Blast has airdropped $Blast tokens to the community at 10pm on June 26th, which also announced the end of a huge airdrop feast. There is no doubt that in terms of investment institutions, community enthusiasm and TVL, Blast is the only king-level project that can be compared with ZKsync this year. Layer 2 has entered the next stage. After the large-scale and controversial airdrop event, how will Blast itself and the Layer 2 ecosystem develop in the future?

Background of the project

Environment drives innovation

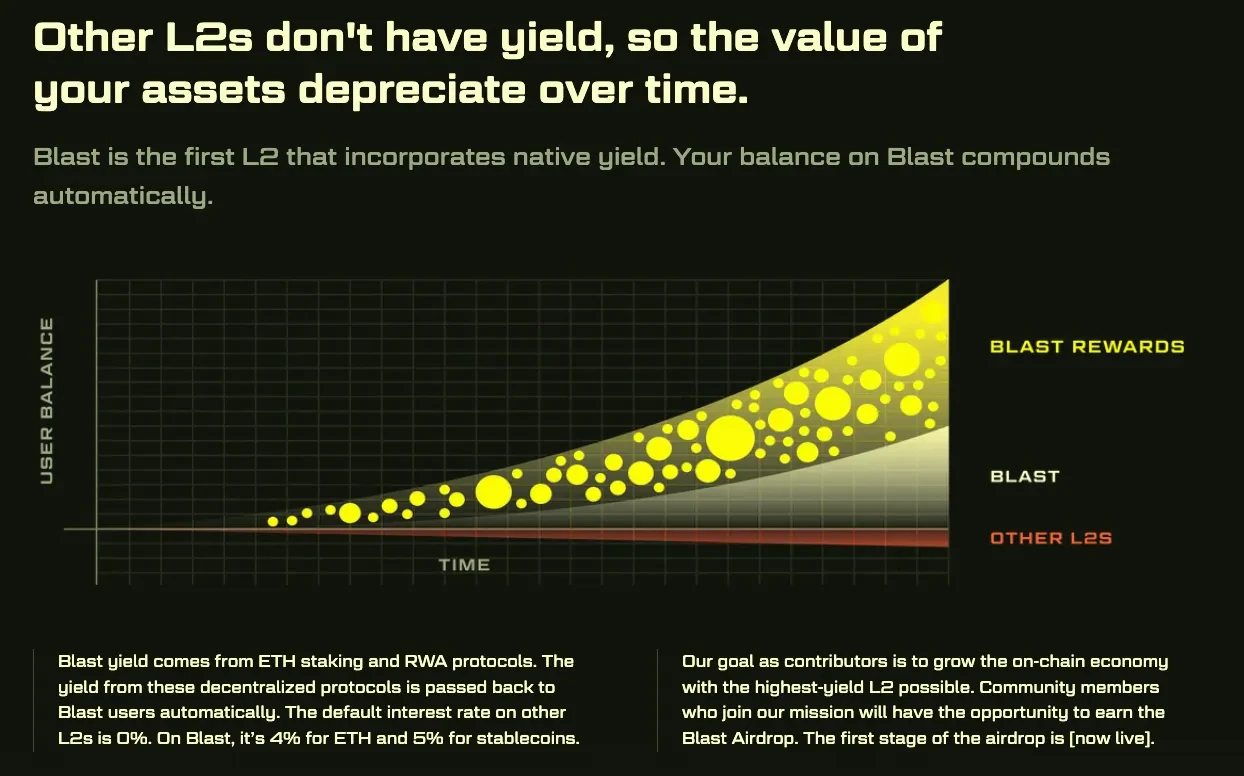

For a long time, in the conventional Layer 2 ecosystem, users have obtained Layer 2 ecosystem tokens as income by staking ecosystem tokens, stablecoins and other tokens. At the same time, Layer 2 project parties use the staked tokens to complete transaction verification and other behaviors under the POS model, and are also willing to provide tokens to encourage users to participate in the maintenance and development of the network to achieve a win-win situation. Generally speaking, since Layer 2 is built on Layer 1, the funds staked on Layer 2 need to bear two system risks from Layer 2 and Layer 1, so Layer 2 projects often need to provide a higher interest rate than Layer 1 staking as risk compensation. Taking the Polygon network as an example, Matics annual interest rate can generally reach 8%-14%, while the annual interest rate of ETH on the ETH network is generally 4%-7%. So is there a way to make the capital gains obtained by Layer 2 a step higher? So Blast came into being.

