Original title: Why is ETH Down so bad?

Original author: Ryan, David, Bankless

Original translation: zhouzhou, BlockBeats

Editors Note: This article discusses and summarizes Ethereums performance in recent years and future trends from multiple perspectives. Bitcoins market value and height have raised questions about Ethereums relative weakness, but Ethereums innovative potential cannot be ignored. ETHs price performance is affected by multiple factors, especially decentralization and Layer 2 operability issues.

Our discussion will focus on the value of decentralization on the Ethereum route, as well as the competitive advantage analysis of Layer 2 and platforms such as Solana. In addition, we will analyze the role of stablecoin issuers as a bridge to centralized exchanges. Driven by these issues, how the future development of Ethereum will evolve still requires our close observation.

TL;DR

Which is better, Ethereum or Bitcoin? : Ethereums $300 billion market cap puts its growth at risk of a gravity effect, and the ambiguity of its value capture mechanism further drags down its performance. He advocates dispersing value in productive assets rather than relying on unproductive assets such as Bitcoin or gold. He also emphasizes that the global nature and permissionless consensus of blockchains such as Ethereum enable it to provide a unified API to manage multiple assets.

Layer 2 Adventure: Solving the Interoperability Problem: The interoperability issues and independent standards between Ethereum Layer 2 solutions weaken the value capture ability of L1. It is a wrong decision for Ethereum to outsource MEV and execution to L2. KyleKyle is skeptical about the Rollup-centric roadmap and believes that the gradual growth of the L2 team will compete with L1 and lead to a breakdown in the partnership.

The secret of value capture: Ryan believes that decentralization is crucial in terms of censorship resistance and inflation resistance, and therefore supports the Rollup-centric route. Kyle believes that Ethereum should focus more on building a permissionless financial system, and over-optimizing node decentralization is not the best strategy, especially at a time when stablecoin issuers and centralized exchanges play a key role in connecting encryption and traditional finance.

Ethereum and Solana, who will win? : Explore the differences in values between Ethereum and Solana. Solana aims to become the worlds largest financial exchange, prioritizing user experience and permissionless access, while Ethereum focuses more on decentralization and the distribution of validators. Although Ethereum has advantages in regulatory status and human capital, limitations in system design may hinder the realization of these advantages.

The following is the original conversation:

David: Here, I want to imagine a scenario for Kyle: suppose all your assets magically turned into ETH, and now the only thing you hold is ETH. What would you do next? Welcome to the Bankless show, where we are committed to exploring the forefront of Internet money and finance. In todays show, we will explore an interesting question: why has the price performance of ETH been sluggish for at least a year. This is indeed a worrying issue. According to data, SOL/ETH has an annual growth rate of 300% in the past year, but the ETH/BTC ratio has fallen by 50% in the past two years, and the market value has been halved relative to Bitcoin.

Left: ETH/BTC ratio has fallen 50% in the past two years; Right: SOL/ETH has grown 300% in the past year

In order to find the answer to this question, Ryan and I asked around, thinking about who would be the most suitable guest to answer this question. Suddenly, we thought that Kyle Samani might be the best candidate. When we asked Kyle this question, it showed that ETH holders were indeed in trouble.

This episode of Bankless Nation is more of a listening opportunity. Ryan and I are going to sit back for a moment, listen to Kyle’s perspective and reasoning, and see what we can learn from it. Solana’s current price performance seems to indicate that Kyle’s investment thesis about Solana is more correct than our predictions in the early years of Bankless. We hope to dive deeper into why this is the case.

Ryan: I said something at the end of the show, and I want to repeat it again: This show may bring some frustration to ETH bulls in many aspects, but I think it is a useful reflection. We did this show because we thought it was necessary to hear the opposing side. I don’t think this discussion will be the end of the topic, so there may be more debates in the future, perhaps with Kyle, or others recommended by the community to explore Kyle’s points in depth and further refute.

I’m excited to introduce you to Kyle Samani, Managing Partner and Co-Founder of Multicoin Capital. Multicoin has been one of Solana’s largest investors and supporters, and they have been promoting the idea of integrated blockchain investing long before Solana completely redefined the crypto space.

Kyle: Hey, everyone. Great to be on the show.

What happened to Ethereum?

Ethereum’s “Midlife Crisis”

David: Let me give you a quick background, SOL/ETH is up 300% year-over-year, while ETH/BTC is down 50% over the past two years, and the Bitcoin to Ethereum ratio seems to have been falling for over 700 consecutive days. While there have been some days of rebounds, the overall trend is still clearly downward. Let’s talk about Ethereum first, and then discuss how Solana affects Ethereum’s valuation.

I want to start with Ethereum itself, assuming it is in a vacuum. When you see Ethereum price performance being weaker than its competitors, what is the first thing that comes to your mind to explain this trend that has lasted for more than a year?

Kyle: I think the most important variable is probably what I call gravity. Its hard to get a big asset to go up. Ethereum is worth about $300 billion right now. There arent many assets in the world that have a market cap of $300 billion, maybe 20 to 40. If you dont count commodities and just look at stocks, there are even fewer.

The law of large numbers is a phenomenon that exists, and like most companies or things, when they reach that size, it becomes more difficult to maintain massive revenue growth and profits.

