Delphi Digital 10,000-word research report: ZetaChain, the future of universal applications

Introduction to Chain Abstraction Technology

One of the big differences between Web3 and Web2 applications is how easy they are to use. Most users don’t understand the complex mechanisms behind Web2 applications. For example, when a user sends an email, they simply enter the content and click send. The system then handles communication between servers, data encryption, and spam without the user’s involvement. Similarly, when you use UberEats to order takeout, there is a very smooth but complex process behind it, including restaurant menu sorting, payment channels, and delivery tracking. The same is true for payment systems, messaging services, and other applications. All of these complex technologies behind them are abstracted away from the user.

Not only that, but the application also adds automated processes on top of this. Netflix not only abstracts the underlying technology, but also automatically plays the next episode of a series without the viewer even having to click a button. These features are all designed to extend the users usage time as much as possible. If the interface lags behind, it is equivalent to handing the user over to others.

Web2 applications have attracted billions of users. To develop well, Web3 applications must be easier to use than the former. But as it stands, Web3 seems to be only available to people with high IQ like Wang Yuheng (nicknamed Shui Ge by netizens). For ordinary users, choosing Web3 applications is very difficult and the steps to use them are even more complicated. Users are faced with countless blockchains, cross-chain bridges, and other infrastructure that connects various chains. It is even more complicated to manage various wallets, protection mnemonics, etc. If you want to build a platform that carries the next generation of consumer applications, you must change the above-mentioned status quo.

Chain Abstract Technology

Account abstraction is of interest for many reasons. It is an important step towards simplifying the Web3 user experience. Features like passkeys, account recovery, and gas fee abstraction are all very valuable improvements. But compared to the overall user experience, these improvements are just a drop in the bucket.

The most difficult challenge is that users not only have to face account problems, but also have to choose from a wide variety of Rollups, L1s, cross-chain bridges, and dApps before they can perform operations. The current fragmented situation makes the environment in which users use applications too complex and confusing. Blockchain abstraction technology solves these problems, and the user experience is solved to the greatest extent. The purpose is to envision an ideal interactive state so that users can use Web3 just like Web2, without having to understand the blockchain or cross-chain bridge technology behind it.

In an ideal environment, the experience of using Web3 applications should be as simple as sending an email or ordering takeout. Users do not need to know which blockchain is processing the transaction, nor do they need to choose the right cross-chain bridge, manage multiple wallets, and remember various mnemonics. All of the above processes should be placed in the background to ensure smooth use. In this way, users do not have to be bothered by the underlying technical details and can focus on the activities they want to do.

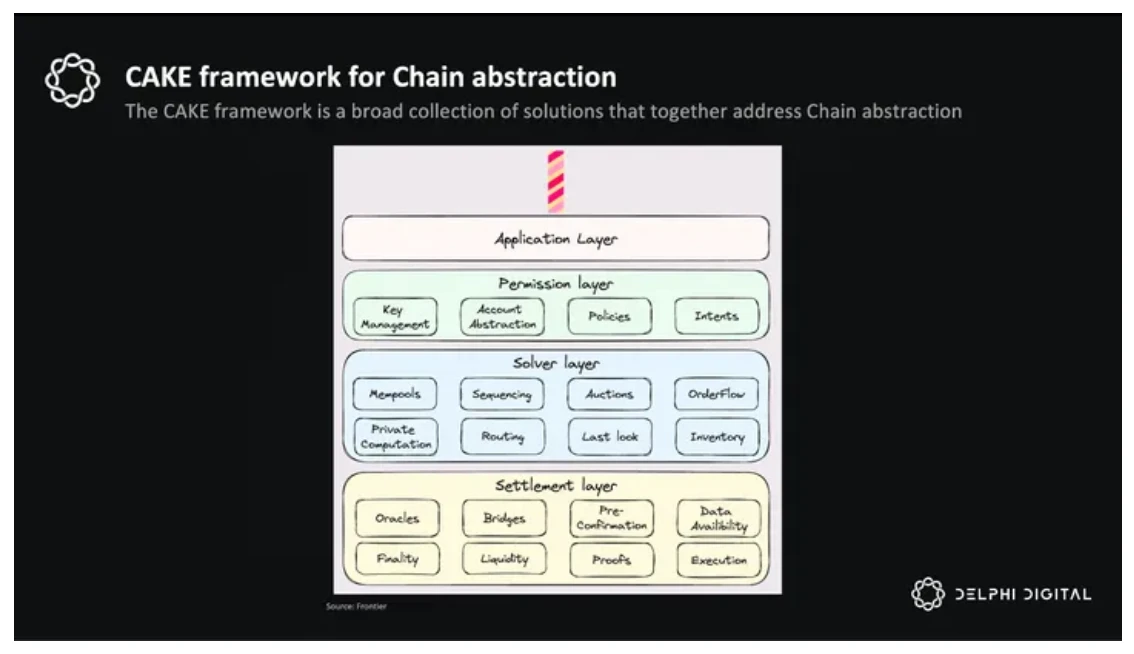

To this end, major projects have proposed their own solutions. The CAKE framework, Near protocol, and Particle network divide this problem into multiple layers, and each layer can only solve one problem. Almost no project can penetrate all layers and can only focus on one layer. The problems can be summarized as account coordination, routing, solver, and bridge selection.

The Frontier team developed the CAKE framework – a three-tier architecture that systematically solves all of the above problems.

-

Permission layer: This layer is responsible for managing accounts and permissions. It includes smart contract wallets and proxy services, and its purpose is to abstract user interactions and maintain a balance between ease of use and user control.

-

Solver layer: This layer focuses on the solver market and competition. The routing problem is solved by finding the best solution based on user preferences for speed, cost, and efficiency. The solver market is constantly optimizing in the competition to find the best transaction journey. These technologies automate the entire decision-making process, reduce the cognitive burden on users when making decisions, and improve the overall user experience.

-

Settlement layer: The last layer mainly solves settlement interactions. This layer uses cross-chain bridges, oracles, and other cross-chain solutions to ensure accurate and efficient completion of various transactions. The object of this layer is the complexity of cross-chain interactions.

We will compare the different solutions in detail below. ZetaChain solves more than one problem.

From a macro perspective, ZetaChain is a first-layer blockchain (L1) based on the Cosmos SDK, using CometBFT as the consensus mechanism. ZetaChain can deploy full-chain smart contracts to provide a unified user experience for applications. This is its core value proposition. Developers only need to deploy a single contract, and ZetaChain will arrange cross-chain interactions. In the next few chapters, we will introduce the operating principle of ZetaChain and further understand its mechanism. After that, we will introduce the improvements of version 2.0, focusing on new features and optimizations.

ZetaChain Architecture

ZetaChain components and functions:

-

Generalized EVM: An improved version of the Ethereum Virtual Machine (EVM) that can be used to build full-chain applications.

-

Communication Mechanism:

-

Full chain: An interoperability layer that allows developers to build full chain apps that can be called from the connected chains.

-

Connector API: point-to-point cross-chain message transmission, supporting the transfer of arbitrary data and value.

-

ZRC-20: A standard for homogenous tokens across all chains. Native Gas and supported ERC-20 tokens can be sent from each connected chain to the full-chain application and used as ZRC-20 tokens. ZRC-20 tokens can be withdrawn back to the connected chain.

