Bitget Research Institute: The main purpose of option trading is risk aversion, and the risk of a second decline in the

In the past 24 hours, many new hot currencies and topics have appeared in the market, and it is very likely that they will be the next opportunity to make money.

On the evening of August 15, cryptocurrencies suddenly plummeted, with Bitcoin falling to its lowest level since the market panic in early August. The largest options transactions as a whole reflected a relatively obvious risk aversion sentiment. Among them:

-

Sectors with strong wealth creation effects are: Solana Meme, Bitcoin Ecosystem Projects

-

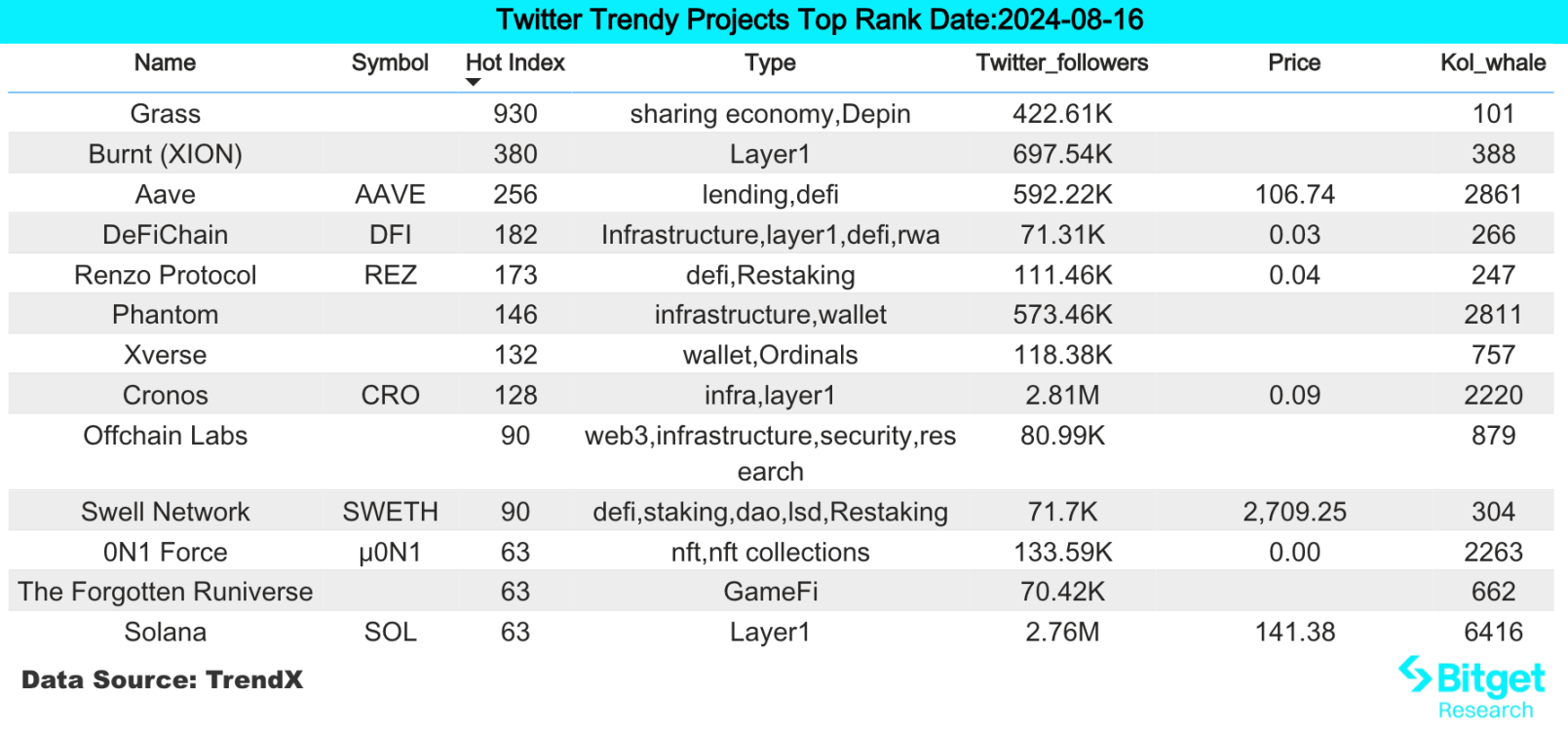

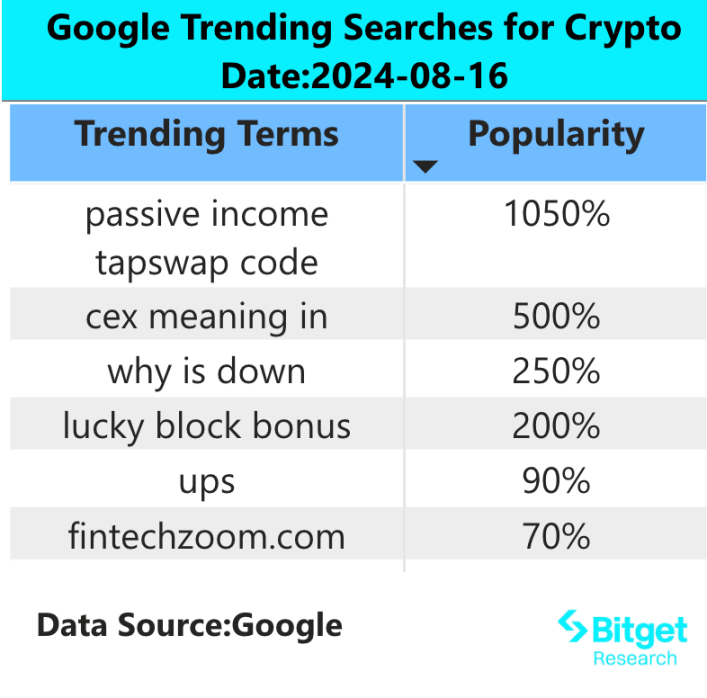

The most searched tokens and topics by users are: Chaos Labs, Swell Network, Tapswap

-

Potential airdrop opportunities include: Sofamon, Lava Network

Data statistics time: August 16, 2024 4: 00 (UTC + 0)

1. Market environment

Cryptocurrencies suddenly plunged on the evening of August 15th, Beijing time, with Bitcoin falling to its lowest level since the market panic in early August. For now, there seems to be no obvious external reason for todays sell-off. US stocks soared again, with the Nasdaq index rising 2.4% and the SP 500 index rising 1.6% – both indexes are now back to the levels before the panic in early August.

The largest option transaction was the purchase of 65,000 call options at the end of the year, and the sale of 85,000 call options at the end of March next year, totaling 380 BTC. The selling of options was mainly to lock in profits, which overall reflected a relatively obvious risk aversion sentiment.

2. Wealth-creating sector

1) Sector changes: Solana Meme (SOLS, JUNGLE)

main reason:

-

USDC Treasury minted 250 million USDC on the Solana chain 15 minutes ago. The increase in liquidity on the Solana chain can promote the performance of various ecological assets.

Rising situation:

-

