DePIN: The superposition of double curves builds a decentralized value network

Original author: Evan, Waterdrip Capital

introduction

DePIN is gradually realizing large-scale interaction between the physical world and Web3, and gradually subverting the operating model of traditional infrastructure. Through the combination of sensors, wireless networks, computing resources, and AI with blockchain technology, and using crypto-economic incentives to promote crowdsourcing development. Analysis of most DePIN projects shows that DePINs business model contains an important feature: hardware revenue is used as the first growth curve, and the realization of data services is superimposed on this basis to form a second growth curve. This is one of the key factors that DePIN can lead the growth of the current cycle, and it also shows how DePIN-like projects can create huge wealth effects in the process of building a decentralized infrastructure network, and ultimately form a large-scale decentralized value network.

1. Build a decentralized world of interconnected everything

Decentralized Physical Infrastructure Network (DePIN) is defined in Messaris 2023 report as the deployment of real-world physical infrastructure and hardware networks using cryptoeconomic protocols. This concept foreshadows an application scenario full of imagination: the common infrastructure around us, including communication base stations, car charging piles, photovoltaic panels, billboards, and data storage and computing equipment behind the operation of the Internet, will no longer be controlled by centralized entities and institutions, but will be divided into units of the same size and in the hands of individuals or large-scale miners. And the physical infrastructure of the same type is highly standardized and scaled, forming a carpet-like coverage.

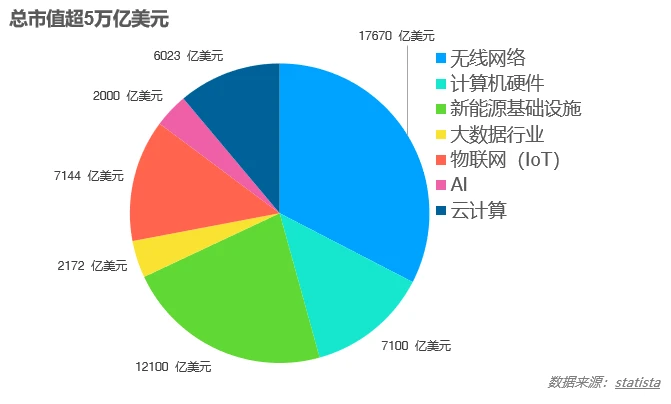

Through a decentralized approach, the layout and utilization of infrastructure can achieve higher efficiency and lower costs, while enhancing the security and resilience of the overall system. Not only that, from energy production to data processing, all types of facilities have the potential to transform to a decentralized model. The above-mentioned DePIN-related industries now have a total market size of more than 5 trillion US dollars. Therefore, Messari predicts that the potential market size of the DePIN field is estimated to be approximately 2.2 trillion US dollars, and is expected to reach 3.5 trillion US dollars by 2028.

Decentralized Internet of Everything effect diagram, reference: Messari

DePIN related industry market size data, data source: Statista

1.1 DePIN Track Division

The DePIN track covers six sub-fields: computing, AI, wireless communications, sensors, energy, and services . From the perspective of the supply chain, DePIN can be divided into:

Upstream: Hardware manufacturers and supply-side users who are “miners”.

Midstream: project platform, blockchain responsible for data verification and token settlement, and on-chain layer 2 protocol serving DePIN; as well as modular service components for developing and managing the DePIN network (such as platform interface, data analysis and standardization services), SDK toolkit developed by DePIN, API interface, etc.

Downstream: DApp applications and interfaces on the demand side.

Except for IoTeX and the former Helium (now the mainnet has been migrated to Solana), most DePIN projects rarely cover every link in the DePIN business. They usually choose Solana or IoTeX as the settlement layer of the token economy. AI and cloud computing projects in the sub-field focus more on on-chain settlement and project platform development and management. The underlying hardware devices dispatch idle electronic devices through middleware, such as mobile phones or computers equipped with high-performance consumer-grade GPUs.

1.2 Overview of DePIN Industry Development

According to DePIN Ninja data, the number of DePIN projects that have been launched has reached 1,215, with a total market value of approximately US$43 billion. Among them, the total market value of projects that have issued tokens and are listed on Coingeckos DePIN sub-section exceeds US$25 billion.

In October last year, this figure was only $5 billion, which has increased fivefold in less than a year, showing the rapid growth of the DePIN industry. This shows that the market demand and recognition for decentralized physical infrastructure networks are constantly increasing. With the launch of more projects and the expansion of application scenarios, the DePIN industry is expected to become an important field for the combination of blockchain technology and real-world applications.

2. Enlightenment from DePIN business logic

The prototype of DePIN can be traced back to the concept of IoT + Blockchain in the previous cycle. Projects such as Filecoin and Storj have transformed centralized storage into a decentralized operation mode through crypto-economic models, and have been put into practical use in the Web3 ecosystem, such as on-chain NFT storage and front-end and back-end resource storage of DApps.

IoT + blockchain only reflects the characteristics of decentralization (De), while DePIN emphasizes the construction of physical infrastructure and large-scale Internet networks. The PI in DePIN stands for physical infrastructure, and N stands for network, which is the value network formed after DePIN hardware reaches a certain coverage scale.

