Market turns uncertain bullish: ETFs, political factors and internal innovation struggle

Original author: IGNAS | DEFI RESEARCH

Original translation: TechFlow

The market has shifted from dull to uncertainly bullish. Crypto markets have been lackluster since May.

Prices are stagnant, airdrops are disappointing, infrastructure projects are tired (people are not paying attention to technical posts anymore), and regular investors (not us, but regular investors who buy casually) are not active. Crypto Twitter now discusses more politics than cryptocurrencies.

The market remains uncertain, but this uncertainty is more bullish than bearish. Let me explain.

External uncertainty

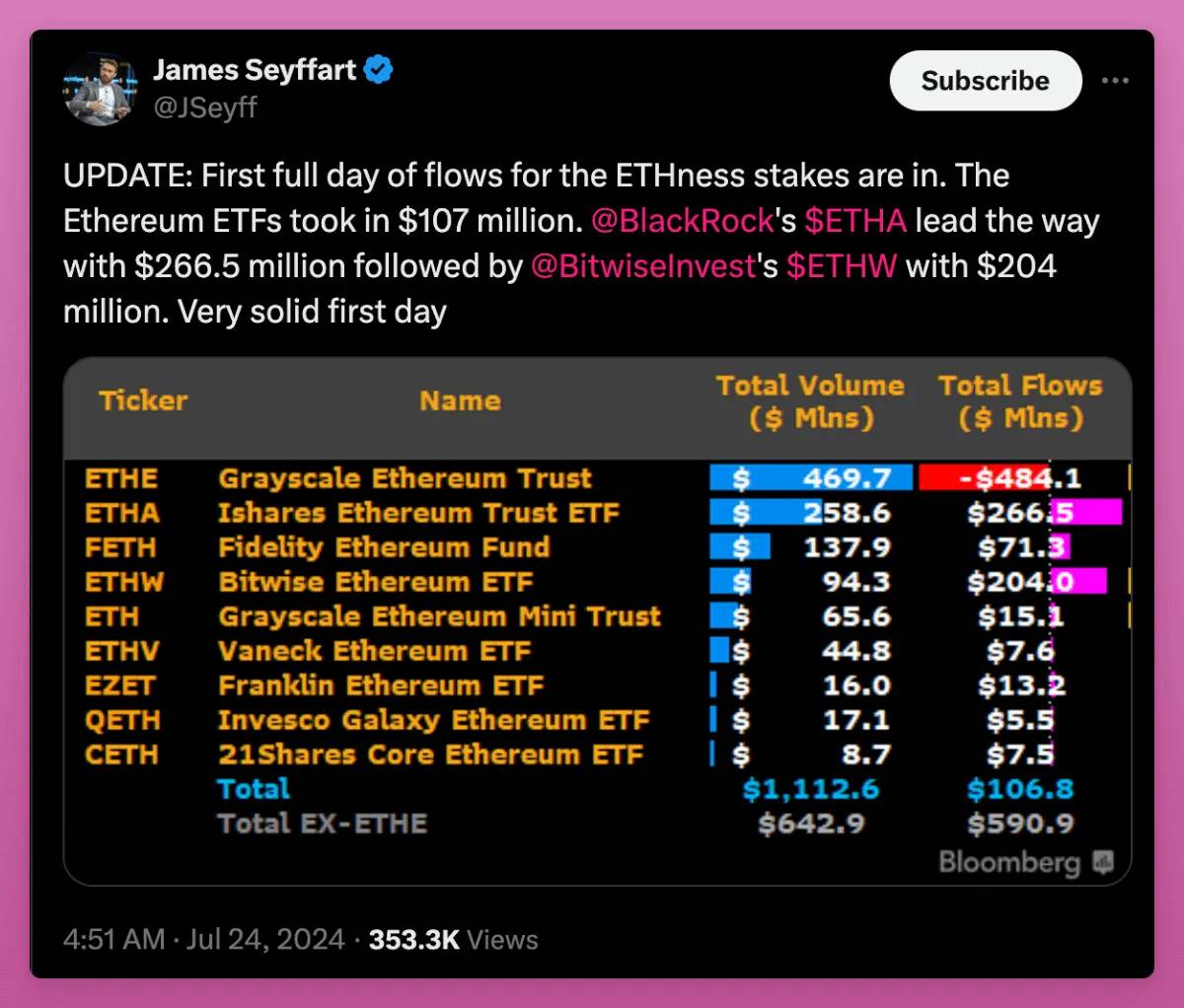

First, the Ethereum ETF is finally online and the data is beginning to be released.

