Animoca founder writes: When MOCA goes online, let’s talk about the significance of tokens again

Original article by: Yat Siu, Co-founder of Animoca Brand

Compiled by: Odaily Planet Daily ( @OdailyChina )

Translator: Azuma ( @azuma_eth )

We are often asked the question: What exactly is a token? Why does a project need a token?

Generally speaking, tokens are seen as a more efficient fundraising tool that allows equity holders to avoid dilution risk; on the other hand, tokens are also seen as practical tools that can be used in games and other virtual environments, similar to virtual currencies.

However, the functionality of tokens is not limited to these scenarios, in fact, it can have all of the above characteristics at the same time. In our view, tokens represent a new way to own a certain type of asset, which did not have a clear ownership structure before the emergence of tokens.

In summary, we view tokens as a new way to own some of the network effects.

Network Effects

Some readers may already be familiar with the basic concept of network effects.

As the number of users of a product, service or platform increases, the overall value of the network to users will also increase. Network effects are an important indicator for evaluating the value of large companies. Whether it is a luxury brand or a technology giant, investors can often evaluate the value of a company by measuring its network effects (including the growth expectations and impact of the effect).

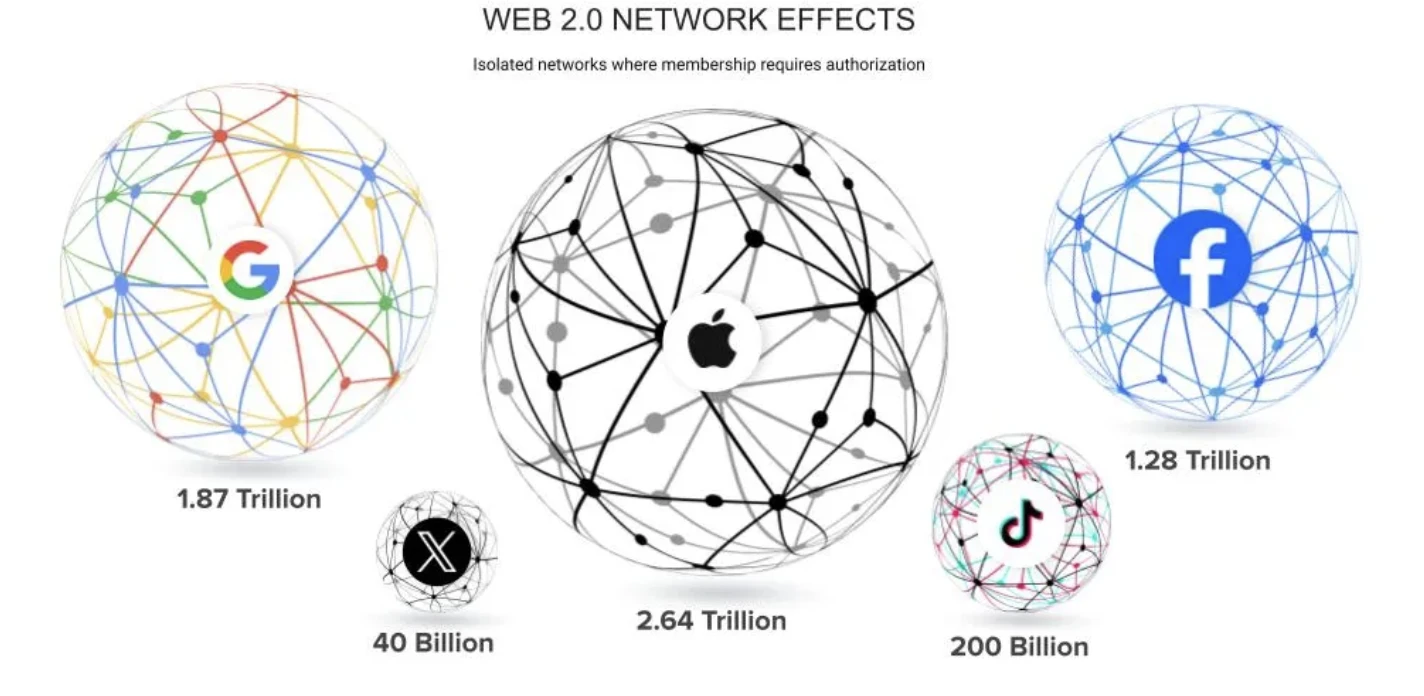

Metcalfes Law states that the value of a telecommunications network is proportional to the square of the number of users or compatible devices connected to it. In other words, the more people or devices participating in a network, the greater the value of the network. We can roughly assess the value of networks such as Facebook, Google, and LinkedIn based on the number of users. The more users there are, the higher the value of the network and the valuation ceiling it may reach.

The same evaluation method will also be used to estimate the potential of the Web3 network, such as focusing on the number of addresses, the number of transactions, the number of developers, etc. Although some people like to directly apply Metcalfes Law, we think Reed s Law (that is, the utility of a large network can be exponentially increased through subgroups of network participants) may be more appropriate here.

Generally speaking, tokens are the embodiment of network effects in a specific network, platform or ecosystem. The emergence of tokens allows users to have partial ownership of the network for the first time, which is significantly different from traditional equity instruments. In addition, because tokens themselves have multiple functionalities and are open and permissionless most of the time, tokens can more easily support various practices and innovations. Therefore, Web3 can create network effects faster and more effectively than the closed network of Web2.

The value of “individuals” is not equal

Both Metcalfe’s Law and Reed’s Law are difficult to use to assess the value of infrastructure projects or large social networks because they assume that each user and device in the network has more or less equal value and contributes equally to the overall value of the network and its network effects. However, this is not the case in reality. A network with more users does not necessarily mean that it is more valuable or has better network effects than a network with smaller users. The value of individual users in the network is also an important factor.