The most typical example is Helium. Founded in 2013, Helium did not decide to use blockchain as an incentive for decentralized deployment of the Internet of Things until 2018. So far, Helium has met almost all the elements of DePIN: node economy, miner model, value network, crowdsourcing incentives, and is a leading project in the field of DeWi (decentralized wireless communication); in addition, at the end of last year, Helium Mobile and T-Mobile launched a $20 communication package service for traditional users. When users use the Helium network for data transmission, they can not only receive token rewards, but also enjoy reliable communication services. At the same time, Helium also helped T-Mobile solve the signal coverage problem in remote areas of the United States, forming a win-win situation for all three parties. The large number of traditional users undertaken by its terminals has greatly promoted the momentum of DePIN to break the circle, and is expected to accelerate the large-scale adoption of blockchain technology and Web3 networks.

Helium and Filecoin both belong to the category of DePIN, but the difference between the two is that Helium places more emphasis on hardware, enabling it to support the growth of data services in the second curve through hardware revenue, build an independent ecosystem, and harvest Alpha and Beta benefits at the same time. Although Helium was involved in false propaganda last year and faced problems such as unpopular programming languages leading to difficulties in development, a series of actions at the end of the year have restarted Heliums second curve growth; and as the first and largest DePIN project, it undoubtedly brings us some inspiration for the DePIN ecosystem.

3. DePIN’s explosive growth is based on the double curve theory

The Second Curve is a concept in management and innovation theory, originally proposed by management scholar Charles Handy. It refers to the need to introduce new innovations or changes when an organization, product or business reaches the peak of its traditional growth curve to start a new growth curve and avoid stagnation or decline.

DePIN Double Curve, reference: The Second Curve: Thoughts on Reinventing Society

From the previous successful DePIN project experience, it can be seen that DePINs business logic naturally points to hardware sales as the first curve of project development, and data value network monetization is superimposed on the first curve as the guiding ideology of the second curve of development;

Product research and development and operational capabilities are the key to ensuring the growth of the first curve; then how to start the growth of the second curve requires two capabilities, first, the organizational capabilities of the decentralized system, and then the service capabilities on the demand side.

Corresponding to the DePIN ecosystem, the project party needs to ensure the smooth operation of the data value network on the premise of having the ability to organize a hardware network that can undertake large-scale data transmission, so that the demand side can access smoothly and finally provide high-quality, standardized data services. Finally, the hyperbolic double growth of business is completed, forming a positive cycle within the project ecosystem.

3.1 Hardware value is the first curve of value creation

In the first growth curve, the business will experience rapid growth at the beginning and then gradually reach its peak. The growth momentum of the first curve of the DePIN project comes from the revenue and profit generated by the sale of hardware.

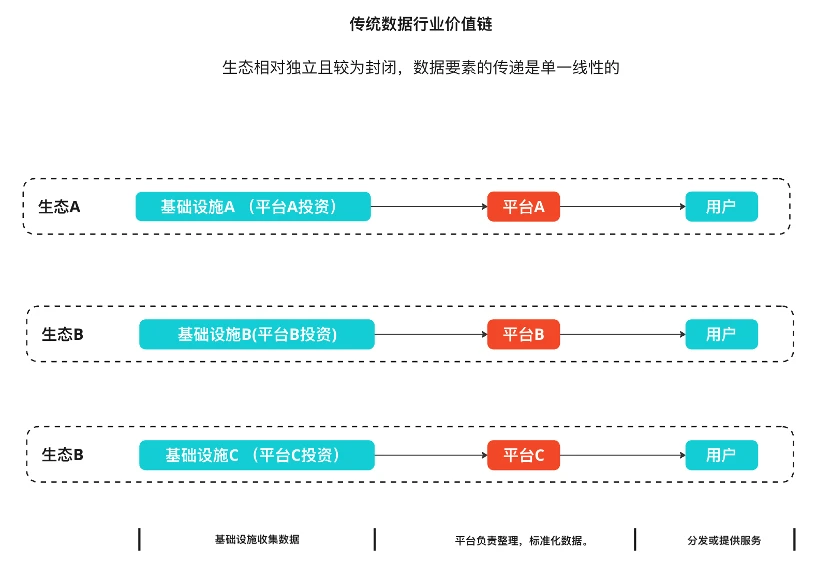

In traditional infrastructure, especially in areas such as data storage and communication services, the business logic of centralized service providers or entities is linear: in the early stages of the business, investment is required to build infrastructure, and services are provided to end users (C-end) after the facilities are complete. Therefore, the development of such businesses often requires the participation of giant companies to bear high costs in the early stages of business operations, including hardware purchases, land leasing, deployment, and the employment of maintenance personnel. Citing BCGs deconstruction of the data value network, its traditional IoT operating model has created the data value chain shown in the left figure below. In this model, data is transmitted in an independent and linear manner as a production factor, and each ecosystem is completely independent.

Traditional data infrastructure value chain, reference: BCG, Data Value Network

The DePIN project splits up the centralized supply side and makes it crowdsourced to complete the establishment of the hardware network.

DePIN hardware network business model deconstruction, reference: BCG, Data Value Network

Therefore, the first step of dismantling the centralized infrastructure is the key to achieving the first curve growth of the DePIN project.

The DePIN project must first work hard to promote itself, spread its own narrative, and attract the participation of supply-side users through a series of operational means, including pre-selling mining machines and airdrops for purchases; transfer the huge infrastructure investment costs to supply-side users to achieve a low-cost and lightweight start-up. Supply-side users also become shareholders of the project in the form of holding hardware, and help the project deploy hardware networks with the expectation of making money from mining in the future.

