Original author: Will Ogden Moore

Original translation: Luffy, Foresight News

Related Reading:

The AI wave strikes again, an article reviews Grayscale AI Fund holdings

Artificial intelligence (AI) is one of the most promising emerging technologies of this century, promising to multiply human productivity and drive medical breakthroughs. Although AI is already making its mark, its impact is only going to grow. PwC estimates that by 2030, it will grow into a massive $15 trillion industry.

However, this promising technology also faces challenges. As AI technology becomes more powerful, the AI industry has become extremely centralized, with power concentrated in the hands of a few companies, which is a potential threat to human society as a whole. AI has also raised serious concerns about deep fakes, bias, and data privacy risks. Fortunately, cryptocurrency and its decentralized and transparent nature offer potential solutions to some of these issues.

Below, we’ll explore the problems caused by centralization and how decentralized AI can help solve some of the ills, and discuss the current intersection of cryptocurrency and AI, highlighting crypto applications in the space that are showing early signs of adoption.

The Problem with Centralized AI

Today, the development of artificial intelligence faces certain challenges and risks. The network effects and intensive capital requirements of artificial intelligence are so significant that artificial intelligence developers outside of large technology companies, such as small companies or academic researchers, either have difficulty obtaining the resources needed for development or are unable to commercialize. This limits overall competition and innovation in artificial intelligence.

As a result, the influence on this critical technology is mainly concentrated in the hands of a few companies such as OpenAI and Google, which raises serious questions about the governance of AI. For example, in February this year, Googles AI image generator Gemini exposed racial bias and historical errors. In addition, last November, the six-member board of directors decided to fire OpenAI CEO Sam Altman, exposing the fact that a few people control these companies.

As AI grows in influence and importance, many worry that a single company, which could gain decision-making power over an AI model that has a huge impact on society, could put up guardrails, operate behind closed doors, or manipulate the model to its own advantage.

How decentralized AI can help

Decentralized AI refers to the use of blockchain technology to distribute AI ownership and governance in a way that increases transparency and accessibility. Grayscale Research believes that decentralized AI has the potential to free these important decisions from closed institutions and put them in the hands of the public.

Blockchain technology can help developers get more exposure to AI and lower the threshold for independent developers to develop and commercialize. We believe this can help improve innovation and competition in the AI industry and achieve a balance between small companies and technology giants.

Additionally, decentralized AI helps democratize AI investing. Currently, there are few ways to gain financial exposure to AI developments outside of a handful of tech stocks. At the same time, a large amount of private equity capital is allocated to AI startups and private companies ($47 billion in 2022 and $42 billion in 2023). As a result, only a small group of venture capitalists and accredited investors can access the financial benefits of these companies. In contrast, decentralized AI crypto assets are equal to everyone, allowing everyone to own a part of the AI future.

How far has this cross-field developed?

