SEC explains: Why are five major tokens such as MATIC considered securities?

Original translation: Carol Wu talks about blockchain

Consensys’ crypto assets have been the target of SEC enforcement actions for being deemed crypto securities. These crypto assets include, but are not limited to, the following: AMP (AMP token, available through MetaMask Swaps since October 2020), AXS (Axie Infinity Shards, available since November 2020), BNB (the native token of the BNB Chain ecosystem, available since March 2021), CHZ (see below for details), COTI (COTI token, available since October 2020), DDX (DerivaDAO token, available since December 2020), FLOW (FLOW token, available since November 2020), HEX (HEX token, available since October 2020), LCX (LCX token, available since October 2020), MANA (see below for details), MATIC (see below), NEXO (NEXO platform token, available since October 2020), OMG (OMG Network token, available since October 2020), The following are the tokens that have been offered since October 2020: BTC (Powerledger token, available since October 2020), POWR (Powerledger token, available since October 2020), SAND (see below for details), LUNA (see below for details), RLY (Rally token, available since October 2020), XYO (XYO token, available since October 2020).

Below is a non-exhaustive list of some of the crypto securities that Consensys is trading for investor accounts through its MetaMask Swaps platform.

Each crypto-asset security was offered and sold as an investment contract since its initial offering or sale and was therefore considered a security. For each crypto-asset security, the issuer and promoter’s representations gave investors a reasonable expectation of profit from the management or entrepreneurial efforts of such issuer and promoter (and related third parties). This reasonable expectation exists whether the investor acquires the crypto-asset security through the initial offering, from prior investors, or through a crypto-asset brokerage platform, including the MetaMask Swaps platform.

A. MATIC

“MATIC” is the native token on the Polygon chain. Polygon, originally called Matic Network and renamed Polygon in 2021, is a blockchain platform founded in 2017 in Mumbai, India by Jaynti Kanani, Sandeep Nailwal, Anurag Arjun and others. Since its creation, the founders of Polygon have been actively involved in the work of Polygon through the entity “Polygon Labs” (Polygon) they created for the “development and growth of Polygon”.

According to Polygons website information, Polygon is an Ethereum expansion platform that claims that through hosting and Ethereum sidechains, developers can build user-friendly dApps with low transaction fees and scalability, and allow users to process transactions and initiate asset transfers and technology development on Polygons sidechain network.

Polygon has issued a fixed supply of 10 billion MATIC tokens. MATIC holders can earn additional MATIC by staking their MATIC on the Polygon platform and becoming a validator, by delegating their MATIC to other validators in exchange for a portion of the fees collected from validating transactions, or by staking their MATIC to other third parties, such as crypto asset platforms that provide staking services.

According to MATIC’s initial whitepaper, “Matic Tokens are expected to provide economic incentives on the Matic Network [now Polygon]…Without Matic Tokens, there is no incentive for users to expend resources to participate in activities or provide services to the overall ecosystem on the Matic Network.”

Around 2018, Polygon raised $165,000 at $0.00079 per 1 MATIC and $450,000 at $0.00263 per 1 MATIC in two early sales rounds. In April 2019, Polygon sold 19% of its total supply to the public at $0.00263 per 1 MATIC through an Initial Exchange Offering (IEO) on Binance, raising an additional $5 million to fund network development.

Since its initial offering, MATIC has been offered and sold as an investment contract and is therefore a security.

The prices of all MATIC tokens will rise or fall together.

Since July 2021, MATIC can be bought and sold through the brokerage service provided by MetaMask Swaps.

The information Polygon publicly disseminates will cause investors, including those who have purchased MATIC since October 2020, to consider MATIC as an investment. Specifically, MATIC holders will reasonably expect that the Polygon protocol will grow and develop through the efforts of the Polygon team, and that such growth and development will in turn increase demand for and value of the MATIC token.

For example, Polygon publicly stated in its white paper that it would use investment proceeds from its private and public fundraising activities to develop and grow its business.

