The history of Bitcoin’s “layering”: from isolated islands of value to interconnectedness

Original article by: Saurabh Deshpande

Original translation: TechFlow

Throughout history, money has fulfilled three key functions in society: it serves as a store of value (wealth), a medium of exchange, and a unit of account. While the form of money is constantly changing, its functions remain essentially the same. Broadly speaking, there have always been two schools of thought, one supporting fiat money or soft money and the other supporting hard money. Like todays fiat currency system, fiat money is always a liability of some kind.

The dollars or rupees you hold are a debt of the government. If the government defaults, your money will not be able to buy basic goods and services.

On the other hand, hard currencies are not a debt of the government. For example, precious metals like gold do not depreciate even if the government defaults. Instead, their value increases because they are considered stable.

Bitcoin is the first successfully implemented non-sovereign hard currency. Satoshi Nakamoto released Bitcoin in 2009, when the world had just experienced a global financial crisis caused by bad lending practices and unilateral interest rate decisions. The strong dollar has depreciated by more than 95% in its lifetime. In his article Paradigm Shifts , macroeconomics guru Ray Dalio wrote about how central banks lower interest rates in response to various crises and the impact it has on their respective economies.

Source – Paradigm Shifts

The chart shows how interest rates have fallen in developed countries since the 1980s. At the same time, the monetary base has grown as a percentage of GDP. Therefore, total output has not grown at the same rate as the money supply. When the money supply increases rapidly, it can lead to higher inflation, higher living costs, increased debt burdens, and greater income inequality, regardless of the rate of household income growth. The high inflation environment we are currently in is a result of the policies adopted by central banks.

In this context, the role of precious metals like gold becomes more significant. Government intervention in the supply of gold is minimal. With less government influence, the supply of gold is more predictable than fiat currencies. This high predictability allows gold to retain its value over decades and serve as a store of wealth.

Bitcoin was created as peer-to-peer electronic cash. Over the years, like many innovations, it has deviated (or at least expanded) from its original electronic cash goals and evolved into digital gold.

In 2018, I came across an interesting analogy comparing cities to blockchains . Because blockchains are isolated from the outside world, they are more like closed islands. Each island has its own priorities and technical and social characteristics. Bitcoin Island always prioritizes security and decentralization over other aspects such as speed and programmability.

Decentralization is a broad and nuanced term. Balaji Srinivasan proposed measuring decentralization by breaking down a blockchain into its subsystems, such as mining, clients, developers, exchanges, nodes, and ownership. He proposed that the overall decentralization could be derived by measuring the Gini 1 and Nakamoto 2 coefficients of the subsystems.

According to many Bitcoin supporters such as Jonathan Bier , we can see decentralization in terms of how difficult it is for users to verify transactions themselves. The difficulty of verifying transactions is the reason why Bitcoin blocks are small (up to 4 MB). In order for a blockchain to provide universal programmability (not just on paper but in practice), developers must plan a few things.

First, the language or system they use should be Turing complete, which means that the system can perform any computation that can be expressed algorithmically, given enough time and memory.

Second, gas metering needs to be optimal. Gas metering refers to how the system is designed to measure the cost of resources (e.g., maximum gas consumption per block and gas consumed by different operations). Ethereums Solidity is a Turing-complete language, but it is generally limited by gas. Bitcoins scripting language is intentionally limited to ensure higher security. In addition, as Matt mentioned, it is a low-level stack-based language that is full of unfixed bugs since Satoshis time and lacks key operators that prevent it from being very useful.

Blockchains such as Ethereum and Solana have grown to interconnect, forming interactions from which they could benefit. However, while Bitcoin Island has firmly adhered to its security goals, it has not incorporated any changes in its infrastructure that would allow for easier movement to other blockchains. Bitcoin Island only allows residents to hold, transfer, or trade their BTC for inscriptions and runes, which provides a poor user experience.

BTC is mostly stored in vaults due to limited use. Meanwhile, assets like ETH have abundant opportunities to enjoy yield and passive income in the form of staking, re-staking, lending, etc. Other blockchains have undergone rapid modernization as they develop new infrastructure, while Bitcoin remains old but strong.

Don’t get me wrong, Bitcoin’s conservative approach ensures its security and decentralization. More features usually bring complexity and increase the attack surface.

The Bitcoin island remains strong but isolated. Other blockchains are connected to each other via stronger bridges.

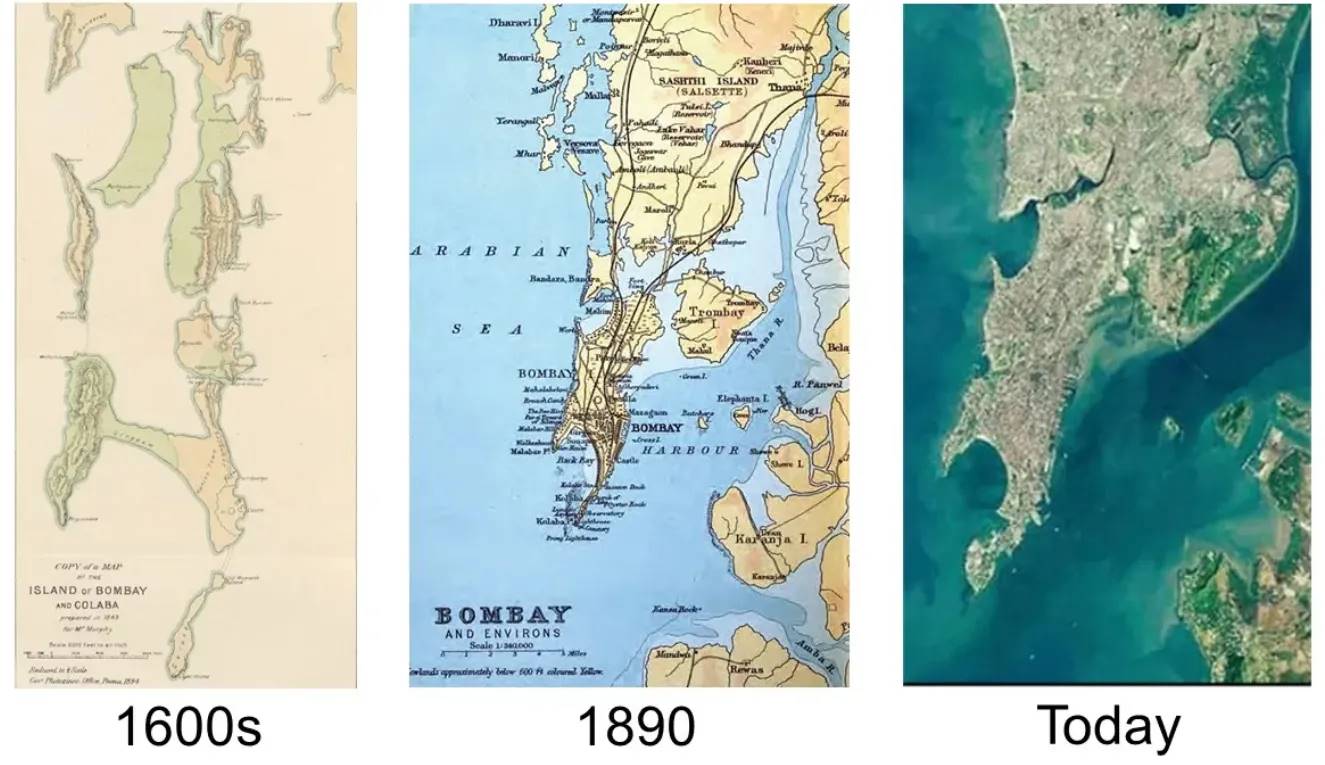

The separated islands reminded me of the history of my hometown, Mumbai. Once known as Bombay, it was originally made up of seven distinct islands. The merging of these islands began in the 1680s and continued over the centuries. Today, as I wander through this busy metropolis, there are few traces of the former separations. The city feels seamlessly unified, its past divisions all but forgotten.

This shift in Mumbai raises an interesting question: Will we see a similar evolution in Bitcoin? Some teams are working on that.

The evolution of the seven islands of Mumbai. Source – Reddit

This post is about how some teams are providing Bitcoin holders with different ways to use their wealth, rather than just holding it. I will lay the foundation by explaining why we need better infrastructure, and then dive into the different approaches teams are taking to expand BTC use cases. Finally, I mention that the ultimate vision is not only about technical consensus, but also about social consensus.

This transformation is happening now as the team is building different auxiliary islands for Bitcoin Island and finding solutions to modernize Bitcoin Island. The permanent reform of Bitcoin Island can only happen after a social revolution among the islanders and they agree to change their rules so that bridges to other islands can be used as confidently as the infrastructure within the island.

Why do we need better infrastructure?

Mature blockchains like Ethereum, Solana, and the upcoming Monad are all built with developers in mind. They are designed as platforms for developers to build applications. These chains offer comprehensive ecosystems that support developers through a variety of learning resources, tools, frameworks, and features. Satoshi did not consider any of this when developing Bitcoin. Bitcoin does not have a well-thought-out API and there is almost no clear documentation to learn Bitcoin development.

There are three key reasons to continually improve network infrastructure — better user experience (UX), more financialization, and payments at scale.

