SignalPlus Volatility Column (20240717): IV goes higher and flat

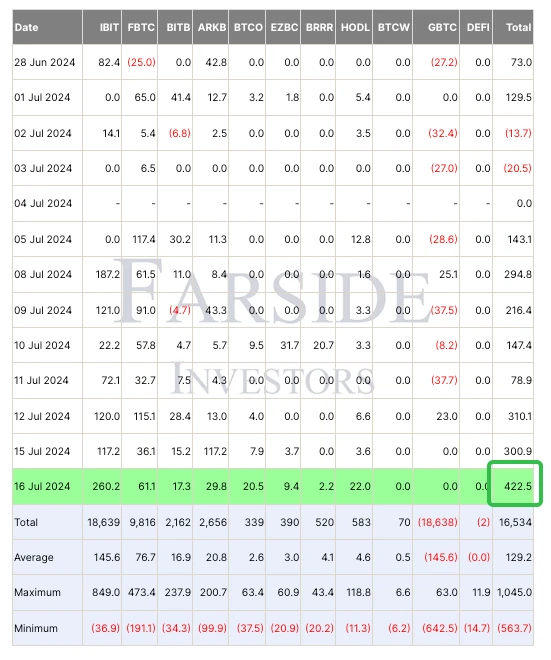

Over the past day, the price of BTC has been rising steadily, breaking through $66,000 at one point, and the daily inflow of spot ETFs reached $422 million, the highest record since June, with a cumulative inflow of more than $1 billion in three days, indicating the increase in investor confidence and institutional investment interest. On the other hand, Kraken began to distribute a total of $3.1 billion in cryptocurrency (BTC/BCH) compensation to Mt Gox creditors, which is expected to be carried out gradually in the next 7 to 14 days. Despite this, we have seen that the selling sentiment caused by potential selling pressure has been offset by the support of institutional investors, and the price of BTC remains strong. At the same time, some people pointed out that the potential sell-off this time is a voluntary act of creditors, which is different from the German governments mandatory coin sale plan, so the impact on the price will be smaller than expected.

