Original author: @DistilledCrypto

Original translation: Vernacular blockchain

The altcoin market has experienced significant volatility this year, leaving many investors treading on thin ice.

However, with the US election and interest rate cuts approaching, the market may be in for major changes.

Here is a summary of the 2024 Altcoin Outlook Report:

1. There is no altcoin season

Many are disappointed that there has not yet been an altcoin season in this cycle.

Altcoins have been underperforming since November 2022, as shown by TOTA L3/BTC.

The ratio of the top 125 cryptocurrencies (excluding BTC/ETH) to BTC has dropped from 1.05 to 0.49.

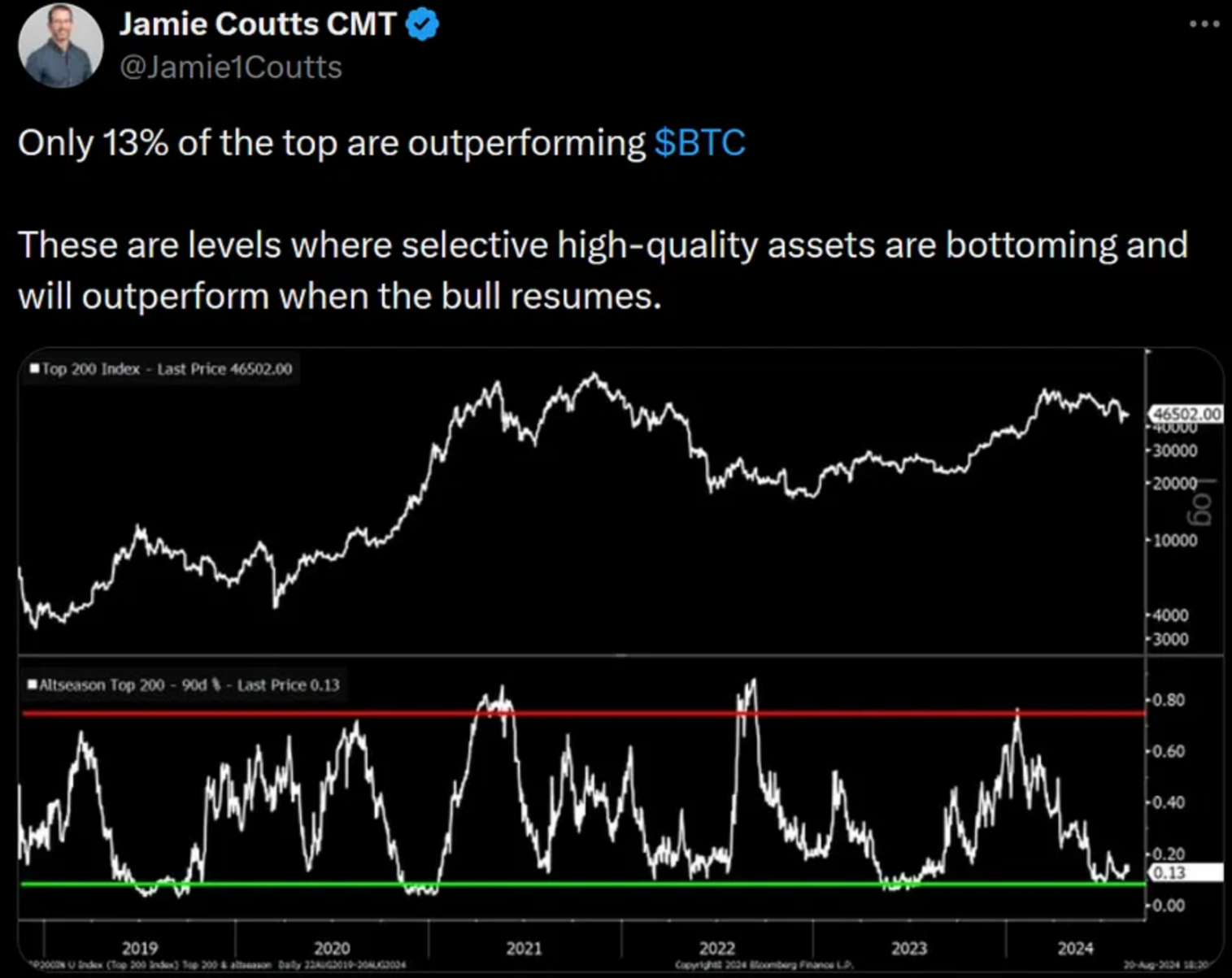

2. Market breadth is a concern

The market is currently highly concentrated and dominated by a few large-cap coins.

Only 13% of the top assets outperformed BTC.

Picking outperforming altcoins is as difficult as finding a needle in a haystack.

3. Key events that affect the market

Here are four key events that have impacted the performance of altcoins versus Bitcoin this year:

-

Spot Bitcoin ETF Debuts

-

Bitcoin Halving

-

Spot Ethereum ETF debuts

-

Ripple Partially Wins Lawsuit Against SEC

4. The end of the “altcoin season”

The launch of the US spot Bitcoin ETF is the most critical event.