Moreover, unlike traditional centralized equipment providers, the update and maintenance of DePIN equipment is jointly completed by the project party and miners, that is, the equipment provider is only responsible for the update, development and sales of the equipment, while the update and maintenance are completed by the supply-side users. In the process of jointly maintaining and building the hardware network, the interaction with the project party and the middleware strengthens the miners (supply-side users) sense of community and their sense of identity with the DePIN project.

If a DePIN project can smoothly run through the links of narrative marketing, mining machine sales, and community operations, then the elements of the projects first growth curve will have been gathered, eventually forming the first curve of increased network coverage – increased token incentives – attracting more miners to join.

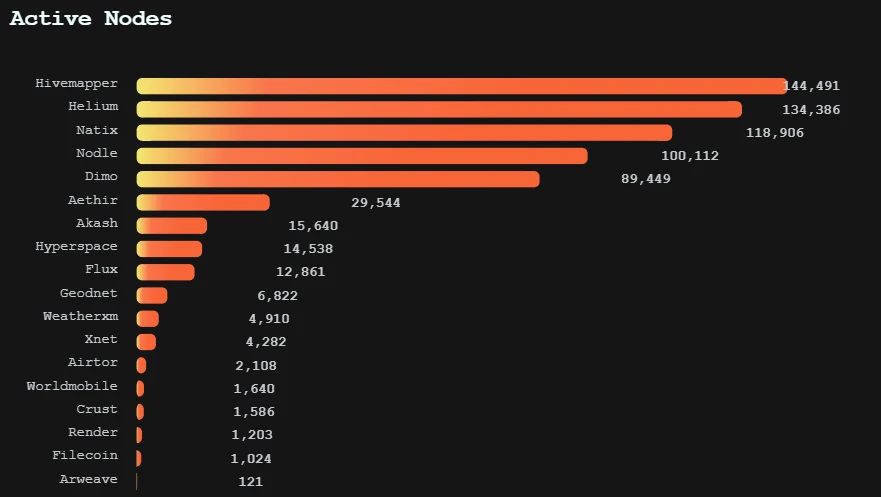

The following is the data on the number of active nodes as of now. Hivemapper, Helium and Natix rank in the top three, and all of them have deployed more than 100,000+ nodes around the world.

Data source: DePIN Ninja

The number of nodes deployed for Hivemapper, Helium, Natix and Nodle has exceeded 100,000, among which Helium and Hivemapper have performed very well:

-

Helium

Helium is a decentralized wireless network whose main businesses include Helium Hotspot, which provides low-power wide area network (LoRaWAN) coverage; Helium Mobile, a mobile communication service launched in cooperation with T-Mobile and TEF.

The $20 mobile plan service launched on January 25 in cooperation with T-Mobile has grown from 0 to 93,000 subscribers in 5 months.

Partnered with Telefónica (TEF), one of Mexico’s largest telecommunications service providers, to enter the Mexican market of 126.7 million people, further strengthening Helium’s revenue stream and market presence.

-

Hivemapper

Hivemapper is a decentralized mapping platform that aims to create a global, real-time updated map ecosystem through blockchain technology and crypto-economic incentives. Hivemappers main business includes HiveMapper Dashcam, a driving recorder that users can install to collect geographic data while driving.

The device is priced at $549, and based on the number of nodes currently deployed, Hivemapper has made more than $60 million in revenue from hardware sales alone.

· So far, the map data collection network established by Hivemapper has covered most of Europe and the United States. Hivemappers data service revenue has also increased significantly.

· In terms of hardware revenue, other projects have also taken a different approach and achieved good growth. For example, Jambo has achieved outstanding sales results in the African market with mobile phones as its selling point. OORT has technical barriers in cloud computing and edge computing, and has achieved significant hardware sales revenue through its innovative model. Ordz Game, as a project in the GameFi track, cleverly integrates DePIN elements to attract a wave of popularity. These projects have successfully achieved breakthroughs in hardware revenue through their respective innovative models and technical advantages, and explored new ways to integrate DePIN in various industries:

-

Jambo

Web3 wallets are the traffic entrance for all crypto users, and Jambo intends to use DePIN+ wallet to achieve large-scale adoption of Web3 in the African market. By selling affordable Jambo phones, using Web3 phones as a selling point, it attracts a large number of traditional Web2 users. Through the pre-installed Web3 wallet application, users can use the one-stop wallet application to play games or watch ads and get JAMBO native token rewards. The Jambo project cooperates with some large data service providers in Africa to achieve a closed loop in business by selling the generated data to service providers.

In the future, Jambo mobile phone will also launch multiple incentive activities such as on-chain data mining. In addition, by pre-installing dApp, users can use Jambo mobile phone to manage DePIN mobile phone. Currently, Jambo mobile phone has been launched in more than 120 countries and regions, with the main market concentrated in Africa. The Jambo mobile phone, priced at US$99, is very affordable and has sold more than 400,000 units. And 1.23 million non-custodial wallet addresses have been activated.

-

OORT

OORT is a decentralized verifiable cloud computing platform designed for AI applications. It leverages global resources from data centers to local edge devices and adopts a proprietary blockchain-based verification layer to ensure the security of all transactions and computing processes from data crowdsourcing and labeling to model training and local inference.

OORT officially provides the Deimos DePIN device as its decentralized edge node, priced at $379. Currently, more than 5,500 edge nodes have been deployed worldwide, covering most countries and regions in the Americas, Europe, and Asia. These nodes together build a powerful decentralized edge computing network, providing reliable data processing and computing capabilities for artificial intelligence applications.