-

TSS Signer: A validator with more responsibilities, including signing and monitoring out-of-chain transactions.

-

TSS address: A specific address used to deposit tokens and initiate cross-chain interactions.

ZetaChain uses threshold signatures like Near Protocol and Lit. Threshold signature mechanism (TSS) is a cryptographic method that multiple participants jointly generate a signature. A valid signature can only be generated when the number of participants reaches a minimum threshold (for example, 3 out of 5 people), and each participant holds part of the private key. Distributing private keys to multiple participants can enhance security, prevent single point failures, and ensure fault tolerance.

Observer-Signer Validators run two pieces of software on ZetaChain:

-

ZetaChain Node: Blockchain node, processing cross-chain transactions, managing ZRC-20 minting and calling of full-chain Apps, etc.

-

ZetaChain Client: An off-chain program run by an observer-signer that monitors transactions on the connected blockchain, signs on behalf of ZetaChain, and broadcasts transactions on the connected chain.

These TSS signers continuously monitor the deposit addresses on all supported chains to ensure that when a transaction is successful, the information can be passed on and the activity on ZetaChain can be initiated. They are also responsible for signing off-chain transactions and sending them to other chains for processing.

This allows contracts deployed on the general EVM to be developed outside of ZetaChain. These contracts can also be called from the connected chain.

Inbound communication:

Users can interact with dApps built on ZetaChain on any external chain. The TSS observer monitors a special deposit address for native Gas tokens and an ERC-20 escrow contract for ERC-20 assets. Transactions sent to the deposit address or ERC-20 escrow contract have function call information embedded in them. The TSS observer verifies this information and sends it to the system contract, which calls the OnCrossChainCall function in the corresponding contract to execute it.

Outbound communication:

Contracts on ZetaChain can use the Connector API to make calls to connected chains. When a contract calls a connector contract, it provides information such as the chain ID, contract address, and message. ZetaChain then processes and sends these details to the target chain. The onZetaMessage function of the receiving contract on the target chain is called.

These mechanisms ensure that contracts on ZetaChain can effectively initiate and respond to requests to other chains, greatly simplifying operations for dApp developers and users.

Users only trigger inbound and outbound chain communications between ZetaChain and other chains on the front end. This means that users can interact directly on the front end without having to understand the underlying mechanisms.

The above is the basic architecture of ZetaChain. Let’s introduce the latest version ZetaChain 2.0 and its extended functions.

ZetaChain 2.0

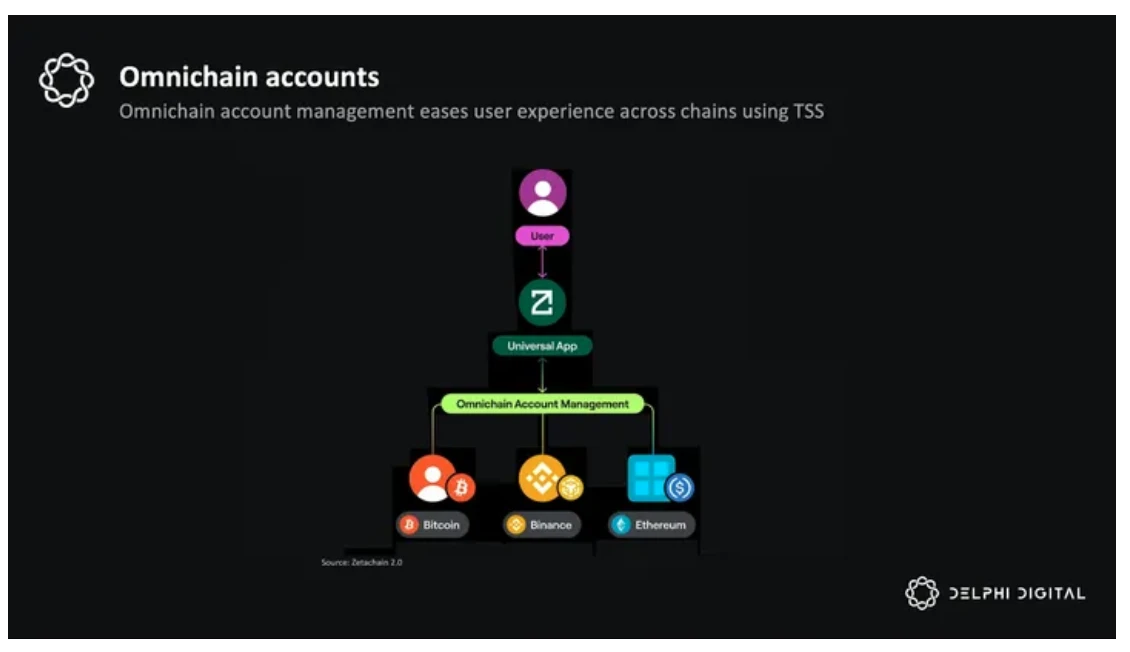

ZetaChain 2.0 is a new version that includes many new features and improves the previous user experience. It supports more compatible Bitcoin addresses, replaces the connector API, strengthens the full chain capability, provides users with full chain accounts, and simplifies the user experience.

Universal applications can directly call contracts on connected chains, making full-chain applications possible. Apps can now handle complex transactions involving multiple assets and multiple cross-chains with a single step. For example, a Bitcoin user can trigger a ZetaChain contract, which can smoothly execute contracts on Ethereum, BNB, and other chains.

Universal Application

One of the biggest new features of ZetaChain 2.0 is Universal Applications. ZetaChain 1.0 provides two separate features: cross-chain message transfer and full-chain applications. When transferring messages between chains using the connector API, users can use ZetaChain as a relay to send arbitrary messages between connected chains. Universal Applications can accept calls from connected chains through the full-chain function to manage homogenous tokens on connected chains.

ZetaChain 2.0 replaces the connector API with an upgraded full-chain function, allowing general applications to call contracts on the connected chain. For example, a user can stake BTC, transfer LST to BNB, exchange LST, and then borrow on Polygon, and the entire process only requires one interaction. The application breaks through the full chain and becomes a general application, capable of multi-step processes.

In terms of mechanism, the Gateway transforms the communication mode into a hub-and-spoke model, reducing costs and execution steps. The early connector API method was more of a point-to-point communication, with more steps and higher costs. The Gateway, as the users entry point, simplifies the interaction process.

Here is a more detailed explanation:

-

Expanded full-chain functionality: General programs can withdraw ZRC-20 tokens through ZetaChain 2.0 and call contracts on connected chains through the withdrawAndCall function. It is also possible to call contracts on connected chains without withdrawing tokens.

-

Disabling connector API: The old version canceled the independent API for implementing full-chain and cross-chain message transmission. The new version provides a unified and coherent API to facilitate developers to build general applications.

-

Gateway contract: The new version introduces a gateway contract, which serves as a single entry point on the chain, allowing developers to interact with general applications. In the past, developers needed to transfer native Gas assets to the TSS address and then transfer ERC-20 assets to the escrow contract. In the new version, developers only need to interact with the gateway contract.

-

Contracts can stake ZETA tokens directly on the chain: Smart contracts can stake ZETA tokens directly on the chain. It will be easier to build general applications and realize decentralized ZETA token staking without relying on off-chain programs.