While bullish for Bitcoin, this breaks the traditional “path of altcoin season”.

The brief altcoin rally was followed by a sharp drop.

The trickle-down effect of Bitcoin is seriously overestimated.

5. Macro uncertainty

Recent macroeconomic changes have significantly increased market uncertainty.

Rising unemployment, high interest rates and the yen carry trade are all important factors.

In this risk-averse environment, altcoins, which reflect consumer confidence, have performed poorly.

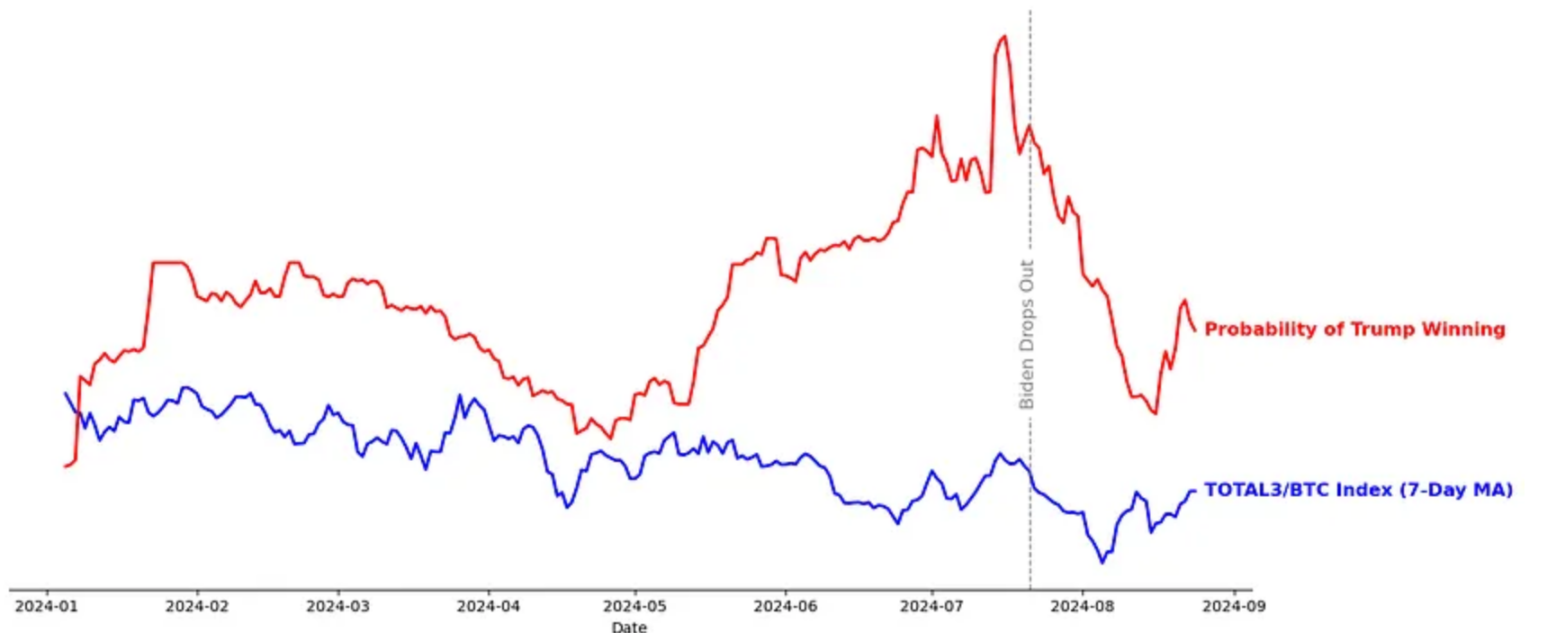

6. Trump Deal

Another important factor is the Trump deal.

It reflects market expectations about the possibility of a second Trump presidency, with a focus on pro-growth policies.

Small-cap stocks surged after Trumps 2016 victory, outperforming large-cap stocks by nearly 8%.

Trump Deal in 2024

With so many events this year, it’s difficult to pinpoint exactly how Trump’s trades will affect the market.

However, we can evaluate this by comparing the Polymarket predicted odds with the market index.

For example, the TOTA L3/BTC index shows little correlation with Trump’s odds.

7. When will the money printing begin?

A key indicator is the global M2 money supply, which suggests prices may eventually rise.

An increase in M2 typically boosts market liquidity and asset prices, including cryptocurrencies.