-

Ordz Game

As the first game platform in the Bitcoin ecosystem, Ordz Game uses the Ordinals protocol to mint each level of retro games into NFTs. Players can play games to earn points, and top-ranked players will receive Games token rewards (original BRC 20 token ORDG) based on their points. It creates a “Play to earn” feature to attract players to participate.

· Currently, Ordz Game has entered the fifth phase of testing, having completed four quarters of public beta testing, with a total number of login wallet addresses exceeding 260,000. In the future, a handheld version of BitBoy will be launched, priced at 0.01 BTC each. The 1,000 pre-sold handhelds with NFTs were sold out within the first few hours of the launch, and more than 2,000 regular versions have been sold. BitBoy, as the mining machine of the Ordz Game platform, empowers the Games tokens issued by the platform, forming a flywheel effect of playing games to mine – token incentives – attracting more players – token value increase.

The above examples all show that hardware sales play a vital role in the early revenue of the DePIN project. It not only affects the initial capital flow of the project, but also determines the speed of large-scale hardware network deployment. Only on the basis of the stable development of the hardware network can the DePIN project smoothly transition to the second stage of the data value network and start the second wave of growth curve.

Except for some specific scenarios that require specialized data acquisition (such as Hivemapper dashcams collecting road data), most C-end data can actually be mined through personal consumer devices such as smartphones and smart watches. The supply chain of such projects is already very mature, and the project parties do not need to invest a lot of RD efforts to promote them on a large scale and reach a wider C-end market. Due to the high profit margins of these devices, the project parties can obtain significant initial revenue growth.

In addition, DePINs large hardware (such as photovoltaic panel matrix) may be able to be put on the chain as RWA in the future. Combined with the mature Defi second-layer protocol on the chain, it may unlock more product innovations and financial services, and enhance the liquidity of the hardware network and the popularity of the hardware trading market.

3.2 Data value and network value realization are the second curve of DePIN growth

As mentioned above, the business logic of the traditional model is relatively linear and closed. After the increment reaches the ceiling, the only thing that can be done is to find ways to improve the user retention rate and attract more and more new users. In addition, if it is a traditional infrastructure provider, it also needs to bear the cost of updating and maintaining the facilities. Therefore, after reaching the ceiling of increment, it will face a large degree of decline.

After the DePIN project has accumulated a certain amount of income by selling hardware in the early stage, that is, before the first curve of equipment sales growth is about to reach the critical point, the second curve will be started after the early equipment sales business reaches its peak. The core of the second curve growth lies in the data value network built on the mature large-scale hardware network.