On the first day, the ETH ETF’s trading volume reached $1 billion, accounting for 25% of the BTC ETF’s trading volume. Most analysts expected the ETH ETF’s trading volume to be between 10% and 20%, indicating that this is a bullish signal.

But will this trend continue? Will inflows exceed Grayscale’s outflows?

This is the main uncertainty for ETH right now, causing the price of ETH to fall. But over time, this uncertainty will gradually diminish, and Grayscale will hold less ETH.

If every day we hold this price level it will be a bullish sign.

Next up is the US election. Will Trump win? Will he declare Bitcoin a reserve asset (not a currency) at his conference in Nashville? Is Kamala really willing to change the Democratic Party’s stance on cryptocurrencies?

Too many uncertainties.

The market doesnt like uncertainty; it wants answers. However, I believe that the U.S. government will eventually change its negative stance on cryptocurrencies as a natural process in the development of technology.

Image tweet content:

– First they ignore you,

– Then they laugh at you,

– Then they fight you,

Finally you win. We are now in the phase where those who have been fighting us for years are finally realizing that confrontation is not the right path. They know it is a losing battle and are now looking for ways to move forward. When you go from no politicians talking about you to bipartisan bills passing Congress and the party that was once seen as your biggest enemy is now trying to get more involved, that is victory.

I just wrote the old “first they ignore you… then you win” cliche when I saw Adam tweet the same thing. I couldn’t agree more. Governments have little to gain and a lot to lose by opposing cryptocurrencies. We will win.

It’s not just the US. China is also reportedly considering lifting its ban on cryptocurrencies. While this is unconfirmed, this uncertainty is also bullish.

Third, Mt Gox creditors. Will they sell their BTC, or will they hold on? Or will they sell BTC and buy other crypto assets?

We don’t know yet. This uncertainty has a negative impact on cryptocurrency prices, but one day we will realize that it doesn’t matter. Just like the German sale of BTC, the Mt. Gox incident will pass, leaving behind the selling pressure we have been worried about for years.

So, what is my point?

It is often said that the markets are driven by two forces: fear and greed. However, I believe that fear is more powerful than greed.

Loss aversion is a powerful force in investing, making fear a more dominant driver than greed. The pain of losing money is stronger than the excitement of making money, making us overly cautious. This fear leads to early selling or makes people unwilling to invest even when there is a good opportunity in front of them.

In markets, this means that fear often drives decisions more than the appeal of potential gains, leading to conservative and overly bearish reactions.

Over time, our fear will decrease and FOMO will set in. The current external uncertainty is temporary. Grayscale will eventually run out of ETH, Mt. Gox creditors will sell what they want, and even if Trump loses and the Democrats remain against crypto, we will be able to continue to prosper as we have for years under this anti-crypto government.

Still not convinced? In a podcast with Blockworks , Lyn Alden predicted a typical liquidity cycle, predicting a boom in 2025. If the above positive events occur, the chances of the market going up will increase.

However, external uncertainty is only part of the bullish sentiment. There are finally some interesting things happening within cryptocurrencies.

Internal uncertainty

Internal uncertainty refers to decisions made by the local crypto community, such as developers, traders, and airdrop farmers. This bull run is somewhat boring because it is mainly driven by external factors, such as:

-

BTC/ETH ETF

-

The governments erratic policies

-

Potential interest rate cuts, etc.

-

We really lack strong internal innovations to attract regular investors and keep them interested. So far, there are only two internal factors that have triggered FOMO in this bull run:

-

Memecoins

-

airdrop

Airdrops have re-energized old and new DeFi dApps, generating seemingly positive engagement metrics, but these are mostly fake and driven primarily by speculators who use dApps solely for the airdrops.

The enthusiasm around the airdrop has waned, evident in the drop in sentiment on X and falling interest rates on lending platforms as farmers borrow assets to maximize their yields.

You can see that the Stablecoin IPOR Index has dropped from 20% to 7% since March, but is still higher than it was a year ago.

This is nothing new to anybody. What is uncertain is how we can continue to issue tokens to the market and convince people to buy them.

This is my biggest obsession. Every cycle, we find new ways to release tokens into the market. Points for airdrops is just the latest trend, but it will certainly not be the last. The first people to realize how it works will get the highest return on investment (ROI). I wrote about how it works before this bull run started.

Echoes of the past: What déjà vu markets tell us about the next bull run.

