The lives of people in the ICO bubble: some have become Bitcoin tycoons, while others have a market value of only 70,000

Original author: Frank, PANews

Golem Network, a project that raised 820,000 ETH in ICO in 2016, has recently attracted much attention for its frequent sales of ETH. As of July 8, it has sold a total of 36,000 ETH worth about $114.5 million. The founding company of EOS, which previously created the largest ICO case in the industry, still holds 140,000 Bitcoins worth about $8 billion.

Investors suddenly found that some of the projects they had invested in at the time had disappeared, while the projects that held their coins were making a lot of money. PANews took stock of the assets of the 10 most popular ICO projects from 2016 to 2017 and found that the investment returns of all the projects were not as good as those of BTC and Ethereum.

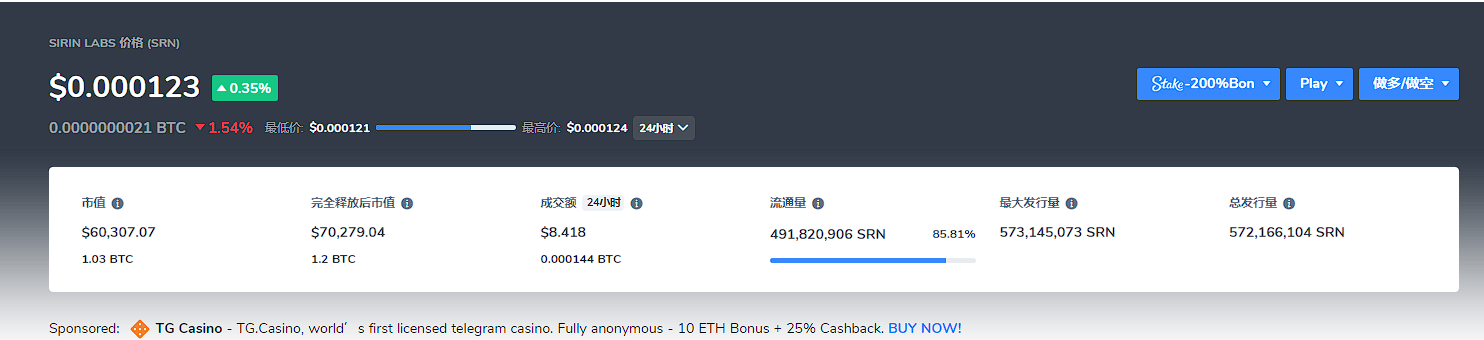

Sirin Labs: Raised 157 million USD, with a token market value of only 70,000 USD

The project with the biggest contrast between the amount of financing and the current development status is Sirin Labs, which raised about $158 million through ICO in 2017. It became one of the star projects with the largest amount of ICO that year. The token it discovered is SRN, and its current market value is only $70,000, and the 24-hour trading volume is only $8.

Sirin Labs was the first company to target Web3 mobile products. As early as 2017, it raised $158 million in the ICO market with the blockchain smartphone Finney as a gimmick. In 2018, football player Messi also endorsed this encrypted phone. However, the good times did not last long. In 2019, Sirin Labs was exposed to layoffs of 25% of its employees and arrears of factory wages due to poor mobile phone sales. In 2021, Sirin Labs investors were sued for using ICO fraud to embezzle more than $250 million.

Today, Sirin Labs’ social media accounts have not been updated in more than three years, and the only insults left in the comment section are “scammers.”

EOS: The highest ICO in history created the richest Block.one

EOS created a peak in ICO fundraising, a record that has not been broken to this day. In 2017, with the star halo of BM and the endorsement of Li Xiaolai, EOS received more than $4 billion in financing as the Ethereum killer and the third-generation public chain, becoming the project with the highest ICO amount in the crypto field to date.

Block.one, the company behind EOS, subsequently exchanged all the ETH it raised for BTC, and its holdings once exceeded 164,000, surpassing the largest Bitcoin holder MicroStrategy. According to the latest data, Block.one still holds more than 140,000 Bitcoins, with a total value of more than $8 billion.

In 2022, the EOS Foundation has tried several times to use legal means to get Block.one to return $4.1 billion and transform EOS into a DAO organization. In April this year, the EOS Foundation tried to launch a new token economics, but the market seems to have completely abandoned this former public chain rising star, and the price has fallen by nearly 40% since April. Today, the market value of EOS tokens is only $780 million, less than one-tenth of the value of Bitcoin held by Block.one.

