Following Trumps speech in support of digital currency at the Bitcoin 2024 Summit on Sunday, news came out the next day that the US government had transferred a large amount of Bitcoin. The potential selling pressure caused investors to feel risk averse. BTC fell from a high of $70,000 to the familiar level of around $66,000. The inflow of funds into BTC ETFs also declined. However, from the ETH side, we saw that ETF products led by Blackrock ETHA resisted the selling pressure from Grayscale ETHE with higher positive capital inflows. The Flow on JUL 30 successfully turned positive, providing confidence for stabilizing prices.

Source: Farside Investors

Today, investors are most concerned about the FOMC meeting at 2 a.m., and the end-of-day options have already priced in the uncertainty with a high premium. But the uncertainty of this meeting does not come from the decision-making. In fact, according to foreign media surveys and statistics, almost all economists expect that there will be no change in interest rates this time. We should pay more attention to Powells subsequent press conference. The market expects that the Fed may first make subtle changes in the wording in the statement and acknowledge the recent improvement in inflation and the balance between inflation and the labor market. People do not expect Fed officials to show great enthusiasm for rate cuts at this meeting, but they may provide initial hints of a rate cut in September and information on what indicators to pay attention to next. For investors who want more and clearer signals, they may have to wait until the Jackson Hole Central Bank Annual Meeting in August, when the Fed Chairman will give a speech at the meeting and announce some important information.

