Coinbase Ventures: Layer3, the AWS moment of the crypto world

Original author: Coinbase Ventures Ryan Y Yi (Coinbase Ventures)

Original translation: TechFlow

Disclosures and footnotes: This article mentions multiple projects in which Coinbase Ventures has invested , including Optimism, Arbitrum, Celestia, Eigenlayer, Stack, ThirdWeb, Syndicate, Conduit, Alchemy, Socket, Everclear, Reservoir, Starkware, and Matter Labs.

L3s (or “Layer 3”) are becoming an emerging phenomenon in on-chain developer deployments, especially in the EVM L2 space. This article will explain the basics of L3s, their value proposition, and their impact on the entire ecosystem.

Summary:

-

While L2s have become central to on-chain activity through lower gas fees and higher throughput and comprise a large portion of the ETH-based economy, they may be limited by the need to maintain decentralization and alignment with ETH L1.

-

Developers who want to [1] experiment and customize applications, and [2] align with L2 for distribution, now choose to build L3s — these are application chains that settle to the underlying L2.

-

This article aims to build a common understanding of L3s.

Key Points

What is L3s?

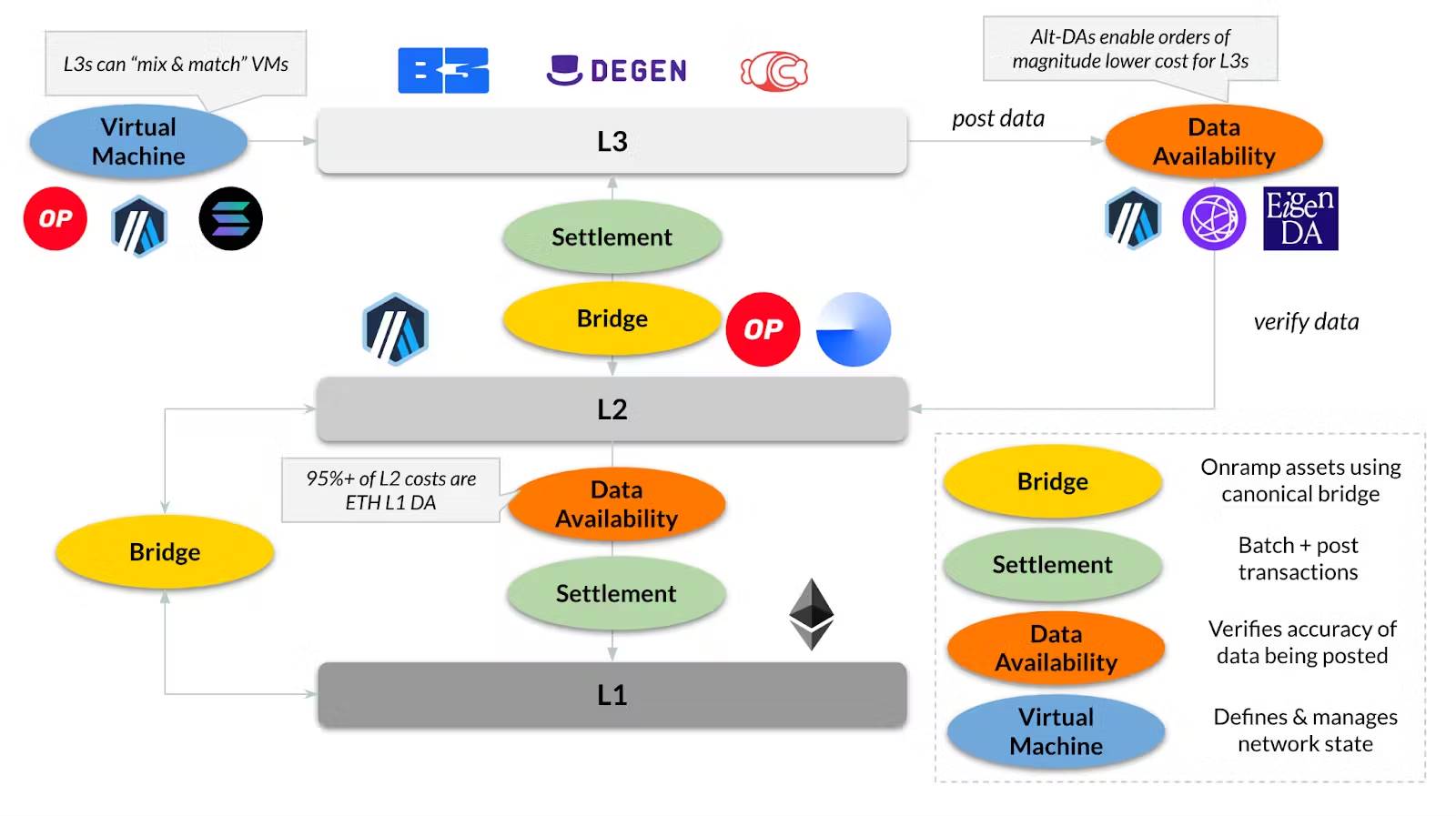

If L2 is the hub on the chain, then L3 can be seen as on-chain servers that have independent state environments and fee markets, but settle to the underlying L2 and utilize its uplink/distribution mechanism. This provides applications with customizable block space while still leveraging the existing liquidity and user base of L2.

-

Cost : Costs can be up to 1000x lower due to a combination of (1) lower onboarding costs (onboarding directly from CEXs to L2), (2) slightly cheaper settlement/execution costs (since trades settle to L2 instead of L1), and most importantly (3) alternative data availability (DA), i.e. how chains verify data accuracy (DA costs for L2 using ETH L1 data account for over 95% of total costs ). Gas fees are also more predictable because L3 has its own fee market (e.g., on L2, a surge in activity for one application raises fees for all other applications).

-

Customizability : L3 has a lower standard of decentralization than L2, which makes it possible to experiment with new token economics (such as custom gas tokens), virtual machines (such as Solana VM on ETH L2), and alternative DAs (such as Celestia instead of ETH L1).