Additionally, following the IEO, Polygon conducted additional MATIC sales, publicly stating that it was doing so to raise the funds needed to support the growth of its network. On February 7, 2022, Polygon reported on its blog that it had raised approximately $450 million in a private sales round to several well-known venture capital firms for its native MATIC token. Polygon reported that with this funding, the core team can ensure that Polygon is at the forefront of the race to drive mass adoption of Web3 applications, a race that we believe will ultimately put Ethereum ahead of other blockchains.

Polygon also reported funding raised from other well-known and celebrity investors.

Polygon stated that approximately 67% of MATIC will be retained to support the Polygon ecosystem, foundation, and network operations. Another 20% of MATIC is further reserved to compensate Polygon team members and advisors to align their interests with investors expectations of MATIC.

Additionally, the Polygon blog provides frequent updates on Polygon’s network growth and development, including weekly active wallets and daily transaction statistics until December 2022, as well as financial metrics such as daily revenue and total network revenue.

Polygon also frequently publicizes when crypto asset trading platforms allow MATIC to be traded.

Polygon has also explicitly encouraged MATIC buyers to view MATIC as an investment in other ways. For example, in a tweet on February 5, 2021, 14 months after MATIC’s biggest price drop, Nailwal likened the token to a boxer who returns from defeat and becomes a champion:

Additionally, on November 3, 2022, Nailwal tweeted: I wont rest until Polygon gets the top 3 spot it deserves (alongside BTC and ETH). No other project comes close. In a Fireside Chat with CNBC posted on YouTube on May 24, 2022, Bejelic described whats different about Polygon: We are extremely dedicated as a team, take a very hands-on attitude towards all our projects, and work 24/7 to drive adoption, which is why we are currently the most popular scaling infrastructure platform. As of 2023, Polygons founders continue to promote the platform through various social media outlets. For example, on February 21, 2023, Nailwal tweeted that Kanani retweeted Polygons growth is exponential. To maintain this amazing growth, we have clarified our strategy for the next 5 years to drive mass adoption of web3 by scaling Ethereum. We remain well funded, with a current balance of over $250 million and over 1.9 billion MATIC tokens.

Since January 2022, Polygon has also advertised that it will “burn” MATIC tokens that accrue as fees, indicating that the total supply of MATIC will decrease. For example, in January 2022, Polygon highlighted the protocol upgrade that made the burn possible in a blog post titled “Burn, MATIC, Burn!” In another blog post published on its website at the same time, Polygon explained that “Polygon’s MATIC supply is fixed at 10 billion, so any reduction in the number of available tokens will have a deflationary effect.” As of March 28, 2023, Polygon has destroyed approximately 9.6 million MATIC tokens. The MATIC destruction mechanism marketed in the “deflationary effect” of the Polygon network has rationalized investors to believe that purchasing MATIC is potentially profitable because there is a built-in mechanism to reduce the supply, thereby increasing the price of MATIC.

B. MANA

MANA is a digital token minted by Decentraland. Decentraland is a virtual reality platform that was developed in June 2015 but was not open to the public until February 2020. Decentraland was launched by an entity called Metaverse Holdings through a core development team, whose members include Ariel Meilich, Esteban Ordano, Manual Araoz and Yemel Jardi. Decentraland runs on the Ethereum chain. According to Decentralands website information, Decentraland is a three-dimensional virtual reality platform where users can create, experience and monetize their content and applications.

MANA is the crypto asset involved in all transactions in the Decentraland VR ecosystem. On August 18, 2017, Decentraland held its initial coin offering (ICO), during which MANA was exchanged for ETH and raised approximately $24.1 million. Currently, the total supply of MANA tokens is approximately 2.19 billion.

Decentraland offers discounted prices for purchasing MANA to early contributors.

Since its initial offering, MANA has been issued and sold as an investment contract and is therefore a security.