Figure 1 Blast-logo

Basic Information

Blast is an Ethereum second-layer network based on Optimistic Rollups launched by PacMan, the founder of Blur. Blur created by PacMan once distributed the fifth largest airdrop in history. Compared with other Layer 2 projects that are aimed at expanding transaction capacity, improving transaction speed, and reducing gas fees, Blast focuses on improving the shortcomings of Layer 1 while providing higher economic benefits. In general, Blast will be the first Layer 2 to provide fixed income for ETH and stablecoin staking, and this narrative based on the perspective of income may guide the construction of Layer 2 to return from technical attributes to the financial attributes of Web3 itself.

development path

-

In November 2023, the project was launched: Blast was founded by PacMan, the founder of NFT platform Blur, and began to operate as an Ethereum expansion solution. The project received a $20 million seed round of financing led by Paradigm and Standard Crypto.

-

November 2023, turning point announcement: Blast announced its unique yield model, returning the profits of Ethereum staking and RWA protocol to users, and the project provides 4% ETH returns and 5% stablecoin returns.

-

February 2024, mainnet launch: Blast officially launches the mainnet, but before that users were unable to withdraw funds locked on the platform, which caused dissatisfaction among some users.

-

May 2024, Airdrop Plan: The BLAST token airdrop originally scheduled for May was postponed to June 26 for some reason, and the airdrop allocation was increased to compensate participants.

-

June 26, 2024, Airdrop: Blast will airdrop on June 26, with 50% of the airdrop rewards allocated to developers (through Blast Gold points) and the other 50% to early users (including users who bridged funds to the network before the mainnet launch.

Market growth

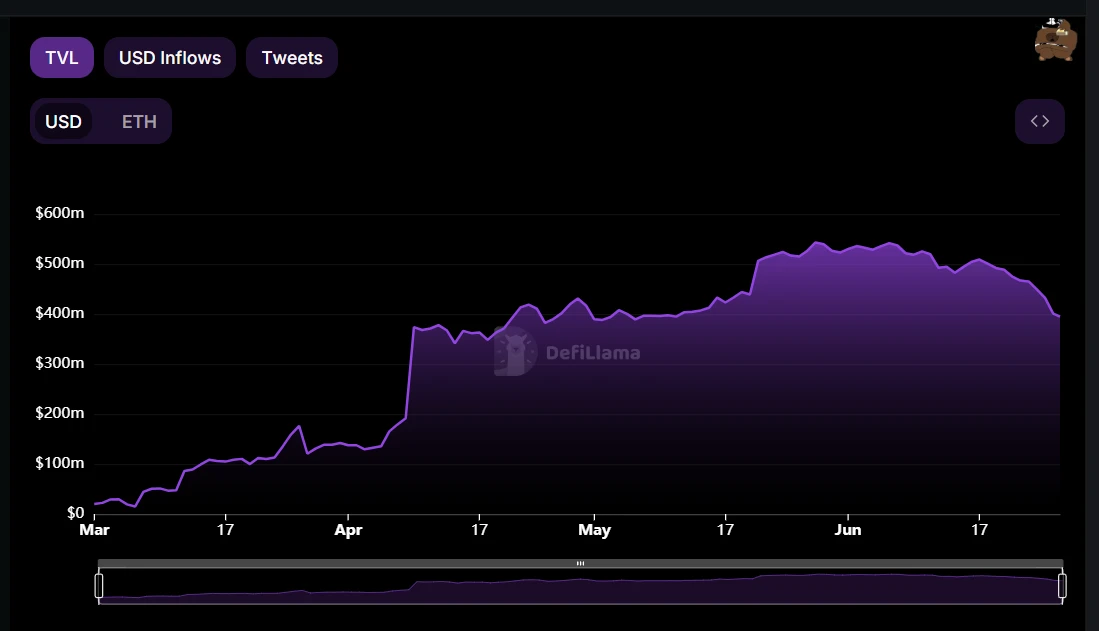

The Blast chain has been highly sought after by the market and it continues to grow. As of the time of writing, its TVL is as high as $1.6 B, making it the 6th chain in TVL and the 11th chain in Protocols. At the same time, its locked assets account for 1.71% of all locked assets on all chains.