How does L3 differ from L2?

L3 is a rollup, so it has many similarities with L2.

-

Settlement : Similar to L2 settlement to L1, L3 settlement to L2

-

Bridging : Similar to bridging assets from L1 to L2, similarly bridging from L2 to L3

-

Virtual Machines : The software stack used by L3 does not necessarily need to be the same stack as its underlying L2. For example, many L3s in production run on Arbitrum Nitro but settle to Base (which runs on OP Stack). In addition, most L3 stacks are modifications of existing popular L2 stacks. For example, Arbitrum (Nitro) and OP Stack have launched modified stacks that target the needs of L3 builders.

-

Data availability : This is the biggest difference. L3 will choose to use alternative DA layers (such as Celestia, EigenDA, Arbitrum AnyTrust), while L2 must use ETH L1 for alignment and decentralization. Therefore, L3 achieves an extremely low-cost gas environment.

How to start L3s?

-

Since L3s primarily leverage permissionless/open source technology stacks, developers can choose to (1) run the stack/infrastructure themselves, (2) leverage a Rollup-as-a-Service (RaaS) provider that offers managed services (e.g., Conduit, Caldera) to deploy and host your L3, or (3) consult a white label service provider (e.g., Syndicate) that “subcontracts” various infrastructure providers (e.g., RaaS, bridges, development tools).

Will there be L4 ?

-

Since L3s offer dedicated blockspace and are able to natively bridge to L2 “hubs” with liquidity and users, we believe this will cover all important on-chain use cases.

-

Even if L2 transaction costs fall, L3s may be the “final” frontier for vertical scaling (i.e., there will be no L4s).

-

The core premise of L3s is the ability to leverage the liquidity and users of the underlying L2 “hub.” Building on “L4” would further distance that and defeat the purpose.

-

Alternative data availability is the reason for the cost difference. Moving up the stack does not significantly change settlement or execution costs.

-

If an L3 reaches its scaling limit, instead of scaling further vertically (“L4”), they may start another L3 that settles into the same L2 (via a local bridge link). The end result is that L3s may scale horizontally rather than vertically.

