BTC Volatility: Week in Review August 26 – September 2, 2024

Key indicators (August 26, 4:00 pm -> September 2, 4:00 pm Hong Kong time) :

-

BTC/USD -9.8% ($63, 600 -> $57,400), ETH/USD -12.2% ($2,735 -> $2,400)

-

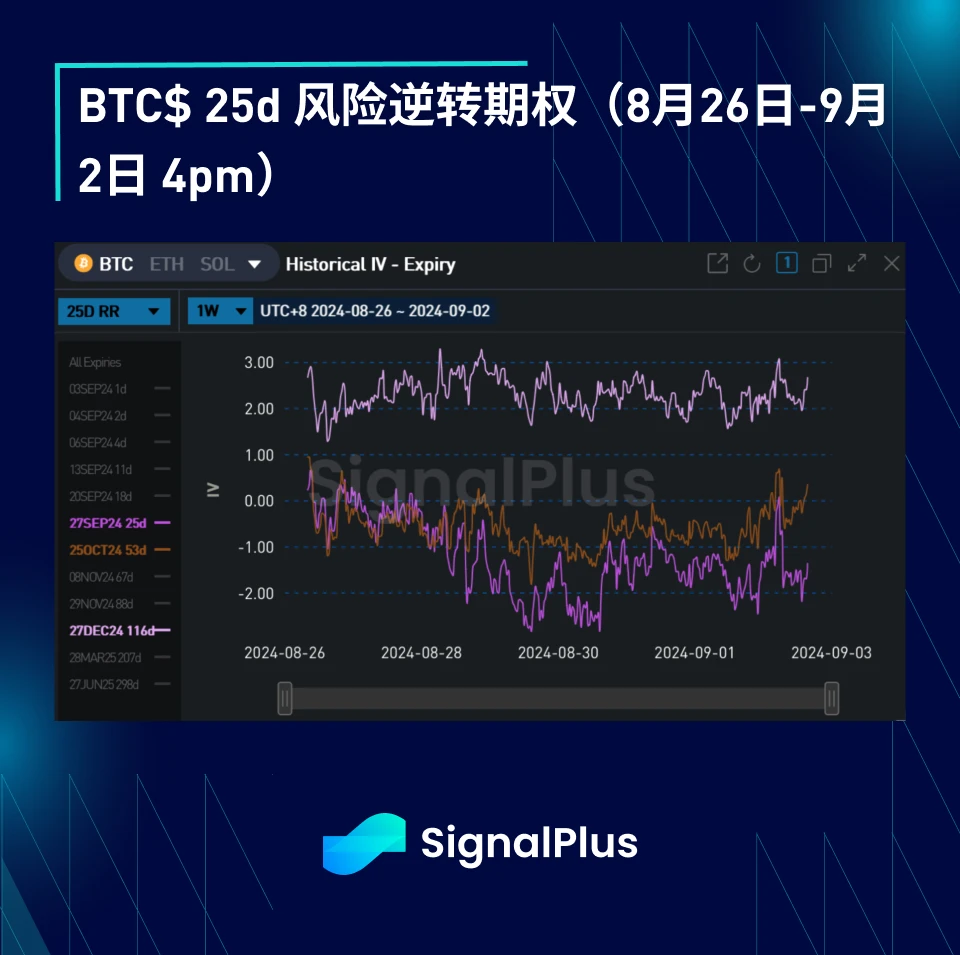

BTC/USD December (end of year) ATM volatility -1.4 v (62.2->60.8), December 25 day risk reversal volatility +0.2 v (2.1->2.3)