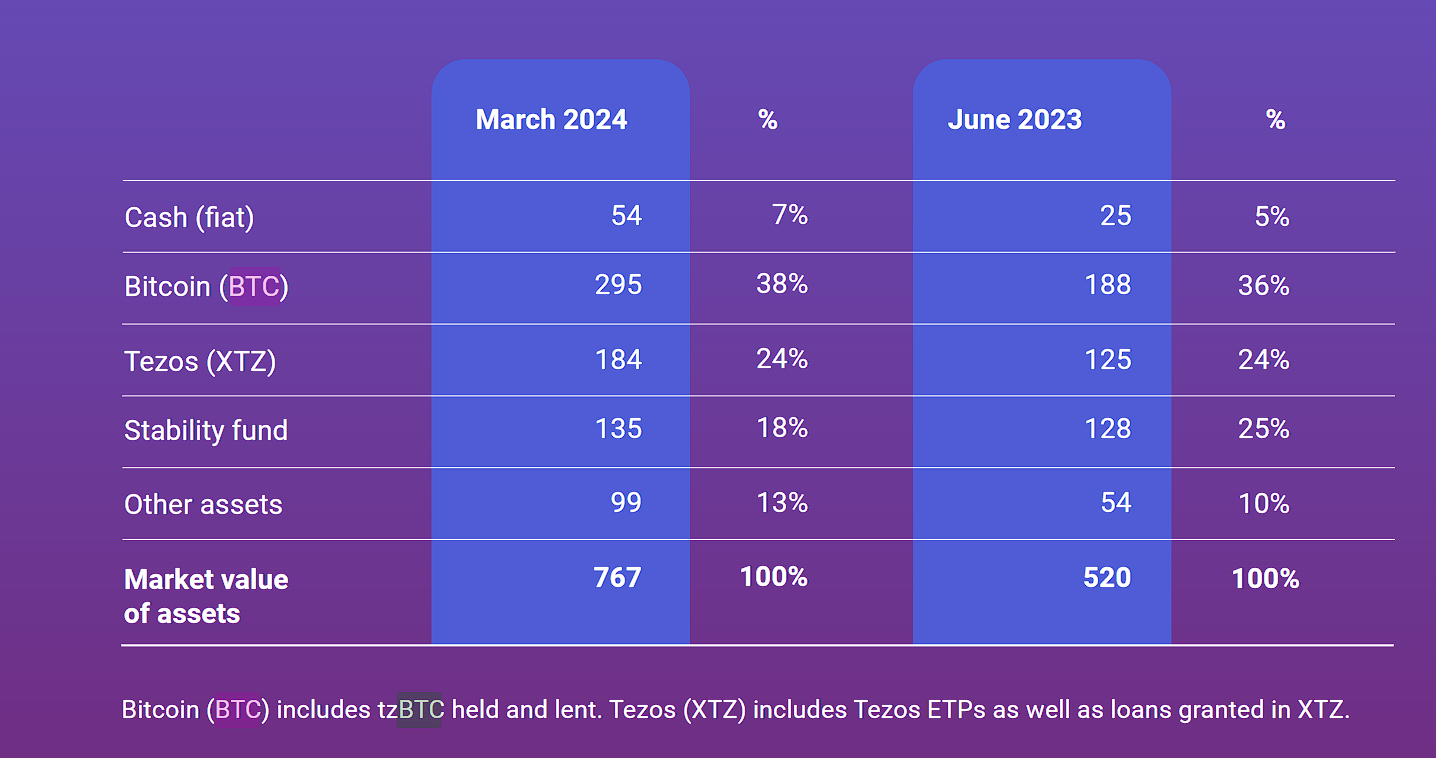

Tezos: Token market value is not as much as foundation assets

The public chain Tezos received $232 million in investment through ICO in 2017. Although it is rumored that the Tezos Foundation holds 17,500 bitcoins, PANews reported that according to the Tezos Foundations report in March 2024, the organization still holds BTC worth $295 million, which is about 5,000 at the BTC price at the time. However, Tezos raised a total of 65,681 bitcoins and 361,000 Ethereums during the ICO. These tokens are now worth about $4.8 billion, while the current total market value of Tezos token TXZ is about $740 million, which is only three times the amount of the fundraising amount, and even less than the 760 million assets of the Tezos Foundation.