SOLS and JUNGLE rose 4.01% and 4.88% respectively in 24 hours;

Factors affecting the market outlook:

-

SOL token trend: In the Solana ecosystem, the trend of SOL tokens will affect the price of the entire ecosystem token, because many tokens on DEX are priced in SOL. Continue to pay attention to the price trend of SOL. If SOL maintains an upward trend, you can continue to hold SOL ecosystem assets.

-

Increase or decrease in open interest: SOLs open interest rose yesterday, indicating an influx of hot money. Use the contract data on the tv.coinglass website to understand the movement of the main funds. First, look at the increase in net long positions on the contract; then look at whether the contract data shows a net increase in long positions, an increase in OI, and an increase in trading volume. If so, it means that the main force continues to buy up and can continue to hold.

2) Sectors that need to be focused on in the future: Bitcoin ecosystem projects (SATS, ATOM)

main reason:

-

Arthur Hayes, co-founder of BitMEX, posted on social media that if the Bank of Japan and the Federal Reserve do not allow the interest rate differential between the U.S. dollar and the yen to narrow, the market will continue to increase leverage. If the fiat currency system collapses, or more fiat currency liquidity chases and flows into assets with limited supply, Bitcoin will skyrocket. Good for the BTC ecosystem.

Specific currency list:

-

SATS: A leading BRC inscription project in the BTC ecosystem, with meme attributes; SATS has recently performed significantly stronger than ORDI, and there may be related good news in the future;

-

ATOMARC: Atomicals Protocol is a simple and flexible protocol that can be used to implement the minting, transfer and update of digital objects on a blockchain based on the UTxO model similar to Bitcoin. As the token with the largest market value in the ecosystem, ATOM has a high concentration of funds and is the first to bear the brunt of the rising market.

