SignalPlus Volatility Column (20240815): CPI Hidden Surprises

Yesterday (14 AUG), the highlight of this week, the release of US CPI data, was released. The data showed that the US seasonally adjusted CPI annual rate at the end of July was 2.9%, falling for the fourth consecutive month, the first time since March 2021 to return to the 2-digit level, slightly lower than the markets expectation of 3%; the core CPI annual rate was 3.2%, in line with market expectations. However, digital currencies suffered a sharp decline after the release of the data. BTC fell from 61,000 to 58,000, a drop of more than 5%. The price of Ethereum initially showed strong resilience, and the price stabilized after a short-term decline to 2,650, but fell again to above 2,600 a few hours before the close, and the intraday decline was also close to 5%. Some traders questioned this, believing that this was not a proper response to the CPI that was “in line with expectations.” Stepping back, as a highly correlated currency pair, ETH is usually more volatile than BTC, so they were a little surprised by yesterday’s market. Let’s expand on this.

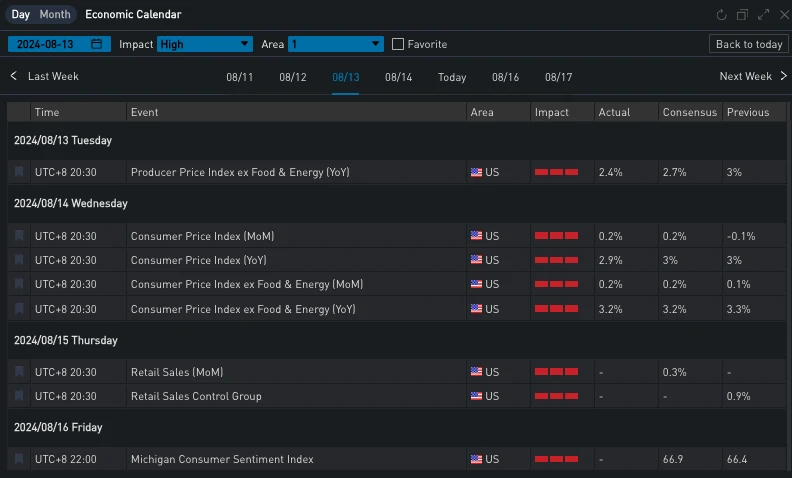

Source: SignalPlus Economic Calendar; TradingView

After the release of CPI, the yield on the 10-year U.S. Treasury bond rose first and then fell, and gradually rose during the day. It can be seen that after the release of the U.S. PPI the day before, the markets expectations for CPI should be lower than expected overall, so this result is disappointing for the dovish market. Looking closely at this report, the most disappointing thing in the market may be the accelerated rise in rents: In June, owner equivalent rent just hit the lowest level since 2021, and in July this indicator accelerated to 0.36%, while housing prices rose by 0.4%, compared with only 0.2% in June, which aroused market doubts. However, since this indicator has a slightly lower weight in the PCE indicator favored by the Federal Reserve, this indicator will be slightly lower than CPI. Rusty Vanneman, chief investment officer of Orion, said that he believes that there is still a high possibility of a rate cut in September, but the current inflation problem is more difficult than the Federal Reserve expected, because the possibility of a 50 basis point rate cut in September needs to be reassessed.

With inflation data successfully falling below 3%, investors can shift their focus from inflation to economic growth and employment. Jack Mcintyre, investment manager at Brandywine Global, said: The U.S. CPI data is important, but in terms of its impact on the market, it may rank third in the hierarchy of economic data – namely employment, retail sales and inflation, so it is not so important. Retail data will be released tonight, and volatility on the front end of options is still flat, implying this part of uncertainty.

