Opinion: Rate cuts may not reduce the attractiveness of BlackRocks BUIDL

Original author: Kaiko

Original translation: 1912212.eth, Foresight News

Interest rate cuts are unlikely to reduce the appeal of tokenized Treasuries.

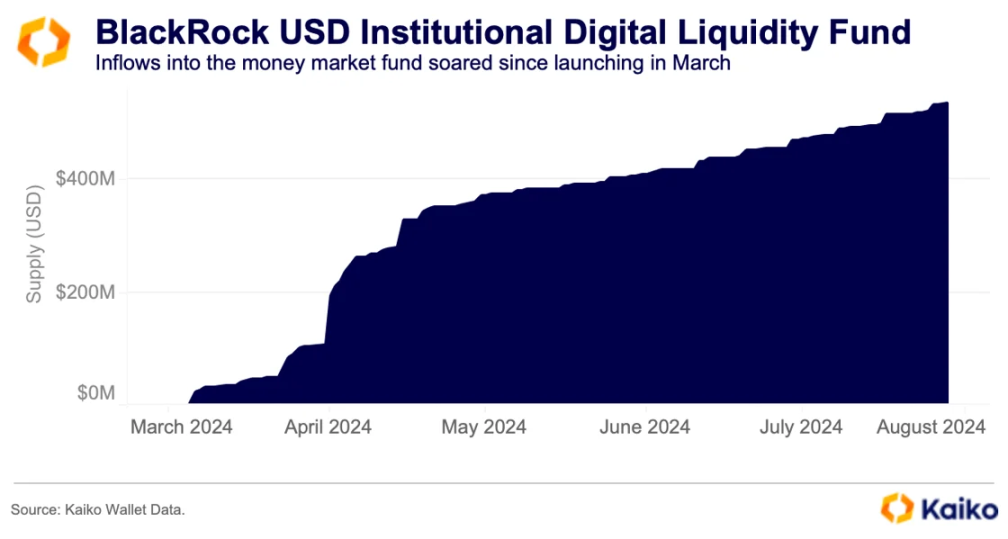

BlackRock’s on-chain tokenized fund BUIDL (which stands for BlackRock USD Institutional Digital Liquidity Fund) is one of many funds launched in the past 18 months that provides exposure to traditional debt instruments such as US Treasuries and has quickly become the largest on-chain fund by assets under management. The fund was launched in March 2024 in partnership with Securitize and has attracted inflows of over $520 million.

Most of these funds invest in short-term U.S. debt instruments, and other top funds include Franklin Templetons FBOXX, Ondo Finances OUSG and USDY, and Hashnotes USYC. Each fund offers a yield thats the same as the Fed funds rate.

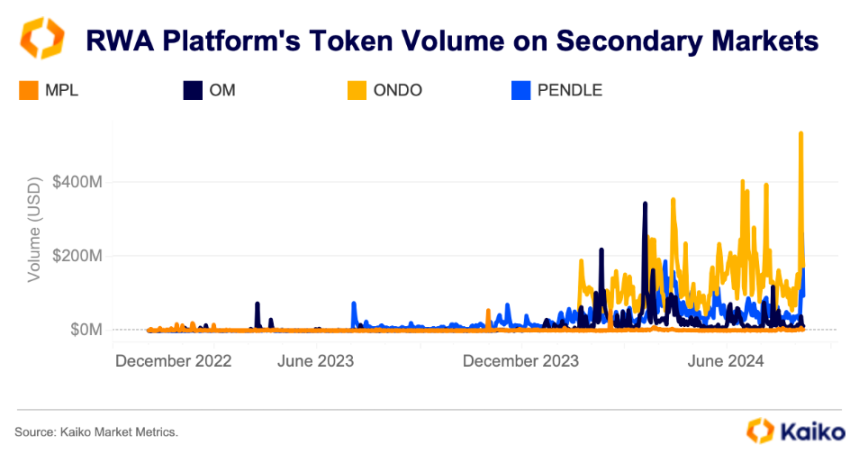

As the popularity of tokenized funds has grown, on-chain flows and secondary market activity for related tokens have also increased. The largest surge in trading volume was seen for Ondo Finance’s governance token, ONDO, which coincided with the announcement of its partnership with BlackRock’s BUIDL. The price of ONDO hit an all-time high of $1.56 in June as BUIDL inflows surged and interest in on-chain funds increased. However, the enthusiasm has since waned, and inflows may face resistance as the US interest rate environment changes.

Since the Aug. 5 sell-off, the narrative has intensified that the Fed is “behind the curve and needs to cut rates more aggressively to avoid a recession,” with markets now pricing in 100 basis points of rate cuts this year.

The weaker-than-expected inflation data released by the United States last week further solidified expectations for a rate cut in September. However, a rate cut does not necessarily mean monetary policy easing. If the Fed cuts nominal interest rates, but inflation falls at the same or faster pace, then real interest rates (i.e. nominal interest rates adjusted for inflation) may remain stable or even rise.

Indeed, even as the Fed has kept nominal interest rates unchanged, the real federal funds rate, adjusted for the Producer Price Index (PPI), a measure of companies’ pricing power, has risen slightly this year.

If real interest rates remain stable, the potential stimulus effect of the Feds rate cuts may be weaker than expected. In this case, Treasuries may still be attractive compared to risky assets, as investors may prefer liquidity and safety rather than taking risks.

This article is sourced from the internet: Opinion: Rate cuts may not reduce the attractiveness of BlackRocks BUIDL

Original compilation | Odaily Planet Daily ( @OdailyChina ) Author: Wenser ( @wenser 2010 ) Editors note: After the market crash in April due to the war situation, the market once again ushered in a periodic dark moment shortly after – according to OKX market data, Bitcoin once fell to $5,3296, a 24-hour drop of nearly 10%; Ethereum once fell to $2,806, a 24-hour drop of more than 10%. Such a huge drop was affected by news such as Mt.Goxs billions of debt claims and the continuous transfer of Bitcoin addresses from the German government, as well as the fact that Bitcoin prices repeatedly broke through the shutdown price of miners and mining companies, Bitcoin spot ETFs continued to net outflow, and some Bitcoin and Ethereum whales were liquidated one…