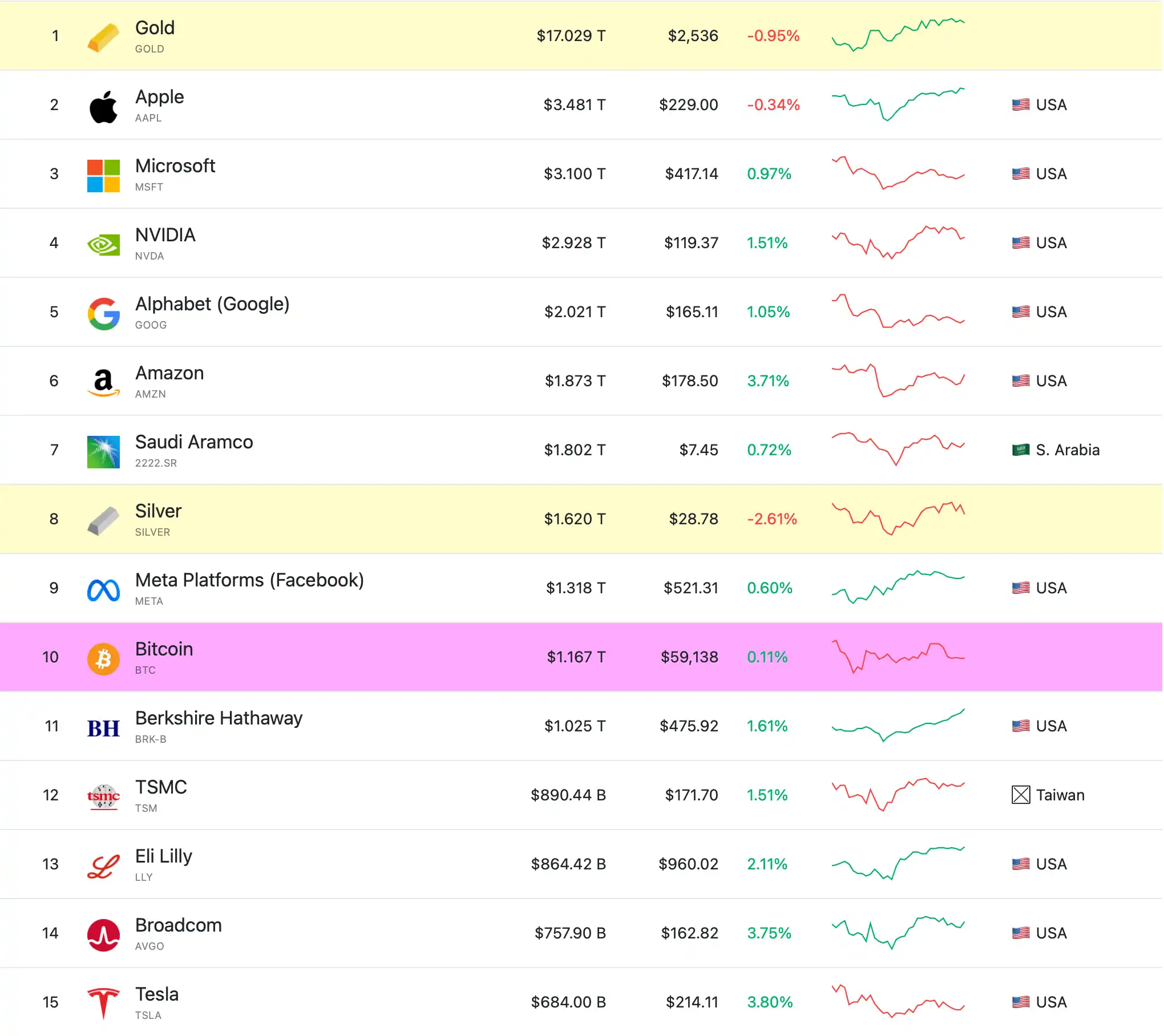

Ryan: Let me give you a data, Ethereum is actually the 34th largest asset in the world, and Bitcoin is the 10th largest asset. There are only 33 assets in the world with a market value greater than Ethereums current $320 billion. Just like Visas market value is about $400 billion to $500 billion, so they are roughly in the same range.

Kyle: I think what ETH holders may not realize is that it is very difficult to grow at this scale. There are exceptions, such as NVIDIA, which recently grew rapidly from $200 billion to $2 trillion, and you are fighting against gravity at this scale.

And then theres another part, which I tweeted a few weeks ago, which is: The larger the market cap, the more the market expects you to generate incremental performance in the future. Or to put it simply, someone making $200,000 or $500,000 a year, you expect them to be more economically productive than someone making $50,000 a year, and thats obvious.

The same thing applies to the market cap of a company, or a stock, or a token. You should hold it to a higher standard. So I think its very unusual for Ethereum to have a market cap of $300 billion, and its now the 34th largest asset in the world, as Ryan just said. If youre at this scale, you need to be very clear about the risks of supporting an asset of this size. In my opinion, Ethereums lack of clarity on the fundamental value capture mechanism is a very vulnerable point. I think this is also a big reason why ETHs performance has been dragged down over the past year or two.

David: Yes, any asset that reaches $300 billion or $500 billion, no matter what it is, will encounter some degree of growth difficulties, and this is not just an Ethereum problem. It just happens that Ethereum is at this bottom, and all assets will eventually go through this test of trying to break through the first trillion market value.

Kyle: Yes, but I dont want to think of it as a bottom, but its harder to grow from a base of 300 billion than from a base of 5 billion. This is mathematically obvious. The only real special case is Bitcoin, because the whole feature of Bitcoin is value storage. If you buy into the value proposition of Bitcoin, then it is indeed partially exempt from the impact of the gravity theory, not completely exempt, but at least partially exempt.

Ryan: Okay, so I want to dig deeper into this. While its an exception to the rule, I would say that this is also the expectation of many ETH holders, including probably ETH bulls like David and me. Bitcoin is now the 10th largest asset in the world and Ethereum is the 34th largest asset. Its market cap is currently $1.2 trillion. Bitcoin reverses external forces such as gravity or entropy that affect large market capitalization assets to reach trillions of dollars.

The top 15 asset rankings in the world by market value, data source: Global ranking

Bitcoin bulls think it’s actually on its way to surpassing the world’s largest asset, gold, which has a market cap of $16.7 trillion. I imagine a lot of ETH bulls are thinking, if Bitcoin can reach these heights, why can’t Ethereum? Because Ethereum is like Bitcoin, but better and more programmable. I guess this might get into your opinion on whether Bitcoin is really worth $1.2 trillion. But I’m still throwing this out there for your response. Why is this possible for Bitcoin but not for Ethereum?

Bitcoin ≠ Public Chain

Kyle: The whole value proposition of Bitcoin is that it is special. It is sound money, it was the first, it is simple, it does nothing extra, and the risk of error is low. Proof of work is objective, while proof of stake is subjective in nature. You can analyze this issue from many angles, but the summary is that Bitcoin is special.

But I dont think Bitcoin is special. I am in the minority on this point. Everyone else in the world thinks Bitcoin is special. So for now, I am not going to convince the world that Bitcoin is not special. I will challenge this view at some point, but now is not the time. But for now, I understand that everyone thinks Bitcoin is special. This is the reality. Dont hate the gamers, hate the game itself.

Ethereum and Solana are clearly not Bitcoin, they are not special like Bitcoin, thats very clear. Ethereum and Solana are often described as functional things, we talk about finance, or we are reinventing global finance and democratizing access, and other interesting things like asset issuance and tokens and so on. So, fundamentally, the lens through which Ethereum and Solana are discussed is that they are changing finance, changing the rails of payments. So if you look at companies like BlackRock, Visa, Stripe, they are clearly relevant to the discussion of these two major economic sectors. So its reasonable to think of Ethereum and Solana as tech stocks or growth assets that compete to some extent with these companies that I mentioned and others.

Therefore, I think it is fundamentally correct to think of Ethereum and Solana as stock-like assets, although not in the true sense of the word company, CEO, compensation structure, etc., but they are indeed like stocks in the sense of functionality, products, and meeting user needs, and thus generating cash flow.

Ryan: The same framework that David and I used in the past is that you have capital assets, which generate cash flows, like stocks, or real estate that has rental income, which are productive assets, which are capital assets. Then you have other types of assets, like commodities, which are consumer goods that are typically used in the process of producing other products. And then, finally, you have store of value type assets, which are special things in the world.

So you could say that gold is special because it doesnt generate cash flow, its not a capital asset, and its not a particularly important raw material in the production of other goods. Its primary value comes from people believing it has value. I want to quickly dig into this a little bit.

It sounds like youre bearish on Bitcoin at $1.2 trillion, and Im assuming youd be even more bearish if Bitcoin reached $10 trillion. So my question is: Kyle, for an asset like Bitcoin, if enough people believe its special, is that enough of a narrative and story?

If the crypto world believes its special, if Larry Fink starts to believe its special, if the new president of the United States starts to believe its special and puts it permanently on the balance sheet of the U.S. Treasury and starts buying it, if enough people think an asset is special, then it actually becomes special. Its a reflexive cycle that seems hard to deny, right? Does this explain the current $1.2 trillion market cap of Bitcoin? Do you question this kind of regularity that we see in asset markets? Do you think theres something wrong with it?

About the value of Bitcoin investment

Kyle: I need to counter one part of what you said, which is the discussion about commodities, capital assets, and stores of value. Commodities are different, like oil, wheat, etc., which are obvious inputs to the basic economy. We have capital assets, things that produce income, right? Then you mentioned that stores of value are independent. I dont agree that there should be a third type of asset because I dont think we need non-productive assets. The only exception is cash, because you need a unit of account to measure the price of things. People need to know that coffee is $2 instead of 4 bushels of wheat. It is useful to have an abstract, universal unit of account, and this is usually dictated by the government. Im not trying to fight the government, but I dont agree with the premise that stores of value should exist independently.

