Original author: Javier Paz, Forbes

Original translation: Luffy, Foreisght News

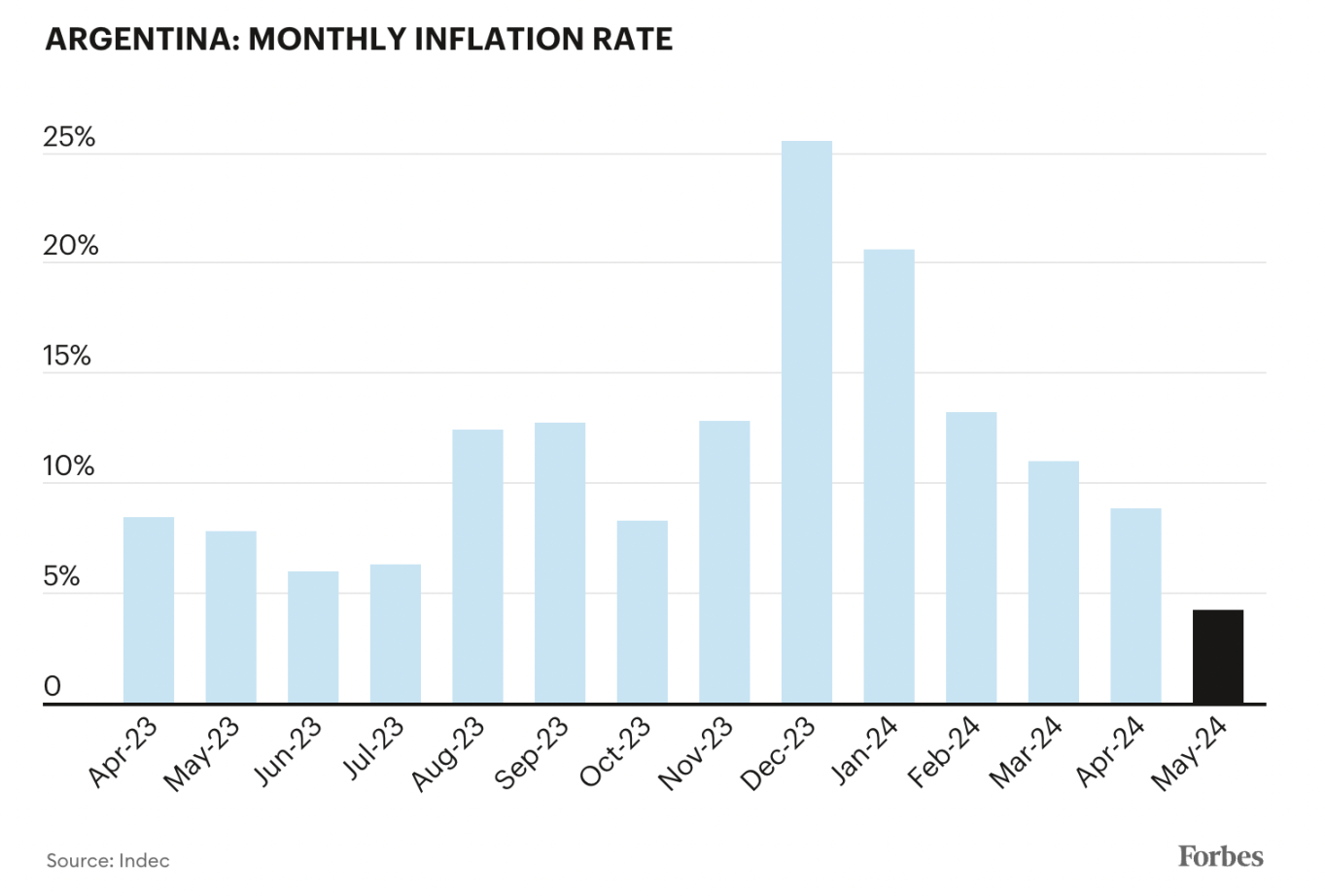

In recent years, Argentina has been labeled as inflationary, just like their world-famous roast beef. In the past 12 months, the countrys cumulative inflation rate has reached 276%. In fact, a typical manifestation of Argentinas soaring inflation rate is that residents eating habits are changing, and their demand for beef is declining, and they are choosing cheaper proteins such as pork and chicken. Some observers believe that the price of beef in Argentina will rise by 600% this year, and steak is no longer a daily staple for Argentines.

Argentinas monthly inflation rate

Although Argentines are only now seeking an alternative to beef, they have been trying to escape the depreciating peso for decades. In fact, Argentines have been buying dollars through black market institutions for 50 years. The most famous black market operators even exist on Florida Avenue, the main artery of the capital, Buenos Aires.