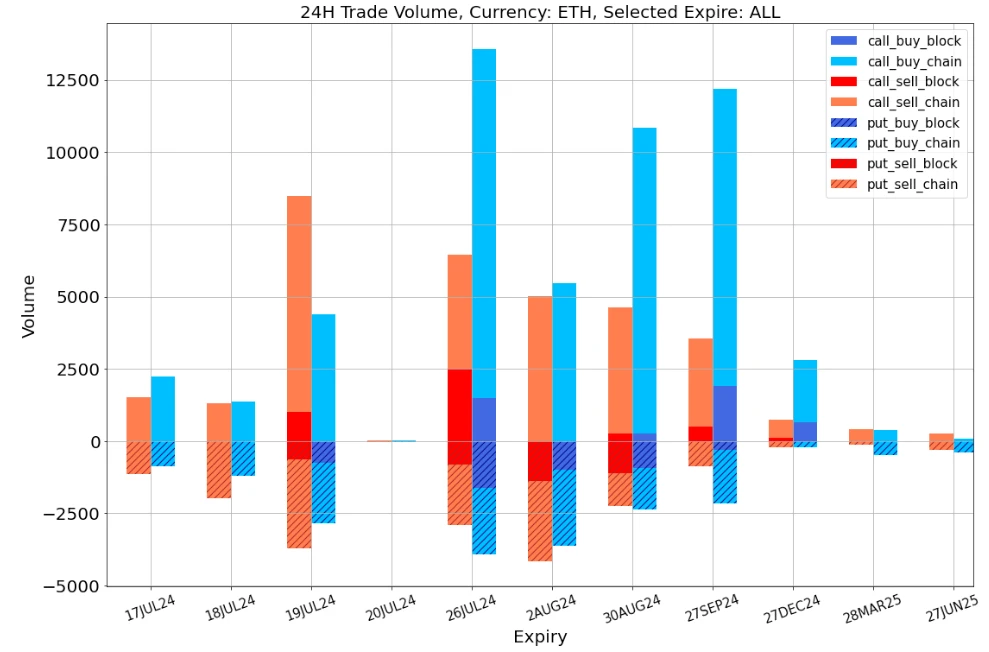

Regarding ETH, the U.S. Securities and Exchange Commission (SEC) officially announced that it has given preliminary approval to asset management companies including BlackRock and VanEck for Ethereum spot ETFs, which will start trading next Tuesday (July 23). This news has once again boosted the digital currency market, with traders buying a large number of call options on expiration dates after the end of July and selling call options on 19 JU L2 4 (before the start of ETH Spot ETF trading) to form a calendar spread strategy.

Source: TradingView;

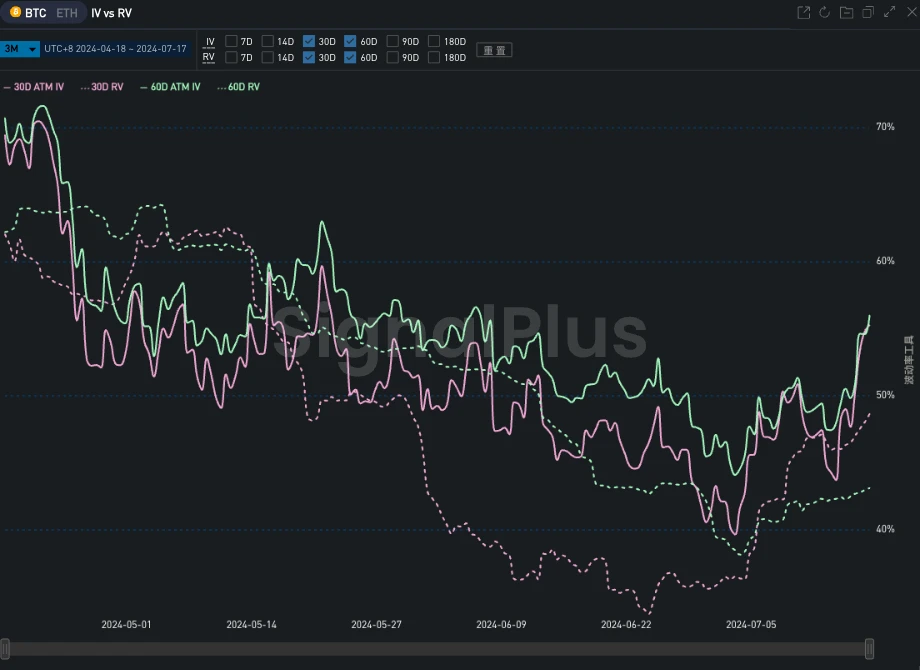

From the perspective of volatility, the mid- and long-term IV levels have been significantly increased in the past 24 hours, and the flattening trend of the BTC term IV Curve has become more obvious. The IV in August and September has reached a high of 60% +, exceeding the historical 75% percentile in the past three months. It can also be seen from the IV vs RV chart that the 30 d/60 d IV has risen rapidly, showing a generous Vol Premium compared with the RV.

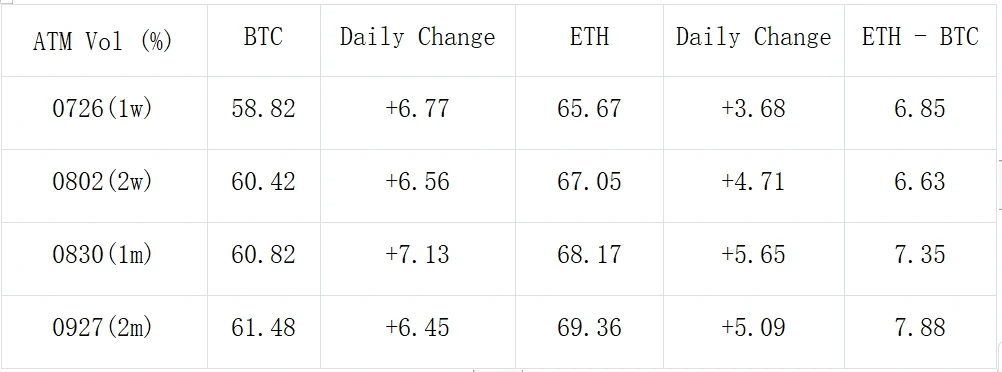

Source: Deribit (as of 17 JUL 16: 00 UTC+ 8)