The basic argument that gold or bitcoin have value is that governments cant print any more of them. I understand the argument, but I think its a ridiculous way to look at a store of value because there are a lot of assets that are naturally inflation-resistant and produce yields. The most obvious example is Walmart and Amazon. If the price of goods goes up, they raise the price of their goods. Im talking about the retail business here, not the AWS business. Its not a perfect hedge because they may become more or less competitive with other retailers. But if you believe that, you can buy a basket of retailer stocks that are inherently inflation-resistant within the boundaries of their operations.

I think that inflation resistance like gold or Bitcoin is mainly based on meme. It is true that there is usually a certain positive correlation between the price of gold and inflation, while Bitcoin has almost no such long-term correlation. While gold may have such a correlation, I cannot explain why this correlation must hold unless we want to repeat the same transactions in the market, reaching trillions of scale, but I think this operation will eventually collapse. Therefore, I reject the premise of value storage as an independent asset class.

Left: Correlation between gold and long-term inflation, source: GoldPriceForcast; Right: Correlation between Bitcoin and 10-year Treasury bond rates, source: CoinDesk

I understand that others believe in the value of Bitcoin, but I personally do not think it is so valuable when managing my balance sheet. That being said, I do hold some Bitcoin, and the Multicoin fund also holds some Bitcoin. But intellectually, I am bearish on Bitcoin. I am not short it in actual operation, but intellectually, I am bearish on Bitcoin at $1.2 trillion, and even if it reaches $10 trillion, I will still remain bearish intellectually.

David: This investment strategy is a bit like Buffett, very value-oriented. I think you are more of a productive asset type, you understand value, and you invest with that frame of reference. You think the productive asset frame can swallow the value store frame, right?

Kyle: Yeah. By the way, I wrote a blog post in 2018 that was probably titled “The Path to $100 Trillion” or “The Path to Billions,” and that post discussed the store of value theory, the utility theory, or the stablecoin theory, about the path to get crypto assets to that scale. It’s interesting to reflect on this from the perspective of six years ago.

David: Another way to understand what youre saying is that you still believe that humans will want to store their value, its just that they will spread that value across two other asset classes, such as capital assets, and this will also be reflected in the prices of capital assets and commodity assets. We dont need a separate class specifically for storing value. I understand that this is your and Kyles view on this issue, and this is also Warren Buffetts view.

But its a bit like an atheist telling all religious people there is no God, you have to convince them. I think because the value storage is a very memetic, human consensus game, we will probably always have this demand. It may be the hardware setting of human beings. Even if you dont like it personally, I guess it shows in your fund that you are not going to short Bitcoin as a value storage, right? You can also understand why it goes up.

Kyle: I think at some point, we do get a big short on Bitcoin. Not in the foreseeable future, but long enough into the future, I expect well have a big short on Bitcoin. But thats still a ways off. I just sent you a link to the blog post called The Utility Hypothesis that you can include when the podcast comes out. Its six years old, so Im sure a lot of the terminology might read a little weird because its older, but I think it really captures the core belief that whats interesting about crypto is that we have a weird path dependency.

Bitcoin appeared, but it was functionally incomplete, with low transaction throughput, no DeFi and other features, and proof of work could not complete transactions quickly, which made it very difficult to build a functional financial system on Bitcoin. As a result, the story of Bitcoin became digital currency, hard gold, unchanging, stable things, so everyone thought that Bitcoin was special, and Ethereum did not appear until a few years later.

The idea of Ethereum is: we can make finance better, because it turns out that there are benefits to having heterogeneous financial rails for payments of different sizes, whether its ACH, credit card, or wire transfer, and different foreign exchange effects between countries. And then you have all the asset markets, bonds, stocks, commodities, all the things I just mentioned, and they are all managed on different rails. Each one has a separate database server and API, which is very heterogeneous and very complex, and none of them operate 24/7.

Obviously, time zones are a problem. So when you need to transfer assets across time zones, it becomes very slow, painful, and terrible. Cryptocurrency is inherently global, the API is permissionless, and you implement the core concept of ownership through cryptography. It turns out that when you have this permissionless consensus cryptography, you can represent assets with any API, whether they are commodities, bonds, stocks, equity, fake tokens, or meme coins. It turns out that it is much simpler to have a unified API to manage all assets, which is by definition truth.

So I think when we look back at the history of cryptocurrency 20 years from now, well find that when Bitcoin first came out, we thought it was digital gold, which was cool. But the real story is that we built a better financial track. It may take 10 to 20 years for the rest of the world to recognize that we do have a better financial track and start moving assets over. Were starting to see some signs now, like BlackRocks BUIDL fund, Hamilton Lane, and PayPals actions. Youll find that these signs are gradually increasing.

At the same time, I think this will be a story for the next 20 years, because the cryptocurrency track is objectively much better than the traditional track. As more and more activities move to the crypto track, there may be emerging areas like crypto games, or perhaps things like DePIN, which I think will definitely continue to exist, and most of these things will happen on Ethereum and Solana, or on some DeFi smart contract platforms such as Aptos and Sui.

At some point, maybe 5 or 10 years from now, most people in the world will look at Ethereum, Solana, Sui, Aptos, etc. and say, Wow, these platforms are clearly running the world in a very real sense. The worlds assets and finance will be represented on these systems. And when they look at Bitcoin, they will see that it is still the same as it is today, just a digital rock under your bed that does nothing. They will start to question why these systems have something in common, like their assets are no longer dependent on the DTCC (Depository Trust and Clearing Corporation) or the traditional financial world. They use the same terms, such as cryptography, permissionless consensus, etc. So people may ask, why is Bitcoin special, it does nothing, but is worth 2 trillion, 5 trillion, or 10 trillion dollars, while Solana or Ethereum is only about 300 billion or 50 billion? I think eventually people will realize that one of the systems is a superset of the other, one system is stupid and the other is useful. Eventually, this view will become a consensus. I dont think we are far from that moment.

Ryan: At that time, you would choose to short Bitcoin, not now, right?

Kyle: Yeah, Ill have to see how the discussion evolves. But I do expect to see a lot of shorting of Bitcoin at some point.

David: Based on this valuation framework and understanding of the future development of cryptocurrencies, why has the price of ETH performed so poorly over the past two years? There are many shortcomings of Ethereum that may be relevant here.

L2 Dilemma: Solving the Interoperability Problem Ethereum’s Shortcomings

Kyle: I think the most direct impact on price is probably the interoperability issue. The derivative effect of this is that a lot of people use Ethereum, and they hate cross-chain bridges, they hate paying high fees, they hate waiting for confirmation times to complete cross-chain transfers. Also, each asset ledger is independent. Your asset ledger on Binance is different from Coinbase, and it’s different from Ethereum L1, and it’s different from Arbitrum, Base, and Solana. These are all independent asset ledgers, and each system records what you own. On Solana, everything is convenient, and on Ethereum, it’s not the case. Of course, we have systems like Li-Fi that try to solve these problems, but for those who understand how Li-Fi or other bridge aggregators work, they have to pay slippage fees for it, which feels bad. So I think the experience of most crypto users today is that interoperability is poor and they don’t like it, and on Solana, they don’t have to deal with these problems. I think this may be the root cause of a lot of people moving their ETH positions to SOL, their actual experience when using these two systems.