Better user experience will boost activity and bring in more fees

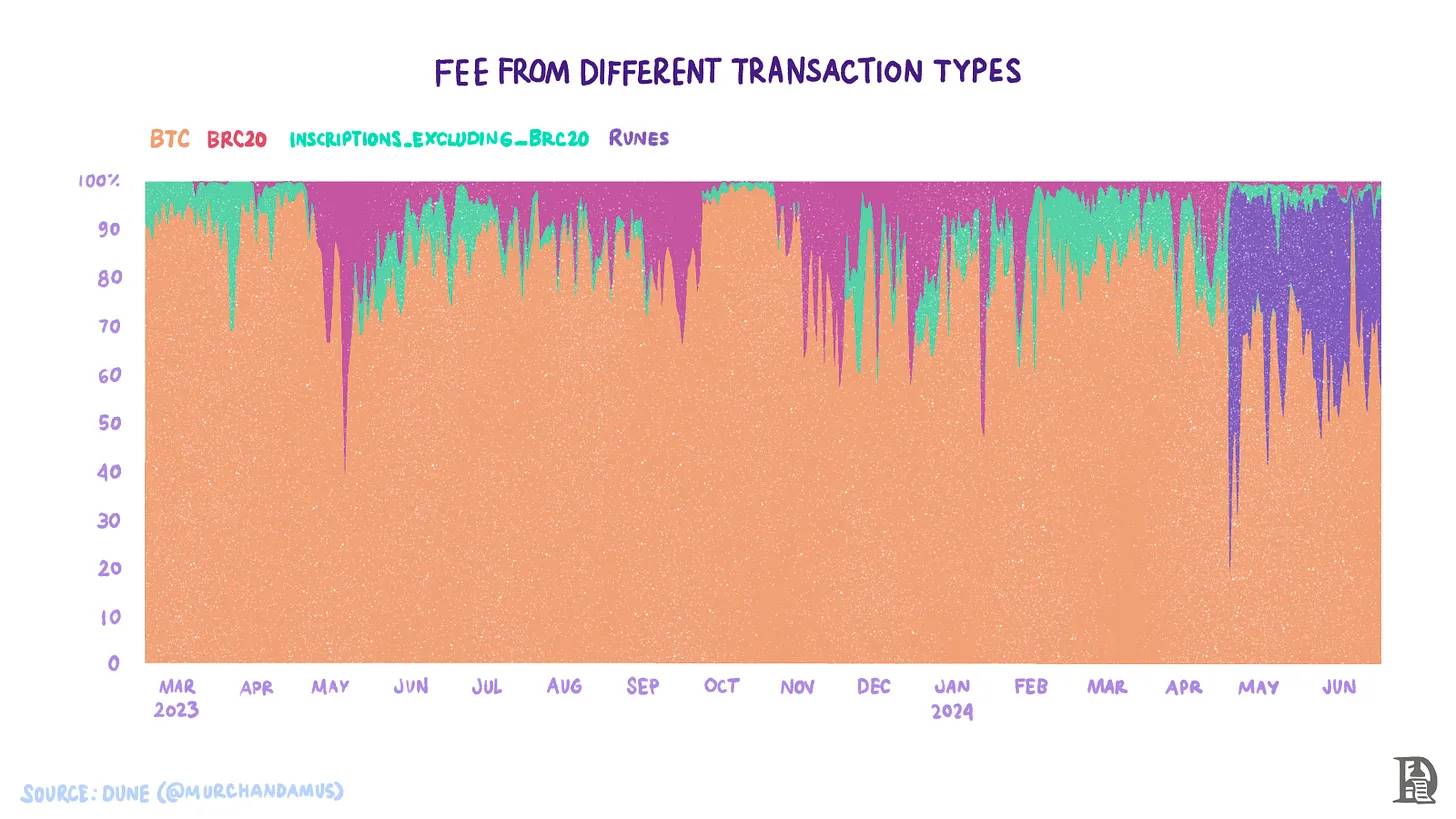

The Ordinals protocol is a way to leverage Bitcoin UTXO and view a single Satoshi (the smallest unit of BTC) in a different way, which has led to innovations such as Inscriptions (NFTs on Bitcoin). The enthusiasm around Ordinals and Inscriptions has led to the evolution of alternative standards such as BRC-20 and Runes . Inscriptions and Runes have brought a boost in activity to Bitcoin. The total number of daily transactions has increased by 70% compared to BTC transfers alone.

These new ways to transact in Bitcoin have helped increase fees by about 40%. However, these new methods have sparked a heated debate within the Bitcoin community. One group believes that Bitcoin should focus on strengthening its core function as a decentralized payment system. They believe that expansion beyond this scope may undermine Bitcoins security, simplicity and effectiveness as a sound currency.

On the other hand, advocates of a more flexible approach argue for expanding Bitcoin’s functionality to cover non-payment use cases. They argue that such an evolution is necessary for Bitcoin to remain competitive and relevant in the rapidly evolving blockchain ecosystem.

Is that enough? Not quite. According to Token Terminal, Bitcoin miners have earned about $109 million in fees in the past 30 days. During the same period, applications like Uniswap and Lido Finance have earned $90 million and $104 million, respectively. With the latest halving in April 2024, miners have seen a 50% reduction in the block subsidy they receive. After the most recent halving, the block reward (subsidy) was reduced from 6.5 BTC per block to 3.125 BTC. This means that miners have seen a 13,500 BTC (3.12514430) reduction in their monthly subsidy. At a price of $66,000 per coin, this is about $891 million, so monthly fees only account for about 12% of the subsidy loss.

Recent developments like Runes are encouraging, but we need more. What are the challenges? Bitcoin’s UX is far inferior to Solana or Ethereum L2s like Arbitrum. Exchanges on Solana take seconds and cost just a few cents. However, if you want to trade Runes on Bitcoin, you’ll need to pay a few dollars in fees and wait for a block to confirm the transaction.

Additionally, when you buy Runes, you have to buy the full amount listed. Buyers cannot modify the amount of Runes they want to buy. Another downside is that Runes are not interchangeable with each other, unlike how we can redeem USDC for MKR on Ethereum. Traders must first sell one Rune for BTC and then buy the other Rune they want. The extra step in the middle adds unnecessary friction to the user experience.

The user experience of trading Runes is far from ideal. There is no way to use BTC as collateral or to make loans. You have to take BTC out of Bitcoin L1 and put it on other chains to use for financial applications.

Increasing the financialization of BTC

First, Bitcoin has a market cap of nearly $1.3 trillion at $66,000 per BTC. Like gold, Bitcoin is an external currency, meaning governments cannot manipulate the supply of Bitcoin. While the exact size of the gold lending market is not available, some reports estimate it at $100 billion. Therefore, one of the most important reasons to build applications on Bitcoin is to use native BTC as collateral to borrow stablecoins. A strong lending market will allow Bitcoin holders to earn yield on their BTC

Taking staking as an example, other native assets such as ETH and SOL have inherent uses in staking to ensure network security; about 27% of circulating ETH is staked in staking protocols, with an annual return of about 4%. Another about 4% of ETH is staked in re-staking protocols, and 67% of circulating SOL is staked. In addition, both ETH and SOL are widely used as collateral assets in their respective DeFi ecosystems.

Wrapped BTC (or WBTC) is the most widely used version of BTC in different DeFi ecosystems, with a market capitalization of about $10 billion, accounting for less than 1% of the total BTC in circulation. This shows the huge potential of BTC financialization.

Assuming BTC usage in staking or DeFi reaches a similar level as Ethereum, reaching about 30%, this amount would reach $390 billion. For comparison, the total locked value of all other chains in all DeFi is currently $101 billion . BTC could become the most productive liquid asset, but this potential is currently constrained by intentional technical limitations.

Expand BTC Payment

The Bitcoin base layer is not designed for high throughput. If Bitcoin is to become the settlement layer of the internet, we need faster transaction speeds. As Mohamed Fauda said, there is a limit to the number of transactions that can be issued in this way. At a maximum block size of 4 MB, Bitcoin can support 6.66 kbps (4 MB / 10 minutes).

The Bitcoin network is currently unable to handle high traffic. Users will experience poor experiences during anticipated events such as Quantum Cats minting and rune releases. Poor user experience affects not only those trying to mint runes, but also those sending and receiving BTC.

Lightning Network (LN), the leading BTC extension network, has poor adoption. The network capacity or liquidity is around 5,000 BTC. This is the amount of BTC locked in all lightning channels. This affects the liquidity of the network and the amount of BTC that can be moved through it.

Why is this important? Lets understand with an example. Joel is raising $1 million to pay coffee plantation workers in India and he decides to use LN to accept donations. He cant just spin up an LN wallet and accept donations. He needs to have $1 million in inbound liquidity. Inbound liquidity is the amount of BTC your counterparties have locked in a channel. Sid is one of Joels counterparties who has locked $10,000. Joel needs more counterparties like Sid who have a total of $1 million locked in order to accept $1 million worth of donations. This is a major challenge for network scaling because inbound liquidity will always be limited by the opportunity cost of capital.

Challenges of Bitcoin Development

Bitcoin is as much a cultural phenomenon as it is a technological one. Social consensus is the last line of defense. For example, the 21 million supply hard cap can be modified by forking the code to increase tail emission by 1%. But for this change to take effect, all miners would have to mine on this fork, which is unlikely to happen. This is because the hard-coded cap has been one of the main value drivers of BTC. If this cap is broken, the value may be perceived to fall. Miners are unlikely to mine on a fork that could lose value.

The technical effort required to change the codebase will be rendered useless due to the lack of social consensus. The last controversial fork of Bitcoin was during the Block Wars in 2017. The network split into two, Bitcoin implemented SegWit (explained later) and Bitcoin Cash, which increased the block size. At the time, most of the computing power chose to stay on BTC.

For something to be considered money or a store of value, it can’t change often. The main reason fiat currencies lose purchasing power over time is that central banks often use their power to increase supply. The unpredictability of this unilateral action by central banks makes some currencies permanently weaker. Bitcoin culture is resistant to change. Even something as non-controversial as Taproot took years from conception to implementation.

Implementing the above changes is more than just changing Bitcoin. The Bitcoin base layer needs to be as simple as possible. Simplicity is critical to reducing attack vectors and improving stability. The idea is to perform complex things like lending and minting stablecoins using BTC as collateral outside of the base layer, just like Ethereum’s L2.

L2 for Bitcoin?

What is L2? It should:

-

Provide sufficient data for the first layer to verify and resolve disputes, if any.

-

Beyond the base layer, there should be no additional security assumptions.

-

Allowing users to unilaterally withdraw their assets to the base layer or layer one.

Since Bitcoin’s current opcodes limit its ability to verify any proof, these conditions cannot be met. Therefore, any chain claiming to be Bitcoin L2 cannot be called a true L2.

Another important aspect of L2 is that its security assumptions should be consistent with Bitcoin’s security assumptions. Every blockchain has some basic security assumptions, such as:

-

Most mining nodes are honest

-

Nodes can independently verify blocks and reject invalid blocks

-

Forks are resolved on the longest branch of the chain, and so on.

The second layer, or L2, should not extend the security assumptions of the base layer it is built on. For example, if the second layer has a centralized sorter that monopolizes block production, users need to be able to challenge block production at low cost. The first layer should be able to instruct the L2 to release user funds as long as the users funds have not been spent. Currently, these mechanisms do not even exist in Ethereums L2.

If we strictly follow the above L2 characteristics, even some consensus Ethereum L2s, such as Arbitrum, are not true L2s. Since Bitcoins current opcodes limit its ability to verify any proof, any chain claiming to be Bitcoin L2 cannot be called a true L2. The Lightning Network may be the only solution that meets the definition of L2. As a general term, this article refers to these solutions as Bitcoin extension layers.

The Current State of Bitcoin’s Scaling Layer

In general, there are two main ways to use BTC: 1) Use a cross-chain bridge, as Bitcoin itself has limited applications, and 2) Create an environment or chain where investors can use BTC applications.

To enable more use cases and scaling, new layers may make additional security assumptions on top of Bitcoin. Users who wish to use their BTC will tend to accept the least security compromises. Ethereum’s scaling roadmap is a good reference for understanding how Ethereum’s scaling design space evolves.

After several years of development, Ethereum has realized that rollups are a key way for it to scale. Currently, we still don’t know which method is the best way to scale and make BTC more programmable.