-

Modular code structure: Earlier versions bundled the state transition and message transmission logic together, making the code very complex. The new version separates them, simplifies the code base, and makes it easier for developers to manage and maintain.

Full chain account

Users can manage cross-chain assets more easily. The new version introduces the withdrawAndCall function. When users withdraw assets and call contracts, they only need to perform a cross-chain transaction. The function first locks the gas fee, then destroys the specified tokens in the users account, and then performs subsequent operations on the target chain.

ZetaChains withdrawAndCall function combines multiple steps into one, simplifying the transaction process. First, the function calculates the gas fees required for both chains (ZetaChain and the transaction chain) and transfers them. Then it safely destroys the specified number of tokens in the users account. The WithdrawalAndCall event is triggered, which records the withdrawal operation and provides the data required to call the smart contract on the target chain. Finally, the subsequent specific operations on the target chain are executed.

The whole process has fewer steps and no need to switch back and forth between networks, making cross-chain operations simple and easy. Here is an example. A user uses a yield aggregator on ZetaChain. After withdrawing the tokens, he moved to another chain and used the smart contract of that chain to execute the investment. The highlight is that from the users perspective, only one transaction occurs in the whole process.

Complete BTC experience

ZetaChain 1.0 only supports transactions using specific address types, which greatly limits the scope of interaction. The new version expands compatibility to include more types of Bitcoin addresses – P2P KH, P 2 SH, P 2 WSH and P 2 TR. Various transaction types have become easier to operate and more user-friendly. In addition, after the new version introduces Taproot (P 2 TR) and continues to support SegWit-based addresses (P 2 WPKH and P 2 WSH), user privacy will be better protected, transaction fees will be lower, and transaction efficiency will be greatly improved.

Bitcoin transaction types

There are three main updates:

-

Address processing

-

More powerful decoding capabilities: The new version has more powerful decoding capabilities and can decode Bitcoin addresses in different formats (such as P2P KH, P 2 SH, P 2 WSH and P 2 TR). These decoding functions are very important because it requires identifying each address type, extracting key components such as public key hash or script hash, and performing comprehensive verification to ensure accuracy and security.

-

Support for Taproot (P2TR): The team is still working on JSON RPC and other related issues. Unlike the functions initially supported by ZetaChain, these address types have features such as Schnorr signatures and advanced scripts. To support Taproot, ZetaChain has created a new address type called Address Taproot. This address follows the same structure and standards, can be integrated with existing infrastructure, and can ensure compatibility with current systems.

-

Create a transaction

-

ZetaChain 2.0 now has specific scripts for each Bitcoin address type, ensuring that transactions meet the special requirements of addresses such as P2P KH, P2SH, P2WSH, and P2TR. These scripts play a key role in defining transaction processing, especially SegWit addresses such as P2WSH and P2TR, which have special requirements such as witness data.

-

Transaction Analysis

-

The parsing logic has been improved to uniformly handle the special features of P2P KH, P2SH, P2WSH, and P2TR address types. The system can correctly identify, extract, and validate the components required for each address type.

New support functions related to chains

ZetaChain has added multiple new chains and expanded the overall network after a careful governance process and software update. The integration process for each new chain has been very smooth. Currently, the ZetaChain team is considering adding Polygon, Base, Solana, and IBC chains.

Each chain has its own signature mechanism, and the difficulty of adding these chains varies. EVM chains like Ethereum are easier to add because their signature mechanism supports a wide range of support. Other chains are a bit more difficult. Newer chains like Solana, NEAR, and TON usually use EdDSA (Ed 25519 curve) instead of ECDSA (scep 256 k 1 curve). This is a problem for TSS modules because ECDSA TSS technology is more mature and has been tested in GG 18 and GG20. EdDSA TSS is not mature enough. Fortunately, these new chains usually have smart contract functions that can efficiently support scep 256 k 1 operations. ZetaChain can use the relatively more mature ECDSA TSS technology to connect these chains.

Additionally, observer validators in the ZetaChain network are required to run nodes for all supported chains. This allows them to verify transactions on different chains.

ZetaChain currently uses the Cross-Chain Messaging Protocol to communicate with ZetaClient TSS and other blockchains. There are proposals to introduce an IBC module to enhance these communications and expand the coverage of full-chain contracts to include application chains in the Cosmos ecosystem.

Other News

RPC: Zetachain is currently forking the Ethermint module to expand its functionality and address these issues. Ethermint has been updated to the latest version to support the latest features and security. The team is also working on issues such as JSON RPC. Customization of the Ethermint EVM module and enhanced RPC compatibility can more effectively handle cross-chain transactions and zEVM contract interactions.

Throttling: To protect the network from unnecessary or malicious activity, ZetaChain uses an adjustable throttling mechanism. This mechanism dynamically adjusts the transaction rate based on the current network conditions and preset rules. It manages transaction flow, enhancing the stability and security of the network and guarding against potential threats such as spam transactions or flash loan attacks. This new feature not only prevents abuse of the network, but also maintains stability and security for users.

General Applications on ZetaChain

ZetaChain 2.0 allows external chains to call contracts, and also allows contracts to be called from external chains. Applications developed with it also have similar general functions at the bottom level. The first part of application development is to create a transaction containing the function call details and send it to the full chain contract. The dApp front end is responsible for this operation. The TSS observer sends the transaction and forwards it to the corresponding contract on ZetaChain. This information is then transferred to the systemContract with a gatekeeping function. This contract can ensure that only authorized functions (such as OnCrossChainCall) can initiate the next step, further enhancing security. The OnCrossChainCall function in the target contract processes the incoming message, identifies and executes the required function.

After this step is successfully executed, the results are processed and then sent to the target chain. The user will receive the final result directly on the wallet on the target chain. From the users perspective, this interaction only involves the act of initiating a transaction on the source chain and then receiving the result on the target chain. ZetaChain handles all the complex details behind the scenes, including creating transactions, verification, and execution, and the entire cross-chain interaction process looks very simple on the surface. Users experience a smooth and direct process, only seeing the transactions they sign and the final results, and ZetaChains infrastructure efficiently manages all the intermediate steps.