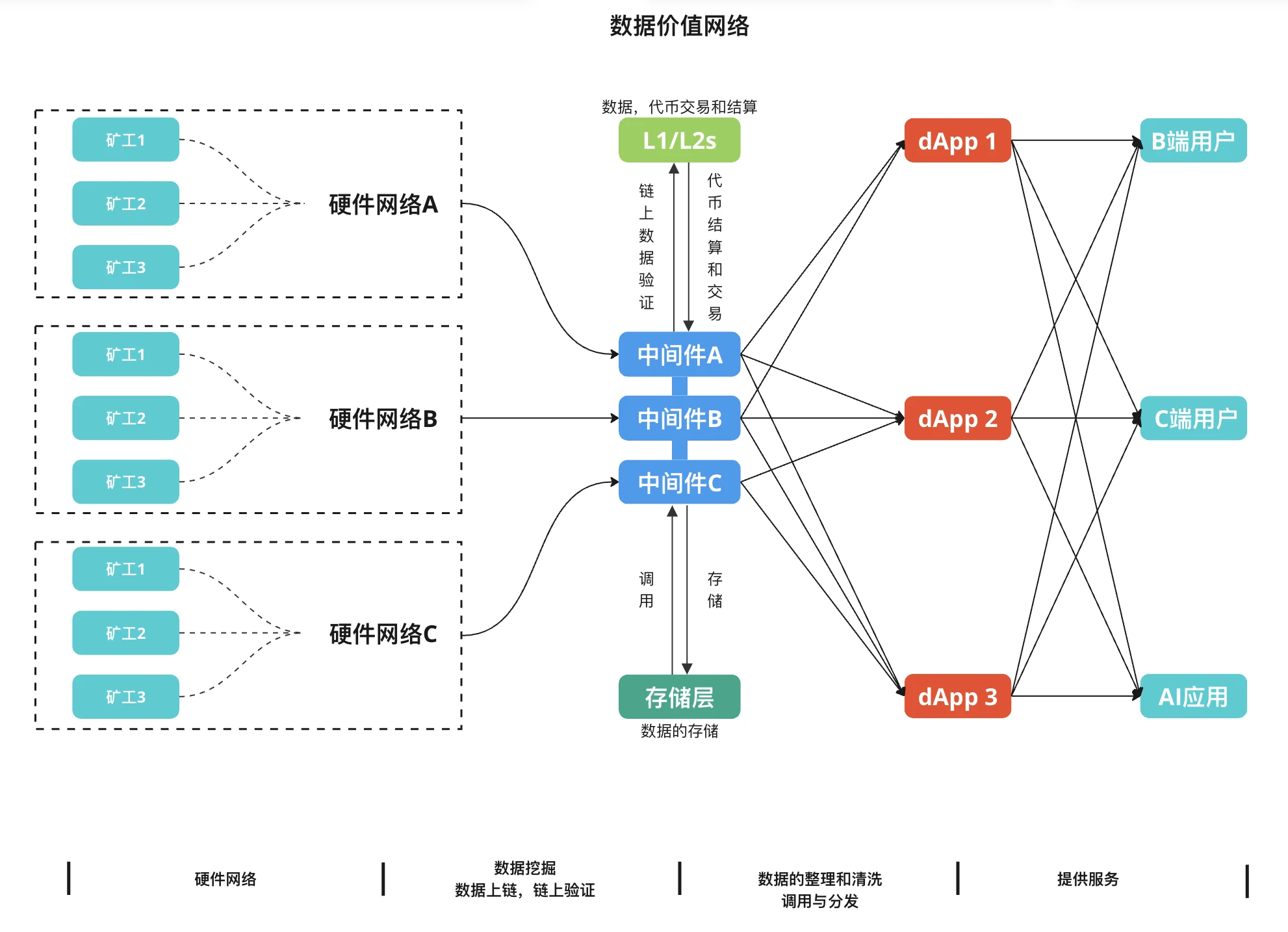

DePIN aggregates a series of value chains, splits the centralized supply side, and uses public chains to aggregate multiple demand sides, ultimately forming a data value network under the DePIN model.

Final version of DePIN’s data value network

Although the DePIN project emphasizes physical properties, its core business logic revolves around how to obtain value from data. After data verification and confirmation at the blockchain storage layer, data becomes a highly liquid transaction object and circulates in the data value network. These data not only flow between different ecological projects, but also directly or indirectly exchanged between the supply side and the demand side.

Once the data value network is able to keep a positive incentive cycle running—usually determined by token economics, the number of nodes, and a good match between supply and demand—the entire ecosystem will create a huge wealth effect around data.

Token economics is the economic foundation of value networks

Among them, token economics, as the economic foundation of the data value network, is the key to whether the DePIN project can run smoothly. The two mainstream ones are BME (burn and mint equilibrium) and SFA (stake for access).

BME is a token burning mechanism. Users on the demand side will destroy the tokens after purchasing services, so the degree of deflation is determined by demand; that is, the stronger the demand, the higher the value of the token; SFA requires users on the supply side to pledge tokens to become qualified miners. The supply determines the degree of deflation, that is, the more miners providing services, the higher the value of the token.

This depends on whether the DePIN product will rely more on the demand side or the supply side. Generally speaking, middleware or platform-based DePIN projects are more inclined to use SFA. The scale and service quality of the supply side determine the upper limit of the project. For example, OORT and Helium both require users on the supply side to stake tokens to become nodes. DePIN projects on the demand side are more suitable for using the BME model to maintain business operations. Similar projects include Render Network.

BME and SFA constitute the basic core framework of the DePIN project, while the empowerment of tokens improves the token economy. For example, points are used as a pre-mining commitment to miners, and tokens are exchanged at a certain ratio after issuance, or an economic model of points + tokens is adopted. Tokens are given governance functions to allow holders to participate in major network decisions, such as network upgrades, fee structures, or reallocation of funds. The staking mechanism encourages users to lock tokens and maintain the stability of token prices; project parties can also use part of their income to purchase tokens and pair them with other major cryptocurrencies or stablecoins to join the liquidity pool to ensure that the tokens have sufficient liquidity, which is convenient for users to trade without significantly affecting prices. These mechanisms help ensure that the interests of users on both the supply and demand sides are consistent with the interests of the project parties in the long term, thereby achieving the long-term success of the project.

The DePIN value network will drive improvement and growth

Once the large-scale data network has achieved good operation and the supply side can provide stable services, a large part of the ultimate value of the DePIN network will flow to the AI industry.

AI has become an important driving force for global economic transformation and industrial upgrading. Its development and application cannot be separated from the support of large amounts of data and computing power. Since 2012, peoples demand for computing power has increased by more than 300,000 times, far exceeding the 12-fold growth of Moores Law. There is no doubt that the explosive growth of AI has greatly boosted the demand for computing power.

In theory, decentralized computing networks such as io.net and Render Network can dispatch distributed idle computing resources to fill the huge market demand for computing resources, track and store data through blockchain technology, ensure the security of AI training, and use cryptocurrency for incentive distribution. Although this set of business processes is very convincing, the actual demand still needs further verification. In the C-end market, these decentralized computing networks will directly face fierce competition from traditional companies such as AWS, Azure and GCP; in the B-end market, these networks can only reach small and medium-sized enterprises that do not have the ability to build their own computing networks, while large-scale enterprises prefer to use mature and stable traditional centralized cloud service providers.

On the other hand, data for training AI is already in short supply. According to research by Epoch AI, if current data consumption and production rates remain the same, humans will run out of low-quality language data between 2030 and 2050, high-quality language data by 2026, and visual data between 2030 and 2060.

AI requires a large amount of raw data and trusted data to support its training process, so DePIN is particularly important in this process. The large number of devices deployed by DePIN can obtain a large amount of raw data at a very low cost, and its decentralized distribution characteristics make the data more valuable and unique. Therefore, the data collected by sensors in the DePIN subfield is naturally conducive to the training of AI models.

In general, based on AIs strong demand for computing power and data, decentralized cloud computing and sensors that provide data for AI training are the two DePIN sub-fields most likely to be the first to realize the data value network.

3.3 Middleware infrastructure will play an important role in bridging the two growth curves

The article begins by analyzing DePIN from a supply chain perspective, where the middleware is the key channel from the physical world to the digital world.