Whether storing data or choosing a cross-chain bridge design, projects are making trade-offs between decentralization, security, speed, and user experience. The answers to the following questions form the design space for projects or companies building extended Bitcoin layers:

-

How to implement a cross-chain bridge from Bitcoin to a new chain?

-

How is the data stored (data availability)?

-

How to use Bitcoin Layer 1 for settlement?

-

Are any changes expected in Bitcoin’s base layer to achieve its full vision?

-

Which execution environment to choose?

-

Does the extended Bitcoin layer facilitate the use of BTC for purposes such as gas and staking?

Various teams are making different types of trade-offs to provide better functionality and scaling for BTC holders.

Bridging mechanism

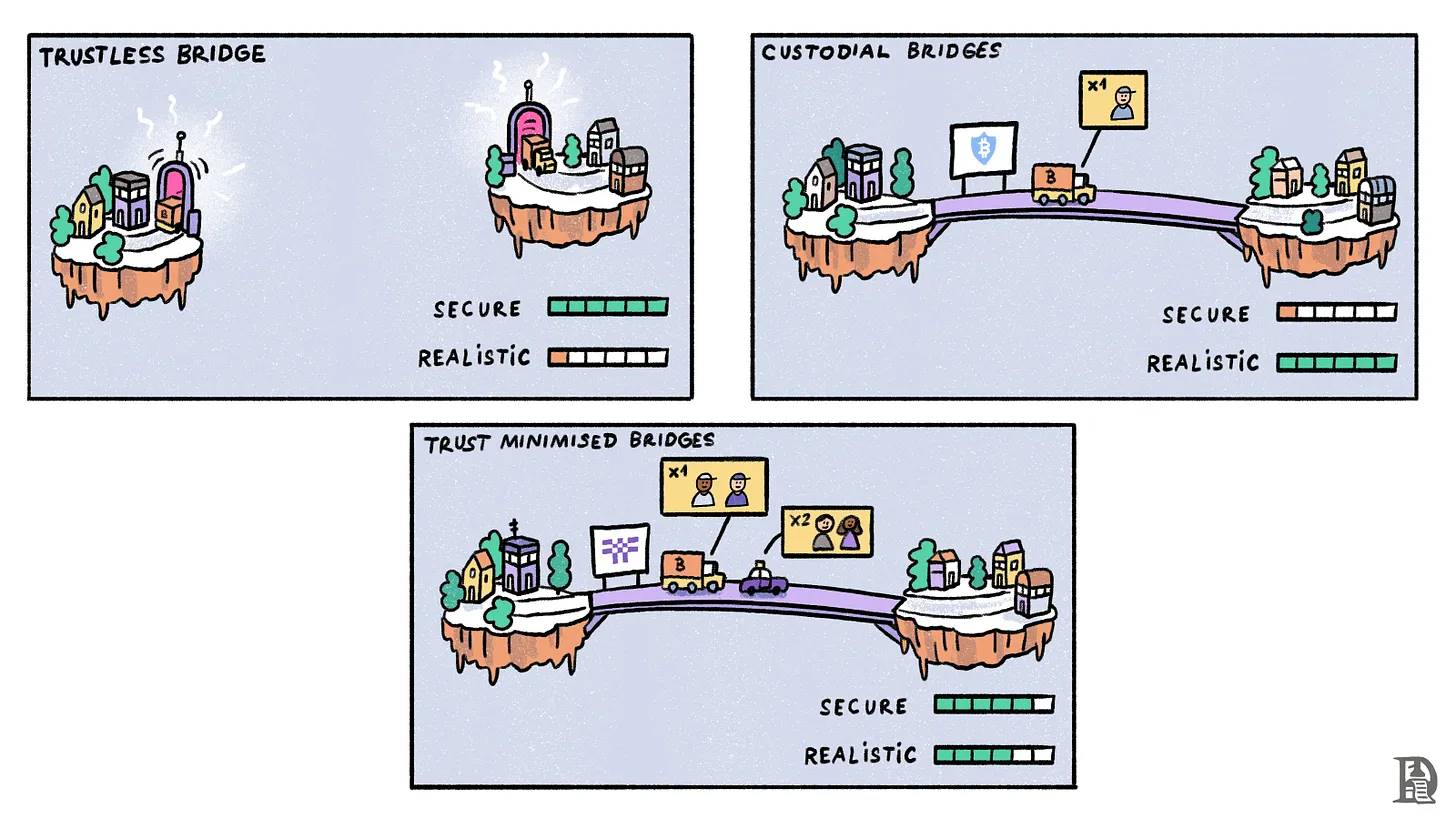

BTC on Bitcoin cannot be directly transferred to other chains, so an infrastructure is needed to achieve this cross-chain transfer. A typical bridge mechanism is to lock the users BTC on the Bitcoin network and mint an equal amount of synthetic tokens on the target chain to represent these BTC.

What is the typical locking mechanism? When a user wants to transfer their BTC from the Bitcoin network to another chain, they send BTC to a specific address on Bitcoin. This address is controlled by the bridge operator. When the bridge operator detects the arrival of BTC, they mint an equal amount of synthetic tokens on the target chain and send it to the address specified by the user.

The risk of this mechanism is that if the bridge operator loses BTC on the Bitcoin network, the tokens minted on the target chain will become worthless. We witnessed this risk after the FTX collapse . SolBTC, a wrapped version of BTC operated by FTX/Alameda, became worthless because FTX no longer honored redemptions after filing for bankruptcy.

Therefore, all operations performed by users on the target chain are completely dependent on how the bridge operator manages and protects the users BTC on the Bitcoin network. Different bridge mechanisms can be divided into three types according to how BTC is managed.

Trustless Bridging

This bridging mechanism is only possible if the first layer (L1) can verify the proof submitted by the second layer (L2). For Bitcoin, this mechanism is currently not feasible because Bitcoin cannot understand anything that happens outside of it.

Trust-minimized bridging that relies on economic security

Another option for BTC bridging is for multiple public parties to handle the locking and unlocking of BTC. These public parties secure users’ BTC on the Bitcoin network and mint and destroy synthetic BTC tokens on other chains. Threshold Network’s tBTC is an example of such a mechanism, which relies on an honest majority.

This means that before an operator can perform any action on a user’s BTC, the majority of operators running Threshold Network nodes must agree. Rather than relying on a centralized intermediary, tBTC randomly selects a group of operators running Threshold Network nodes to protect the BTC deposited by users.

Who can become a node operator on the Threshold Network? The network has a governance token, T. While T is used for governance, a minimum of 40,000 T is required to become a node operator. As of June 25, 2024, there are 139 active nodes on the network.

The tBTC Beta Stakers program aims to gradually decentralize the node network. Beta stakers can delegate their stake to five professional node operators – Boar, DELIGHT, InfStones, P2P, and Staked. Beta stakers are expected to run nodes for at least 12 months and actively participate. For example, they need to be highly responsive to network upgrades, ideally upgrading their nodes within 24 hours of notification.

Whenever a user requests to mint tBTC, a new deposit address is generated on the Bitcoin network. This address is dedicated to the user and is controlled by a node on the Threshold Network. Users can request to mint tBTC on networks such as Ethereum, Arbitrum, Optimism, Mezo, and Solana.

The user needs to provide two addresses – a recovery address on Bitcoin (to which BTC will be returned if there is a problem in the minting process) and an address on the target chain (where the user hopes to receive tBTC). Once the request is made, the user must deposit BTC into the generated address and wait for the guardian to confirm their deposit. Once confirmed, the minter will send tBTC to the users address on the target chain.

Currently, there is approximately 3,500 BTC locked in the Threshold Network, valued at over $200 million.

Trust-minimized bridges are currently arguably the best bridge implementation given the capabilities of Bitcoin opcodes. The specific implementation of a trust-minimized bridge may vary depending on the design of the multisig. Threshold Network’s tBTC, Stack’s upcoming sBTC implementation, and Botanix’s spiderchain are all examples of trust-minimized bridges.

Managed Bridge

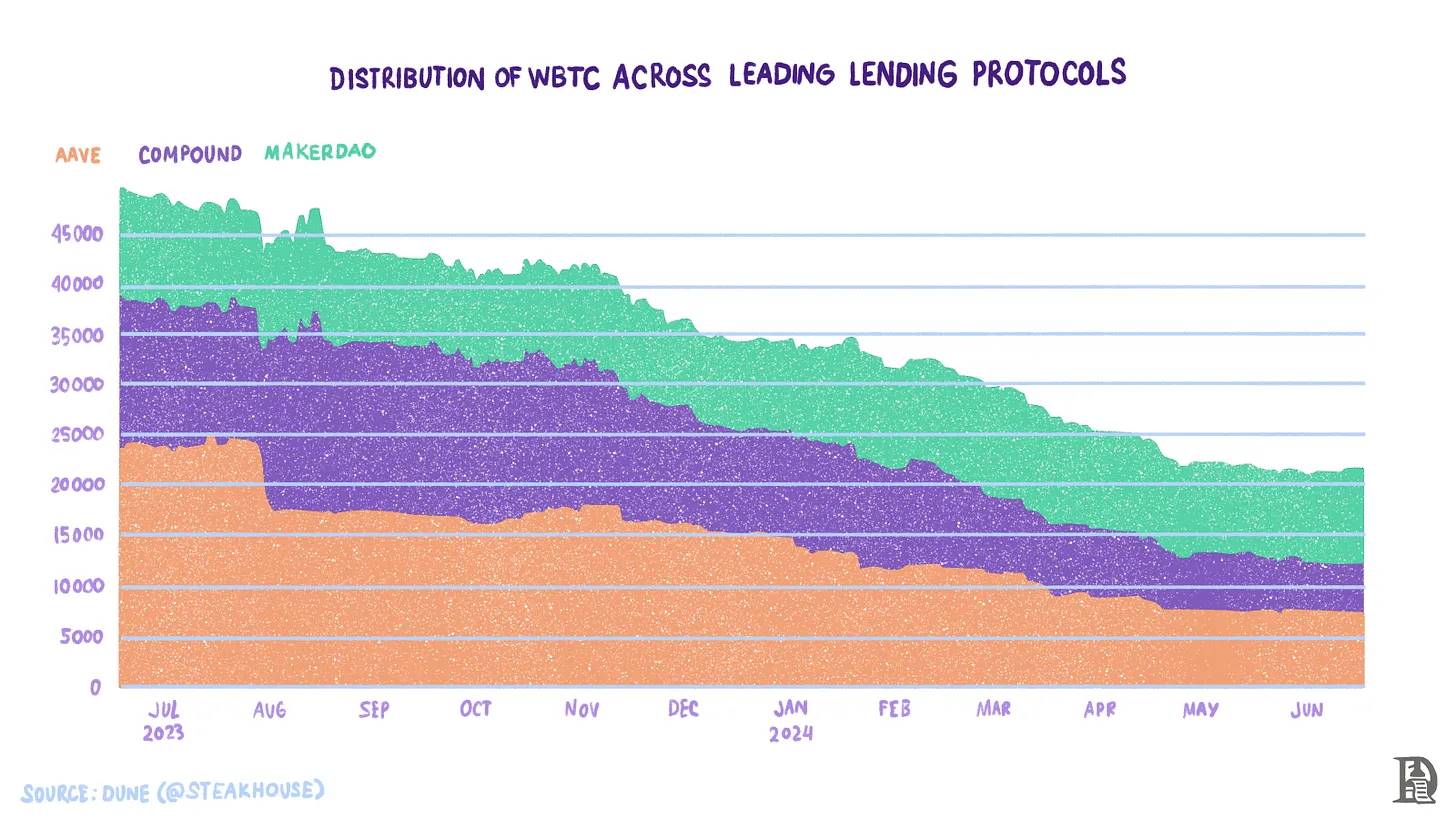

In this design, a centralized provider locks the users BTC in an address managed by a custodian. BitGos WBTC is the most widely used method for bridging BTC to other chains, with more than 150,000 BTC already bridged via WBTC. The current distribution of WBTC is as follows.

