Crypto market weathervane: interpreting three bearish warnings and three bullish signals

Original author: CRYPTO, DISTILLED

Original translation: TechFlow

Cryptocurrencies, like most risk assets, are currently facing severe macro headwinds, leading to increased volatility and fear in the market.

Despite these challenges, the strong value proposition of Bitcoin and blockchain continues to support a long-term bullish outlook.

Expect some challenges in the short to medium term. Focus on safety, keep an open mind, and be cautious in taking opportunities.

Here are three bearish signals and three bullish signals for your reference.

Bearish Signal #1 – Gold Breakout

In 2019, when gold broke out again, Bitcoin hit its highs.

This pattern repeats itself in March 2024.

Will the market cool down for 6-9 months before 2025?

Source: Intocryptoverse

(i) Why is a breakout in gold bearish?

As a safe haven, gold tends to outperform other risky assets in risk-averse markets.

Currently, macro uncertainty is high due to geopolitical conflicts, an uncertain US election, and the yen carry trade.

While Bitcoin may follow gold, riskier altcoins may not.

Bearish Signal #2 – Rate Cutting Environment

Rate cuts can be bullish in the long run, but their immediate impact tends to be negative for risk assets.

During the last rate cut cycle (2019), the ALT/BTC trading pair took a big hit.

As oscillators, these trading pairs could face more pain if the market remains risk-off.

Source: Intocryptoverse

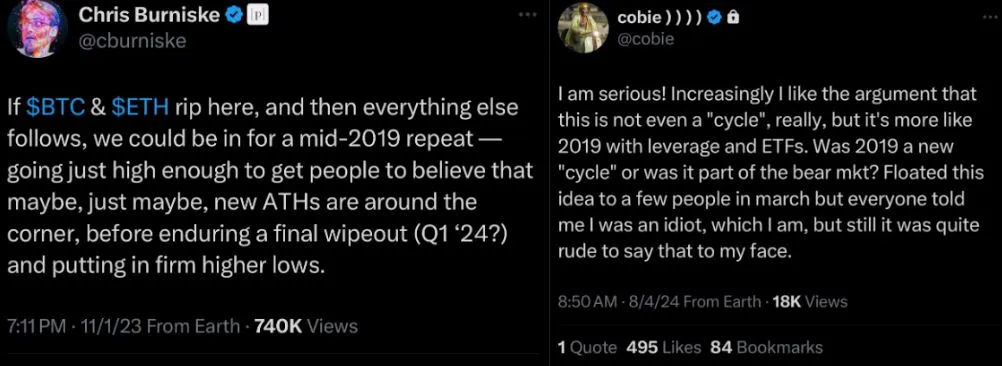

(i) Parallel to 2019 – The bull run has not started yet?

Key thought leaders like Cobie and Chris Burniske also see similarities in 2019. Here are their key takeaways:

-

Bitcoin dominance rises ahead of liquidity recovery

-

We are not yet in a bull market (2023/2024 is an echo bubble)

-

March 2024 is the mid-cycle high

Bearish Signal #3 – Sahms Rule

Sahms rule predicts a US recession (based on unemployment data).

(Note from Shenchao: The Sahm rule is an indicator used to identify economic recessions, which mainly judges economic conditions by observing changes in the unemployment rate. This rule was proposed by economist Claudia Sahm and aims to provide a simple and effective method to help policymakers and economic analysts identify the risks of economic downturns in a timely manner.)

Since 1950, every time the index exceeds 0.5, a recession has followed.

Last week it flickered again.

Source: saxena_puru

(i) Beyond Sahms Rules:

Note that the triggering of Sahm’s rule is not the end of the story.

The key will be how global banks respond through monetary policy and liquidity provision.

The next few months will be critical in shaping the market’s trajectory through 2025.

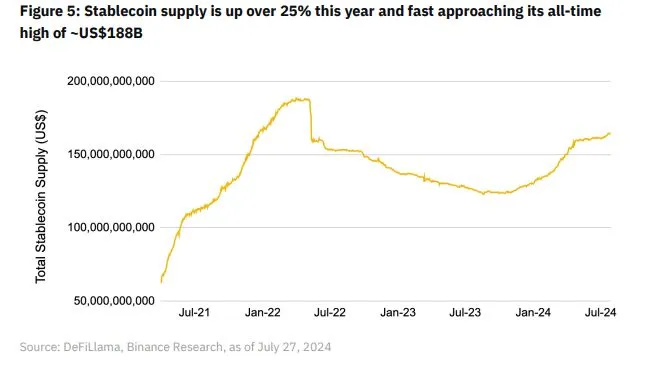

Bullish Signal #1 – Stablecoin Inflows

Despite the slump in cryptocurrency prices, stablecoin supply is approaching new all-time highs (ATH).

This year, stablecoin supply has grown by more than 25%.

As capital continues to flow into the crypto market, a long-term bearish outlook is difficult to sustain.

Source: Binance Research

(i) Why is rising stablecoin supply bullish?

The increase in stablecoin supply indicates that more liquidity is flowing into the crypto market.

Stablecoins are capital that can be invested in crypto assets.

Historically, rising supply has typically foreshadowed rising cryptocurrency prices.

(ii) Interest rate cuts and the rise of stablecoins:

While rate cuts may have a negative impact on riskier assets in the short term, they are bullish for stablecoins in the long term.

As yields on traditional assets decline, on-chain returns become more attractive.

This could boost the expansion of stablecoins in the coming months.

Source: SplitCapital

Bullish Signal #2 – US Regime Supporting Cryptocurrency

Positive regulatory adoption of cryptocurrencies is growing.