The black market is a last resort for Argentines, who risk being scammed. At these unauthorized and unsafe money changers, Argentines sometimes exchange pesos for dollars at twice the government-published rate. The current rate is 41% higher than the official 954 pesos to the dollar. And thats not the only risk. Other major risks include customers being robbed by their counterparties or receiving counterfeit money, according to El Nacion, one of the two main local newspapers.

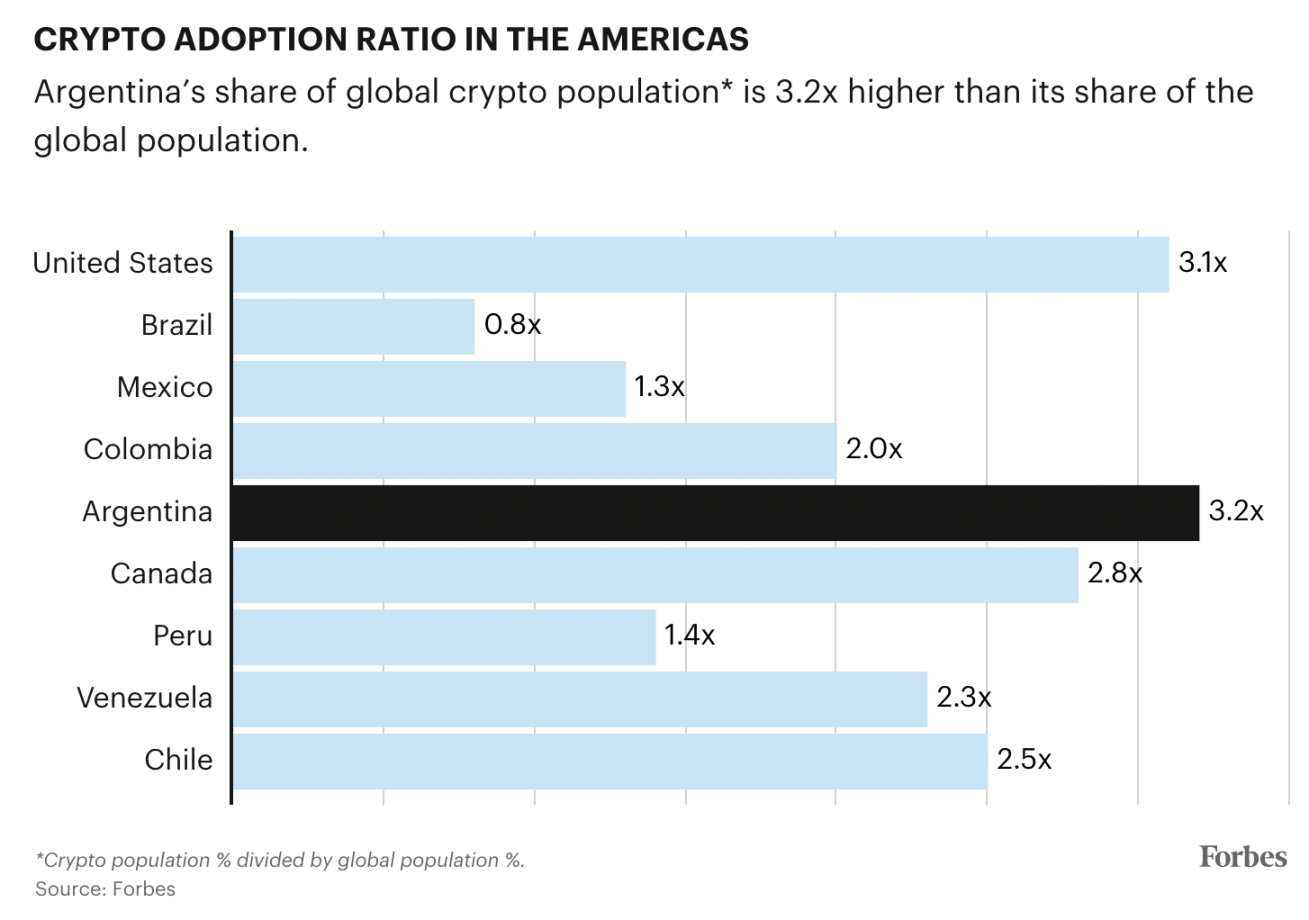

But now, a new way to access dollars has emerged: cryptocurrency. In fact, Argentina has a higher cryptocurrency adoption rate (cryptocurrency users as a percentage of the total population) than any other country in the Western Hemisphere. A study by Forbes in partnership with data analytics firm SimilarWeb found that of the 130 million visitors to the world’s 55 largest exchanges, 2.5 million were from Argentina.