If the first curve is driven by hardware and the second curve is driven by data, then to successfully cross from the first curve to the second curve requires a very critical role to connect the equipment and the miners and users on both the supply and demand sides, that is, to provide middleware with standardized interfaces and toolkits, to realize the public chain or second-layer chain for token trading and settlement, and the second-layer protocol to enhance liquidity.

First of all, blockchain, as the settlement layer of DePIN project tokens, is responsible for the settlement and data verification of project tokens:

-

Solana

· Currently, Solana is the preferred platform for most DePIN projects. Its low latency and high performance are very suitable for the deployment of DePIN projects. For example, Helium and HiveMapper are deployed on Solana. However, the mainstream public chain was mainly used for transactions at the beginning, and the SDK toolkit optimized for DePIN projects cannot fully meet the needs of DePIN projects.

· The DePIN project requires a specialized customized public chain with features such as data verification and openness to AI as a foundation. For example, Near Chain began to emphasize its narrative around AI, while IoTeX emphasized its public chain customized for IoT devices as early as the last cycle. This customized public chain can better meet the special needs of the DePIN project and ensure its efficient operation in data processing and device connection. Iotex also provides a series of standardized interfaces and plug-and-play open tools, so that a DePIN application involving on-chain links can be quickly deployed on the Iotex chain.

-

Peaq

A chain designed specifically for DePIN. Peaq includes a range of versatile modular DePIN features, including self-sovereign identity of machines/things (peaq ID), role-based access management (peaq access), peer-to-peer payment (peaq pay), and data verification (peaq verify). The Web3 Machine Control Center (peaq control) provides a holistic way to connect any machine, device, sensor, vehicle or robot to the network. Project parties can use such modules to easily deploy DePIN applications on the Peaq chain. Peaq can also achieve seamless interaction between multiple chains, allowing data from other projects to be easily migrated to the Peaq chain.

In addition, the middleware that connects devices and DePINs network is also very critical, providing a very friendly one-stop service for developers who want to enter DePIN but do not understand the crypto economy. This is also one of the deterministic requirements for the prosperity of the DePIN ecosystem. This part of the project not only includes developer-friendly tools and one-stop services such as DePHY and Swan; there is also a re-staking protocol Parasail that specifically serves DePIN, which aims to enhance the liquidity and value utilization of the native tokens of the DePIN network.

-

DePHY

DePHY provides open source hardware solutions, SDKs, and tools for the DePIN project, and significantly reduces the manufacturing and network messaging costs of hardware products bridging blockchains by synchronizing 500 ms off-chain network nodes running on blockchains.

For example, Starpower, which is based on DePHY, developed its product Starplug, a smart socket that records users electricity usage and electricity consumption, and gives token rewards. DePHY has opened up various customizable hardware design solutions to the community, helping Starpower to quickly complete the hardware design of Starplug and enter the mass production stage. In addition, DePHY also shared its hardware production resources, providing Starpower with great manufacturing convenience and cost efficiency. Starpower also adopted the open source hardware solution of the DID system and built-in TEE module provided by DePHY to ensure the security and immutability of data.

-

Swan Chain

Swan Chain (formerly known as FilSwan) is a full-stack AI smart chain based on OP Stack technology, a decentralized cloud computing network dedicated to AI. Through Swan Chain, enterprises, data centers, cloud providers, and cryptocurrency mining operators contribute idle GPU resources to the network and monetize computing assets through the UBI incentive model to obtain stable income. At the same time, enterprises, developers, and AI enthusiasts can use Swan Chains global computing resource network to build and deploy decentralized AI models and applications, which is expected to save up to 70% of computing power costs.

Developers often encounter complexity issues when managing tokens and using various SDKs, which distracts from the main functions of the product. The lack of convenient Web3 application access tools hinders the efficient creation of decentralized applications (dApps), slows down development, and limits economic potential. In response, Swan Chain provides a set of development tools that allow developers to access resources across multiple blockchains, simplify storage provider selection and data management. And by introducing a cross-chain consensus layer, it provides a comprehensive infrastructure solution to help developers use cross-chain tools to seamlessly access Web3 resources on multiple blockchain networks. These tools include payment channels and Web3 infrastructure, which simplifies the development process.

In addition, Swan Chain supports the use of a single cryptocurrency to pay for Web3 services on all different chains, which reduces the barriers to use and saves developers time and energy in connecting to various Web3 services.

· Public data shows that during the testnet stage, the number of active addresses on Swan Chain has exceeded 25M, the number of computing providers on the entire network has exceeded 2,000, and more than 2,100 GPUs have been provided. The computing resources cover more than 30 regions in 17 countries around the world, ensuring the efficient execution of computing tasks and the security of data. As the only AI DePIN project in the fourth phase of the Binance Labs incubation program, Swan Chain has received investments from Binance labs, SNZ, Waterdrip Capital, Protocol Labs, Chainlink and other institutions.

-

Unibase

The current data availability solutions such as EigenDA, Celestia, and Avail are mainly designed for ledger transactions, and have the following problems: they cannot support the big data scenarios of AI and DePIN in terms of performance and capacity, and they perform off-chain data verification based on DAC or DAS, lacking the security and legitimacy of Ethereum.

· The data used for AI training has always needed to solve the problem of data credibility. Therefore, Unibase provides a set of AI data verification solutions based on zero-knowledge proof, allowing anyone to safely and economically deploy decentralized, verifiable, and autonomous AI applications on Unibase. Unibase is also a DA layer and storage layer, supporting millions of DePIN devices to contribute storage, computing power, and bandwidth for mining, providing secure, highly available storage and data verifiable reasoning services, and supporting DePIN to provide high-quality native data for AI training. Compared with swan, unibases main service objects will be closer to the AI application side.