The prices of all MANA tokens will rise or fall together.

Since October 2020, MANA can be bought and sold through the brokerage service provided by MetaMask Swaps.

The information Decentraland publicly disseminates leads investors, including those who have purchased MANA since October 2020, to believe that MANA is an investment. Specifically, MANA holders would reasonably expect growth and development through the efforts of the Decentraland team, and that such growth would in turn increase demand for and value of MANA.

Investor funds raised during the MANA ICO were used centrally to fund the marketing, operational expenses, and completion of the Decentraland platform. For example, on July 5, 2017 — a few weeks before the MANA ICO — Jardi published a blog post detailing Decentraland’s intended use of token sale proceeds, as follows:

The blog post further explains that the “first priority” of revenue is developing a virtual world, and that even after Decentraland is created, “the development budget will be focused on continually improving the user experience in the world browser.”

Indeed, Meilich explained in a separate blog post that after the ICO, Decentraland will implement a “continuous token model,” in which the supply of MANA will increase by 8% in the first year, followed by a slower rate in subsequent years to allow Decentraland to “regularly scale to accommodate new users… Proceeds from tokens sold through the [continuous token model] will fund Decentraland over the long term, keeping it aligned with the prosperity of the network.”

In April 2020, the Decentraland team announced the formation of the Decentraland Foundation, which currently holds the intellectual property rights to the products and services provided on the Decentraland platform, including virtual environments and tools. Meilich publicly stated that the initial supply of MANA tokens issued during the ICO will be allocated as follows: 20% to the founding team, advisors, and early contributors; 20% to the foundation; 40% open to the public for purchase; and 20% reserved for incentives for early users, developers, and partners who want to build within Decentraland.

As Meilich explained in his public blog post, “To incentivize value creation within Decentraland, additional tokens will be allocated to development teams, organizational reserves, and to accelerate community and partner participation.”

For example, Decentraland publicly released a white paper (the “Decentraland White Paper”) that describes the architecture that will be built into the VR platform and the steps to support Decentraland’s growth. The White Paper further makes it clear that the development of the platform is only in its early stages and lists a number of “challenges” that need to be addressed during development to ensure the success of the platform.

According to Melich, even after the ICO, Decentraland is preparing a land allocation policy, as well as a method for groups to purchase larger contiguous plots of land. Since the ICO, Decentraland has developed tools (such as the Marketplace and the Builder) for use on its platform. In a public blog post published on March 19, 2018, the Decentraland team described the Marketplace as the first in a series of tools.

Additionally, the Decentraland whitepaper explains how the foundation will “foster the development of the network” by saying it will “host competitions for the creation of art, games, applications, and experiences, with prizes awarded based on reaching a series of milestones. New users will also be allocated stipends that allow them to immediately participate in the economy.” The Decentraland whitepaper further claims that “these financial incentives will help the utility value of the network grow rapidly until it can independently attract users and developers.”

The Decentraland whitepaper and website also tout how the protocol will “burn” MANA tokens when used within the Decentraland ecosystem.

The Decentraland whitepaper is still available on the Decentraland website.

C. CHZ

CHZ is a token on the Ethereum blockchain that is advertised as “the native digital token of the Chiliz sports and entertainment ecosystem, currently powering Socios,” a sports fan engagement platform built on the Chiliz blockchain. The Chiliz blockchain was launched in early 2018 by Alexandre Dreyfus, the protocol’s founder and current CEO, and is operated by a Maltese entity called HX Entertainment Ltd. The Chiliz whitepaper describes the Chiliz Protocol as a platform “where fans can directly vote in their favorite sports organizations, connect with and help fund new sports and esports entities.”

The CHZ token allegedly allows fans to acquire branded Fan Tokens from any team or organization that partners with the Socios platform and exercise their voting rights as fan influencers. For example, after purchasing CHZ tokens, holders of Fan Tokens can participate in voting and influence team decisions, including selecting player warm-up uniforms and team flag designs.