The key evidence is the increasing likelihood of a pro-cryptocurrency U.S. regime. Several notable developments include:

-

Bitcoin holdings by U.S. companies increase

-

Democrats and Republicans Supporting Cryptocurrency

-

Bitcoin fair accounting rules will come into effect in 2025.

While there may be some short-term hurdles, the overall trend remains positive and strong.

Bullish Signal #3 – Global Debt at Record Highs

Global debt hit an all-time high of$315 trillion earlier this year. With elections in more than 50 countries in 2024, governments may be inclined to:

-

Tax cuts

-

Cash stimulus policy

(i) Why is rising debt bullish?

Bitcoin is a hedge against currency debasement and geopolitical uncertainty.

“I believe that if the world is fearful, Bitcoin will go up” — Larry Fink (CEO of Blackstone Group)

Source: Andre_Dragosch

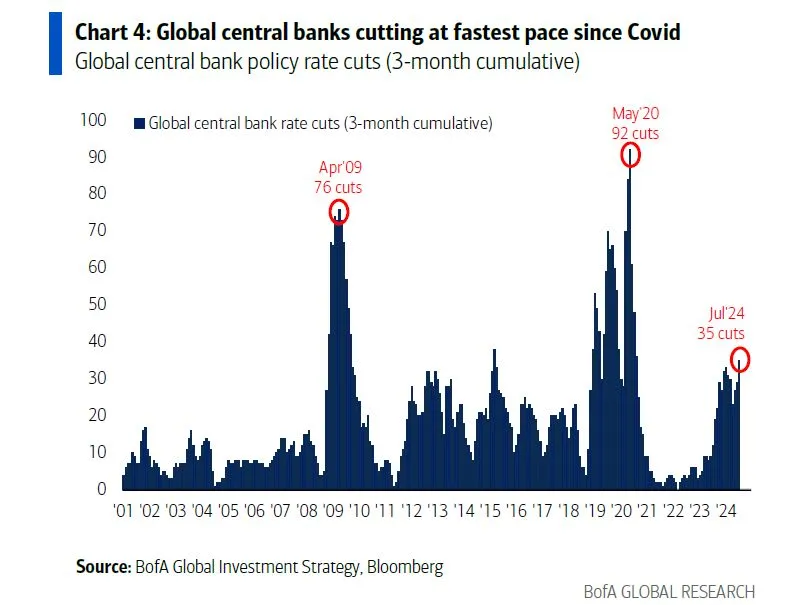

(ii) Central Bank Liquidity and Stimulus:

In the medium to long term, altcoins may benefit from liquidity injections targeting debt issues.

Central banks may stimulate economic activity to mitigate recessions.

Interest rate cuts have already begun, and fiscal policy may soon follow.

Source: Zerohedge

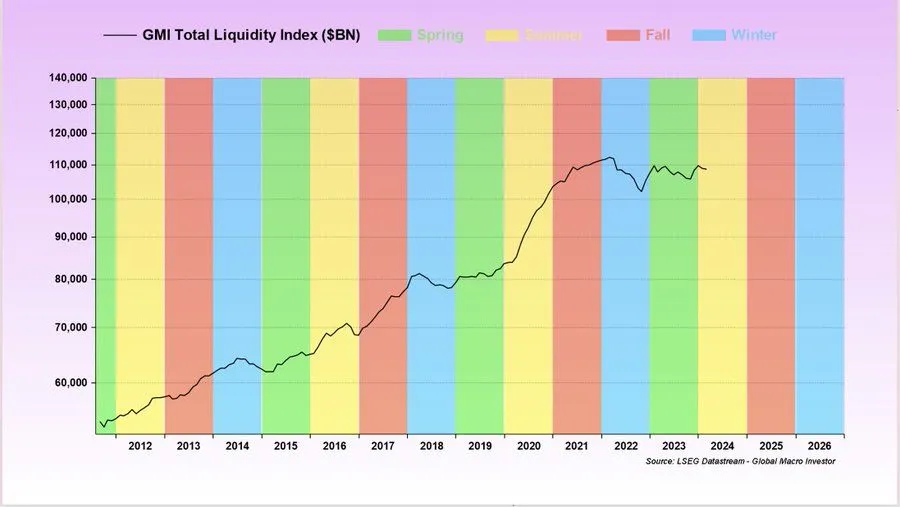

(iii) Macro Summer in the Four-Year Liquidity Cycle:

Finally, you can look at the “debt problem” through the four-year liquidity cycle.

Since 2008, this cycle has been based on governments refinancing their debt.

We are currently in the “macro summer” and earnings are expected to gradually rise.

This phase usually leads to a risky macro fall.

Source: Raoulgmi

This article is sourced from the internet: Crypto market weathervane: interpreting three bearish warnings and three bullish signals

Original source: Cointelegraph, Decrypt Compiled by: Felix, PANews The Bitcoin 2024 conference opened in Nashville, Tennessee on July 25. The conference attracted widespread attention in the weeks before due to the addition of several well-known politicians to the Nashville event speaking lineup, including presidential candidates Donald Trump and Robert Kennedy Jr., as well as Michael Saylor, Cathie Wood, Senator Marsha Blackburn, Cynthia Lummis, etc. Image source: Cointelegraph The bitcoin fans who flocked to Nashville this year weren’t focused on the asset’s price. Instead, they were soaking up the bull market and networking with like-minded attendees. For many, this year’s conference wasn’t their first. But a lot has changed since the first one in Miami 14 months ago, when the price of Bitcoin was hovering around $28,000. At the conferences main…