-

Parasail

Parasail is a re-staking protocol specifically for DePIN services. DePIN projects have the potential to generate sustainable revenue through decentralized infrastructure and services, but their widespread adoption and trust building are often difficult and costly. Parasail provides economic guarantees for DePIN services by activating idle assets in mature networks (such as staked or re-staked tokens), helping DePIN projects attract more users and service providers.

Currently, Parasail mainly provides re-staking services on the Filecoin chain. In the future, it will open re-staking services on chains such as Iotex, Arbitrum, and Ethereum. The following uses FIL as an example to show how Parasail works:

· Pledge FIL tokenization: Storage providers can stake FIL and mint pFIL tokens at a 1:1 ratio.

An open market for pFIL: Storage providers can sell pFIL to gain liquidity, and token holders can buy pFIL to gain FIL mining rewards.

Risk recovery and reward distribution: When the staked FIL is released or miners receive block rewards, the Repl protocol recovers FIL and repurchases pFIL through auction, and the excess proceeds are distributed as rewards.

Parasail’s TVL exceeded $10 million in the first two weeks after its launch. According to Defillama data, Parasail’s TVL has now exceeded $60 million.

On the other hand, the integrated AI + Data products that combine decentralized storage and decentralized computing for AI training are also worth paying attention to. At the recent Data + AI Summit, Databricks released many new features and applications that combine big data and AI. Founder Ali Ghodsi clarified the teams mission at the meeting, which is to democratize DATA + AI, and emphasized the importance of promoting the combination of AI + Data.

-

Databricks

Databricks is a general data analysis platform whose products integrate data warehouses, data lakes, and ultra-fast big data query engines. The company has announced its entry into the AI field and is trying to combine AI with the big data analysis industry, launching data analysis application scenarios based on natural language input. In 2023, Databricks valuation has exceeded US$38 billion, with revenue exceeding US$1 billion, and an average annual growth rate of 70%. Therefore, a general data analysis platform based on decentralized storage and decentralized cloud computing has a lot of room for imagination.

-

Kyve

Kyve is a Web3 project similar to Databricks that provides data aggregation as a service, including decentralized general data analysis services such as data lakes and data pipelines. The Kyve network enables decentralized data verification, immutability, and retrieval by providing fast and simple tools. Uploaders collect data from sources, store it on decentralized providers such as Arweave, and submit it to the data pool for verification by network participants (validators). Data consumers can access verified data to build decentralized applications without trusting Kyve or any intermediaries.

