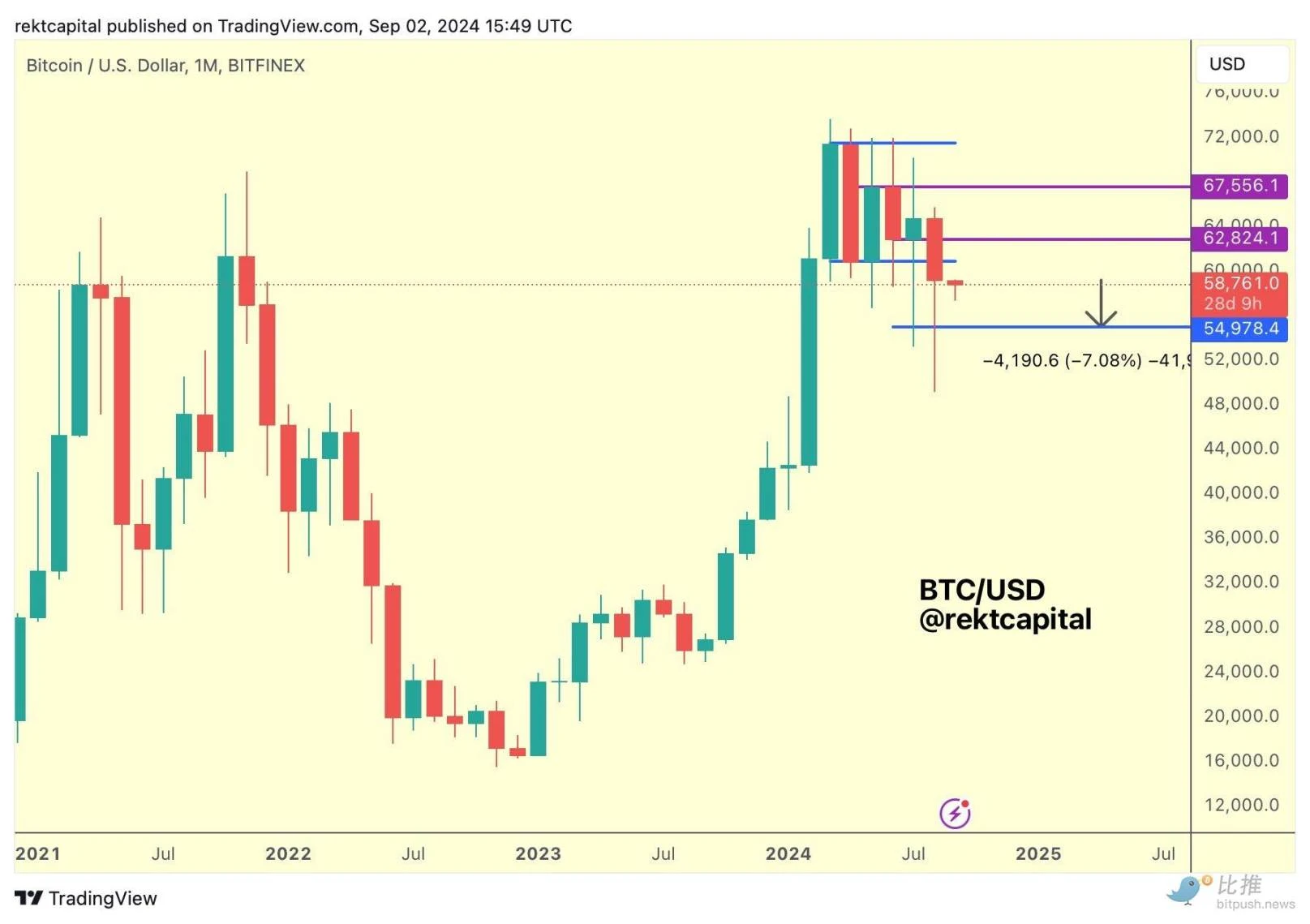

As for near-term expectations, market analyst Rekt Capital noted that September has historically been a negative month for Bitcoin.

Rekt Capital warned: “If Bitcoin also experiences a historically common 7% drop in September this year…it means that Bitcoin will fall to around $55,000 again.”

This article is sourced from the internet: Market tensions hit in September, and the trend is heavily dependent on data

Related: DePIN: Decentralized value network construction driven by dual curves

Hash of this article ( SHA1 ): b 5 be 995 ca 6 de 70 a 97 afdd 995 fe 484 dc 091 b 3 c 2d d No.: Lianyuan Security Knowledge No.011 DePIN (Decentralized Physical Infrastructure Network) is gradually realizing large-scale interaction between the physical world and Web3, and gradually subverting the operation mode of traditional infrastructure. Through the combination of sensors, wireless networks, computing resources, AI and blockchain technology, By using crypto-economic incentives to promote crowdsourcing development, DePIN is forming a decentralized value network. DePINs business model includes an important feature: hardware revenue is the first growth curve, and data services are superimposed on this basis. The superposition of these two curves is one of the key factors that enable DePIN to lead the growth of the current…