Specific applications

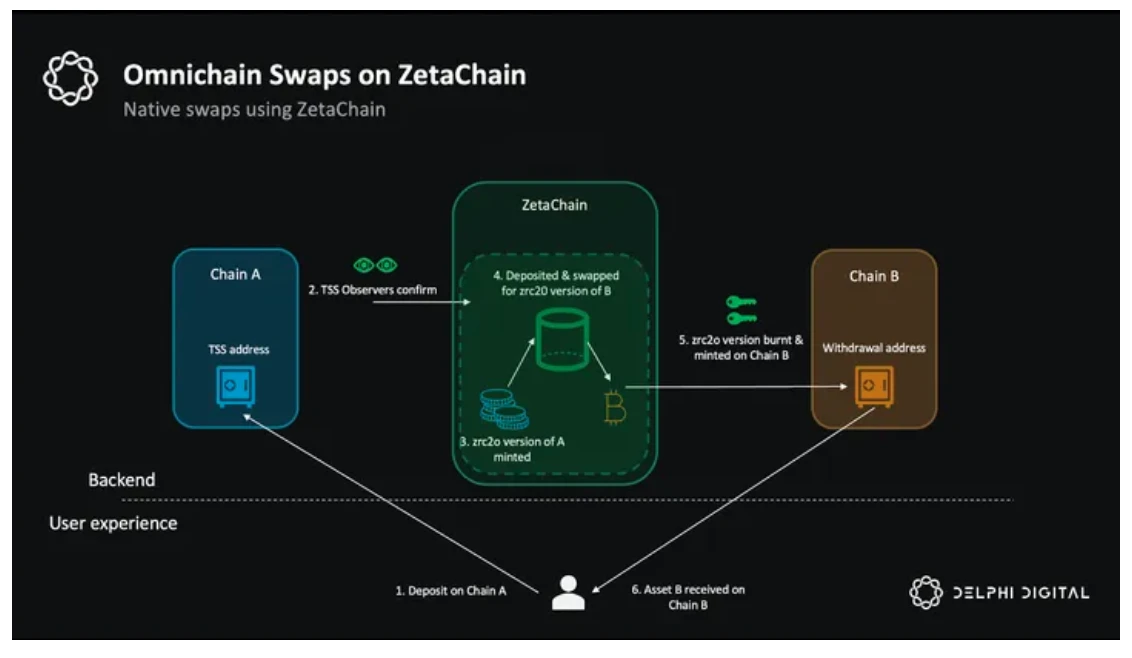

Native Swap

Developers can develop cross-chain Swap applications by integrating the functionality of their applications into ZetaChain’s universal contracts. Users first transfer native Gas or supported ERC-20 assets to the gateway contract on the connected chain, along with the address and message of the universal contract (including the target token and the recipient). The Observer-Signature-Verifier monitors and processes the transaction. The homogenous token module mints ZRC-20 tokens, mapping the tokens deposited by the user into the gateway contract, and then the system contract calls the onCrossChainCall function of the universal contract. The function accepts the ZRC-20 token, the call information (including the ID of the connected chain and the caller address), and the message. The universal contract then enables an available liquidity pool (default Uniswap v2 pool or any other decentralized exchange contract) to convert the received ZRC-20 tokens into the ZRC-20 version of the target token and the ZRC-20 version of the Gas token on the target chain. Finally, the contract calls the ZRC-20 withdrawal method, destroys the ZRC-20 Gas token (to pay for the Gas fee on the target chain), and withdraws the ZRC-20 version of the target token to the target chain, converting it into a native asset.

Staking

Smart contracts can stake ZETA tokens, which simplifies the process of developing liquidity staking and staking applications on ZetaChain.

In the past, staking applications required off-chain programs to monitor users depositing ZETA tokens into smart contracts and execute ZETA staking for users. This off-chain approach planted the seeds of centralization and made it difficult for developers to build a staking protocol that is both flexible and decentralized.

With the addition of the ZETA token staking function, the smart contract itself can accept ZETA tokens from users and other contracts, use the native staking mechanism on the chain (such as the staking module of the Cosmos SDK) to stake, and can also check the staking status and claim rewards.

Universal applications can use this feature to accept tokens from connected chains, provide ZETA tokens and stake them on behalf of users, and earn returns by staking the transferred tokens on the linked chain.

NFT Applications

ZetaChain supports general applications to directly call smart contracts on the connected chain. Developers can use this function to develop more innovative NFT applications. Such applications can receive tokens and messages from the connected chain, mint NFTs, and users can also transfer NFTs back and forth between ZetaChain and the connected chain.

ZetaChain opens a new chapter of applications

DeFi applications can operate on multiple chains through ZetaChains full-chain infrastructure, breaking through the limitations of a single chain. A key advantage of Web3 is composability, where smart contracts can interact and build on each other. Currently, the interaction of contracts is limited to a single chain. ZetaChain extends this composability to all chains, even chains without native smart contracts (such as Bitcoin and Dogecoin). Benefiting from full-chain abstraction, developers will get more application scenarios, and dApp innovation has a solid foundation.

Full-chain financial management

Managing finances on multiple blockchains is a complex task. When an organizations assets are distributed across different chains and each chain has a separate account, management becomes very difficult, and improper handling may result in the loss of assets. Without unified management of property, the person in charge of finance must handle multiple accounts, coordinate signatures from stakeholders on each chain, and manually track assets on each network. This fragmented management method deepens operational risks, and financial personnel are unable to efficiently manage and deploy assets, and their capabilities are limited.

Organizations can use ZetaChains infrastructure to centrally manage finances while maintaining the decentralized nature of blockchain assets. The most critical innovation lies in programmable TSS and smart contracts.

The person in charge of finance only needs to deploy a single smart contract on ZetaChain and edit the management logic by themselves. This contract will be used as a centralized management hub for all financial operations on multiple chains. During the initial setup, stakeholders only need to provide a key once on ZetaChain, which greatly simplifies the approval process.

Once set up, ZetaChain’s smart contracts can orchestrate complex financial operations across different blockchains. Assets can be transferred, allocated, or used on ZetaChain with a single approval process, without the need for repeated signatures from stakeholders on each protogenesis chain.

This approach is not limited to the transfer of assets. Financial rules, spending limits, and approval thresholds can be directly programmed into smart contracts, ensuring that the application is consistent across all chains. Moreover, this approach brings more possibilities, such as cross-chain asset readjustment, optimizing returns, and more complex financial management strategies can also be implemented. Due to the need to manage accounts on multiple chains separately, the above functions could not be achieved with previous technologies.

Full-chain portfolio management

Managing a crypto portfolio on multiple chains is difficult, and it is extremely laborious for users to adjust assets and track investment performance across different networks. ZetaChain has created a unified platform that simplifies the status quo and enables full-chain portfolio management.

A full-chain smart contract can act as a central control tower for all types of user crypto assets. The contract uses TSS technology to interact directly with accounts on different chains. Users can program investment strategies and rules on the ZetaChain smart contract. The contract then uses TSS to execute transactions, move assets, and adjust portfolios on different blockchains.

Such smart contracts can monitor market conditions on multiple chains, automatically adjust portfolios, and execute complex transactions without human intervention. TSS generates signatures, which can securely control assets on multiple chains.

This approach not only automates cross-chain operations, but also provides a panoramic view of the portfolio performance. Complex investment strategies such as cross-chain arbitrage and multi-chain mining are also possible, which was not possible with previous technologies.

It is difficult for new users to fully grasp the various operation steps of each chain. Users interested in returns will be attracted by such functions, and more and more new users will join. ZetaChain abstracts the complexity of multi-chain operations, allowing more ordinary users to access more advanced crypto asset portfolio management.

Native asset exchange

We have already introduced asset exchange applications like ThorChain in the previous article, where users can deposit and receive assets using native tokens. From the users perspective, this process is as simple as depositing and withdrawing funds on a centralized exchange. Depositing and withdrawing coins are just simple asset transfers on the connected chain, so this method is much cheaper than the expensive message-based method (which requires calling contracts, such as verifying messages, etc.). Logic execution is no longer cross-chain segmented logic, but is all concentrated in a full-chain contract.