Cryptocurrency adoption rates in the Americas

Argentines don’t play Memecoin or try to get rich overnight with the next hot token. Instead, they typically buy and hold Tether (USDT), a synthetic dollar with a market value of $112 billion. “Argentina is an outlier market, and many people just buy USDT,” said Maximiliano Hinz, head of Latin America at cryptocurrency exchange Bitget. “We don’t see this elsewhere. Argentines buy spot USDT and then do nothing.”

Although stablecoins such as SUDT seem to be the perfect way out of Argentina’s inflation woes, they also come with certain risks. The country has yet to create any regulations to regulate this crazy industry, and the world’s most trusted exchanges and marketplaces ( by Forbes ) are not the most widely available options for Argentinians.

Argentinas new liberal president, Javier Milley, has said he is open to dollarization in Argentina. On May 17, he told a business conference that the country is moving toward a competitive currency system where everyone can choose which currency to use for payments and transactions. He expects this will lead to Argentina using the peso less and less, and when it almost stops, we will move toward dollarization and eliminate the central bank so that corrupt politicians cant steal wealth by printing money.

USD stablecoins align with the idea of dollarization, but buyers must find a safe way to buy, hold, and use them. Argentina offers no reliable safeguards for cryptocurrency users.

Argentina has a higher rate of cryptocurrency adoption than any other country in the Western Hemisphere. According to a Forbes study of data from the website Similarweb, 2.5 million of the 130 million visitors to the worlds 55 largest exchanges are from Argentina. In addition, crypto data analysis company Chainalysis stated in a report at the end of last year that as of July 2023, Argentina leads Latin America in raw trading volume, with an estimated transaction value of $85.4 billion.

However, Argentina’s stablecoin of choice, USDT, has a complicated history. Based in the British Virgin Islands, Tether is cagey about its inner workings, never undergoing an audit, and not disclosing which banks it uses. In 2021, the CFTC and New York Attorney General forced Tether to pay $41 million and $18.5 million in fines, respectively, for falsely claiming that USDT was pegged to the dollar on a one-to-one basis. In a country still plagued by triple-digit inflation, none of these red flags seemed to have attracted enough attention from users.

