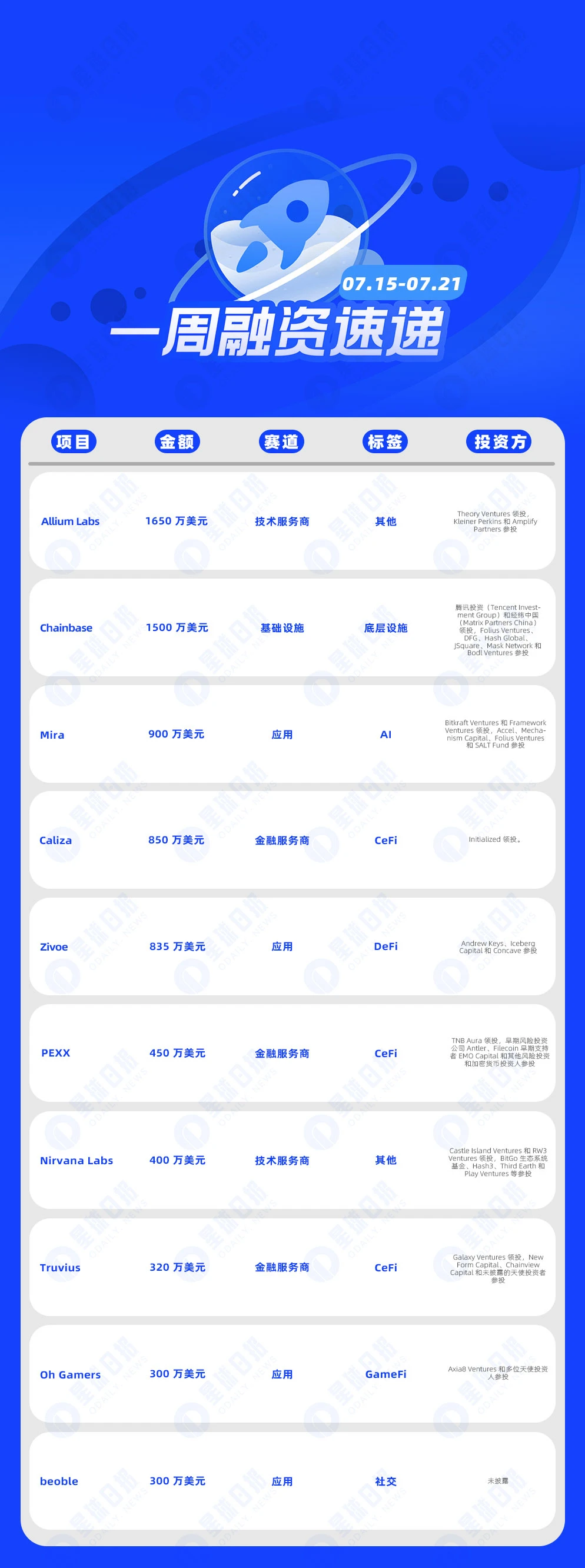

One-week financing express | 19 projects received investment, with a total disclosed financing amount of approximately U

According to incomplete statistics from Odaily Planet Daily, there were 19 blockchain financing events at home and abroad announced from July 15 to July 21, an increase from last weeks data (16). The total amount of financing disclosed was approximately US$82.55 million, an increase from last weeks data (US$128 million).

Last week, the project that received the most investment was blockchain data provider Allium Labs ($16.5 million); blockchain data network Chainbase followed closely behind ($15 million).

The following are specific financing events (Note: 1. Sort by the amount of money announced; 2. Excludes fund raising and MA events; 3. * indicates a traditional company whose business involves blockchain):

On July 18, blockchain data provider Allium Labs announced the completion of a $16.5 million Series A financing round led by Theory Ventures, with participation from Kleiner Perkins and Amplify Partners. As of now, its total financing amount has reached $21.5 million. The new funds are intended to be used to strengthen data infrastructure and listing plans to provide services that enable financial institutions to accept digital assets.