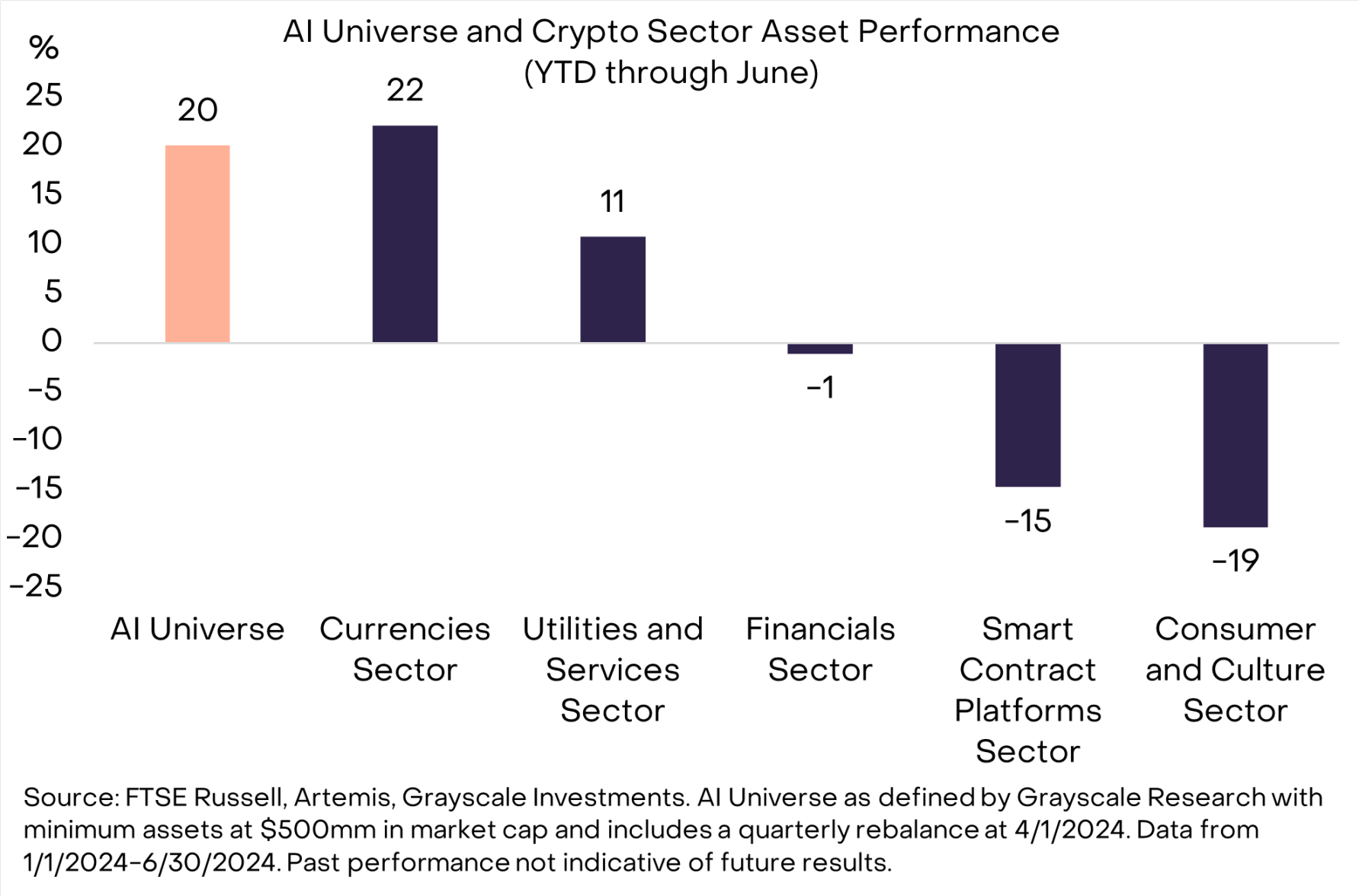

The intersection of cryptocurrency and artificial intelligence is still in its early stages, but the market response is encouraging. As of May 2024, AI concept crypto assets (Note: A cryptocurrency portfolio defined by Grayscale Research, including NEAR, FET, RNDR, FIL, TAO, THETA, AKT, AGIX, WLD, AIOZ, TFUEL, GLM, PRIME, OCEAN, ARKM and LTP.) have a return rate of 20%, second only to the currency concept category (Figure 1). In addition, according to data provider Kaito, artificial intelligence is currently the hottest narrative on social platforms compared to other topics such as DeFi, Layer 2, Memecoin and real-world assets.

Recently, some well-known figures have begun to embrace this emerging cross-field and are committed to solving the shortcomings of centralized artificial intelligence. In March of this year, Emad Mostaque, the founder of the well-known artificial intelligence company Stability AI, left the company to explore decentralized artificial intelligence. He said that now is the time to make artificial intelligence open and decentralized. Cryptocurrency entrepreneur Erik Vorhees recently launched Venice.ai, a privacy-focused artificial intelligence service with end-to-end encryption.

Figure 1: AI has outperformed almost every cryptocurrency sub-sector so far this year

We can divide the convergence of cryptocurrency and AI into three main subcategories:

-

Infrastructure layer: networks that provide platforms for AI development (e.g., NEAR, TAO, FET);

-

Resources required for artificial intelligence: Provide key resources such as computing, storage, and data required for artificial intelligence development (e.g. RNDR, AKT, LPT, FIL, AR, MASA);

-

Solving AI problems: Attempting to solve AI-related problems such as the rise of bots and deepfakes and model verification (e.g. WLD, TRAC, NUM).

Figure 2: Project landscape integrating artificial intelligence and cryptocurrencies, source: Grayscale Investments

AI Infrastructure Network

The first category is networks that provide permissionless, open architectures built specifically for AI development. These networks are not focused on a single AI product or service, but rather create underlying infrastructure and incentives for a variety of AI applications.

NEAR stands out in this category, with its founder being one of the co-authors of the Transformer architecture, which powers AI systems such as ChatGPT. However, the company recently used its AI expertise to announce its work on developing user-owned AI through a research and development department led by a former OpenAI research engineer advisor. In late June 2024, Near launched an AI incubator program to develop Nears native base models, AI application data platform, AI agent framework, and computing marketplace.