Figure 2 Blast locked assets ratio

Figure 3 Changes in Blast indicators

Token Economics

Token Function

$Blast tokens will be similar to other Layer 2 tokens in terms of token functions, with basic functions such as ecosystem governance, airdrop incentives, and staking income, and so far they do not have any outstanding features. However, in terms of ecosystem governance, the Blast ecosystem has more complete governance regulations and rules and regulations than other Layer 2 ecosystems, which may reflect the relative completeness of the Blast ecosystem construction.

Token Allocation

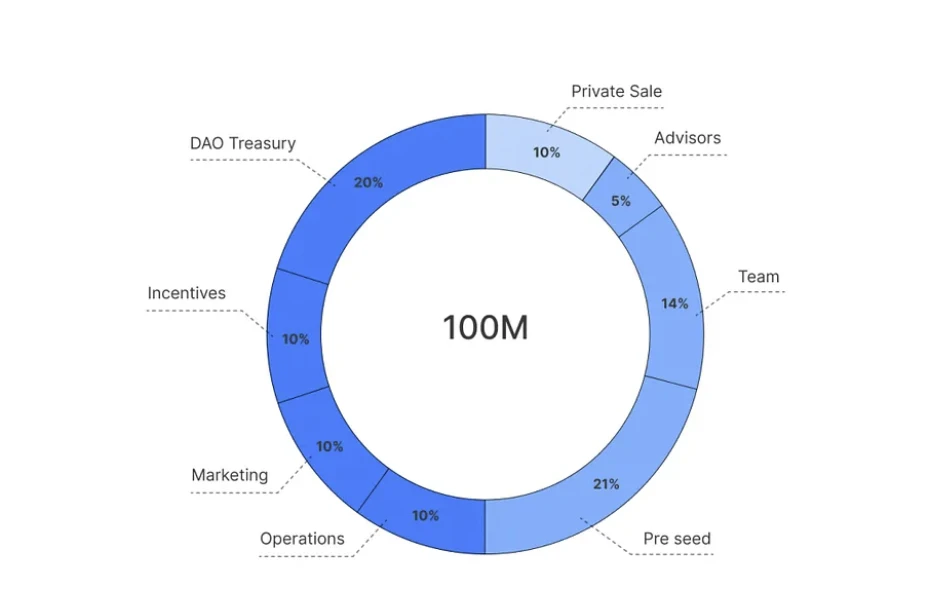

The total supply of Blast tokens is 10 billion, allocated to the community, core contributors, investors, and the foundation.

-

The community receives 50% of the airdrop, a total of 50,000,000,000 tokens, which will be unlocked linearly within 3 years from the TGE date.

-

Core contributors receive 25.5% of the airdrop, a total of 25,480,226,842 tokens, of which 25% will be unlocked 1 year after the TGE date, and 75% will be unlocked linearly over the next 3 years.

-

Investors received 16.5% of the airdrop, a total of 16,519,773,158 tokens, of which 25% were unlocked 1 year after the TGE date and 75% were unlocked linearly over the next 3 years.

-

The Blast Foundation receives 8% of the airdrop, totaling 8,000,000,000 tokens, which will be unlocked linearly over 4 years from the TGE date.

