Token Migration Case Study: What are the key considerations for project founders?

Original author: panadol girl

Original translation: Luffy, Foresight News

If you are a crypto project founder who wants to migrate an old token or merge with another token to give it a “second life” and transform token economics and utility, then this article may help you.

Some may say that projects only have one chance to launch a token, but the reality is that markets and narratives change, team strategies and visions change, and even community expectations change.

Therefore, token branding and market positioning must evolve to stay relevant, and token utility will change with it. Founders and teams should have this choice, as long as it is reasonable, well-thought-out, and approved by the community.

@karmen_lee and I spent hours doing a deep dive into 5 previous token migration and consolidation case studies to get a more comprehensive understanding of the key considerations, migration mechanics, timelines, price performance, and community reaction.

We also developed a high-level design blueprint that we hope will be helpful to founders and builders. This article will highlight our findings from these 5 case studies, as well as some of my own thoughts:

-

MC -> BEAM

-

RBN -> AEVO

-

AGIX, FET, OCEAN -> ASI

-

KLAY, FNSA -> PDT

-

OGV -> OGN

1. MC->BEAM

Merit Circle’s migration to Beam is probably one of the most successful and mature token migration cases. It is a great example of an application (chain game guild) transitioning to a blockchain with clear and consistent community communication and proposal processes.

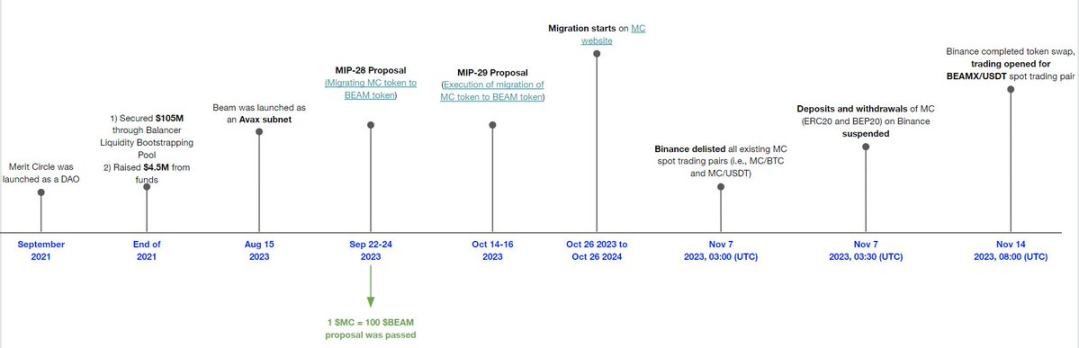

Detailed timeline for Merit Circle migration to Beam

Why upgrade?

-

Better alignment between token branding and underlying network.

-

Enhance the utility of tokens.

-

Market positioning and brand awareness.

-

Quickly align internal and external parties’ attention to BEAM’s new vision.

Why not just do a token airdrop?

-

BEAM is designed to replace MC tokens, not co-exist.

-

Since MC tokens are constantly changing hands, it is difficult to conduct a fair and accurate airdrop.

-

Costly (including transaction costs).

Price Impact

-

BEAM price increased by about 200% in the six weeks after the migration

-

Since the migration began on October 26, 2023, MC prices have also surged more than 3 times.

2. RBN -> AEVO

In the DeFi space, the merger of Ribbon Finance and Aevo is an interesting case that integrates an automatic staking mechanism into the merger process.

Switching from 2 different products and 1 RBN token to 1 unified product and 1 new AEVO token.

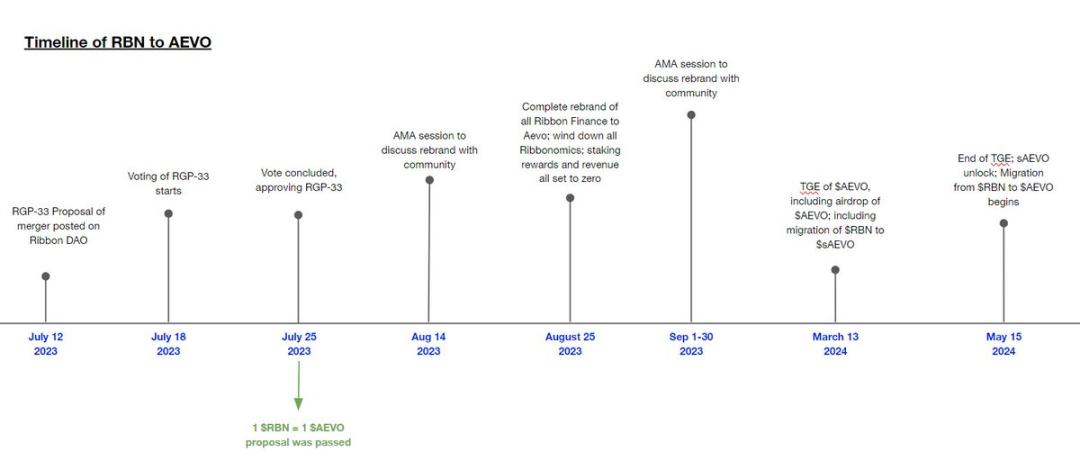

Timeline of the Ribbon Finance and Aevo merger

Why merge?