4. Reflections on the DePIN narrative, limitations and challenges beyond the growth curve

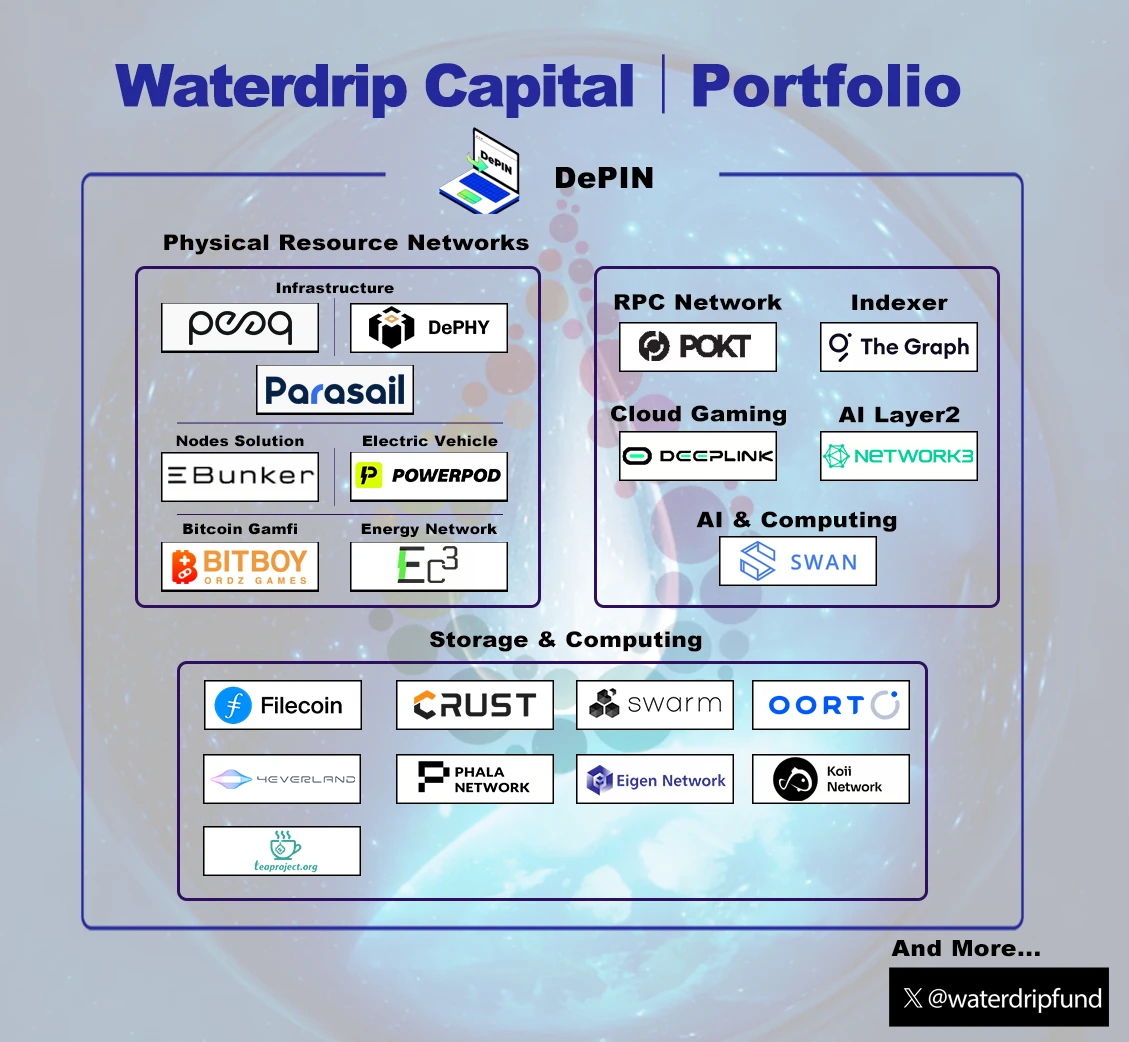

The DePIN track covers a wide range of categories, including storage, computing, data collection and sharing, communication technology, etc. The existing markets in each field present different degrees of competition. In the bull market cycle from 2020 to 2022, the decentralized storage and computing track has been the darling of the crypto market. Based on this trend, Waterdrip Capital was fortunate to strategically deploy many projects that are now classified as DePIN in the early stage, actively participating in and promoting the development of this field. However, although DePIN has shown great potential, its development also faces many limitations and challenges, but there are also opportunities to dig out high-quality targets.

Waterdrip Capital DePIN track ecological layout

DePIN projects with hardware supply chains and sales channels have greater growth potential

The concept of DePIN emphasizes a form of crypto-economy based on physical hardware. Projects with strong hardware supply chain capabilities can achieve rapid business growth in the first curve through equipment sales and agency models. While achieving a large-scale network, it can obtain a considerable profit income with a lower cost advantage (the price of DePIN equipment is already very high relative to the cost); provide large-scale hardware infrastructure for the business growth of the projects second curve, and have good cash flow support in the subsequent acquisition, operation and maintenance of the project.

Cross-chain interoperability can maximize the value of data

Currently, most DePIN projects are deployed on Ethereum, Solana, Peaq, and IoTeX. Although there are many mature solutions for cross-chain transactions, for DePIN projects, achieving data interoperability between multiple chains will maximize the value of data. This is not only a potential outbreak point for the DePIN track, but will also enable cross-chain protocols to directly benefit from this wave of growth.

Data trustworthiness is crucial to the development of AI

The data used to train AI may involve risks of ethical, legal and moral issues. If the data is contaminated or maliciously tampered by hackers, the results of AI generation will be affected. The traceability and verification mechanism of blockchain helps to improve the credibility of data, ensure the integrity of data and transparency of sources, and prevent data tampering. In addition, by combining the crypto-economic model, it can incentivize the generation of high-quality data on the supply side, which will further promote the improvement and large-scale adoption of the AI industry. IBM and other technology companies are already exploring how to use blockchain technology to improve the credibility and security of AI data.

References:

Messari: State of DePIN 2023, https://messari.io/report/state-of-DePIN-2023

·FMG Group: THE FUTURE OF DEPIN, https://docsend.com/view/54umt32m7y3xwv4 i

borderless_cap: DePIN Thesis 2.0: https://borderless.docsend.com/view/5t3tsu3apqewc3ce

State of AI Report 2023: https://www.stateof.ai/

BCG Data Value Network: https://web-assets.bcg.com/77/1c/ 30 afc 5 e 048 deba 352 aaae 316 a 16 c /bcg-data-value-networks-cn-mar-2024.pdf

Charles Handy: The Second Curve: Thoughts on Reinventing Society

· Ryze Labs 10,000-word research report: A comprehensive interpretation of the DePIN track, https://www.theblockbeats.info/news/46686

Youbi Capital: Born on the edge: How does the decentralized computing network empower Crypto and AI? https://mp.weixin.qq.com/s/ S 6 Td 3 L 8 ydiI 9 c 7 QjupzN 8 Q

OORT Docs: https://docs.oortech.com/oort

Swan Chain: https://s.foresightnews.pro/article/detail/62762

Swan Chain Docs: https://docs.filswan.com/

Kyve: https://docs.kyve.network/learn

Peaq Article: https://www.peaq.network/blog/what-are-decentralized-physical-infrastructure-networks-DePIN

Parasail Docs: https://docs.parasail.network/

DePIN Ninja Dashboard: https://DePIN.ninja/leader-board

This article is sourced from the internet: DePIN: The superposition of double curves builds a decentralized value network

Cryptocurrency prices saw significant volatility on Thursday, with liquidations of all leveraged crypto derivatives positions surging to over $360 million that day, the highest level since May 1: The sectors with strong wealth-creating effects are: RWA sector and Ethereum staking sector; Hot search tokens and topics by users are: Plume Network, Lista (LISTA); Potential airdrop opportunities include: Sanctum, Synthr; Data statistics time: May 24, 2024 4: 00 (UTC + 0) 1. Market environment Cryptocurrency prices saw significant volatility on Thursday. Before the approval, ETH first fell to $3,500 around the closing time of the traditional U.S. market, then soared to around $3,900, and finally stabilized above $3,800 after confirmation. Bitcoin also fell to a low of $66,000, then soared to $68,300 before falling back below $68,000. According to data from…