On July 18, blockchain data network Chainbase completed a $15 million Series A financing round, led by Tencent Investment Group and Matrix Partners China, with participation from Folius Ventures, DFG, Hash Global, JSquare, Mask Network and Bodl Ventures. Chainbase co-founder and COO Chris Feng revealed that this round of financing was completed in the fourth quarter of last year in the form of equity financing and token warrants, but declined to comment on the valuation.

On July 16, crypto AI startup Mira announced the completion of a $9 million seed round of financing, led by Bitkraft Ventures and Framework Ventures, with participation from Accel, Mechanism Capital, Folius Ventures and SALT Fund. Mira is a crypto AI startup focused on building decentralized machine learning infrastructure to help developers quickly build AI-native applications.

Stablecoin payment company Caliza completes $8.5 million financing, led by Initialized

On July 17, Caliza, a stablecoin payment fintech company, announced the completion of a $8.5 million financing led by Initialized. Caliza provides a crypto stablecoin payment system using USDC, and uses the API and front-end payment system of the existing real-time payment network to achieve instant transfers, and provides digital dollar account services for international merchants.

On July 18, Zivoe, a real-world asset (RWA) credit agreement, completed a new round of financing of US$8.35 million, with participation from Andrew Keys, Iceberg Capital and Concave. It is reported that Zivoe will use the funds to expand its credit channels and plans to launch its credit agreement on July 31.

Stablecoin payment platform PEXX completes $4.5 million seed round of financing, led by TNB Aura

On July 16, the stablecoin payment platform PEXX announced the completion of a $4.5 million seed round of financing, led by TNB Aura, with participation from early venture capital firm Antler, early Filecoin supporter EMO Capital, and other venture capital and cryptocurrency investors. It is reported that PEXXs payment platform allows users holding Tether (USDT) and Circle (USDC) stablecoins to transfer their assets directly to bank accounts, helping individuals and businesses to trade across borders without the need for intermediaries or bank accounts.

Nirvana Labs Completes $4 Million Seed Round Led by Castle Island Ventures and RW 3 Ventures

On July 20, blockchain cloud computing company Nirvana Labs announced the completion of a $4 million seed round of financing, led by Castle Island Ventures and RW 3 Ventures, with participation from BitGo Ecosystem Fund, Hash 3, Third Earth and Play Ventures, bringing the companys total financing in the past six months to $5.7 million. Nirvana Labs is developing a cloud infrastructure designed specifically for Web3, and its clients include Chainlink, BitGo, Goldsky, Thirdweb and Pairpoint.

On July 19, crypto investment platform Truvius announced the completion of a $3.2 million Pre-Seed round of financing, led by Galaxy Ventures, with participation from New Form Capital, Chainview Capital and undisclosed angel investors. It is reported that Truvius is a cryptocurrency investment platform for individual and institutional investors, mainly providing independent indexes for the cryptocurrency industry and scale. The platform cooperates with Anchorage Digital, the only federally chartered crypto bank in the United States, to provide custody and trading services to its customers.

On July 17, Web3 player community platform Oh Gamers announced the completion of a $3 million seed round of financing, with participation from Axia 8 Ventures and several angel investors. This funding will drive Oh Gamers early development and help it achieve its mission of focusing on players and reshaping the value distribution of the gaming ecosystem.

Web3 social platform beoble completes $3 million in financing

On July 15, Web3 social platform Beoble announced the completion of US$3 million in financing. Beoble stated that the funds will be used for new features, new experiences and new repurchases.

On July 15, Liquidium, an Ordinals lending platform on the Bitcoin chain, officially announced on the X platform that it had completed a $2.75 million seed round of financing, with participation from @Wise 3 Ventures, @PortalVentures, @goasymmetric, @cmsholdings, @Newmancapitalvc, @NGC_Ventures, @DeGodsNFT, AGE Fund, VidenVC, and many angel investors including CryptoSlate CEO Nate Whitehill, NFT giant Dingaling, Rugradio owner Threadguy, Gm Capital founder Beanie, Taproot Wizards owner Far, Asymmetric founder Dan Held, Degods founder Frank, and Wumbo Labs founder Crrius.