BitVM

In addition to the three existing types of bridges, Robin Linus released the BitVM white paper at the end of 2023. BitVM proposes a new way to implement Turing complete smart contracts on Bitcoin. If a system can perform any calculation given enough time, it is called Turing complete. As mentioned earlier, Bitcoin is Turing incomplete by design, and BitVM proposes a way to overcome this problem without changing the existing opcodes, and proposes a so-called trustless bridge mechanism.

The core idea of BitVM is to optimistically verify zero-knowledge proofs (ZK proofs) on Bitcoin. As long as no one disputes the execution of a transaction, it is assumed to be correct. This system generally assumes that there is at least one honest verifier. If the execution is incorrect, at least one honest verifier should dispute it.

Therefore, as long as the zero-knowledge proof is not challenged, everything works fine. If there is any objection, the challenger and the prover will enter a challenge-response or binary game on the chain. The specific definition of the binary game is beyond the scope of this article, but a link is provided for interested readers. The result of the binary game is an increase in the transaction load on the chain.

Liquidity management was another significant flaw in early versions of BitVM. When a user withdraws funds from the bridge, the system completes a portion of the withdrawal and the bridge operator must provide liquidity in advance. The operator is later compensated from the bridge. As the amount locked in the bridge increases, the operator must maintain more liquidity to honor withdrawals. This puts pressure on the operator and makes the design highly capital inefficient.

Assume that on average the operator needs to keep 10% of the bridge’s total locked value (TVL) in liquidity at all times. If the bridge TVL is $10 billion, the operator needs to keep $1 billion in liquidity at all times. As the bridge attracts more liquidity, the operator needs to keep more BTC in inventory. Tyler White and Rijndael wrote an excellent article that explains the problem with BitVM in detail.

Execution Layer

In order to improve the practicality of BTC, it is key to design a chain that provides the best user experience (UX). Developers need to consider multiple factors when designing this chain.

-

Execution Environment – Should you use an Ethereum Virtual Machine (EVM) compatible chain? EVM compatibility has many advantages, such as:

-

Tools accumulated over the years, such as wallets and bridges to other EVM chains, are available to developers directly.

-

Users are already very familiar with this UX.

-

Ethereums second layer network (L2) has benefited from EVM compatibility. EVM-compatible L2s like Arbitrum and Optimism can quickly attract users and applications already on Ethereum. However, L2s that are not EVM-compatible, such as Starknet, face greater adoption difficulties.

-

However, the EVM also has its disadvantages. Since the EVM needs to execute transactions serially, parallel processing is not possible. Newer execution environments, such as the Solana Virtual Machine (SVM) and the upcoming Monad, support parallel processing.

-

Data availability – Similar to Ethereum, several rollup solutions have emerged in the Bitcoin space. Rollups come in different forms depending on where and how the data is stored. Some store state differences (differences between two states of the chain after executing a batch of transactions) and validity proofs on L1. Some store compressed transaction data on L1, and some store only validity proofs on L1, while storing transaction data on a separate layer.

-

Some chains like Stacks use Bitcoin as a checkpointing mechanism. Stacks block time is much shorter than Bitcoins. Stacks publishes the data between its blocks on every Bitcoin block.

-

The execution layer can publish transaction data on Bitcoin in the form of inscriptions. Recall the Bitcoin networks 6.66 kbps bandwidth. If we assume that the size of a compressed transaction is 10 bytes (usually around 20 bytes), a Bitcoin block can theoretically contain about 600 compressed transactions. However, this maximum is almost impossible to achieve, because 4 MB blocks are very rare, and it is even rarer that the entire 4 MB space is available for inscriptions.

-

The block size depends on the mix of SegWit and non-SegWit transactions. SegWit (Segregated Witness) separates the transaction data from the witness data. The idea is that not all data stored in a block is equally important. Instead of limiting the block size to the traditional 1 MB, SegWit proposes a new limit of 4 million weight units. So if a block is all non-SegWit transactions, the limit will be 1 MB. But if it is all SegWit transactions, it can go up to 4 MB.

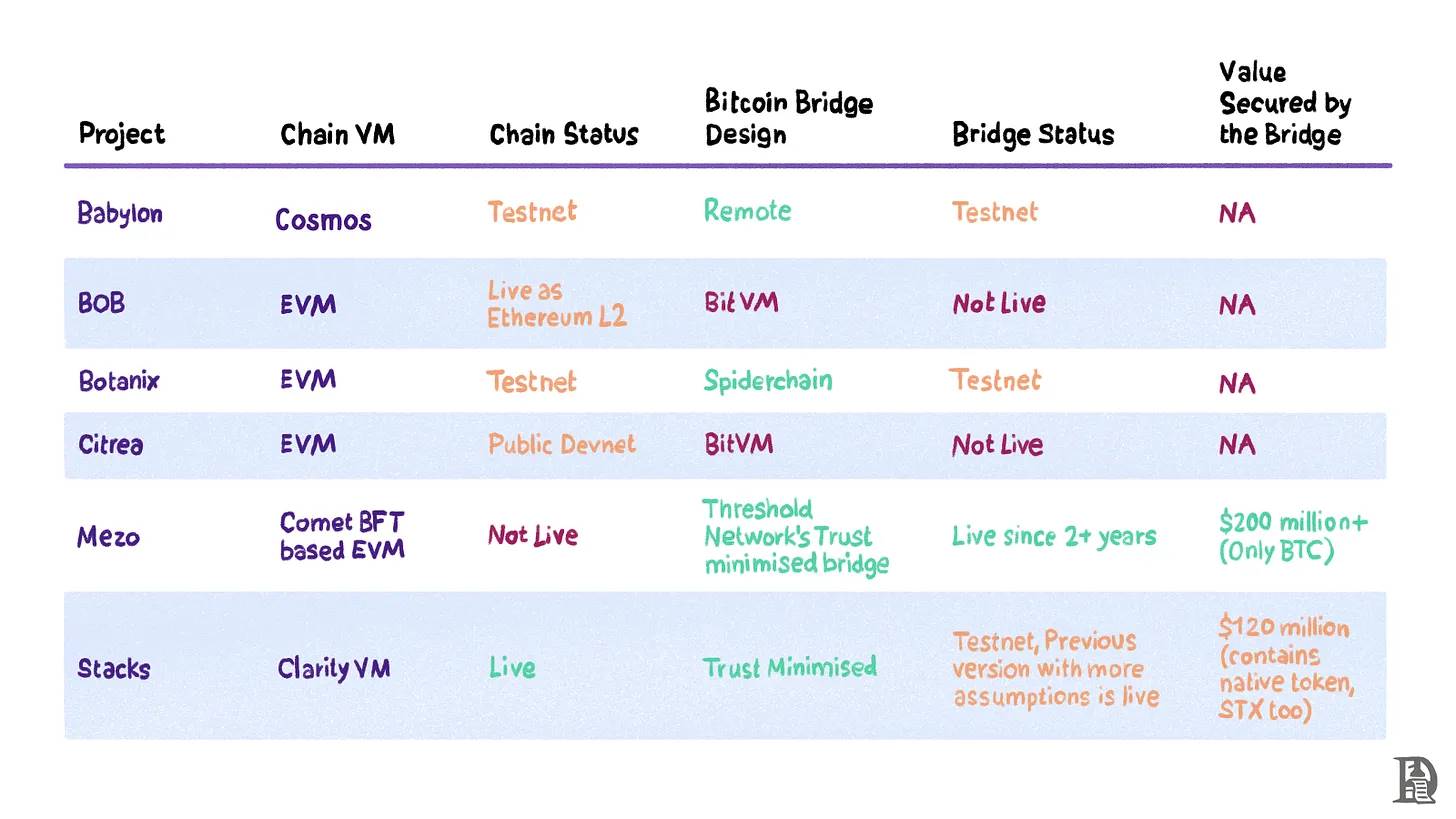

Multiple teams are building layers on top of Bitcoin to take advantage of BTC’s massive liquidity. This article examines six different teams that are making different tradeoffs and have interesting designs. We briefly describe how they work, their stages of development, and their progress to date.

Babylon

Babylon is focused on expanding the use of BTC as a collateral asset. It proposes a new approach different from other Bitcoin layers (the so-called L2) called remote staking BTC. Instead of locking BTC on the Bitcoin network to mint synthetic versions, this approach introduces the following mechanism:

-

Users lock their BTC in a self-custodial vault by creating a UTXO that can only be spent once. This UTXO can only be spent after a predetermined staking period ends or after the user burns the staked UTXO via their special EOTS (extractable one-time signature).

-

After confirming the staking transaction, users can use their EOTS to verify blocks on the PoS chain in the Cosmos ecosystem to earn rewards.

-

If the user behaves honestly, they can unlock their BTC at the end of the staking period or submit an unstaking transaction to the Bitcoin network.

-

If dishonest behavior is detected, the users EOTS will be exposed to the public. Babylons monitor ensures that there is at least one honest operator. This program suite acts as a relayer for data between Bitcoin and Babylon. The submitter program submits the Babylon checkpoint to the Bitcoin network using OP_RETURN . The reporter program scans the Babylon checkpoint and reports it back to Babylon. If anomalies are detected, anyone (called a slasher) can use the public EOTS key and submit a Bitcoin transaction to obtain the malicious users stake.

-

A common question is why users cant just use their keys to get their stake back. The answer could be that when miners see this transaction, if someone else initiates the same transaction, the miner will choose the one with the higher fee. For example, if the stake amount is 5 BTC, the slasher can share 4.99 BTC with the miner and make a profit. In this case, the miner keeps most of the profit instead of the slasher. However, the malicious user will lose most of the stake anyway, either to the slasher or the miner.