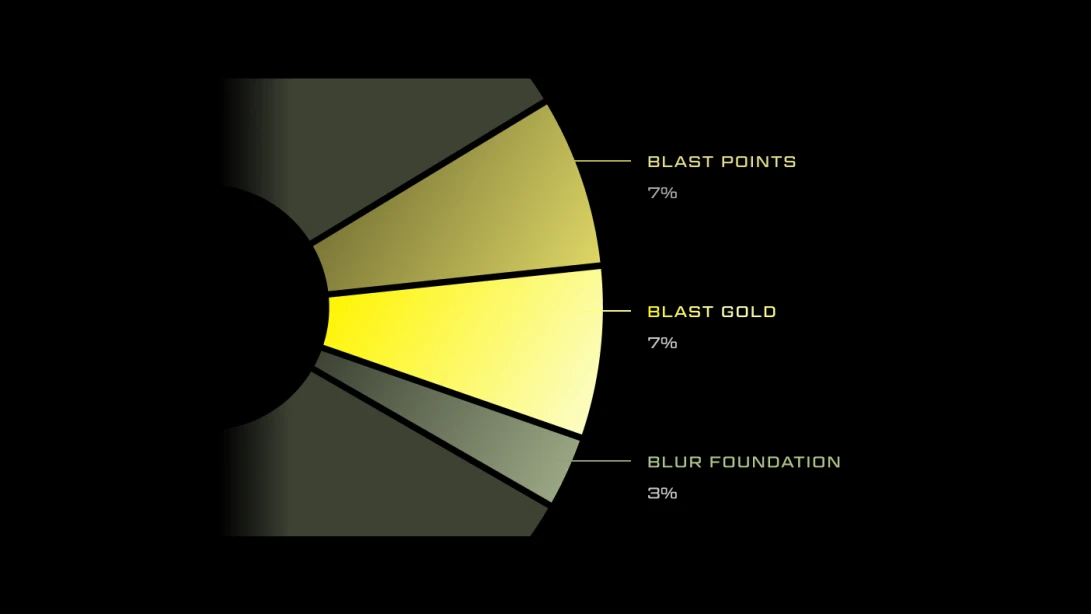

Figure 4 Blast airdrop allocation

Phase 1 Airdrop

-

Users holding Blast Points will share 7% of the total supply of airborne rewards based on the number of points they hold.

-

Users holding Blast Goal points will share an airdrop reward of 7% of the total supply based on the number of points they hold.

-

The Blur Foundation will receive an airdrop reward of 3% of the total supply to be distributed to the Blur community.

In addition, the airdrops of the top 0.1% of wallets will be released linearly within 6 months, which effectively alleviates the huge selling pressure when the tokens are released. At the same time, the number of Blast Goals is far less than that of Blast Points, so the benefits of holding Blast Goals are far higher than Blast Points.

Figure 5 Blast Q1 airdrop allocation

Narrative Features

Perfect compatibility with EVM

The compatibility of EVM is very important for Layer 2 on ETH. The higher the compatibility, the lower the migration cost and the faster the ecosystem construction. Although the perfect compatibility of EVM is not original to Blast, the Blast chain has adopted a free choice approach in compatibility, which reflects a certain degree of innovation.

Blasts perfect compatibility with EVM relies on the function that contracts can freely choose Auto-Rebasing. Auto-Rebasing means automatic rebasing. In the contract, you can choose whether to participate in this mechanism. For contracts that do not need to choose this mechanism, DAPP migration can be easily completed with less code modification.

The perfect solution to eat more fish

The slogan of the Blast ecosystem is that it is the only Layer 2 that can achieve native returns on ETH and stablecoins. How is this solved?

ETH is not an ERC-20 native token. Generally speaking, in blockchain and DeFi, we deposit ETH into contracts, and the wallet can obtain the corresponding amount of WETH, etc. The converted WETH can be used to obtain income in DEX, lending platforms, liquidity pools, etc. In such a process, high gas fees are often lost, resulting in users with smaller funds being unable to participate in staking activities. At the same time, ETH staking on platforms such as Lido needs to be converted into STETH, etc., and also faces similar loss problems.

At this time, Blast proposed the Auto-Rebasing solution, which aims to automatically update the users account balance without WETH, STETH or any other ERC 20 tokens. At the same time, the ETH staked in Blast is currently automatically staked with Lido, directly updating the native ETH balance, allowing users to automatically obtain benefits without any operation. In addition, the native stablecoin USDB provided by Blast can be exchanged for DAI when bridged back to Ethereum through MakerDAOs T-Bill protocol.

This plan seems very complicated. In essence, it is to automatically stake the tokens originally locked in the contract in DeFi such as Lido and MakerDAO, and continuously convert them into native token income, realizing compound interest while avoiding high gas fees. At the same time, the Blast RD team has shown that it will be able to achieve this operation without Lido and MakerDAO in the future. Therefore, the funds staked in Blast may not only obtain the staking rewards of the Blast chain itself, but also have a base interest rate similar to that of the ETH chain, achieving a perfect one-fish-two-kill.