I bet that Friend Tech could revive the “fair launch” model with a 100% airdrop, but I lost. Similarly, Nostra’s 100% launch unlock and Ekubo’s 1/3 allocation airdropped to the community and the other 1/3 sold over two months produced mixed results. The token finally rose, but the airdrop was small and the market cap remains low.

We also conducted some experiments on the gamification of points. I mentioned 7 emerging trends in my previous blog post. However, the results of these experiments were mixed, for example, the $CLOUD airdrop disappointed me.

Rebranded token migrations are also promising. This happens when a protocol adopts a new brand and migrates tokens to start over, rather than opting for a simple v2 or v3 upgrade. We’ll see how Fantom’s migration to Sonic performs, but Connext’s migration to Everclear and Arweave’s new AO tokens and AR farms have produced mixed results.

Currently it seems that only memecoins are still performing relatively well.

As the market turned bullish this week, memecoins emerged as the best performing sector. This means that speculators are bullish but waiting for the right time to enter the market.

With nothing else going up besides memecoins, the team was desperate. So its no surprise that Jupiter decided to work with Irene to launch a new experimental memecoin.

In summary, some crypto teams are innovating, but most prefer to go the safe route (like deBridge) because nothing new is good enough: newly launched tokens are selling off under unlocking pressure (although ZRO is doing well).

Making money on memecoins is equally challenging because thousands of memecoins enter the market and most go directly to zero.

I believe this uncertainty about the future of token issuance is why DeFi tokens may perform well later in the cycle.

DeFi OG tokens like UNI, MKR, LDO, AAVE, and SNX have large circulating supplies, reducing the risk of a massive sell-off.

With potential regulatory clarity, these tokens, backed by solid business models and revenue generation, could attract more capital inflows. In particular, DeFi OG tokens offer an interesting hedging option as the market tires of memecoins and new tokens pour in.

Currently, memecoins are doing well because tokens with utility are considered “securities” by regulators, while memecoins lack utility and are less risky from a regulatory perspective. Positive signals from the government could significantly change the mentality around cryptocurrencies.

But its all still full of uncertainty.