Ethereum mainnet funds frequently migrate to various L2s every week. Data source: Dune

Ryan: ETH supporters might respond by saying, Yes, Kyle, Ethereum will solve this problem. There is actually a roadmap to solve this problem already. They might list a few different ideas on the roadmap, such as different Layer 2s creating their own superchains, integration between Layer 2s, shared sequencers, Rollup-based solutions. Vitalik once tweeted that we are actually very close to solving this problem, we just need to adopt some EIP-type standards to make the wallet experience smooth and make it feel like the same Ethereum chain. What is your response to this? Do you think Ethereum will solve this problem? Most ETH supporters will probably admit that this is a problem at present, but it will not be a problem in the future.

L2 interoperability challenges

Kyle: First of all, I don’t think there is a solution to this problem, because it’s obviously true that teams like Polygon, Optimism, Starkware, Arbitrum are all building their own interoperability standards within their respective ecosystems. I don’t see any standard that is universal across all of these ecosystems. I’m also not sure if it’s actually possible to implement a standard even if Vitalik came up with one, given the way assets are stored in underlying cross-chain contracts in systems like ZK-Sync, Starkware, Optimism, Arbitrum, etc., I’m not sure if it’s possible to make all of these systems interoperable as smoothly as Solana. I could be wrong here, but it’s really hard.

Even if such a proposal existed, there is no guarantee that it would be implemented, because you would need all teams to agree to implement it, and there is no guarantee that they would agree. So this is essentially a standards problem.

The problem with standards is that you have to get everyone to agree to the standard. However, there are obviously some obvious incentives for people not to agree to it. So I dont think its a given, even if its achievable in theory, in practice its very difficult because there are very obvious economic interests that hinder the implementation of standards.

The third point, and probably the most important one, is that Ethereum is nine years old. It just turned nine a few weeks ago. Thats a long time in terms of time. For example, SpaceX launched its first successful rocket in six years. I remember the first three failed, but the fourth one was successful, and it took about six years or six and a half years, and the total investment was about $100 million or $80 million. Musk only had $180 million at the time, and he was the only investor in SpaceX. Ethereum is nine years old, and its estimated that billions of dollars have been invested in the development of cryptocurrencies. So I think there is a basic anxiety that people are generally: guys, why is this taking so long? Weve been waiting here for so long.

Secondly, some features of Ethereum are not in production yet. I think if you are a $300 billion asset, dont just tell me, show it. Why should I believe you? When you have a $300 billion market cap behind you, this is the standard you have to meet. This is no longer a Devcon Zero thing where five researchers are running around in London.

David: You mentioned the actual user experience. This broken layer 2 interoperability issue is the first thing that users encounter when they touch the chain. Its in front of them, its the choice they have to face. So its like the part of the iceberg thats visible above the water. How much of a role do you think this user experience plays in the actual pricing, like the ETH/BTC ratio, the ETH/SOL ratio, the USD price of ETH? How much of an impact do users actually experience slippage on Ethereum and the friction of cross-chain bridging have on price?

Kyle: I think thats the biggest factor. The money in crypto, or the wealth in crypto, is using Ethereum and Solana. Obviously, in a sense, 100% of the capital was originally in Ethereum, not Solana. If you go back to before the Solana chain was launched, the ratio has basically been adjusted in one direction since the Solana chain was launched. I think the reason why capital moved from the initial 100% Ethereum to the current relative wealth distribution of about 80% Ethereum and 20% Solana is obvious because of the actual user experience.

I think it took a long time for people to come to two conclusions. One, to use Solana, there were enough NFTs, enough assets, enough things to play with, that it felt worth getting up, setting up a wallet, and starting to use it. Everyone has a different threshold for experimentation and different motivations to do these things. Two, finally clearly recognizing that the experience of one platform is clearly superior to the other.

Then looking at the Ethereum roadmap, although you can see that Ethereum has many advantages, you can’t understand how it can compete with Solana in the actual user experience. I think more and more people have realized this at different points in time over the past four years.

Ryan: As for Bitcoin, obviously different rules apply. Im not sure how many users are actually using Bitcoin Chain or Bitcoin wallets, but the experience is obviously not good. But people buy Bitcoin for other reasons.

Kyle: Yes, Bitcoin is special. Although I don’t agree with it intellectually, I understand why it is special socially.

We can go into the depths of Layer 2 issues for Bitcoin, and I think they are interesting and will have some impact, but I don’t understand how any Layer 2 solution for Bitcoin can compete with Solana or Ethereum in the long term.

David: That’s the discussion about Layer 2 interoperability issues. You know which one of these is probably the second biggest issue that has the biggest impact on the whole price lag?

Kyle: I think the second issue is the issue of data availability (DA) as a value capture mechanism, or you might phrase it as L2 capturing value rather than L1, or even parasitic. Ive said publicly many times that I think L2 is detrimental to L1, and I still stand by that view. We use software every day. If youre listening to this podcast, youre obviously using an iPhone or a computer or something. The actual experience that each of us uses software every day is that the marginal cost of software is almost zero, software is free, beautiful, and accessible, and this is the economic revolution of software – the marginal cost of software is zero – we all instinctively understand this.

Then blockchains came along and we discovered that you couldnt have marginally free software due to the scarcity of throughput, you had to have a fee market. This was obviously an economic imperative in the earliest days, especially when scaling was absolutely terrible. Bitcoin could only handle about 4 transactions per second, L1 was probably around 7. So given that the V1 versions of these systems were technically extremely inefficient, this was a necessity at the time.

Today, obviously we havent reached some theoretical state of perfection, transaction costs still exist, but transaction costs are clearly approaching zero. And the whole point of L2 is its cheaper than L1, which is obviously approaching zero. I think from a valuation perspective, I would model transaction costs as zero. Obviously today on Solana, Sui, Aptos, ETH, or other L2s, transaction costs are not zero. But from a valuation perspective, the intellectually conservative approach is to model it as zero because thats the history of the software, and the experience of using the software every day is that the marginal cost of the software is zero.