While Babylon offers an interesting way to expand the use of BTC, its mechanisms are quite complex. For example, the slashing mechanism has not been successfully implemented on many PoS chains, even though some have been online for many years. In addition, while Babylon can make BTC available to secure other PoS chains using remote staking, it requires a bridge to enable other BTC use cases, such as lending.

Build on Bitcoin (BOB)

Better known as BOB, Build on Bitcoin is an Optimism-based rollup settled on Ethereum as of June 2024. It claims to be an Ethereum L2 aligned with Bitcoin. BOB will be launched in four phases:

-

Phase 1 – OP Stack Rollup. At this stage, it is purely an Ethereum rollup. Fraud proofs are not yet live on mainnet. Fraud proofs are a mechanism that allows anyone to question the validity of transactions included in a rollup batch.

-

Phase 2 – Ethereum rollup with Bitcoin security. In this phase, BOB will utilize Bitcoin’s merged mining. Merged mining allows miners to secure (or mine) multiple chains at the same time as Bitcoin.

-

Phase 3 – Optimistic Bitcoin Rollup via BitVM. BitVM is not live yet. When it is live with improvements over the current version, BOB will start using BitVM for settlement on Bitcoin.

-

Phase 4 – Zk Rollup on Bitcoin. BOB will settle on Bitcoin using Zk proofs after Bitcoin accepts opcodes that allow verification of Zk proofs.

As of June 17, 2024, BOBs TVL is approximately $60 million , of which Sovryn DEX contributes approximately $20 million.

Botanix

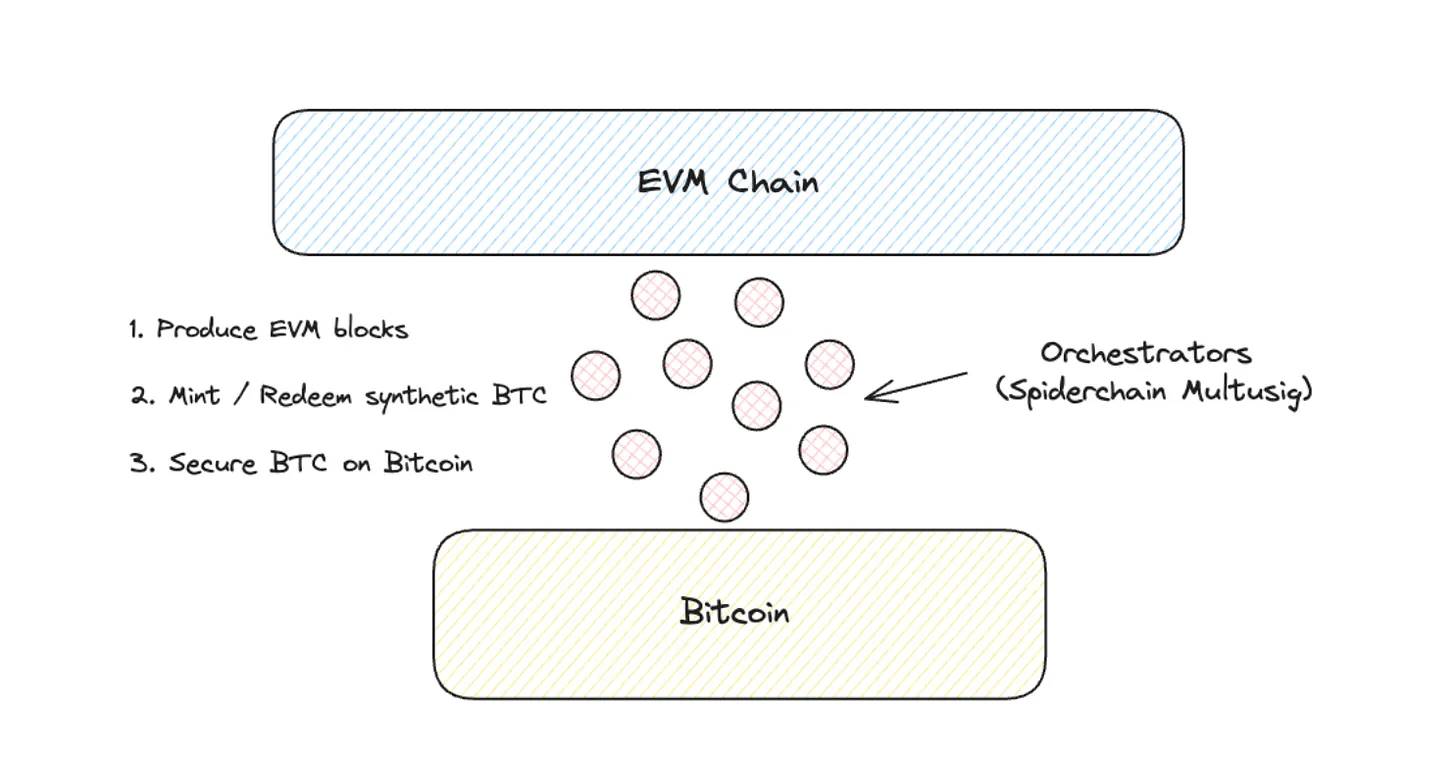

The Botanix team brought an important innovation: Spiderchain. What is Spiderchain? It is a coordinating node for a rolling multi-signature mechanism on Botanix. Lets explain it in detail. As we mentioned before, an L2 requires a bridge and a chain to execute transactions. The coordinating node is responsible for protecting user funds on Bitcoin and minting and destroying synthetic BTC on the EVM layer. The coordinator runs the Bitcoin and Spiderchain EVM (Botanix) nodes.

Assume there are N coordinators on the network. Each Bitcoin block randomly selects M (

Botanixs chain is EVM-compatible and secured by a PoS consensus mechanism. In addition to securing BTC on Bitcoin and facilitating the minting and redemption of synthetic BTC by participating in a rolling multi-signature network, coordinators also participate in the block construction of the EVM chain. They publish the root hash (a compact version) of the Botanix EVM transaction as an inscription on Bitcoin.

It is important to note that simply publishing data on Bitcoin does not mean settlement. The difference here is that the data published in the form of inscriptions by external chains like Botanix is stored in places that are not verified by Bitcoin nodes (miners). The Bitcoin protocol is completely unaware of this data. Therefore, it is impossible to determine whether the transaction data published in the inscription is correct.

As of June 2024, Botanix EVM and Spiderchain are still in the testnet stage.

Citrea

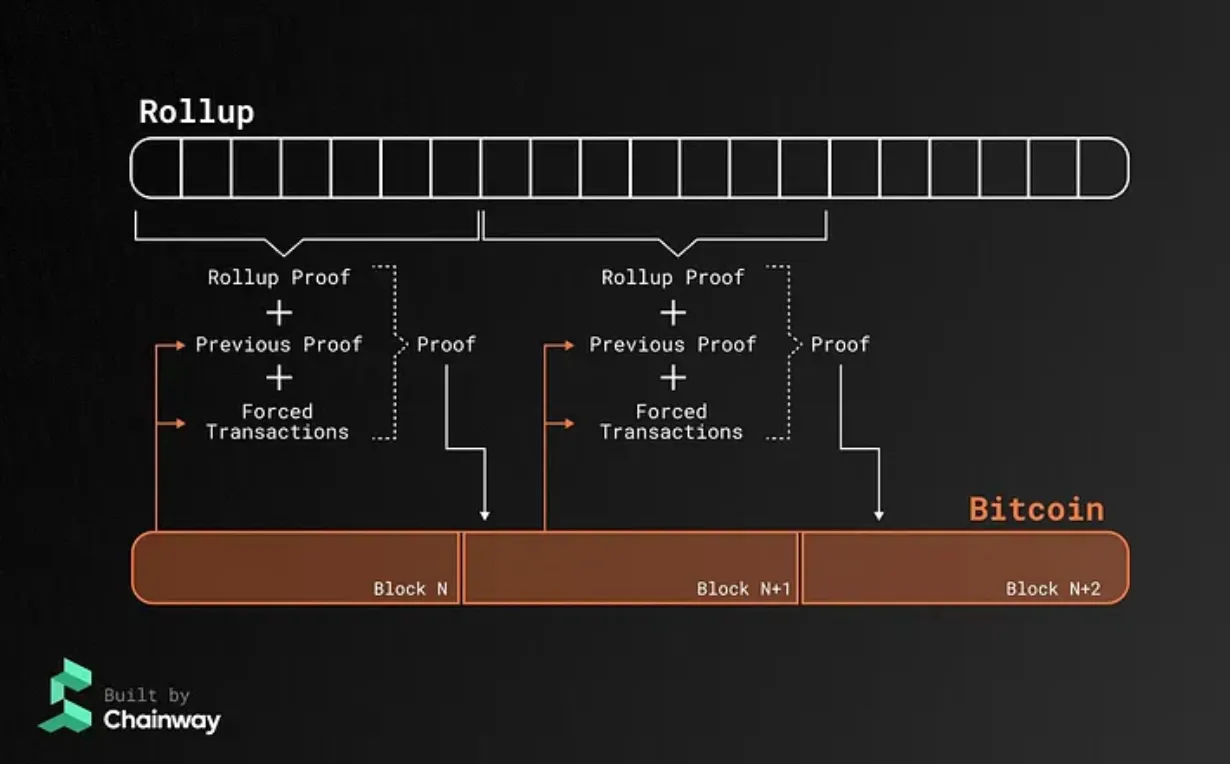

Citrea is building a Zk rollup on top of Bitcoin. ‘On top of Bitcoin’ means that it intends to use Bitcoin as a data availability layer. Citrea says the most secure and incentive-aligned way to scale the Bitcoin blockchain is to shard execution through on-chain verifiability and data. Sharding execution means dividing the execution task into smaller parts.

Citrea then aggregates these shards, or batches of transactions, and publishes the state difference between two batches of transactions on Bitcoin along with a proof called a proof of validity. But the problem is that Bitcoin does not have the ability to verify these proofs. Citrea’s final form will have to wait until Bitcoin has opcodes that allow it to verify zk proofs.

In the meantime, it will use the BitVM implementation as a temporary solution to handle proofs and bridge BTC in and out of Rollups. Naturally, Citrea also inherits the shortcomings of BitVM mentioned in the previous section. In the future, as BitVM improves, Citrea will improve its bridging capabilities.

Source — Citrea

As of June 2024, Citrea is in the testnet stage.