3. User Hot Searches

1) Popular Dapps

Chaos Labs:

Blockchain risk analysis service provider Chaos Labs has completed a $55 million Series A financing round led by Haun Ventures, with participation from F-Prime Capital, Slow Ventures and Spartan Capital, as well as Lightspeed Venture Partners, Galaxy Ventures and PayPal Ventures.

2) Twitter

Swell Network:

Swell launched the first Bitcoin LRT swBTC in the Ethereum ecosystem to help Bitcoin holders earn income from EigenLayer and other re-staking protocols Symbiotic and Karak. Users can deposit WBTC to obtain swBTC, and it is expected to generate income from mid-September. Re-staking WBTC can earn 3 times the black pearls and symbiotic points.

3) Google Search Region

From a global perspective:

Tapswap:

TapSwap is a Tap2Earn Mini App that was once liked by Telegram founder Pavel Durov. It was launched at the end of 2023. It was originally released on the Solana network and later transferred to the TON ecosystem. The overall popularity of the project is extremely high.

From the hot searches in each region:

(1) The hot topics in Asia are relatively scattered, and the term “RWA” has been trending in many countries;

(2) There are also no obvious hot spots in Europe and the United States. The Philippines has shown interest in US stocks such as Tesla and Nvidia.

(3) Latin America showed a higher interest in SOL and ETH, and AI project tracks appeared on the hot searches in Colombia and Argentina.

Potential Airdrop Opportunities

Sofamon

Sofamon is a project based on the Base network. It is currently working on a personal chat sticker market on Telegram. Users can manage their own sticker sets, invite friends, access Sofamons private group chats, and more.

Web3 social project Sofamon has completed its seed round of financing, with participation from Polychain Capital, Seed Club Ventures, Inception Capital, etc. Angel investors include Celestia COO Nick White, former Coinbase engineer 0x Beans, Divergence Ventures co-founder George Lambeth, etc.

How to participate: The official has not yet announced specific airdrop information, but based on Sofamon’s current popularity on social media and in the crypto community, there is a high probability that there will be airdrop opportunities. Investors can purchase a series of NFT stickers launched by Sofamon.

Lava Network

Lava network is known as the Celestia of 2024. It quickly became popular due to its large amount of seed round financing and strong investment lineup. It completed a $15 million seed round of financing in February this year, led by Jump Capital, Hashkey Capital and Tribe Capital, and participated by North Island Ventures, Dispersion Capital, Alliance DAO, Finality Capital Partners and others. Executives from blockchain projects such as Celestia, Cosmos, StarkWare and Filecoin also participated in this round of financing.

Lava Network is currently in the testnet and plans to launch the mainnet in the first half of this year. Before the mainnet goes live, Lava launched the Magma points reward program. Users can earn Magma points by switching RPC connections to Lava.

Specific participation methods: 1) Log in to the official website, link your wallet, join DC and follow X. 2) Log in to the metamask network settings and change the RPC of your existing wallet to the RPC provided by Lava.

More information about Bitget Research Institute: https://www.bitget.fit/zh-CN/research

Bitget Research Institute focuses on focusing on on-chain data and mining valuable assets. It mines cutting-edge value investments through real-time monitoring of on-chain data and regional hot searches, and provides institutional-level insights for crypto enthusiasts. So far, it has provided Bitgets global users with early-stage valuable assets in multiple popular sectors such as [Arbitrum Ecosystem], [AI Ecosystem], and [SHIB Ecosystem]. Through in-depth data-driven research, it creates a better wealth effect for Bitgets global users.

【Disclaimer】The market is risky, so be cautious when investing. This article does not constitute investment advice, and users should consider whether any opinions, views or conclusions in this article are suitable for their specific circumstances. Investing based on this information is at your own risk.

This article is sourced from the internet: Bitget Research Institute: The main purpose of option trading is risk aversion, and the risk of a second decline in the crypto market is increasing. It is recommended to wait and see

Original article by Min Jung Compiled by Odaily Planet Daily Golem ( @web3_golem ) Editors note: The crypto prediction market has received a lot of attention in this cycle, and many people believe that it is an important representative of the new round of blockchain applications that have broken through the circle. Data shows that the cumulative transaction volume of the leading crypto prediction platform Polymarket in 2024 exceeded US$600 million, and its user base exceeded 150,000. Such an impressive performance has even been publicly praised by Ethereum founder Vitalik . However, has the crypto prediction market really become popular on a large scale? The most popular prediction topics on Polymarket are all related to the US election, and the predicted prize pool for the winner of the 2024 US…