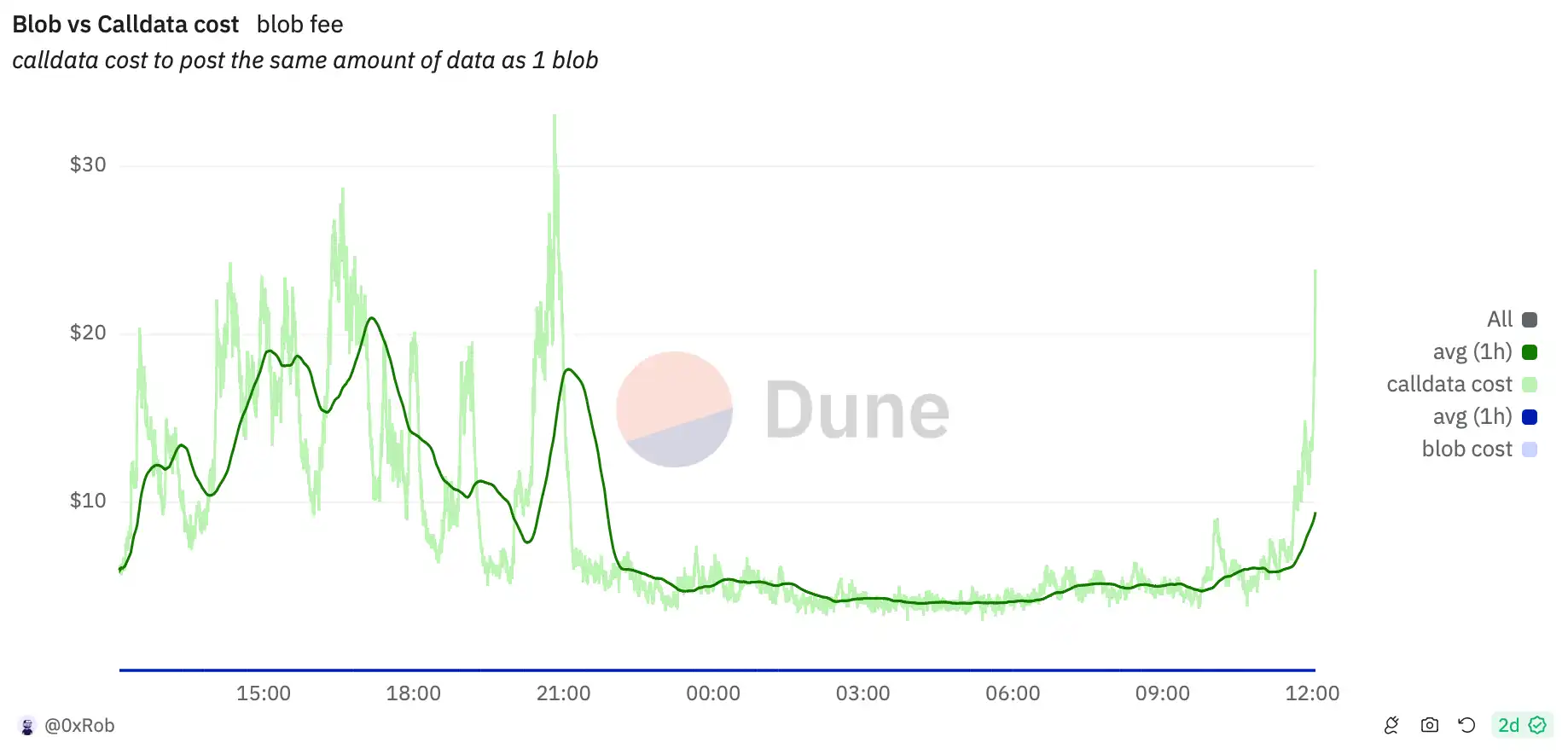

Comparison of Ethereum Call Data cost and blob cost after EIP-4844, data source: Dune

So I dont think execution or DA is valuable in this context. Maybe Im exaggerating a bit, the costs are not necessarily completely zero, but they are asymptotically approaching zero. Whatever the cost is, approaching zero means its financially negligible. If youre a market maker, you need to know how much gas you pay on your balance sheet, and thats fine. But for Solana and ETH holders and the valuation models for these assets, the conservative assumption is to model transaction costs as zero.

The only input that has a fundamental impact on valuation is MEV (Maximum Extractable Value). MEV is nothing more than a function of entropy in financial markets, which always exists in financial markets. The more assets you own, the more assets you trade, the more entropy and MEV there is, and this will always be true. Obviously, there are ways to mitigate the effects of MEV, and depending on the system design, you can direct the value capture of MEV to different places. A lot of people are working on these issues today in the Ethereum and Solana space.

But MEV will always exist, and I think MEV is the only value driver for L1 or L2 assets. And Ethereums L2 centralized roadmap very clearly abandons MEV.

You might say that a Rollup-based solution could solve the problem. I dont fully understand how Rollup-based solutions work, but from a path dependency perspective, I think its unlikely to be implemented. Because now we have these huge Layer 2 teams that have raised a lot of money, have resources, brands, and assets, and they are attracting customers, whether its Base, Arbitrum, or other teams. They are unlikely to give MEV (maximum extractable value) back to Ethereum L1. So even if the Ethereum Foundation launches a Rollup-based solution and provides some excellent libraries and calls on everyone to use these Rollups, the leading teams that are currently building L2 will not choose to join this solution because it will destroy their own revenue. So to answer your valuation question, this is the core.

David: Exactly, and I don’t think anyone can deny the cash flows coming in from places like Arbitrum’s Treasury or the Optimism Collective. We discuss the revenue that Coinbase earns from Base at least once a month in our weekly reports. As to whether or not that revenue is being “stolen” from Ethereum L1, that’s probably a question worth discussing. ETH bulls might explain it this way: We’re creating induced demand, and this is newly created economic activity for these Layer 2s, and Ethereum wouldn’t have been able to capture that value otherwise. But there’s definitely a one-way flow going on.

ETH bulls might think that we have Base, Arbitrum, Optimism, and soon we will have all the ZK EVMs like Polygon, ZK Sync, and eventually Ethereum will become a blockchain of blockchains and generate a lot of entropy. You look at Optimism and Arbitrum, maybe they are fragmented, but they are still growing revenue and have positive cash flow. ETH has value just by generating this network. This may be a simplified argument for Ethereum, although it is not perfectly expressed, but how would you refute it? Or do you oppose this point of view?

How does L2 suck the blood of ETH?

Kyle: Yeah, first of all, youre not capturing MEV. MEV is all flowing to all L2s, and thats my fundamental problem. I think transaction costs will eventually go to zero. What is an Ethereum transaction? About 50 bytes of data? 100 bytes of data? In terms of the price of a 1 TB hard drive you can buy, thats almost a rounding error, close to zero. Yes, you have a 1,000x or even 10,000x replication factor on the network, but it doesnt matter because it still costs close to zero. So I dont understand how transaction fees can support $300 billion in asset value.

The generic response is “ETH is money”, and I want to say, okay, but you didn’t tell me it’s a special thing, like Bitcoin is. While this argument is not entirely self-consistent, the problem is that there is enough social consensus around Bitcoin that it is a special thing, and Ethereum has competition. Solana, Aptos, Sui, etc. are all saying, “Look, my system is better.” You may not agree that they are better, but the problem is that enough other systems exist that explicitly reject the “ETH is a special thing” framework because these systems are functionally equivalent. This proves that ETH is not a special thing. I don’t think anyone thinks ETH is a special thing like Bitcoin.

David: I was going to mention the theory that Polenya developed that all execution would move to Layer 2 and then ETH would become the unit of account in all of these Layer 2s. Even if Ethereum L1 doesnt capture much value, the value of the unit of account as a currency still exists. They would say that currency is the greatest value. But weve been talking about this for 20 minutes and you clearly dont accept this valuation. So are you opposed to a Rollup-centric roadmap as an architecture?

The false proposition of Rollup-Centric?

Kyle: People can use Rollup, and Rollup may indeed have its uses, and the most obvious use may be on PerpDex (perpetual contract decentralized exchange). So I am not fundamentally opposed to their existence. There may be some very specific applications that can intelligently utilize them. Whether this is the case remains to be seen. To me, the most obvious category is PerpDex. So they may exist. But betting all on the Ethereum roadmap centered on Rollup, and in particular making a series of design decisions to abandon the expansion of L1 and push activity to L2, I think this is a catastrophic mistake.

Related reading: From theory to practice: Can Based Rollup realize the L1 sorting-driven Rollup solution ?

We don’t know if the Ethereum Foundation will try to retract this decision or try to reverse course slightly, now that this issue is clearly being discussed in public view.

But even assuming that they take relatively radical steps and really try to turn things around and say, Come back to L1, were going to solve all these problems, I think the ship has already sailed away from the dock anyway. Now these other teams have clear incentives, and if the Ethereum Foundation says, Come back to L1, the L2 roadmap is no longer being implemented, then all the L2 teams will now be in direct confrontation with L1. At the moment, they may still be pretending to be at peace, such as ETH is our common goal, but I always think that this is nonsense and I dont think its true. But its true that they are still pretending to be friendly at the moment. If L1 wants to make up for the lost ground, that superficial harmony will disappear.