Mezo

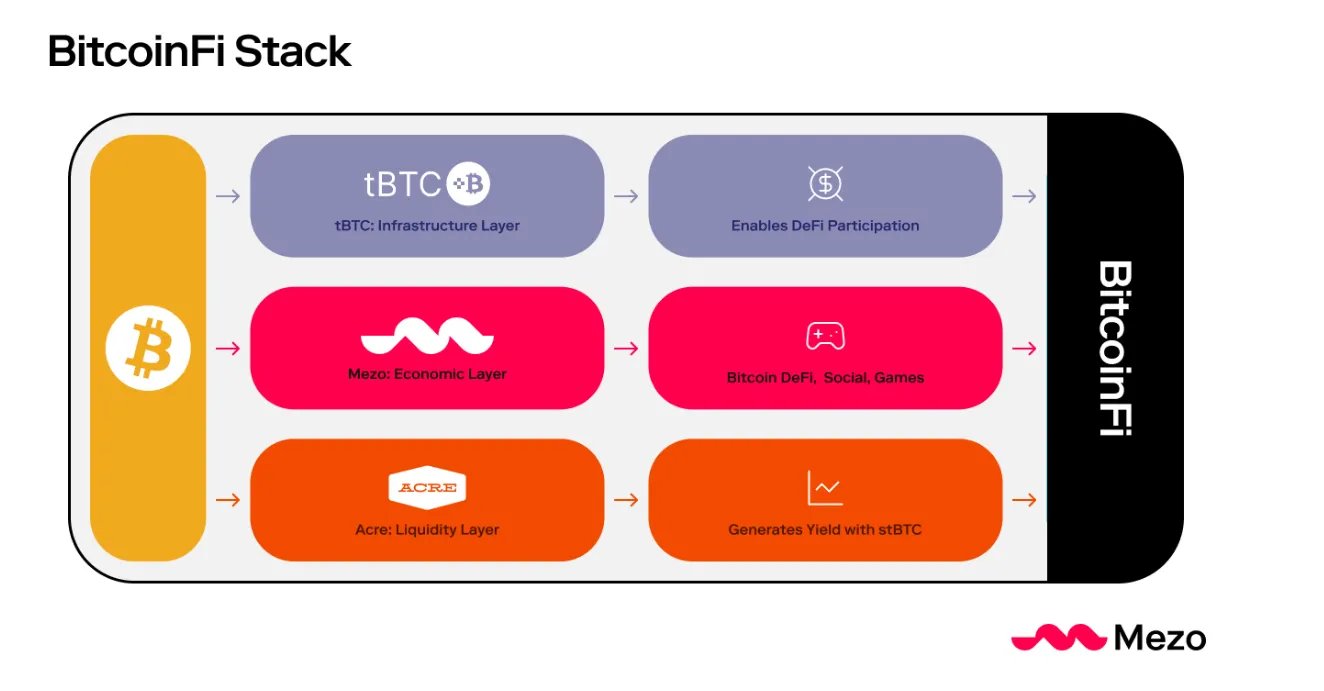

Mezo claims to be Bitcoins economic layer, not Bitcoins L2. It uses Threshold Networks tBTC bridge to bring BTC into and out of the EVM chain Mezo.

Mezo is built by the team that developed products such as tBTC , Fold , Keep , and Taho . This team has been working on the development of Bitcoin-related applications for many years. Mezos goal is simple: to expand the use cases of BTC. It achieves this goal through the following three mechanisms:

-

Allow Mezo users to secure the network and earn returns by staking BTC.

-

Allows users to pay gas fees with BTC, which will be distributed among veBTC and veMEZO stakers.

-

Build an end-to-end BitcoinFi experience.

So, what is BitcoinFi and the economic layer? Most new chains, including EVM chains, rely on existing user experiences, such as the same wallets and bridge tools. Improving the user experience is almost never a priority. Mezo designed the entire user experience from scratch, which is very rare. It includes the following:

-

A native stablecoin (mUSD) backed by BTC, without the need for users to bridge from other chains.

-

A long-tail lending protocol secured by BTC.

-

Fully integrated entry and exit access via Fold .

-

Integrated wallet experience powered by Taho .

Combining all of these applications, Mezo creates a unique end-to-end BitcoinFi experience.

Mezo is based on the Cosmos SDK and uses Comet BFT as the consensus mechanism.

-

CometBFT is software for safely and consistently replicating applications across multiple machines. By safe, we mean that CometBFT works as long as less than a third of the machines fail in any way. By consistent, we mean that every non-faulty machine sees the same transaction log and computes the same state. Safe and consistent replication is a fundamental problem in distributed systems; it plays a key role in fault tolerance in a wide range of applications, from currencies to elections to infrastructure orchestration. — Source: CometBTF documentation

CometBFT consists of two components: a consensus engine and a general API. Based on the Tendermint core, the consensus engine is responsible for block production, verification, and finality. Tendermint is one of the earliest proof-of-stake consensus designs, providing Byzantine Fault Tolerant (BFT) consensus that can tolerate up to one-third of malicious nodes.

The Application Blockchain Interface (ABCI) separates the consensus engine from the application. A major advantage of the ABCI is that since consensus and applications are separate, developers do not have to build applications in the same language as the consensus engine. The interface acts as a medium to pass transactions to the application for execution. This capability makes the system more modular and helps attract more application developers. Initially, Mezo will only be compatible with the EVM runtime.

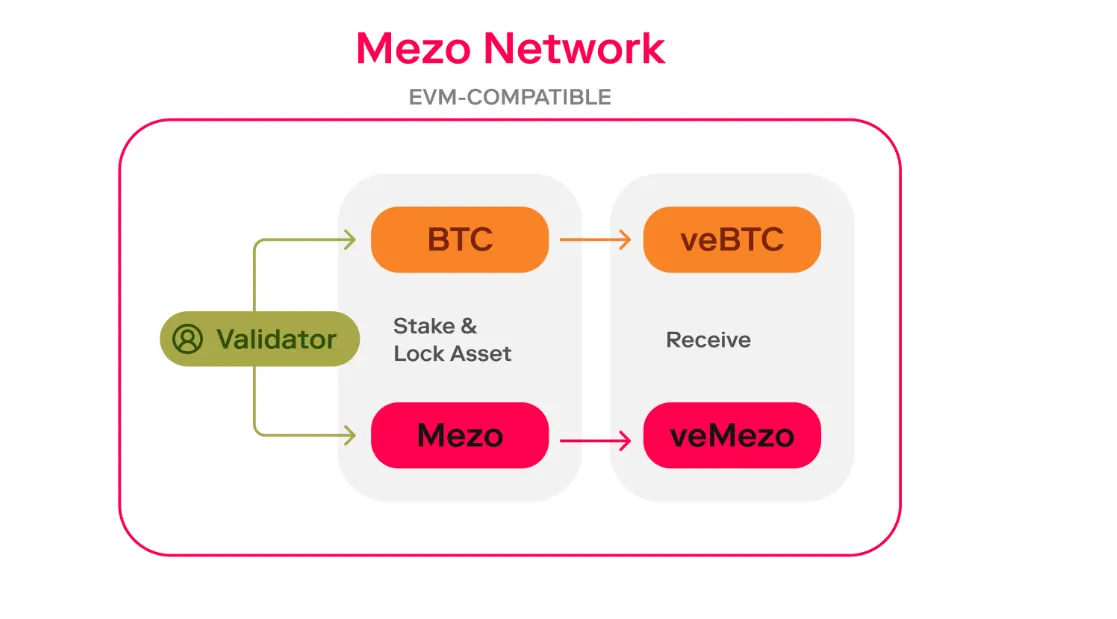

Mezos economic design is such that as it grows in popularity, BTC holders may benefit directly or indirectly. They can stake BTC on Mezo to earn staking yield, or if they choose to continue holding BTC on the Bitcoin network, they will receive some benefit from BTC being taken out of circulation (to pay for fees on Mezo).

Mezo has a dual staking model, as shown in the figure below. Validators on the network can stake BTC and MEZO (the native token of the Mezo network). By staking BTC and MEZO, validators receive veBTC and veMezo respectively. The ve stands for validator escrow, and these tokens are usually locked in smart contracts. Validator escrow token holders have governance rights, and network rewards and fee income are shared with them.

The longer the asset is locked, the more ve tokens are issued. veBTC stakers earn BTC, and veMEZO stakers earn MEZO rewards. Part of the MEZO rewards can be burned to increase the BTC inventory.

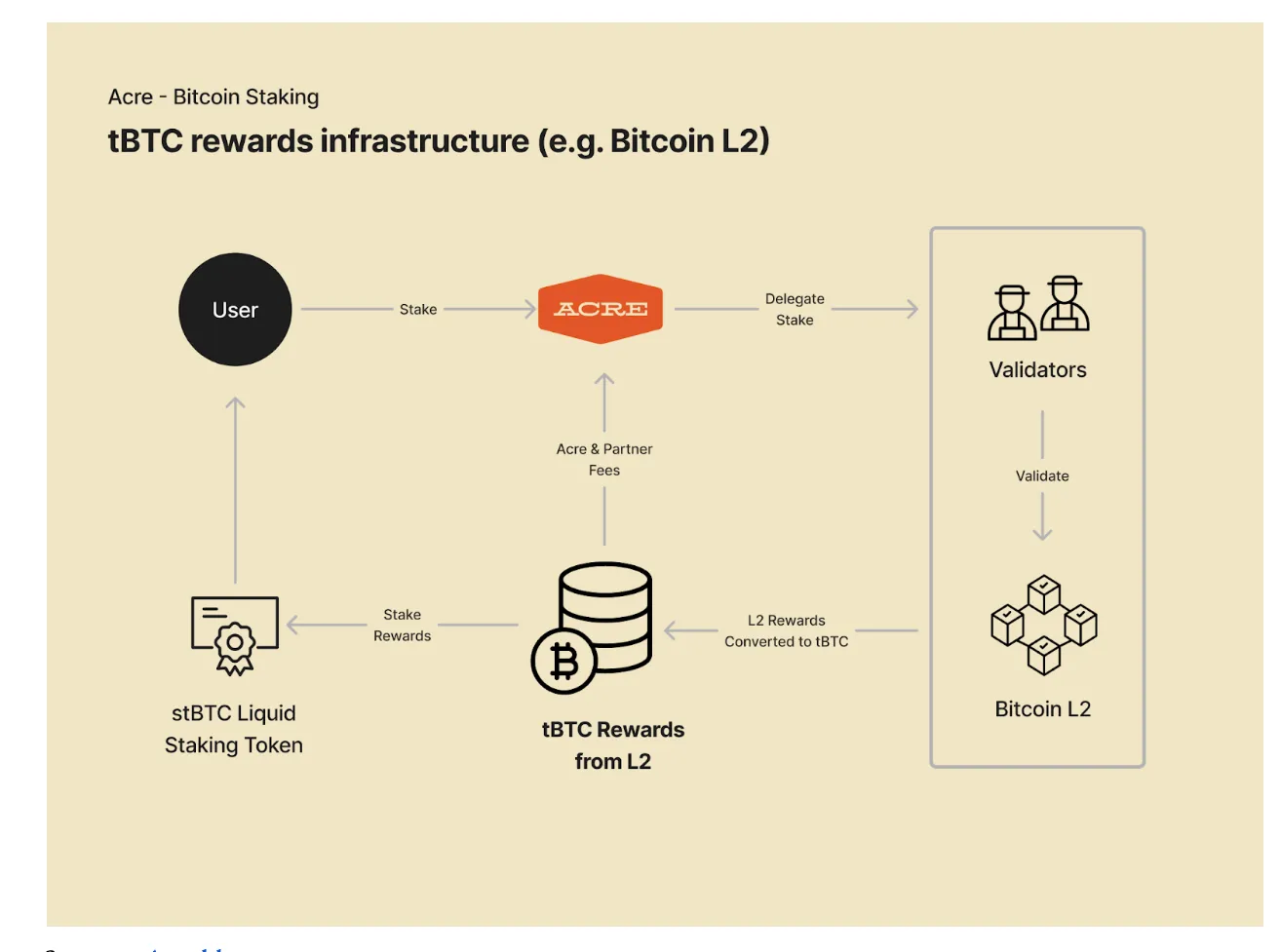

Yield generation is one of Mezos core features, as fees paid by users are distributed to validators who stake BTC. Mezo plans to further expand the application scope of BTC staking through liquidity staking provided by its sister project Acre. When users deposit BTC into Acre , they receive a liquid staking token, stBTC, in return. The deposited BTC is used for cross-chain and DeFi applications. The income generated through these activities is accumulated in stBTC, which can be exchanged for BTC at a 1:1 ratio.