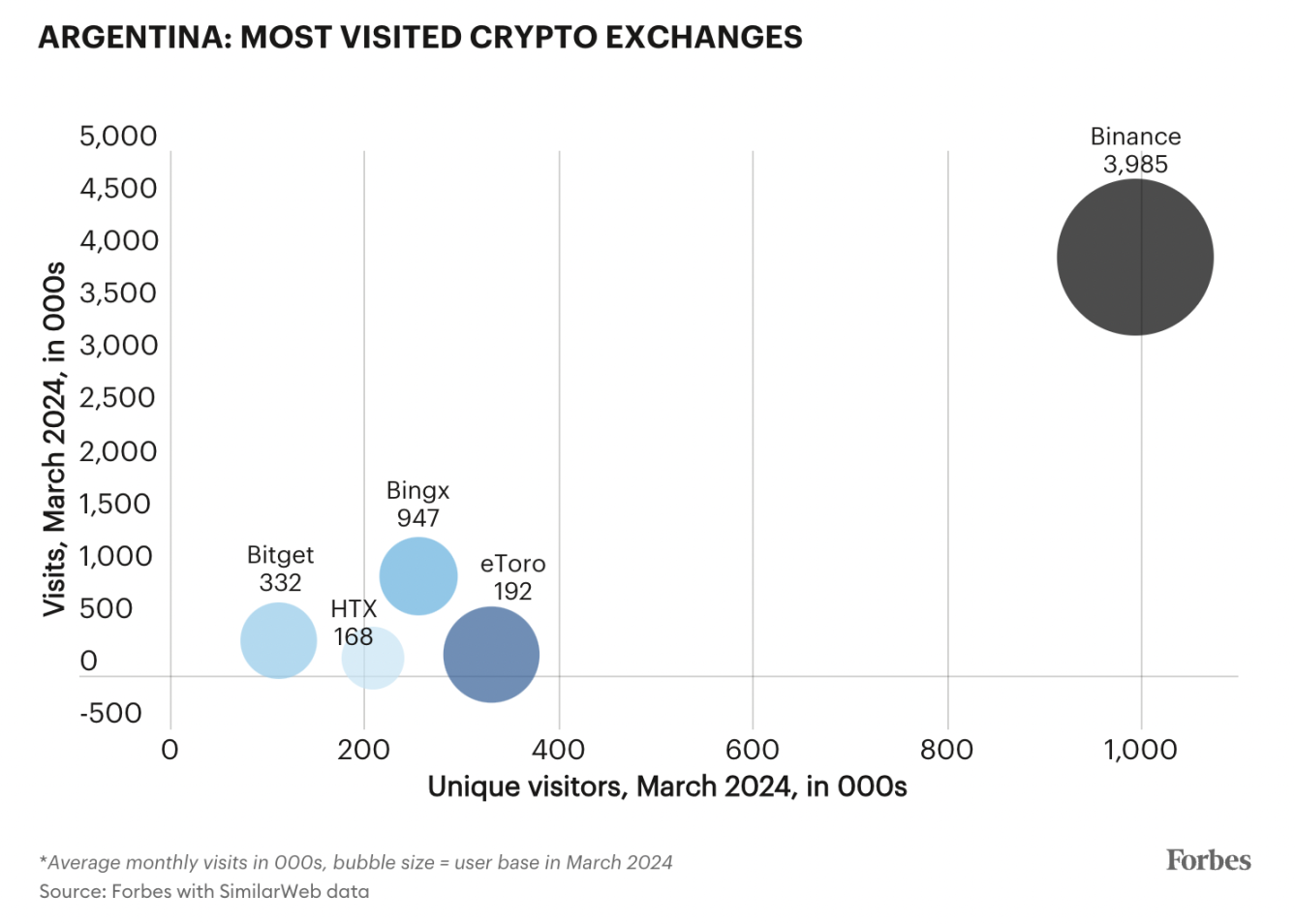

The risks don’t stop there, but also include exchanges and markets that serve Argentina. In May, Forbes selected the world’s 20 most trusted cryptocurrency exchanges, and Argentina’s top five cryptocurrency providers—Binance, eToro, BingX, HTX, and Bitget—were not selected due to a lack of domestic regulatory oversight. Binance is the most visited exchange website, with more traffic from Argentina than any other country. But Binance is not even supervised by a national regulator, let alone a local regulator.

Most visited cryptocurrency exchanges by Argentines

Sources of visitors to Binance website

How dangerous is it to do business with Binance? We know that Binance previously admitted to violating US money laundering regulations, resulting in a $4.3 billion fine and long-term monitoring by US regulators to prevent such incidents from happening again.

But that’s not all. Forbes’ previous investigation into Binance also revealed that customers’ online account balances were unreliable, as the final say over the tokens they held came from the company’s internal books, which were not open to the public. (Translator’s note: Binance published proof of reserves ) The company had moved funds outside the exchange as collateral for issuing stablecoins. However, in Binance’s favor, it has not fallen into bankruptcy, has been largely able to process customer withdrawals, and is still operating normally.

It’s difficult for the average Argentine or other novice investor to understand and appreciate these risks. Fernando Apud, a software engineer living in the country’s northern Tucumán province, recently evaluated sites like local firm Cocos Capital and the larger, more complex Binance site. While these sites tout security and convenience as their main selling points, he found that even large sites like Binance were reluctant to disclose basic information, such as whether they were registered to do business in Argentina and who actually owned the company.

When Forbes asked Rose Zimler of Binance’s Spanish communications team about Binance’s status in Argentina, she said the company was “in close contact with the authorities” but had not yet registered in Argentina. She did not specify why it was not registered or whether it intended to register. She said Binance has 18 licenses around the world.

Binance is not alone. None of Argentina’s other top cryptocurrency exchanges are registered with the national securities regulator, the Comisión Nacional de Securación (CNV). They generally tell Forbes that they are trustworthy to their customers because they have a proven history of operations. BingX brand ambassador Pablo Monti, who represents the exchange’s communications team, declined to reveal the nature of the platform’s regulatory compliance in Latin America, but told Forbes on May 20: “As we approach our 6th anniversary, BingX is expanding further into Argentina and other countries such as Turkey and Vietnam.” A company spokesperson for eToro did not address the issue of non-registration. However, she said: “As a business regulated by financial authorities in multiple jurisdictions around the world, eToro is committed to complying with applicable rules and regulations in the jurisdictions in which it operates.” Bitget is a cryptocurrency exchange that counts world-renowned Argentinian soccer star Lionel Messi as its brand ambassador. “To my knowledge, there are no licensing requirements in the Latin American countries where Bitget operates,” said Maximiliano Hinz of Bitget. Finally, HTX, an exchange associated with Justin Sun, did not respond to emailed inquiries about its Argentinian operations.