Ryan: Kyle, I want to summarize your point, from my perspective, your statement is internally consistent. You are basically saying that Ethereum L1 outsourced all MEV and execution to L2, and this was a wrong decision.

Kyle: Yes, sorry, I want to add an important point, it’s not just MEV, it’s state. The source of MEV is state, and state is directly linked to fungible assets. This includes stablecoins, Aave, ETH, as well as NFTs, liquidity provider positions, lending, and so on.

Ryan: Ethereums state, especially the execution state, is clearly moving off L1 and onto L2. This includes smart contracts and assets, all of which are sources of MEV. Ethereum outsourced these to Layer 2, which was a bad decision because if you think of these assets as cash flow assets, all the value comes from block ordering, which is MEV and execution. So the core of the game is which chain can get the most state to extract rent, which is MEV, and give it back to the asset holders. This is what makes the asset valuable. And Ethereum woke up one day and decided to hand over this cash cow to other chains, which is a bad decision in your opinion.

Even if they try to reverse it now and Ethereum decides, “We did this L2 thing, now we’re going to bring execution back to mainnet, we’re going to embed some ZK EVM or something like that.” Your point is that now you’ve given enough power to other chains that they don’t actually want this to happen, and they’re in an adversarial relationship with L1. So it’s going to be a very difficult problem to solve. Again, this is not something that’s on the short-term roadmap. And you don’t believe ETH is money, you don’t believe there’s a monetary premium on any asset, whether it’s gold or crypto or anything else, and you don’t accept the argument of ETH bulls that Ethereum gave up this temporary cash flow position in exchange for a monetary unit position in the Ethereum economy. So what is the Ethereum economy?

Its all these Layer 2s, and ETH as an asset will have a special status in these Layer 2s because they have to pay settlement fees, DA fees in ETH. In other words, its like a tax. Its the only neutral currency that is decentralized in these systems, so it will be elevated to the status of getting a monetary premium. You think all this is nonsense because there is no so-called value storage or monetary premium at all. Am I understanding correctly?

Kyle: Yeah, and one more thing to add is that money is what you use to buy coffee. If you ask the average person, what is money? Forget all the intellectual explanations of unit of account, medium of exchange and store of value, they will say, I dont know, its what I use when I go to the coffee shop to buy coffee. In this very basic sense, ETH will never be money because ETH fluctuates relative to the US dollar. If we were talking about a world where the US dollar no longer existed, I would say, Well, thats a different world. You can talk about the state of that world, but Im not interested in that world, and I dont want to live in that world. I think we would have a lot of big problems in that world.

ETH is not money, assuming at least the existence of the US dollar. It is psychologically dissonant for the average person to measure their daily expenses in an asset that fluctuates relative to the asset they consider wealth to be denominated in (the US dollar). This is actually further reinforced by long-term contracts where the liabilities are denominated in a fixed unit of account. The existence of long-term contracts actually creates a network effect for money. This is also why we see efforts like China trying to denominate oil in RMB.

Daily living expenses, especially major commodity inputs, are not denominated in ETH, which means that even if you choose to say ETH is money, it is incorrect from a financial perspective to denominate your wealth in ETH because you are ignoring all the other realities going on around you.

David: So I think these two topics that weve talked about, the first one is the issue of Layer 2 interoperability, the actual experience of users, and the second one is that Layer 2 is not part of Ethereum, they dont contribute to the value capture of ETH, these two topics actually go together very well because they are about user feelings and investor valuations respectively. When you combine these two factors, how much do you think they explain the whole story? I also listed four other factors, but if we only talk about these two factors, do you think they explain 80% of the lag in ETH price over the past two years? How much do you think these two factors account for?

Kyle: Yeah, between 80% and 90%, probably explained by those two variables. That sounds about right.

David: OK, Kyle, I want to give you a simulation. All of your assets magically become ETH. The only thing you hold now is ETH. This is not a dream, this is a nightmare. What would you do next? What changes would you like to see in the Ethereum roadmap? How would you like to see the future trajectory of Ethereum change?

David: Wait, Kyle, in this simulation, are your assets locked up? Do you have to hold them?

Ryan: Yeah, he’s locked in. You can’t sell it, Kyle, for 10 years.

Kyle: In that case, I would ask Vitalik to re-assume the role of benevolent dictator and try to establish an interoperability standard, find a way to get all the L2 teams to agree on a common interoperability standard. That would be the first goal. And then I would – no, I take that back, thats not true. I would find a way to scale L1. I dont know how Vitalik and the Ethereum Foundation core team would deal with this technically, and Im not here to prescribe technical prescriptions for them because they know more technically than I do. But I would tell them, find a way to solve it, you need to solve this problem now.

And then I would tell them, go talk to your customers. Mark Zeller was on the Bell Curve podcast recently, which I just listened to yesterday. He said in the podcast that he had never talked to anyone from the Ethereum Foundation, he had never talked to Vitalik, they had never contacted him. And he is the person who mainly manages Aave today, and Aave is the largest application on Ethereum, with about $20 billion TVL in terms of the total amount of funds in the system, which is a huge number. I find this completely incredible. How can the core people who are supposed to be building the future of Ethereum build it without communicating with the core users?

Related reading: EF has no dreams

Aave and Uniswap are the two most important projects in my opinion. The Solana Foundation has very distinct teams, like the DeFi team, the decentralized infrastructure team, and the stablecoin team. They have a clear division of labor for designing interfaces with various stakeholder groups. They listen to what needs to be built. You can see very clearly that the token expansion and other things that these feature teams have launched are a direct reflection of the work of the Solana Foundation. So I would tell the Ethereum Foundation to talk to your customers, listen to them, and figure out what they want.

I think it’s safe to say that if you did that in 2020, Aave would be like, “Wait a minute, you’re going to have 10, 20, 50 instances of Aave? They’re going to have their own separate collateral pools? This is going to be really weird and confusing.” If you told Uniswap, they’d be like, “Wait, I’m going to have an ETH/USDC XYK curve, but I’m going to have 50 of them instead of just one.”

They might say, What are you talking about? This is not good. Maybe you will eventually choose to go down the L2 roadmap, I dont know, but I can tell you very objectively that from the perspective of these two applications, they will feel that this is detrimental to the functionality of their applications. Now, you can choose to ignore their opinions, but the problem is that even this interaction has not happened, which I think is a very serious problem.

The Secret of Value Capture

Decentralized Finance vs Open Finance

Ryan: Kyle, I think theres a key reason behind this that maybe Id love to hear your thoughts on, and thats the word decentralization. I completely agree that its a very emotionally charged word, and sometimes theres a purity test that comes with it. However, its not a useless word because it does have some functionality in terms of maintaining censorship resistance, inflation resistance, or some kind of corruption resistance. Those are really valuable properties that I think derive from the concept of decentralization.

If you talk to an Ethereum supporter or the Ethereum Foundation about the decision they made when choosing a Rollup-centric roadmap, their answer will be related to decentralization. They will say that we are trying to maintain a decentralized validator set and cannot let the node requirements become too large. Tasks such as execution and state are very heavy, so we have to outsource these tasks to Layer 2 and let them use Ethereum as a data availability layer. We all know how this got to this point today.