According to the Chiliz whitepaper from November 2018, it raised approximately $66 million in the “Chiliz Token Generation Event” in the second quarter of 2018, with approximately 3 billion CHZ tokens “performed through a private placement.” CHZ tokens were initially minted in 2018 with a maximum supply of 8,888,888,888 tokens. However, it was not until the second quarter of 2019 that Chiliz offered “Fan Tokens” on the Socios platform that could be purchased using CHZ.

CHZ has been available for buying and selling through the MetaMask Swaps platform since at least December 2020.

From the initial private offering of CHZ tokens in 2018 to public announcements in 2023, information released by the Chiliz team, including announcements during the period when CHZ could be traded on MetaMask Swaps, led CHZ holders to reasonably view CHZ as an investment and expect to profit from the team’s efforts to develop, expand, and grow the platform, thereby in turn increasing demand for and value of CHZ.

The Chiliz website describes the Chiliz team as “composed of nearly 350+ cross-industry professionals from 27 different countries, and growing.” The Chiliz team operates the Chiliz Protocol and Socios.

In fact, the Chiliz white paper and other public statements also introduce several members of the Chiliz leadership team, disclose the resumes of these leadership or advisory teams, and their past successful entrepreneurial experience. The Chiliz website claims that the Chiliz team is building web3 infrastructure for sports and entertainment.

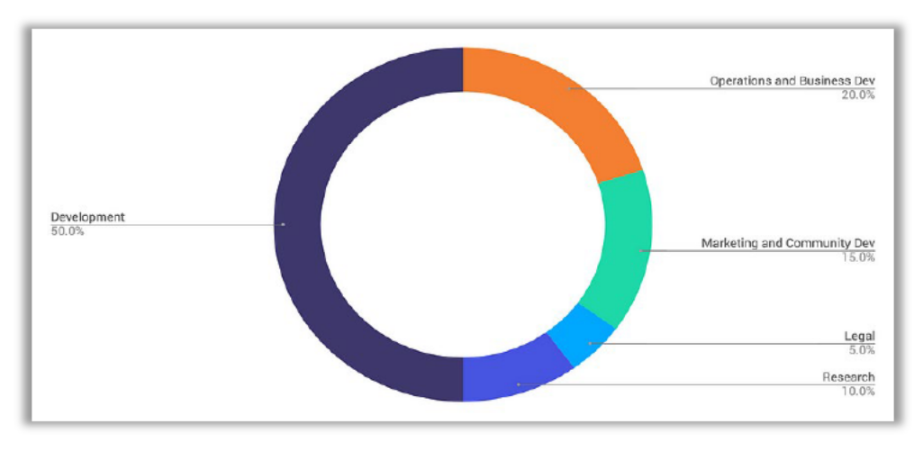

The Chiliz team has also publicly stated that they will use the proceeds from the CHZ sale to fund the development, marketing, business operations and growth of the Chiliz protocol, thereby increasing the demand for CHZ associated with the protocol. For example, the white paper explains that the funds raised through the token sale will be allocated as follows: 58% for operating expenses (the majority of funds will be passed from the issuer to affiliates to develop the Socios platform, secure partnerships and implement the platforms digital infrastructure); 20% for user acquisition (funds will be used to acquire new users for the Socios platform and increase participation in its voting features); 10% for corporate restructuring; 5% for security and legal; and 7% for ecosystem support.

Additionally, 5% and 3% of the total allocated CHZ tokens are allocated to the Chiliz team and advisory board, respectively, two groups responsible for the creation and development of the platform, aligning the fate of management with that of CHZ investors.

The CHZ whitepaper further clarifies the alignment of interests (alignment of fate) between promoters and investors when it warns that “if the value of BTC, ETH or Chiliz fluctuates, the Company may not be able to fund development to the necessary extent or may not be able to develop or maintain the Socios platform in the manner intended.”