Figure 6 Blast vs. other L2s

Ecological Construction

Blast ecosystem construction covers multiple tracks such as SocialFi, GameFi, DeFi, NFT, etc. Compared with traditional Layer 2, Blast ecosystem has better narrative and comprehensiveness, integrating multiple functions and features to form a diversified ecosystem.

DEX leader Thruster

Thruster is a yield-first DEX built for degens, supported by Blast Points chads, founders and an excellent community. Its TVL has grown rapidly since March and is currently as high as $438m. In the Blast airdrop event, users can obtain Blast Points and Thruster Credits points by cross-chain and providing liquidity, and enjoy multiple benefits

Figure 7 Thruster TVL growth

-

Thruster inherits the AMM model of conventional DeFi, allowing users to provide liquidity and earn fees.

-

Thruster provides a simple mode and a complex mode web UI to provide convenience for users.

-

Thruster utilizes the USDB and ETH staking income automated by the Blast chain, thereby improving the liquidity and transaction efficiency of the DEX itself and providing support for the launch of new tokens.

-

Thruster has uniquely designed a weekly no-loss lottery Thruster Treasure pool reward, which has attracted a large number of active users to participate.

Figure 8 Thruster鈥攍ogo

In addition, Thruster also provides versions of different AMM models. For example, Thruster V3 uses centralized liquidity AMM with different transaction fee structures, which is suitable for high-frequency traders.

Juice Finance, the leader in leveraged lending

Juice Finance is currently the largest leveraged lending platform on the Blast chain. It uses an innovative cross-margin Defi protocol, mainly providing lending and yield farming functions, and optimizes users earnings and point acquisition by integrating Blasts native rebase tokens (such as ETH, WETH and USDB) and gas refund mechanisms. Its current TVL is as high as $394m.

Figure 9 Juice Finance TVL growth

-

Leveraged lending: Users can lock WETH as collateral in the protocol and borrow up to 3 times USDB. USDB can be deployed in other yield strategies on the Blast chain to maximize returns.

-

Yield Farm: Similar to other yield farms, Juice Finance provides users with a variety of strategy vaults where users deposit USDB to earn yields. It is worth mentioning that Thruster is also included in the strategy vault service.

Figure 10 Juice Finance

Compared with other lending platforms, Juice Finance also has permissionless lending and cross-margin functions, providing a basis for users to fully utilize their funding advantages to make capital gains.