Cross-chain lending

ZetaChain 2.0 can enhance cross-chain lending capabilities and directly call functions on external chains. Cross-chain lending protocols are possible, and they can accept deposits from lenders on any chain without the need for users to perform additional operations. Funds can come from liquidity pools, liquidity pledge assets, etc., and the range of supported chains is extremely wide. Borrowers can pledge assets across multiple chains, with a wide variety of optional assets and a very flexible lending ecosystem. The BTC native lending market is very limited. Cross-chain lending brings new opportunities and opens up new markets for developers, who can earn income through Bitcoin and borrow with other assets. ZetaChain has more options than ThorChain, and the deposit and withdrawal of the same token can build different application architectures.

Cross-chain asset re-staking

The assets on the supporting chain can provide re-pledge security for other chains, which is somewhat similar to the Eigenlayer approach. Users can re-pledge with various assets (such as BTC, ETH, etc.), but the penalty mechanism is triggered under certain specific conditions of the target chain or application. This fund pool security model allows different chains and applications to form a diversified re-pledge asset portfolio, which improves the overall security and the entire ecosystem is better protected.

This application is similar to Exocore, where smart contracts on ZetaChain orchestrate key functions. These contracts act as modules and manage everything, such as AVS registration, staking delegation tracking, processing deposits and withdrawals, and executing penalty mechanisms.

When users interact with the system – whether depositing tokens or delegating assets to others – all transactions are recorded by the corresponding smart contracts. This ensures that all user activities can be recorded and managed in the ZetaChain ecosystem.

TSS signers actively monitor validators to ensure their reliability. If a validator behaves maliciously or a user initiates a withdrawal, the slashing module will confiscate the pledged funds on the native chain.

Cross-chain settlement

Suppose a user wants to borrow and lend assets on different chains. The problem he and existing applications face is that it is difficult to effectively monitor and manage the liquidation of assets. Only by continuously monitoring assets on each chain and ensuring that asset-related execution is fast enough can the protocols losses be minimized. ZetaChain can lock assets in TSS addresses and use automated market makers or decentralized exchanges on the source chain to liquidate assets. Liquidity on the source chain is usually greater than wrapped tokens on other chains. Liquidation and cross-chain bridge times are reduced, and greater native liquidity also brings better exchange rates. TSS observers will continuously monitor these positions, and general applications on ZetaChain will track the status of these positions. Once the asset price reaches the liquidation price, the smart contract will trigger the liquidation function, and the TSS signer will relay the transaction and finally liquidate on the native chain.

Bitcoin Racetrack App

ZetaChain can also realize inscription markets like Ordinal, exchange and lending of Bitcoin assets such as BRC 20, etc. These applications can be combined not only with other applications on ZetaChain, but also with applications on supported chains. The ordinary smart contract applications supported by ZetaChain are also equipped with Bitcoin full chain functions.

TSS addresses can be used for lending and borrowing between BTC and ETH assets. Applications on ZetaChain can be deployed as general programs with underlying logic. If a user wants to borrow ETH by pledging BTC, they only need to deposit BTC on the native chain and sign with their wallet. BTC will be locked in the TSS address, awaiting subsequent operations (withdrawal or liquidation). The TSS observer will record the transaction, mint the ZRC-20 version of ETH on ZetaChain, then transfer the token to the Ethereum chain and exchange it for ETH, and finally transfer it directly to the users account. Users can receive ETH in their ETH wallet by depositing BTC with their own wallet. It can be used as a centralized exchange. The operating principles of other markets and exchange apps like Ordinal are also so simple.

Cross-chain orchestration

Chain abstraction solves problems in many areas, including account aggregation, algorithmic solutions, orchestration, settlement, and clearing. Let’s explore several solutions to the orchestration problem and compare them with ZetaChain.

Agoric

Agoric is a smart contract platform written in JavaScript. It uses the Cosmos SDK toolkit and Comet BFT consensus engine. It also uses IBC and Axelar to communicate with other Cosmos chains. Agoric aims to attract millions of JavaScript developers to join the Web3 field. The Agoric Orchestration API abstracts the complex orchestration process of cross-chain contracts and simplifies the development process.

A very prominent feature of Agoric is its unique asynchronous model (async/await model). Smart contracts deployed on Agoric can use this model to interact with other chains on multiple modules, wait for responses, or perform tasks. The messages sent by Agoric to other chains contain instructions such as account creation, function calls, and required parameters. After the target chain processes these instructions and returns the results, the Agoric smart contract will continue to execute the next step specified in its logic.

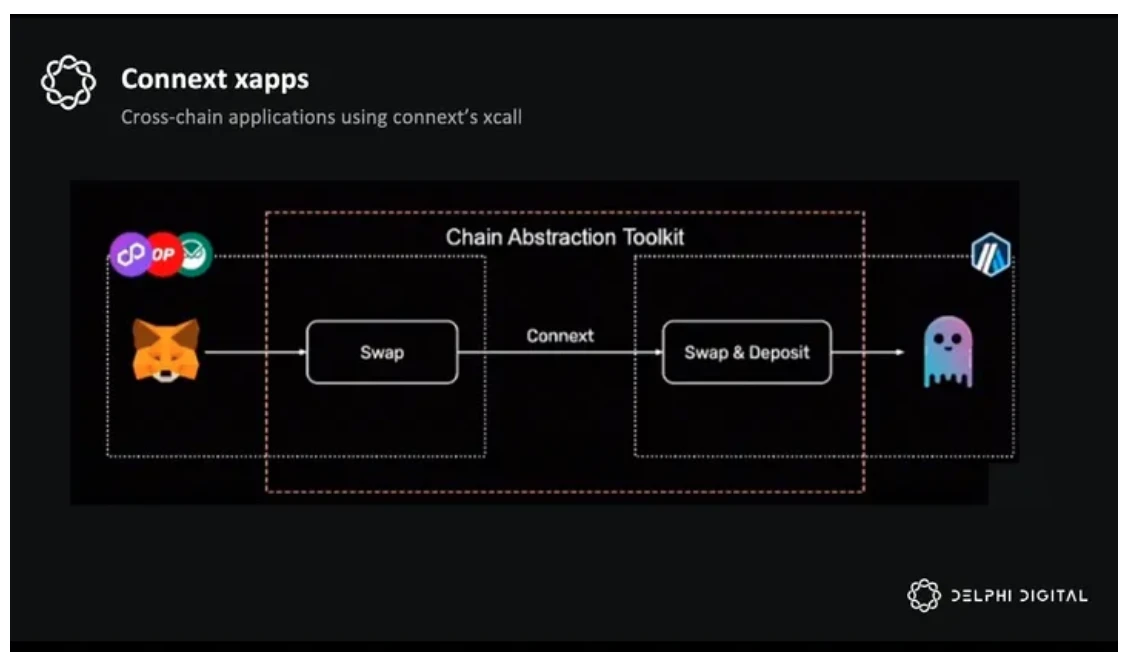

Everclear (formerly Connext)

Everclear is a cross-chain bridge, formerly known as Connext , that can handle cross-chain workflows and re-staking of multiple L2s. Everclear integrates the Connext SDK, allowing xApps to send special messages called xcalls across chains. The Connext contracts on the source and target chains and an adapter contract jointly manage these messages, enabling cross-chain function calls.

xApp uses Connext SDK to generate and send xcall messages, which contain all execution details such as function calls, funds, gas information and other data. These messages are first processed by the Connext contract on the source chain and then forwarded to the corresponding contract on the target chain. The adapter contract plays a very important role on the target chain. After receiving these messages, it converts assets on demand and executes the specified function with the correct parameters. Connexts system supports nested xCalls, which are similar to callbacks between chains. Their main function is to verify state changes and perform asynchronous subsequent operations.