Source: Investing

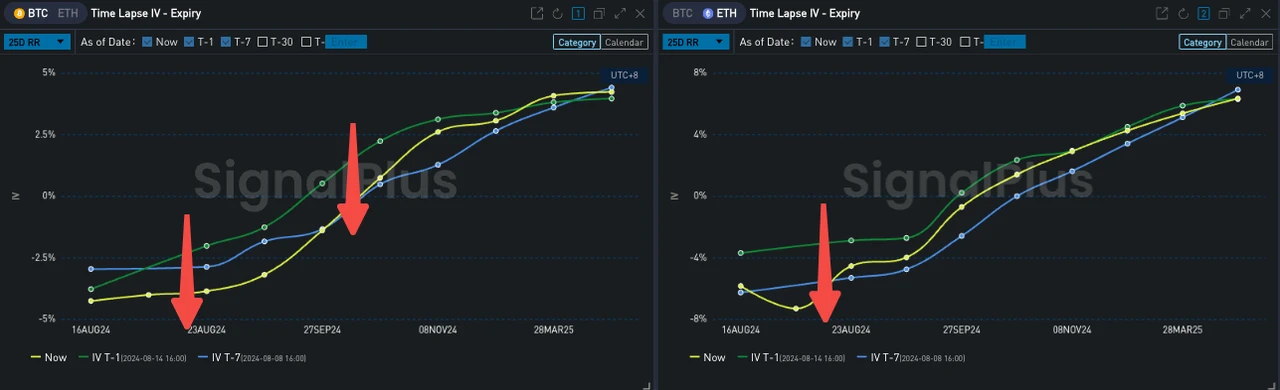

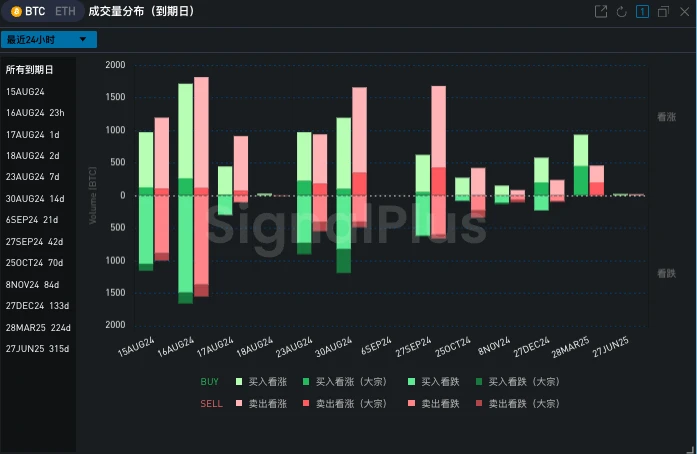

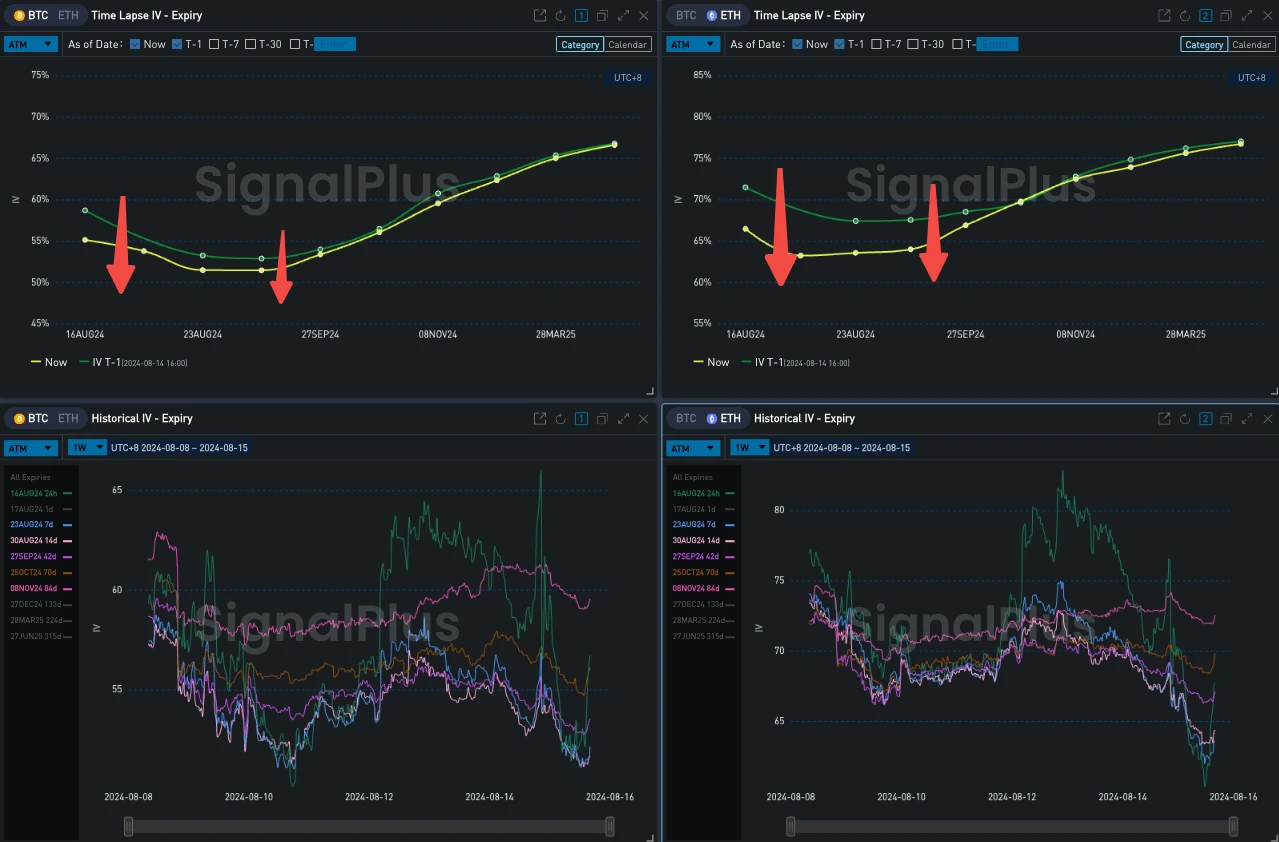

In another piece of news, the US government transferred 10,000 bitcoins to CoinBase Prime, which triggered market concerns about potential sell-offs and led to a drop in bitcoin prices. From the perspective of option transactions, there is a large demand for put option protection in the short and medium term for BTC, which has led to an overall decline in the mid- and front-end Risky. From the perspective of overall volatility, ETHs front-end IV ended its obvious decline after the release of CPI, while BTC maintained an upward trend under the uncertainty brought about by higher actual volatility and potential selling pressure. Tonights US retail data will once again test the digital currency market.

Source: SignalPlus, BTC RR is reduced overall

Source: SignalPlus, BTC transaction distribution

Source: Deribit (as of 16 AUG 16: 00 UTC+ 8)

Source: SignalPlus

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240815): CPI Hidden Surprises

Related: SignalPlus Volatility Column (20240715): When the gunshots sounded

At 18:00 on July 13, local time in the United States, Trump held a new round of presidential campaign rally speeches in Butlobe, Pennsylvania. At 18:11, a gunman fired several shots at him from a high position outside the venue, injuring Trumps right ear, and also sounded the American peoples support for Trump, causing his election victory rate to soar to more than 70%. Considering his use and support of digital currency (at least during this campaign), the assassination also indirectly supported the continued rise in BTC prices and the rapid rise in overall volatility levels from the bottom of the weekend. Source: TradingView; SignalPlus But then again, the credit for Bitcoins recovery is not all his. According to data provided by Farside Investors, traditional funds have been re-injected into…