The Chiliz team also frequently touts the growth potential of the sports and esports industries, and hopes to monetize them through the expansion of its platform through the Chiliz team’s efforts. For example, the CHZ whitepaper highlights the size of the gaming industry and the potential for esports revenue, as well as the use of CHZ to drive and monetize fan engagement in traditional sports. Regarding the June 2018 “Token Generation Event,” the whitepaper states: “We are no longer pursuing fundraising measures, but are instead focused on leveraging accumulated resources to achieve the Chiliz/Socios vision.” The whitepaper continues: “Once the infrastructure is established, Chiliz and the Socios platform it supports will expand our tokenized fan voting model to other sports, using football as a benchmark, to cater to global markets where different competitive verticals dominate – cricket in the Indian market, baseball in Japan, etc.”

Public statements from the Chiliz team and its executives have indicated that the CHZ token is primarily used to purchase “Fan Tokens” on Socios, and that the demand and price of the CHZ token is directly dependent on the demand for Socios fan tokens and their interests.

The Chiliz team has also made other public statements highlighting the economic realities of the Chiliz blockchain design that rely on CHZ to operate – as Chiliz expands its platform by partnering with more teams that provide attractive opportunities for token holders, the value of the corresponding Fan Tokens will increase, and in turn the value of CHZ will also increase.

For example, the FAQ section on the Chiliz website (which was publicly available from at least December 2021 to December 2022) reads: As more esports teams, leagues and game titles join the platform and more fans want voting rights, demand for Chiliz tokens continues to grow.

Chiliz’s CEO has echoed the same sentiment in other public statements. In February 2020, he said: “Thousands of regular soccer fans have already started using crypto, buying $CHZ to purchase Fan Tokens, and we expect more to do so in the future as we continue to add more partners, expand our reach, and elevate our brand.” In March 2021, he tweeted: “Monthly Active Users (MAU) of the Socios app, powered by $CHZ. You can see the demand for $CHZ (Exchanges, Etherscan Wallet, etc.) exploding. Everything is related. We are building a mainstream consumer product, powered by the Chiliz blockchain.” In February 2023, he tweeted: “I am biased, but I am very confident that the Chiliz ecosystem will bring a lot of value to fans, sports assets, and innovation.”

The Chiliz team is also promoting secondary trading of CHZ by offering the token on crypto asset trading platforms. For example, an early version of the white paper highlighted “ongoing discussions” to offer CHZ on Asian trading platforms, and the Chiliz website has a “Listing Content and QA” document reflecting the proposal to offer CHZ on the Binance platform.

The Chiliz team has also told investors that they plan to burn CHZ tokens as a mechanism to support the price of CHZ by reducing its total supply. For example, in 2020, the Chiliz team announced through its Fan Token exchange that it would destroy 20% of net transaction fee revenue, 10% of Fan Token sales revenue, and 20% of net NFT and collectible proceeds. As with the other crypto-asset securities described in this article, this market-based destruction of CHZ makes investors reasonably believe that purchasing CHZ has the potential to be profitable.

D. SAND

“SAND” was created on the Ethereum blockchain and is the native token of The Sandbox platform. The Sandbox was originally a virtual gaming platform first released by Pixowl, Inc. (“Pixowl”) in 2012 as a downloadable game on mobile phones. Pixowl is headquartered in San Francisco and was founded in 2011 by Arthur Madrid (“Madrid”) and Sebastien Borget (“Borget”). In 2018, Hong Kong-based Animoca Brands, Inc. (“Animoca”) acquired Pixowl and announced its intention to build a new 3D version of The Sandbox using blockchain technology. Following the acquisition of Pixowl, the intellectual property rights of The Sandbox were transferred to TSB Gaming Ltd (“TSB”), a wholly-owned subsidiary of Animoca, along with other assets of Pixowl. Madrid is the CEO of TSB and Borget is the COO.

According to The Sandbox’s website, SAND is the token required to access the Sandbox platform, participate in platform governance, and earn rewards through the staking program on the platform.