Source — Acre Blog

Despite BTC’s market cap exceeding $1 trillion, it barely plays a role in the lending market. The chart below shows the distribution of WBTC in the lending market. The data shows that from July 2023 to June 2024, the amount of WBTC used in the top three lending applications decreased from about 50,000 to about 23,000. The decline in the total amount of WBTC in lending applications can be attributed to the 48% drop in WBTC supply, from 285,000 WBTC in May 2022 to just over 150,000 WBTC now. This decline is mainly due to the market’s awareness of the risks of centralized parties in the aftermath of the Luna, 3AC, and Alameda incidents.

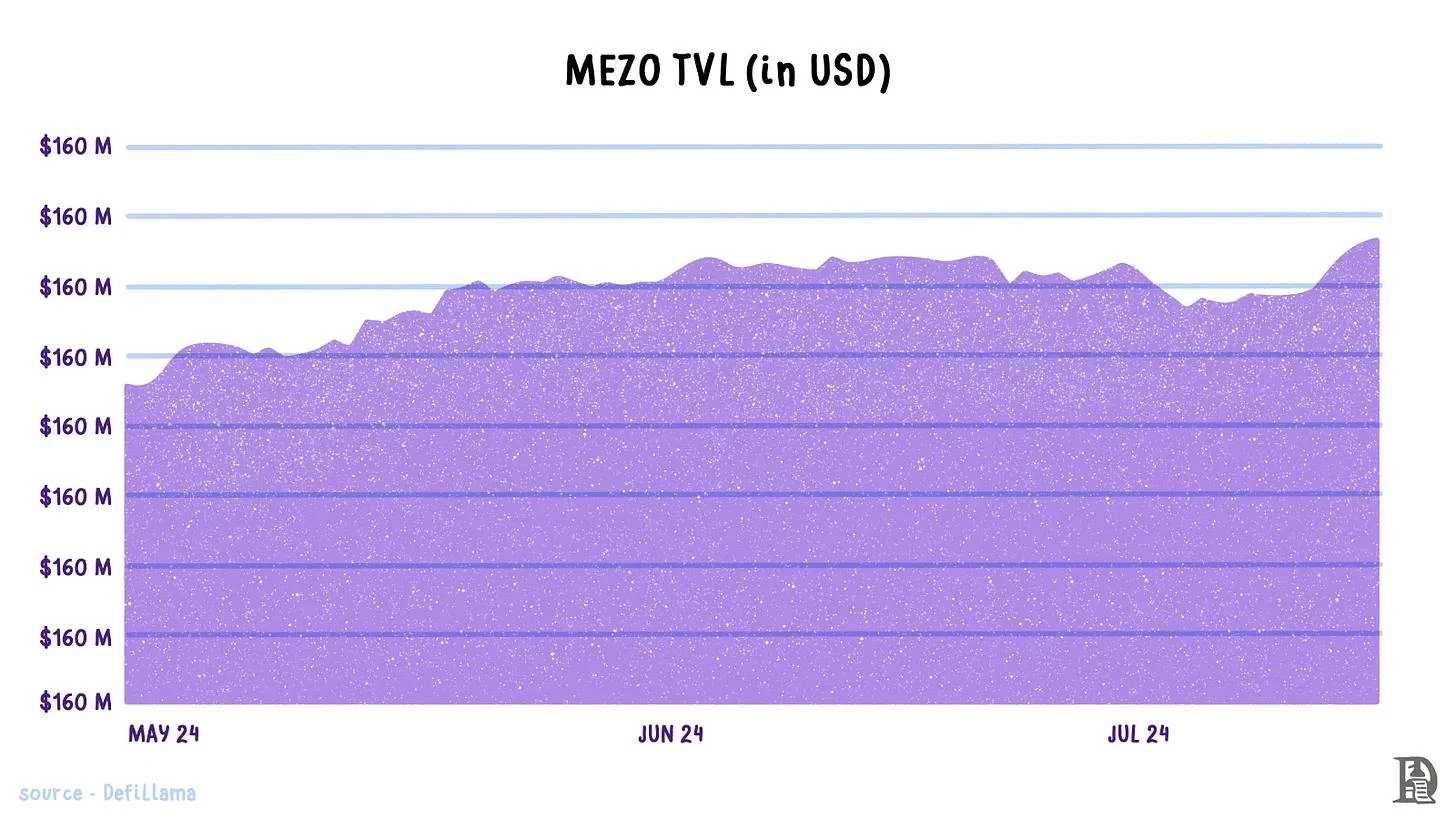

In the first phase of the initial launch, Mezo has begun accepting BTC deposits with three lock-up periods: two months, six months, and nine months. Deposits earn points in the form of HODL points. One BTC generates 1,000 points per day, and the longer the lock-up period, the higher the multiplier. Users can also deposit other assets such as USDe, USDC, and USDT to increase the returns on BTC deposits. As of July 2024, Mezos TVL (total locked volume) is $135 million .

In addition to rewarding holders, Mezo will also share some of its fees with the Bitcoin Core protocol.

Stacks

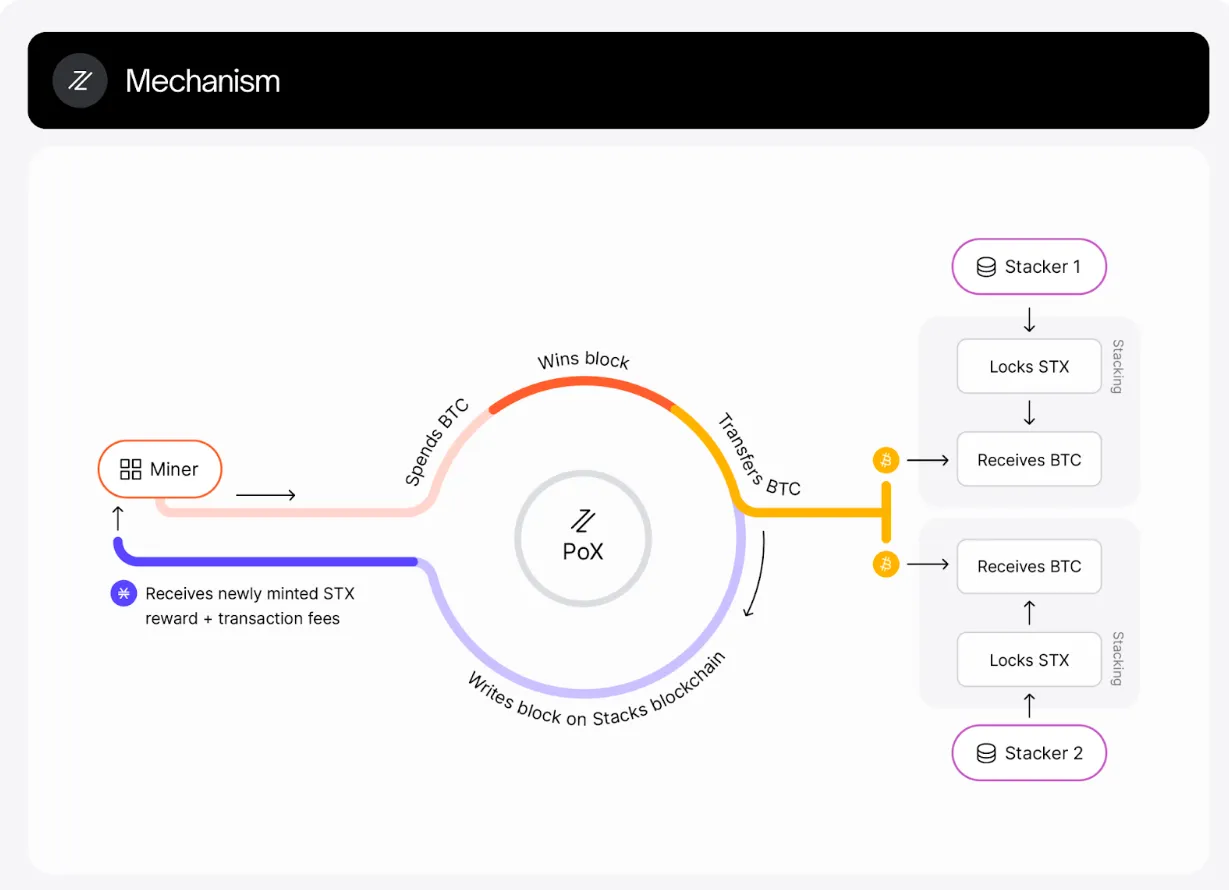

Stacks, formerly known as Blockstack, recently launched its much-anticipated Nakamoto upgrade, which aims to address issues such as forks and slow transactions before the upgrade. Stacks uses the Proof of Transfer (PoX) consensus mechanism.

Therefore, Bitcoin miners interested in generating blocks on Stacks need to send some BTC. Lets assume that miner Alice is randomly selected to generate blocks on Stacks. This miners BTC will be distributed to those who stake (lock/stake) STX (the native token of the Stacks chain). This is interesting because although the reward is smaller, it is provided in the form of BTC. On most chains, the reward is only provided in the native token of the chain.

Once selected, Alice can keep generating Stacks blocks until the next Bitcoin block is mined. As she generates Stacks blocks, they are sent to signers for verification. When more than 70% of signers accept these Stacks blocks, they are accepted by the Stacks network. Suppose Alice generates 10 Stacks blocks before the next Bitcoin block is mined, and Bob wins the opportunity to generate the next Stacks block.