Connext is therefore effective as a cross-chain bridge, which can execute contract functions between multiple chains and support complex cross-chain workflows. The working principle is quite similar to ZetaChain, where the function call is relayed to the target chain and then executed.

xERC-20 and ZRC-20 Token Comparison

ZetaChain and Connext have each developed token standards, ZRC-20 and xERC-20, to support cross-chain applications.

ZRC-20 tokens are an extended version of Ethereums ERC-20 standard, specifically designed for ZetaChains cross-chain functionality. ZRC-20 tokens are minted on ZetaChain only after the corresponding ERC-20 token is deposited into a TSS address managed by ZetaChain. Each chains ERC-20 tokens are uniquely marked on ZetaChain. For example, USDT from Ethereum will appear as ZRC-20 USDT from the Ethereum chain, and if it comes from Binance Smart Chain, it will appear as ZRC-20 USDT from BSC. Although these tokens are all ERC-20 tokens, ZetaChain positions them as different assets, but they can still be used interchangeably.

In contrast, xERC-20 tokens maintain their homogeneity across different chains. All xERC-20 USDT tokens are treated as the same token, regardless of their source chain. This helps to centralize liquidity and avoid dilution of ZRC-20 tokens. Cross-chain management of homogeneous tokens is more efficient, and xERC-20 tokens can be sent by xcall messages, calling functions and accompanying other transaction details.

Particle Network

In the early days of the project , Particle Network focused on wallet and account abstraction infrastructure, which met the needs of users at the time. The project later expanded its technology stack and added key components of chain abstraction on Particle L1, such as decentralized Bundler, Paymaster and Keystore, to manage cross-chain accounts. The idea of Keystore originated from Vitalik Buterins concept of solving the multi-chain account problem.

Particles abstract technology stack includes three aspects:

-

Universal accounts: These accounts upgrade traditional smart contract accounts by integrating a new user operation structure, keystore, and Merkle tree for signature verification. Particle L1 acts like a centralized repository for smart accounts, handling settings and key-related data while storing binding information for user private keys in the Merkle tree. When users initiate transactions, they verify key ownership through Merkle proofs. Scroll, Keybase, and Stackr have also proposed similar approaches. We will discuss Keystore in detail in the unified account management section.

-

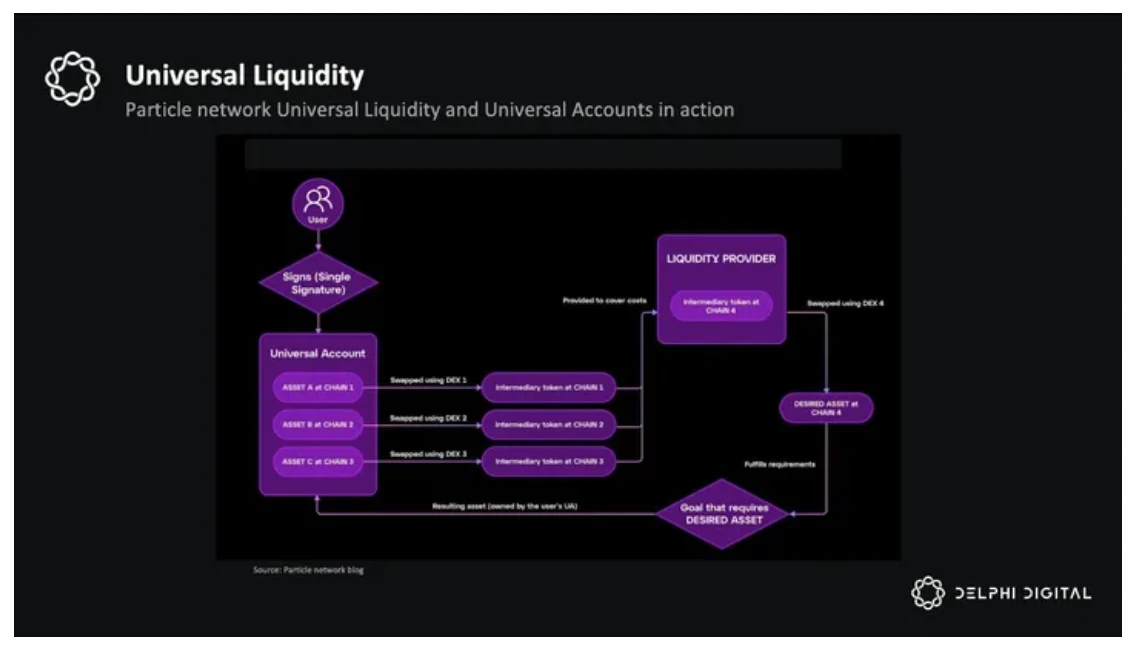

Universal Liquidity: The Bundler node network performs the operations required by users to trade, such as token swaps, interactions with liquidity providers, etc. Users can use tokens across chains and easily interact with new chains even if they do not hold tokens from those chains. With only one signature, users can interact with multiple blockchains. Universal accounts and Bundler manage transactions, signatures, and routing.

-

Universal Gas Token: When a user initiates a transaction, the user is prompted to select a Gas token on the operation interface. This token is processed by Particles Paymaster contract and paid to the source and target chains. Part of the fee will be converted into Particles native token $PARTI and deposited on Particle L1.

Together, these three solutions create a very powerful abstract experience for developers and users. Users can conduct cross-chain transactions without having to manage multiple accounts or pay multiple gas fees to the target chain. The above methods are all designed to make the user experience smoother.

NEAR

NEAR aims to provide a cross-chain experience without a cross-chain bridge, which is unique. Its approach is to introduce chain signatures, multi-chain relayers and multi-chain Gas Stations, as well as a decentralized front end.

Account aggregation simplifies the user experience by allowing transactions to be signed on any blockchain using just one account. NEAR has developed a multi-party computation (MPC) protocol called “ Chain Signatures ” that leverages this protocol and Eigenlayer’s validators. The protocol can generate and manage accounts on external chains without the need for additional keys or addresses. These addresses are derived from existing NEAR accounts. We will discuss how this works in detail in the unified account section.

NEAR is similar to Particle Network. Its multi-chain Gas Station and relayer can abstract the gas fees of external chains and simplify the user experience. Users only need to interact with the front end of the dApp, and the backend will handle a series of operations including orchestration, signing, gas payment, relaying, etc.

The biggest feature of NEAR is the ability to transfer ownership of assets across chains without actually transferring the assets. The first step in this process is to use the MPC network to create an account on another chain that is associated with the users NEAR account. Assets are not packaged or transferred. The ownership keys of these accounts are converted into NFTs on NEAR. Users can trade these NFTs on NEAR, which allows them to transfer ownership without transferring the assets themselves.

NEAR’s high throughput capabilities make the exchange of native assets a breeze, as only control keys are exchanged and the assets are not transferred.

Neutron

Neutron is built using CosmosSDK, focusing on cross-chain transactions and achieving a seamless experience through key components. The Inter-Chain Account (ICA) manages accounts on remote Cosmos chains, enabling them to hold assets and perform transactions. The Packet Forwarding Middleware (PFM) forwards IBC packets between chains, simplifying cross-chain communication. The IBC Hook allows smart contracts to execute custom logic when receiving an IBC packet.