Polkadot: Still holds 300,000 Ethereums that have not been sold

Recently, the public chain Polkadot has caused heated discussions due to its first half financial report. The $87 million promotion fee and $1.1 million in revenue have caused concerns in the community. It seems that the $87 million promotion fee is not as high as the topic caused by a financial report. As a star project in 2017, Polkadot has raised $140 million in financing that year and raised more than 429,000 Ethereum. According to on-chain data, the current ICO smart contract address still holds 306,000 Ethereum, worth about $930 million. Therefore, the outside worlds concerns about the Polkadot treasury seem to be unnecessary. This part of the Ethereum tokens has not been sold since the beginning.

Bancor: From everyone to no one

Decentralized trading protocol Bancor raised about 390,000 Ethereum through ICO in 2017, worth more than $150 million, exceeding the amount raised by The DAO. These tokens are currently worth about $1.1 billion, while the market value of Bancors token BNT is only about $70 million. For users who invested at the time, this result is obviously unacceptable.

Golem: Selling more assets

Golem Network is a very early ICO project. As early as 2016, Golem Network proposed the concept of a decentralized computing power market. By 2024, Golem Network is not famous for its forward-looking market deployment, but for its coin holding strategy that is good at financial management. In 2016, Golem Network raised 820,000 Ethereum through ICO, which is the project that raised the most Ethereum besides EOS. Although the progress of Golems project has been tepid, the project party did not sell ETH as quickly as other teams, but sold it in small quantities and multiple times over the years. From the earliest ICO worth $9 million, to June 2019, although the number of coins held dropped to 369,000, the value exceeded $100 million. Now the number of coins held has dropped to 125,000, with a total value of $390 million. Riding on the dividends of Ethereums price growth, Golems assets can be said to be sold more and more. I wonder what those who invested $11 in ETH in Golem felt at the time.