Zest, a platform for enhancing capital effects

Figure 11 Zest platform

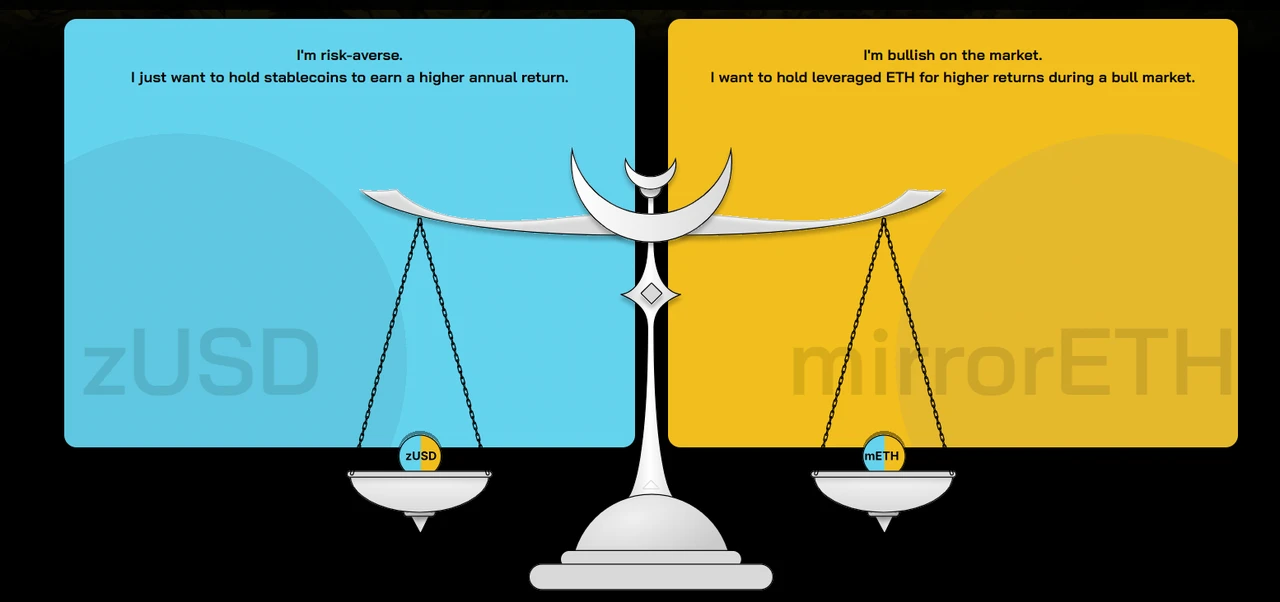

On conventional mortgage platforms, the general mortgage rate reaches 150%, which cannot fully exert the utility of tokens. Zest will use the native ETH income of the Blast chain to

Improve capital efficiency. When a user stakes $150 worth of ETH in Zest, he or she can get $100 worth of zUSD and $50 of Leveraged ETH. The yield of ETH is inherited by zUSD, and the volatility is inherited by Leveraged ETH. Because all fluctuations of ETH are absorbed by Leveraged ETH, zUSD has risk-free leveraged returns, which improves capital efficiency.

Therefore, compared with other platforms, Zest provides an auxiliary solution with higher returns and lower risks, which is suitable for working with other DeFi to achieve higher returns.

Figure 12 Zest Profit Chart

SocialFi Faucet

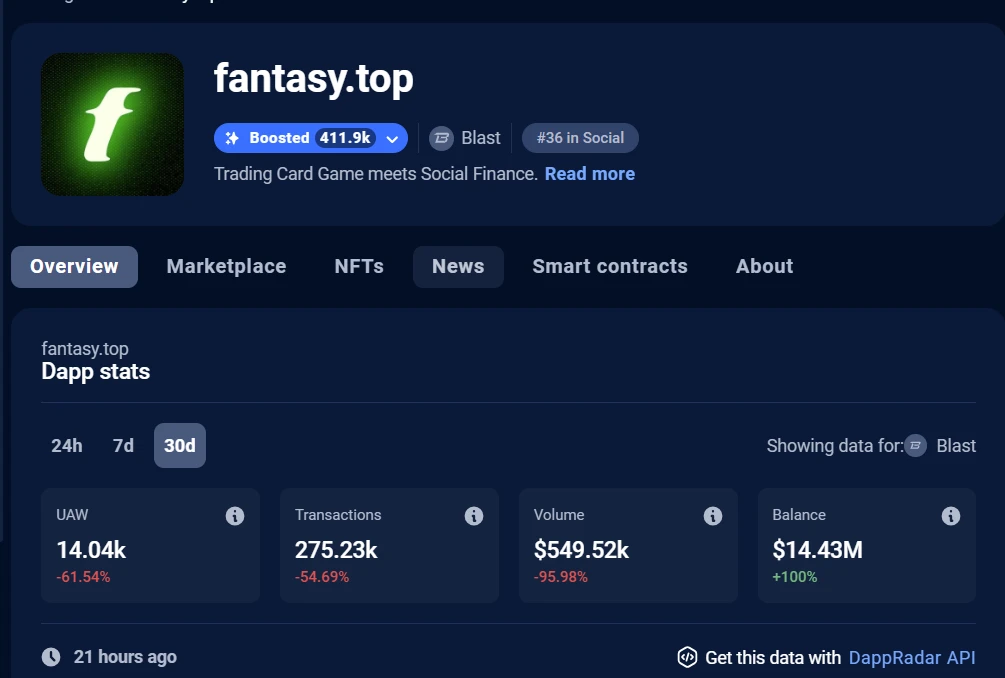

Fantasy is a revolutionary social finance trading card game that combines elements of social finance and trading card games to provide users with a new interaction and revenue model.