Taking an economy as an example, an economy’s population can be viewed as the size of its network, and its gross domestic product (GDP) can indicate the value of the network.

Hong Kong has a population of approximately 7.5 million and a GDP of approximately $407 billion; North Korea has a population of 27.5 million and a GDP of $48.3 billion. The difference in value (GDP) between the two networks is primarily due to the difference in value of the network nodes (i.e., the population or businesses within the economy). Although North Korea’s network is more than 3.5 times larger than Hong Kong’s, its value is relatively low due to its isolated economy and closed network effects, making its entire network much less valuable than the smaller Hong Kong.

The same is true in the Web3 world, where networks with lower potential will be less attractive in terms of investment, developers, and users. Therefore, anyone building in Web3 should aim to create a network with higher value and stronger network effects.

How to measure network effects?

There is no single path to drive the growth of network effects. Project owners must combine a variety of appropriate methods to create lasting appeal for the network, including emphasizing user reach (similar to TON), attracting more developers and investors (such as Ethereum and other Layer 1 and Layer 2), or increasing total transaction volume through various measures.

In addition to focusing on the number of network users, another commonly used measure of network effects is to focus on the total amount of investment within the network. Many blockchains focus on increasing the total value locked (TVL), which is a measure of the total value of assets locked or pledged in the network, which helps attract investment and entrepreneurial activities.

In the current Web3 world, the most noteworthy indicator may be user stickiness, because Web3 networks are generally open and permissionless by design, which means that users can enter and exit freely instead of being trapped in a closed network. This is very different from the situation in Web2, where network effects are not owned by end users, but are strongly monopolized by the network itself (for example, it is difficult to transfer data and network effects from Facebook to TikTok).

Web3 provides users with greater flexibility than Web2, so when building a decentralized network, user retention will become crucial, and an effective measure to increase user stickiness is to invest in cultural capital.

“Cultural Capital” and NFTs

According to Pierre Bourdieu’s theory of capital and class division, “cultural capital” consists of intangible resources such as knowledge, skills and experience, which play an important role in social mobility and opportunity. “Economic capital” and “cultural capital” can complement each other – for example, joining a high-end club, attending a top university or living in a specific neighborhood can significantly increase an individual’s chances of improving their economic and social status.

NFTs, due to their unique nature and their ability to reflect personal identity and cultural capital, can create more profound and complex network effects than homogeneous tokens (FTs). Although the network effects driven by NFTs may not grow as fast as homogeneous tokens, they can establish a deeper and more loyal network of relationships based on common cultural capital, thereby forming a stronger line of defense and a stronger network effect.

This is already evident in the real world, where we can see people’s loyalty to brands like Hermès, Nike or Apple, and we are starting to see similar cultures emerge in the virtual world, too, with projects like Pudgy Penguins, Bored Ape Yacht Club and Animoca Brands’ Mocaverse.

Mocaverse Vision

One of the key indicators to measure the potential of a network is to observe the scale of investment it receives, which often represents the growth potential of the network, just like a country’s investment in infrastructure development. The greater the investment amount, the greater the development potential.

Animoca Brands is one of the most active investors in the Web3 space, with over 450 companies and a multi-billion dollar balance sheet. We will continue to invest to expand our network and its associated economic and cultural network effects, which will lay the foundation for the expansion of the Moca Network (an interoperable economy consisting of partner subnets and users connected by the Mocaverse). At the same time, we will use the full-chain token MOCA to drive the growth of the Animoca Brands network.

So what is Mocaverse? It is an interoperable infrastructure stack that aims to enhance network effects and bring together various cultural capital and economic capital to maximize mutual benefit. Mocaverse will integrate multiple fields including games, music, sports, animation, NFT, digital identity (DID), etc., and then build a collaborative ecosystem, any of which can boost the development of the entire ecosystem.

Mocaverse is currently developing Moca ID, a universal identity reputation layer across the entire chain that will play a connecting role across the ecosystem. Given that Animoca Brands is already one of the most active investors in the Web3 space, this will help drive growth across the entire Web3 industry. Both Mocaverse and MOCA itself are “cultural capital”, which may still seem somewhat “isolated” today (similar to most NFTs), but as the Mocaverse reputation layer grows, its significance will become more social.

Our goal is to create a set of truly mutually beneficial relationships that will bring more value to our portfolio network and incentivize Mocaverse users based on time, loyalty, and attention. All participants will be able to benefit from this common network effect, which is the core spirit of Web3.

This article is sourced from the internet: Animoca founder writes: When MOCA goes online, let’s talk about the significance of tokens again

Related: First Bitcoin theft: Crypto OG loses 25,000 Bitcoins due to key leak

Author: The Bitcoin Historian , Crypto KOL Compiled by: Felix, PANews Allinvain mined Bitcoin when the price was less than $0.05 and owned 25,000 Bitcoins. This article takes you through the biggest robbery in the history of cryptocurrency: the tragic story of Allinvains $1.6 billion loss. In 2010, Allinvain founded one of the first Bitcoin exchanges, Bitcoin Express. Bitcoin Express allowed users to buy BTC using PayPal. Allinvain sold 1,000 BTC for $5. That’s $0.005 per BTC. But Allinvain is also a dedicated Bitcoin miner. He can mine 500 BTC per hour using only his laptop. That’s 1,200 Bitcoins per day. Here’s what mining Bitcoin looks like when it’s worth $10, Allinvain still has access to his home computer. He presses a button and generates BTC. By 2011, mining difficulty…