When users use Neutron to conduct cross-chain transactions, the Cross-Chain Transaction (ICTX) module acts as a central coordinator. Smart contracts on Neutron send requests to the ICTX module, specifying the target chain, cross-chain account, and the operation to be performed. ICTX then creates an IBC packet containing the transaction information and sends it to the target chain via a relay. The remote chain processes the transaction and sends back a confirmation. The method of sending function calls using the cross-chain bridge is similar to Connext and ZetaChain.

Comparison with ZetaChain

Most cross-chain orchestration schemes involve the use of cross-chain bridges, which require assets to be transferred along with corresponding function call information and parameters. These assets and instructions are deployed on the target chain and executed by the contract. ZetaChain 2.0 also uses this approach, with TSS signers and observers relaying relevant data to ensure the security and accuracy of transactions.

ZetaChain allows dApp developers to create smart contracts and manage assets on multiple chains using TSS. TSS is programmable and implemented through the logic of dApp. Developers can define complex rules for cross-chain asset management and cross-chain automatic transactions. This approach opens up the possibility of completely new applications and protocols.

ZetaChain allows developers to create unified states and logic on a single chain, improving cross-chain applications. This is fundamentally different from traditional cross-chain bridges, which operate in fragmented ways on multiple chains.

Applications can use ZetaChain to maintain their state and logic in one place, achieving synchronous and sophisticated execution. Cross-chain bridge peer-to-peer communication systems rely on asynchronous, event-driven processes in various fragmented states, and ZetaChains solution greatly improves this situation.

Unified performance brings huge benefits. It reduces the complexity of cross-chain applications. For example, the execution of automated market makers like Curve will become simpler. Developers do not need to operate on multiple chains, they only need to write a smart contract, and all the logic is centralized. Another core advantage is reliability. Every step in the fragmented system may introduce potential failure points during the cross-chain transaction process. The transaction may be terminated midway and the funds may be frozen. ZetaChain eliminates these risks. There are only two possible situations for a transaction, success or failure. When the transaction fails, the funds will be returned to the original state.

If a transaction needs to be rolled back, it can usually be done quickly and easily on the main chain. This is because most of the state and logic are centralized. If the external call process is complex and faces failure, the application can use asynchronous rollback. This is critical for certain specific operations, such as controlling the range of slippage in token swaps. On ZetaChain, if the slippage exceeds the allowed range and a rollback callback function is provided, the entire transaction will be rolled back. This protects users from unexpected losses caused by changes in market conditions during execution.

Unified account management

Block space used to be a scarce resource, but now it is plentiful thanks to alternative L1s, Rollups on Ethereum, and Lisks. Applications are now distributed across layers, giving users many options. Some account management solutions, like Magicspend and Keystore Rollup, address these issues directly. It would take more than a single report to cover all of these in depth. Therefore, we will focus on unified solutions like Near, Particle, and ZetaChain and how they differ.

Particle Network

Particle Network developed BTC Connect to let Bitcoin users experience the benefits of account abstraction. Although account abstraction is not directly implemented on the Bitcoin blockchain L1, it is implemented through L2. These special L2 solutions use Particles account abstraction infrastructure, such as Bundler and Paymaster, and users can enjoy gas-free transactions, restore accounts, use Passkey functions, etc.

BTC Connect has been connected to Bitcoin wallet providers such as UniSat, OKX and Bitget. When a user interacts with an application, he can link BTC Connect through his personal wallet. Subsequently, a smart account will be automatically generated on Bitcoin L2. Users can choose to interact with dApps on Bitcoin L1, or bridge BTC to L2 and use AA wallet. BTC Connect abstracts the entire process, and the user experience is very friendly and smooth.

Near

NEAR allows users to sign transactions on any blockchain with just one account. NEARs account model incorporates account abstraction technology. Account names are very human-readable, and different keys are configured for different applications to unlock specific access rights. NEAR extends this model through Chain Signatures technology, which not only supports multi-chain interaction, but also allows NEAR accounts to create and manage remote accounts on other chains without users having to manage these accounts separately.

This process uses the TSS protocol supported by NEAR validators. This is an innovative protocol that allows validators to join or leave the network without changing their public keys or secret key shares, making TSS stable and reliable in the signing process without the need for frequent adjustments.

Users can create new accounts on each chain, and the TSS network acts as a signer, so users do not need to maintain the private keys of these accounts. The TSS network can derive multiple accounts for the same chain through NearID, further enhancing security and ease of use. The process that users ultimately experience is very simple – only one NEAR account is needed to manage all connected chains and use TSS to sign. Users enjoy all the advantages of account abstraction technology.

There is a key difference between NEAR and ZetaChain in account management. NEAR is highly dependent on its own network during the interaction process. Users must use a NEAR account as the starting point for all interactions in order to create accounts or sign transactions on other chains. Accounts on other chains are derived from Near accounts and are managed by the MPC network. In contrast, when using ZetaChain, users can retain existing accounts on other chains and maintain full control over the past. Users can initiate interactions on any source chain, and even if they do not have an account on ZetaChain, they can use general applications developed and deployed on ZetaChain. This eliminates the need for users to create multiple accounts and can simply continue to use their original accounts on other chains. Another important point is that users still hold their personal private keys, so they retain full control over their accounts.

Both protocol solutions have their pros and cons. NEAR’s approach is to lock users into one account, making that account the entry point for interacting with all other chains, which simplifies account management to a certain extent. ZetaChain gives users more control and enhances the flexibility of managing accounts, and users can interact on any chain. As for which protocol will prevail in the future, it ultimately depends on the user’s personal preference – NEAR’s integrated account solution or ZetaChain’s flexible “bring your own” account solution.

Bitcoin re-staking

Bitcoin is the largest and most secure digital asset, mainly due to its PoW mechanism. However, due to the limitations of programmability, Bitcoin can only be used for basic transactions, and its use cases are extremely limited. We discussed earlier how the ZetaChain infrastructure supports re-staking and full-chain staking functions, including support for Bitcoin. ZetaChain also provides other full-chain applications for Bitcoin assets, such as lending, native token swaps, and Ordinal markets. Any application driven by smart contracts can be deployed in the Bitcoin ecosystem through ZetaChain.

Restaking applications opens up the possibility of extending Bitcoin’s security to other applications and PoS chains. In the next section, we will explore and compare some other solutions for extending Bitcoin’s security to various applications. We will also compare ZetaChain as a platform to Bitcoin L2.

Babylon Chain

Babylon is a blockchain developed using Cosmos technology, especially the CometBFT engine, which enhances the security of the POS chain by staking Bitcoin. To stake Bitcoin, you must lock the tokens and let the validator manage them. Unlike Ethereum, the Bitcoin chain can stake tokens directly. Generally speaking, BTC needs to be locked in a multi-signature or threshold signature (TSS) account before it can be staked. However, Babylon uses a trustless method. It uses Bitcoin scripts to lock BTC for a period of time, during which users can unlock and unstake BTC. Forfeiture is performed through extractable one-time signatures (EOTS).