In addition to cryptocurrency exchanges, Argentines can also use cryptocurrencies through domestic companies. These companies allow users to buy and spend cryptocurrencies through prepaid cards, such as Lemon and Buenbit. However, these companies also have regulatory loopholes. In the latest Chainalysis Latin America report, Alfonso Martel Seward, head of compliance at Lemon Cash, said that his company has about 2 million Argentine users, while the countrys total number of crypto users is about 5 million.

Argentines have had enough of the peso. Its depreciation has caused them considerable trouble since the country ended its one-to-one peg to the dollar in January 2002. Years of overspending and debt defaults have dogged the peso since then, with the dollar falling to around 4 pesos a decade after the peg was broken and to 64 pesos per dollar in early 2020 as the Covid-19 pandemic took hold.

While a devaluation of the peso boosted the country’s foreign trade in the early 2000s, that benefit faded after 2009, according to Bloomberg data. Over the past decade, inflation-adjusted gross domestic product has fallen by an average of 0.1% per year, with only four years of growth.

Why is Argentina in trouble? In addition to a bloated public sector with 3.5 million employees and a lack of commitment to fiscal austerity, external factors such as weather patterns (La Nina) have had a major impact on food exports (the countrys main source of hard currency) last year and this year. Argentina has experienced its worst drought in the past 60 years. It has never happened that all three crops, soybeans, corn and wheat, failed, said Julio Calzada, director of economic research at the countrys main agricultural exchange. We are all waiting for the rain, and crop losses mean less dollar income, which pushes up food prices and increases default risk and interest rates. In his Inauguration Day speech on December 10, 2023, Milley made it clear that he planned to end the previous approach. This is the day we bury decades of failure and meaningless struggle, he said. There is no turning back. At the time, Argentina had an annualized inflation rate of 143%, a trade deficit of $43 billion, and a fiscal deficit equivalent to 3.5% of the countrys GDP. Six months after Milley took office, inflation remains high, but the country has achieved a trade surplus for six consecutive months and a fiscal surplus of 1.1% of GDP.

Millet is trying to turn around Argentinas economy. His measures include firing tens of thousands of public sector employees, suspending public works, eliminating energy subsidies, raising taxes and reducing the federal revenue sharing with provinces. These measures have been met with massive opposition, sparking street protests and a significant reduction in Millets austerity measures, which have limited support in Congress. In June, a scaled-back set of fiscal measures was narrowly passed by the Senate and will now go to the House of Representatives for consideration.

Milley’s conservative strategy may be the strong medicine the country needs to finally move forward, but it’s missing a spoonful of sugar to make it easier to swallow.

Even if Argentina’s fortunes improve, decades of economic mismanagement mean there will be a continued rush to the dollar, both in paper and digital currencies, without the government doing much to protect its citizens.

What are the cryptocurrency regulations in Argentina? More than three months ago, CNV announced a registration requirement for “all those who use web pages, social networks or other means to send advertisements to individuals residing in Argentina” and receive user funds “through the use of any technology.” There is no deadline for registration. “Unregistered institutions will not be able to operate in the country,” said Robert E Silva, president of CNV.

The requirement is neither complex nor onerous for registrants. However, many of the 55 cryptocurrency companies in the Forbes study operate in Argentina, but none of them registered three months after the rules came into effect on March 25. As of June 20, the public registry showed 48 companies listed, most of which are relatively small local operations. Argentine officials did not respond to multiple requests for comment on this matter.

Registration is a small step, and it’s clearly not enough for the world’s 22nd largest economy with a GDP of $633 billion. Bitcoin and digital currencies were born in the Great Recession that hit the United States in 2008. But it would have been just as well if Bitcoin had started in this Andean country, which has long been plagued by inflation and political turmoil.

This article is sourced from the internet: Forbes: Why are Argentines embracing cryptocurrency?

Related: Galaxy Research Report: ETH ETF net inflows are expected to be $1 billion per month

Original author: Charles Yu Original translation: TechFlow Key Takeaways The Bitcoin ETF saw net inflows of $15.1 billion between its launch on January 11, 2024 and June 15, 2024. Nine issuers are vying to launch 10 Ethereum spot ETFs in the United States. The SEC is expected to allow the instruments to begin trading in July 2024, after approving all 19b-4 filings on May 23. As with the Bitcoin ETF, we believe the primary new accessible market is independent investment advisors, or those associated with banks or broker/dealers. We expect ETH ETF net inflows to reach 20-50% of BTC ETF net inflows in the first five months, with a target of 30%, which would imply $1 billion in net inflows per month. Overall, we believe ETHUSD is more price sensitive…