Bob will add the hash of the first block generated by Alice on Stacks to the block submission transaction he submits to the Bitcoin chain. Stackers will detect this transaction and create a term change transaction on Stacks that includes the hash of the last block generated by Alice, which is block 10. This way, Bob knows that he needs to continue building on Alices block 10.

Although the development of the Bitcoin layer is still in its early stages, below is a comparison of the above chains. It takes into account chain design, bridge design, and the dollar value secured.

We must also mention that in addition to the above teams, there are many other teams such as Alpen, Bison, BitLayer, Rootstock, SatoshiVM and Soveryn that are also building extension layers for Bitcoin. Readers can find the full list here .

The relationship between L2 and L1

L2s help L1s in two ways: scaling and reducing costs. They provide users with a cheaper way to transact without sacrificing too much security (or even no security loss in the case of L2s with non-custodial, trustless bridges, and no additional security assumptions).

Take Ethereum L2 as an example. According to Token Terminal, in the second week of June 2024, Ethereum supported 7.1 million transactions with revenue of $10.6 million. The cost per transaction for users was about $1.5. At the same time, five L2s – Arbitrum, Base, Blast, Optimism, and Polygon – supported more than 70 million transactions with a total fee of $2.75 million. The fee per transaction was about $0.03.

We can debate the quality of these transactions, including whether they are bots or trading value, etc. However, the fact is that Ethereum itself cannot support that many transactions.

However, one downside of this is that L1 is no longer directly connected to its users. In traditional commerce, it is usually the businesses closer to the end user that capture most of the value. Amazon is a good example. Its vast distribution network gives it an advantage over suppliers and manufacturers.

Dollar Shave Club disrupted the razor industry by selling razors directly to consumers through a subscription model, eliminating traditional retail channels. This allows them to sell their products at a lower price and retain most of the value rather than sharing it with the entire supply chain.

Generally adding another layer between you and your customers is a bad idea. So why are L1s going this route? By introducing L2s into the mix, L1s are not losing customers. They are bringing a B2B model to what was previously a strictly B2C business model. But the question remains – are L2s capturing the majority of the value? Are they passing enough fees to L1s?

Fortunately, Ethereum has already walked this path in the past three years, and we can observe the impact of L2 on Ethereum’s value capture. There are two ways to understand whether L2 is predatory to Ethereum.

1. The first is to see if Ethereum has lost revenue to L2. We can test this by examining the change in Ethereum’s share of Ethereum ecosystem revenue. The following chart shows the revenue of Ethereum and the five leading L2s. Ethereum always accounts for more than 90% of the revenue stream.

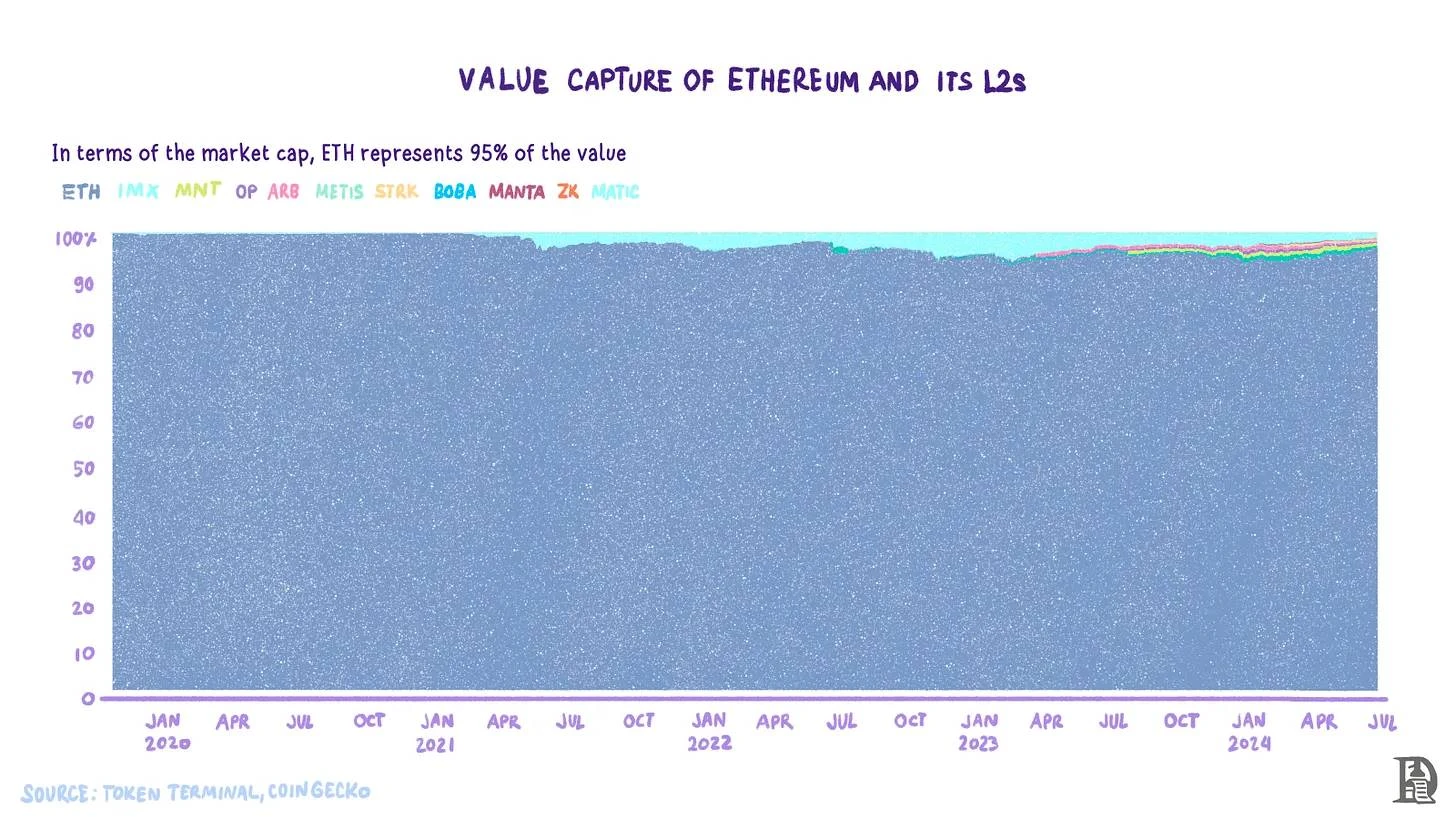

2. Another way is to look at market cap or price. Because value capture is almost always reflected in price, ETH accounts for over 95% of the total market cap of the Ethereum ecosystem, taking into account the market cap of its top 10 L2s.

Ethereum itself cannot support that many transactions, but it still captures more than 90% of the ecosystem value, which shows that L2 is the right step to scale Ethereum. As long as L2 settles on L1, healthy competition between L2 for L1 block space is good for the health of the base layer.

Whats next?

Imagine the island metaphor again. For a true L2, the two islands must work together to build a bridge. But this is impossible without an internal consensus among the residents of Bitcoin Island. The current situation is that projects that want to become Bitcoin Island L2 are working hard to build infrastructure as a temporary solution.

So once Bitcoin Island residents agree that bridging to other islands is needed to facilitate growth, L2 islands are ready. Until then, it is important not to try to find more complex ways to bridge and create L2s, but to focus on using infrastructure that has already been proven to work and has been battle-tested.

How different projects are modernizing Bitcoin Island and preparing bridge infrastructure to connect other islands

Bitcoin Islanders are known to be opinionated and take the islands safety very seriously. Any changes to the island are thoroughly discussed. Anyone who wants to suggest a change to Bitcoin can draft a Bitcoin Improvement Proposal (BIP). After informal discussions on various forums, the author will incorporate feedback and make changes to the BIP. The Islander Committee will then number the BIP, making it official.

Some islanders understand the importance of carefully modernizing Bitcoin Island. Teams like Botanix, Taproot Wizards, and Thesis are laying the foundation for adding opcodes to expand Bitcoin’s programmability. BIP-420 (also known as OP_CAT), proposed by Ethan Heilman and Armin Sabouri, will open up a ton of exciting possibilities for Bitcoin. CAT stands for Connect. It was part of the original Bitcoin opcodes but was removed by Satoshi Nakamoto due to security issues that have been mitigated as the Bitcoin execution environment has evolved.

This opcode allows two pieces of data to be connected together. It unlocks a multitude of possibilities from custom transaction types (such as dynamic escrow systems), smart contracts (such as atomic swaps), to different DeFi applications and greater interoperability with external chains.

Teams like Starkware have suggested that OP_CAT could bring STARK verification to Bitcoin. This means Bitcoin could verify Zk proofs, thus enabling rollups. This design paradigm not only allows for general purpose design on Bitcoin, but also improves its much-needed scalability.

Other designs from the Taproot Wizards team, such as CATVM , are already in progress. This design will use OP_CAT to create a trustless bridge. Unlike the current BitVM design, CATVM has no liquidity requirements. CATVM will enable decentralized trading of ordinals and runes, and its user experience is as good as other chains.

Segregated Witness paved the way for Taproot, which in turn is essential to Ordinals. Ordinals and Inscriptions make BRC-20 and Runes possible. Recent enthusiasm from Bitcoin developers shows that they are increasingly supporting social consensus to achieve BIP-420. It is also backwards compatible, so the network does not need a hard fork to activate it. We look forward to it going live and witnessing a new era of true Bitcoin native programmability.

There has been a clear increase in interest from Bitcoin developers for a long time. All the independent projects built around Bitcoin are like small modern islands surrounding the mighty Bitcoin island. With the introduction of BIP-420, there may be a way to merge these islands together into one thriving and modern island.

With all the changes in Bitcoin, I hope that in the future we will be able to use BTC in different financial applications without having to understand the underlying layers. The integration of the Bitcoin layer will be as natural as walking through Mumbai today, we have no idea that this busy metropolis was once seven separate islands of Mumbai.

This article is sourced from the internet: The history of Bitcoin’s “layering”: from isolated islands of value to interconnectedness

Related: Agent-Fi on AO: Financial paradigm integrating AI agents

Imagine that in the future world, AI agents and humans form a digital companion/symbiotic relationship. Autonomous agents can clarify intentions in conversations based on natural language requirements raised by users, automatically break down tasks and achieve expected results. AO has established an asynchronous parallel network based on Actor. It does not reach consensus on the entire contract calculation process, but only reaches consensus on the transaction order. It optimistically defaults to a fixed transaction order and runs the same result in the virtual machine. This choice allows the AO network to be expanded on a large scale until it supports any type of calculation. The AR network is used as the consensus layer for the transaction order and the storage layer for the transaction result status. Compared with other current…