Figure 13 Fantasy Market

The Fantasy project was originally launched by Travis Bickle on the Blast mainnet on May 1 and became one of the 47 winning works in the BIG BANG competition. Compared with the traditional SocialFi project, Fantasy defines a new way to link social media influence with platform currency and collections, and points out a new direction for SocialFi to improve user stickiness.

-

Essential features: The Fantasy platform provides cards with avatars of well-known traders, investors, industry analysts and project initiators in the Crypto Twitter community, and uses cards as a medium for profit distribution, which distinguishes it from traditional SocialFi.

-

Income features: Players holding cards can passively earn 1.5% of their card transaction volume in ETH while earning 4% native income from the Blast chain itself.

-

Nature of the competition: Players purchase cards to form decks, and are ranked and rewarded based on market trading activity and social media influence in weekly competitions.

As of the time of writing, the total NFT transaction volume on the Fantasy platform reached $93.11M, with 36.7K participants, making it the 5th SocialFi in the Blast chains overall ranking.

Figure 14 Fantasy data

Although Fantasy has done a good job of connecting users to the platform through card decks, it is still a big challenge to retain users and even attract more users to participate after the rewards. So far, the actual user base of Web3 cannot be compared with the user base of traditional media platforms, and users are much more profit-seeking than traditional platforms, so this problem is also a dilemma that all SocialFi platforms must face.

Future development and risk opinion

Figure 15 Blast promotional image

Future trends

Compared to all previous Layer 2s, Blast is the first to narrate the economic benefits of Layer 2. In essence, it is similar to the first Layer 2 solution that attempts to solve the Layer 1 expansion problem – both have pioneered a new research idea and path. Therefore, it is undeniable that Blast is likely to become a symbolic project like Uniswap. The future development of Blast may be related to the following points.

-

Due to the high-yield characteristics of Blast, in the long run it will inevitably draw funds from other Layer 2 and the Ethereum chain itself until the profit characteristics of the Blast chain are balanced with those of other chains.

-

The automatic profit-generating capability of the Blast chain provides fertile ground for the development of DeFi. DeFi projects built on Blast naturally have higher and more stable returns than DeFi projects on other chains, and will also develop faster.

Hidden risk analysis

The Blast chain relies on the powerful Auto-Rebasing function to automatically obtain Layer 1 staking income and avoid currency losses caused by inflation. This is essentially an automated way of killing two birds with one stone, obtaining the income of both Layer 1 and Layer 2 on Layer 2 at the same time.

-

From a technical perspective, Blast achieves automated staking through Auto-Rebasing and reduces the gas fees for staking, while reducing the personal risks of single user operations and optimizing overall capital efficiency.

-

From the perspective of risk, obtaining income through staking through Lido and MakerDAO will undoubtedly greatly increase the systemic risk of funds in the entire chain. At the same time, it is still unknown whether losses will occur due to the inability to recover funds in time due to market fluctuations.

-

From the perspective of authority, Blasts automatic pledge of funds to Lido and MakerDAO means that users automatically bear the corresponding risks. Whether this infringes on users rights to dispose of funds is also worth considering.

In general, Blasts high returns are not free, and are accompanied by an increase in the overall risk of the funding system. However, for individuals with small amounts of funds, the growth in returns is obviously far greater than the growth in risk, and it still has very good prospects. At the same time, the return characteristics of Blast are likely to be adopted by other Layer 2s, and are also worthy of continued attention.

This article is sourced from the internet: Blast: The beginning of a revenue-oriented narrative

Original author: Footprint Analytics Original translation: TechFlow There has been some discussion lately about whether blockchain gaming is dead, and there are good points on both sides. Let鈥檚 analyze it from a data perspective. Active games As of May, the Footprint platform tracks 3,153 games, of which 263 games have more than 1,000 monthly active users (MAU), accounting for 8.2% of the total. If the standard is raised to 10,000 MAU, this number will be significantly reduced. It should be noted that these data only include on-chain users. Many games allow users to play without wallet login, while still including Web3 elements. Currently, this part of the data is difficult to obtain, which may affect the statistics of the actual number of players. Daily active users and transactions In May,…