Consumer Applications

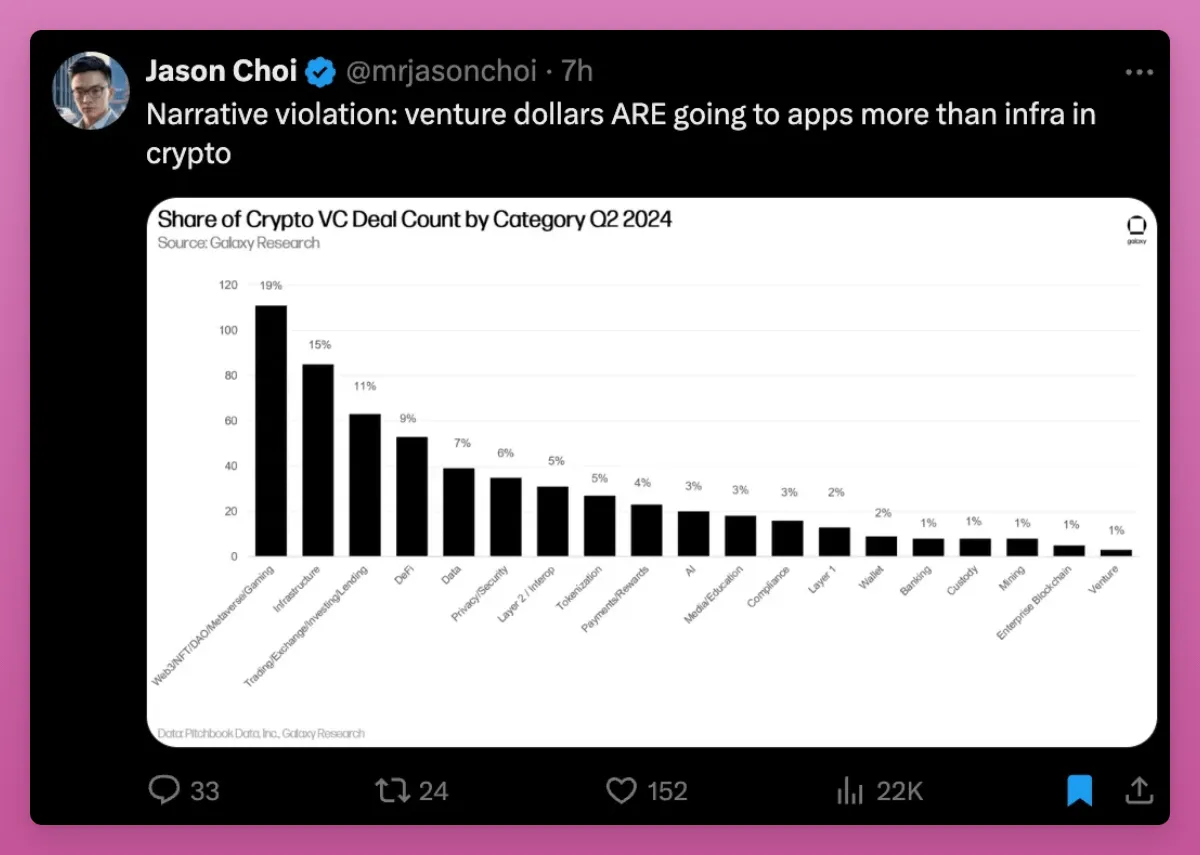

The fatigue with high-ticket infrastructure projects is real. While few are excited about new AI-based zk Layer 2s like Zircuit, this is actually a positive sign.

We are finally realizing the need to develop consumer applications through this infrastructure.

Venture capital money is finally flowing more towards applications rather than infrastructure. Hopefully, some useful products will emerge from this.

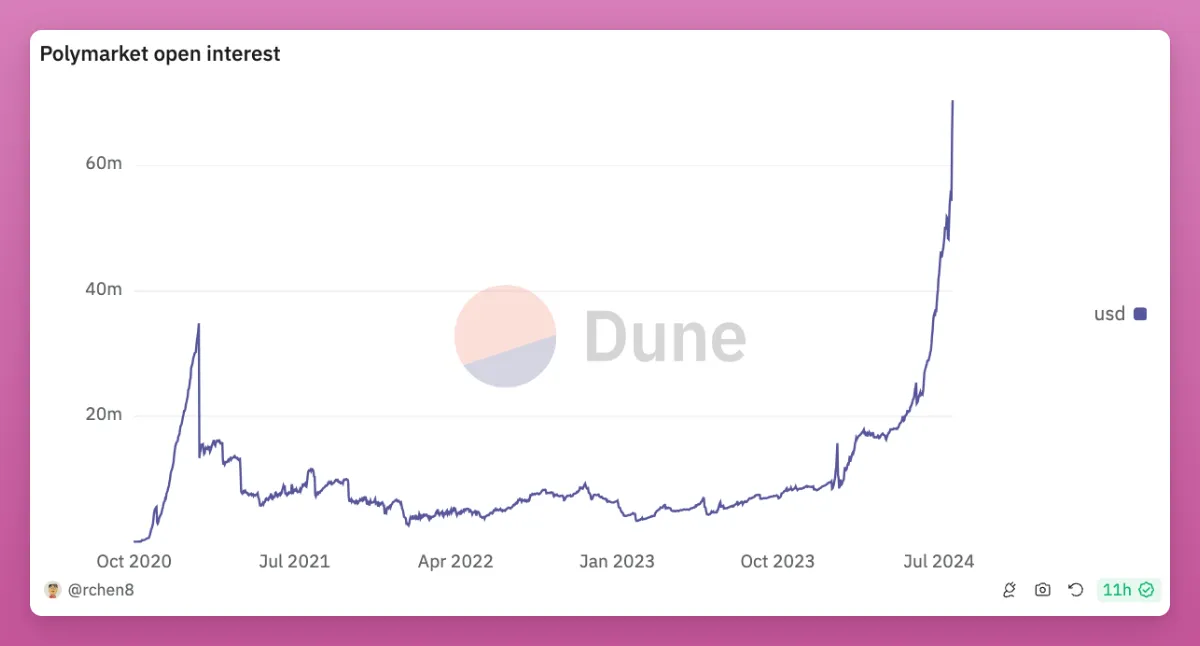

The biggest winner in the consumer application space is Polymarket, which is not only good for speculation, but also provides a reliable source of truth in an era dominated by biased traditional media.

Even though Polymarket is one of the coolest consumer applications for crypto, we currently have no way to invest in it directly! However, I am preparing for a possible airdrop by placing bets on multiple markets with multiple wallets.

If Polymarket was bold enough, they should have launched their token before the US election, when the market is hottest.

If consumer apps become the new trend, I recommend you experiment to see what you like and find ways to invest in them before everyone else. That’s what I plan to do.