When we were talking about Bitcoin earlier, you described the use cases for blockchain, and Ethereum promised a similar world. I remember when I was talking to David, a phrase that popped into my head was: Kyle is a big believer in open finance, but Im not sure he believes in decentralized finance. I mean, were talking about a world with open financial APIs, where all applications and infrastructure can talk to each other, but Im not sure if the world youre describing is decentralized and has the kind of embedded property rights that Bitcoin holders describe, which cant be censored or taken away by the state. I think what youre describing is more like a NASDAQ + all traditional finance world, with a permissionless API that everyone can connect to.

So I think there may be some vision differences here, but Id like to hear your response to this line of thought. What do you think of the decentralization embedded in Ethereum and the concept of decentralized finance (DeFi)? What do you think of true decentralized finance and open finance?

DeFi, Fiat Currency, and Inflation

Kyle: I agree with your basic diagnosis that this is a difference in values. Both Ethereum and Bitcoin have a set of values. There are many promises of Bitcoin, such as censorship resistance, transaction inclusion, etc., but the core promise of Bitcoin is the fixed supply of 21 million. If you want to summarize Bitcoin in one word, it is 21 million. Bitcoin explicitly provides the strongest guarantee of future monetary supply and inflation policy. If you put it in quantitative terms, Bitcoin provides close to 100% certainty of future supply schedule. Of course, it cant reach 100% because there may be bugs in the system or some unexpected situation, but we can say that it provides a very high certainty.

Bitcoin provides a stronger guarantee on the finality of its supply schedule than any asset in human history, including gold, because we don’t know how much gold there is on Earth, and we don’t know if we will ever mine gold from asteroids. Therefore, Bitcoin provides a higher guarantee on its supply schedule than any other asset, and this commitment is very clear.

Left: Gold supply growth trend to M2, source from Vaulted; Right: BTC supply growth trend, source from newhedge

However, I take issue with this because I dont think its necessary to optimize to near 100% supply schedule assurance. Every additional nine of certainty you provide is 10 times less important than the previous nine, as you asymptotically approach 100%. I dont know if the right answer is two nines, three nines, or four nines, and I dont care.

I think both Ethereum and Solana today offer somewhere between two nines and four nines of certainty about future supply schedules. Yes, Ethereum may offer higher certainty about future inflation, given the burn mechanism and other factors, although you cant be sure about the other side, but if we ignore the burn part and just talk about the inflation part, Ethereum may offer higher guarantees than Solana. I agree with this statement. I think they are both between two nines and four nines, and I think thats enough. Its not necessary to optimize the guarantees of the supply schedule, and this is the wrong direction to optimize.

There does need to be a foundational layer of finality, otherwise were back to fiat, where you can print money and stuff like that, which is obviously a bad situation. We have to put all of this in the context of values. Bitcoins values are clear, and Ethereum and Solana, I think, are in that range, two nines to four nines. The question then is, what are the core values beyond the supply schedule? It seems like the core value that drives Ethereum is the decentralization of the validator set. If you wanted to sum it up in one word, you might call it independent staking or family staking or something like that. Im not sure if thats entirely correct, but based on my understanding, its probably a fair description.

Ryan: I might also add that properties that are related to this would be things like censorship resistance and invalid state changes.

Kyle: Of course, censorship resistance and invalid state changes are mechanically very different. L2 today is clearly a single entity that controls all censorship, and while they may change to see if they can figure out decentralized sorter clusters and so on, as of today, L2 is clearly an N-to-1 structure. I dont want to get hung up on the semantic details of these, my point is that it seems like the core value proposition of Ethereum is maximizing the number of nodes, and this includes home stakes for L1 chain validation. This is a value that can be optimized. If your goal is to win, I think its the wrong value to optimize.

At the core of these systems is the financial system. Weve been building a decentralized NASDAQ since day one, and what were doing here is building the best, most permissionless, most accessible financial markets in the world. A byproduct is that you can also make payments, because what are financial markets? Its like two atomic payments in one transaction. So payments are implicitly included in financial markets that are accessible to everyone in the world.

Solana is very explicitly trying to be the worlds largest global financial exchange in its design decisions, providing permissionless access and cryptographically secured asset ownership. These are two different values. One is about the validator set, which may provide certain guarantees, perhaps about censorship resistance, although given the L2 roadmap, this is not the case. It may be about guarantees of valid state transfer, which is fundamentally and correctly rooted in the goal of increasing the number of validators.

The other is our goal of building the best atomic state machine so that everything for all financial markets magically works in a single state. So one is a user-centric functional view of what users want or what we think they might want, and the other is a more abstract notion of censorship resistance and validity of state transitions.

The last thing I want to say is that Bitcoin provides the so-called nine nines certainty of future supply schedules, which I think is unnecessary. You could say Ethereum is optimizing for the so-called nine nines state transition validity guarantees. This is an intellectually and academic way to think about the world, but I think its the wrong way.

The point is that the most important actors with respect to the validity of any chain state are the centralized entities that interact with the chain.

A bridge between stablecoin issuers and CEX

Mainly stablecoin issuers and centralized exchanges, because they are the entities that accept user deposits, debit user accounts, and then allow users to withdraw fiat or other off-chain assets. So these entities are very important in the operation of these systems because the traditional fiat system will be around for a while. Maybe not 50 years, but at least for the foreseeable future, like at least 5 years, maybe 10 years, even 20 years, or even longer, these systems will be around. And most of the worlds wealth will still be denominated in these systems. We have this cryptocurrency thing, and obviously crypto is growing. And the bridge between these two things is very important, and the two most important stakeholder groups are the stablecoin issuers and obviously the CeFi exchanges that provide these bridges.

Coinbase runs nodes to accept your deposits and eventually allow you to withdraw dollars to your bank account, or Circle runs nodes to accept stablecoins, and if you want to exchange them for dollars, they will send you dollars. Coinbase and Circle dont care how many other nodes exist, they only care about how the state of their local node is represented in consensus. The business logic of all these organizations is clear. They have some Web2 database that records everything, and then they say, Wait, my local blockchain node tells me what the state of the Solana network is, or the Ethereum network, or the Arbitrum network? They use this information to decide what assets will go in and out.

Of course, they care about consensus because the state needs to be updated, so you do care about that 2/3 threshold of getting consensus finality, but once you get consensus finality, they don’t care if there’s one other person or five other people or five thousand or five million people who agree with them, as long as they know they’re at the tip of the chain and that these people are the actual bridge to the real world.

So I think optimizing my ability to know my effective status at home is the wrong variable to optimize, especially given the need for a bridge back to traditional finance.

David: Kyle, I remember going to the Solana Breakpoint event in Amsterdam a while ago, and that was my first deep dive into the Solana community and what Solana developers are like. Understanding the archetypes of these different crypto tribes is one of the most interesting things that this crypto industry has to offer people, like the Bitcoin community, the Ethereum community, and now the Solana community. Solana developers are more business-oriented, they understand their customers, and they communicate with their customers, and as you said, they do a very good job of that.

However, developers on Ethereum, such as Rune Christensen, proposed that part of the new path for MakerDAO, the “Endgame,” is to launch a brand new blockchain that leans toward centralization. On the same day, Vitalik sold all of his MKR, indicating that he disagreed with these choices.

Vitalik once wrote an article called In Defense of Bitcoin Maximalism in which he talked about how the Nine Nines of optimizing security are like Galadriels light, which is the light that illuminates the darkness for you when all other lights go out. So I think this may be a difference in values between Solana developers and Ethereum critics.