Source: SignalPlus

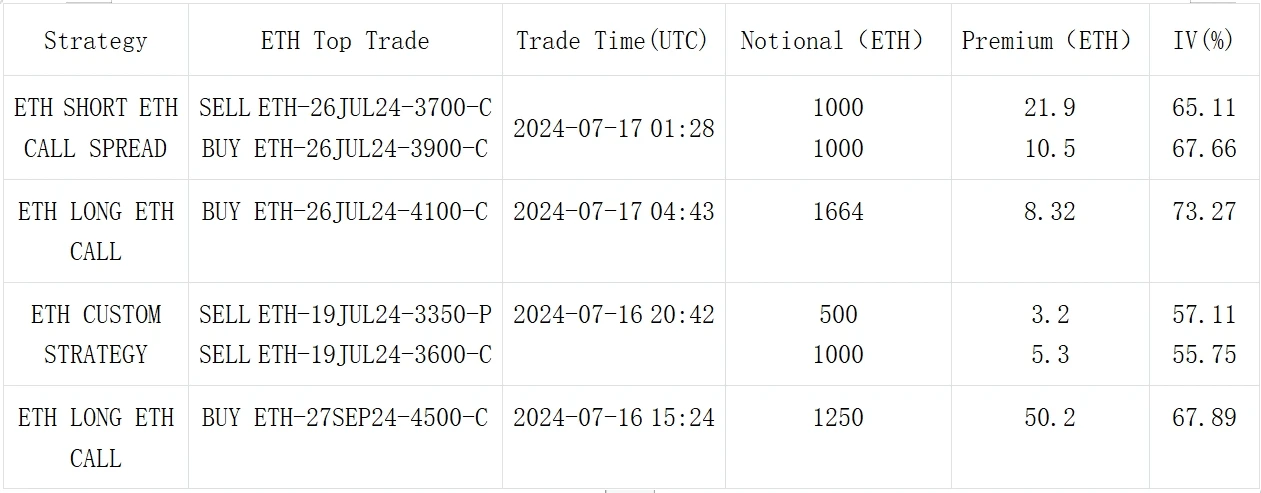

Data Source: Deribit, overall distribution of ETH transactions; with 7.23 as the dividing point, the front end sells calls, and the middle and back ends buy calls