Some consumer apps worth trying:

-

Receipts : Share your running, cycling and exercise records and earn points (not yet online)

-

Sound.xyz : Discover new music and prove you were first

-

Fileverse : Peer-to-peer file sharing with enhanced privacy

-

You can see other applications in this article by David.

Finally, you should definitely try Farcaster and Lens. These are probably the biggest winners in the consumer app trend.

New Token Economics

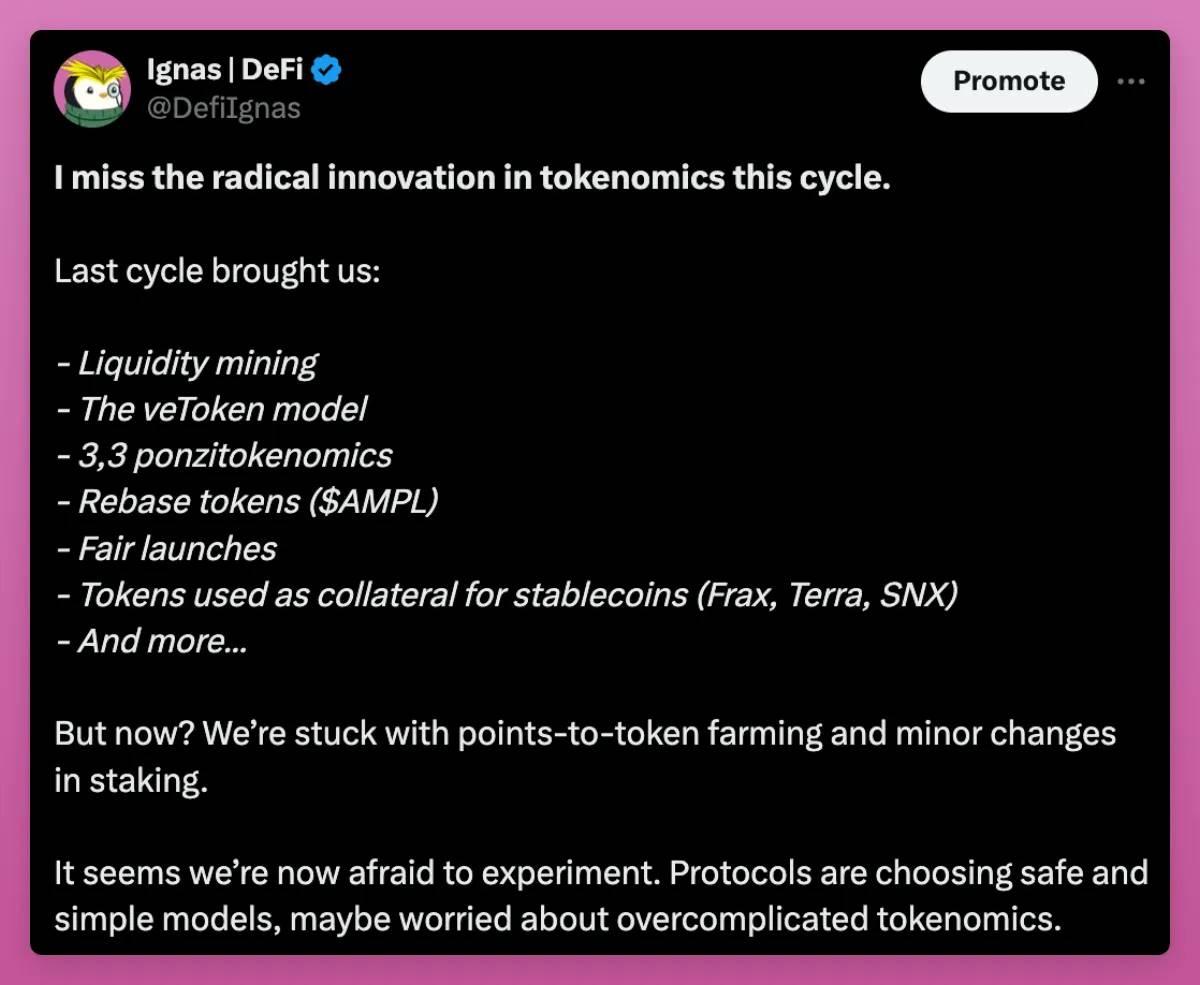

This cycle has not been good for internal innovation. Radical innovation in token economics is badly needed.

The tweet in the picture:

I miss the radical innovation in token economics.