On July 19, multi-chain DEX ZKEX announced the completion of a $2.5 million seed round of financing, with participation from Fenbushi Capital, KKXVC, RockTree Capital, NGC Ventures, L2 Iterative Ventures, Crypto.com Capital, IDG Blockchain, Whale Ground, Moonhill Capital, Blocklabs Capital, Optic Capital, Hyperithm Group and G20 Group. The new funds will support the launch of mobile applications and Telegram robots and other services in the next quarter.

Stablecoin developer Bima Labs completes $2.25 million seed round led by Portal Ventures

On July 16, stablecoin developer Bima Labs raised $2.25 million in a seed round of financing, led by Portal Ventures, with participation from Draper Goren Blockchain, Sats Ventures, Luxor Technology, CoreDAO, Halo Capital, Ankr’s Ryan Fang, Chorus One’s Brian Crain, Sei Labs’ Jeffrey Feng, and Berachain’s Smokey.

On July 16, RateX, a margin-based leveraged synthetic interest rate trading platform, announced the successful completion of its seed round of financing. Investors in this round of financing include GSR, SNZ Holdings, Presto Labs, Animoca Ventures, Initial Ventures, G Ventures, KuCoin Ventures, Summer Ventures and LeadBlock Bitpanda Ventures.

Modular network DILL completes Pre-Seed round of financing, led by FSL Ecosystem

On July 16, the modular network DILL completed its Pre-Seed round of financing, led by FSL Ecosystem, with participation from LayerZero Labs, Modular Capital, Pendle co-founder TN Lee, Mantas victorji.eth, and others. The specific amount has not been disclosed yet.

On July 17, RWA and DePIN project SkyTrade announced the completion of Pre-Seed round of financing on X, led by Modular Capital and Portal Ventures, with participation from Solana Foundation, Mercatus Center, and angel investors such as Adam Gries and Jason Yanowitz.

On July 17, the cross-chain interoperability protocol Owlto Finance announced on the X platform that it had completed a new round of financing with a valuation of US$150 million, with participation from Matrixport, BIXIN Ventures, Presto and other institutions.

Derivatives trading platform JOJO completes seed round financing, led by SevenX Ventures

On July 19, Base chain derivatives trading platform JOJO completed its seed round of financing, led by SevenX Ventures, with participation from SmrtiLab, Shadow Labs, Bitlink, PAKA and Clairvoyant.

Blockchain gaming infrastructure GGEM announces investment from IBC Group and GensoKishi

On July 21, GGEM, a Web3 game launcher and game infrastructure designed for blockchain games, encryption and blockchain technology, announced the completion of new financing, with IBC Group and GensoKishi participating, but the specific amount and valuation data have not been disclosed. It is reported that the new funds will support GGEM to introduce more games to its game launcher, while expanding its community and game partners, as well as building and integrating crypto wallets.

This article is sourced from the internet: One-week financing express | 19 projects received investment, with a total disclosed financing amount of approximately US$82.55 million (7.15-7.21)

Related: A brief analysis of the liquidity war in the re-pledge market

Original author: Larry Sukernik, Myles ONeil Original translation: Frost, BlockBeats At Reverie, we spend a lot of time researching restaking protocols. It’s an exciting investment category for us because everything is fuzzy (opportunities exist in fuzzy markets) and there’s a lot happening (dozens of projects will launch in the restaking space in the next 12 months). In our work studying re-pledge mechanisms, we have gained some insights, so we wanted to predict how the re-pledge market will develop in the next few years. A lot of this is new, so what works today may not work tomorrow. Nonetheless, we wanted to share some initial observations about the business dynamics of the re-pledge market. LRT as a leverage point Today, LRTs like Etherfi and Renzo hold a powerful position in the…