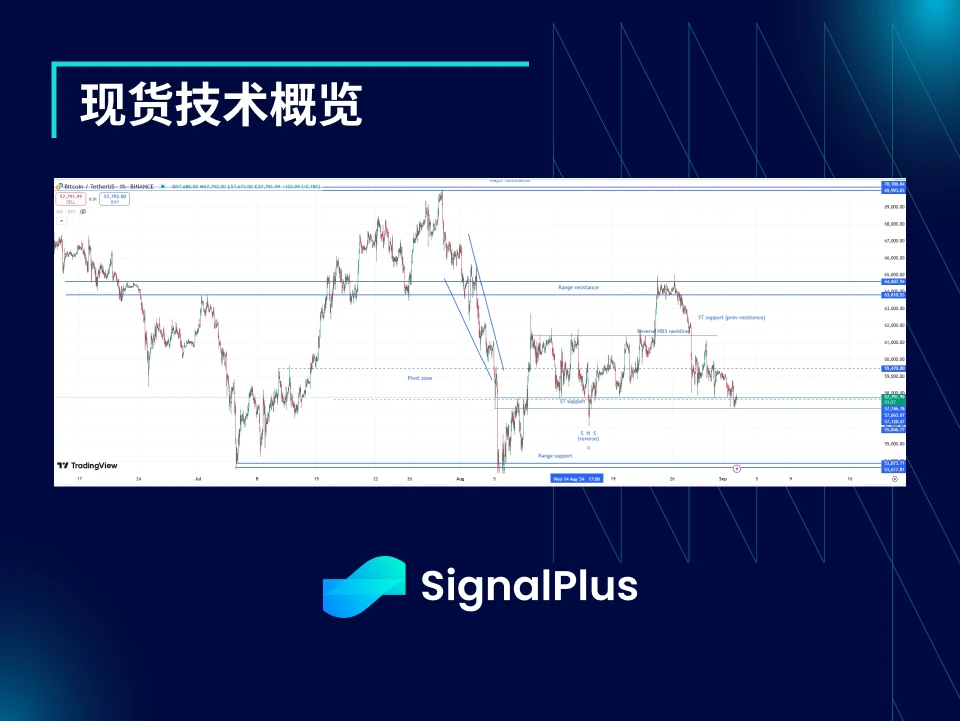

Overview of spot technical indicators

-

After an unsuccessful attempt to break through the $64-65k range resistance, BTC price quickly fell back to the short-term support level of $57k.

-

A break below $57k could trigger a steeper decline that could challenge the $53-54k price range support. We believe the risk-reward is likely to trade further lower in the very short term, but a strong reversal signal could form a solid bottom that could set the stage for upside momentum into the next FOMC meeting and the US election.

Market Events:

-

Overall, the market was relatively calm this week as market participants were still digesting the sharp fluctuations at the beginning of the month and enjoying the last days of summer before facing the US election and the busy schedule at the end of the year.

-

Cryptocurrency prices lack upward momentum, the US dollar still benefits from its higher yields, and the market has digested the Feds interest rate cut expectations. BTC/USD encountered resistance at the $64-65k resistance level and fell back below $60k. It may challenge the lower limit of the $50-70k range next. At the same time, ETH/USD continued to show weakness and failed to break through the selling pressure near $2800.

-

Betting odds in the U.S. show Trump and Harris almost tied, undermining the optimism generated by Trumps continued bullish rhetoric (although there has been some initial pro-cryptocurrency rhetoric from Harriss camp).

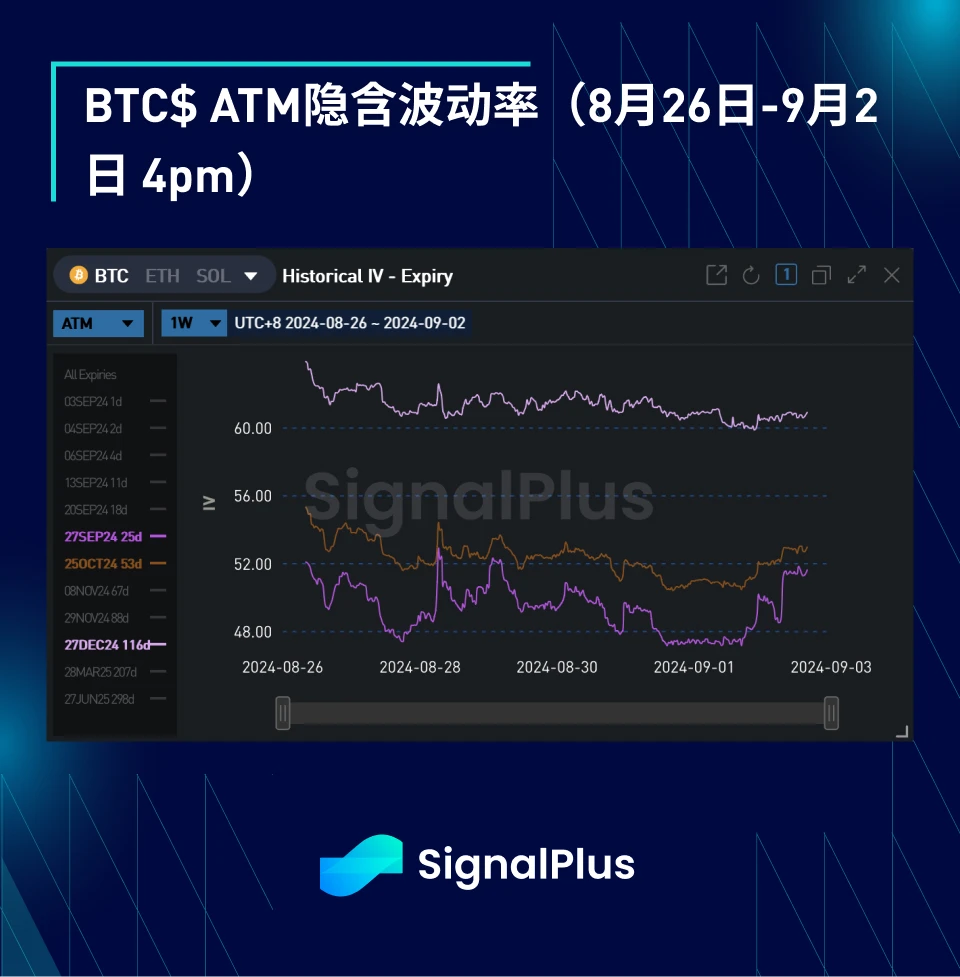

ATM Implied Volatility

Implied volatility was weak this week, mainly due to market participants selling call options to profit as spot prices rose.