Components

-

Extractable One-Time Signature (EOTS)

-

Restrictions

-

Timestamp

Covenant

The restrictions lock the BTC in a Vault and will not be released until certain conditions are met. The scripting op-code used to lock the coin can be OP_CHECKTEMPLATEVERIFY ( OP_CTV ). The security performance of the Bitcoin PoW mechanism ensures that BTC is always safe until these conditions are met.

EOTS:

Validators use EOTS to sign blocks on the PoS chain. These signatures are one-time. If a validator signs two blocks at the same height and a conflict occurs, EOTS will expose the validators private key, and the protocol can cut the BTC staked. This punishes dishonest behavior and encourages honest verification behavior.

Timestamp:

Timestamps can generate immutable data and transaction records, preventing long-range attacks on the PoS chain. It can synchronize Bitcoin and the PoS chain, ensure data integrity, and speed up the unlocking of staked BTC. Timestamps shorten the time that tokens are locked, allowing users to quickly withdraw assets while avoiding long-range attacks.

Babylon uses these components to provide users with a trustless re-staking service.

Stroom Network

Users can stake Bitcoin through the Stroom network and receive native BTC returns without locking up funds. Users can also obtain liquidity staking tokens for Ethereums DeFi protocol to increase investment returns. The core concept is to use Bitcoin on the Lightning Network to provide liquidity and distribute the fees generated to users, DAOs, and node operators.

-

Stroom Cross-Chain Bridge: This cross-chain bridge connects Bitcoin and EVM-based blockchains. After users deposit BTC into the Stroom DAO vault, they will receive st BTC or bst BTC on Ethereum. These wrapped tokens can be used in Ethereums DeFi protocol, allowing users to earn additional income.

-

Lightning Network nodes supported by Stroom: These nodes use users Bitcoin deposits to manage payment channels of the Lightning Network. Nodes cannot directly access BTC, and changes in channel status require confirmation from validating nodes. Channel management is secured by a federated multi-signature setup and Schnorr signatures. Validating nodes also act as sentry towers to monitor various activities of Lightning Network nodes.

-

Stroom Validator NodesThese nodes use the FROST algorithm to implement Schonorr threshold signatures to confirm operations and ensure the security of the protocol. They independently verify events to ensure decentralization and security. They also store channel status and revocation keys to facilitate updating the status of the Lightning Network when needed. As a sentry tower managed by the DAO, the node monitors the channels of the Lightning Network through an integrated Bitcoin full node.

tBTC

tBTC is a decentralized cross-chain bridge protocol that allows BTC to be used on Ethereum. Users can lock BTC in an account controlled by the Threshold Network to mint tBTC. This is an ERC-20 token that can be used in Ethereums DeFi ecosystem, bringing more usage scenarios to Bitcoin users.

The cross-chain bridge randomly selects operators in each cycle to ensure security. To ensure the security of Bitcoin deposits, tBTC requires the unanimous consent of the majority of operators (usually 51 of the 100 thresholds – ESDSA-supported wallets). This replaces centralized intermediaries and ensures a decentralized, encrypted system.

When a user wants to deposit Bitcoin, they need to transfer it to one of the wallets using pay-to-script-hash (P 2 SH) or pay-to-witness-script-hash (P 2 WSH). The transaction contains the users Ethereum address. The operator verifies the transaction and mints tBTC on Ethereum, converting Bitcoin into Ethereum-compatible tokens.

To redeem tBTC back to BTC, users need to provide a Bitcoin address. The system will deduct the users tBTC balance and then release the same amount of Bitcoin in the provided wallet address.

Products developed on the tBTC cross-chain bridge include:

-

Mezo: Mezo creates an economic layer through tBTC. It is a PoS network that guarantees security by staking Mezo and tBTC, and users can use it for BTC DeFi investment and other use cases.

-

Acre: Acre provides a Bitcoin staking process for depositing and withdrawing BTC. Users deposit BTC and receive stBTC, which represents partial ownership of BTC in the Acre vault. Users can hold BTC while holding stBTC to ensure liquidity. Acre pledges users BTC to various L2 networks to provide economic security, and validators can receive L2 tokens or BTC rewards. Users can receive rewards after redeeming their stBTC on Acre, or they can transfer it back to BTC.

Although these methods can be re-pledged, they are limited to the purpose of re-pledge. On ZetaChain, users can not only re-pledge, but also combine with applications, such as lending, token exchange, etc., and such operations can be synchronized in real time in one environment, thereby improving the efficiency of capital. Applications can also reach the user base of other applications in the ecosystem.

Comparison with Bitcoin L2

The Bitcoin L2 network uses MPC cross-chain bridges and wrapped assets to increase Bitcoins use cases. ZetaChain uses TSS to manage addresses on the Bitcoin network and map ZRC-20 tokens on its own chain. Compared to the MPC technology of Bitcoin sidechains, TSS is more decentralized because a wider and more decentralized collection of TSSs has higher Byzantine fault tolerance.

Moreover, ZetaChain’s TSS technology supports full-chain applications and can be combined with contracts on other chains. In other words, Bitcoin applications on ZetaChain can seamlessly interact with multiple contracts on different chains. Bitcoin’s L2 solution can only achieve composability within its own platform.

Although the BitVM and CatVM cross-chain bridges can theoretically eliminate trust or minimize trust, this cannot be truly achieved at present.

Looking into the future of user experience and ZetaChain’s role

Infrastructure like ZetaChain will greatly improve the user experience on blockchain in the future. Let’s look at the various roles ZetaChain plays in this process:

-

Seamless interaction: The current development direction of user experience is seamless and intuitive. Users cannot perceive the complex underlying technology. ZetaChains chain abstraction technology is an important part of achieving this goal. Interactions on the blockchain can be as simple as Web2 applications.

-

Unified user interface: After fundamentally empowering cross-chain interaction capabilities, applications can provide users with a unified interactive interface to manage assets on multiple chains, execute transactions and other chain interactions on a single platform. This greatly improves the overall user experience.

-

Expansion of the application ecosystem: ZetaChain supports more complex cross-chain functions, which will further enrich and develop the application ecosystem. These systems provide services with higher integration and operability, and can provide users with comprehensive tools and functions.

-

Becoming a mainstream technology: Simplifying the user experience is the key to promoting blockchain technology to the mainstream. ZetaChain avoids lowering the complex technical threshold for users, greatly enhancing the usability of applications, and plays an important role in introducing non-technical users to the blockchain world.

-

Innovative use cases: As it becomes possible to perform complex operations on multiple blockchains, more innovative use cases will emerge. Developers can now use these tools to create applications that were not possible in the past, further advancing innovation in this field.

This article is sourced from the internet: Delphi Digital 10,000-word research report: ZetaChain, the future of universal applications

Original author: @Web3 Mario (https://x.com/web3_mario) This week, the market officially entered the cool-off period before the Jackson Hole meeting. Everyone is waiting for Powell to make an official interpretation of the latest employment and inflation data and give clear guidance on future monetary policy, which will undoubtedly become a key reference for the interest rate decision in September. However, there was a very interesting piece of information last Friday that did not attract much attention in the crypto world. That is, Democratic presidential candidate Harris officially announced his first clear economic policy framework, the Opportunity Economy framework. Because I was sorting out the analysis article about Usual Money last Friday, I did not notice it. I carefully studied the relevant details over the weekend and found some interesting insights. I…