Ethereum’s critics might say that Solana only works when things are good, but when things get bad, you need Ethereum, you need those “nine nines” of network security because those additional security guarantees will determine whether the network and its upper-layer applications actually work.

Ethereum and Solana, who will win? Differences in values

Kyle: Okay, let me reflect on that discussion a little bit. Actually, this goes back to what I said earlier about Coinbase and Circle. Lets talk about the crisis, for example, after the FTX incident, did Solana have fewer validators? The answer should be yes, although I dont know exactly what the specific situation is, but lets assume that the answer is yes. Did the market value decrease? Obviously it decreased a lot. TVL (total value locked) has dropped a lot. The issuance of stablecoins has also decreased a lot. A lot of Solana was unlocked, and if you look at the period of December 2022, this actually caused a lot of FUD (fear, uncertainty and doubt) on Twitter, and there were concerns that a lot of Solana was unlocked and people might sell it. We were also worried internally at the time, oh my god, a lot of Solana is being unlocked, will there be consensus problems? Will consensus fail? Will there be some kind of chain reaction collapse? But in the end, nothing happened.

So my point is that optimizing for ability of independent stakers to stay home is not a functionally useful goal. Of course, you want the code to be bug-free, you dont want the system to crash and malfunction. If there are factors about unlocking speed that might affect consensus security, you need to understand those factors. Ethereum has a more stringent framework for this than Solana, and Solana has almost no framework for this and is actually very primitive in terms of unlocking and consensus security. But at least so far, experience has shown that it doesnt matter. Maybe in some future crisis this will change, I dont know. But we obviously went through a crisis and it didnt affect anything.

What really matters is the perception of the CeFi bridge, which is actually the right anchor for trust in blockchain, which is a bit counter-intuitive, especially for people in the crypto community, because we all want to believe that our consensus is endogenous and based on our cryptoeconomic security systems and consensus mechanisms. Mechanically, this is obviously true because the network must reach consensus and consensus is strictly an endogenous function of the state of the network based on the proof mechanism. But it is not enough because these systems do not exist in isolation, they exist on the earth in 2024, and the vast majority of economic activity still occurs on the old track. The bridge from the old track to the new track is critical to the operation of the new system. Those participants are what matter.

Going back to the question of values, you can optimize for those values, which is great, but I just dont think thats a functionally relevant set of values. I think most of the empirical evidence would support my view. Sure, you can say there are some weird tail risks and so on, and thats true, and you can keep pursuing more nines to reduce the risk of asymptotic failure. But at the same time, you have to ask yourself, should we sacrifice functionality, value capture, and the flexibility of the entire ecosystem for the guarantee of a fifth nine, a sixth nine, or a seventh nine? Is this the right direction to optimize?

Ryan: This has been a great conversation, and I can already imagine the Twitter feed after this episode airs, and there will definitely be a lot of ETH bulls who are very upset that David and I didnt refute it in a timely manner on the show. But I think the purpose of this episode is to hear your views, because the current situation in the market, at least in this cycle, shows that ETH is squeezed between Bitcoin and Solana. Bitcoins narrative emphasizes its monetary premium, while Solana attracts a lot of users through meme coins, practicality, ease of use, and non-fragmentation. From this perspective, this conversation is very helpful.

One last thing Id like to ask you to do, Kyle, if youre willing, is to provide some support for the opposing view. If youre wrong about the strength of your view on Ethereum and the roadmap and the value of Ethereum as an asset, where might you be wrong? What are the best arguments against your view?

「If I support ETH」

Kyle: Ethereum has a privileged regulatory position, and Solana does not. Thats clearly true. The overall size of the Ethereum ecosystem is also larger than the Solana ecosystem. In fact, I think whats important here is not the size of the TVL (total value locked), but the size of the human capital. Clearly, there are many more high-IQ people in the Ethereum camp than in the Solana camp, just as a function of the number of people. Im not commenting on the median or the average, I dont know or think thats the relevant variable, but there are clearly more super-high-IQ people in Ethereum. This has always been true in the past, it still is true now, whether it will change in the future Im not sure, but it is true today.

What drives the world forward is super smart people working hard at things, and frankly, average people working hard at things doesnt drive incremental progress in the world. Innovation is driven by super smart, motivated, hard working people, and Ethereum has more of those people than Solana. So I think the human capital argument is a reasonable argument. However, I think the human capital argument faces limitations in system design that fundamentally prevent human capital from being used. But the total amount of human capital is still unquestionably biased in favor of Ethereum. Those are probably the two best arguments.

Comparison of developer resources and human capital status of Ethereum and Solana ecosystems. Image source: Electric Capital

Does Layer 2 have an impact on Solana?

Ryan: Do you think Layer 2 will have an impact on Solana? Do you think Solana will start adopting Layer 2 in some form?

Kyle: People will launch Layer 2s on Solana, like Eclipse, and while Eclipse may be cross-chain to Ethereum, there are people working on Layer 2 for Solana. Weve obviously received a lot of proposals for these projects, and weve rejected them all. Will they exist? Yes. Will they be used at any meaningful scale? Im skeptical. Theyre permissionless systems, though, so theyll obviously exist. I suspect theyll find some niche, which I actually think is a fairly likely outcome, but Im very skeptical that theyll replace a lot of economic activity.

David: Which is your favorite Ethereum Layer 2?

Kyle: They all look the same to me. I think that’s actually one of their most fatal flaws. They spend a lot of energy trying to be different, but in reality they are almost 100% the same EVM (Ethereum Virtual Machine) and the same applications. So to me, they are interchangeable.

Ryan: Kyle, David was trying to get you to say something nice about Ethereum at the end. So why don’t we end with this? Say something nice about Ethereum, okay? At least say something nice about Vitalik.

Kyle: I like the human capital part, which is pretty good. I think the Ethereum Foundation has been a big part of creating a lot of the right norms and standards around governing a system that claims to be credibly neutral (or at least credibly neutral-ish). I think they overdid it in a lot of ways. But the splits between the original Ethereum founders, like between Charles and Vitalik, was corporate versus non-profit. I think they made the right choices at that critical moment and created a lot of the norms and standards that are valid and that most L1 foundations have adopted and should adopt. I think thats been pretty influential.

Ryan: Kyle, thank you so much for joining us today on Bankless. Its been an interesting discussion. Thank you for sharing your perspective. As an Ethereum supporter, Im hoping this is the bottom of the bear market, but you never know. These are opposing viewpoints, of course, but thank you so much for spending time with us today.

Finally, of course, we have to end with our usual disclaimer. None of the above discussion is financial advice. Cryptocurrency is risky and you could lose your money, but we are moving west. This is the frontier and it’s not for everyone, but we are glad you are joining us on the Bankless journey. Thank you, everyone.

This article is sourced from the internet: Multicoin talks about Ethereum: What went wrong with ETH?

Related: Why L2 Won’t Make Ethereum Deflationary?

Original author: BREAD , Crypto KOL Original translation: Felix, PANews There is a view circulating in the crypto community that L2s will cause Ethereum to fall into deflation again. This statement is incorrect, and there are already examples to prove it. This is a report on L2, blobs, and why the Ultrasound Money meme will die without mainnet users. (Note: A meme related to Ethereum that is used to highlight its potential to become deflationary in the long term. The basic concept is that if the supply of gold or Bitcoin is capped and is considered Sound Money, then the supply of Ethereum is decreasing and should be considered Ultrasound Money) Key points: L2s will only deflate ETH if both blob and regular fee markets are saturated L2 is largely…