Prior to the minting of SAND in July 2019, on or about May 23, 2019, Animoca raised approximately $2.5 million in cash and crypto assets through TSB by issuing Agreements for Future Equity (“SAFEs”) and SAND tokens to “fund the development of the upcoming blockchain version of The Sandbox.” According to Animoca’s press release on May 23, 2019, most investors allocated their investment between the purchase of SAND tokens and future TSB equity obtained through SAFE agreements (in the amount of $2 million), while some investors allocated their investment exclusively to SAND tokens ($500,000). According to the press release, the round was led by Hashed at approximately $1 million, with participation from a number of other crypto venture investors.

TSB minted a total of 3 billion SAND on the Ethereum blockchain around July 2019 and raised $3 million through private sales and an IEO on Binance.

Since October 2020, SAND has been available for buying and selling through the MetaMask Swaps platform.

The information publicly disseminated by TSB caused SAND holders (including those who purchased SAND since May 2022) to reasonably view SAND as an investment and expect to profit from TSB’s efforts to expand the Sandbox Protocol, thereby increasing demand for and value of SAND.

In blog posts announcing “exchange listings,” The Sandbox touted its “listing” and the liquidity of SAND tokens on secondary markets. For example, in a Medium blog post on September 21, 2021, The Sandbox stated that “$SAND is listed on more than 60 cryptocurrency exchanges worldwide, including the top dozen exchanges by market cap.”

Additionally, The Sandbox stated that it would pool proceeds from the private token sale and IEO to develop and promote the platform. For example, a press release on May 23, 2019 stated: The funds raised through this transaction will be used to expand the development team and infrastructure of The Sandbox gaming platform, support marketing efforts by acquiring creators and intellectual property licenses, and provide security, legal and compliance expenses, and general and administrative expenses. The Sandbox whitepaper also described the same use of the $3 million raised in the IEO.

According to The Sandbox white paper, of the 3 billion SAND tokens initially minted, 19% will be allocated to The Sandboxs founders and team, and 25.8% will be allocated to company reserves.

“An interesting property of the SAND token is that, due to its scarcity, its value may increase over time,” The Sandbox said in a Medium blog post on July 25, 2019. “The supply of SAND will be limited to 3 billion.”

TSB has publicly stated that it will take measures to manage the SAND market, including The Sandbox team mentioned in the SAND white paper controlling the supply of SAND tokens and implementing controllable supply mechanisms, such as purchasing SAND from multiple exchanges, and Although the total supply of SAND is fixed, the initial number of SAND provided will provide a scarcity effect, reducing the per capita SAND supply, thereby promoting demand.

On many occasions, Animoca has promoted the backgrounds of Pixowl, TSB and core members of The Sandbox (including Madrid and Borget) when describing the success and future development of The Sandbox:

Following the acquisition of Pixowl, Animoca co-founder and director Yat Siu stated in a press release on August 27, 2018, “Pixowl’s experienced developers will greatly enhance our development capabilities. Its founders are well-respected game industry veterans who have developed multi-million dollar game projects. We believe that a blockchain version of The Sandbox has great potential… We look forward to taking advantage of the many growth opportunities presented by this acquisition.”

In a 2018 press release, Madrid also commented: “Animoca Brands is a perfect fit for Pixowl and we are excited to add our brand relationship to its portfolio while accelerating the growth of our key intellectual property, The Sandbox…”

The 2018 press release also touted that Ed Fries, founder of Microsoft Game Studios and co-founder of the Xbox project, is a special advisor to Pixowl, the original developer of The Sandbox, and will continue to serve on the advisory team.

The Sandbox white paper further states: “We have a strong product roadmap and a first-class team to execute a strong vision to build a unique virtual world gaming platform where players can build, own and monetize their gaming experience and promote blockchain as the dominant technology in the gaming industry.”