Realized volatility was generally quiet after a quick retreat to $60k, which led to a significant drop in volatility at the front end of the curve, despite many important events in September. However, on Monday morning, almost all of the declines in front-end implied volatility were fully reversed, with spot prices challenging the recent low of the range at $57k.

There is continued demand for US election-related options, mainly in the form of rolling September/October call options into November/December. There is also some interest in September 18-19 FOMC meeting options, with some September 13 vs September 20 calendar spread options bought.

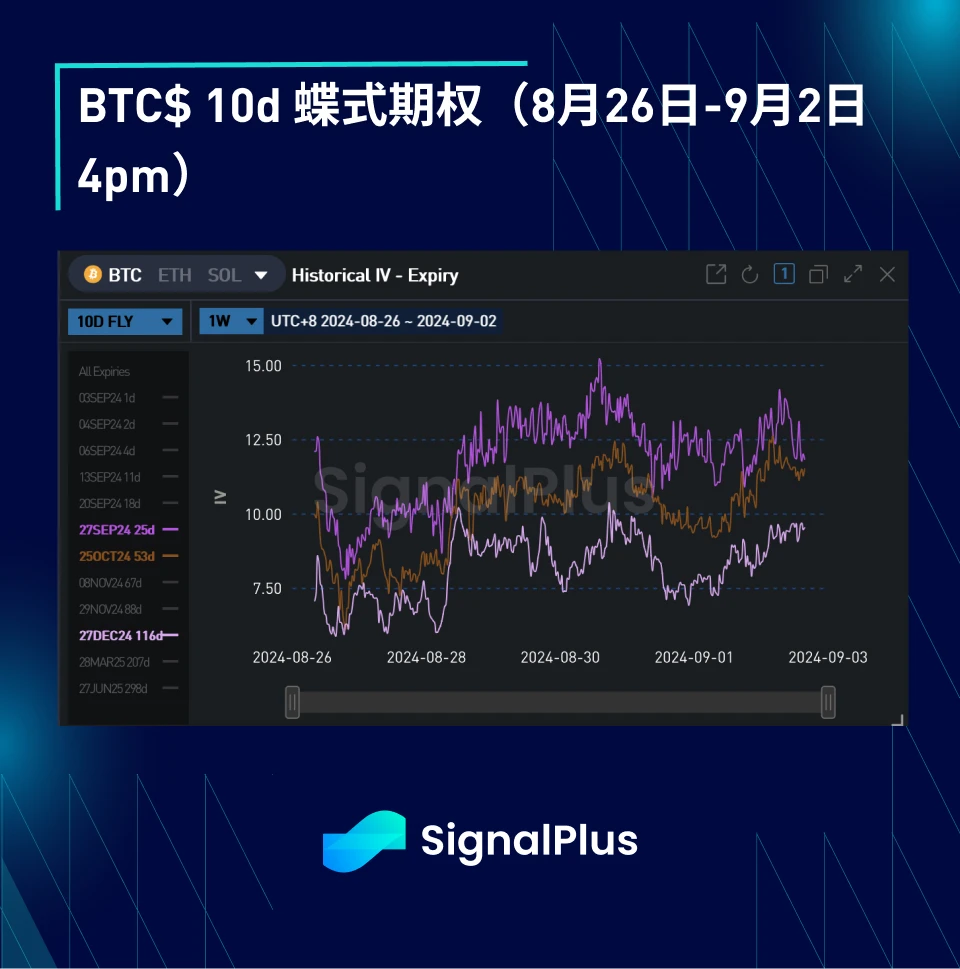

Skewness/Convexity:

-

The skew has stabilized this week after last week’s sharp correction; implied volatility has declined on spot pullbacks, while call selling pressure has eased over the weekend due to the downward spot price correction, easing pressure on the upper skew and butterfly options.

-

Butterfly IV rebounded overall after last week’s slump; we continue to believe volatility will rise as BTC challenges or breaks the $50-70k price range.

Good luck with your trading this week!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: BTC Volatility: Week in Review August 26 – September 2, 2024

Related: How to objectively evaluate Ethereums Layer2 strategy?

Original author: Haotian Recently, the voices of FUD Ethereum and @VitalikButerin have become stronger. In particular, overseas KOLs have had very interesting discussions on topics such as Blobs space utilization and Layer 2 revenue. Putting aside the emotions of the secondary market, how should we evaluate Ethereums layer 2 strategy simply by looking at the data? Next, I would like to express my opinion: Let鈥檚 go back to before the Ethereum Cancun upgrade. Everyone was enthusiastic about RaaS and DA War, because the layer 2 off-chain one-click issuance has sprung up like mushrooms after a rain, which will directly drive the demand for Ethereum mainnet DA capabilities in layer 2 Batch transactions, and then set off a price war for Blobs space. Then a large amount of ETH was destroyed…