-

The last cycle brought us:

-

Liquidity Mining

-

veToken Model

-

3.3 Ponzi Token Economics

-

Rebase Token ($AMPL)

-

Fair Start

-

Tokens as collateral for stablecoins (e.g. Frax, Terra, SNX)

-

And more…

But now? We are stuck in small changes of points exchange tokens and staking. It seems that we are afraid to experiment now. The protocol chose a safe and simple model, probably for fear of over-complex token economics.

Even memecoins has more innovation than DeFi in its bonding curve issuance model on pumpdotfun. But in addition to the bonding curve, memecoins also abandoned previous experiments such as transfer taxes.

One area of innovation from 0 to 1 is through re-staking of AVSes.

-

Eigenlayer’s dual-token structure (EIGEN and staked bEIGEN) allows forks to be managed through social consensus.

-

Dual staking model: Additional demand for tokens helps maintain the floor price.

-

Ethena and Symbiotic are experimenting with utility tokens by adding economic security.

Recently, Karak announced a partnership with Etherfi and Maker to launch their restaking tokens.

Karak’s “Universal Restaking” brings staking functionality to any token. It increases the utility of tokens by helping to decentralize on any chain and adding additional utility that is not possible otherwise.

We need to see how it works in practice, but staking on Karak will automatically migrate your MKR to NewGovToken in Maker’s Endgame roadmap.

Likewise, you can re-stake ETHFI to earn Karak XP points, but I’m very curious what other re-staking features Etherfi and Karak will introduce.

If the re-staking utility models of Ethena, Etherfi, and Karak are successful, we may see a significant increase in the Liquid Re-staking Tokens (LRT) of other DAOs, which will greatly increase the valuation of the re-staking platform tokens (especially Symbiotic and Karak, as Eigenlayer does not support other assets yet), and also increase the valuation of the DAO tokens themselves.

Imagine a world with lrtMKR, lrtAAVE, and any other token.

Speaking of restaking, Aave has launched a rather interesting new feature.

Aave’s Umbrella is a new security module that allows users to use aTokens as collateral assets.

The tweet in the picture:

Umbrella Key Features

-

Aave aTokens are used as collateral assets. If you provide liquidity in Aave, you can choose to participate in Umbrella to obtain additional income (but there is a risk of slashing).

-

Automatic reduction mechanism. No governance involvement is required; whenever bad debts are generated, the system automatically covers them.

-

Staking by Network. You can stake your aTokens in any network provided to Aave and participate in the security of that specific network.

-

Improved incentive mechanism. Provide multiple rewards for each staked asset and adopt more complex algorithms.

Imagine you lend USDT and want to earn extra yield. You provide aUSDT to the security module, and in the event of a bad debt, part of your aUSDT will be used to cover the bad debt.

The concept is so simple and powerful that I dont understand why no one has thought of it before.

This is also a major shift from the previous use of stkAAVE as a guarantee of “governance token security.” Think about it, if Aave became insolvent, the tokens would be sold off anyway.

Uncertainty surrounding the crypto market has been high. Despite this, we have success stories in global crypto adoption, such as ETFs, RWAs, and crypto becoming a political issue. I believe this adoption trend will continue.

This uncertainty is actually bullish because it allows us to overcome obstacles and make progress. Like religion, cryptocurrency is reaching more and more people. However, once it becomes a dominant force and the uncertainty disappears, the growth potential will decrease.

Uncertainty is the fuel of growth.

There are different types of uncertainty within. What worked before no longer works. We have hit a wall and need new innovative ways to move forward. While some innovation is emerging, it is not clear what will truly disrupt the new token issuance mechanism.

I am bullish on the crypto market because I believe I can be one of the first to find it.

This article is sourced from the internet: Market turns uncertain bullish: ETFs, political factors and internal innovation struggle

Related: Meme coin trader: The ten meme coins you bought might all be issued by me

Original author: Mia, ChainCatcher Original translation: Marco, ChainCatcher When talking to ChainCatcher about the release of Meme, Lao Mai (pseudonym) used an old joke: How many steps does it take to put an elephant into a refrigerator? In Lao Mai’s opinion, a Meme project is like “putting an elephant into a refrigerator”, which only requires three steps: preheating coin issuance, market value management, and community maintenance. During Meme Summer, ChainCatcher talked to several Meme coin traders. Some of them actively issued Meme coins following the hot topics and then operated the projects; some issued Meme coins wholesale, issued a lot of them, and kept changing the hot topics; some bought Meme coins and became shareholders and operators of the projects. In this wealth-creating movement, human joys and sorrows are not…