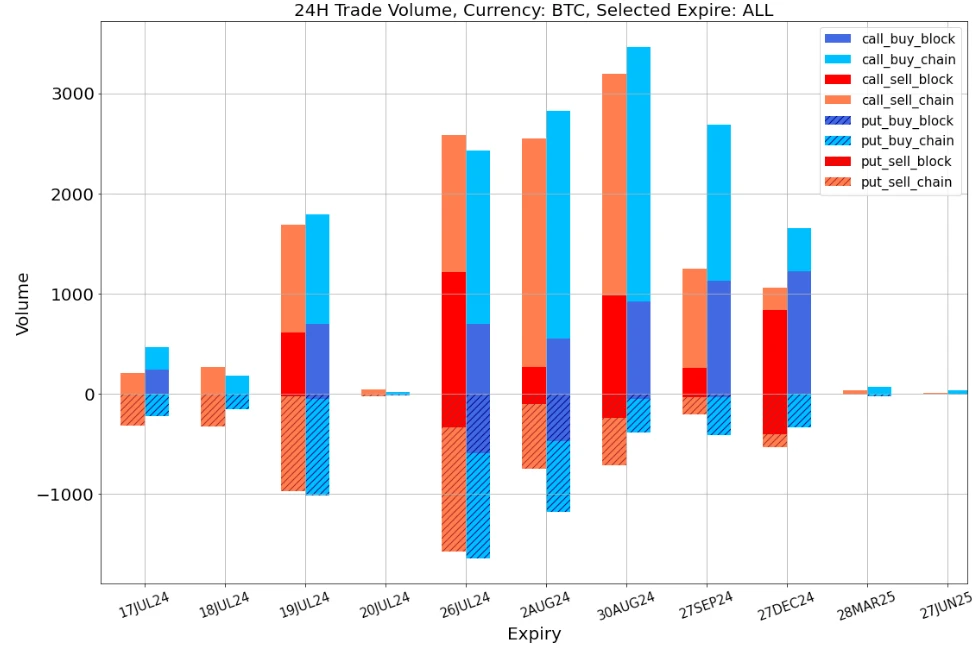

Data Source: Deribit, overall distribution of BTC transactions

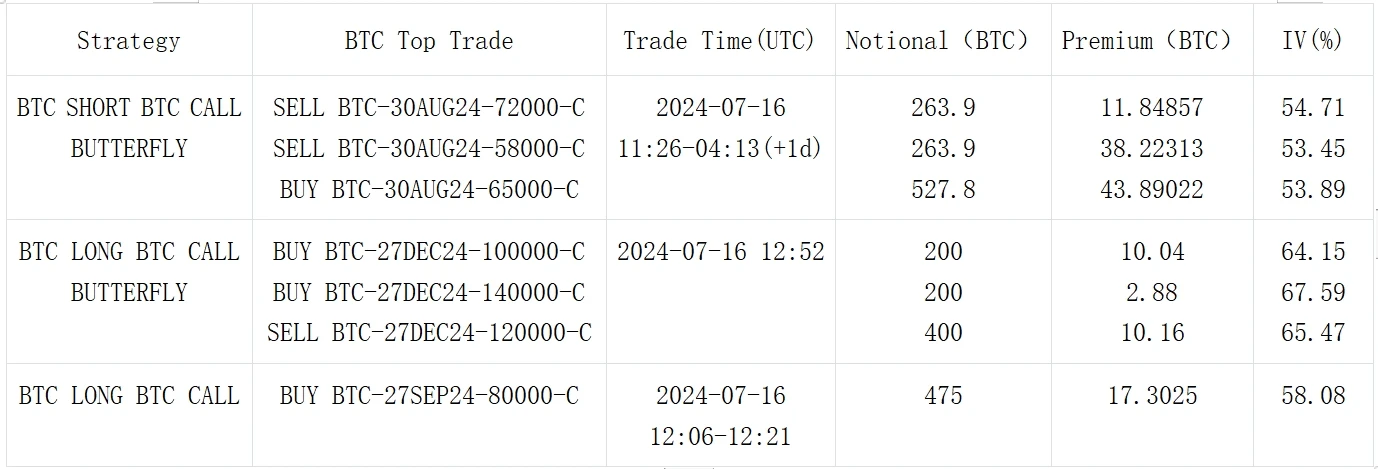

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240717): IV goes higher and flat

In the past 24 hours, many new popular currencies and topics have appeared in the market, which may be the next opportunity to make money, including: The sectors with relatively strong wealth-creating effects are: Meme sector, AI sector, and ETH ecological projects Hot searched tokens and topics by users: UXLINK, ETH, JD Vance Potential airdrop opportunities include: Sonic, Solayer Data statistics time: July 16, 2024 4: 00 (UTC + 0) 1. Market environment In the past 24 hours, BTC has been on a unilateral rise, with the price of BTC rising continuously from $62,000 to the current level of $64,500. BTC spot ETF has had net inflows for the seventh consecutive trading day, with a net inflow of $300 million yesterday, becoming the main driving force for BTCs rise. Balchunas,…