Bittensor is another notable example. Bittensor is a platform that uses TAO tokens to economically encourage the development of artificial intelligence. Bittensor is the underlying platform for 38 sub-networks, each with different use cases such as chatbots, image generation, financial forecasting, language translation, model training, storage, and computing. The Bittensor network rewards the best performing miners and validators in each sub-network with TAO tokens and provides developers with a permissionless API to help them build specific AI applications.

The AI infrastructure network also includes other protocols such as Fetch.ai and Allora. Fetch.ai is a platform for developers to create complex AI assistants (i.e. AI agents), which recently merged with AGIX and OCEAN, with a total value of approximately $7.5 billion. Another is the Allora network, which focuses on applying AI to the financial sector, including decentralized exchanges and automated trading strategies for prediction markets. Allora has not yet launched a token and conducted a strategic round of financing in June, with a total financing amount of $35 million.

Providing the resources needed for AI

The second category is projects that provide the resources needed for AI development in the form of computing, storage, or data.

The rise of AI has created an unprecedented demand for computing resources in the form of GPUs. Decentralized GPU marketplaces such as Render (RNDR), Akash (AKT), and Livepeer (LPT) provide a supply of idle GPUs to developers who need compute for model training, model inference, or rendering 3D generative AI. Render is estimated to offer around 10,000 GPUs, with a focus on artists and generative AI, while Akash offers 400 GPUs, with a focus on AI developers and researchers. Meanwhile, Livepeer recently announced its new AI subnet initiative, with the goal of completing text-to-image, text-to-video, and image-to-video capabilities by August 2024.

In addition to requiring a lot of computation, AI models also require a lot of data. Therefore, the demand for data storage has increased significantly. Data storage solutions such as Filecoin (FIL) and Arweave (AR) can serve as an alternative to storing AI data on centralized AWS servers. These solutions not only provide cost-effective and scalable storage, but also enhance data security and integrity by eliminating single points of failure and reducing the risk of data leakage.

Finally, existing AI services such as OpenAI and Gemini have continuous access to live data through Bing and Google Search, respectively. This puts all other AI model developers outside of the tech giants at a disadvantage. However, data scraping services such as Grass and Masa (MASA) can help level the playing field by allowing individuals to commercialize their application data by using it for AI model training, while maintaining control and privacy over their personal data.

Solving AI-related problems

The third category includes projects that attempt to address issues related to artificial intelligence, including the proliferation of bots and deepfakes.

One of the major issues exacerbated by AI is the proliferation of bots and disinformation. AI-generated deepfakes have already impacted presidential elections in India and Europe, and experts are “very afraid” that the upcoming presidential race will be caught in a “tsunami of disinformation” driven by deepfakes. Projects that hope to help solve problems related to deepfakes by establishing verifiable content sources include Origin Trail (TRAC), Numbers Protocol (NUM), and Story Protocol. Additionally, Worldcoin (WLD) seeks to solve the bot problem by proving a person’s humanity through unique biometrics.

Another risk of AI is ensuring trust in the models themselves. How can we trust that the AI results we receive have not been tampered with or manipulated? Currently, there are several protocols working to help solve this problem through cryptography, zero-knowledge proofs, and fully homomorphic encryption (FHE), including Modulus Labs and Zama.

in conclusion

While these decentralized AI assets have made initial progress, we are still in the early stages of this intersection. Earlier this year, well-known venture capitalist Fred Wilson said that AI and cryptocurrency are two sides of the same coin and that Web3 will help us trust AI. As the AI industry continues to mature, Grayscale Research believes that these AI-related crypto use cases will become increasingly important, and these two rapidly developing technologies have the potential to support each other and develop together.

There are many signs that the era of artificial intelligence is coming, which will have far-reaching effects, both positive and negative. By leveraging the characteristics of blockchain technology, we believe that cryptocurrency can eventually help mitigate some of the dangers brought about by artificial intelligence.

This article is sourced from the internet: Grayscale: How will crypto use cases flourish in the AI era?

Related: One-week token unlock: NEON starts one-year daily linear unlock

Next week, 18 projects will have token unlocking events. NEON, PIXEL, STRK, and CYBER have higher unlocking ratios, but NEON has a relatively small unlocking amount. Neon Project Twitter: https://twitter.com/Neon_EVM Project website: https://neonevm.org/ Number of unlocked tokens this time: 6.26 million Amount unlocked this time: Approximately 2.38 million US dollars Neon is a compatible Ethereum Virtual Machine (EVM) that provides a low-friction solution to enable Ethereum DApps to run in Solana. The Neon EVM enables Ethereum developers to enjoy the benefits of the Solana network, including low fees, high transaction speeds, and the ability to execute transactions in parallel. NEON is about to usher in the first round of linear unlocking (starting from the 17th). Almost all NEON tokens will be released linearly during the cycle, with a total of…