-

Solving the scalability problem of DeFi options, Ribbon encountered difficulties in scalability.

-

Synergy of product offerings.

-

Technical advantages of UI/UX: Aevo L2 Rollup aims to provide users with solutions such as 0 Gas fees, reduced order delays, improved order processing capabilities, and active market makers.

-

Development direction and goals: To become a high-performance derivatives trading platform and provide more products under 1 brand.

Staking Mechanism

The converted AEVO tokens are subject to a 2-month lock-up period. AEVO tokens are converted to sAEVO (staked AEVO) and then locked, mitigating price volatility caused by sell-offs.

3. AGIX, FET, OCEAN -> ASI

One of the hottest merger cases this year was the merger of 3 high FDV AI tokens: Fetch.ai, SingularityNET, and Ocean Protocol. When the news first broke in March, our team immediately got on a call with Singularity to understand the rationale and mechanics.

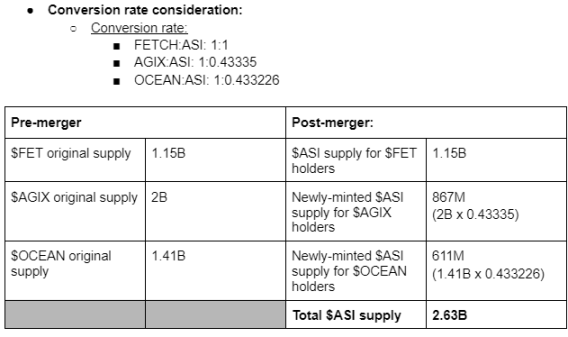

The key thing we can learn from this case is their thinking on the token conversion ratio and why they did not apply any premium or discount to the token valuation.

Why merge?

-

Consolidating Liquidity: Liquidity is expensive.

-

Build the largest independent company in the field of artificial intelligence research and development.

Exchange rate

-

The exchange rate is based on the average price of the 15 days prior to the announcement.

-

To reduce friction in valuation negotiations, teams only need to value tokens under the same market conditions, without applying premiums/discounts based on liquidity/volume differences.

-

FET was chosen as the base token, so the exchange rate with ASI is 1:1.

You can find the two-stage merge process currently underway here .

4. KLAY, FNSA->PDT

This year, the 2 oldest tokens in South Korea also decided to merge. One is backed by Kakao and the other is backed by LINE, they are the 2 largest communication apps in South Korea. Their vision is to become the largest blockchain in Asia with a user base of 250 million wallets, more than 240 DApps and services.

The focus of our research is on their combustion mechanisms:

-

Approximately 22.9% of the total supply of new PDT tokens will be destroyed.

-

The uncirculated portion will be 100% destroyed.

-

Purpose: To reduce inflation and control supply.

They published a very detailed document explaining the destruction process.

5. OGV->OGN

Purpose of the upgrade: To integrate all of Origin’s product suite with a single governance and revenue token, OGN, and to consolidate liquidity.

The learning we gained from this case study was the catalyst: the team realized that OGV was mispriced and its market cap/TVL ratio was much lower than other competitors.

Conclusion

Token migration or merger does not guarantee short-term or long-term price appreciation. Therefore, please make sure you have a good and solid reason to explain why you are migrating or merging.

Token migration is not a one-time event, communication, transparency, and governance proposals are an ongoing process, which is why I believe some cases are more successful than others.

The migration period for most of these five cases has not yet ended, so it is necessary to monitor the overall product and ecosystem progress as well as token performance before judging whether this is a successful migration or merger.

This article is sourced from the internet: Token Migration Case Study: What are the key considerations for project founders?

Headlines 200 million XRP unlocked from unknown escrow wallet, worth over $119 million According to Whale Alert monitoring, 200 million XRP were unlocked from an unknown escrow wallet, worth US$ 119,178,067 . Ethereum beacon chain stakes exceed 34 million ETH Dune data shows that the total amount of Ethereum beacon chain staked is 34,048,349 ETH, and the staked ETH accounts for 27.83% of the total supply. Among them, the stake share of the liquidity staking protocol Lido reached 28.82%. BTC fell below 63,000 USDT in the short term, with a 24-hour drop of 5.05% OKX market data shows that BTC fell below 63,000 USDT in the short term and is currently trading at 63,128 USDT, a 24-hour drop of 5.05%. Montenegrin court upholds ruling paving way for Do Kwons extradition…