Ecosystem impact

L3s will become another preferred direction for on-chain developers, potentially leading to a small number of L2 “hubs” with millions of L3 “servers”.

-

L3s represent a potential paradigm shift for on-chain developers as they break through the sub-cent barrier, lowering the barrier to building mainstream-scale on-chain applications, potentially leading to an “app store” moment with millions of L3s.

-

L3s provide developers with a playground for experimentation, ideal for high-throughput and low-cost applications – which can then leverage the liquidity and distribution mechanisms of the underlying L2 hubs.

-

The likely outcome is that there are tens to hundreds of L2 centers, and millions of L3s.

From a cost perspective, L3s could be a potential “AWS” moment.

-

L2s are becoming their own on-chain hubs. Due to their proximity to L1s, the cost of operating an L2 is typically high, potentially in the 7-8 figure USD per year.

-

On the other hand, L3s are much cheaper to operate, and the annual cost of operating one L3 may be between 25~50K USD.

L3s developers will drive the adoption of frameworks beyond Solidity/Vyper, leading to multi-VM environments.

-

There are projects trying to deploy alternative frameworks on Ethereum (such as MoveVM, SolanaVM, Arbitrum Stylus). These projects aim to expand the developer tool set while leveraging Ethereums existing network effects, liquidity, and uplink channels.

-

These frameworks may be applied at the L2 level first, but we can expect them to be deployed as L3, leveraging L2 centers like Base.

-

The end result is that L2 can attract the broadest total potential market of developers at the L3 level while maintaining its own chain on the EVM (rather than trying to integrate multiple virtual machines directly into L2).

L3 value streams will rely on the application layer

-

The key performance indicators of a single L3 are users and transactions and the utility of the token, not sorter fees. The average value created by a single L3 may be small, but as the number of L3s increases, this will produce a network effect.

-

The growth of L3s typically creates value on the software side (e.g., developer tools, Rollup As A Service) and on the protocol side (data availability, chain abstraction), but can only scale if there are a large number of L3s.

-

We can expect that a single issuer or project may launch multiple L3s, forming their own L3 ecosystem. For example, an on-chain gaming ecosystem may have one L3 for each game and launch additional L3s for other games, forming an emerging ecosystem that provides cumulative value and is shared with other stakeholders.

L3 needs smoother interoperability and chain abstraction to succeed

-

If the purpose of L3 is to leverage the user experience of L2 users, and we expect the number of L3s per application use case to continue to increase, then the interaction with these L3s needs to become seamless at the user level.

-

Similar to L2, bridging for L3 can be achieved in two ways: natively if L3 settles into L2, or through a third-party provider. Due to the experimental nature of the L3 stack, third-party providers are more suited to L3, which may result in a non-uniform and flexible bridging layer (see Bridging Status ).

-

At the same time, L3 may only prioritize interoperability with its regulated L2 settlement chain, rather than aiming to fully interoperate with all other chains. Therefore, they will focus on enhancing bridge functions, such as reducing latency and providing one-stop liquidity, to improve the overall user experience.

-

Additionally, ongoing protocol RD revolves around how to introduce local concepts at the sorter level (see Based Rollups ).

Future Outlook

In summary, the L2 ecosystem should expect to see growth in L3 builders who want to create isolated on-chain application experiences while leveraging the underlying L2 hub.

This article is sourced from the internet: Coinbase Ventures: Layer3, the AWS moment of the crypto world

In the past 24 hours, many new popular currencies and topics have appeared in the market, which may be the next opportunity to make money, including: The sectors with relatively strong wealth creation effects are: Solana sector, Bitget platform currency The most popular tokens and topics searched by users are: Pixels, ENS, HERO, Sony Exchange Potential airdrop opportunities include: Mitosis, GaiaNet Data statistics time: July 2, 2024 4: 00 (UTC + 0) 1. Market environment The market continued to fluctuate yesterday, with BTC fluctuating in a narrow range of $62,500 to $63,500, with a certain amount of intraday trading space. ETH has a higher volatility, and in the options market, the implied volatility of BTC and ETH is 44 and 59 respectively. Generally speaking, if the implied volatility of ETH…