The Sandbox white paper describes the role of the Sandbox Foundation as supporting the Sandbox ecosystem by providing funding to incentivize high-quality content and game production on the platform. It further states that the overall valuation of the metaverse grows through the valuation of all games funded by the foundation, forming a virtuous circle that enables funding of larger games. The Sandboxs Gitbook also states that the Sandbox Foundation supports competitions and cross-games to earn game tokens to encourage wider adoption of SAND; supports marketing activities to promote awareness of NFT, the metaverse, and SAND adoption, including joint marketing with exchanges and influencers.

E. LUNA

LUNA is the native token of the Terra blockchain, created by Terraform and its founder Do Kwon. The Terra blockchain was launched in April 2019, with 1 billion LUNA tokens created at the same time.

During all relevant time periods, Terraform and Kwon retained hundreds of millions of LUNA tokens for themselves.

There is a “bridge” called “Shuttle” that allows LUNA holders to create a “wrapped” version of LUNA (“wLUNA”). wLUNA tokens are identical to LUNA in all important respects, except that they can be traded on the Ethereum blockchain instead of the Terra blockchain.

From the time of their issuance and until May 2022, LUNA and wLUNA were offered and sold as investment contracts and, therefore, were securities.

Investors can pay fiat currency or crypto assets to obtain LUNA and wLUNA.

LUNA and wLUNA have the same price and are interchangeable on a one-to-one basis. Any wLUNA holder has the right to exchange wLUNA for LUNA at any time.

Therefore, investors in LUNA and wLUNA have the same risk in both rising and falling prices, that is, if one investor makes a profit, all investors will profit in the same proportion to the total amount of LUNA or wLUNA they hold.

LUNA and wLUNA first began trading through MetaMask Swaps in January 2021.

Terraforms repeated public dissemination of information about LUNA or wLUNA and Terraforms planned efforts to make those assets more valuable has caused investors (including those who have purchased LUNA or wLUNA since January 7, 2021) to view LUNA and wLUNA as investments in Terraforms efforts. Specifically, holders of LUNA and wLUNA would reasonably expect to profit from Terraforms efforts to scale the Terra blockchain because such growth would in turn increase demand for and value of LUNA and wLUNA.

Terraform and Kwon told investors that Terraform would use proceeds from LUNA sales to fund operations and help build and expand the Terra ecosystem. For example, in the July 2018 token sale agreement, Terraform told potential investors that the funding was “for the purpose of building and operating” the systems developed by Terraform.

In a public interview in 2021, Terraform’s head of business development said LUNA is “‘equity’ in our company.

On April 7, 2021, Kwon posted on X that “$Luna value is viable in the long run — growing as the ecosystem grows.”

Terraform’s director of special projects similarly said in a June 2021 video presentation, “Owning LUNA is essentially owning a portion of the network and betting that its value will continue to grow over time.”

In marketing materials, Terraform further touts the expertise of its team, claiming that Terraform is led by serial entrepreneurs and is a team with deep, relevant expertise.

Based on these facts and other factors, on December 28, 2023, the United States Court for the Southern District of New York ruled that both LUNA and wLUNA were offered and sold as investment contracts.

This article is sourced from the internet: SEC explains: Why are five major tokens such as MATIC considered securities?

Original author: Noah Ho , YuppieZombie , Lumos Ngok introduction In recent days, the blockchain community has witnessed significant controversy surrounding the ZkSync and LayerZero airdrops. These events have sparked widespread discussion, prompting us to pause and reflect on the current and future state of airdrops in the crypto ecosystem. This article will discuss the historical evolution of airdrops, highlight several important projects that have shaped this space, and analyze the controversial airdrops of ZkSync and LayerZero in detail. Finally, we propose some key reflections and considerations for the future of airdrops. Airdrop in blockchain In the field of blockchain, airdrop refers to the act of sending free tokens or cryptocurrencies to a specific digital wallet address. In laymans terms, airdrop is the act of a project giving away crypto…