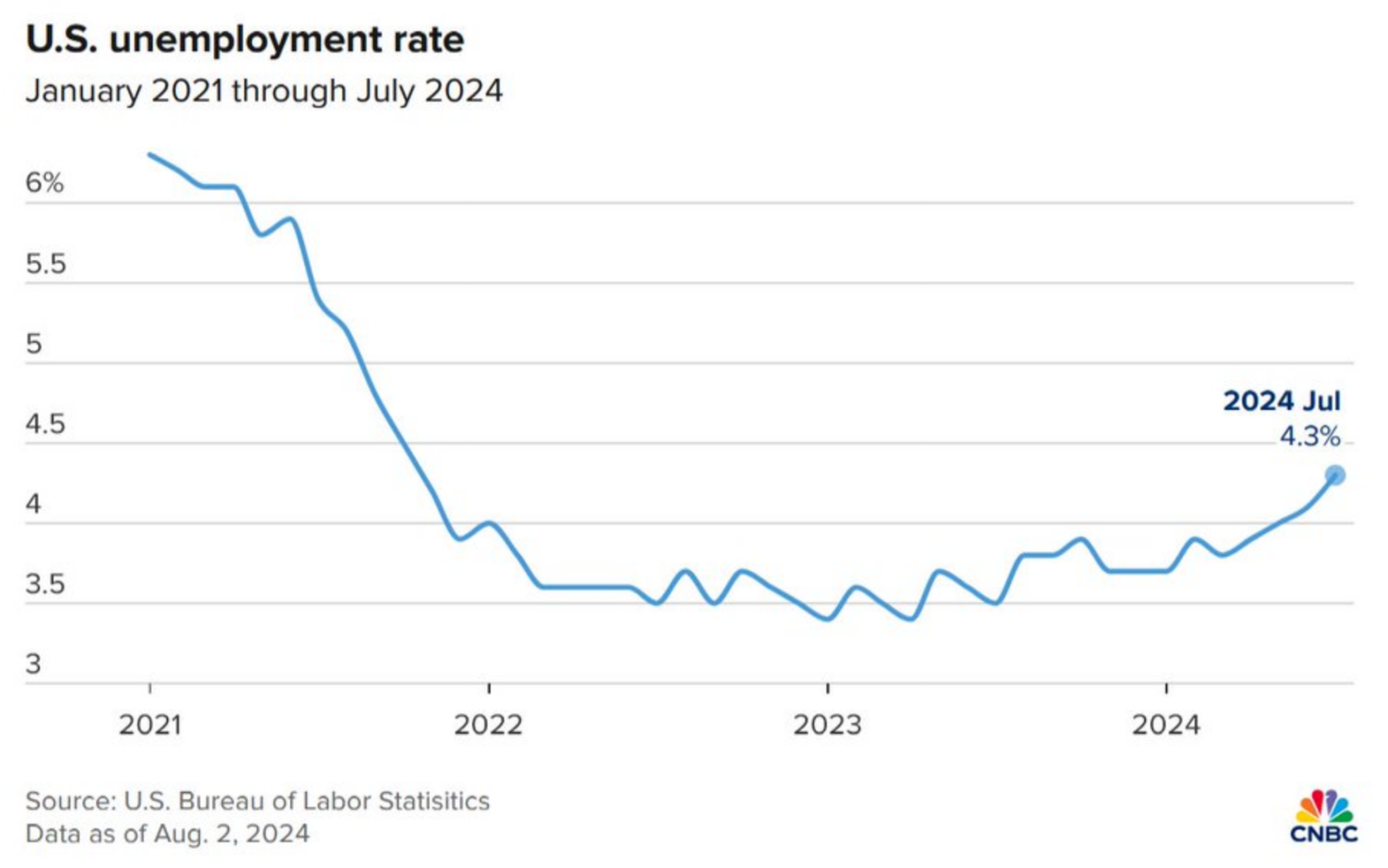

8. Unemployment and recession concerns

As the U.S. unemployment rate rose to 4.3% in July, Sahms rule signals the possibility of a recession.

In this environment, investors tend to move to safer assets, which can have a negative impact on altcoins.

Note: Trading based on macro data is difficult due to the forward-looking nature of the market.

9. Where to go next?

By the end of the year, if rate cuts stabilize the economy, Bitcoin’s market dominance could decline.

However, if recession fears intensify, Bitcoin’s market dominance could remain elevated.

In either case, expect differentiation between altcoins to increase (with due diligence).

This article is sourced from the internet: Will there still be a copycat season in 2024?

Original author: Christine, Galaxy Research Original translation: Ismay, BlockBeats Editors Note: As Ethereum gradually shifts to a Rollup-centric development roadmap, the importance of its protocol changes is gradually diminishing. This article delves into the reasons for this shift and its potential impact on the ecosystem. By analyzing the changing priorities of Ethereum protocol developers, the author reveals that as Rollup matures, the direct impact of protocol-level changes on users will decrease. The article also quotes the views of Aya Miyaguchi, executive director of the Ethereum Foundation, emphasizing the risks and necessity of reducing the roles of protocols and foundations. At the same time, this article points out that the core building blocks of future finance are being built outside of the protocol, and Rollup and other innovative technologies will gradually…

“If you’ve lost money fraudulently to any company, broker, or account manager and want to retrieve it, contact www.Bsbforensic.com They helped me recover my funds!”