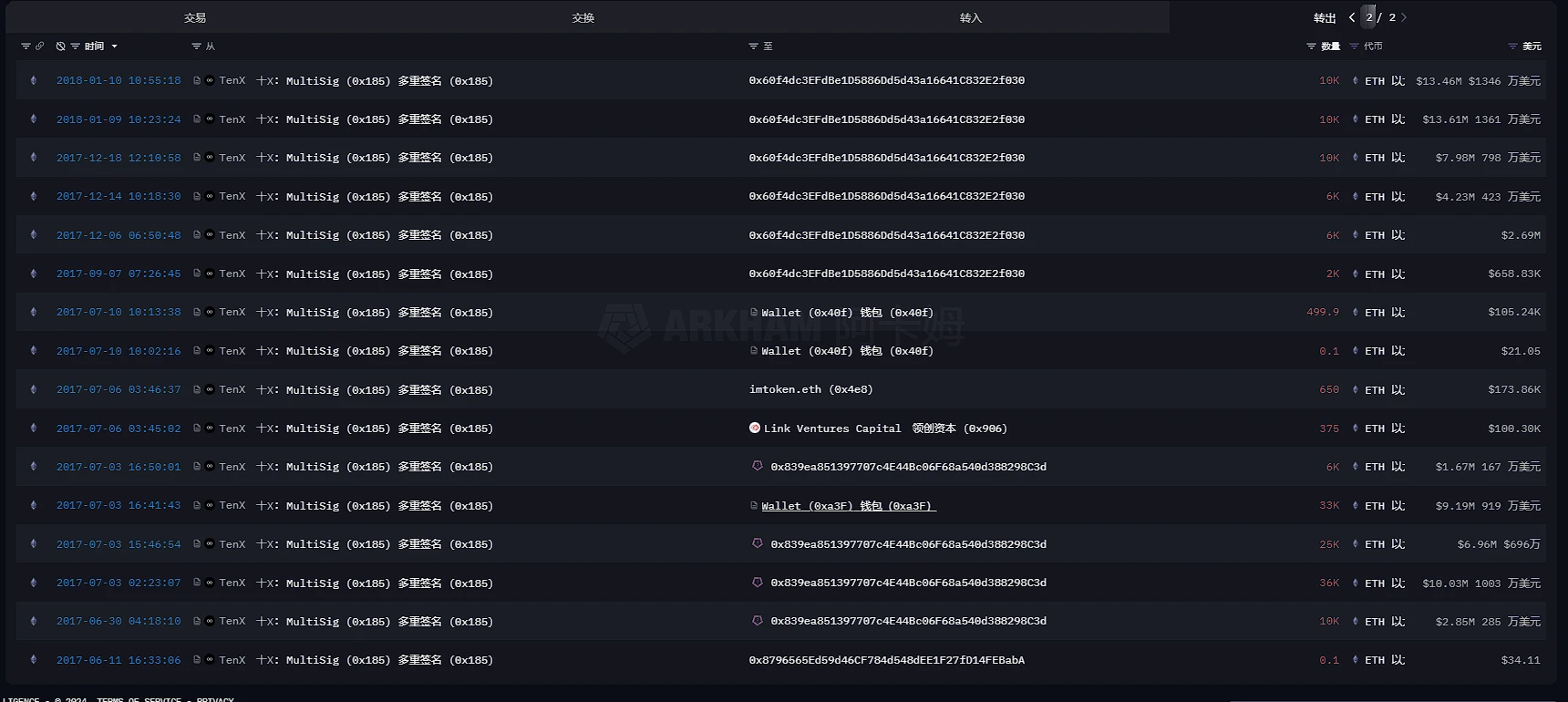

TenX: The project cashed out in a wave, and the market value is only 1.64 million US dollars

The payment project TenX raised more than $80 million in 2017, a total of 245,832 Ethereum. However, the project team did not seem to have much confidence in the crypto market, and began to sell most of the tokens through exchanges one month after the ICO. Currently, the market value of the projects token PAY is only $1.64 million.

Filecoin: The star of decentralized storage still has some heat

Filecoin is a popular decentralized storage project and one of the projects with the highest financing amount in 2017. Filecoin raised $253 million through ICO. To this day, many crypto investors still mine FIL tokens through mining machines. From the results, the current market value of FIL tokens is about $2.2 billion, second only to Polkadot among the star projects in 2017.

Qtum: A tape falls from grace

Qtum was a popular and controversial project in 2017. From the perspective of the ICO amount, Qtums $15.6 million was not much, and the surge in the price of Qtum in 2018 made the project a well-known blockchain project. But with the exposure of Li Xiaolais recording, the image of the Qtum founder was also pulled down from the altar, and Qtum has never recovered since then. Qtum raised 11,000 BTC and 75,000 ETH, and is now worth more than $870 million. Far more than the market value of QTUM tokens of $240 million.

Status: It was hard to get a coin back then, but now I am lucky I didn’t invest

Status completed a $105 million ICO in 2017, raising a total of 300,000 ETH. Since 2017, the project has gradually sold its tokens and currently holds 17,000 Ethereum, worth about $54 million. The market value of its token SNT is about $150 million. Status was also unusually popular in 2017. According to official sources, the ICO returned as many as 347,000 ETH, which is more than the amount raised. I wonder if these investors who failed to get on the train are now glad that they did not exchange their ETH for SNT.

Summarize

In addition to the projects listed above, there were a large number of projects in the hot ICO era of 2016-2017, many of which have been completely shut down and silent in the market. Looking back on history is always meaningful. Judging from the 10 projects listed, these projects were undoubtedly the most dazzling stars of that era. With the halo of celebrities, they easily obtained huge investments. Seven years have passed, and the projects that claimed to build the next Bitcoin and Ethereum have changed a group of players. This also makes us think, how many of todays star projects will still exist in the public eye in another seven years, and who can fulfill their promises or survive on financing.

This article is sourced from the internet: The lives of people in the ICO bubble: some have become Bitcoin tycoons, while others have a market value of only 70,000

Original | Odaily Planet Daily Author | How to At noon today, Bitcoin briefly fell below 54,000 USDT, reaching a low of 53,269 USDT, a new low since February 26 this year. The maximum drop in 24 hours exceeded 10%. As of press time, it has rebounded to 64,600 USDT. The altcoins were even more terrible, with an average drop of about 10%. The real-time market of OKX is as follows: ETH once fell to 2806 USDT, and is currently trading at 2881.61 USDT, a 24-hour drop of 8.01%; SOL fell to as low as 120.65 USDT, and is currently trading at 126.74 USDT, a 24-hour drop of 6.38%; PEPE once fell to 0.000008221 USDT, and is currently reported at 0.000008326 USDT, a 24-hour drop of 12.58%; OP once fell…