Source: SignalPlus, Economic Calendar

Source: SignalPlus

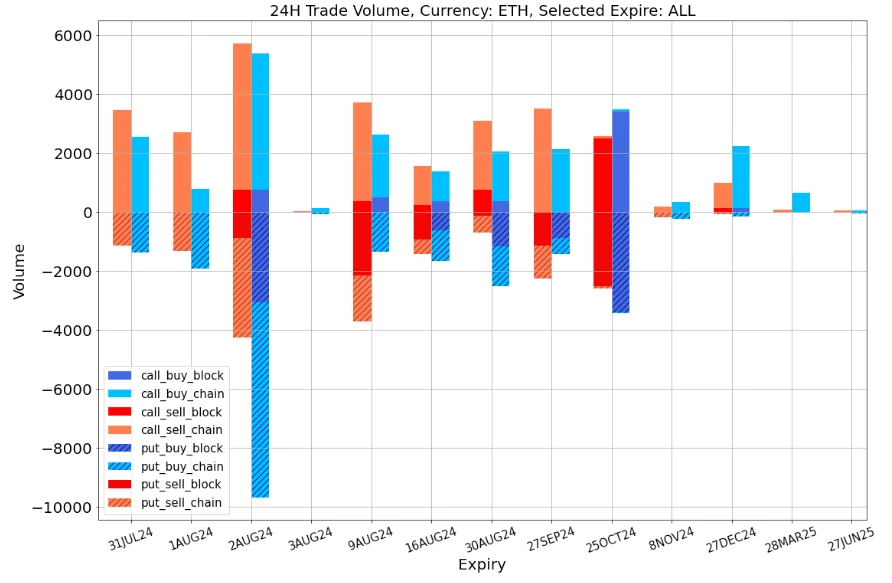

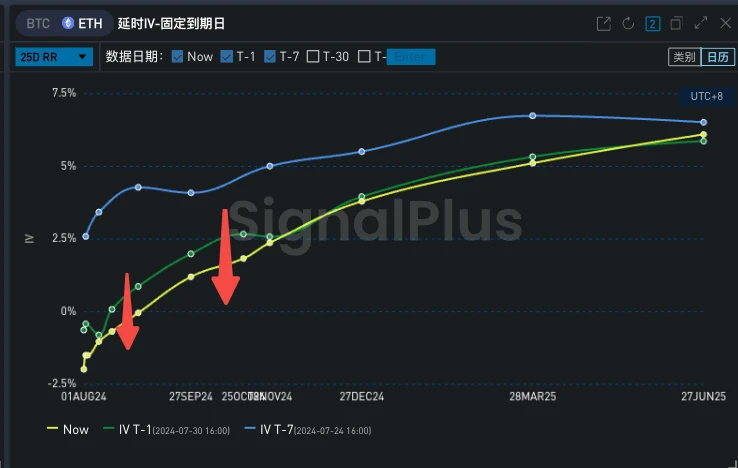

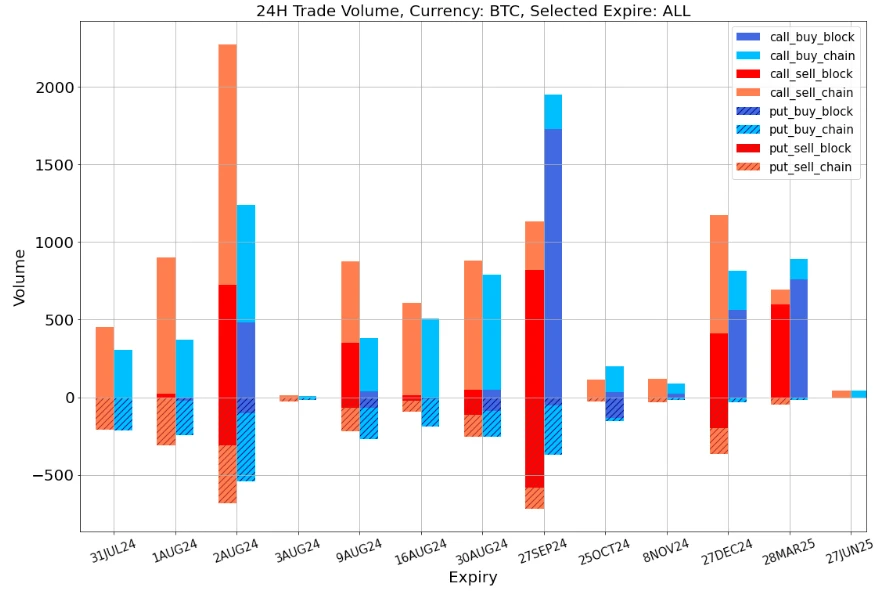

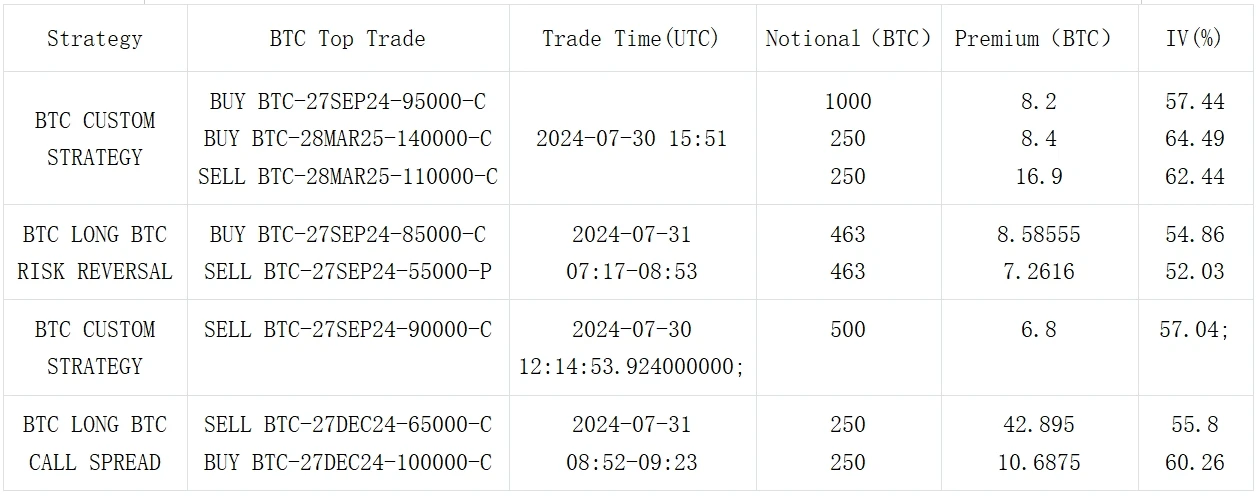

In terms of trading, investors bought a large number of put options on ETH 2 AUG for protection, and sold a large number of call options in the middle and front ends, causing the Vol Skew to fall in this range; in terms of BTC, the market sold call options on 2 AUG to eat the premium brought by the uncertainty of FOMC. At the same time, there was still sufficient supply on the far top side. The more representative ones were 1,000 September 95,000-C call purchases, 85,000 vs 55,000 Long Risky, and December 65,000 vs 100,000 call rolls, which pushed up the premium on the topside wing and tilted the far Vol Skew towards call options.

Source: Deribit (as of 31 JUL 16: 00 UTC+ 8)

Data Source: Deribit ETH transaction overall distribution; SignalPlus 25 dRR

Data Source: Deribit BTC transaction overall distribution; SignalPlus 25 dRR

Source: Deribit Block Trade

Source: Deribit Block Trade

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240731): FOMC Outlook

Related: A new global consensus? The ranks of “crypto presidents” are growing

Original author: Huo Huo 2024 is a super election year, with dozens of countries and regions around the world holding key elections, involving a total population of more than 4 billion. The US election is undoubtedly the biggest focus. However, unlike in the past, among all the super PACs participating in the 2024 US election, the topic of cryptocurrency ranks third in popularity. I still remember that four years ago, it was rare for presidential candidates to discuss Bitcoin during campaign events. Three years ago, when El Salvador first adopted Bitcoin as legal tender, everyone was still watching. However, in last years primary election, the situation began to change, and the era when encryption was marginalized in politics seemed to be gone forever. On the one hand, former President Trump…